MR头显

Search documents

研判2025!全球及中国MR头显行业发展历程、发展现状、出货量、竞争格局及未来发展趋势分析:联接数字与现实,MR头显引领下一代计算平台革命[图]

Chan Ye Xin Xi Wang· 2026-01-12 01:13

Core Insights - The MR headset is emerging as the next-generation computing platform that connects the physical and digital worlds, driven by AI empowerment, supply chain optimization, and ecosystem development by major players [1][10] - Global VR (including MR) headset shipments are expected to reach 9.6 million units in 2024, with a market size exceeding $72.4 billion, supported by both B2B productivity scenarios and B2C entertainment scenarios [1][12] - The Chinese MR market is projected to grow to 4.859 billion yuan in 2024, driven by the demand from Generation Z and independent innovation, with an expected surge to 41.381 billion yuan by 2028, reflecting a compound annual growth rate of over 50% [1][12] Industry Overview - MR (Mixed Reality) headsets integrate optical display, spatial positioning, and multi-modal sensing to achieve deep integration and real-time interaction between virtual content and the real environment, distinguishing it from VR and AR [2][3] - The core functions of MR headsets include real-time seamless integration of virtual and physical environments, supporting multi-modal natural interaction methods such as gesture and eye tracking [3][4] Market Dynamics - The global MR headset market is characterized by a concentrated oligopoly, with Meta, Sony, and Apple holding nearly 90% of the market share, where Meta dominates with a 73% share [13] - In China, the MR headset market is led by domestic giants Huawei and PICO, which together account for over 60% of the market, focusing on different segments such as enterprise and consumer markets [13] Development Trends - The Chinese MR headset industry is expected to advance along three main lines: technological iteration focusing on lightweight and precise interaction, ecological collaboration for a full-link synergy, and expansion of application scenarios [15][16] - Future technological advancements will prioritize user experience, with a focus on reducing device weight and enhancing interaction precision, while domestic supply chains will achieve breakthroughs in core components [15][16] - The market will see a parallel development of B2B high-value applications and B2C consumer scenarios, with manufacturers adopting differentiated positioning to drive market expansion [17]

智启未来:在乌镇峰会看见数智未来新图景

Shang Hai Zheng Quan Bao· 2025-11-09 17:22

Group 1 - The World Internet Conference in Wuzhen focused on building a community with a shared future in cyberspace, celebrating the 10th anniversary of this concept [2] - The conference attracted over 1,600 guests from more than 130 countries and regions, with the "Internet Light" expo featuring 670 companies from 54 countries [2] - Over 100 key cooperation projects in the digital economy were signed, with a total signing amount exceeding 100 billion yuan for three consecutive years [2] Group 2 - The conference established specialized committees on e-commerce and cultural heritage digitization, with over 70 members in the e-commerce committee [3] - A new immersive technology exhibition showcased advancements in AI, including core models and diverse industry applications [3] - The conference featured a "Future Town" vision, highlighting innovative experiences such as AI-assisted reading and exoskeleton robots [4][5] Group 3 - Ten companies, including Tencent and Baidu, were recognized for their innovative development cases, emphasizing the importance of responsible technology [5] - AI is expected to enhance personalized services and emotional computing, transforming user interactions and daily experiences [5][6] - The integration of AI with industry is seen as crucial for maximizing its potential and driving efficiency [6]

