EOPTOLINK(300502)

Search documents

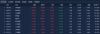

通信行业资金流入榜:中际旭创、新易盛等净流入资金居前

Zheng Quan Shi Bao Wang· 2025-10-24 10:05

Core Viewpoint - The Shanghai Composite Index rose by 0.71% on October 24, with the communication and electronics sectors leading the gains at 4.73% and 4.72% respectively, while the oil and coal sectors experienced declines of 1.36% and 1.29% [1] Market Overview - A total net inflow of 21.96 billion yuan was observed in the two markets, with 11 sectors seeing net inflows. The electronics sector had the highest net inflow of 22.39 billion yuan, followed by the power equipment sector with a 2.20% increase and a net inflow of 3.71 billion yuan [1] - Conversely, 20 sectors experienced net outflows, with the pharmaceutical and biological sector leading with a net outflow of 2.49 billion yuan, followed by the food and beverage sector with a net outflow of 1.75 billion yuan [1] Communication Sector Performance - The communication sector saw a rise of 4.73% with a net inflow of 2.66 billion yuan, where 98 out of 125 stocks in the sector increased in value, and one stock hit the daily limit [2] - The top three stocks with the highest net inflow in the communication sector were Zhongji Xuchuang with 1.26 billion yuan, followed by Xinyi Sheng and Changxin Bochuang with 800 million yuan and 265 million yuan respectively [2] - The stocks with the highest net outflows included China Unicom, Sanwei Communication, and China Telecom, with outflows of 169 million yuan, 160 million yuan, and 107 million yuan respectively [3]

人工智能概念股走强,相关ETF涨超5%

Mei Ri Jing Ji Xin Wen· 2025-10-24 07:05

Core Viewpoint - The artificial intelligence (AI) concept stocks have shown strong performance, with notable increases in share prices for several companies, indicating a positive market sentiment towards the AI sector [1]. Group 1: Stock Performance - Zhongji Xuchuang's stock price increased by over 11%, while Xinyi Sheng and Beijing Junzheng rose by over 7%, and Tianfu Communication saw an increase of over 6% [1]. - The AI-related ETFs in the ChiNext market also experienced significant gains, with an overall increase of over 5% [1]. Group 2: ETF Details - The following are the performances of various ChiNext AI-related ETFs: - Guotai AI ETF (159388): Current price 1.805, up 0.095 (5.56%) - Huaxia AI ETF (159381): Current price 1.665, up 0.086 (5.45%) - Dachen AI ETF (159242): Current price 1.490, up 0.077 (5.45%) - Huabao AI ETF (159363): Current price 0.884, up 0.046 (5.49%) - Nanfang AI ETF (159382): Current price 1.893, up 0.096 (5.34%) - Fuguo AI ETF (159246): Current price 1.667, up 0.084 (5.31%) - Hu'an AI ETF (159279): Current price 1.010, up 0.049 (5.10%) [2]. Group 3: Market Insights - Analysts indicate that the AI application ecosystem is becoming increasingly robust, with rapid penetration of large model technologies in vertical sectors such as finance, healthcare, and education, surpassing market expectations for commercialization [2]. - With increased policy support and accelerated domestic computing power development, leading companies across the AI industry chain are expected to continue benefiting [2].

【深度】机构与游资共舞:“易中天”、“寒王”是如何“飞天”的?

Xin Lang Cai Jing· 2025-10-24 06:57

Core Viewpoint - The recent surge in stock prices of major technology companies in the A-share market is significantly influenced by market rumors and speculative trading, particularly through "small essays" that create hype around these stocks [1][2][4]. Group 1: Market Dynamics - The rumor that major telecom operators will purchase 10,000 chips monthly from Cambrian Technology led to a rapid increase in its stock price, rising over 7% in a single day [1]. - Other technology stocks, such as Xinyi Technology and Zhongji Xuchuang, also experienced significant price increases due to similar market rumors regarding demand for optical modules [1]. - Year-to-date, major technology stocks have shown remarkable performance, with Xinyi Technology, Zhongji Xuchuang, and Cambrian Technology achieving maximum gains of 791.10%, 758.95%, and 206.51% respectively [1]. Group 2: Investment Trends - Institutional and retail investors are increasingly aligning their investment preferences, driving the rise of technology stocks [5][13]. - Xinyi Technology serves as a prime example of this trend, with significant increases in holdings by open-end funds and ETFs, reflecting a growing institutional interest [5][13]. - The stock's performance has been bolstered by its strong financial results, with net profits for the first half of the year showing substantial year-on-year growth [13]. Group 3: Investor Behavior - The influx of retail investors into stocks like Tianfu Communication has been notable, with the number of shareholders increasing significantly during price surges [11]. - The trend of institutional and retail investors gravitating towards technology stocks is seen as a shift from previous speculative trading patterns to a focus on fundamentals and performance [13][19]. - The popularity of technology stocks has led to a rise in the number of thematic funds, particularly in AI, which has attracted substantial capital inflows [15][27]. Group 4: Market Risks and Concerns - The concentration of investments in technology stocks has raised concerns about market fragmentation, with other sectors like consumer and real estate facing capital outflows [19][21]. - The high concentration of institutional holdings in certain technology stocks poses risks of liquidity issues and potential sell-offs if market sentiment shifts [24][27]. - Historical precedents from previous market bubbles highlight the potential for rapid declines in stock prices when investor enthusiasm wanes [24][27].

