新药研发

Search documents

百济神州20251020

2025-10-20 14:49

Summary of the Conference Call for BeiGene Company Overview - **Company**: BeiGene - **Date**: October 20, 2025 - **Industry**: Biotechnology, specifically focusing on hematology and oncology Key Points and Arguments Financial Performance - **Revenue Guidance**: For 2025, BeiGene's revenue is projected to be between $4.9 billion and $5.3 billion, with an upward adjustment from the initial guidance of $4.9 billion to $5.3 billion made during the mid-year report [3][4] - **Gross Margin**: Expected gross margin is between 80% and 90%, with operating profit remaining positive throughout the year [3][4] Product Performance - **Zebutinib**: - Global sales reached $1.3 billion in 2023, expected to double to $2.6 billion in 2024, and exceed $3.5 billion in 2025, particularly strong growth in the U.S. market [2][6] - Sales in the first half of 2025 reached $1.74 billion, with $1.25 billion from the U.S. alone [6][9] - **PD-1**: - Projected domestic sales of $621 million (approximately 4.5 billion RMB) in 2024, with commercialization in the U.S. starting in October 2025, expected to enhance overseas contributions [2][6] Research and Development Achievements - **R&D Capabilities**: BeiGene has a robust R&D framework, rapidly advancing molecular drugs through global clinical trials, particularly in hematology [4][12] - **Combination Therapies**: The combination of BTK inhibitors with BCL-2 inhibitors and BDKC degraders has shown an overall response rate (ORR) exceeding 90% and a complete response (CR) rate of 70% to 80% [10][11] Strategic Initiatives - **Global Expansion**: Plans to strengthen the global team and optimize sales efficiency through a combination of self-developed products and agency models [5][7] - **Market Listings**: Intent to list on U.S., Hong Kong, and STAR Market to secure funding for ongoing R&D [8][12] Future Development Strategies - **Hematology Focus**: Continued emphasis on blood cancers, with plans for head-to-head clinical trials for new therapies [9][11] - **Solid Tumors**: Initiating Phase III clinical trials for CDK4/6 inhibitors in breast cancer and advancing ADC development to address drug resistance and efficacy issues [12][13] Additional Insights - **Market Dynamics**: The decline in ibrutinib market share due to patent expiration is noted, highlighting the competitive landscape [2][6] - **Patient-Centric Approach**: The company aims to address diverse patient needs through innovative drug development across multiple therapeutic areas [2][4] This summary encapsulates the critical insights from the conference call, focusing on BeiGene's financial outlook, product performance, R&D achievements, strategic initiatives, and future development plans.

泽璟制药:盐酸吉卡昔替尼片治疗活动性强直性脊柱炎的III期临床试验达到主要疗效终点

Zhi Tong Cai Jing· 2025-10-20 08:40

Core Viewpoint - Zejing Pharmaceutical (688266.SH) announced that its self-developed Class 1 new drug, Jikaxitinib Hydrochloride Tablets (formerly known as Jackatinib Tablets), has achieved the primary efficacy endpoint in a Phase III clinical trial for treating active ankylosing spondylitis, demonstrating statistical significance (p<0.0001) [1] Group 1 - The Phase III clinical trial titled "Efficacy and Safety of Jikaxitinib Hydrochloride Tablets in Patients with Active Ankylosing Spondylitis: A Multicenter, Randomized, Double-Blind, Placebo-Controlled Study" has met its primary efficacy endpoint [1] - The company plans to accelerate the market launch process for Jikaxitinib Hydrochloride Tablets for the indication of active ankylosing spondylitis [1]

