新能源车

Search documents

9月逆变器出口同比维持上涨,瑞浦兰钧发布多款战略新品 | 投研报告

Zhong Guo Neng Yuan Wang· 2025-10-27 03:09

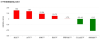

Group 1: Market Performance - The electric equipment and new energy sector increased by 4.90% this week, ranking 3rd in terms of performance, outperforming the Shanghai Composite Index [1][2] - The lithium battery index saw the highest increase at 7.05%, while the wind power index had the smallest increase at 0.62% [1][2] Group 2: New Product Launches - Ruipu Lanjun launched multiple strategic new products covering energy storage, commercial vehicles, and passenger vehicles on October 23, 2025 [2] - In the energy storage sector, new cells of 392Ah and 588Ah were introduced, along with a 6.25MWh system achieving an energy efficiency of 35.5% [2] - The passenger vehicle segment featured a hybrid battery capable of 80% charge in 10 minutes and over 4500 cycles, while the commercial vehicle solutions included a 600kWh battery box and a 455kWh battery cluster [2] Group 3: Export Data - In September 2025, China's inverter exports amounted to 5.085 billion yuan, showing a year-on-year increase of 4.96% but a month-on-month decrease of 19.21% [3] - From January to September 2025, total inverter exports reached 48.487 billion yuan, reflecting a year-on-year growth of 7.54% [3] - The Australian market experienced significant growth, with a monthly export value of 447 million yuan, up 306% year-on-year [3] Group 4: Electricity Consumption - In September 2025, the total electricity consumption in society was 888.6 billion kWh, representing a year-on-year growth of 4.5% [4] - From January to September 2025, cumulative electricity consumption reached 7,767.5 billion kWh, with a year-on-year increase of 4.6% [4] - The first industry saw a 10.2% increase in electricity consumption, while the second and third industries grew by 3.4% and 7.5%, respectively [4]

机构风向标 | 星源材质(300568)2025年三季度已披露持仓机构仅9家

Sou Hu Cai Jing· 2025-10-26 23:57

Core Insights - Star Source Material (300568.SZ) reported its Q3 2025 results, revealing that as of October 26, 2025, nine institutional investors held a total of 91.1557 million A-shares, accounting for 6.79% of the company's total share capital [1] - The institutional holding percentage decreased by 0.92 percentage points compared to the previous quarter [1] Institutional Investors - The institutional investors include Hong Kong Central Clearing Limited, Industrial and Commercial Bank of China - GF National Index New Energy Vehicle Battery ETF, and several asset management plans from Huatai Securities [1] - The total institutional holding percentage is now 6.79%, reflecting a decline from the previous quarter [1] Public Funds - One public fund, GF National Index New Energy Vehicle Battery ETF, increased its holdings by 0.65% compared to the last period [2] - Two public funds, Southern National 1000 ETF and ChiNext 200 ETF, reported a slight decrease in holdings [2] - A total of 164 public funds did not disclose their holdings this period, including several notable funds focused on new energy vehicles [2] Social Security Funds and Foreign Investment - One social security fund, the National Social Security Fund 604 Portfolio, did not disclose its holdings this period [3] - One foreign fund, Hong Kong Central Clearing Limited, increased its holdings by 0.30% compared to the previous period [3]

