CIG(603083)

Search documents

午间涨跌停股分析:73只涨停股、5只跌停股,CPO概念走强,剑桥科技涨停

Xin Lang Cai Jing· 2025-10-20 03:43

Group 1 - A-shares saw 73 stocks hitting the daily limit up and 5 stocks hitting the limit down during the first half of the trading day on October 20 [1] - The forestry sector was active, with Pingtan Development achieving two consecutive limit ups [1] - The CPO concept strengthened, with Cambridge Technology hitting the limit up [1] - The coal mining sector rose, with Dayou Energy achieving 6 limit ups in 7 days, Antai Group achieving 3 consecutive limit ups, and Yunmei Energy hitting the limit up [1] Group 2 - *ST Yuancheng experienced 6 consecutive limit downs [2] - *ST Yazhen faced 2 consecutive limit downs [2] - *ST Zhengping and Hunan Baiyin also hit the limit down [2]

市场高位震荡,创业板指半日涨2.49%,煤炭、算力硬件股集体走强

Feng Huang Wang Cai Jing· 2025-10-20 03:42

Market Performance - The market experienced high volatility in the morning session, with the ChiNext Index leading the gains [1] - As of the midday close, the Shanghai Composite Index rose by 0.69%, the Shenzhen Component Index increased by 1.38%, and the ChiNext Index surged by 2.49% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 1.16 trillion yuan, a decrease of 16.5 billion yuan compared to the previous trading day [1] Index Details - The Shanghai Composite Index closed at 3866.09, with a gain of 0.69% and 1717 gainers against 529 decliners [2] - The Shenzhen Component Index closed at 12863.53, up by 1.38%, with 2367 stocks advancing and 486 declining [2] - The ChiNext Index ended at 3008.56, increasing by 2.49%, with 1202 stocks rising and 179 falling [2] Sector Performance - Key sectors showing strong performance included coal, CPO, and battery industries, while non-ferrous metals experienced declines [3] - Notable stocks in the computing hardware sector, such as the "Yizhongtian" optical module leaders, saw significant gains, with several stocks hitting the daily limit [2] - The robotics sector was active, with stocks like Sanlian Forging and Dayang Electric achieving consecutive gains [2] - The chip industry also showed strength, with Sanfu shares achieving three gains in four days and Ruineng Technology hitting three consecutive limits [2] - The coal sector continued its strong performance, with Dayou Energy achieving six gains in seven days [2] - In contrast, the precious metals sector faced collective declines, with Hunan Silver hitting the daily limit down [2]

通信ETF(159695)盘中上涨3.52%,成分股剑桥科技10cm涨停,机构:持续看好25Q4通信板块机会

Sou Hu Cai Jing· 2025-10-20 03:36

Group 1 - The communication ETF has seen a turnover of 6.83% with a transaction volume of 17.29 million yuan, and its net value has increased by 76.97% over the past two years, ranking 80 out of 2353 index equity funds, placing it in the top 3.40% [3] - The highest monthly return since the establishment of the communication ETF is 33.97%, with the longest consecutive monthly gains being 5 months and a maximum increase of 76.35%, while the average return during rising months is 7.57% [3] - Galaxy Securities indicates strong demand and sustained prosperity in the AI-driven computing power industry, despite potential short-term market fluctuations and adjustments, maintaining a positive outlook for the AI computing sector from a medium to long-term perspective [3] Group 2 - According to Zheshang Securities, the communication industry is expected to see a 2.8% year-on-year revenue growth and a 7.8% increase in net profit attributable to the parent company in the first half of 2025, with steady performance improvements anticipated [3] - The report predicts continued high growth in sectors such as optical modules and liquid cooling in Q3 2025, with an ongoing improvement in the main business of operators and an increase in the proportion of innovative businesses [3] - The satellite internet industry is gradually establishing trends and is expected to see significant growth, with a positive outlook for opportunities in the communication sector in Q4 2025 [3] Group 3 - As of September 30, 2025, the top ten weighted stocks in the Guozheng Communication Index include Zhongji Xuchuang, Xinyi Sheng, ZTE Corporation, China Telecom, China Mobile, China Unicom, Tianfu Communication, Zhongtian Technology, Transsion Holdings, and Hengtong Optic-Electric, collectively accounting for 66.02% of the index [4] - The performance of individual stocks shows varied changes, with Zhongji Xuchuang increasing by 8.68% and Tianfu Communication rising by 9.80%, while China Telecom and China Mobile experienced slight declines [6] - Investors can access AI-driven optical communication investment opportunities through the communication ETF linked fund (019072) [6]

A股突变!000626,罕见“天地天”

