NCI(01336)

Search documents

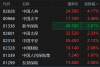

新华保险涨2.01%,成交额5.26亿元,主力资金净流出2883.48万元

Xin Lang Cai Jing· 2025-10-21 02:25

Core Viewpoint - Xinhua Insurance's stock price has shown significant growth this year, with a year-to-date increase of 43.81% and a recent upward trend in the last 5, 20, and 60 trading days [1] Financial Performance - As of June 30, 2025, Xinhua Insurance reported a net profit of 14.799 billion yuan, representing a year-on-year growth of 33.53% [2] - The company has distributed a total of 35.939 billion yuan in dividends since its A-share listing, with 13.913 billion yuan distributed over the past three years [3] Shareholder Information - The number of shareholders decreased by 15.88% to 61,000 as of June 30, 2025, while the average number of circulating shares per person increased by 18.96% to 34,325 shares [2] - Major shareholders include Hong Kong Central Clearing Limited, which holds 60.5095 million shares, an increase of 6.6977 million shares from the previous period [3] Stock Market Activity - On October 21, Xinhua Insurance's stock rose by 2.01%, reaching 68.61 yuan per share, with a total market capitalization of 214.032 billion yuan [1] - The stock experienced a net outflow of 28.8348 million yuan from main funds, with significant buying and selling activity from large orders [1]

港股内险股集体拉升上涨,中国人寿涨超4%

Mei Ri Jing Ji Xin Wen· 2025-10-21 01:56

Core Viewpoint - The Hong Kong insurance stocks experienced a collective surge, with notable increases in share prices for major companies in the sector [1] Group 1: Stock Performance - China Life Insurance led the gains with an increase of over 4% [1] - China Pacific Insurance rose by 3.5% [1] - New China Life Insurance saw a rise of 2.6% [1] - Other companies such as New China Life, Ping An Insurance, China Pacific Insurance, and AIA Group all recorded increases of over 2% [1]

港股异动丨内险股集体上涨 中国人寿涨超4% 中国平安涨超2%

Ge Long Hui· 2025-10-21 01:52

Group 1 - The core viewpoint of the article highlights a collective rise in Hong Kong insurance stocks, with China Life leading the gains at over 4% [1] - Major insurance companies such as China Life, New China Life, and PICC have announced significant profit increases, with net profit growth exceeding 40% year-on-year, and China Life leading with a projected increase of 50% to 70% [1] - The strong performance in equity investments is identified as a key driver behind the net profit growth of these companies [1] Group 2 - Several brokerage firms maintain an optimistic outlook on the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [1] - Continuous policy support from multiple departments encourages insurance capital to enter the market as long-term funds, promoting the establishment of a long-term assessment mechanism [1]

新华保险10月20日获融资买入3.00亿元,融资余额24.59亿元

Xin Lang Cai Jing· 2025-10-21 01:31

Core Insights - On October 20, Xinhua Insurance's stock rose by 0.45%, with a trading volume of 1.988 billion yuan, indicating positive market sentiment towards the company [1] - The company reported a net profit of 14.799 billion yuan for the first half of 2025, reflecting a year-on-year growth of 33.53% [2] Financing and Margin Trading - On October 20, Xinhua Insurance had a financing buy-in of 300 million yuan, with a net financing purchase of approximately 92.98 million yuan, indicating strong investor interest [1] - The total financing and margin trading balance reached 2.470 billion yuan, with the financing balance accounting for 1.75% of the circulating market value, which is above the 90th percentile of the past year [1] - In terms of margin trading, 13,300 shares were repaid, while 56,400 shares were sold short, with a total short selling amounting to approximately 3.7935 million yuan [1] Shareholder and Dividend Information - As of June 30, the number of shareholders for Xinhua Insurance was 61,000, a decrease of 15.88% from the previous period, while the average circulating shares per person increased by 18.96% to 34,325 shares [2] - Since its A-share listing, Xinhua Insurance has distributed a total of 35.939 billion yuan in dividends, with 13.913 billion yuan distributed over the last three years [3] - The top ten circulating shareholders include Hong Kong Central Clearing Limited, which increased its holdings by 6.6977 million shares to 60.5095 million shares [3]

