PING AN OF CHINA(02318)

Search documents

机构眼中的“资产明珠”,中国平安三季报再度起舞

Ge Long Hui· 2025-10-29 09:45

Core Viewpoint - The Chinese capital market is showing a clear upward trend, with the Shanghai Composite Index hovering around the 4000-point mark, reaching a nearly ten-year high. Goldman Sachs predicts a "slow bull" market for Chinese stocks, with the MSCI China Index expected to rise by 30% over the next two years [1][2]. Group 1: Company Performance - China Ping An reported a significant increase in operational profit for the first three quarters of 2025, reaching 116.26 billion yuan, a year-on-year growth of 7.2%. The net profit attributable to shareholders was 132.86 billion yuan, up 11.5%, with a substantial quarterly increase of 45.4% [1][2]. - The company's equity attributable to shareholders reached 986.41 billion yuan as of September 30, 2025, reflecting a 6.2% increase from the beginning of the year [1]. Group 2: Business Segments - The insurance sector remains a strong foundation for China Ping An, with life and health insurance new business value growing by 46.2% year-on-year, accelerating from a mid-year growth rate of 39.8% [4][5]. - The agent channel has seen a significant improvement, with new business value per agent increasing by 29.9% year-on-year, and the overall new business value from this channel growing by 23.3% [7]. - The bancassurance channel has emerged as a key growth driver, with new business value soaring by 170.9% year-on-year, benefiting from strategic partnerships with major banks [7][9]. Group 3: Strategic Initiatives - The integration of comprehensive finance and healthcare services is enhancing customer engagement and operational efficiency, with operational profit for the first three quarters reaching 116.26 billion yuan, a 7.2% increase [10][12]. - The healthcare and elderly care services have expanded significantly, with nearly 127 billion yuan in health insurance premiums and a 58% increase in sales of pension insurance products that include home care services [13][12]. Group 4: Market Dynamics - The current market environment is characterized by a focus on stable cash returns, making Ping An's consistent dividend policy and high dividend yield attractive to investors [20]. - The company's valuation is appealing, with several institutions maintaining "buy" ratings and projecting significant potential upside based on strong core indicators [18][22]. Group 5: Technological Integration - The integration of AI technology is reshaping Ping An's business model, enhancing efficiency, cost management, service quality, and risk prevention [21]. - AI is being utilized across various functions, including agent recruitment, training, and personalized sales support, contributing to business growth and improved customer experience [21].

机构眼中的“资产明珠”,中国平安三季报再度起舞

格隆汇APP· 2025-10-29 09:31

Core Viewpoint - The article highlights the formation of a "slow bull" market in China's capital market, with the MSCI China Index expected to rise by 30% over the next two years, driven by a reassessment of asset values by global funds [2][3]. Group 1: Company Performance - China Ping An reported a significant increase in operational profit for the first three quarters of 2025, reaching CNY 116.26 billion, a year-on-year growth of 7.2%, and net profit of CNY 132.86 billion, up 11.5% [3]. - The third quarter saw a remarkable net profit growth of 45.4%, indicating strong market response to the company's performance [3]. - The company's stock price surged following the earnings report, with a peak increase of over 3% on the day of the announcement [3]. Group 2: Core Business Resilience - The insurance sector remains a solid foundation for China Ping An, showcasing resilience through improved operational efficiency and channel restructuring [6][11]. - The life insurance and health insurance sectors demonstrated robust growth, with new business value increasing by 46.2% year-on-year, surpassing the mid-year growth rate of 39.8% [7]. - The agent channel's new business value grew by 23.3%, while the bancassurance channel saw a staggering increase of 170.9% in new business value [9]. Group 3: Integrated Financial and Healthcare Ecosystem - The integration of comprehensive finance and healthcare services is a key strategy for China Ping An, enhancing customer engagement and operational efficiency [12][19]. - The company has achieved significant penetration in the healthcare sector, with nearly 127 billion CNY in health insurance premiums and extensive service coverage in 85 cities [18]. - Customers benefiting from the healthcare ecosystem show a much higher retention rate and contract numbers compared to those without access to these services [19]. Group 4: Market Dynamics and Valuation - China Ping An's growth trajectory aligns with macro policies and industry regulations, creating a favorable environment for business expansion [23]. - The company is viewed as an attractive investment opportunity, with several institutions maintaining "buy" ratings and projecting significant price increases based on strong core indicators [24]. - The ongoing bull market and the demand for stable cash returns make Ping An's consistent dividend policy appealing to investors [26]. Group 5: Technological Empowerment - The integration of AI technology is transforming various aspects of Ping An's operations, enhancing efficiency, cost management, and risk assessment [26]. - AI is also pivotal in creating a seamless connection within the healthcare ecosystem, further solidifying the company's competitive edge [26]. - The strategic use of technology is expected to yield sustainable growth and a robust competitive position in the market [27].

