油价上涨

Search documents

12月30日【油价上涨】原油大涨超2%,国内油价涨幅65元/吨,预期收窄落空,距搁浅仅差20元

Sou Hu Cai Jing· 2025-12-30 06:34

Core Viewpoint - The domestic gasoline and diesel prices are expected to rise due to a significant increase in international oil prices, with the upcoming price adjustment window on January 6, 2026, being closely monitored [1][2]. Group 1: International Oil Prices - On December 29, international oil prices saw a notable increase, with WTI crude oil priced at $58.08 per barrel, up by 2.36%, and Brent crude at $61.94 per barrel, up by 2.14% [1]. - The average price of WTI crude for the current pricing cycle is $57.98 per barrel, while Brent's average is $61.92 per barrel, reflecting a slight increase of $0.01 from the previous day [1]. Group 2: Domestic Price Adjustments - As of December 30, the domestic gasoline and diesel prices are projected to increase by 65 yuan per ton, translating to an increase of approximately 0.05-0.06 yuan per liter [2]. - The current price increase is just above the 45 yuan per ton threshold, indicating that if international oil prices decline in the next four days, the increase may narrow to the threshold range [2]. Group 3: Current Domestic Fuel Prices - The average prices for gasoline and diesel in China are as follows: 92-octane gasoline at 6.7 yuan per liter, 95-octane gasoline at 7.15 yuan per liter, and 0-octane diesel at 6.31 yuan per liter [3]. - Throughout 2025, domestic oil prices have generally trended downward, with an overall decrease exceeding 0.7 yuan per liter, benefiting consumers with lower fuel costs [3].

美委、俄乌、以伊--2025的尾声,地缘风险走高,推动油价大涨

Hua Er Jie Jian Wen· 2025-12-23 00:24

Group 1: Geopolitical Tensions Impacting Energy Markets - The global energy market is currently facing significant geopolitical tensions, particularly in the Caribbean, Black Sea, and Middle East, raising concerns over supply disruptions [1][5] - The U.S. Coast Guard has intensified its interception actions against Venezuelan oil exports, marking a significant escalation in the blockade of Venezuelan oil [3][4] - Israel is planning new military actions against Iran's missile facilities, which could further destabilize the region and impact oil supply dynamics [5][6] Group 2: Market Reactions and Price Movements - International oil prices surged significantly due to the aforementioned geopolitical risks, with Brent crude futures rising by $1.60 (2.7%) to $62.07 per barrel, and WTI crude futures increasing by $1.49 (2.6%) to $58.01 per barrel [1] - Market participants are reassessing the risks associated with Venezuelan oil supply disruptions, as the likelihood of U.S. sanctions impacting exports has increased [3] - The attack on energy infrastructure in the Black Sea has heightened market sensitivity, contributing to rising oil prices as traders react to the vulnerabilities in energy supply chains [6]

特朗普:全面封锁!油价拉升!

Zheng Quan Shi Bao· 2025-12-17 16:57

Group 1: Oil Price Surge - International oil prices experienced a sudden spike, with WTI and Brent crude oil rising sharply due to reports of the U.S. preparing new sanctions against Russia if Moscow does not agree to a peace plan regarding Ukraine. Brent crude futures saw an increase of up to 2.4%, surpassing $60 per barrel during trading [1]. Group 2: U.S. Actions Against Venezuela - President Trump ordered a complete blockade of all sanctioned oil tankers entering or leaving Venezuela, citing reasons such as asset theft, terrorism, drug trafficking, and human trafficking [2][4]. - The U.S. military seized a tanker near Venezuela, which was allegedly involved in transporting oil from Venezuela and Iran, as part of a broader strategy to enforce sanctions against entities supporting foreign terrorist organizations [6]. - The U.S. Treasury updated its sanctions list, adding six tankers related to Venezuela, while Venezuela's Foreign Minister condemned the seizure as an act of "international piracy" [6]. Group 3: Military Presence and Tensions - The U.S. has increased its military presence in the Caribbean near Venezuela, deploying F-35A fighter jets and EA-18G Growler electronic warfare aircraft, indicating preparations for potential military action rather than mere symbolic displays of force [6]. - Venezuela's Defense Minister stated that surrender is not an option for the country, emphasizing readiness to defend against U.S. actions and asserting that the Venezuelan people are resisting what they perceive as U.S. imperialism [6][7].

汽油“预涨3.35%”,原油易涨难降,接下来汽柴油涨幅或激增!

