港股IPO

Search documents

港股IPO热持续,业内:架构合规成企业闯关核心

Di Yi Cai Jing· 2025-10-31 14:19

Group 1 - The Hong Kong stock market has become the preferred destination for IPO fundraising globally, with 80 companies completing IPOs and raising HKD 216 billion as of October 2025, alongside secondary fundraising exceeding HKD 229 billion [1][2] - The performance of the Hong Kong stock market is attributed to the current US interest rate cut cycle, which has led to a capital outflow from US stocks into Hong Kong, along with attractive asset valuations, as the Hang Seng Index's average P/E ratio stands at 12.2, significantly lower than that of US stocks [1][2] - The Hang Seng Index has risen from 20,000 to 26,000 points since 2025, marking a cumulative increase of approximately 30%, while the Hang Seng Tech Index has surged by 36% [2] Group 2 - The liquidity of the Hong Kong stock market has significantly improved, with the average daily trading volume reaching HKD 250 billion in 2025, double that of previous years, largely supported by southbound capital, which has increased its share from around 20% to 50% [2] - The Hong Kong Stock Exchange is characterized by transparent regulations, strong policy predictability, and a streamlined approval process, allowing companies to flexibly conduct financing based on their needs while retaining the option for future A-share listings [2][3] - The choice between Hong Kong and US markets has become clearer, with Hong Kong's market performance, policy support, and liquidity advantages making it the current preferred option for companies [2]

张艺谋导演的《印象大红袍》冲击港股,九成收入靠一场戏;业务深度绑定武夷山,游客转化已现天花板

Sou Hu Cai Jing· 2025-10-31 07:57

Core Viewpoint - The company "Impression Da Hong Pao" is preparing for its IPO, showcasing a significant rebound in profits in 2023, but faces challenges due to its reliance on a single performance and regional limitations [3][4][12]. Financial Performance - In 2023, the company reported a net profit of 47.5 million RMB, a recovery from a loss of 2.6 million RMB in 2022. However, projections for 2024 indicate a slight decline to 42.8 million RMB, reflecting a nearly 10% year-on-year decrease [3][6]. - The revenue from the main performance "Impression Da Hong Pao" accounted for over 90% of total income, with revenues of 58 million RMB in 2022, 136 million RMB in 2023, and projected 130 million RMB in 2024 [7][10]. Business Model and Risks - The company's business model is heavily dependent on a single performance, which poses significant risks. In 2024, adverse weather conditions led to a drastic drop in audience numbers, severely impacting revenue [8][9]. - The introduction of a new performance, "Yue Ying Wuyi," has not yet proven profitable, incurring a loss of 1.816 million RMB in the first half of 2024 [9][10]. Market Position and Competition - The cultural tourism and performance market is becoming increasingly competitive, with other shows like "Song City Qian Gu Qing" and "You Jian Ping Yao" emerging as rivals. The sustainability of the novelty of "Impression Da Hong Pao" is in question [9][12]. - The company’s operations are geographically confined to Wuyi Mountain, which limits growth potential. In 2024, Wuyi Mountain is expected to receive approximately 17.3 million visitors, with "Impression Da Hong Pao" attracting only 813,100, indicating a conversion rate of 4.7%, which is above the industry average of 3% but still presents challenges for further growth [11][12]. Strategic Outlook - The company is at a crossroads, facing both opportunities and challenges as it approaches its IPO. While it has established brand recognition and market barriers, the dual limitations of a single product and single region pose significant hurdles for future expansion [12].

“创业教父”遇考验:亲弟清仓套现,投诉10万+,拉卡拉港股IPO前景几何?

