保险业

Search documents

境内险企获准在港发行“侧挂车”保险连接证券

Shang Hai Zheng Quan Bao· 2025-10-28 19:44

Core Viewpoint - The Financial Regulatory Administration has issued a notification supporting domestic insurance companies to issue "sidecar" insurance-linked securities in the Hong Kong market, which allows for better risk management of catastrophic events [1][2]. Group 1: Regulatory Framework - The notification allows domestic insurance companies to transfer catastrophic risks from natural disasters or public health emergencies to specially established purpose insurance companies, which will issue equity or debt securities to raise funds for fulfilling compensation obligations [1]. - This initiative follows a previous notification from 2021 that supported the issuance of catastrophe bonds by domestic insurance companies in Hong Kong [1]. Group 2: Financial Implications - The introduction of "sidecar" insurance-linked securities is expected to enhance the financial stability of insurance companies by allowing them to share catastrophic risks with the capital market, thereby smoothing operational volatility [2]. - The new securities are anticipated to provide a unique investment product in the Hong Kong market, with low correlation to traditional financial assets, as their triggers are primarily related to natural disasters rather than economic cycles [2]. Group 3: Future Developments - The Financial Regulatory Administration plans to continue supporting willing insurance companies in issuing "sidecar" insurance-linked securities to enrich risk management tools and improve the management of catastrophic risks [2].

金融监管总局副局长周亮:正联合起草保险业支持科创有关文件

Shang Hai Zheng Quan Bao· 2025-10-28 19:43

Group 1 - The core viewpoint is that the insurance industry can significantly support technological innovation by providing long-term capital and financing solutions tailored to the lifecycle of tech enterprises [1][2] - The average liability duration of insurance capital and the average R&D cycle of tech companies in China are both between 10 to 15 years, indicating a strong alignment for investment opportunities [1] - Insurance capital has already directly invested thousands of billions in technology-related enterprises, highlighting the industry's commitment to supporting innovation [1] Group 2 - The insurance industry is actively adapting to the integration of technology and industry, with over 40 million new energy vehicles currently insured [2] - A memorandum of cooperation between the insurance and automotive industries aims to enhance vehicle safety, improve pricing models, and boost competitiveness [2] - The use of technology in insurance services is being expanded, including the establishment of a second-hand car information service platform to address information asymmetry in transactions [2] Group 3 - The insurance sector is encouraged to leverage technology to improve service efficiency in areas such as agricultural insurance, disaster insurance, and health insurance [2] - Advanced technologies like satellites, drones, and risk models are being utilized to enhance underwriting, claims processing, and risk reduction services [2] - The application of wearable devices and AI in health and pension insurance is aimed at providing proactive health management suggestions to policyholders [2]

