光刻气

Search documents

凯美特气光刻气获ASML认证,业绩预告扭亏为盈

Jing Ji Guan Cha Wang· 2026-02-11 08:09

Core Viewpoint - The certification of KaiMet Gas's photolithography gas products by ASML's subsidiary Cymer is a significant milestone in the semiconductor specialty gas sector, potentially enhancing market attention on the company's transformation prospects [1] Group 1: Stock Performance - Over the past week, KaiMet Gas's stock price has shown a downward trend, with a cumulative decline of 2.42% and a fluctuation of 4.65% [2] - On February 10, the main capital outflow was 22.557 million yuan, while on February 9, there was a net inflow of 4.9854 million yuan, indicating intensified capital competition [2] - As of February 11, the stock closed at 20.55 yuan, down 1.63% for the day, with a turnover rate of 2.48%, underperforming compared to the basic chemical sector and the overall market index [2] Group 2: Financial Report Analysis - The company's 2025 performance forecast indicates a turnaround to profitability, primarily due to steady revenue growth, reduced stock incentive expenses, and a year-on-year decrease in asset impairment losses [3] - The financial report for the first three quarters of 2025 shows a 13.19% year-on-year revenue increase, with a net profit attributable to shareholders of 75.3981 million yuan and a gross margin improvement to 35.75% [3] - However, the net profit for the third quarter alone declined by 13.72% year-on-year, reflecting business volatility [3] Group 3: Institutional Perspectives - Institutions maintain a neutral rating on KaiMet Gas, with profit forecasts indicating a 314.14% year-on-year increase in net profit for 2025, but the price-to-earnings ratio (TTM) stands at 237.71 times, significantly above the industry average, suggesting high valuation [4] - Analysts point out that the company's transition to the electronic specialty gas business still needs to validate its revenue growth capacity, with the short-term high valuation relying on concept speculation [4]

技术突破打破垄断!光刻机(胶)国产替代加速跑,国产军团加速崛起

Jin Rong Jie· 2025-11-21 07:42

Industry Overview - Recent developments in the photolithography materials sector have been positively influenced by multiple factors, including government support and technological advancements [1] - The National Standardization Management Committee has announced the establishment of the first testing method for extreme ultraviolet (EUV) photoresist, which is expected to support industrialization [1] - The "02 Special Project" continues to invest over 50 billion yuan in key material research, including photoresists [1] - The global high-end ArF and EUV photoresist markets are dominated by foreign companies, with domestic ArF photoresist localization rate below 1% and EUV photoresist still absent, indicating significant replacement potential [1] Company Highlights Guofeng New Materials - The company has completed the trial run of a 38,000-ton high-end functional polypropylene film project, enhancing its technical research and manufacturing capabilities [2] - The acquisition of a 58.33% stake in Jinzhan Technology for 699 million yuan is under review, which will integrate the upstream functional film industry chain for new displays [2] - The stock has seen significant trading activity, with a three-day limit-up and a total turnover rate of 34.87% [2] KMT Gas - The company focuses on electronic specialty gases for photolithography, with its products certified by ASML's subsidiary Cymer, gaining recognition from major international equipment manufacturers [3] - Its photolithography gas products meet advanced industry standards in purity and stability, entering the supply chains of several major domestic wafer fabs [3] - Recent interest in the photolithography sector has led to a net inflow of funds into the company's stock [3] Gaomeng New Materials - The company holds a 3.6698% stake in Beijing Kehua Microelectronics, a key player in the domestic semiconductor photoresist market [4] - It is progressing with a project to produce 124,500 tons of adhesive annually, with some products already passing customer tests [4] - The company's diverse business across multiple sectors has increased market discussion and interest [4] Saiwei Electronics - The company specializes in MEMS core processes, holding key technologies such as silicon through-silicon vias and wafer bonding [5] - Its MEMS products have competitive advantages in precision manufacturing and stability, aligning with the photolithography supply chain needs [5] - The construction of 8-inch and 12-inch MEMS production lines in Beijing is ongoing, with capacity gradually being realized [5]