Feng Huang Wang Cai Jing· 2025-10-30 07:52

Core Viewpoint - The company Lakala, once a leader in the digital payment sector, is facing significant challenges as it prepares for its IPO in Hong Kong, with declining revenues, increasing complaints, and compliance issues overshadowing its market position [1][3][25]. Group 1: Company Performance - Lakala claims to be a leading digital payment and business solutions provider in Asia, with a market share of 9.4% in the independent digital payment service sector, amounting to over 4 trillion yuan in total payment volume for 2024 [5][4]. - The company's revenue from 2022 to 2024 shows a decline, with figures of 5.361 billion yuan in 2022, 5.928 billion yuan in 2023, and 5.754 billion yuan in 2024, while profits fluctuated from a loss of 1.438 billion yuan in 2022 to a profit of 457 million yuan in 2023, and a profit of 351 million yuan in 2024 [7][10]. - In the first three quarters of 2025, Lakala reported a revenue of 4.068 billion yuan, a year-on-year decrease of 7.32%, and a net profit of 339 million yuan, down 33.9% year-on-year, attributed to pressures in the bank card payment business [8][11]. Group 2: Business Structure and Challenges - The company’s core digital payment services account for 89% of its revenue, indicating a heavy reliance on a single business line that is facing industry growth bottlenecks [11]. - Lakala's cross-border payment business saw a significant increase of 77.56% year-on-year in the first three quarters of 2025, reaching 60.2 billion yuan, but this still represents less than 2% of the company's total payment volume [11]. - The company has acknowledged potential liquidity risks due to net current liabilities recorded as of December 31, 2022, and June 30, 2025, which may limit operational flexibility [11]. Group 3: Compliance Issues - Lakala is currently facing a compliance crisis, with over 100,000 complaints filed on the Black Cat Complaint platform, highlighting issues such as unauthorized fees and poor service [26][30]. - The company has been penalized multiple times for regulatory violations, including a fine of 2.5 million yuan for various infractions related to transaction management and customer due diligence from 2022 to June 2025 [33][34]. - Recent fines include 250,000 yuan for violations of acquiring business management regulations and 4.06 million yuan for failing to meet customer identification requirements [33][34]. Group 4: Shareholder Actions - The founder's family and early investors are reducing their stakes in Lakala, with significant sell-offs by major shareholders, including a total cash-out of 493 million yuan by the founder's brother [16][19]. - Lenovo Holdings, the largest shareholder, has also been gradually reducing its stake, from 26.54% to 23.54%, raising concerns about the company's attractiveness to investors [19][22].

“创业教父”遇考验:亲弟清仓套现,投诉10万+,拉卡拉港股IPO前景几何?

凤凰网财经· 2025-10-30 07:36

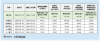

Core Viewpoint - The article discusses the challenges faced by Lakala, a prominent player in the digital payment industry, as it prepares for its IPO in Hong Kong amidst declining performance, compliance issues, and significant shareholder exits [1][2][3]. Group 1: Performance Decline - Lakala's revenue and net profit have shown a downward trend, with revenues of 5.361 billion RMB in 2022, 5.928 billion RMB in 2023, and a projected 5.754 billion RMB in 2024, while net profits were -1.438 billion RMB, 0.457 billion RMB, and 0.351 billion RMB respectively [4][6]. - In the first three quarters of 2025, Lakala reported a revenue of 4.068 billion RMB, a year-on-year decrease of 7.32%, and a net profit of 0.339 billion RMB, down 33.9% year-on-year [6][11]. - The company attributes its revenue decline to pressure on its card payment business, with digital payment revenue decreasing by 7.63% [6][11]. Group 2: Shareholder Exits - The article highlights significant shareholder exits, including the complete divestment of the founder's brother, Sun Haoran, who has sold shares worth 493 million RMB [16][20]. - Lenovo Holdings, the largest shareholder, has also reduced its stake from 26.54% to 23.54%, cashing out approximately 580 million RMB [20][23]. Group 3: Compliance Issues - Lakala faces a severe compliance crisis, with over 100,000 complaints on the Black Cat Complaint platform regarding service issues and unauthorized charges [26][27]. - The company has been fined multiple times for regulatory violations, including a fine of 2.5 million RMB for various infractions related to payment processing and customer due diligence [36][38]. - The cumulative fines from 2022 to mid-2025 amount to 16.76 million RMB, indicating significant operational challenges [38]. Group 4: Future Outlook - Lakala is attempting to pivot towards cross-border payments, which saw a 77.56% increase to 60.2 billion RMB in the first three quarters of 2025, but this still represents less than 2% of its total payment volume [11][12]. - The company acknowledges potential liquidity risks and challenges in maintaining profitability, raising concerns about its financial health as it seeks to expand through its IPO [11][12].