36年老牌企业连亏6年,上半年净利润大跌超520%,知名大佬关键时刻溢价近五成接盘!股价连续3日涨停

Mei Ri Jing Ji Xin Wen· 2025-10-16 07:43

Core Viewpoint - After the change of control, Asia-Pacific Pharmaceutical has experienced three consecutive trading days of stock price increases, indicating market optimism regarding the new leadership and strategic direction of the company [1][6]. Group 1: Change of Control - On October 13, Asia-Pacific Pharmaceutical announced a change in its controlling shareholder to Zhejiang Xinghao Holding Partnership (Limited Partnership), with the actual controller being Qiu Zhongxun, founder and CEO of Yaodou Network [2][3]. - The share transfer involved a total of approximately 14.61% of the company's shares, amounting to about 109 million shares, at a price of 8.26 yuan per share, totaling 900 million yuan, representing a premium of 45.68% over the pre-transaction price of 5.67 yuan per share [3]. Group 2: Fundraising and Strategic Direction - Asia-Pacific Pharmaceutical plans to raise no more than 700 million yuan through a private placement to Xinghao Holding, with the funds entirely allocated for new drug research and development projects [2][4]. - The company aims to transition from traditional chemical generics to improved new drugs and innovative drug development, indicating a strategic shift in its business model [4]. Group 3: Financial Performance and Challenges - The company has faced continuous financial pressure, with a negative net profit for six consecutive years from 2019 to 2024, and a significant decline in revenue of 31.48% year-on-year in the first half of 2025 [4]. - As of the first half of 2025, the company reported an operating income of 152 million yuan and a net profit attributable to shareholders of -48.86 million yuan, raising concerns about its financial viability [4]. Group 4: Potential Future Developments - Qiu Zhongxun's leadership may lead to potential asset injection plans from Yaodou Technology, which has a significant presence in the pharmaceutical e-commerce sector and a robust sales network [5]. - There are speculations that the acquisition and subsequent fundraising could be a strategy akin to "backdoor listing," as Yaodou Technology has previously expressed intentions to enter the capital market [5].

亚太药业扣非连亏六年半押注新药 邱中勋拟9亿入主包揽7亿定增助转型

Chang Jiang Shang Bao· 2025-10-14 23:34

Core Viewpoint - Asia-Pacific Pharmaceutical (002370.SZ) is undergoing a significant ownership change, with a new controlling shareholder, Starry Holdings, leading the company towards a transformation into new drug development due to ongoing poor performance in its main business [1][3]. Ownership Change - The current controlling shareholder, Fubon Group, is transferring 14.61% of its shares to Starry Holdings for a total price of 900 million yuan, making Starry Holdings the new controlling shareholder [1][3]. - Following the transfer, Starry Holdings will increase its stake to 22.38% after a private placement to raise up to 700 million yuan [1][4]. Financial Performance - In the first half of 2025, Asia-Pacific Pharmaceutical reported revenue of 152 million yuan, a year-on-year decline of 31.48%, and a non-recurring net loss of 48.86 million yuan, marking six and a half years of continuous non-recurring net losses [2][7]. - The company has not distributed dividends during this period, indicating ongoing financial struggles [2][7]. Market Reaction - Following the announcement of the ownership change, Asia-Pacific Pharmaceutical's stock price hit the daily limit, closing at 6.24 yuan per share, reflecting a 10.05% increase [6]. Future Plans - The new management under CEO Qiu Zhongxun aims to pivot the company towards new drug research and development, focusing on innovative drug platforms and complex formulations [7][8]. - The company plans to utilize the funds raised from the private placement entirely for new drug development projects, including various cancer treatments and long-acting formulations [7][8]. Commitments from Fubon Group - Fubon Group has committed that by 2025, the company's main business revenue will not be less than 360 million yuan, with a non-recurring net profit loss cap of 70 million yuan [1][9]. - Additional commitments include maintaining accounts receivable below 140 million yuan and ensuring a recovery rate of over 70% for accounts receivable by April 2026 [9].

