CNOOC(600938)

Search documents

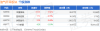

油气开采板块10月22日涨2.06%,中国海油领涨,主力资金净流入1.51亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:26

Core Insights - The oil and gas extraction sector experienced a 2.06% increase on October 22, with China National Offshore Oil Corporation (CNOOC) leading the gains [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Sector Performance - CNOOC (600938) closed at 27.13, up 3.51% with a trading volume of 889,700 shares and a transaction value of 2.384 billion [1] - Blue Flame Holdings (000968) closed at 7.71, up 0.78% with a trading volume of 362,000 shares and a transaction value of 27.6 million [1] - Intercontinental Oil and Gas (600759) closed at 2.50, up 0.40% with a trading volume of 3.3821 million shares and a transaction value of 84.2 million [1] - ST Xinchao (600777) closed at 4.20, down 1.18% with a trading volume of 196,700 shares and a transaction value of 82.394 million [1] Capital Flow - The oil and gas extraction sector saw a net inflow of 151 million from main funds, while retail investors experienced a net outflow of 794.055 million [1] - CNOOC had a main fund net inflow of 248 million, but retail investors saw a net outflow of 144 million [2] - Blue Flame Holdings had a main fund net inflow of 3.2647 million, with retail investors experiencing a net outflow of 5.974 million [2] - ST Xinchao had a main fund net outflow of 8.2383 million, while retail investors had a net inflow of 5.3715 million [2] - Intercontinental Oil and Gas had a main fund net outflow of 92.0383 million, with retail investors seeing a net inflow of 65.3056 million [2]

中国风电锚定“50亿千瓦”新目标,央企现代能源ETF(561790)备受关注,石化油服涨停

Xin Lang Cai Jing· 2025-10-22 05:54

Core Insights - The China Securities National New State-Owned Enterprises Modern Energy Index has seen a slight decline of 0.13% as of October 22, 2025, with mixed performance among constituent stocks [3] - The "Wind Energy Beijing Declaration 2.0" was released on October 20, 2025, at the International Wind Energy Conference, setting ambitious targets for wind power installation during the 14th and 15th Five-Year Plans [3] Group 1: Market Performance - The top-performing stocks include PetroChina Oilfield Services, which rose by 10.00%, and China Nuclear Engineering, which increased by 4.10% [3] - The recent trading volume for the National Modern Energy ETF was 161.57 million yuan, with a turnover rate of 3.62% [3] - Over the past year, the National Modern Energy ETF has seen an average daily trading volume of 615.35 million yuan [3] Group 2: Policy Changes - Starting November 1, 2025, the 50% VAT refund policy for onshore wind power will be canceled, while the policy for offshore wind power will continue until the end of 2027 [4] - The cancellation of tax incentives for onshore wind power is expected to impact net profits by approximately 19%, creating short-term pressure on profitability [4] Group 3: Industry Outlook - Despite the short-term challenges, the long-term outlook for the wind power industry remains robust due to China's commitment to its "dual carbon" strategy [4] - The wind power supply chain is anticipated to enter a recovery phase, with a focus on leading turbine manufacturers and offshore expansion [4] - The "Two Seas" strategy for wind power equipment is expected to enhance market share and overall profitability for companies in the sector [4] Group 4: Index Composition - As of September 30, 2025, the top ten weighted stocks in the index include Changjiang Electric Power and China Nuclear Power, accounting for 47.72% of the index [6]

宇树、泡泡玛特等都将到场,新一届进博会即将举办

Xuan Gu Bao· 2025-10-22 05:21

Group 1: Event Overview - The 8th China International Import Expo (CIIE) will be held in Shanghai from November 5 to 10, 2025, with a theme of "New Era, Shared Future" [1] - The exhibition area is expected to exceed 360,000 square meters, with participation from over 150 countries and regions, maintaining a participation rate of over 70% from Fortune 500 and industry-leading companies [1] - This year's expo will feature a product zone for least developed countries that have established diplomatic relations with China, expanding the existing African product zone [1] Group 2: Key Exhibitors and Sectors - Notable participating companies include Yushutech, Pop Mart, Jindawei, and Longan Automobile, among others [5] - The expo will showcase various sectors, including medical equipment and healthcare products, with participation from 700 Fortune 500 pharmaceutical companies and the top 10 medical equipment companies [9] - The automobile and smart mobility sector will feature 300 Fortune 500 exhibitors [11] Group 3: Related Conferences and Activities - The expo will host significant conferences such as the "Digital Economy Empowerment" forum and the "China-Latin America Economic and Trade Cooperation Think Tank Forum" [1] - Other notable events include discussions on intellectual property protection and the internationalization of enterprises, highlighting the importance of innovation and collaboration [1] Group 4: Trade Performance Insights - In September, China's import and export growth rates exceeded expectations, with a notable rebound in imports, particularly in machinery and electrical products [2] - The strong rebound in trade reflects the resilience of China's foreign trade amid tariff disruptions, reinforcing its position as a global manufacturing hub [2]

