YUEXIU PROPERTY(00123)

Search documents

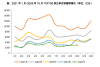

2025年1-10月中国房地产企业新增货值TOP100排行榜

克而瑞地产研究· 2025-11-01 03:19

Core Viewpoint - The real estate market in China is experiencing a downturn, with a significant decline in land acquisition activities among major companies, reflecting a cautious investment attitude due to reduced land supply and market pressures [15][16][30]. Group 1: Land Acquisition Trends - In October, over half of the 30 monitored companies did not engage in land acquisition, with only four companies acquiring land worth over 5 billion yuan [16]. - The total land acquisition value for the top 100 real estate companies reached 19,443 billion yuan, with a year-on-year increase of 27% [24]. - The average premium rate for land transactions in October was 2.7%, marking the lowest level of the year [18]. Group 2: Market Performance Metrics - The total area of land sold through public bidding in China was 60.57 million square meters, a 13% decrease month-on-month and a 25% decrease year-on-year [18]. - The total transaction amount for land was 151.9 billion yuan, reflecting a 20% month-on-month decline and a 35% year-on-year decrease [18]. - The threshold for the top 100 companies in terms of new land value decreased by 5% year-on-year to 4.28 billion yuan [21]. Group 3: Investment Behavior - The investment amount of the top 100 companies increased by 45% year-on-year, indicating a rebound in land acquisition despite the overall market decline [23][24]. - The land acquisition ratio for the top 100 companies was 0.29, with the top 10 companies showing a higher ratio of 0.42, indicating more aggressive investment strategies [26]. - Companies are focusing on acquiring quality land in core first- and second-tier cities, maintaining a rational approach to avoid overpaying [30][33]. Group 4: Future Outlook - The fourth quarter is expected to see continued cautious and rational land acquisition strategies, with over 40% of the top sales companies likely to maintain zero new land reserves [33]. - Central government policies are anticipated to optimize land supply, focusing on improving housing quality and urban renewal projects [33].

华尔街见闻早餐FM-Radio | 2025年11月1日

Hua Er Jie Jian Wen· 2025-10-31 23:17

Market Overview - Amazon shares surged nearly 10% following strong earnings, boosting tech stocks, while major US indices closed higher. Apple opened high but closed slightly down. Meta fell 2.72%, marking a nearly 12% decline in October [3] - The 10-year US Treasury yield dipped by 0.4 basis points, with a weekly increase of 9.23 basis points. The dollar rose for three consecutive days, gaining 0.27% [3] - Bitcoin rebounded by 1.80%, testing $111,000, while Ethereum saw a rise of over 3.9% [3] - Spot gold decreased by 0.55%, trading at $4002, briefly falling below $4000. Oil prices fluctuated due to the situation in Venezuela [3] Key Economic Indicators - China's official manufacturing PMI fell to 49 in October, while the non-manufacturing index rose to 50.1, indicating expansion in three key sectors [22] - High-tech manufacturing, equipment manufacturing, and consumer goods sectors maintained expansion with PMIs of 50.5%, 50.2%, and 50.1% respectively [22] - The new orders index remained at 46.0%, indicating weak market demand in the non-manufacturing sector [22] AI Sector Developments - Nvidia reached a significant AI agreement with South Korean tech giants, deploying 260,000 Blackwell chips to create Asia's first "Industrial AI Cloud" [25] - The AI sector is witnessing a shift towards off-balance-sheet financing, with companies like Meta raising $30 billion through special purpose vehicles (SPVs) [26] Company Performance - The "hottest AI sector" saw mixed results, with "Yizhongtian" experiencing significant growth, while only Zhongji Xuchuang met high expectations with a steady increase in revenue and profit margins [23] - The lithium battery industry reported a notable recovery, with a 32.86% year-on-year increase in net profit for the first three quarters, driven by surging demand in energy storage [30] International Relations Impact - Xi Jinping emphasized the importance of open development and economic globalization during the APEC meeting, proposing five key suggestions to maintain trade stability and promote inclusive growth [20] - The meeting between Xi and Canadian Prime Minister Carney highlighted the need for mutual understanding and cooperation in various sectors, including trade and energy [20]