Zhong Guo Ji Jin Bao· 2025-10-20 03:35

Market Overview - On October 20, A-shares opened higher with all three major indices rising, the ChiNext Index increased by over 3%, and the Shenzhen Component Index rose nearly 2% [1] - The Shanghai Composite Index closed at 3861.65, up 21.90 points or 0.57%, while the Shenzhen Component Index closed at 12930.81, up 241.87 points or 1.91% [2] Sector Performance - The computing hardware sector led the market, with significant gains in CPO, electronic components, and semiconductor sectors, while precious metals, banking, and agriculture sectors experienced fluctuations [4] - Over 4200 stocks rose during the trading session [4] Notable Stocks - CPO concept stocks saw a surge, with Yuanjie Technology hitting a 20% limit up, and Tianfu Communication and Zhongji Xuchuang also showing strong gains [8][11] - In the communication equipment and electronic components sectors, Zhongwei Electronics and Jingwei Huikai both reached a 20% limit up [12][13] - Solid-state battery concept stocks also performed well, with Haike Xinyuan hitting a 20% limit up, and other companies like Huasheng Lithium and Tianqi Materials following suit [14][17] Hong Kong Market - The Hong Kong market also saw gains, with the Hang Seng Technology Index rising over 3%, and notable increases in stocks such as NetEase, NIO, and Alibaba, all rising over 4% [5][6][7]

港股IPO早播报:滴普科技、三一重工、八马茶业和剑桥科技开始招股

Xin Lang Cai Jing· 2025-10-20 03:32

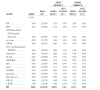

Core Viewpoint - The article provides information on the upcoming IPOs of several companies in Hong Kong, including their share prices, subscription dates, and financial details. Group 1: Company Information - Dipo Technology (01384.HK) plans to globally offer 26.632 million H-shares with a price of HKD 26.66 per share, expecting to start trading on October 28, 2025 [2] - Sany Heavy Industry (06031.HK) intends to globally offer 580 million H-shares at a price range of HKD 20.30-21.30, with trading expected to commence on October 28, 2025 [6][10] - Eight Horses Tea (06980.HK) aims to globally offer 9 million H-shares priced at HKD 45-50, with trading also set to begin on October 28, 2025 [12] - Cambridge Technology (06166.HK) plans to globally offer 67.0105 million H-shares with a maximum price of HKD 68.88, expecting to start trading on October 28, 2025 [16][20] Group 2: Financial Performance - Dipo Technology reported revenues of RMB 100.47 million, RMB 129.04 million, RMB 242.93 million for 2022, 2023, and 2024 respectively, with a loss of RMB 655.23 million in 2022 [6] - Sany Heavy Industry's total revenues were RMB 80,838.53 million, RMB 74,018.94 million, and RMB 78,383.38 million for 2022, 2023, and 2024 respectively, with profits of RMB 4,432.82 million in 2022 [11] - Eight Horses Tea's revenues were RMB 1,817.54 million, RMB 2,122.31 million, and RMB 2,143.26 million for 2022, 2023, and 2024 respectively, with net profits of RMB 165.85 million in 2022 [15] - Cambridge Technology's revenues were RMB 3,783.74 million, RMB 3,085.36 million, and RMB 3,649.89 million for 2022, 2023, and 2024 respectively, with net profits of RMB 171.11 million in 2022 [21]

光通信板块活跃 初灵信息涨幅居前

Xin Lang Cai Jing· 2025-10-20 03:30

Core Viewpoint - The optical communication sector is experiencing significant activity, with multiple stocks reaching their daily limit up [1] Group 1: Stock Performance - Stocks such as Huylv Ecological, Cambridge Technology, Jingwang Electronics, and Ruiskanda have hit the daily limit up [1] - Other notable performers include Chuling Information, Tianfu Communication, Zhongji Xuchuang, Weiergao, Dongshan Precision, and Qingshan Paper, which have shown substantial gains [1]

CPO概念强势拉升,剑桥科技涨停,源杰科技等大涨

Zheng Quan Shi Bao Wang· 2025-10-20 02:31

Core Viewpoint - The CPO concept has seen a strong surge in the market, with significant increases in stock prices for companies involved in the optical module industry, driven by rising demand for 1.6T optical modules and the overall growth in the sector [1] Group 1: Market Performance - Yuanjie Technology has surged over 15%, while Tianfu Communication, Zhongji Xuchuang, and Zhongshi Technology have all increased by over 10%, with Cambridge Technology hitting the daily limit [1] Group 2: Demand and Supply Dynamics - A recent survey by Xingzheng Securities indicates that the demand for 1.6T optical modules is continuously being revised upwards, with overseas major clients increasing their procurement plans for 2026 from 10 million to 15 million, and now to 20 million units [1] - The primary drivers for this demand increase are the accelerated deployment of GB300 and the subsequent Rubin platform, alongside the rapid growth in bandwidth requirements for AI training and inference networks, leading to the mass production of 1.6T products [1] Group 3: Future Outlook - Huatai Securities has noted that the demand for 800G optical modules is expected to continue its rapid growth in the third quarter, with leading manufacturers likely to maintain a high growth trend year-on-year [1] - The anticipated increase in 1.6T optical module production is expected to positively impact related manufacturers in the optical module and optical engine segments, while domestic demand for 400G optical modules is also expected to be released quickly, driving performance improvements for relevant companies [1] - The optical chip segment (CW light sources, 100G EML) is projected to see continued high growth in performance for leading domestic manufacturers, with MPO demand expected to maintain a year-on-year high growth trend [1]