IDC:预计到2029年全球智能眼镜市场出货量将突破4000万台

智通财经网· 2025-10-20 05:49

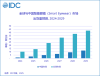

Core Insights - The global smart glasses market is projected to reach 4.065 million units shipped in the first half of 2025, representing a year-on-year growth of 64.2%, driven by advancements in AI technology, supply chain optimization, and the entry of major players into the ecosystem [1][3] - By 2029, global shipments of smart glasses are expected to exceed 40 million units, with China's market share steadily increasing and a compound annual growth rate (CAGR) of 55.6% from 2024 to 2029, the highest globally [1] Market Overview - In the first half of 2025, Chinese smart glasses manufacturers shipped over 1 million units, capturing 26.6% of the global market share, with a year-on-year growth of 64.2% [3] - Despite the dominance of international brands in the consumer market, Chinese manufacturers are gaining significant ground through aggressive marketing and channel expansion [3] - The supply chain advantages of Chinese firms in optical modules, sensors, and assembly are facilitating their overseas expansion, particularly in North America, Europe, and Southeast Asia [3] Competitive Landscape - The smart glasses market is entering a phase of restructuring, characterized by intense competition among major players and innovative breakthroughs by tech companies in niche segments [5] - The audio and audio-capturing glasses segment saw shipments surpassing 2.4 million units in the first half of 2025, with audio glasses being the primary growth driver [6] - Meta continues to dominate the global market, while Chinese brands like Xiaomi are enhancing market activity, achieving a 35.5% market share in China, surpassing the U.S. [6] Product Segmentation - The extended reality (ER) glasses market experienced a shipment growth rate of 95.2% in the first half of 2025, with Chinese manufacturers holding over 97% of the market share [7] - Non-binary full-color glasses are being optimized for weight reduction, with Chinese firms like Yiwentech and Yingmu Technology capturing over 65% of the global market [9] - The augmented reality (AR) glasses market saw a 1.3% year-on-year growth, with China holding a 57.3% market share, as domestic companies build competitive advantages through rapid product iterations [10] Future Outlook - The mixed reality (MR) headset market is currently experiencing a decline in shipments, influenced by product updates from Meta, while Chinese firms are exploring commercial applications to drive growth [11] - The virtual reality (VR) headset market is witnessing regional disparities, with Chinese manufacturers expanding their influence, particularly in the B2B sector, which accounts for over 50% of the market [12] - As core component costs decrease and display technologies mature, more manufacturers are expected to diversify their product lines to capture market opportunities [14]

上半年智能眼镜销量翻倍,小米们成幕后功臣,AR眼镜未来可期?

3 6 Ke· 2025-08-27 04:36

Core Insights - The global smart glasses market is projected to see a 110% year-on-year increase in shipment volume in the first half of 2025, according to Counterpoint [1] - IDC forecasts that China's smart glasses shipments will reach 2.907 million units in 2025, marking a 121.1% year-on-year growth [1] Industry Overview - Smart glasses, once considered niche products, are emerging as a new force in the smart terminal market [4] - The current domestic market for smart glasses is primarily divided into audio recording glasses and AR glasses, with audio recording glasses being the main sales driver due to their lower entry barriers and more affordable pricing [5] Company Contributions - Xiaomi is identified as a significant contributor to the growth in smart glasses sales, with its AI glasses achieving over 30,000 user activations shortly after launch, setting a new sales record in China [7] - Other major brands like Huawei and 雷鸟 are also performing well in sales across major e-commerce platforms, showcasing the brand power of established companies [9] Technological Advancements - AI glasses are evolving to include features such as voice interaction, simple touch controls, and multi-modal technologies, enhancing user experience [5][12] - AR glasses are advancing with unique functionalities, such as real-time translation and navigation, as seen in products like Rokid Glasses [13] Market Dynamics - The decline in prices of smart glasses is a key factor driving their adoption, with basic models now available for a few hundred to a couple of thousand yuan, making them more accessible to consumers [19] - The market is expected to continue its rapid growth, particularly in China, as local manufacturers enhance product offerings and consumer awareness increases [21] Future Outlook - The smart glasses market is anticipated to diversify, with AI glasses excelling in various applications, AR glasses shining in consumer entertainment, and XR glasses showing significant potential [21] - Despite the growth, challenges remain in areas such as battery life, comfort, and market awareness, which need to be addressed for broader acceptance [22][23]

苹果、vivo、荣耀接连入局!手机厂商为何看好MR新赛道?

Zheng Quan Shi Bao Wang· 2025-08-26 13:54

Group 1: Industry Overview - The mixed reality (MR) market is still in its early stages, with various companies like vivo, Honor, Xiaomi, Huawei, and OPPO entering the space, reflecting a broader industry anxiety about growth [1][4] - Apple's MR headset, Vision Pro, faced disappointing sales, with only 500,000 units sold by the end of 2024, leading to its production halt [3][4] - The Chinese consumer-grade XR device market saw a retail volume of 307,000 units in the first half of 2025, a 17.6% year-on-year increase, but the VR/MR segment experienced a 25.6% decline [3][4] Group 2: Company Strategies - Vivo launched its first MR headset, the vivo Vision Exploration Edition, which is the lightest MR headset on the market at 398g, but it is currently only available for reservation [2] - Vivo's MR team has grown to 500 members, with a long-term vision of integrating MR technology into household robotics [2][3] - Xiaomi adjusted its annual smartphone sales target to approximately 175 million units due to market conditions, indicating a shift in focus towards MR technology [6] Group 3: Market Dynamics - The global VR/MR shipment is expected to reach 5.6 million units in 2025, potentially growing to 14.4 million units by 2030 [5] - The smartphone market is saturated, prompting manufacturers to explore MR as a means to expand their business boundaries and create a multi-device ecosystem [6][7] - The integration of MR with robotics is seen as a way to enhance human-machine interaction, with MR serving as a data collection tool for robots [7][8] Group 4: Challenges and Future Outlook - Industry experts highlight several challenges for MR and robotics, including the need for high-performance sensors, real-time data processing, and cost-effective production [7][8] - The development of a robust application ecosystem and user-friendly interfaces is crucial for the widespread adoption of MR technology [4][5] - The transition from consumer electronics to more reliable systems for robotics is necessary for companies looking to leverage MR technology [8]