Sou Hu Cai Jing· 2025-11-02 11:13

Core Insights - The article discusses the imminent increase in gasoline and diesel prices in China, with a projected rise of 3.35% for 92 and 95 octane gasoline, translating to an increase of 160 yuan per ton, which equates to approximately 0.13 yuan per liter [1][3]. Price Trends - As of November 2, 2025, the WTI crude oil price is reported at $60.57 per barrel, while Brent crude is at $65 per barrel, with an average crude oil price of $62.81 per barrel for the first four working days of the pricing cycle [3]. - The oil price increase has shown a significant reduction in growth, with a decrease of 70 yuan per ton compared to the first working day of the cycle [3]. Market Factors - The decrease in U.S. crude oil inventories by 6.86 million barrels has exceeded market expectations, contributing to a more optimistic outlook on energy demand [3]. - Ongoing geopolitical tensions, including the Israel-Hamas situation and the Russia-Ukraine conflict, are raising concerns about potential reductions in Russian oil exports, further impacting market sentiment [3]. Economic Indicators - The Federal Reserve's recent interest rate cut of 25 basis points is expected to support market economic prospects, particularly with a weakening U.S. dollar, which may boost energy demand [5]. - Positive developments in U.S.-East Asia trade negotiations are alleviating concerns over trade disputes, contributing to a more optimistic global economic recovery outlook [5]. Future Projections - The domestic crude oil price change rate is expected to rise to 3.42%, with gasoline and diesel price increase expectations potentially reaching 165 yuan per ton [5]. - The article suggests that if OPEC+ does not meet production increase expectations in November, it could further support a strong oil market, indicating a risk of continued price increases in the following week [5].

港股异动丨三桶油逆势上涨 中国海洋石油盘初涨超3% 亚市早盘油价攀升

Ge Long Hui· 2025-10-23 02:22

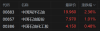

Core Viewpoint - The Hong Kong stock market saw an initial rise in the shares of the three major oil companies, driven by an increase in oil prices following new sanctions imposed by the U.S. on Russian oil companies due to the ongoing Russia-Ukraine conflict [1]. Group 1: Oil Price Movement - Oil prices in Asia rose significantly, with West Texas Intermediate crude futures increasing by 2.9% to $60.22 per barrel and Brent crude futures also rising by 2.9% to $64.39 per barrel [1]. - The rise in oil prices is attributed to the U.S. sanctions on Russia's largest oil producers, which has alleviated concerns over supply excess amid signs of excessive recent selling and a decrease in U.S. crude oil inventories [1]. Group 2: Company Performance - China National Offshore Oil Corporation (CNOOC) saw its stock price increase by 2.36%, reaching HKD 19.960 [1]. - PetroChina's stock rose by 1.01%, reaching HKD 7.970 [1]. - Sinopec's stock experienced a smaller increase of 0.48%, reaching HKD 4.150 [1].

美国对俄两大石油巨头实施制裁,国际油价应声跳涨

Zhi Tong Cai Jing· 2025-10-23 00:13

Group 1 - The U.S. government has imposed sanctions on major Russian oil producers, leading to a significant increase in oil prices, with West Texas Intermediate rising by 2.5% to nearly $60 per barrel and Brent crude settling around $63 per barrel [1] - The sanctions target state-owned Russian oil giants Rosneft PJSC and Lukoil PJSC, which together account for nearly half of Russia's crude oil exports, with an average daily export volume of approximately 2.2 million barrels in the first half of this year [2] - The sanctions come as part of a broader strategy to pressure President Putin to negotiate an end to the war in Ukraine, marking a shift in the U.S. administration's stance [1] Group 2 - The European Union has reached an agreement on a new package of sanctions against Russia, which is expected to be approved soon, targeting 45 entities that assist Russia in evading sanctions, including 12 companies based in mainland China and Hong Kong [2] - The oil and gas sector contributes about one-quarter of the Russian federal budget, highlighting the economic significance of these sanctions [2] - Despite the recent price increase, futures prices may continue to decline for the third consecutive month due to signs of global oversupply [1]

10月3日外盘头条:政府停摆加剧美元风险 亚马逊遭联邦调查 马斯克号召取消订阅奈飞 英特尔股价...

Xin Lang Cai Jing· 2025-10-02 21:40

Group 1 - President Trump claims the government shutdown presents a "once-in-a-lifetime opportunity" to cut more Democratic priorities, indicating a strategy to undermine political opponents during the shutdown period [4][5] - The White House has frozen approximately $18 billion in funding for two major infrastructure projects in New York City and canceled about $8 billion in climate-related projects favoring Democratic states [4][5] Group 2 - A top forex analyst warns that the government shutdown exacerbates risks for the US dollar, with critical Federal Reserve communications becoming essential for traders due to the absence of economic data [7] - The political deadlock has delayed the release of weekly jobless claims data and may postpone the monthly non-farm payroll report [7] Group 3 - Amazon is under federal investigation after two Prime Air delivery drones collided with a crane in Arizona, leading to a temporary halt of drone services in the area [9] - The incident occurred near a commercial area close to an Amazon warehouse, prompting the company to cooperate with authorities for an investigation [9] Group 4 - Intel's stock price surged over 50% last month, with shares reaching above $37, resulting in the value of the US government's 10% stake in the company rising to approximately $16 billion [11] - The Trump administration acquired 433.3 million shares of Intel at $20.47 per share, totaling an investment of $8.9 billion [11] Group 5 - Elon Musk urged his followers to cancel their Netflix subscriptions due to controversy surrounding an animated show, which has drawn criticism from conservative groups [13] - The controversy relates to the show's representation of transgender characters, leading to its cancellation after two seasons in 2023 [13] Group 6 - President Putin stated that if the global market loses Russian oil supply, prices could "skyrocket" and exceed $100 per barrel [15] - He emphasized the severe implications for the global energy sector and economy if Russian oil is removed from the market [15]

92号汽油逼近7.2元,新一轮调价在即,车主该何时加油?