中国海油涨2.02%,成交额10.72亿元,主力资金净流入2488.82万元

Xin Lang Zheng Quan· 2025-10-22 03:37

Group 1 - The core viewpoint of the news is that China National Offshore Oil Corporation (CNOOC) has seen a stock price increase of 2.02% on October 22, reaching 26.74 CNY per share, with a total market capitalization of 1,270.95 billion CNY [1] - CNOOC's stock has decreased by 5.31% year-to-date, but has shown a recent upward trend with a 3.55% increase over the last five trading days and a 5.01% increase over the last 60 days [1] - The company reported a net inflow of main funds amounting to 24.89 million CNY, with significant buying activity from large orders [1] Group 2 - CNOOC, established on August 20, 1999, primarily engages in the exploration, production, and sales of crude oil and natural gas, with operations in various countries including China, Canada, the USA, the UK, Nigeria, and Brazil [2] - The company's revenue composition is as follows: 82.73% from oil and gas sales, 14.96% from trading, and 2.31% from other activities [2] - As of June 30, 2025, CNOOC reported a total revenue of 207.61 billion CNY, a year-on-year decrease of 8.45%, and a net profit attributable to shareholders of 69.53 billion CNY, down 12.79% year-on-year [2] Group 3 - CNOOC has distributed a total of 255.99 billion CNY in dividends since its A-share listing, with 179.05 billion CNY distributed over the past three years [3] - As of June 30, 2025, the number of shareholders for CNOOC was 232,800, a decrease of 0.25% from the previous period [2][3] - Hong Kong Central Clearing Limited is noted as a new major shareholder, holding 5.95 million shares [3]

我国首个国家级深水油气应急救援基地在琼启用

Hai Nan Ri Bao· 2025-10-22 01:20

Core Points - The establishment of China's first national-level deep-water oil and gas emergency rescue base in Hainan marks a significant breakthrough in the construction of the offshore emergency rescue system, greatly reducing response times in the southern sea areas of China [1][3]. Group 1: Base Overview - The Hainan base is a joint construction by the Ministry of Emergency Management, Hainan Provincial Government, and China National Offshore Oil Corporation (CNOOC), covering an area of over 11,000 square meters [3]. - The base is equipped with China's first independently developed 3,000-meter underwater emergency well sealing device and an underwater oil recovery system, enabling rapid well sealing and efficient oil recovery [3]. Group 2: Response Time Improvement - Prior to the establishment of the Hainan base, domestic deep-water oil and gas well control emergency rescue relied heavily on foreign assistance, with an average response time of about 30 days from the nearest foreign emergency base [4]. - With the Hainan base operational, domestic emergency response teams can now reach relevant sea areas in the southern part of China within 48 hours [4]. Group 3: Future Development - The Hainan base aims to enhance offshore emergency rescue capabilities and continuously improve a multi-functional emergency rescue system, integrating deeply into the risk prevention framework of the Hainan Free Trade Port [4]. - The base will provide critical support for the development of the national marine economy and ecological protection [4].

深海油气勘探开发体系逐步完善

Jing Ji Ri Bao· 2025-10-21 22:01

Group 1 - China National Offshore Oil Corporation (CNOOC) has launched the country's first national-level deepwater oil and gas emergency rescue base, significantly reducing emergency response time in southern maritime areas [1] - The establishment of the rescue base marks a major breakthrough in China's offshore emergency rescue system and is a crucial step in enhancing the deep-sea oil and gas exploration and development framework [1] - The South China Sea holds approximately 24.8 billion tons of oil and 42 trillion cubic meters of natural gas, with about half of these resources located in deepwater areas [1] Group 2 - The domestic emergency response for deepwater oil and gas well control previously relied on foreign assistance, with an average response time of about 30 days; the new domestic capabilities can now respond within 48 hours [1] - Since the 14th Five-Year Plan, China has developed several deepwater oil and gas fields, including the "Deep Sea No. 1" gas field, which is the largest offshore gas field in terms of production [1] - CNOOC has improved its ultra-deepwater marine equipment manufacturing capabilities, launching the "Qinghai Techigh" brand for deepwater oil and gas production equipment [2] Group 3 - In 2024, China's dependence on foreign oil is projected to be approximately 71.9%, while natural gas dependence is expected to be around 41%, highlighting the urgency to enhance energy security and resource assurance [3] - The construction of the deepwater oil and gas exploration and development system is accelerating, with marine oil and gas production expected to grow by 4.7% and 8.7% year-on-year, respectively [3] - The increase in marine crude oil production is expected to account for nearly 80% of the national crude oil production increase, making it a significant growth driver for China's oil and gas reserves [3]