神州细胞回复定增问询函:拟募资6-9亿元补充流动资金,控股股东全额认购

Xin Lang Cai Jing· 2025-10-14 15:33

Core Viewpoint - Shenzhou Cell is planning to raise 600-900 million yuan through a private placement of A-shares to supplement working capital and support R&D efforts, with the controlling shareholder, Lhasa Ailike, subscribing to the entire issuance at a price of 36 yuan per share [1][2]. Fundraising Necessity and Sources - The fundraising is aimed at enhancing operational funds, ensuring R&D investments, and reducing operational and financial risks. Despite revenue growth from 2022 to the first half of 2025, the company faces significant funding needs in the biopharmaceutical and vaccine sectors, with cumulative losses reaching 3.863 billion yuan and a debt ratio of 97.03% as of June 30, 2025 [2]. - Lhasa Ailike's subscription will be financed through a combination of self-owned funds (approximately 440 million yuan) and borrowed funds, with Huanneng Guicheng Trust providing up to 600 million yuan at an interest rate of 5.8% to 7% [2]. Compliance and Stock Price Analysis - The issuance has complied with relevant decision-making procedures and disclosure obligations, aligning with legal regulations and company bylaws. Since the pricing date of June 6, 2025, the company's stock price has increased, reflecting industry trends and operational performance [3]. Previous Fundraising Projects - In the previous public offering, 99.52% of the raised funds were allocated to non-capital expenditures, with adjustments made to improve fund utilization efficiency and align with policy directions and company strategies [4]. Operational Performance Analysis - The core product, Anjia, experienced revenue and gross margin fluctuations due to centralized procurement, with sales revenue declining by 37.99% year-on-year in the first half of 2025 [5]. - R&D expenses have decreased recently as several major products have completed Phase III clinical trials, leading to reduced spending on clinical trial costs [6]. Pipeline Progress and Risks - As of June 30, 2025, the company has one recombinant protein drug and four antibody drugs approved for market, with several products in clinical and preclinical stages. However, there are inherent risks in new drug development, and the company cannot guarantee the timing or success of product approvals [7]. Sales Expense Increase - Sales expenses have risen annually due to new product launches and the expansion of the sales team, with promotional costs including professional service fees and patient welfare projects [9]. Asset and Liability Situation - The company's cash and interest income are well-matched, and there are no issues with fund occupation. The overall aging structure of accounts receivable is good, with sufficient provisions for bad debts [11][12]. - Inventory provisions have been adjusted reasonably, with a significant provision of 95.37% for COVID-19 vaccine products in 2023, which has since decreased [13]. Intangible Assets and Debt Risk - The increase in intangible assets is attributed to growth in R&D technology, and the company has established a robust financial risk management system to ensure debt repayment, despite an increase in borrowing [14][15]. Collaboration with Shiyao Group - The collaboration with Shiyao Group has been terminated, with related funds reclassified in accordance with accounting standards, and this has not adversely affected the company's operations [16].

神州细胞回复审核问询函:业绩波动,多举措应对挑战

Xin Lang Cai Jing· 2025-10-14 15:33

Core Viewpoint - The financial performance of Beijing Shenzhou Cell Biotechnology Group Co., Ltd. has shown significant fluctuations, with a notable decline in revenue and net profit due to price reductions from centralized procurement and medical insurance cost control measures. The company is also advancing its product pipeline but faces inherent risks in new drug development [2][3]. Group 1: Operating Performance - The company's operating revenue for the reporting period was 1,023.18 million yuan, 1,887.35 million yuan, 2,512.71 million yuan, and 519.74 million yuan, with net profits of -518.99 million yuan, -396.86 million yuan, 111.93 million yuan, and 64.06 million yuan respectively [2]. - In the first half of 2025, the company reported operating revenue of 972.02 million yuan and a net loss of -33.86 million yuan, marking a year-on-year decline of 37.99% in sales revenue due to the impact of centralized procurement and medical insurance cost control [2]. - Research and development expenses decreased in 2024 and the first half of 2025, primarily due to the completion of Phase III clinical trials for several products and other pipelines being in early stages [2][3]. Group 2: Asset and Liability Situation - As of June 30, 2025, the company had cash and cash equivalents of 302.87 million yuan, accounts receivable of 795.72 million yuan, inventory of 281.61 million yuan, and intangible assets of 176.20 million yuan [4]. - The company’s short-term borrowings amounted to 1,235.41 million yuan, with a total debt increase primarily for advancing research and industrialization projects and supplementing working capital [4]. - The company has a decreasing debt-to-asset ratio, with sufficient bank credit lines and a well-arranged repayment plan for short-term borrowings, indicating manageable debt repayment risks [4]. Group 3: Other Matters - As of June 30, 2025, the company had no significant financial investments, and there were no new or planned financial investments in the six months prior to the board resolution for this issuance [5]. - The company has timely and accurately transitioned construction in progress to fixed assets, with prepaid expenses mainly related to material procurement and service payments [5].

