高端化转型

Search documents

秦川机床第三季度营收增超16%,运营效率持续提升,高端化转型提速

Zheng Quan Shi Bao Wang· 2025-10-23 11:17

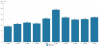

Core Viewpoint - Qin Chuan Machine Tool (000837) reported steady revenue growth in Q3 2025, with increased R&D investment and capacity construction, indicating a trend of marginal recovery in its main business [1] Revenue Growth and Market Position - In the first three quarters of 2025, Qin Chuan Machine Tool achieved total operating revenue of 3.121 billion yuan, a year-on-year increase of 8.14%, marking two consecutive years of growth [2] - The revenue for Q3 alone reached 1.009 billion yuan, reflecting a significant year-on-year growth of 16.73%, indicating enhanced operational momentum in the second half of the year [2] - As a leading enterprise in the machine tool industry, Qin Chuan Machine Tool outperformed the overall industry, which faced challenges such as insufficient domestic demand and increased uncertainty in external demand [4] Operational Efficiency and Cash Flow - The company showed continuous improvement in operational efficiency, with inventory turnover increasing from 1.24 times to 1.29 times year-on-year [5] - The total asset turnover ratio improved from 0.3 times to 0.32 times, and accounts receivable turnover days decreased from 92.58 days to 87.79 days, indicating better cash collection efficiency [5] - The net cash flow from operating activities reached 162 million yuan, reversing three years of negative operating cash flow, primarily due to enhanced sales collection capabilities [5] R&D Investment and Technological Development - In the first three quarters of 2025, R&D expenses amounted to 166 million yuan, a year-on-year increase of 19.7%, consistently accounting for over 5% of operating revenue [6] - The company has developed into one of the most comprehensive enterprises in China's machine tool industry, with a strong market presence in high-end manufacturing sectors such as new energy vehicles and semiconductors [8] Investment Projects and Future Outlook - Qin Chuan Machine Tool is advancing nine key fixed asset investment projects in 2025, including the installation of equipment for the new energy vehicle component R&D project and the construction of a high-end CNC machine tool industrial park [8] - The company is effectively implementing a three-year action plan for the advanced manufacturing industry cluster, achieving significant progress in various initiatives over the past six months [8]

深圳市兆驰股份有限公司 2025年第三季度报告

Zheng Quan Ri Bao· 2025-10-22 22:12

Core Viewpoint - The company reported a decline in revenue and net profit for the first three quarters of 2025, but showed significant improvement in the third quarter due to strategic adjustments and expansion of overseas production capacity [4][5]. Financial Performance - For the first three quarters of 2025, the company achieved revenue of 13.896 billion yuan and net profit of 1.103 billion yuan, with a net profit attributable to shareholders of 1 billion yuan, indicating a decline compared to the same period last year [4]. - The third quarter saw a 13.72% increase in revenue compared to the second quarter and a 45.38% increase compared to the first quarter, demonstrating resilience in operations despite external challenges [5]. Business Strategy - The company is focusing on global expansion and smart manufacturing, with overseas production capacity reaching 11 million units by mid-2025, which is crucial for meeting seasonal demand [6]. - Plans for the fourth quarter include accelerating the smart transformation of overseas production bases to reduce costs and improve operational efficiency, which is expected to enhance the gross margin of the smart terminal business [6]. Emerging Business Segments - Emerging businesses, including the LED industry chain and optical communication, contributed over 60% of profits, serving as a core driver for growth amid pressures on traditional business [7]. - The LED segment is focusing on high-end products, with successful launches in Mini/Micro LED technology, enhancing the company's position in the high-end display market [7][8]. Future Outlook - The company is committed to long-term strategies, balancing stable operations with transformative initiatives, which are expected to solidify its competitive advantage and growth potential [10]. - The focus on building a robust supply chain and advancing smart manufacturing is anticipated to facilitate the commercialization of technological advancements and break through development bottlenecks [10].