【非银】权益投资收益大幅增长,保险股配置机会再现——上市险企2025年前三季度业绩预增公告点评(王一峰/黄怡婷)

光大证券研究· 2025-10-20 23:07

Core Viewpoint - The three listed insurance companies in China have announced significant profit growth forecasts for the first three quarters of 2025, driven by improved equity investment returns and favorable market conditions [5][6]. Group 1: Earnings Forecasts - China Life Insurance expects a net profit attributable to shareholders of 156.8-177.7 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 50%-70%. The estimated net profit for Q3 2025 is projected to be 115.9-136.8 billion yuan, with a growth of 75%-106% [5]. - New China Life Insurance anticipates a net profit attributable to shareholders of 29.99-34.12 billion yuan for the first three quarters of 2025, reflecting a year-on-year increase of 45%-65%. The Q3 2025 net profit is expected to be 15.2-19.3 billion yuan, with a growth of 58%-101% [5]. - China Pacific Insurance forecasts a net profit of 37.5-42.8 billion yuan for the first three quarters of 2025, indicating a year-on-year growth of 40%-60%. The estimated Q3 2025 net profit is projected to be 13-18.3 billion yuan, with a growth of 57%-122% [5]. Group 2: Performance Drivers - The strong earnings growth is attributed to a recovery in the stock market, which has significantly boosted equity investment returns. The CSI 300 Index rose by 17.9% in Q3, an increase of 1.8 percentage points compared to the same period last year [6]. - As of the end of September, the yield on 10-year government bonds increased by 21 basis points compared to the end of June, which is expected to positively impact China Life's service fees in Q3 [6]. - New China Life's acquisition of a stake in Hangzhou Bank is anticipated to contribute positively to its financial results due to a change in accounting treatment for the investment [6]. - China Pacific Insurance benefits from a reduction in the impact of major disasters and improvements in its non-auto insurance segment, leading to enhanced underwriting profits [6]. Group 3: Asset Allocation Trends - As of the end of H1 2025, the total stock investment of five major listed insurance companies reached 1.8 trillion yuan, a growth of 28.9% from the beginning of the year, with stock investments now accounting for 9.3% of total investment assets, an increase of 1.5 percentage points [7]. - The proportion of total invested assets in TPL stocks for these companies is 5.6%, up by 0.3 percentage points from the start of the year, indicating a significant increase in asset flexibility [7]. - New China Life's stock investment proportion is 8.9%, while China Life's is 6.7%, both showing increases from the beginning of the year, suggesting a trend towards higher equity exposure among insurance firms [7].

分红实现率大比拼 不同险企新老产品大不同

Bei Jing Shang Bao· 2025-10-20 15:35

Core Insights - The continuous decline in deposit rates has led to a growing popularity of participating insurance products, which offer both guaranteed benefits and dividend distributions [1][3] - The disclosure of dividend realization rates for participating insurance products is nearing completion, with over 70 life insurance companies having reported their rates for 2024 [3][4] Summary by Sections Dividend Realization Rate - The dividend realization rate is a key indicator for consumers, reflecting the actual dividends distributed compared to the projected benefits at the time of sale [3][4] - The overall performance of dividend realization rates has improved compared to the previous year, with many products exceeding a realization rate of 100% [3][4] Regulatory Environment - The increase in dividend realization rates for 2024 is attributed to insurance companies actively managing their funds and achieving higher returns in a recovering capital market [4] - Regulatory changes have allowed for more flexible dividend settings, enhancing the potential for insurance companies to distribute dividends [5] Performance Variability - There is significant variability in dividend realization rates among different insurance companies and their products [7] - Leading companies like Xinhua Insurance and Ping An Life have reported numerous products with realization rates at or above 100%, while some smaller firms have struggled to achieve similar results [7][8] Product Comparison - Older products generally have lower realization rates (25%-50%), while newer products, which have lower projected rates, tend to show higher realization rates [8] - The realization rate is not a direct measure of absolute dividend amounts but rather a ratio reflecting the alignment of actual and projected dividends [9][10] Consumer Considerations - Consumers should consider the dividend realization rate as an important factor when selecting insurance products, but should also focus on the insurer's long-term stability, operational strength, and investment capabilities [10] - Historical data on dividend realization rates and the insurer's overall financial health are crucial for informed decision-making [10]