珠免集团拟转让格力房产100%股权

Zheng Quan Ri Bao· 2025-10-21 16:36

Core Viewpoint - Zhuhai Free Trade Group Co., Ltd. plans to transfer 100% equity of Zhuhai Gree Real Estate Co., Ltd. to Zhuhai Toujie Holdings Co., Ltd. in a cash transaction, which aligns with the company's commitment to exit the real estate sector within five years and focus on its duty-free business [2][3] Group 1: Transaction Details - The transaction is part of a broader strategy to divest from real estate, with the company previously committing to gradually dispose of its real estate business after a major asset swap [2] - The transfer of Gree Real Estate's equity is expected to lower the company's debt ratio, optimize asset structure, and enhance operational efficiency [2] Group 2: Business Focus and Strategy - The company's business layout focuses on three main sectors: duty-free, commercial management, and trade, with significant investments in key areas like Hainan Free Trade Port and the Hengqin Guangdong-Macao Deep Cooperation Zone [3] - Successful completion of the transaction would mark a substantial step in the company's "de-real estate" strategy, providing greater space for core business focus and capital operations [3] - The company's strategy aligns with the policy window period, aiming to leverage opportunities in the port economy by deepening its presence in the Guangdong-Hong Kong-Macao Greater Bay Area and Hainan Free Trade Port [3]

中国海洋石油有限公司 关于执行董事、副董事长及首席执行官辞任的公告

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-10-21 10:48

Core Points - The announcement states that Mr. Zhou Xinhai has resigned from his positions as Executive Director, Vice Chairman, and CEO of China National Offshore Oil Corporation (CNOOC), effective October 20, 2025 [1] - The board of directors approved the resignation with a unanimous vote of 8 in favor, with no opposition or abstentions [1] - Mr. Zhou confirmed that there are no disagreements with the board and no matters related to his resignation that need to be brought to the attention of shareholders or stock exchanges [1] Acknowledgment - The board expressed sincere gratitude for Mr. Zhou's contributions to the company and the offshore oil industry [2]

把二氧化碳“锁”回深海

Huan Qiu Wang· 2025-10-21 09:53

Core Insights - China National Offshore Oil Corporation (CNOOC) announced that its first offshore carbon dioxide (CO2) storage demonstration project, the Enping 15-1 oilfield CO2 storage project, has cumulatively stored over 100 million cubic meters of CO2, equivalent to the carbon absorption of 2.2 million trees, indicating the maturity of China's offshore CO2 storage technology and capabilities [1][8][12] Group 1: Project Overview - The Enping 15-1 platform, located in the Pearl River Mouth Basin of the South China Sea, began operations on May 22 this year, marking China's first offshore CO2 capture, utilization, and storage (CCUS) project [3][8] - The project aims to reduce CO2 emissions while enhancing oil production, utilizing high CO2 content in the oilfield to prevent corrosion and atmospheric release [7][10] Group 2: Technical Details - The CCUS technology involves capturing CO2 from emission sources, compressing it, and injecting it into geological formations for long-term storage [8][10] - The project has achieved a CO2 storage capacity exceeding 40 million cubic meters annually, with plans to scale up to over 1 million tons in the next decade, driving an additional 200,000 tons of oil production [9][12] Group 3: Industry Implications - The successful implementation of the project provides a technical template for large-scale CO2 reduction in coastal enterprises and oilfield development [12][14] - China's offshore CO2 storage potential is estimated at 25.8 billion tons, with ongoing projects aimed at creating a complete and internationally competitive offshore CCUS industry chain [14]

油气开采板块10月21日涨1.23%,洲际油气领涨,主力资金净流出5815.38万元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:28

Core Insights - The oil and gas extraction sector experienced a 1.23% increase on October 21, with Intercontinental Oil leading the gains [1] - The Shanghai Composite Index closed at 3916.33, up 1.36%, while the Shenzhen Component Index closed at 13077.32, up 2.06% [1] Sector Performance - Intercontinental Oil (600759) closed at 2.49, with a rise of 3.32% and a trading volume of 3.2767 million shares, amounting to a transaction value of 808 million yuan [1] - ST Xinchao (600777) closed at 4.25, up 3.16%, with a trading volume of 271,000 shares [1] - China National Offshore Oil Corporation (600938) closed at 26.21, with a slight increase of 0.42% [1] - Blue Flame Holdings (000968) closed at 7.65, up 0.13%, with a trading volume of 420,600 shares [1] Capital Flow Analysis - The oil and gas extraction sector saw a net outflow of 58.1538 million yuan from major funds, while retail investors contributed a net inflow of 59.9322 million yuan [1] - Intercontinental Oil had a net inflow of 13.8447 million yuan from major funds, while retail investors saw a net outflow of 3.6901 million yuan [2] - ST Xinchao experienced a net inflow of 2.7074 million yuan from major funds, with a net outflow of 4.3513 million yuan from retail investors [2] - China National Offshore Oil Corporation had a significant net outflow of 29.2681 million yuan from major funds, but a net inflow of 27.5971 million yuan from retail investors [2] - Blue Flame Holdings faced a net outflow of 45.4378 million yuan from major funds, while retail investors contributed a net inflow of 40.3766 million yuan [2]