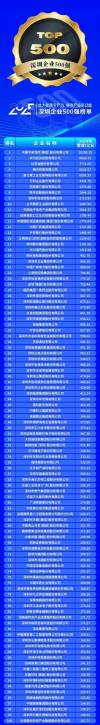

2025深圳企业500强榜单发布:平安、华为、比亚迪位列前三

Sou Hu Cai Jing· 2025-10-28 17:42

Core Insights - The "2025 Shenzhen Top 500 Enterprises List" was officially released, with Ping An Insurance, Huawei Investment, and BYD ranking as the top three, maintaining their leading positions [1][16] - The list is based on the companies' revenue for the fiscal year 2024, and the accompanying report analyzes various dimensions of enterprise development, including scale, operational efficiency, innovation capability, social contribution, and internationalization [1][16] Group 1: Key Characteristics of the Top 500 Enterprises - Overall revenue growth is observed, with 18 companies exceeding 100 billion yuan in revenue, but the average sales profit margin has decreased to 4.86%, down from 5.10% in 2023 [1][2] - The number of companies in the 1-10 billion yuan revenue range has increased to 331, a year-on-year growth of 5.41%, with total revenue in this segment rising by 9.76% [1][2] Group 2: Competitive Landscape - The competition among top enterprises is intensifying, with 97 new entrants making up 19% of the list, and only 22 companies maintaining their previous rankings [2] - The revenue threshold for entering the list has been consistently rising over the past five years, indicating a rapidly evolving competitive landscape [2] Group 3: Private Sector Dynamics - Private enterprises account for 70% of the list, contributing over 45% of total revenue, particularly excelling in high-end medical devices and robotics sectors [2] - The manufacturing sector remains robust, with 207 manufacturing companies on the list showing a revenue growth of 13.82%, although traditional manufacturing faces transformation pressures [2] Group 4: Regional Development - The regional development is categorized into three tiers: Nanshan and Futian as the "core leading tier," Longgang and four other districts as the "growth and challenge tier," and Luohu and three other districts as the "transformation and adjustment tier," highlighting distinct industrial characteristics and collaboration opportunities [2] Group 5: Future Directions - Shenzhen's top 500 enterprises need to focus on enhancing value addition, optimizing innovation workforce allocation, balancing industrial development, and improving overseas business layouts to drive sustainable growth and support the city's economic high-quality development [16]

国家金融监督管理总局:支持境内保险公司在香港发行“侧挂车”保险连接证券

Zheng Quan Ri Bao Wang· 2025-10-28 14:24

Core Viewpoint - The National Financial Regulatory Administration has issued a notice to support domestic insurance companies in issuing "sidecar" insurance-linked securities in the Hong Kong market, aiming to enhance catastrophe risk management and diversify risk channels [1][3]. Group 1: Issuance of "Sidecar" Insurance-Linked Securities - The notice supports domestic insurance companies in issuing "sidecar" insurance-linked securities in Hong Kong, which allows for the transfer of catastrophe risks such as earthquakes, typhoons, and floods to specially established special purpose insurance companies [1][2]. - The issuance of these securities is part of a broader strategy to explore catastrophe bonds and effectively utilize reinsurance to mitigate risks [1]. Group 2: Management and Regulatory Requirements - The notice outlines management requirements for special purpose insurance companies, including the establishment and management of these entities, reinsurance arrangements, and securities issuance, in accordance with existing regulatory guidelines [2]. - It also specifies solvency requirements related to reinsurance receivables and reserves, ensuring compliance with solvency supervision regulations [2]. Group 3: Benefits of "Sidecar" Insurance-Linked Securities - The introduction of "sidecar" insurance-linked securities is expected to enhance China's catastrophe risk protection system by providing additional coverage from the Hong Kong capital market, complementing traditional reinsurance [3]. - These securities will improve the financial stability of insurance companies by allowing them to share catastrophe risks with the capital market, thus smoothing operational volatility and increasing resilience against catastrophic events [3]. - Additionally, "sidecar" insurance-linked securities will offer a new investment product in the Hong Kong market, characterized by low correlation with traditional financial assets and typically triggered by natural disasters, providing investors with diversified options [3].

金融监管总局发文支持境内保险公司在香港市场发行“侧挂车”保险连接证券

Xin Hua Wang· 2025-10-28 12:54

Core Viewpoint - The Financial Regulatory Administration has announced support for domestic insurance companies to issue "sidecar" insurance-linked securities in the Hong Kong market, aiming to enhance catastrophe risk management and diversify risk distribution channels [1] Group 1: Regulatory Support - The Financial Regulatory Administration issued a notification to support domestic insurance companies in issuing "sidecar" insurance-linked securities in Hong Kong [1] - This initiative is part of efforts to strengthen the construction of Hong Kong as an international financial center [1] Group 2: Product Definition - "Sidecar" insurance-linked securities involve domestic insurance companies transferring catastrophe risks from natural disasters or public health emergencies to specially established special purpose insurance companies [1] - These special purpose companies will issue equity or debt-type insurance-linked securities to raise funds for fulfilling compensation obligations [1] Group 3: Benefits to the Industry - The introduction of "sidecar" insurance-linked securities is seen as an effective supplement to the traditional reinsurance market, expanding catastrophe risk distribution channels [1] - This move is expected to smooth out operational fluctuations for insurance companies and enhance the resilience of the insurance industry in managing catastrophe risks [1] - Additionally, it provides new investment products for the Hong Kong market, enriching investment options available [1]