CPO高歌猛进,中际旭创飙涨超10%!云计算ETF汇添富(159273)大涨近4%!机构:长期看好算力产业链!

Sou Hu Cai Jing· 2025-10-24 06:06

Group 1 - The core viewpoint of the news highlights the significant performance of the cloud computing ETF, Huatai-PineBridge (159273), which surged nearly 4% due to favorable policy developments, with trading volume exceeding 420 million yuan, far surpassing the previous day's total [1][3] - As of October 23, the latest scale of the cloud computing ETF Huatai-PineBridge has exceeded 1.6 billion yuan, maintaining a leading position among its peers [1] - Major stocks within the ETF's index saw positive movements, with notable gains from companies such as Zhongji Xuchuang (over 10% increase) and Xinyi Sheng (7% increase) [4] Group 2 - A recent agreement between China and the U.S. involves Chinese representatives visiting Malaysia for economic and trade discussions from October 24 to 27, indicating ongoing diplomatic engagement [3] - High-level discussions emphasized significant achievements in high-quality development and advancements in technological self-reliance during the "14th Five-Year Plan" period [3][6] - Analysts from China Galaxy Securities express a long-term positive outlook on the computing power industry, driven by AI and semiconductor growth, with expectations for continued demand in various sectors [6][7] Group 3 - Domestic AI computing power leaders, Haiguang Information and Cambricon, reported substantial revenue growth in their third-quarter results, indicating a robust expansion phase for domestic AI computing capabilities [9] - Haiguang Information achieved a revenue of 9.49 billion yuan, a year-on-year increase of 54.65%, while Cambricon reported a staggering 2386.38% increase in revenue, reaching 4.607 billion yuan [9] - The cloud computing ETF Huatai-PineBridge is positioned to capture opportunities in the AI-driven computing landscape, covering a wide range of sectors including hardware, cloud services, and IT services [9]

算力狂飙带飞光模块 5000亿中际旭创再创新高

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 06:04

Core Viewpoint - The domestic computing power industry in China is entering a period of explosive growth by 2025, driven by high capital expenditure from major companies and a consensus on domestic computing power. This is supported by breakthroughs in advanced processes and innovation, leading to a self-controlled industrial chain [1][2]. Demand Side - Major companies are continuing to increase capital expenditure, indicating a strong demand for domestic computing power. The consensus on domestic computing power is gradually forming [1][2]. - By 2025, China's intelligent computing power scale is expected to reach 1037.3 EFLOPS, with a compound annual growth rate of 46.2% from 2023 to 2028, highlighting the significant demand for high-end computing power in AI training and inference scenarios [3]. Supply Side - Breakthroughs in advanced processes are being made, with companies like Cambrian and Moore Threads seeing revenue growth. Huawei has announced a three-year plan for its Ascend products, contributing to the formation of a self-controlled domestic computing power industrial chain [2]. - The light module sector is expected to benefit significantly from the computing power revolution, with companies like Zhongji Xuchuang and New Yisheng showing strong financial performance and technological advancements [1][4]. Financial Performance - Zhongji Xuchuang reported a revenue of 14.789 billion yuan in the first half of 2025, a year-on-year increase of 36.95%, with a net profit of 3.995 billion yuan, up 69.4%. The company's gross margin improved to 39.96% [4]. - New Yisheng experienced explosive growth, with a revenue of 10.437 billion yuan in the first half of 2025, a year-on-year increase of 282.64%, and a net profit of 3.942 billion yuan, up 355.68% [4][5]. Market Trends - The global AI computing power market is projected to reach 1.2 trillion USD by 2025, with China accounting for 38%. Key sectors driving demand include intelligent driving, industrial AI, and medical imaging, which together contribute 62% of computing power consumption [3]. - The light module market is expected to maintain high growth, with significant capital expenditure from major cloud companies projected to increase by 50% to 333.8 billion USD in 2025 [7]. Competitive Landscape - Chinese companies have established a dominant position in the global midstream market, with Zhongji Xuchuang and New Yisheng ranking among the top three globally [5]. - Zhongji Xuchuang's competitive advantages include high-quality delivery capabilities, supply chain strength, and a leading position in silicon photonics technology [8].