赛力斯启动全球发售:折价或高达27%及基石阵容失衡背后 估值与业绩匹配失衡及独立性挑战凸显

Xin Lang Zheng Quan· 2025-10-30 02:15

Core Viewpoint - The company, Seres, is set to launch a global offering on October 27, with a pricing date of November 3 and listing on the Hong Kong Stock Exchange on November 5. The offering price is capped at HKD 131.50 per share, with a base issuance of approximately 100 million shares, potentially raising up to HKD 174.3 billion if the overallotment option is fully exercised. This IPO could become the third largest in Hong Kong this year and the largest for a complete vehicle manufacturer since 2022. However, the offering features an unusual discount of over 26%, a lack of participation from foreign long-term funds, and a reliance on government and industrial capital, indicating deeper risks related to valuation and performance, particularly the dependency on Huawei [1][5][13]. Pricing Strategy - The pricing strategy for Seres' IPO shows a stark contrast to similar large A to H projects this year, with a discount of 26.9% compared to the A-share closing price of CNY 163.99. This discount is significantly higher than the typical range for comparable projects, where discounts are generally kept below 20% [2][4]. Investor Composition - The IPO attracted 22 cornerstone investors, raising a total of USD 830 million, which accounts for 48.7% of the base issuance. However, the investor composition is heavily skewed towards government and industrial capital, with foreign long-term funds largely absent, raising concerns about the long-term value perception of the company [5][6]. Performance and Valuation Concerns - Seres' sales data indicates a weakening growth trend, with September 2025 sales of 48,000 vehicles showing an 8.33% year-on-year increase, but a cumulative decline of 7.79% for the first nine months. The company's reliance on Huawei is diminishing, as evidenced by its ranking among Huawei's electric vehicle models, where it faces increasing competition from other manufacturers [7][9][12]. Financial Metrics - As of the current valuation, Seres has a market capitalization of HKD 306.9 billion, with projected P/E ratios for 2024, TTM, and 2025 at 47.2x, 38.6x, and 27.9x respectively. These figures are significantly higher than the average P/E ratios of traditional automakers in Hong Kong, which hover around 14.9x to 22x, indicating a potential valuation bubble lacking solid fundamental support [10][11][12]. Dependency on Huawei - The valuation premium associated with Seres is largely attributed to its partnership with Huawei. Prior to this collaboration, Seres had a market value of only CNY 10 billion, which skyrocketed to over CNY 250 billion post-collaboration. However, as Huawei diversifies its partnerships with other manufacturers, Seres risks losing its competitive edge and growth momentum, raising concerns about its long-term sustainability [13].

港股IPO热度与监管力度并行:清退违规企业,筑牢市场根基

Sou Hu Cai Jing· 2025-10-29 01:59

Core Viewpoint - The Hong Kong stock market is experiencing a dual trend of active IPOs and stringent regulatory measures, leading to a healthier market environment for quality development [2]. Group 1: IPO Market Dynamics - In 2025, the Hong Kong IPO market remains vibrant, with 75 new companies listed and 275 applications submitted, covering sectors such as new economy, high-end manufacturing, and healthcare, enhancing market structure and attractiveness [4]. - The influx of quality enterprises is expected to provide more investment opportunities for investors, further boosting the competitiveness of the Hong Kong market [4]. Group 2: Delisting and Market Cleanup - As of 2025, 45 companies have been delisted, nearly 60% of the new listings, indicating a significant market cleanup effect [5]. - Among the delisted companies, 21 were forced to delist due to regulatory breaches, while 22 chose voluntary delisting due to poor stock performance or strategic restructuring [6]. Group 3: Regulatory Enhancements - The regulatory environment has intensified, with a focus on compliance and accountability for both companies and their executives, aiming to eliminate problematic enterprises from the market [7][9]. - The number of investigations conducted by the Hong Kong Stock Exchange reached 86 in the first half of 2025, with a proactive approach to identifying and addressing compliance issues [9][10]. Group 4: Individual Accountability - The regulatory framework has expanded to include personal accountability for executives, with 18 individuals publicly reprimanded and 40 receiving regulatory letters in the first half of 2025 [11][13]. - This shift aims to increase the personal cost of violations, thereby enhancing the deterrent effect against misconduct [11][13]. Group 5: Compliance Recommendations for Companies - Companies are advised to strengthen compliance measures, including timely and accurate disclosure of financial performance, regular operational assessments, and adherence to regulatory updates to ensure long-term sustainability [14][16].