兆驰股份前三季度新兴业务利润贡献超60%

Zheng Quan Ri Bao· 2025-10-22 16:37

Core Viewpoint - Zhaochi Co., Ltd. reported significant growth in revenue and net profit for Q3 2025, driven by strategic expansions and new business developments [1][2]. Group 1: Financial Performance - In Q3 2025, Zhaochi achieved revenue of 5.413 billion and a net profit of 339 million, with total revenue for the first three quarters reaching 13.896 billion and net profit of 1 billion [1]. - Revenue increased by 13.72% compared to Q2 and by 45.38% compared to Q1, indicating a strong recovery and seasonal performance [1]. Group 2: Business Transformation - Zhaochi has transitioned from a traditional TV ODM business to a diversified model including LED, optical communication, and internet video operations, focusing on upgrading and expanding its business segments [1][2]. - The company’s overseas production capacity reached 11 million units annually, which is crucial for meeting seasonal demand [1]. Group 3: Emerging Business Contributions - Emerging businesses, particularly in the LED and optical communication sectors, contributed over 60% to profits in the first three quarters of 2025, helping to offset pressures from traditional operations [2]. - The LED business is focusing on high-end products, with increasing market share in Mini/MicroLED, automotive LEDs, and high-end lighting [2]. Group 4: Future Outlook - Zhaochi is enhancing its internet video platform, with its subsidiary successfully transitioning to an AI content creation and distribution model, indicating a strategic shift towards integrated digital solutions [3]. - The company anticipates that its traditional business will recover while new sectors will enter a profit phase, positioning Zhaochi for sustained growth and market consolidation [3].

中国造船业交出高质量发展成绩单

Zhong Guo Xin Wen Wang· 2025-10-22 09:33

Core Insights - China's shipbuilding industry is experiencing significant growth, with full order books extending to the end of 2028 and some orders reaching into 2029 [1][4] - The global new ship orders during the "14th Five-Year Plan" period show that 64.2% are secured by Chinese shipbuilders, an increase of 15.1 percentage points compared to the "13th Five-Year Plan" [3] - Despite external pressures, such as the U.S. imposing port "service fees" on Chinese vessels, orders continue to flow to Chinese shipyards, exemplified by New Zealand's recent decision to award contracts to Chinese firms [3] Industry Performance - As of the first three quarters of 2025, China's market share in completed ships, new orders, and backlog orders stands at 53.8%, 67.3%, and 65.2% respectively, maintaining a global lead [3] - The shipbuilding sector's export value exceeded $40.1 billion in the first three quarters of 2025, reflecting a year-on-year growth of 21.4% [5] Technological Advancements - China's shipbuilding strength is attributed to significant advancements in self-innovation, overcoming previous technological monopolies held by a few countries [5] - The industry has successfully developed key high-end vessels, including aircraft carriers, large cruise ships, and large LNG carriers, positioning itself to challenge South Korea's record of $54.1 billion in exports set in 2011 [5] Green Transition - The Chinese shipbuilding industry is aligning with global decarbonization goals, with a projected 78.5% market share in new green ship orders by 2024 [6] - The industry has established a comprehensive supply chain that enhances its competitive edge, with a focus on domestic production and innovation [6] Economic Impact - The shipbuilding sector generates significant economic activity, with a reported 1 yuan investment in cruise ship construction yielding 14 yuan in industry output [7] - The industry has created thousands of jobs through domestic projects, demonstrating a strong multiplier effect on the economy [7] Competitive Landscape - China's shipbuilding industry has maintained its position as the world's leading shipbuilder for 16 consecutive years, driven by advancements in technology, sustainability, and a robust supply chain [7] - The ongoing transition of global shipbuilding centers reflects the industry's competitive evolution, with China emerging as a formidable player on the world stage [7]