剑桥科技启动招股 将成港股CPO第一股 霸菱、大摩、红杉等豪华基石护航

Zheng Quan Shi Bao Wang· 2025-10-20 02:23

Core Viewpoint - Cambridge Technology (603083.SH) has officially launched its IPO process in Hong Kong, aiming to raise up to $682 million, potentially becoming the largest IPO in the communication equipment sector in both A-share and Hong Kong markets [1] Group 1: IPO Details - The company plans to issue 67.01 million H-shares at a maximum price of HKD 68.88 per share, with total fundraising potentially reaching up to $682 million if the over-allotment option is fully exercised [1] - The IPO is expected to be listed on the Hong Kong Stock Exchange on October 28, with the stock code "6166.HK" [1] - The fundraising amount for the Hong Kong IPO is projected to be close to RMB 5 billion, which is over 13 times the RMB 368 million raised during its A-share listing in 2017 [1] Group 2: Investor Participation - Cambridge Technology has attracted a prestigious lineup of cornerstone investors, including Barings, MSIP, and several other prominent funds, with a total subscription amount of $290 million, accounting for 48.89% of the offering [2][4] - The diverse and international nature of the cornerstone investors is noted as rare in the industry, indicating strong confidence in the company's long-term prospects [4] Group 3: Technological Innovation - The company is recognized as a leading provider of efficient connectivity solutions in optical communication, broadband, and wireless technology, driven by technological innovation [5] - Key technological advancements include the development of the second-generation 1.6T OSFP DR8 optical module and multiple 800G OSFP silicon photonic modules, which are currently undergoing customer testing [5][6] Group 4: Production Expansion Strategy - To address global economic and trade challenges, the company is implementing a "multi-localization" strategy, shifting production of products destined for the U.S. to Malaysia and enhancing production capabilities in Germany and the U.S. [7] - The company aims to increase the production capacity of its 800G high-speed optical modules, with plans to reach an annual capacity of 2 million units by the end of this year [7] Group 5: Fund Utilization - The funds raised from the H-share listing will primarily be used to enhance R&D investment, expand production capacity, and explore global markets, thereby strengthening the company's competitiveness in core product areas [8] - The company reported a net profit of RMB 121 million for the first half of 2025, a year-on-year increase of 51.12%, indicating strong financial performance ahead of the IPO [8]

A股CPO概念强势,中际旭创涨超8%,1.6T光模块需求再度大幅上修!汇绿生态、剑桥科技涨停,天孚通信涨超9%,景旺电子涨超8%

Ge Long Hui· 2025-10-20 02:19

Core Viewpoint - The A-share market's CPO concept shows strong performance, with several companies experiencing significant stock price increases, driven by rising demand for 1.6T optical modules due to accelerated deployment of AI training and inference networks [1][2]. Group 1: Company Performance - Hui Green Ecology (001267) and Cambridge Technology (603083) both reached the daily limit with a price increase of 10% [2]. - Tianfu Communication (300394) rose by 9.83%, while Zhongji Xuchuang (300308) and Jingwang Electronics (603228) increased by over 8% [1][2]. - Other notable performers include Shijia Photon (688313) with a 7.62% increase, and Ruisi Kanda (603803), Xinyi Sheng (300502), and Sui Rui New Materials (688102) all rising over 5% [1][2]. Group 2: Market Demand Insights - A recent survey by Xingzheng Securities indicates a continuous upward adjustment in demand for 1.6T optical modules, with total industry demand expected to rise from 10 million to 20 million units [2]. - Major overseas clients have revised their procurement plans for 1.6T optical modules for 2026, with some customers locking in production capacity for the upcoming year [2].

A股异动丨CPO概念强势,中际旭创涨超8%,据报1.6T光模块需求再度大幅上修

Ge Long Hui A P P· 2025-10-20 02:07

Core Viewpoint - The A-share market is witnessing strong performance in the CPO concept, driven by increasing demand for 1.6T optical modules, with significant price increases in several related stocks [1][2] Group 1: Market Performance - Stocks such as Hui Green Ecology and Cambridge Technology hit the daily limit up, while Tianfu Communication rose over 9%, and several others saw increases of more than 5% [1] - The overall market sentiment is positive, with MACD golden cross signals indicating a favorable trend for these stocks [2] Group 2: Demand and Supply Dynamics - According to a recent survey by Xingzheng Securities, the demand for 1.6T optical modules is being continuously revised upwards, with total industry demand expected to increase from 10 million to 20 million units [1] - Major overseas clients have recently adjusted their procurement plans for 1.6T optical modules for 2026, with some customers locking in production capacity for the upcoming year [1]