中国平安(601318):增配权益带动业绩超预期,NBV增速进一步扩张

KAIYUAN SECURITIES· 2025-10-29 09:12

Investment Rating - The investment rating for Ping An Insurance (601318.SH) is maintained as "Buy" [1] Core Insights - The group's operating profit for the first three quarters of 2025 reached 116.3 billion yuan, a year-on-year increase of 7.2%, significantly improving from the 3.7% growth in the first half of 2025, primarily driven by improvements in asset management and property insurance segments [4] - The net profit attributable to shareholders for the same period was 132.9 billion yuan, up 11.5% year-on-year, with a substantial increase of 45.4% in the third quarter, driven by high investment returns [4] - The new business value (NBV) for individual insurance reached 35.7 billion yuan, a year-on-year increase of 46.2%, indicating strong growth in the insurance sector [5] - The company has adjusted its net profit forecasts for 2025-2027 to 138.9 billion, 151.2 billion, and 168.0 billion yuan respectively, reflecting a positive outlook for future performance [4] Financial Performance Summary - For the first three quarters of 2025, the insurance service revenue was 253.4 billion yuan, a year-on-year increase of 3.0%, with a combined cost ratio of 97.0%, showing a year-on-year improvement of 0.8 percentage points [6] - The total investment income for the insurance fund portfolio was 5.4%, an increase of 1.0 percentage points year-on-year, indicating a solid investment performance [6] - The NBV margin improved to 30.6%, up 9.0 percentage points year-on-year, driven by a reduction in the preset interest rate and optimization of product structure [5] Valuation Metrics - The projected new business value for 2025 is 38.7 billion yuan, with a year-on-year growth of 35.5% [7] - The estimated net profit for 2025 is 138.9 billion yuan, reflecting a year-on-year increase of 9.7% [7] - The price-to-earnings (P/E) ratio for 2025 is projected at 7.57, indicating a favorable valuation compared to historical levels [7]

保险板块10月29日涨0.92%,中国平安领涨,主力资金净流出5.05亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

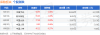

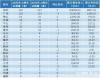

Core Insights - The insurance sector experienced a rise of 0.92% on October 29, with China Ping An leading the gains [1] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index closed at 13691.38, up 1.95% [1] Insurance Sector Performance - China Ping An (601318) closed at 58.95, with a gain of 2.06% and a trading volume of 1.0444 million shares, amounting to a transaction value of 6.172 billion [1] - New China Life Insurance (601336) closed at 70.05, up 1.49%, with a trading volume of 169,100 shares [1] - China Pacific Insurance (601601) closed at 37.60, up 0.80%, with a trading volume of 590,700 shares [1] - China Life Insurance (601628) closed at 45.22, up 0.27%, with a trading volume of 175,700 shares [1] - China Reinsurance (601319) closed at 8.83, up 0.46%, with a trading volume of 589,300 shares [1] Fund Flow Analysis - The insurance sector saw a net outflow of 505 million from institutional investors, while retail investors contributed a net inflow of 434 million [1] - Among individual stocks, New China Life Insurance had a net inflow of 27.46 million from institutional investors, while China Ping An experienced a net outflow of 306 million [2] - China Life Insurance saw a net inflow of 19.49 million from retail investors, despite a net outflow of 51.38 million from institutional investors [2]

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].