A股超4900只个股下跌,两只湘股逆势涨停

Sou Hu Cai Jing· 2025-11-21 07:33

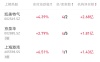

Market Overview - The A-share market experienced a collective adjustment with the Shanghai Composite Index down by 1.88%, the Shenzhen Component Index down by 2.72%, and the ChiNext Index down by 3.18% as of the midday session [1] - The total trading volume in the Shanghai, Shenzhen, and Beijing markets reached 13,174 billion yuan, an increase of 2,004 billion yuan compared to the previous day [1] - Over 4,900 stocks in the market declined, with only about 100 stocks rising [1] Notable Stocks - 28 stocks hit the upper limit of their trading range despite the overall market decline, including two companies from Hunan Province [1] - KMT Gas, a company in the chip and photoresist sector, saw its stock rise by 10% and hit the upper limit [1] - Huaci Co., a leading stock in the consumer electronics and Huawei concept sector, also hit the upper limit, marking its sixth day of five consecutive trading limits [1] Company Performance - KMT Gas reported a revenue of 485 million yuan for the first three quarters of 2025, representing a year-on-year increase of 13.19% [1] - The company achieved a net profit attributable to shareholders of 75.4 million yuan, marking a turnaround from losses in the previous year [1] - KMT Gas's subsidiary, KMT Electronics Special Rare Gas Co., has received certification as a qualified supplier from Cymer, a subsidiary of ASML, for its photolithography gas products [1] Industry Developments - The Huawei Mate80 series launch event is scheduled for November 25, featuring innovative technologies such as the Kirin 9030 chip and a 3D facial recognition large display [1] - The launch is expected to stimulate order growth in the consumer electronics supply chain and drive demand for foldable screens and AI hardware [1]

龙虎榜复盘 | 稀土分化,eSIM异动

Xuan Gu Bao· 2025-10-14 10:36

Group 1: Institutional Trading Insights - On the institutional trading leaderboard, 42 stocks were listed, with 26 experiencing net buying and 16 facing net selling [1] - The top three stocks with the highest net buying by institutions were: KaiMeiTeQi (2.68 billion), JingQuanHua (1.81 billion), and Shanghai GangWan (1.43 billion) [1] Group 2: Company Highlights - KaiMeiTeQi's electronic specialty gas project produces ultra-pure gases and photolithography products essential for chip manufacturing, achieving high quality and certifications from leading international companies [2] - NewLaiFu's acquisition of JinNan Magnetic Materials for 10.54 billion focuses on key components for micro-special motors, holding over 60% global market share in motor magnetic strips [2] - AnTai Technology specializes in high-end powder metallurgy materials, advanced functional materials, and environmental engineering materials [2] Group 3: eSIM Market Developments - DongXinHePing's eSIM products and management platform are applied in various fields including vehicle networking and smart homes, with multiple GSMA certifications [3] - China Unicom announced the opening of eSIM reservation channels, indicating a growing trend in eSIM applications alongside the proliferation of 5G technology [4] - The eSIM market is projected to expand significantly, becoming a key technology in the IoT sector, with applications in smart transportation, smart cities, wearables, and more [4]