新易盛股价涨5.24%,天治基金旗下1只基金重仓,持有1160股浮盈赚取2.11万元

Xin Lang Cai Jing· 2025-10-24 06:04

Group 1 - The core viewpoint of the news is that Chengdu Xinyi Communication Technology Co., Ltd. (新易盛) has seen a significant increase in its stock price, rising by 5.24% to 365.99 yuan per share, with a trading volume of 15.186 billion yuan and a turnover rate of 4.76%, resulting in a total market capitalization of 363.784 billion yuan [1] - The company specializes in the research, development, production, and sales of optical modules, with a revenue composition of 98.86% from products above 25G, 0.87% from products below 25G, and 0.26% from other sources, while PON contributes 0.00% [1] Group 2 - Tianzhi Fund has a significant holding in Xinyi, with its Tianzhi Trend Selected Mixed Fund (350007) holding 1,160 shares, accounting for 3.08% of the fund's net value, making it the fourth-largest holding [2] - The Tianzhi Trend Selected Mixed Fund has achieved a year-to-date return of 48.25%, ranking 867 out of 8,154 in its category, and a one-year return of 56.79%, ranking 413 out of 8,025 [2] - The fund manager, Liang Li, has been in position for 4 years and 194 days, with the fund's total asset size at 71.0539 million yuan, achieving a best return of 15.8% and a worst return of -63.99% during her tenure [2]

【市场万象】 从“易中天”“纪连海” 看A股市场的谐音梗

Zheng Quan Shi Bao Wang· 2025-10-24 06:01

Group 1 - The article discusses the phenomenon of "homophonic puns" in the A-share market, where certain stocks are associated with well-known figures like "Yi Zhongtian" and "Ji Lianhai" due to their phonetic similarities [1][2] - The companies mentioned, such as Xinyisheng (300502), Zhongji Xuchuang (300308), and Tianfu Communication (300394), have seen their stock prices double this year and increase over tenfold from their lows in previous years, driven by the popularity of the CPO concept [1] - The article highlights that these associations are often superficial and do not reflect any real connection between the companies and the figures they are linked to, indicating a trend of speculative trading based on market attention rather than fundamentals [2] Group 2 - Investors are cautioned against relying on homophonic puns for long-term investment strategies, as this approach is deemed unreliable and carries significant risks [2] - An example provided is Chuan Dazhi Sheng (002253), which was linked to "Trump" and faced a decline of over 20% despite a general market uptrend, illustrating the potential pitfalls of such speculative investments [2] - The article emphasizes the importance of understanding the fundamentals of companies before making investment decisions, rather than succumbing to the impulse of short-term speculation based on trends [2]

CPO概念板块领涨,上涨5.79%

Di Yi Cai Jing· 2025-10-24 06:00

Core Viewpoint - The CPO concept sector has led the market with a rise of 5.79%, indicating strong investor interest and potential growth in this area [1] Group 1: Sector Performance - The CPO concept sector experienced a significant increase of 5.79% [1] - Notable performers include: - Fangzheng Technology, which rose by 10.05% [1] - Zhongji Xuchuang, with an increase of 10.01% [1] - Huilv Ecology, up by 9.98% [1] - Other companies such as Changxin Bochuang, Xinyi Sheng, and Jingwang Electronics also saw gains exceeding 6% [1]

芯片、AI算力持续拉升,半导体设备ETF(561980)、云计算ETF(159890)联袂走强

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 04:23

Group 1 - The semiconductor and AI computing sectors are experiencing significant gains, with notable increases in stock prices for companies such as North Huachuang and Zhongwei Company, which rose by 2.56% and 4.96% respectively, and others like Tuojing Technology, which surged by 5.10% [1] - The Cloud Computing ETF (159890) increased by 2.04%, while the Semiconductor Equipment ETF (561980) rose by 3.54%, indicating strong investor interest with a net inflow of over 340 million yuan in the last 10 trading days [1][2] - The policy environment continues to favor technological innovation, with support for unprofitable companies to enter the capital market, which is expected to accelerate the listing process for semiconductor giants by 2025 [3] Group 2 - The Semiconductor Equipment ETF (561980) tracks the CSI Semiconductor Index, which has approximately 70% exposure to semiconductor equipment and materials, focusing on key areas of technological advancement [3] - The CSI Semiconductor Index has shown a remarkable increase of 480.37% from January 1, 2019, to October 23, 2025, making it the top performer among mainstream semiconductor indices [4] - Major companies in the ETF's top holdings include Zhongwei Company, North Huachuang, and others, which are pivotal in the semiconductor equipment, materials, and integrated circuit design and manufacturing sectors [3]

A股午评:沪指刷新年内新高,商业航天板块强势爆发

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:57

Market Performance - The market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year, while the ChiNext Index rose over 2% [1] - As of the morning close, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component Index rose by 1.3%, and the ChiNext Index gained 2.09% [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Chang'an Chip and Puran Co. both hitting new highs [1] - The commercial aerospace sector had a strong performance, with Dahua Intelligent Technology achieving two consecutive trading limit ups, and over ten commercial aerospace stocks hitting the daily limit [1] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [1] Trading Volume and Individual Stocks - The total trading volume for the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [3] - Zhongji Xuchuang led individual stock trading with a transaction volume exceeding 13.2 billion yuan, followed by Shenghong Technology, Luxshare Precision, and Xinyi Sheng with high trading volumes [4]