以双碳目标牵引全面绿色转型,十五五战略目标已清晰勾勒

SINOLINK SECURITIES· 2025-10-26 09:17

Investment Rating - The report maintains a "Buy" rating for key companies in the wind energy sector, including Goldwind Technology, Yunda Co., and Mingyang Smart Energy, based on their competitive advantages and expected market share growth [9][12]. Core Insights - The report outlines China's strategic tasks in the energy sector during the 14th Five-Year Plan, emphasizing a green transition driven by dual carbon goals, including specific measures such as carbon emission control, industrial decarbonization, and the development of renewable energy [6][13]. - The wind energy sector is expected to see a significant increase in installed capacity, with a target of no less than 120GW of new installations annually during the 14th Five-Year Plan, including at least 15GW from offshore wind [7][5]. - Hydrogen energy has been recognized as a key future industry, with strong policy support anticipated to accelerate its industrialization and commercialization, positioning it as a new growth driver [13][15]. Wind Energy - The "Wind Energy Beijing Declaration 2.0" has revised the market's expectations for wind power installations, indicating a slowdown in the trend of larger wind turbines, with a focus on products that meet market demands for power trading [7][8]. - Goldwind's Q3 performance exceeded expectations, with a revenue increase of 25.4% year-on-year and a net profit growth of 170.6% [9]. - The competitive landscape in the wind turbine sector is expected to undergo a "value reshaping" as companies adapt to market conditions and enhance product offerings [7][8]. Hydrogen and Fuel Cells - Hydrogen energy has been elevated to a national strategic level, with policies expected to support its rapid development and integration into various sectors [13][15]. - The report highlights the acceleration of green hydrogen projects and the rising demand for fuel cell vehicles, indicating a significant market opportunity [14][15]. - The establishment of a complete commercial model for green hydrogen in shipping is seen as a breakthrough that could lead to broader applications in other industries [15][16]. Photovoltaics and Energy Storage - The introduction of new measures in Henan Province is expected to enhance the profitability of independent energy storage projects, confirming the report's previous assertions about the growing demand for large-scale energy storage [17][18]. - The export of photovoltaic components remains strong, with a notable increase in shipments to emerging markets, indicating sustained demand [19][20]. - The report suggests a bottom-up investment approach in the solar and storage sectors, focusing on leading companies and innovative technologies [20]. Lithium Batteries - The lithium battery sector is experiencing a surge in demand, with some negative electrode manufacturers raising prices due to increased production capacity utilization [21][24]. - A significant breakthrough in solid-state battery technology has been achieved by XINWANDA, with a new polymer solid-state battery reaching an energy density of 400Wh/kg [26][27]. - The report emphasizes the importance of strategic partnerships in the lithium battery supply chain, particularly for enhancing sustainability and competitive advantage [22].

风机高质量发展,荣旗科技进军固态电池等静压设备领域

GOLDEN SUN SECURITIES· 2025-10-26 06:12

Investment Rating - The report maintains an "Increase" rating for the industry [5] Core Insights - The report highlights the resilience of the photovoltaic market amid supply-demand balance, with stable prices across major segments. The average transaction price for N-type raw materials is 53,200 RMB/ton, and for N-type granular silicon is 50,500 RMB/ton, both remaining stable month-on-month. The expected production of polysilicon in October is projected to reach an annual peak, with a total output of 382,000 tons in Q4, reflecting a slight year-on-year increase of 3.0% [14][15] - The wind energy sector is set to see significant growth, with the "Wind Energy Beijing Declaration 2.0" proposing an annual new installed capacity of no less than 120GW during the 14th Five-Year Plan, with offshore wind power contributing at least 15GW annually. This represents a 140% increase in the target for new installations by 2030 compared to the previous declaration [15][16] - The hydrogen energy sector is witnessing advancements, with Dongfeng and Honda launching hydrogen fuel cell commercial vehicles, aiming to contribute to carbon neutrality. The report suggests focusing on leading equipment manufacturers in this field [18][19] Summary by Sections 1. New Energy Generation - **Photovoltaics**: The market shows resilience with stable prices. The average price for N-type silicon wafers is 1.70 RMB per piece, and the delivery price for 210N components has seen a noticeable increase, with some companies quoting between 0.72-0.75 RMB per watt. Domestic component inventory is expected to decrease to around 30GW in October, indicating an improving supply-demand relationship [14][15] - **Wind Power & Grid**: The wind energy sector is expected to grow significantly, with a focus on high-quality development and price stability. The report emphasizes the importance of technological innovation and reliability in wind turbine manufacturing [15][17] - **Hydrogen & Energy Storage**: The report notes the launch of hydrogen fuel cell vehicles and suggests focusing on companies with strong brand and channel advantages in the hydrogen sector. For energy storage, it highlights the bidding and winning of projects, with a focus on companies with high growth certainty in large-scale storage [18][19][27] 2. New Energy Vehicles - The report discusses Rongqi Technology's acquisition of a 19.81% stake in Sichuan Lieneng, which specializes in isostatic pressing equipment crucial for solid-state battery production. This move is expected to enhance the production capabilities of solid-state batteries, addressing key challenges in mass production [29][30] 3. Price Dynamics in the Photovoltaic Industry Chain - The report provides insights into the price dynamics of the photovoltaic industry, indicating stable prices across various segments, with specific price points for polysilicon and silicon wafers [31][32] 4. Important News of the Week - The report summarizes significant developments in the new energy vehicle sector, including major investments in battery technology and projects aimed at enhancing production capabilities in solid-state batteries [33][34]

