VGT(300476)

Search documents

AI手机概念涨3.88%,主力资金净流入17股

Zheng Quan Shi Bao Wang· 2025-10-24 10:04

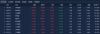

Core Viewpoint - The AI mobile concept sector has seen a significant increase of 3.88% as of the market close on October 24, ranking sixth among concept sectors, with 24 stocks rising, including notable gains from companies like 汇顶科技 (10.00%) and 江波龙 (16.73%) [1][2]. Market Performance - The AI mobile concept sector experienced a net inflow of 28.39 billion yuan, with 17 stocks receiving net inflows, and 7 stocks exceeding 1 billion yuan in net inflows [2][3]. - The top net inflow was from 胜宏科技, which saw a net inflow of 10.54 billion yuan, followed by 领益智造 (5.68 billion yuan) and 汇顶科技 (3.14 billion yuan) [2][3]. Stock Performance - Key performers in the AI mobile concept sector included: - 胜宏科技: +7.95% with a net inflow ratio of 5.65% [3] - 领益智造: +4.65% with a net inflow ratio of 14.57% [3] - 汇顶科技: +10.00% with a net inflow ratio of 18.86% [3] - 江波龙: +16.73% with a net inflow ratio of 3.92% [3] - 佰维存储: +10.70% with a net inflow ratio of 3.36% [3] Sector Comparison - Other notable concept sectors included: - Storage chips: +5.66% - National big fund holdings: +4.88% - AI PC: +3.99% - Advanced packaging: +3.65% [2]

59.15亿主力资金净流入 PCB概念涨3.32%

Zheng Quan Shi Bao Wang· 2025-10-24 10:02

Core Insights - The PCB sector has seen a significant increase of 3.32% as of the market close on October 24, ranking it 10th among concept sectors, with 156 stocks rising, including notable gainers like C Super Ying and Shengyi Electronics reaching their daily limit of 20% [1][2] Group 1: Market Performance - The PCB concept sector experienced a net inflow of 5.915 billion yuan, with 96 stocks receiving net inflows, and 18 stocks exceeding 100 million yuan in net inflows [2] - Leading the net inflow is Fangzheng Technology with 1.08 billion yuan, followed by Shenghong Technology and C Super Ying with 1.054 billion yuan and 852 million yuan respectively [2][3] Group 2: Stock Performance - C Super Ying had an extraordinary increase of 397.60%, while other notable performers included Shengyi Electronics with a 19.99% rise and Fangzheng Technology with a 10.05% increase [1][3] - Stocks with the highest net inflow ratios include C Super Ying at 30.83%, Dawi Technology at 27.67%, and Fangzheng Technology at 21.04% [3] Group 3: Decliners - The stocks with the largest declines included Xianfeng Holdings, Dongcai Technology, and Huagong Technology, which fell by 2.73%, 2.60%, and 1.91% respectively [1][2]

59.15亿主力资金净流入,PCB概念涨3.32%

Zheng Quan Shi Bao Wang· 2025-10-24 09:58

Group 1 - PCB concept index rose by 3.32%, ranking 10th among concept sectors, with 156 stocks increasing, including Kexiang Co. and Shengyi Technology hitting the 20% limit up [1][2] - Notable gainers included C Chaoying with a staggering increase of 397.60%, followed by Inno Laser and Qiaofeng Intelligent with increases of 11.89% and 9.86% respectively [1][2] - The largest declines were seen in Xianfeng Holdings, Dongcai Technology, and Huagong Technology, with decreases of 2.73%, 2.60%, and 1.91% respectively [1][2] Group 2 - The PCB sector attracted a net inflow of 5.915 billion yuan, with 96 stocks receiving net inflows, and 18 stocks exceeding 100 million yuan in net inflow [2][3] - The top net inflow stock was Fangzheng Technology, with a net inflow of 1.08 billion yuan, followed by Shenghong Technology and C Chaoying with net inflows of 1.054 billion yuan and 852.36 million yuan respectively [2][3] - C Chaoying, Dwei Co., and Fangzheng Technology had the highest net inflow ratios at 30.83%, 27.67%, and 21.04% respectively [3] Group 3 - The PCB concept sector's performance was highlighted by significant trading volumes, with stocks like Fangzheng Technology and Shenghong Technology showing high turnover rates of 10.86% and 7.27% respectively [3][4] - Other notable performers included Shengyi Technology with a 19.99% increase and a turnover rate of 2.61% [3][4] - The overall market sentiment for the PCB sector appears positive, driven by strong capital inflows and notable stock performances [2][3]