持续火热!4只港股同日上市 最高涨幅超150%丨港美股看台

Zheng Quan Shi Bao· 2025-10-28 14:49

Core Viewpoint - The recent IPOs of four companies, including Dipu Technology, Bama Tea, Sany Heavy Industry, and Cambridge Technology, have shown strong performance on the Hong Kong stock market, with significant first-day gains, particularly for Dipu Technology, which saw a closing increase of 150.56% [2][3][4]. Group 1: Company Performance - Dipu Technology's stock surged by 150.56% on its first trading day, following an impressive dark market increase of 94.67% [2][3]. - Bama Tea and Cambridge Technology also performed well, with closing gains of 82.70% and 33.86%, respectively, after dark market increases of 78.80% and 36.90% [4][5]. - Sany Heavy Industry, despite a modest first-day gain of 2.82%, did not experience a drop below its offering price, indicating stable investor confidence [6]. Group 2: Fundraising and Market Trends - Sany Heavy Industry raised approximately HKD 135 billion, making it one of the top three IPOs in Hong Kong this year, following the record HKD 410 billion raised by CATL [7]. - Cambridge Technology raised HKD 46 million, while both Dipu Technology and Bama Tea raised less than HKD 10 million, with amounts of HKD 7.1 million and HKD 4.5 million, respectively [7]. - The overall trend in the Hong Kong IPO market remains strong, with high levels of oversubscription for new listings, particularly for companies like Dipu Technology, which achieved an oversubscription rate of 7569.83 times [9][10]. Group 3: Market Potential and Company Strategies - Dipu Technology focuses on providing enterprise-level AI application solutions, with a projected market size of RMB 386 billion by 2024, expected to grow at a CAGR of 44.0% until 2029 [13][14]. - Despite its growth potential, Dipu Technology reported losses of RMB 5.03 billion, RMB 12.55 billion, and RMB 3.08 billion for the years 2023, 2024, and the first half of 2025, respectively [14].

鱼油龙头冲刺港股IPO:净利下滑超七成,流动性面临考验

Xin Lang Cai Jing· 2025-10-28 12:16

Core Viewpoint - Yuwang Biological Nutrition is facing significant challenges as it prepares for its initial public offering in Hong Kong, with declining performance and structural issues impacting its business outlook [2][3]. Financial Performance - Yuwang Biological Nutrition's revenue projections for 2022 to 2024 are 534 million, 661 million, and 832 million RMB, respectively, with net profits of 67.3 million, 102 million, and 125 million RMB, indicating rapid growth [5]. - However, in 2025, the company experienced a sharp decline in revenue to 343 million RMB, a decrease of 27.02%, and a net profit drop of 74.01% to 22.8 million RMB, with adjusted net profit margin falling from 18.6% to 12.6% [7]. - The gross margin decreased significantly from 29.6% in the first half of 2024 to 20.7% in the first half of 2025, primarily due to falling terminal prices and high procurement costs [7]. Product Structure - The company's reliance on its refined fish oil business has decreased, with its revenue share dropping from 36.7% in 2022 to 26.2% in the first half of 2025, while the share of CDMO dietary supplements increased from 59.5% to 70% [9]. - The gross margin for refined fish oil plummeted from 24.7% to 8.3% in the same period, significantly impacting profitability [11]. - The average selling price of CDMO dietary supplements has also declined, with fish oil soft capsules dropping from 136,000 RMB per million capsules in the first half of 2024 to 99,000 RMB in the first half of 2025 [14]. Market Dynamics - The global food-grade fish oil market is maturing, with limited growth prospects. The market size is expected to decline after a brief recovery, with projections indicating a drop to 9.9 billion USD by 2029 [16]. - In China, the food-grade fish oil market is projected to shrink from 25.6 billion RMB in 2023 to 12.9 billion RMB by 2029, indicating a lack of growth potential [18]. - Yuwang Biological Nutrition holds only an 8.1% market share, limiting its pricing power amid intense competition [18]. Operational Challenges - The company is heavily reliant on third-party traders, with 52.1% of its revenue coming from these channels, which poses risks if relationships with these traders weaken [19]. - The company has increased its credit terms to customers, leading to a rise in accounts receivable, which reached 54 million RMB in the first half of the year, exceeding net profits for the same period [20]. - Yuwang Biological Nutrition's liquidity issues and declining performance raise concerns about its upcoming IPO, as it struggles with cost pressures and a lack of bargaining power in the supply chain [20].