Sou Hu Cai Jing· 2025-09-28 19:37

Core Viewpoint - The recent surge in oil prices is driven by geopolitical tensions and market dynamics, with expectations of further increases in the near future [1][3][4] Price Adjustments - A new round of oil price adjustments is underway, with an expected increase of 120 yuan per ton, leading to a rise of 0.1 yuan per liter for 92 and 95 gasoline [1][2] - By October 13, the price increase could reach 200 yuan per ton, potentially pushing 92 gasoline prices above 7.2 yuan per liter [2] Market Dynamics - The oil price fluctuations are influenced by ongoing geopolitical tensions, particularly the Russia-Ukraine conflict, which has created supply concerns in the European market [3] - The recent softening of the US dollar due to Federal Reserve policies has attracted speculative investments in the oil market, further driving up prices [3] Consumer Behavior - Consumers face a dilemma on whether to refuel now or wait for potential price drops, with current prices in Shandong around 7.08 yuan per liter [4] - The upcoming holiday season is expected to increase gasoline demand, contributing to the likelihood of price hikes [3][4]

3 Stocks You Want to Keep in Case Oil Rallies

MarketBeat· 2025-09-23 11:57

Economic Outlook - There is a disconnect between oil prices and future growth expectations of the U.S. economy, especially with the Federal Reserve cutting interest rates in September 2025 [1] - Lower interest rates are expected to boost business activity and earnings potential, which could lead to increased demand for oil [2] Oil Demand and Stock Opportunities - Historically, increased business activity leads to higher oil demand, and current low inventories could result in a price spike if demand rises [2] - Companies like First Solar Inc. (FSLR), Southwest Airlines Co. (LUV), and Transocean Ltd. (RIG) are positioned to benefit from potential increases in oil prices [2] First Solar Inc. (FSLR) - First Solar's stock is currently priced at $219.20, with a P/E ratio of 18.75 and a price target of $228.80, indicating potential for growth [3] - EPS is expected to rise from $3.18 to $5.79 by Q4 2025, representing an 82% increase [5] - The PEG ratio suggests that 60% of First Solar's EPS growth has yet to be priced in, with analysts projecting a target of $262, implying a 23% upside [6][7] Southwest Airlines Co. (LUV) - Southwest Airlines is noted for its effective fuel cost hedging, which may provide a competitive advantage if oil prices rise [8] - The stock trades at a P/E ratio of 48.91, significantly higher than the transportation sector average of 13.9, reflecting market confidence in its performance [9] - Insider buying activity, such as the purchase of 3,345 shares by a company director, indicates positive sentiment ahead of potential oil price increases [10] Transocean Ltd. (RIG) - Transocean's stock is currently priced at $3.40, with a price target of $4.26, suggesting room for growth [13] - The company is expected to benefit from increased drilling activity as oil demand rises, which could lead to significant EPS growth [14] - Institutional investors have increased their holdings in Transocean, reflecting confidence in its potential upside as oil demand rebounds [14][15]

小摩:上调中国海洋石油(00883)目标价 评级上调至“增持”

智通财经网· 2025-09-04 05:52

Core Viewpoint - Morgan Stanley has raised the target price for CNOOC (00883) to HKD 23 and RMB 30 for A-shares, citing improved medium to long-term earnings per share and free cash flow outlook [1] Group 1: Target Price and Ratings - The H-share rating for CNOOC has been upgraded from "Underweight" to "Overweight," while the A-share rating remains "Overweight" [1] - The upgrade reflects an anticipated increase in oil prices by USD 5 per barrel and recent progress in optimizing natural gas sales by CNOOC [1] Group 2: Performance Comparison - CNOOC's A/H shares have underperformed compared to China Petroleum & Chemical Corporation (00857) A/H shares by 13-22% year-to-date [1] - The report suggests that OPEC's production increase signals demand recovery and healthy global inventory levels rather than chaos or price wars within OPEC [1] Group 3: Dividend Strategy - CNOOC's unexpected willingness to align its dividend yield with that of China Petroleum, which has successfully decoupled from oil prices, may help limit the downside risk for its stock price [1] - Even with potential oil price declines to USD 55 per barrel by Q1 2026, this strategy could provide some support for CNOOC's stock [1]