“炒股”赚翻了,新华保险、人保财险、中国人寿三季报业绩大幅预喜

Xin Lang Cai Jing· 2025-10-20 11:00

Core Viewpoint - The insurance industry is experiencing significant growth in both premium income and profitability, with major companies reporting substantial increases in net profit for the first three quarters of 2025, driven by strong investment returns and improved product structures [1][2]. Premium Income and Structure Improvement - The overall insurance industry has maintained a growth trend in premium income, with China Pacific Insurance's life insurance premiums reaching 232.436 billion yuan, a year-on-year increase of 10.9%, and New China Life Insurance reporting 172.705 billion yuan, with a growth rate of 19% [4]. - New China Life Insurance achieved a premium income of 158 billion yuan from January to August 2025, reflecting a year-on-year growth of 21%, partly due to the "炒停售" effect before the adjustment of the predetermined interest rate [4]. Profit Growth Driven by Investment Returns - China Life Insurance expects a net profit attributable to shareholders of approximately 156.785 billion to 177.689 billion yuan for the first three quarters of 2025, representing a year-on-year increase of about 50% to 70% [2]. - New China Life Insurance anticipates a net profit of 29.986 billion to 34.122 billion yuan, with a year-on-year growth of 45% to 65% [2]. - The increase in profits is largely attributed to strong investment performance, with companies optimizing their asset allocation in response to a recovering capital market [3]. Investment Strategy and Asset Allocation - Insurance companies are increasing their allocation to high-quality equity assets while maintaining liquidity safety margins, benefiting from the overall recovery of the A-share market [3]. - By the end of the second quarter of 2025, the total investment in stocks by life and property insurance companies exceeded 3 trillion yuan, an increase of nearly 1 trillion yuan compared to the same period in 2024 [3]. - New China Life Insurance's investment assets included 11.6% in stocks and 18.6% in funds, significantly higher than industry peers [3]. Product Structure Transformation - In response to the adjustment of predetermined interest rates, listed insurance companies are accelerating product structure transformation, focusing on participating insurance and other floating income products [5]. - By the first half of 2025, participating insurance accounted for over 50% of the first-year premium income in individual insurance channels for China Life Insurance, while China Pacific Insurance's new policy premium income from participating insurance rose to 42.5% [5]. Market Outlook - The insurance sector is expected to continue its strong performance, with a projected premium growth rate of around 10% as the market prepares for the "开门红" period [5]. - Despite potential slowdowns in growth due to interest rate adjustments, the overall structure of the business is expected to improve, with optimistic expectations for investment returns in the fourth quarter [5].

【Fintech 周报】多地预警黄金投资骗局;今年超300家中小银行合并、解散;农行股价“12连阳”