美国低头稀土争夺,卡脖子变主动权,资金大举抄底热门股

Sou Hu Cai Jing· 2025-10-25 21:45

Group 1 - The article discusses the significance of rare earth elements in global manufacturing, particularly in the semiconductor and electric vehicle industries, highlighting China's dominance in supplying over 90% of these materials [3][5] - The recent trade tensions between the US and China, including the proposed 100% tariff on Chinese goods, have led to a realization in the US that it heavily relies on Chinese rare earths, prompting a shift towards seeking negotiation and cooperation [3][5] - The US manufacturing sector is currently facing challenges, with PMI remaining below the growth line for three consecutive months, leading to inflationary pressures that could worsen with the imposition of tariffs [5] Group 2 - Following the news of potential easing in trade tensions, there was a significant influx of over 20 billion yuan into technology stocks in the A-share market, particularly in sectors like AI, semiconductors, and electric vehicles, indicating strong investor interest [7] - Despite the positive market response, there are concerns among investors regarding the high valuations of technology stocks and the potential for a market correction if company performance does not align with stock price increases [7][10] - The government is working on regulatory measures to control price surges, but there is a disconnect between regulatory intentions and market realities, leading to volatility and uncertainty for investors [9][10]

西安一保时捷行驶途中突然起火,车被烧成空架,“车辆未涉及碰撞”!专家:新能源车火灾发生概率与燃油车相差不大,但强度更高

Mei Ri Jing Ji Xin Wen· 2025-10-25 12:35

Core Viewpoint - A Porsche Taycan caught fire while driving in Xi'an, Shaanxi, with no casualties reported. The cause of the fire is under investigation, and this incident is part of a concerning trend of electric vehicle fires in recent days [1][3]. Group 1: Incident Details - A Porsche Taycan was completely engulfed in flames while in motion, leaving only the frame of the vehicle [1]. - This incident marks the third electric vehicle fire in two days, following similar incidents involving a Li Auto MEGA and a Volkswagen Touareg [3]. Group 2: Fire Risk Analysis - The probability of fire incidents in electric vehicles is comparable to that of traditional fuel vehicles, but the intensity of fires in electric vehicles is significantly higher [4]. - Data from the National Fire Rescue Administration indicates that the fire occurrence rate for electric vehicles is 0.288% compared to 0.2% for fuel vehicles [4]. - Over 50% of electric vehicle fires occur while the vehicle is charging or stationary, often due to battery thermal runaway [4][6]. Group 3: Safety Standards and Regulations - China has established some of the highest safety standards globally for electric vehicles, including a new mandatory standard for battery safety set to take effect in July 2026 [9]. - The revised battery safety standard emphasizes that batteries must not catch fire or explode during thermal runaway events, and includes new tests for battery protection against impacts [9][10]. - New regulations also require mechanical door handles on electric vehicles to ensure safety in emergencies, reflecting a proactive approach to managing risks associated with electric vehicle innovations [10].

未来十年,谁在撑起中国消费的天花板

Sou Hu Cai Jing· 2025-10-25 11:09

Core Insights - The article discusses the significant rise of the middle class in China, projecting an increase of 400 million middle-class individuals over the next decade, bringing the total to over 800 million, which is likened to "recreating a Europe" [3] - The "14th Five-Year Plan" outlines a goal for China to achieve basic socialist modernization by 2035, with per capita GDP expected to exceed $23,000 [3] - The focus is on not just economic growth but also on strengthening the economy through consumption upgrades, industrial advancements, and green transformations [3] Economic Projections - By 2025, the total retail sales of consumer goods in China are expected to surpass 50 trillion yuan [3] - Key industries such as smart home appliances, cultural tourism, and new energy vehicles are anticipated to enter a rapid growth phase [3] Government Initiatives - The government is enhancing resident confidence through income distribution reforms, social security improvements, and more effective public investment [3] - New productive forces such as "artificial intelligence," "low-altitude economy," and "brain-computer interfaces" are expected to accelerate in the coming decade [3] Strategic Economic Shift - The focus of the Chinese economy is shifting from GDP to GNI, emphasizing both national accounts and individual wealth [3] - This transition aims to synchronize wealth creation with the sharing of economic benefits among the population [3] Role of the Middle Class - The 800 million middle-class individuals are positioned not only as consumers but also as the main force driving China's modernization [3]