揭秘涨停丨封板超330万手,稀土龙头获大资金抢筹

Zheng Quan Shi Bao Wang· 2025-10-13 11:00

Core Insights - The article highlights significant trading activity in the stock market, particularly focusing on companies involved in rare earth elements and advanced manufacturing technologies, indicating strong investor interest and potential growth in these sectors. Group 1: Rare Earth Sector - Baogang Co. saw a trading limit with a total order volume of 9.24 billion yuan, leading the market in rare earth stocks [2] - The Ministry of Commerce announced export controls on rare earth-related technologies, which may impact supply dynamics and pricing [2] - North Rare Earth announced an adjustment in the trading price of rare earth concentrates to 26,205 yuan per ton for Q4 2025, indicating a price increase [3] Group 2: Advanced Manufacturing Technologies - Companies like XGL Electronic and KMT Gas are involved in the production of advanced materials for photolithography, which is crucial for semiconductor manufacturing [4] - The controlled nuclear fusion sector is seeing increased activity, with companies like Hezhu Intelligent participating in the manufacturing of core components [5][6] Group 3: Market Activity - A total of 13 stocks saw net purchases exceeding 100 million yuan, with China Rare Earth and others attracting significant institutional investment [7] - The net buying amounts for key stocks included 2.03 billion yuan for Canxin Co. and 1.77 billion yuan for Duofluor, indicating strong market confidence [7]

午后异动!两只龙头股,逆势涨停

Zhong Guo Zheng Quan Bao· 2025-10-10 08:59

Market Overview - The A-share market experienced fluctuations with a shift in sector performance, particularly in non-ferrous metals, batteries, and semiconductors, which collectively adjusted [1] - The Shanghai Composite Index fell by 0.94%, the Shenzhen Component Index dropped by 2.7%, and the ChiNext Index decreased by 4.55%, with a total market turnover of approximately 2.53 trillion yuan [1] Sector Performance - The military equipment restructuring concept, third-quarter report pre-increase, and gas sectors saw significant gains, while energy metals, national big fund holdings, batteries, semiconductors, and chips faced adjustments [2] - Notable movements included the surge in gas sector stocks, with Dazhong Public Utilities and Hongtong Gas hitting the daily limit [2] - The nuclear power sector also performed well, with companies like Hezhan Intelligent and China Nuclear Engineering achieving consecutive gains [2] Key Stocks - The optical lithography concept stocks saw a rise, with leading stocks like New Lai Ying Material and Kaimete Gas reaching the daily limit [3] - New Lai Ying Material announced that its CDU products are now applied in data center liquid cooling systems, with a subsidiary set to establish operations in August 2024 [5] - Kaimete Gas maintains a leading position in the high-purity gas sector and has received certifications for its lithography gas products from ASML's subsidiary [6] Investment Insights - Institutions remain optimistic about sectors such as new energy, non-ferrous metals, and AI computing, despite the current market adjustment [7] - CITIC Securities highlighted the rapid increase in gold prices and the potential for gold to exceed $4,500 per ounce by Q1 2026 due to various market factors [7] - Open Source Securities noted that the upgrade of Sora2 capabilities and user growth is expected to sustain high demand for AI computing [8]

3只光刻机概念股年内大涨 其中一只涨超200%

Chang Sha Wan Bao· 2025-09-21 11:23

Core Insights - The light lithography machine concept sector has seen significant stock price increases, with 100 out of 105 stocks rising this year, averaging a 49.18% increase [1] - The light lithography machine is a critical device in wafer manufacturing, with low current domestic production rates, but notable progress has been made since the implementation of the "02 Special" project in 2009 [1][2] - The semiconductor industry's recovery and the demand for advanced process capacity driven by artificial intelligence are key factors contributing to the market's interest in light lithography machines [2] Company Performance - United Chemical has the highest stock price increase at 346.74% this year, with a net profit of 34 million yuan, up 21.62% year-on-year [3] - Kai Mei Teqi has seen a stock price increase of 207.83%, with a net profit of 55.84 million yuan, reflecting a significant year-on-year growth of 199.82% [3][4] - Tengjing Technology and Kent Catalysis also reported substantial stock price increases of 186.67% and 180.20%, respectively, with net profits of 37 million yuan and 39 million yuan [3] Industry Trends - The international semiconductor industry association predicts that capital expenditure for advanced process equipment will surge to over $50 billion by 2028, a 94% increase from $26 billion in 2024, with a compound annual growth rate of 18% [2] - The Ministry of Industry and Information Technology's 2024 guidance includes domestic KrF and ArF lithography machines, indicating progress in DUV lithography machine technology [1]