房企“银十”成绩单:48家企业销售额环比上涨

Di Yi Cai Jing· 2025-10-31 14:27

Core Insights - The total sales of the top 100 real estate companies in China for the first ten months of 2025 reached 289.67 billion yuan, representing a year-on-year decline of 16.3%, with the decline rate widening by 4.1 percentage points compared to the first nine months of the year [1] - The sales performance in October showed a slight month-on-month recovery, with a total sales amount of 253 billion yuan, reflecting a 0.1% increase from the previous month [6] Group 1: Sales Performance by Company Tier - The average sales for the top 10 real estate companies was 143.09 billion yuan, down 15.0% year-on-year [4] - The average sales for companies ranked 11 to 30 was 35.51 billion yuan, down 17.8% year-on-year [4] - The average sales for companies ranked 31 to 50 was 17.21 billion yuan, down 16.6% year-on-year [4] Group 2: Company Breakdown - There are 7 companies in the 100 billion yuan and above tier, with sales figures of 222.7 billion yuan, 201.1 billion yuan, 189.1 billion yuan, 169.6 billion yuan, 156.0 billion yuan, 114.6 billion yuan, and 106.5 billion yuan respectively [4] - The second tier (500-1000 billion yuan) has 7 companies, down 2 from the previous year, with sales figures of 92.6 billion yuan, 92.1 billion yuan, 86.3 billion yuan, 68.7 billion yuan, 62.1 billion yuan, 55.7 billion yuan, and 55.3 billion yuan respectively [4] - The third tier (300-500 billion yuan) has 6 companies, down 3 from the previous year, with sales figures of 43.8 billion yuan, 43.5 billion yuan, 41.5 billion yuan, 33.9 billion yuan, and 32.7 billion yuan respectively [4] Group 3: Market Trends - In October, first-tier cities recorded a total transaction volume of 1.68 million square meters, remaining flat month-on-month but down 41% year-on-year [6] - The total transaction volume in 26 second and third-tier cities was 7.91 million square meters, with a slight month-on-month increase of 1% but a year-on-year decline of 35% [6] - The city of Chengdu led in monthly transactions with 800,000 square meters, followed by Qingdao, Wuhan, and Xi'an [6] Group 4: Policy Implications - The recent "14th Five-Year Plan" emphasizes boosting consumption and may lead to the relaxation of housing purchase restrictions in major cities [7] - The industry anticipates that as year-end performance targets approach, supply in key cities may improve, providing some support to the market [7] - A more comprehensive approach from the central government is needed to stabilize the industry and break the negative cycle [7]

楼市“金九银十”落幕 广州土拍市场揽金约86亿元

Zhong Guo Jing Ying Bao· 2025-10-31 12:51

Core Insights - Guangzhou's Tianhe District successfully auctioned two residential land parcels, with total sales amounting to approximately 34.83 billion yuan, acquired entirely by Yuexiu Property [1][2] Group 1: Land Auction Details - The eastern parcel (棠德路东地块) covers approximately 48,500 square meters with a floor area of about 70,300 square meters, starting floor price at approximately 31,380 yuan per square meter [2] - The western parcel (棠德路西地块) spans around 30,900 square meters with a floor area of about 41,300 square meters, starting floor price at approximately 30,950 yuan per square meter [2] - Both parcels have a maximum floor area ratio of ≤2.1 and must comply with specific urban design and public service facility requirements [2][3] Group 2: Market Context and Trends - In October, Guangzhou's residential land transactions totaled 7 parcels, with a total construction area of 492,300 square meters and a total transaction value of approximately 8.07 billion yuan, compared to 520 million yuan for 2 parcels in September [1] - The total transaction value for residential land during the "Golden September and Silver October" period reached approximately 8.59 billion yuan [1] - Yuexiu Property's acquisition of these parcels reflects a strategic focus on core cities and aims to enhance its presence in the Guangzhou market, particularly in the economically strong Tianhe District [3][4] Group 3: Competitive Landscape - Local state-owned enterprises, such as Yuexiu Property, remain dominant in Guangzhou's land auction market, although external developers are also showing interest [4][5] - Recent transactions by external developers, such as Xiamen Guomao Real Estate and Greentown South China, indicate a competitive environment in the Guangzhou real estate market [5]

还得看天河!一天落袋近35亿!越秀地产连拿两地!

Sou Hu Cai Jing· 2025-10-31 08:39

Core Insights - Yuexiu Properties successfully acquired two plots of land in the Tianhe area, with a total transaction value of approximately 34.83 billion yuan, indicating strong market activity in the region [1][4]. Group 1: Land Acquisition Details - The eastern plot was sold for a total price of 2.205 billion yuan, with a floor price of 31,380 yuan per square meter [1]. - The western plot was sold for a total price of 1.278 billion yuan, with a floor price of 30,950 yuan per square meter [1]. - The proximity of the two plots suggests a high likelihood of contiguous development by Yuexiu [4]. Group 2: Development Potential - The land sale announcement encourages the establishment of aerial corridors or underground passages between the two plots if acquired by the same entity [6]. - The plots must adhere to height restrictions due to the nearby Cencun Airport and must reserve space for the future construction of Line 19 of the subway [7]. - The area is part of the Guangtang district, which has seen significant land acquisition activity, with a total of 1,043 acres of land compensation agreements signed earlier this year [8]. Group 3: Future Planning and Amenities - The approved detailed planning for the Guangtang area includes diverse land uses such as research, commercial, and medical facilities, along with ecological amenities like the Chebei Wetland Park [9]. - The surrounding area features various amenities, including shopping centers and educational institutions, which enhance the attractiveness of the location [11]. - The region has previously seen significant land sales, with notable transactions in 2019 and 2023, indicating a robust market trend [11].