东鹏饮料的“资本迷局”:一边分掉54亿利润,一边携百亿现金赴港募资|IPO观察

Xin Lang Cai Jing· 2025-10-28 07:36

Core Viewpoint - Dongpeng Beverage Group Co., Ltd. is planning an IPO in Hong Kong, heavily relying on energy drinks for revenue, which constitutes at least 70% of its income, raising concerns about its product diversification and financial strategies [2][5]. Financial Performance - Dongpeng Beverage's revenue and profit have shown an upward trend during the reporting period, with revenues of 85 billion RMB, 112.57 billion RMB, and 158.3 billion RMB, and profits of 14.41 billion RMB and 20.4 billion RMB [3][8]. - The company distributed a total of 54 billion RMB in dividends, accounting for 58.81% of its total profit of 91.82 billion RMB during the same period [3][6]. Product Structure - The company primarily focuses on energy drinks, with sales revenue from this category reaching 82.21 billion RMB in 2022, 103.54 billion RMB in 2023, and projected to be 133 billion RMB in 2024 [2][3]. Market Position - Dongpeng Beverage has maintained its leading position in China's functional beverage market, being ranked first in sales volume for four consecutive years since 2021, with a market share projected to reach 26.3% in 2024 [3][8]. IPO Purpose - The funds raised from the Hong Kong IPO will be used for capacity expansion, supply chain upgrades, brand development, channel network expansion, overseas market development, and general operational funding [5][6]. Cash Flow and Financial Health - The company has demonstrated strong cash flow generation, with net cash inflows from operating activities of 20.26 billion RMB, 32.81 billion RMB, and 57.89 billion RMB over the reporting period [6][8]. - Despite having substantial cash reserves, the rationale for seeking additional funding through the IPO has been questioned [6][8].

东鹏饮料的“资本迷局”:一边分掉54亿利润,一边携百亿现金赴港募资 | IPO观察

Tai Mei Ti A P P· 2025-10-28 06:26

Core Viewpoint - Dongpeng Beverage's revenue is heavily reliant on energy drinks, accounting for at least 70% of its income, which raises concerns about its product diversification despite strong financial performance [2][3][5]. Financial Performance - Dongpeng Beverage's revenue and profit have shown an upward trend during the reporting period, with revenues of 85 billion RMB, 112.57 billion RMB, 158.3 billion RMB, and 107.32 billion RMB, and profits of 14.41 billion RMB, 20.4 billion RMB, 33.26 billion RMB, and 23.75 billion RMB respectively [4][11]. - The compound annual growth rates for revenue and profit from 2022 to 2024 are 36.47% and 51.92% respectively [4]. Dividend Policy - The company has distributed a total of 54 billion RMB in dividends during the reporting period, which represents 58.81% of its total profit of 91.82 billion RMB [5][7]. - The dividend amounts for the years were 8 billion RMB, 10 billion RMB, 23 billion RMB, and 13 billion RMB [5]. IPO and Fundraising - Dongpeng Beverage is pursuing an IPO in Hong Kong to raise funds for capacity expansion, supply chain upgrades, brand building, and market expansion, despite having substantial cash reserves [7][8]. - As of the end of 2023, the company had over 60 billion RMB in cash and cash equivalents, and projected to exceed 100 billion RMB in cash-like assets by 2024 and the first half of 2025 [8][10]. Market Position - According to Frost & Sullivan, Dongpeng Beverage has maintained its position as the leading functional beverage brand in China by sales volume for four consecutive years, with a market share of 26.3% in 2024 [5].