AI日报丨最强人形机器人“大脑”!英伟达推Jetson Thor,AI性能暴涨7.5倍

美股研究社· 2025-08-26 12:58

Group 1 - Nvidia launched the Jetson Thor robotics platform, significantly enhancing AI computing power by 7.5 times and energy efficiency by 3.5 times compared to previous models. The developer kit starts at $3,499, while bulk orders of the production module are priced at $2,999 each. Over 2 million developers are currently utilizing Nvidia's robotics technology stack [5][6][11]. - Mobile manufacturers are increasingly investing in new human-computer interaction technologies, with companies like Apple, Vivo, Honor, Xiaomi, Huawei, and OPPO entering the mixed reality (MR) and augmented reality (AR) markets. However, initial sales of Apple's MR headset were disappointing, leading to its discontinuation, and Xiaomi's AI glasses faced a return wave [5][6]. - Saudi AI company Humain is constructing its first data centers, set to begin operations in early 2026, and plans to import chips from Nvidia and other suppliers to establish Saudi Arabia as a regional AI hub [6][7]. Group 2 - Wedbush reported that Nvidia's demand-to-supply ratio is 10:1 ahead of its earnings report, making it a focal point for market attention. Analysts expect Nvidia's earnings per share to be $1.01, with revenue projected at $46 billion [11][12][13].

马斯克正式起诉OpenAI和苹果,电商成为小红书一级入口 | 蓝媒GPT

Sou Hu Cai Jing· 2025-08-26 10:48

Group 1: Legal Actions and Allegations - Musk's company xAI has filed a lawsuit against OpenAI and Apple, accusing them of illegal collusion to hinder competition in the AI sector [1] - Musk claims that Apple is violating antitrust laws by favoring OpenAI in its app store rankings, making it difficult for other AI companies to compete [1] - Musk has threatened immediate legal action against Apple and questioned why Apple has not included xAI's applications in its recommended section [1] Group 2: E-commerce Developments - Xiaohongshu has launched a new version of its app, making e-commerce a primary entry point, indicating a significant investment in its e-commerce business [1] - The new version features a "Market" page in the bottom navigation bar, positioned near the main "Home" page, showcasing Xiaohongshu's lifestyle e-commerce offerings [1] Group 3: Technology and Product Innovations - Zhixiang Future has introduced a new self-regressive image editing framework called VAREdit, which executes user commands accurately and improves editing speed to 0.7 seconds [1] - Multiple smartphone manufacturers, including Vivo, Honor, Xiaomi, Huawei, and OPPO, are entering the mixed reality (MR) and augmented reality (AR) markets, reflecting a strategic shift towards new human-computer interaction opportunities [2] - Meta Platforms plans to unveil a new type of smart glasses with a display at the upcoming Connect conference, priced around $800, indicating ongoing expansion in augmented reality and wearable technology [3]

8.26犀牛财经早报:ETF规模达5.07万亿元再创新高 车企高管称新能源汽车行业利润率5%

Xi Niu Cai Jing· 2025-08-26 02:17

Group 1: ETF Market in China - The scale of China's ETF market has reached a historical high of 5.07 trillion yuan, marking the entry into the 5 trillion yuan era [1] - The number of ETFs in the market is currently 1,271, with 101 ETFs exceeding 10 billion yuan in scale and 6 exceeding 100 billion yuan [1] - The equity ETF market has seen a year-to-date growth of over 24%, with a total scale of 41,170.94 billion yuan as of August 25, 2023 [1] Group 2: Public Fundraising Trends - Several fund companies are engaging in "second launches" for high-performing funds, which allows for more efficient fundraising and quicker market entry [2] - As of August 25, 2023, 127 public fund institutions have initiated self-purchases of their equity funds, with stock and mixed funds making up nearly half of these purchases [2] Group 3: A-Share Company Performance - By August 25, 2023, 1,688 A-share companies reported a total revenue of 9.5 trillion yuan for the first half of the year, with a slight year-on-year decrease of 0.1% [3] - The net profit attributable to shareholders reached 615.198 billion yuan, showing a year-on-year increase of 3.98% [3] - In the second quarter, these companies achieved a revenue of 4.87 trillion yuan, reflecting a quarter-on-quarter growth of 6.72% [3] Group 4: Lithium Industry Insights - The lithium price recovery is expected to improve the supply-demand relationship in the lithium mining industry, despite some companies reporting losses due to previous price drops [4] - The price of carbonate lithium has recently surged above 80,000 yuan per ton, which may positively impact miner profits and supply responses [4] Group 5: Automotive Industry Challenges - The COO of Lantu Automotive indicated that the electric vehicle industry is facing intense competition, with profit margins around 5% [5] - The need for stable cash flow and reasonable profit margins for supply chain companies is emphasized to ensure high-quality development in the automotive sector [5] Group 6: Company Announcements - Dongfeng Motor Group has acquired a 55% stake in Dongfeng Motor Co., with no change in the actual controller [7] - Beijing Junzheng is planning to issue H-shares and list on the Hong Kong Stock Exchange [8] - Hunan Gold's subsidiary has temporarily suspended operations due to a fatal accident, which may impact production and operations [9] - Yangfan New Materials announced that its controlling shareholder is under investigation, but control of the company remains unchanged [10] - Dazhu Laser reported a net profit of 488 million yuan for the first half of the year, a decline of 60.15% year-on-year [11] - Jianghuai Automobile reported a net loss of 773 million yuan for the first half of 2023 [12]