元件板块10月24日涨6.98%,N超颖领涨,主力资金净流入60.12亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:21

Core Insights - The component sector experienced a significant increase of 6.98% on October 24, with N Chao Ying leading the gains [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Stock Performance - N Chao Ping (603175) saw a remarkable rise of 397.60%, closing at 84.99 with a trading volume of 368,400 shares and a transaction value of 2.764 billion [1] - Other notable performers included: - Kexiang Co. (300903) with a 20.00% increase, closing at 14.76 [1] - Shengyi Electronics (688183) with a 19.99% increase, closing at 88.94 [1] - Fangzheng Technology (600601) with a 10.05% increase, closing at 11.72 [1] Capital Flow - The component sector saw a net inflow of 6.012 billion in main funds, while retail investors experienced a net outflow of 3.761 billion [2][3] - Main funds showed significant interest in N Chao Ying, with a net inflow of 1.010 billion, representing 36.54% of the total [3] - Other companies like Shenghong Technology (300476) and Fangzheng Technology (600601) also attracted main fund inflows, but faced net outflows from retail investors [3]

A股午评:沪指刷新年内新高,商业航天板块强势爆发

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:57

Market Performance - The market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year, while the ChiNext Index rose over 2% [1] - As of the morning close, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component Index rose by 1.3%, and the ChiNext Index gained 2.09% [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Chang'an Chip and Puran Co. both hitting new highs [1] - The commercial aerospace sector had a strong performance, with Dahua Intelligent Technology achieving two consecutive trading limit ups, and over ten commercial aerospace stocks hitting the daily limit [1] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [1] Trading Volume and Individual Stocks - The total trading volume for the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [3] - Zhongji Xuchuang led individual stock trading with a transaction volume exceeding 13.2 billion yuan, followed by Shenghong Technology, Luxshare Precision, and Xinyi Sheng with high trading volumes [4]

胜宏科技获融资资金买入超23亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:24

Market Overview - The Shanghai Composite Index rose by 0.22% to close at 3922.41 points, with a daily high of 3926.22 points [1] - The Shenzhen Component Index also increased by 0.22%, closing at 13025.45 points, reaching a high of 13042.34 points [1] - The ChiNext Index saw a slight increase of 0.09%, closing at 3062.16 points, with a peak of 3066.46 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24434.98 billion yuan, with a financing balance of 24263.77 billion yuan and a securities lending balance of 171.21 billion yuan, reflecting a decrease of 13.34 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12437.9 billion yuan, down by 7.95 billion yuan, while the Shenzhen market's balance was 11997.07 billion yuan, decreasing by 5.39 billion yuan [2] - A total of 3455 stocks had financing funds buying in, with Shenghong Technology, Zhongji Xuchuang, and Xinye Technology being the top three, attracting 2.345 billion yuan, 2.189 billion yuan, and 1.762 billion yuan respectively [2] Fund Issuance - Four new funds were issued yesterday, including CITIC Prudential Consumer Opportunity Mixed A, Huatai-PB Yingtai Stable 3-Month Holding Mixed (FOF) A, Huatai-PB Yingtai Stable 3-Month Holding Mixed (FOF) C, and CITIC Prudential Consumer Opportunity Mixed C [3][4] Top Net Purchases on the Dragon and Tiger List - The top ten net purchases on the Dragon and Tiger list included Keda Guochuang with a net purchase of 139.12 million yuan, Hehe Intelligent with 130.14 million yuan, and Beifang Shares with 104.56 million yuan [5] - Keda Guochuang's closing price was 32.69 yuan, reflecting a 20.01% increase, while Hehe Intelligent closed at 24.21 yuan with a 3.77% rise [5] - The net purchases also included companies from various sectors such as machinery, coal, and media, indicating diverse investor interest [5]

昨日328股获融资买入超亿元 胜宏科技获买入23.45亿元居首

Ge Long Hui· 2025-10-24 01:29

Core Insights - On October 23, a total of 3,725 stocks in the A-share market received financing funds, with 328 stocks having a buying amount exceeding 100 million yuan [1] Financing Buy-In Amount - The top three stocks by financing buy-in amount were Shenghong Technology, Zhongji Xuchuang, and Xinyisheng, with buy-in amounts of 2.345 billion yuan, 2.189 billion yuan, and 1.762 billion yuan respectively [1] Financing Buy-In Proportion - Six stocks had financing buy-in amounts accounting for over 30% of the total transaction amount on that day. The top three were Jinqian Protein, Kemei Diagnostics, and Xinfengguang, with proportions of 35.28%, 34.33%, and 33.03% respectively [1] Net Financing Buy-In Amount - Seventeen stocks had net financing buy-in amounts exceeding 100 million yuan. The top three were Shenghong Technology, SMIC, and Sunshine Power, with net buy-in amounts of 466 million yuan, 451 million yuan, and 250 million yuan respectively [1]