中国平安(601318):2025年三季报点评:投资驱动,增速转正

Huachuang Securities· 2025-10-29 07:31

Investment Rating - The report maintains a "Strong Buy" rating for Ping An Insurance (601318) with a target price of 74.3 CNY [1][6]. Core Insights - In Q1-Q3 2025, the group achieved a net profit attributable to shareholders of 132.9 billion CNY, a year-on-year increase of 11.5%, and an operating profit of 116.3 billion CNY, up 7.2% year-on-year [1]. - The new business value (NBV) for life insurance increased by 46.2% year-on-year to 35.7 billion CNY, indicating strong growth in new business [1]. - The combined ratio (COR) for property insurance improved by 0.8 percentage points to 97%, reflecting better cost management and a decrease in natural disaster impacts [1]. - The non-annualized net investment return rate was 2.8%, down 0.3 percentage points year-on-year, while the comprehensive investment return rate rose to 5.4%, an increase of 1 percentage point year-on-year [1]. Financial Performance Summary - For Q1-Q3 2025, the life insurance segment's new business premium (NBP) grew by 2.3% year-on-year to 141.8 billion CNY, marking a return to positive growth [1]. - The bank insurance channel saw a remarkable increase of 170.9% in NBV, driven by the expansion of external cooperation networks and product upgrades [1]. - The overall property insurance segment reported a premium income of 256.2 billion CNY, with non-auto insurance premiums growing by 14.3% [1]. - The investment portfolio size exceeded 6.41 trillion CNY, reflecting an 11.9% increase since the beginning of the year [1]. Earnings Forecast - The report adjusts the EPS forecast for 2025-2027 to 8.0, 8.8, and 9.5 CNY respectively, up from previous estimates of 7.1, 8.2, and 9.1 CNY [1][7]. - The projected net profit for 2025 is 145.1 billion CNY, representing a year-on-year growth of 14.6% [7].

险资举牌次数再创新高,这类资产是挚爱

Mei Ri Jing Ji Xin Wen· 2025-10-29 06:27

Group 1 - The core viewpoint of the articles highlights that insurance capital has reached a record high in shareholding activities this year, with 31 instances of stake acquisitions, surpassing the previous peak in 2020 and reaching the highest level since records began in 2015 [1] - Ping An Asset Management has increased its stake in China Merchants Bank H-shares to 18.04% by purchasing 3.278 million shares, indicating that the underlying client is likely to be insurance capital [1] - Analysts suggest that the insurance capital strategy has transitioned from a "buy-and-hold" phase (1.0) to a more selective and balanced approach (2.0) [1] Group 2 - This year, insurance capital has made 24 stake acquisitions, primarily in the financial and public utility sectors, with additional investments in electrical equipment, information technology, and healthcare [1] - Low valuations and high dividend yields are significant reasons for the selection of investment targets by insurance capital, as exemplified by the Agricultural Bank of China H-shares, where Ping An's average purchase price increased from HKD 4.2257 at the beginning of the year to HKD 5.6306 by October 20 [1] - The dividend yield of Agricultural Bank of China H-shares has decreased from 5.95% at the beginning of the year to around 4.4%, but it still offers a favorable spread compared to current life insurance product interest rates [1] Group 3 - Ping An's investment style is characterized as a "sweeping" approach, focusing solely on financial stocks, including Postal Savings Bank H-shares, China Merchants Bank H-shares, Agricultural Bank of China H-shares, China Pacific Insurance H-shares, and China Life H-shares [2] - Other companies exhibit a more diversified selection style, as seen with Great Wall Life's stake acquisitions in China Water Affairs, Datang Renewable, Qinhuangdao Port, and New天绿能, spanning public utilities and transportation sectors [2] - For investors looking to emulate insurance capital strategies, a focus on H-share banks can be achieved through the Hong Kong Stock Connect Financial ETF, which has a 60% weight in H-share banks, while those seeking a diversified style may consider the Hong Kong Central State-Owned Enterprises Dividend ETF [2]

2025广东企业500强出炉:中国平安、华润、华为位居前三

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-29 06:01

Core Insights - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1] - The total operating revenue of the top 500 enterprises reached 19.36 trillion yuan, with total assets exceeding 68 trillion yuan and total R&D investment amounting to 584.96 billion yuan [1][3] Revenue Growth - The total revenue of Guangdong's top 500 enterprises has increased from 16.73 trillion yuan in 2021 to 19.36 trillion yuan in 2025, marking a historical high with a growth rate of 3.36% in 2025, a significant rebound from 0.37% in 2024 [3][5] - The revenue growth reflects the resilience and innovative vitality of these enterprises amid complex international situations and domestic reform challenges [3] Asset Expansion - The total assets of Guangdong's top 500 enterprises grew from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5] - This growth indicates a continuous strengthening of the comprehensive strength of these enterprises [5] R&D Investment - The total R&D expenditure of Guangdong's top 500 enterprises is projected to reach 584.96 billion yuan by 2025, with a focus on basic research and key core technology areas [5] - The knowledge-intensive sectors, particularly scientific research and technical services, show a high R&D intensity of 19.00%, with R&D expenses amounting to 191.65 billion yuan [6] Tax Contributions - Despite the growth in assets and revenue, the total tax contributions of these enterprises have steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [6] Regional Coordination - The report highlights a significant disparity in the distribution of enterprises, with 98.25% of revenue and 98.91% of net profit concentrated in the Pearl River Delta region, while other regions like East Guangdong and West Guangdong have less than 0.3% [8][10] - To address this imbalance, the report suggests establishing a regional collaborative system that combines innovation radiation from the Pearl River Delta with the unique characteristics of East and West Guangdong [10]