四大证券报精华摘要:8月26日

Zhong Guo Jin Rong Xin Xi Wang· 2025-08-26 00:21

Group 1 - The rare earth industry is experiencing positive mid-year performance due to policy support and growing demand, with the Wande Rare Earth Concept Index rising by 19.41% since August 18 [1] - Analysts believe the rare earth sector will benefit from increasing demand in applications such as electric vehicles and robotics, highlighting the scarcity of resources and potential price increases [1] - The Central Committee and State Council's recent opinions support the development of a national carbon market, aiming for comprehensive coverage of major industrial sectors by 2027 and a robust carbon pricing mechanism by 2030 [1] Group 2 - During the 14th Five-Year Plan period, China's customs will manage an average of 5.2 billion tons of imports and exports annually, with a total value of 41.5 trillion yuan, making it the largest globally [2] - The customs authority, in collaboration with over 20 ministries, has launched annual cross-border trade facilitation initiatives, expanding participation to 25 cities across 17 provinces [2] Group 3 - Over 1600 listed companies reported their mid-year results, with insurance funds entering the top ten shareholders of over 120 companies, particularly favoring sectors like chemicals, machinery, and electrical equipment [3] - The onshore RMB strengthened against the USD, closing at 7.1517, a rise of 288 basis points, influenced by a decline in the dollar index and improved market sentiment [3] Group 4 - The bond market is under pressure, with rising yields leading to capital losses, and traditional investment logic failing, prompting a shift towards a risk preference-driven pricing state [4] - Analysts suggest that the most pessimistic phase for the bond market may be over, indicating potential trading and allocation opportunities [4] Group 5 - Agricultural Bank of China announced a tender for AI quality inspection capabilities, reflecting the banking sector's active engagement in AI development [5] - The white liquor market faces challenges due to a lack of unified standards for vintage liquor, leading to issues of trust and quality [6] Group 6 - The implementation of personal consumption loan interest subsidies is set for September 1, with banks preparing to assist customers despite pending policy details [7] - Public fund institutions have been actively purchasing their own products, with equity funds making up a significant portion of these purchases [7] - The total scale of equity ETFs in China reached a historical high of 4.117 trillion yuan, marking a 24.05% increase since the beginning of the year [7]

手机厂商纷纷押注新赛道 竞逐人机交互下半场

Zheng Quan Shi Bao Wang· 2025-08-25 23:12

Core Viewpoint - The mobile industry is increasingly investing in mixed reality (MR) and augmented reality (AR) technologies, reflecting a strategic shift to explore new opportunities in human-computer interaction, driven by growth anxieties in the traditional smartphone market [1] Group 1: Industry Developments - Following Apple's launch of its MR headset, companies like Vivo and Honor are entering the MR space, while Xiaomi has recently introduced its first AI glasses [1] - Huawei and OPPO have also ventured into AR and AI glasses, indicating a broader trend among smartphone manufacturers to diversify their product offerings [1] Group 2: Market Challenges - Apple's initial MR headset faced poor sales and has since been discontinued, highlighting potential market challenges for new entrants [1] - Xiaomi's AI glasses experienced a wave of returns, suggesting consumer hesitance or dissatisfaction with new technology [1] Group 3: Strategic Implications - The push into MR and AR technologies by these companies is seen as a proactive measure to capitalize on future human-computer interaction opportunities, rather than a mere reaction to current market conditions [1] - This trend also reflects the overall anxiety within the industry regarding growth prospects in the traditional smartphone segment [1]