一条绿线,引发OPPO的中年危机

凤凰网财经· 2025-10-20 13:51

Core Insights - 2025 is a significant year for OPPO as it marks the company's 30th anniversary and a critical phase in its transformation towards a high-end brand [2][6] - OPPO has faced a decline in market ranking, now trailing behind competitors like Huawei, Xiaomi, and vivo [3][34] - A sudden product trust crisis has emerged due to widespread reports of a "green line" issue on screens, impacting consumer confidence [4][34] Group 1: Product Trust Crisis - Users have reported a persistent "green line" appearing on screens of OPPO and OnePlus devices, particularly after approximately four years of use [7][10] - The issue has affected various models, including the high-end Find X series and the mid-range Reno series, leading to a growing number of complaints [6][10] - OPPO's customer service has been criticized for inconsistent policies regarding screen replacements, with many users facing difficulties in obtaining free repairs due to missing purchase receipts [17][20][26] Group 2: Market Performance - In Q3 2025, OPPO's domestic shipment volume was 9.9 million units, with a market share of 14.5%, reflecting a decline from previous quarters [34][35] - OPPO's global market presence has weakened, dropping out of the top five smartphone manufacturers by Q3 2025, indicating a significant loss in competitive standing [36][38] - The company's high-end market performance remains insufficient, with flagship models like the Find X series failing to achieve significant sales compared to competitors [38][39] Group 3: Challenges and Future Outlook - OPPO's struggles are attributed to a lack of core technological innovation, which has hindered its ability to compete effectively in a saturated market [39] - The company faces internal competition between its Reno and OnePlus product lines, leading to market inefficiencies [38][39] - To overcome its current challenges, OPPO must focus on technological advancements, quality control, and improving customer service to rebuild trust with consumers [39]

老凤祥的“黄金局”

Zhong Guo Ji Jin Bao· 2025-10-16 22:37

Core Viewpoint - The gold and jewelry industry is under pressure, prompting Lao Feng Xiang to embark on a high-end transformation journey in the luxury market [1][2]. Industry Overview - Rising gold prices have suppressed consumer demand, and the franchise model faces growth bottlenecks, making the situation difficult for domestic gold and jewelry companies this year [2]. - While traditional gold brands are experiencing declines in revenue and net profit, Lao Pu Gold has seen its revenue and net profit increase by over 200% year-on-year in the first half of the year, highlighting the potential for local brands to pursue high-end strategies [2]. Company Strategy - Lao Feng Xiang is pursuing a dual-track strategy by entering the luxury goods sector through "equity investment + brand agency" [3]. - In September, Lao Feng Xiang announced an investment of 50 million yuan to establish Shanghai Lao Feng Xiang Zhenpin Trading Co., Ltd., focusing on high-end products such as gold and silver jewelry, diamonds, and watches [3]. Recent Developments - In October, Lao Feng Xiang further invested 24 million USD to acquire a 20% stake in Maybach Luxury Goods Asia Pacific Company (MAP), which covers luxury lifestyle products but excludes Maybach automotive business [4][7]. - Lao Feng Xiang has also secured the distribution rights for Maybach luxury goods in the Asia-Pacific region, committing to a total procurement amount of no less than 13 million USD from 2025 to 2027 [7]. Financial Performance - Lao Feng Xiang has faced a decline in revenue and net profit, with a 20.5% drop in revenue to 56.793 billion yuan and an 11.95% decrease in net profit to 1.95 billion yuan in 2024 [8]. - The downward trend continued into the first half of 2025, with revenue down 16.52% to 33.4 billion yuan and net profit down 13.07% to 1.22 billion yuan [9]. Business Model Challenges - Lao Feng Xiang's franchise system, with 96% of its stores being franchises, contrasts with the direct sales model preferred by luxury brands, which complicates brand image and customer experience management [11][12]. - The company has fewer than 200 direct stores, primarily in Shanghai, making it challenging to provide a luxury consumer experience [12]. Market Trends - The gold and jewelry industry is witnessing a shift towards high-end customization and fast fashion markets, with leading brands focusing on product differentiation [13]. - Capital markets currently favor Lao Pu Gold's business model, which emphasizes cultural consumption over mere investment attributes [13]. Conclusion - Lao Feng Xiang's high-end transformation is a significant test of its strategic determination and operational capabilities, serving as an important case study for the transformation of traditional Chinese brands [14].