国务院关于金融工作情况的报告:科技、绿色、普惠、养老、数字经济产业贷款均明显高于全部贷款增速

Bei Jing Shang Bao· 2025-10-28 12:00

Financial Support for the Real Economy - From November 2024 to September 2025, 98 companies in the A-share market conducted initial public offerings (IPOs), raising a total of 91.8 billion yuan, with 86% being private enterprises and 92% in strategic emerging industries [1] - Listed companies raised 996.8 billion yuan through refinancing, which is equivalent to the total amount raised in the previous two years combined [1] Improvement in Financial Services for Key Areas - A policy framework has been established focusing on five key areas: technology finance, green finance, inclusive finance, pension finance, and digital finance [2] - The introduction of a "technology board" in the bond market and the creation of risk-sharing tools for technology innovation bonds have been implemented to enhance financial support for technological innovation [2] - By the end of September 2025, loans for technology, green, inclusive, pension, and digital economy sectors increased by 11.8%, 22.9%, 11.2%, 58.2%, and 12.9% respectively, all significantly higher than the overall loan growth rate [2] - Over 600 entities issued technology innovation bonds totaling approximately 1.4 trillion yuan [2]

高净值银发族养老收入替代率75%,保险可以做什么?

Sou Hu Cai Jing· 2025-10-28 11:39

Core Insights - The aging population in China is becoming a pressing reality, with projections indicating that by the end of 2024, the elderly population aged 60 and above will reach 310 million, accounting for 22% of the total population [3] - High-net-worth individuals show a strong preference for home-based elderly care, with 68% opting for it, while 21% choose institutional care, and 11% prefer community care [3] - The average annual expenditure for high-net-worth individuals on institutional care is 275,000 yuan, with 37% spending over 300,000 yuan annually [3] Group 1: Aging Population and Financial Services - The role of commercial insurance in elderly care is becoming increasingly significant, with high-net-worth retirees enjoying a replacement income rate of 75%, significantly higher than the national average of 42.6% [4] - Over 50% of high-net-worth individuals have actively allocated funds to commercial annuity insurance, indicating a strong inclination towards financial products that support retirement [4] Group 2: Company Initiatives and Strategies - On its 25th anniversary, China CITIC Bank Life Insurance launched a comprehensive elderly care service system that integrates medical care, wealth management, and cross-border cooperation, marking a new era in response to national elderly care strategies [5] - The company aims to build a comprehensive elderly financial service system focusing on the four core areas of health, care, education, and wealth, providing one-stop solutions for individuals, families, and enterprises [5][6] Group 3: Future Home Project - The "Future Home" project aims to combine traditional family care with diverse elderly services, creating a comprehensive service system that includes health protection, spiritual nourishment, and life experiences [7] - The project will feature facilities such as medical rooms, rehabilitation centers, and a secondary hospital embedded within the elderly care institution, ensuring a patient-centered medical care system [7] Group 4: Talent Development and Professionalization - To enhance the implementation of elderly financial services, the company has initiated a certification management system for elderly financial planners, aiming to cultivate professionals with comprehensive capabilities in wealth management and care services [8] - The introduction of ten representatives from various subsidiaries as elderly financial planners signifies an upgrade in the talent support for the elderly financial service system [8]