下周大盘如何?成交量与主力资金表现成关键

Chang Sha Wan Bao· 2025-09-19 11:49

Market Overview - On September 19, A-shares experienced a volatile session with the Shanghai Composite Index down 0.30% closing at 3820.09 points, the Shenzhen Component down 0.04% at 13070.86 points, and the ChiNext Index down 0.16% at 3091.00 points [1] - The trading volume in the Shanghai and Shenzhen markets was 232.38 billion yuan, a significant decrease of 81.13 billion yuan compared to September 18 [1] - The market showed a mixed performance with more sectors declining than advancing, particularly in energy metals, education, tourism, coal, and electronic chemicals [1] Sector Performance - The coal sector showed strong performance on September 19, becoming a key support for the market, with expectations of improved supply-demand dynamics in the second half of the year and significant quarterly performance improvements [2] - The military trade sector had the highest gains, attributed to a rebound after previous declines and external geopolitical tensions drawing investor attention [2] - The robotics sector experienced notable declines due to previous overperformance, indicating a normal correction phase [2] Company Focus: Kai Mei Teqi - Kai Mei Teqi specializes in the production of dry ice, liquid carbon dioxide, and other industrial gases, with a projected earnings per share of 0.08 yuan and a net profit of 55.8461 million yuan for the first half of 2025, reflecting a year-on-year growth rate of 199.82% [3] - The company has secured certifications for its ultra-pure gases and photolithography products from leading international firms, enhancing its market position [3] - Kai Mei Teqi has established 12 sets of production facilities for electronic specialty gases, catering to high-demand sectors such as semiconductors, aerospace, and medical [3]

龙虎榜复盘 | 光刻机逆市表现,存储再度大涨

Xuan Gu Bao· 2025-09-19 10:38

Group 1: Stock Market Activity - 26 stocks were listed on the institutional trading leaderboard, with 11 stocks seeing net purchases and 15 stocks experiencing net sales [1] - The top three stocks with the highest net purchases by institutions were Ganfeng Lithium (6.71 billion), Guangdong Hongda (3.25 billion), and Hanhigh Group (1.03 billion) [1][2] Group 2: Ganfeng Lithium - Ganfeng Lithium's stock increased by 10.00%, with 3 buyers and 1 seller on the leaderboard [2] - The company has made significant progress in solid-state battery research and has established a comprehensive layout covering key areas such as sulfide electrolytes, oxide electrolytes, and metallic lithium anodes [2] Group 3: Photolithography Equipment - Core components are identified as key barriers in the photolithography industry, with major components including light sources, illumination, lenses, and worktables [3] - The global photolithography equipment market is projected to reach $29.37 billion by 2025, with specific market sizes for various components [3] Group 4: Storage Industry - The company is investing in new storage technology through industry funds, focusing on PCM chip development and manufacturing [5] - Major storage companies in the U.S. saw significant stock price increases, with Micron Technology and SanDisk rising over 5% and Western Digital increasing by over 4% [5] - Samsung is expected to raise prices for DRAM and NAND products by 15%-30% and 5%-10%, respectively, in Q4 [5][6] - Micron Technology has notified customers of a halt in pricing for various storage products, with potential price increases of 20%-30% [6] - Demand for storage is expected to surge due to AI advancements, leading to a supply shortage and price increases [6]

金宏气体(688106.SH):暂未涉及光刻气产品

Ge Long Hui· 2025-09-18 10:49

Group 1 - The company positions itself as a comprehensive gas service provider, offering a one-stop gas supply solution for various bulk gases, specialty gases, and fuels [1] - Currently, the company does not engage in the production of photolithography gases, but it will adhere to information disclosure rules if there are future business plans related to this area [1] - Any relevant information will be disclosed in a timely manner according to the company's obligations, and stakeholders are advised to refer to official company announcements for accurate updates [1]