价值研究所|老凤祥的“黄金局”

Zhong Guo Ji Jin Bao· 2025-10-16 16:17

Core Viewpoint - The gold and jewelry industry is under pressure, prompting Lao Feng Xiang to embark on a high-end transformation journey amidst declining performance in traditional gold brands [2][5]. Group 1: Industry Challenges - Rising gold prices have suppressed consumer demand, and the franchise model is facing growth bottlenecks, making the situation difficult for domestic gold and jewelry companies this year [2]. - Traditional gold brands are experiencing a decline in both revenue and net profit, while Lao Pu Gold has seen a remarkable increase, with revenue and net profit growth exceeding 200% year-on-year in the first half of the year [2][5]. Group 2: Lao Feng Xiang's High-End Strategy - Lao Feng Xiang is adopting a dual-track approach by entering the luxury goods market through "equity investment + brand agency" [2]. - In September, Lao Feng Xiang invested 50 million yuan to establish Shanghai Lao Feng Xiang Zhenpin Trading Co., focusing on high-end products [5]. - In October, Lao Feng Xiang acquired a 20% stake in Maybach Luxury Goods Asia-Pacific Company (MAP) for 24 million USD, expanding its reach into luxury lifestyle products [5]. Group 3: Financial Performance - In 2024, Lao Feng Xiang's revenue decreased by 20.5% to 56.793 billion yuan, and net profit fell by 11.95% to 1.95 billion yuan [6]. - The downward trend continued into the first half of 2025, with revenue down 16.52% to 33.4 billion yuan and net profit down 13.07% to 1.22 billion yuan [6]. Group 4: Business Model Concerns - Lao Feng Xiang's franchise system may conflict with high-end brand operations, as 96% of its stores are franchises, limiting control over brand image and customer experience [7][8]. - In contrast, competitors like Lao Pu Gold operate a direct sales model, emphasizing brand experience and exclusivity [8]. Group 5: Market Perspectives - The market is divided on the high-end positioning of brands, with some analysts suggesting that not all local brands are suited for high-end transformation [9]. - The success of Lao Feng Xiang's high-end journey will test its strategic determination and operational capabilities, serving as a significant case study for the transformation of traditional Chinese brands [10].

价值研究所|老凤祥的“黄金局”

中国基金报· 2025-10-16 16:05

Core Viewpoint - The overall gold and jewelry industry is under pressure, prompting Lao Feng Xiang to embark on a high-end transformation journey to penetrate the luxury market [2][3]. Industry Overview - Rising gold prices have suppressed consumer demand, and the franchise model faces growth bottlenecks, making the situation challenging for domestic gold and jewelry companies this year [3]. - While traditional gold brands are experiencing declines in revenue and net profit, Lao Pu Gold has seen a remarkable performance, with revenue and net profit both increasing over 200% year-on-year in the first half of the year [3]. Lao Feng Xiang's High-End Transformation - Lao Feng Xiang's high-end transformation could either be a turning point for its performance or a risky gamble [4]. - The company has adopted a dual-track approach by entering the luxury goods sector through "equity investment + brand agency" [6]. - In September, Lao Feng Xiang announced an investment of 50 million yuan to establish Shanghai Lao Feng Xiang Zhenpin Trading Co., focusing on high-end products [7]. Strategic Partnerships - In October, Lao Feng Xiang furthered its strategy by investing $24 million to acquire a 20% stake in Maybach Luxury Goods Asia Pacific Company (MAP), which covers various luxury lifestyle products [9]. - Lao Feng Xiang has also secured distribution rights for MAP products in the Asia-Pacific region, committing to a minimum purchase of $13 million over three years [11]. Financial Performance - Lao Feng Xiang has faced declining revenues and profits, with a 20.5% drop in revenue to 56.793 billion yuan and an 11.95% decrease in net profit to 1.95 billion yuan in 2024 [13]. - The company's retail business has a gross margin of 23.61%, while the wholesale business, which accounts for over 70% of revenue, has a much lower gross margin of 9.39% [15]. Challenges in High-End Positioning - Lao Feng Xiang's franchise system may conflict with high-end brand operations, as the majority of its stores (96%) are franchises, limiting control over brand image and customer experience [18]. - The company needs to clarify its specific path and synergies for high-end transformation to investors [11]. Market Trends - The gold and jewelry industry is shifting towards two main directions: high-end customization targeting high-net-worth individuals and fast fashion aimed at younger consumers [20]. - Capital markets currently favor Lao Pu Gold's business model, which emphasizes cultural consumption over pure investment attributes [20]. Conclusion - The high-end transformation journey for Lao Feng Xiang is a significant test of its strategic determination and operational capabilities, serving as an important case study for the transformation of traditional Chinese brands [22].