328股获融资买入超亿元,胜宏科技获买入23.45亿元居首

Di Yi Cai Jing· 2025-10-24 01:21

Summary of Key Points Core Viewpoint - On October 23, a total of 3,725 stocks in the A-share market received financing funds, with 328 stocks having a buying amount exceeding 100 million yuan, indicating strong investor interest in certain stocks [1] Group 1: Financing Buy Amount - The top three stocks by financing buy amount were Shenghong Technology, Zhongji Xuchuang, and Xinyisheng, with amounts of 2.345 billion yuan, 2.189 billion yuan, and 1.762 billion yuan respectively [1] - Six stocks had financing buy amounts accounting for over 30% of the total transaction amount for the day, with Jinchuan Protein, Kemei Diagnostics, and New Wind Power leading at 35.28%, 34.33%, and 33.03% respectively [1] Group 2: Net Financing Buy Amount - Seventeen stocks had net financing buy amounts exceeding 100 million yuan, with Shenghong Technology, SMIC, and Sunshine Power ranking the highest at 466 million yuan, 451 million yuan, and 250 million yuan respectively [1]

17股获融资净买入额超1亿元 胜宏科技居首

Zheng Quan Shi Bao Wang· 2025-10-24 01:21

个股方面,10月23日有1714只个股获融资净买入,净买入金额在3000万元以上的有115股。其中,17股 获融资净买入额超1亿元。胜宏科技获融资净买入额居首,净买入4.66亿元;融资净买入金额居前的还 有中芯国际、阳光电源、赣锋锂业、德明利、中际旭创、拓荆科技、中国铝业、同花顺等股。 Wind统计显示,10月23日,申万31个一级行业中有11个行业获融资净买入,其中,机械设备行业获融 资净买入额居首,当日净买入3.59亿元;获融资净买入的行业还有电力设备、煤炭、有色金属、电子、 计算机等。 ...

主力资金 | 尾盘“回马枪”?主力资金尾盘大幅加仓股出炉

Sou Hu Cai Jing· 2025-10-23 12:36

Core Insights - The main point of the articles is the analysis of capital flows in various industries and individual stocks, highlighting significant inflows and outflows of funds on October 23rd, 2023. Group 1: Industry Performance - The main stock markets experienced a net outflow of 257.81 billion yuan, with the ChiNext board seeing a net outflow of 82.54 billion yuan and the CSI 300 index experiencing a net outflow of 58.03 billion yuan [1] - Among the 21 primary industries, the coal industry had the highest increase at 1.75%, while the telecommunications sector saw the largest decline at 1.51% [1] - Five industries received net inflows, with the coal industry leading at 8.12 billion yuan, followed by media and comprehensive industries with inflows of 5.61 billion yuan and 1.31 billion yuan, respectively [1] Group 2: Individual Stock Performance - The leading stock for net inflow was Shenghong Technology, with 6.66 billion yuan, and it increased by 2.74% [2][3] - Demingli, a storage chip stock, followed with a net inflow of 6.19 billion yuan and a rise of 4.10% [2][3] - Other notable stocks with significant inflows included Duofluo (5.93 billion yuan), Ganfeng Lithium (4.81 billion yuan), and Sunshine Power (4.72 billion yuan) [2][3] Group 3: Major Outflows - ZTE Corporation experienced the largest net outflow at 9.39 billion yuan, followed by Xinyi Technology and BYD with outflows exceeding 4 billion yuan [4][5] - The machinery and equipment sector saw the highest net outflow, totaling 42.22 billion yuan, with the pharmaceutical and telecommunications sectors also experiencing significant outflows [1] Group 4: End-of-Day Capital Flows - At the end of the trading day, there was a net inflow of 35.86 billion yuan, with the ChiNext board contributing 25.56 billion yuan [6][7] - Notable stocks with significant end-of-day inflows included Dongfang Fortune and Keda Guokuan, each exceeding 2.4 billion yuan [6][7]