板块轮动到谁了?沪指逼近4000点 机构正大幅买入这些主题ETF

Mei Ri Jing Ji Xin Wen· 2025-10-25 04:54

Market Overview - The Shanghai Composite Index has surged past 3950 points, reaching a nearly ten-year high and approaching the 4000-point mark [1][2] - The total trading volume for the week in the Shanghai and Shenzhen markets was 8.9 trillion yuan, with the Shanghai market accounting for 3.93 trillion yuan and the Shenzhen market for 4.97 trillion yuan [2] ETF Fund Flows - Over 200 billion yuan has flowed out of stock and cross-border ETFs this week, with a net outflow of 212 billion yuan from thematic industry ETFs [2][15] - Major broad-based index ETFs experienced a net outflow of 88.41 billion yuan, with the ChiNext ETF seeing a net outflow of 37.16 billion yuan [8][15] Sector Performance - The brokerage and robotics ETFs have attracted significant capital, with net inflows of 9.87 billion yuan and 7.06 billion yuan, respectively [13][17] - Conversely, the artificial intelligence and new energy vehicle-related ETFs faced substantial outflows, with net outflows of 8.81 billion yuan and 5.93 billion yuan, respectively [15][17] Notable ETF Movements - The brokerage ETF (512000) saw its shares increase by 16.76 billion, reaching a new high of 649.19 billion shares [16][17] - The robotics ETF (562500) also experienced a rise, with shares reaching 226.54 billion, marking a new high [17] Upcoming ETF Issuance - Six new ETFs are set to be issued next week, tracking sectors such as the satellite industry, technology, and photovoltaic industries [25][26]

指数缩量新高,你赚钱了吗!下周靴子落地,还有哪些投资机会?

Sou Hu Cai Jing· 2025-10-24 08:52

Group 1 - The A-share market is seeing a shift towards dividend assets due to "high cut low" demand, adjustments in the technology sector, and the calendar effect in the fourth quarter, leading to concentrated purchase limits on several dividend funds [1] - The main sectors attracting net inflows include semiconductors, new energy vehicles, PCB boards, military industry, and new energy vehicle components [1] - The top concepts with net inflows are domestic chips, Huawei supply chain, artificial intelligence, 5G, and robotics [1] Group 2 - Recent credit risk events in two U.S. regional banks have caused market turbulence, but overall corporate cash flow remains healthy and bank liquidity is sufficient, keeping credit risk manageable [3] - The U.S. banking sector faces long-term integration pressures due to a large number of small banks and rising deposit costs, which may challenge their business models [3] - Global risk asset valuations are high, and market volatility is increasing due to tariff risks and overseas credit issues, suggesting a shift from broad market optimism to a focus on fundamental performance [3] Group 3 - International gold prices have surged, with gold ETFs seeing increased management scale and investment interest, driven by geopolitical risks and global credit conditions [5] - Despite potential short-term fluctuations, the long-term importance of gold as a core asset remains strong, supported by ongoing institutional buying [5] - The recent rise in gold prices is largely driven by speculative factors rather than fundamental changes, making future price movements difficult to predict [5] Group 4 - The Shanghai Composite Index has reached new highs, with financial stocks leading the market, and insurance funds diversifying their investment sources [11] - The Huawei Harmony ecosystem is highlighted for its combination of technology growth and self-sufficiency themes, with positive catalysts expected in September [11] - The A-share allocation strategy suggests focusing on sectors poised for recovery, such as AI computing, CROs, and basic metals, which are expected to benefit from the Federal Reserve's interest rate cuts [11]

已购车辆的这些安全隐患,谁来管一管?

3 6 Ke· 2025-10-24 03:38

Core Viewpoint - The recent surge in recalls among electric vehicle manufacturers highlights significant safety concerns and the varying responses from companies, indicating a potential crisis in quality control within the industry [1][2][3]. Group 1: Recall Statistics and Implications - In the past two months, major recalls have been announced by companies such as BYD, Xiaomi, and XPeng, with BYD recalling 115,783 vehicles and Xiaomi recalling 116,887 vehicles [1][2]. - As of September 2025, a total of 3,230 recalls have been implemented in China, affecting 120 million vehicles, with 652 recalls influenced by regulatory investigations, accounting for 53.18% of total recalls [2]. Group 2: Specific Recall Issues - BYD's recalls involve the 2015 Tang series and Yuan Pro models, with issues ranging from design flaws in the drive motor controller to improper installation of battery seals, both posing serious safety risks [3][10]. - Xiaomi's recall of the SU7 is due to deficiencies in the L2 highway navigation assistance feature, while XPeng's P7+ recall addresses steering assist sensor issues [11][13]. Group 3: Quality Control Concerns - The frequency of recalls, particularly for BYD, raises questions about the company's quality management systems, especially as these models represent a significant portion of their sales [10][25]. - Complaints from consumers regarding various models, including the DM-i series, indicate ongoing quality issues that have not met recall standards but still affect vehicle safety [18][20]. Group 4: Industry Response and Future Considerations - The industry's rapid expansion has led to a neglect of quality control, with companies like BYD prioritizing market share over product safety, which may harm long-term growth [25][33]. - Regulatory bodies are beginning to impose stricter safety requirements, as seen in the recent ban on fully hidden door handle designs, reflecting a shift towards prioritizing consumer safety in automotive design [40][42].