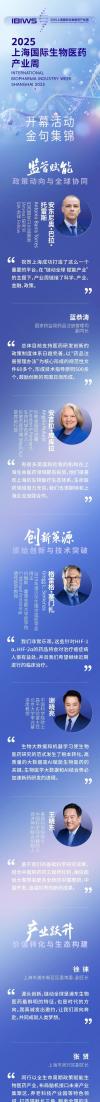

2025上海国际生物医药产业周,嘉宾们说了哪些金句?一起来看→

Di Yi Cai Jing Zi Xun· 2025-10-14 14:21

IBIW 2025上海国际生 2025 上海国际生物医药 产业周 INTERNATIONAL BIOPHARMA INDUSTRY WEEK SHANGHAI 2025 新東源 技术突破 创 新与 原始 7集锦 監管財能 政策动向与全球协同 ntonio Barra Torn 木迦歌 (esivu) 66 祝贺上海成功打造了这么一个 重要的平台,在"链动全球 赋能产业" 的主题下,产业周链接了科学、产业、 金融、政策。 99 蓝恭涛 国家药监局药品注册管理司 副司长 66 总体目前支持医药研发创新的 政策制度体系日趋完善,以"药品注 册管理办法"为核心形成的规范性文 件60多个,形成技术指导原则500多 个,鼓励创新的氛围日渐形成。 A 66 有很多英国和伦敦的机构在上 海生命医药领域都有投资,他们很喜 欢上海的生物医疗生态体系。生命医 药领域潜力无穷,我们也很期待和上 海企业加强合作。 99 ttps://www.blogs.com/program regger nonswill and subside provincial provincial provincial provincial provinci ...

2025上海国际生物医药产业周,嘉宾们说了哪些金句?一起来看→

第一财经· 2025-10-14 13:59

IBIW INTERNATIONAL BIOPHARMA INDUSTRY WEEK SHANGHAI 2025 阜 年 監管財能 政策动向与全球协同 Atonio Barra Torr an All Produktion Comment Co 66 祝贺上海成功打造了这么一个 重要的平台,在"链动全球 赋能产业" 的主题下,产业周链接了科学、产业、 金融、政策。 B 蓝恭涛 国家药监局药品注册管理司 副司长 66 总体目前支持医药研发创新的 政策制度体系日趋完善,以"药品注 册管理办法"为核心形成的规范性文 件60多个,形成技术指导原则500多 个,鼓励创新的氛围日渐形成。 2025上海国际 International Biopharma Indu 2025 上海国际生物医药 产业周 66 有很多英国和伦敦的机构在上 海生命医药领域都有投资,他们很喜 欢上海的生物医疗生态体系。生命医 药领域潜力无穷,我们也很期待和上 海企业加强合作。 S 新集馆 原始创新与技术突破 sia edCity) 播 enemzs 士理学成医学 66 我们非常乐观,这些针对HIF-1 α、HIF-2α的药品将会对治疗癌症病 人很有 ...

亚太药业涨停 富邦集团等套现9亿新实控人包揽7亿定增

Zhong Guo Jing Ji Wang· 2025-10-14 06:59

中国经济网北京10月14日讯 亚太药业(002370.SZ)今日复牌一字涨停,截至发稿,报6.24元,涨 幅10.05%。 本次向特定对象发行股票的发行对象为新控股股东星浩控股,因此本次发行构成关联交易。 截至预案公告日,公司现控股股东为富邦集团,实际控制人为宋汉平、傅才、胡铮辉组成的管理团 队,富邦集团及汉贵投资合计持有公司108,945,566股股份,占公司总股本的14.61%。 2025年10月13日,星浩控股与公司签订附条件生效的《股份认购协议》。同时,公司现控股股东富 邦集团及汉贵投资与星浩控股及星宸投资签署了《股份转让协议》;星浩控股与星宸投资签署了《一致 行动人协议》《表决权委托协议》。 亚太药业昨日晚间披露《2025年度向特定对象发行股票预案》《关于筹划公司控制权变更事项进展 暨公司股票复牌的公告》等公告。 2025年10月13日,公司控股股东富邦集团及一致行动人汉贵投资与浙江星浩控股合伙企业(有限合 伙)(以下简称"星浩控股")及一致行动人浙江星宸股权投资合伙企业(有限合伙)(以下简称"星宸 投资")签署了《股份转让协议》。富邦集团和汉贵投资拟通过协议转让方式转让公司14.62%股份,共 计 ...

桂林三金:目前公司产品BC006单抗注射液项目,即将完成I期临床试验

Mei Ri Jing Ji Xin Wen· 2025-10-14 04:00

Group 1 - The core point of the article is that Guilin Sanjin has confirmed the progress of its BC006 monoclonal antibody injection project, which is nearing the completion of Phase I clinical trials and is expected to enter Phase III soon [2] - The company stated that if a significant breakthrough is achieved, it will disclose the information in accordance with the requirements of the Shenzhen Stock Exchange [2]