万科再获深铁集团不超过22亿元借款;远大住工向法院提交破产重整申请 | 房产早参

Mei Ri Jing Ji Xin Wen· 2025-10-30 22:03

Group 1: Vanke's Loan from Shenzhen Metro Group - Vanke announced that Shenzhen Metro Group will provide a loan of up to 2.2 billion yuan, which will be used to repay the principal and interest of bonds issued in the public market [1] - The loan has a term of no more than 3 years, with an interest rate of 1-year LPR minus 66 basis points, currently at 2.34% [1] - This loan, combined with previous asset disposals and debt extensions, is expected to alleviate Vanke's short-term repayment pressure and strengthen market confidence in its liquidity stability [1] Group 2: Yuanda Construction's Bankruptcy Restructuring - Yuanda Construction submitted a bankruptcy restructuring application to the Changsha Intermediate People's Court due to severe debt and operational crises exacerbated by macroeconomic conditions and real estate regulations [2] - The company has taken various self-rescue measures, but they have proven ineffective, leading to an inability to repay due debts [2] - This move reflects ongoing risk transmission within the real estate supply chain and signals an orderly risk clearance process [2] Group 3: Beijing Urban Construction's Land Acquisition - Beijing Urban Construction and Beijing Mingjia won a residential land bid in Changping District for 2.809 billion yuan, with a floor price of 32,008 yuan per square meter [3] - The project must include a 500-square-meter community management service facility and meet high standards for green building and prefabricated construction [3] - This land acquisition is expected to meet the housing needs of internet workers in nearby areas and highlights the dual focus on public welfare and quality in land sales [3] Group 4: Yuexiu Property's Land Acquisition in Guangzhou - Yuexiu Property acquired two residential land parcels in Guangzhou's Tianhe District for a total of 3.48 billion yuan, with floor prices around 31,000 yuan per square meter [4] - This acquisition brings Yuexiu's total land purchases in Guangzhou for 2025 to seven parcels, totaling over 8.1 billion yuan [4] - The focus on high-quality land in major cities during the industry adjustment period exemplifies structural opportunities in the sector [4] Group 5: Zhujiang's Cash Management Strategy - Zhujiang announced plans to use up to 220 million yuan of idle raised funds for cash management to enhance fund utilization efficiency and increase returns [5] - The investment products will be safe, liquid, and have a term of no more than 12 months, including structured deposits and time deposits [5] - This prudent cash management approach signals the company's commitment to safeguarding shareholder interests and reinforces market confidence in the regulated operations of transformation-oriented state-owned enterprises [5]

越秀地产(00123)竞得广州市天河区广棠地块及成都市成华区舜和家园地块

智通财经网· 2025-10-30 11:41

Core Viewpoint - The company successfully acquired two residential land parcels in Guangzhou and Chengdu through public bidding, enhancing its land reserves and strategic position in these cities [1][3]. Group 1: Guangzhou Land Acquisition - The company, through its subsidiary Guangzhou Tianyue, won the bidding for two adjacent land parcels in Guangzhou's Tianhe District for a total of RMB 34.84 billion [1]. - The land parcels, designated for residential use, have a total area of approximately 55,138.45 square meters and a total construction area of about 167,943.48 square meters [2]. - The Guangzhou parcels are strategically located about 11 kilometers from Zhujiang New Town and 10.3 kilometers from Pazhou West, with nearby amenities including schools and shopping centers [2][3]. Group 2: Chengdu Land Acquisition - The company, through its subsidiary Chengdu Yuesui, successfully acquired a residential land parcel in Chengdu's Chenghua District for RMB 13.21 billion [1]. - The Chengdu parcel covers an area of approximately 40,038.52 square meters with a total construction area of about 115,173.66 square meters [2]. - The Chengdu site is located near established commercial and medical facilities, enhancing its attractiveness for residential development [3].