华安基金:港股红利上周逆势上涨,配置价值仍较高

Xin Lang Ji Jin· 2025-10-28 06:09

Market Overview and Key Insights - The Hong Kong dividend sector saw a counter-trend increase last week, with the Hang Seng Hong Kong Stock Connect China Central Enterprises Dividend Total Return Index rising by 1.11%, while the Hang Seng Index fell by 3.96% and the Hang Seng Technology Index dropped by 7.98% [1] - The utility sector led the gains among Hang Seng's primary industries, while the information technology sector experienced the largest decline [1] Investment Perspective - The previous fluctuations in the dividend style may have reached a sufficient correction, making the current investment value more attractive, with capital likely to shift towards Hong Kong dividend stocks [1] - The ongoing U.S.-China tensions may cause short-term market disturbances, and the growth sector has accumulated significant gains, leading to potential profit-taking and capital reallocation [1] - Compared to the growth sector, Hong Kong dividends have shown notable stagnation and even some decline over the past two months, highlighting a more favorable valuation [1] Policy Perspective - Policy support has enhanced the attractiveness of dividend assets, with A-share companies increasing their dividend payouts significantly in 2024, injecting long-term valuation reformation momentum into dividend assets [1] - New regulations on bond value-added tax may indirectly benefit dividend-type assets [1] Funding Perspective - The demand for long-term capital allocation, particularly from insurance funds, is expected to continue, providing stable inflows into dividend assets despite potential shifts in trading capital towards growth sectors [1] Dividend Yield and Valuation - The Hang Seng Hong Kong Stock Connect China Central Enterprises Dividend Index boasts a dividend yield of 6.02% compared to 4.42% for the CSI Dividend Index, with a price-to-book (PB) ratio of 0.61 and a price-to-earnings (PE) ratio of 6.81 [2] - Since the beginning of 2021, the total return index has achieved a cumulative return of 138%, outperforming the Hang Seng Total Return Index by 128% [2] ETF Overview - The Huaan Hong Kong Stock Connect Central Enterprises Dividend ETF (code: 513920) tracks the Hang Seng Hong Kong Stock Connect China Central Enterprises Dividend Index, reflecting the performance of high-dividend securities listed in Hong Kong with state-owned enterprises as the largest shareholders [3] - This ETF is the first in the market to combine the attributes of Hong Kong stocks, central enterprises, and dividends, providing investors with opportunities to capitalize on the valuation reformation of central enterprises [3] Recent Performance of ETF - The performance of the Huaan Hong Kong Stock Connect Central Enterprises Dividend ETF (513920) was noted last week [4] Top Holdings Performance - The top ten weighted stocks in the Hang Seng Hong Kong Stock Connect Central Enterprises Dividend Index showed varied performance, with notable dividend yields and weekly price changes [6]

山西监管局同意太平洋寿险太原市高新支公司变更营业场所

Jin Tou Wang· 2025-10-28 03:58

Core Viewpoint - The National Financial Supervision Administration of Shanxi has approved the relocation of the Pacific Life Insurance Taiyuan High-tech Branch to a new address in Taiyuan City, Shanxi Province [1] Group 1 - The new business location for the Pacific Life Insurance Taiyuan High-tech Branch is set to be at Room 901 and 905, 9th Floor, No. 215, Sports Road, Xiaodian District, Taiyuan City, Shanxi Province [1] - The approval includes a directive for the Pacific Life Insurance Taiyuan Center Branch to timely handle the relocation and license renewal procedures as per relevant regulations [1]

机构风向标 | 彩蝶实业(603073)2025年三季度已披露持仓机构仅5家

Xin Lang Cai Jing· 2025-10-28 01:52

Core Viewpoint - Caidie Industrial (603073.SH) reported its Q3 2025 results, indicating a decline in institutional investor holdings compared to the previous quarter [1] Institutional Holdings - As of October 27, 2025, five institutional investors disclosed holdings in Caidie Industrial, totaling 3.2955 million shares, which represents 2.84% of the company's total share capital [1] - The institutional holding percentage decreased by 0.28 percentage points compared to the previous quarter [1] Public Fund Disclosures - One new public fund was disclosed this quarter, namely the CITIC Prudential Multi-Strategy Mixed (LOF) A [1] - A total of 47 public funds were not disclosed this quarter, including notable funds such as Nuon Multi-Strategy Mixed A, Huaxia CSI 500 Index Enhanced A, and others [1]