中国平安(601318):3Q25归母净利润/归母营运利润yoy+45%/+15%,表现亮眼

Shenwan Hongyuan Securities· 2025-10-29 05:57

Investment Rating - The report maintains a "Buy" rating for the company, with an upward adjustment of profit forecasts for 2025-2027 [6]. Core Insights - The company's net profit attributable to shareholders for Q3 2025 increased by 45.4% year-on-year, reaching 648.09 billion yuan, while the operating profit rose by 15.2% to 385.32 billion yuan, indicating strong performance [4][5]. - For the first three quarters of 2025, the company achieved a net profit of 1,328.56 billion yuan, a year-on-year increase of 11.5%, and an operating profit of 1,162.64 billion yuan, up 7.2% [4]. - The company’s new business value (NBV) for Q3 2025 surged by 58.3% year-on-year, reflecting robust growth momentum driven by anticipated interest rate cuts [5][8]. Financial Performance Summary - The company’s total revenue for 2025 is projected to be 1,064.09 billion yuan, with a year-on-year growth rate of 3.4% [7]. - The net profit attributable to shareholders is expected to reach 142.92 billion yuan in 2025, representing a 12.9% increase compared to the previous year [7]. - The company’s price-to-earnings (P/E) ratio for 2025 is estimated at 7.32, while the price-to-embedded value (P/EV) is projected to be 0.69 [7]. Business Segment Performance - The life insurance, property insurance, and banking segments reported operating profits of 787.68 billion yuan, 150.74 billion yuan, and 222.21 billion yuan respectively, with year-on-year growth rates of 1.9%, 8.3%, and a decline of 3.5% [4]. - The asset management segment showed improvement, turning profitable with a contribution of 49.7 billion yuan to operating profit [4]. Investment Asset Growth - The company’s investment assets grew by 11.9% year-to-date, reaching 6.41 trillion yuan, with non-annualized net and comprehensive investment returns of 2.8% and 5.4% respectively [6].

2025广东企业500强出炉:中国平安、华润、华为位居前三

21世纪经济报道· 2025-10-29 05:56

Core Viewpoint - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1]. Group 1: Scale and Growth - The total revenue of the top 500 enterprises in Guangdong reached 19.36 trillion yuan, setting a historical record [2][3]. - From 2021 to 2025, the total revenue of these enterprises is projected to increase from 16.73 trillion yuan to 19.36 trillion yuan, with a growth rate of 3.36% in 2025, significantly rebounding from 0.37% in 2024 [3]. Group 2: Asset Expansion - The total assets of Guangdong's top 500 enterprises are expected to grow from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5]. - In 2025, the total R&D expenditure of these enterprises is projected to reach 584.96 billion yuan, indicating a shift towards investing more in fundamental research and key core technologies [5]. Group 3: Industry Structure and R&D Investment - Knowledge-intensive sectors are particularly active, with the scientific research and technical services industry having a R&D intensity of 19.00%, amounting to 191.65 billion yuan in R&D expenses [6]. - The manufacturing sector, as a cornerstone of the economy, has a total R&D expenditure of 279.51 billion yuan [6]. Group 4: Taxation and Policy Impact - Despite growth in assets and revenue, the total tax paid by enterprises has steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [8]. - This "two increases and one decrease" trend indicates that tax reduction policies have created favorable conditions for enterprises to increase R&D investment and expand production [8]. Group 5: Regional Coordination and Challenges - The report highlights a significant disparity in performance among regions, with the Pearl River Delta region accounting for 98.25% of the revenue and 98.91% of the net profit of the top 500 enterprises [10]. - The report suggests establishing a regional collaborative system that combines "Pearl River Delta innovation radiation + unique undertakings in eastern and western Guangdong" to enhance coordination and innovation spillover effects [12].