越秀地产(00123.HK)竞得广州市天河区广棠地块及成都市成华区舜和家园地块

Ge Long Hui· 2025-10-30 11:07

Core Viewpoint - Yuexiu Property (00123.HK) successfully acquired two residential land parcels in Guangzhou and one in Chengdu through public bidding, indicating a strategic expansion in key urban areas in China [1][2]. Group 1: Guangzhou Land Acquisition - Yuexiu Property, through its subsidiary Guangzhou Tianyue Real Estate Development Co., successfully bid for two adjacent land parcels in Guangzhou's Tianhe District for RMB 12.78 billion and RMB 22.05 billion [1]. - The land parcels in Guangzhou Tianhe District, referred to as "Guangzhou Tianhe Guotang Land," have respective areas of approximately 19,670.68 square meters and 33,467.77 square meters, with total construction areas of about 62,452.37 square meters and 105,491.11 square meters [1]. - The planned use for the Guangzhou Tianhe Guotang land is residential, with the properties intended for sale [1]. Group 2: Chengdu Land Acquisition - The Chengdu land parcel, acquired through Chengdu Yuesui Real Estate Development Co., was successfully bid for RMB 13.2 billion, located in the Chenghua District [2]. - The Chengdu land parcel covers an area of approximately 40,038.52 square meters, with a total construction area of about 115,173.66 square meters and a planned construction area of approximately 80,077 square meters [2]. - This Chengdu site is strategically located near the core of the Chenghua District, close to established commercial and medical facilities, enhancing its attractiveness for residential development [2].

越秀地产(00123) - 公告 - 收购土地

2025-10-30 10:56

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告之內容概不負責,對其準確性或完整性亦不發表 任何聲明,並明確表示,概不就因本公告全部或任何部份內容而產生或因倚賴該等內容而引致之任何損失承擔任 何責任。 (在香港註冊成立的有限公司) (股份代號:00123) 公 告 收購土地 本公司透過成都樾穗,通過公開掛牌方式以人民幣1,321,270,500元成功競得成都市成華區舜 和家園地塊。 成都市成華區舜和家園地塊佔地面積約40,038.52平方米,總可建築面積約115,173.66平方 米,其中計容建築面積約80,077平方米。成都市成華區舜和家園地塊擬為住宅用地。成都市 成華區舜和家園地塊所建住宅物業擬用於出售。 成都市成華區舜和家園地塊位於成華區崔家店核心,緊鄰本公司天悅雲萃一期及二期項目。地 塊位於成華樞紐經濟集聚區。地塊周邊配套較為成熟,鄰近成都萬象城、龍湖濱江天街等優質 商業配套及成都新生堂婦女兒童醫院、成都市成華區第七人民醫院等醫療配套。地塊距離約 300米到達成都7號線的雙店路站,距離約6km到達天府廣場及春熙路。 越秀地產股份有限公司(「本公司」)董事會(「董事會」)欣然宣佈,於二○二五年十 ...

成都核心区热度不减 越秀补仓成华区

Cai Jing Wang· 2025-10-30 04:36

Core Insights - Chengdu has sold two residential land parcels, generating a total revenue of 53.4 billion yuan, ranking fourth nationally after Hangzhou, Beijing, and Shanghai [1][4] - The land parcels are located in prime areas with mature infrastructure, attracting significant attention prior to the auction [2] Summary by Sections Land Sale Details - The first parcel in Chenghua District has a total land area of 40,038.52 square meters and a planned construction area of 80,077 square meters, with a starting floor price of 14,800 yuan per square meter and a starting price of 1.185 billion yuan. It was ultimately acquired by Yuexiu at a floor price of 16,500 yuan per square meter, totaling 1.321 billion yuan, with a premium rate of 11.49% [2] - The second parcel in Jinjiang District is a smaller "mini" plot of approximately 6 acres, with a planned construction area of 10,067.42 square meters and a face price of 18,100 yuan per square meter. It was acquired by Renhe for 181 million yuan [2][3] Market Context - The Chenghua District parcel is expected to enhance community integration with existing projects, as it is adjacent to Yuexiu's previous developments [2] - The Jinjiang District parcel, despite its small size, is located in a well-established area with multiple metro lines and commercial centers, which may pose challenges for developers in creating a cohesive community [3] Market Performance - In 2023, the average transaction price for new homes in Jinjiang District was approximately 40,667 yuan per square meter, with an average total price of 7.66 million yuan, maintaining the highest position in Chengdu [4] - From January to September 2023, Chengdu's residential land sales totaled 64 parcels, generating 53.4 billion yuan, with a 39% increase in land area sold compared to the previous year and an average premium rate of 25.2%, reflecting heightened interest in core area land [4]