前8个月制造业享受减税降费及退税近1.3万亿元

Zheng Quan Ri Bao· 2025-10-15 15:41

Core Insights - The high-quality development of the manufacturing sector is crucial for the overall high-quality economic development in China [1] - Tax reduction and fee exemption policies have significantly alleviated the financial burden on manufacturing enterprises, providing strong support for their development [3] Tax Policies and Financial Impact - From January to August this year, tax reduction and fee exemption policies, along with tax refunds, amounted to 1.2925 trillion yuan, directly benefiting the manufacturing sector [1] - Key policies include R&D expense deductions and a reduced corporate income tax rate of 15% for high-tech enterprises, which provided a total benefit of 485.7 billion yuan [1] - The advanced manufacturing, integrated circuit, and industrial mother machine sectors received a VAT offset benefit of 112 billion yuan, while other supportive policies contributed 694.8 billion yuan [1] Manufacturing Sector Performance - The manufacturing sector showed a positive growth trend in the first three quarters, with sales revenue increasing by 4.7% year-on-year, accounting for 29.8% of total sales revenue across all enterprises [1] - The equipment manufacturing sector experienced a sales revenue growth of 9%, with significant increases in specific areas such as computer communication equipment (13.5%) and industrial mother machines (11.8%) [2] - High-end manufacturing sectors, including new energy vehicles and aerospace, saw substantial tax revenue growth, with increases of 49.7% and 12% respectively [2] Transformation Trends - The intelligent transformation of the manufacturing sector is evident, with a 10.6% year-on-year increase in digital technology procurement, leading to a 23.6% growth in smart equipment manufacturing [2] - The green transformation is progressing, with high-energy-consuming manufacturing's revenue share decreasing by 1.4 percentage points year-on-year, and a 34% increase in procurement of energy-saving and environmental protection services [2]

聊城黑色金属产业构建梯级发展新格局

Qi Lu Wan Bao· 2025-10-15 11:30

Core Insights - Liaocheng City aims to strengthen its manufacturing sector by enhancing the black metal industry chain through industrial chain investment and project implementation [1][2] Group 1: Economic Performance - In 2024, 206 large-scale enterprises in Liaocheng achieved revenue of 69.99 billion yuan and profit of 3.61 billion yuan, representing year-on-year growth of 4.7% and 32.2% respectively [1] - In the first half of 2025, the city's revenue reached 32.065 billion yuan, a year-on-year increase of 10.1%, with total profit amounting to 1.045 billion yuan, up 91.7% [1] Group 2: Industrial Development Strategy - Liaocheng is recognized as a national hub for steel pipes and has established four key industrial clusters: high-end steel pipes, special steel plate processing, steel structures and transportation facilities manufacturing, and recycling of scrap steel [1][2] - The city is focusing on attracting high-end projects, including a 500,000-ton continuous hot-dip aluminum-zinc-magnesium plate project and a 310,000-ton hot-dip aluminum-zinc-silicon plate project, among others [2] Group 3: Innovation and Collaboration - The city is promoting the upgrade of seamless steel pipes for high-end applications in aerospace and automotive lightweighting, creating a full-chain ecosystem from basic materials to deep processing and end applications [3] - Liaocheng is collaborating with local leading enterprises and integrating resources from small and medium-sized enterprises to attract high-end special steel pipe projects [3] Group 4: Brand Development - The city is enhancing its global influence by leveraging regional brands like "Liaocheng Steel Pipe" and "Guanzhou Steel Plate," and developing sub-brands such as "Liaocheng High-end Seamless Pipe" [4] - Liaocheng is participating in international exhibitions and utilizing "Belt and Road" initiatives to connect with domestic downstream industry demands, thereby increasing brand value and market competitiveness [4]