Sou Hu Cai Jing· 2025-10-20 10:34

Regulatory Dynamics - The Financial Regulatory Bureau has published a list of 238 insurance institutions with designated regulatory responsibilities, effective until June 30, 2025, indicating a shift of regulatory authority to local agencies for most property, reinsurance, and life insurance institutions [1] - Multiple local governments have issued warnings about scams related to gold custody, rental returns, and virtual investments, urging the public to be cautious of high-yield investment traps [1] Industry Dynamics - Over 300 small and medium-sized banks have merged, dissolved, or exited the market in 2025, indicating a significant acceleration in industry consolidation, particularly among local rural commercial banks and village banks [2] - Agricultural Bank of China has integrated over 190 rural commercial bank branches in Jilin, reflecting a systematic approach to reform and restructuring in the rural banking sector [3] - Several payment institutions have undergone capital adjustments and personnel changes, with La Ka La reducing its registered capital from approximately 788 million to 777 million yuan [4] Corporate Dynamics - China Pacific Insurance expects a net profit increase of 40% to 60% for the first three quarters of 2025, driven by stable economic performance and strategic business improvements [7] - New China Life Insurance reported a 19% year-on-year increase in premium income, totaling 172.7 billion yuan for the first nine months of 2025 [7] - Yuexiu Group has completed an 18 billion HKD acquisition of Hong Kong Life, enhancing its financial services portfolio [7] - Ant Group's acquisition of Yao Cai Securities has received approval from the Hong Kong Securities and Futures Commission, pending further regulatory approvals [8] - Agricultural Bank of China's A-share stock has experienced a "12 consecutive days" rise, with its price-to-book ratio surpassing 1 for the first time in years [8]

泉XIN守护│以专业守护诠释文化内核,新华保险全程护航济南马拉松顺利完赛!

Qi Lu Wan Bao· 2025-10-20 07:53

9 > 济南(泉城)马拉松 . . . C NCI 新华保险 最新 ABS 以专业寄护途聚文化内核 新华民险会程护航济南马拉松 ·顺利完赛! 2025 当大明湖畔的晨光唤醒赛道,2025 济南(泉城)马拉松于10月19日7时30分鸣 枪开跑。作为赛事官方唯一指定保险赞 助商,新华保险以"保险赞助+全程服务 +深度参与"的三维实践,将"奋进自 强、守正创新"的文化主旨与"人民美 好生活守护者"的使命担当深度融合, 为这场中国田协A1认证的专业赛事筑牢 安全防线,注入金融温度。 专业保障筑根基 Part.01 践行"行稳致远"承诺 本届济南马拉松吸引10万余人报名,最终3万名跑 友从21个国家和地区汇聚济南,赛事规格与参与热 度创历届新高。针对赛事专业性升级需求,新华保险精 准定制全场景保障方案,为全体参赛选手、赛事工作人 员及志愿者构建涵盖意外身故、伤残、医疗及突发急性 病的全方位风险保障,累计保额392.7亿元;并同步纳 入公众责任险,覆盖马博会及赛道周边观众,以"诚信审 慎"的专业态度筑牢赛事安全基石。 依托全国多场马拉松赛事保障经验,新华保险山东 分公司组建专属服务团队,开通赛事保障绿色通道, 建立"线上 ...

龙头保险公司业绩超预期,关注证券保险ETF等投资机会

Mei Ri Jing Ji Xin Wen· 2025-10-20 07:04

Core Viewpoint - The A-share third quarter reports are accelerating disclosure, with several insurance companies exceeding expectations, particularly China Life, which is projected to see a year-on-year increase in net profit attributable to shareholders of 50%-70% for the first three quarters, and a quarterly increase of 75%-106% in Q3 despite last year's high base [1] Group 1: Company Performance - China Life's net profit attributable to shareholders is expected to grow by 50%-70% year-on-year for the first three quarters, with a Q3 single-quarter growth of 75%-106% [1] - New China Life has also announced a profit increase, with a year-on-year growth rate exceeding 45% [1] Group 2: Market Trends - There are signs of a market style shift towards undervalued blue-chip stocks in the fourth quarter [1] - The current valuation of A-share insurance stocks remains low, but their growth rate is relatively high compared to the entire industry, highlighting their investment value [1] - As the fundamentals on both the asset and liability sides continue to improve, the valuation center of insurance stocks is expected to rise further [1]