EOPTOLINK(300502)

Search documents

A股午评:沪指刷新年内新高,商业航天板块强势爆发

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:57

Market Performance - The market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year, while the ChiNext Index rose over 2% [1] - As of the morning close, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component Index rose by 1.3%, and the ChiNext Index gained 2.09% [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Chang'an Chip and Puran Co. both hitting new highs [1] - The commercial aerospace sector had a strong performance, with Dahua Intelligent Technology achieving two consecutive trading limit ups, and over ten commercial aerospace stocks hitting the daily limit [1] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [1] Trading Volume and Individual Stocks - The total trading volume for the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [3] - Zhongji Xuchuang led individual stock trading with a transaction volume exceeding 13.2 billion yuan, followed by Shenghong Technology, Luxshare Precision, and Xinyi Sheng with high trading volumes [4]

新易盛成交额达100亿元,现涨4.58%。

Xin Lang Cai Jing· 2025-10-24 03:33

Group 1 - The core point of the article is that Xinyisheng achieved a transaction volume of 10 billion yuan, with a current increase of 4.58% [1] Group 2 - The transaction volume of Xinyisheng reached 10 billion yuan, indicating strong market activity [1] - The stock price of Xinyisheng has risen by 4.58%, reflecting positive investor sentiment [1]

胜宏科技获融资资金买入超23亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:24

Market Overview - The Shanghai Composite Index rose by 0.22% to close at 3922.41 points, with a daily high of 3926.22 points [1] - The Shenzhen Component Index also increased by 0.22%, closing at 13025.45 points, reaching a high of 13042.34 points [1] - The ChiNext Index saw a slight increase of 0.09%, closing at 3062.16 points, with a peak of 3066.46 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24434.98 billion yuan, with a financing balance of 24263.77 billion yuan and a securities lending balance of 171.21 billion yuan, reflecting a decrease of 13.34 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12437.9 billion yuan, down by 7.95 billion yuan, while the Shenzhen market's balance was 11997.07 billion yuan, decreasing by 5.39 billion yuan [2] - A total of 3455 stocks had financing funds buying in, with Shenghong Technology, Zhongji Xuchuang, and Xinye Technology being the top three, attracting 2.345 billion yuan, 2.189 billion yuan, and 1.762 billion yuan respectively [2] Fund Issuance - Four new funds were issued yesterday, including CITIC Prudential Consumer Opportunity Mixed A, Huatai-PB Yingtai Stable 3-Month Holding Mixed (FOF) A, Huatai-PB Yingtai Stable 3-Month Holding Mixed (FOF) C, and CITIC Prudential Consumer Opportunity Mixed C [3][4] Top Net Purchases on the Dragon and Tiger List - The top ten net purchases on the Dragon and Tiger list included Keda Guochuang with a net purchase of 139.12 million yuan, Hehe Intelligent with 130.14 million yuan, and Beifang Shares with 104.56 million yuan [5] - Keda Guochuang's closing price was 32.69 yuan, reflecting a 20.01% increase, while Hehe Intelligent closed at 24.21 yuan with a 3.77% rise [5] - The net purchases also included companies from various sectors such as machinery, coal, and media, indicating diverse investor interest [5]

国内AI人工智能板块正在爆发,AI人工智能ETF(512930)盘中涨超2.4%

Xin Lang Cai Jing· 2025-10-24 02:46

Group 1 - The user base of generative AI in China is rapidly increasing, expected to reach 515 million by June 2025, doubling in six months with a penetration rate of 36.5% [1] - The usage of Doubao large model tokens surged from 120 billion in May 2024 to over 30 trillion by September 2025, marking a 253-fold increase [1] - The policy support for computing power and data is advancing, with over 50 standards to be revised or established by 2027 to enhance the computing power standard system [1] Group 2 - The domestic AI ecosystem is continuously improving, with the AI industry chain accelerating, indicating a potential spiral growth in large models, computing power, and applications [2] - As of October 22, 2025, the CSI Artificial Intelligence Theme Index accounted for 6.3% of the total A-share trading volume, showing a recovery in trading density [2] - The CSI Artificial Intelligence Theme Index (930713) rose by 2.63% on October 24, 2025, with significant gains in constituent stocks such as Huida Technology (up 10.00%) and Beijing Junzheng (up 7.11%) [2] Group 3 - The AI Artificial Intelligence ETF has the lowest management fee of 0.15% and a custody fee of 0.05% among comparable funds [3] - As of October 23, 2025, the AI Artificial Intelligence ETF had a tracking error of 0.009% over the past three months, the highest tracking accuracy among comparable funds [3] - The CSI Artificial Intelligence Theme Index includes 50 listed companies that provide essential resources, technology, and application support for AI, with the top ten stocks accounting for 61.36% of the index [3] Group 4 - The top ten weighted stocks in the CSI Artificial Intelligence Theme Index include companies like Xinyi Sheng (6.52%), Zhongji Xuchuang (6.71%), and Hanwujing (6.45%), reflecting their significant influence on the index [5] - The AI Artificial Intelligence ETF is connected to various fund classes, enhancing its accessibility to investors [5]

新易盛涨2.02%,成交额41.39亿元,主力资金净流入9198.05万元

Xin Lang Cai Jing· 2025-10-24 02:29

Company Overview - Chengdu New E-Sun Communication Technology Co., Ltd. was established on April 15, 2008, and listed on March 3, 2016. The company specializes in the research, production, and sales of optical modules [1][2]. Stock Performance - As of October 24, the stock price of New E-Sun increased by 2.02%, reaching 354.77 CNY per share, with a trading volume of 4.139 billion CNY and a turnover rate of 1.33%. The total market capitalization is 352.632 billion CNY [1]. - Year-to-date, the stock price has risen by 331.40%, with a 12.16% increase over the last five trading days, a 2.68% increase over the last 20 days, and a 105.31% increase over the last 60 days [1]. Financial Performance - For the period from January to June 2025, New E-Sun achieved operating revenue of 10.437 billion CNY, representing a year-on-year growth of 282.64%. The net profit attributable to shareholders was 3.942 billion CNY, reflecting a year-on-year increase of 355.68% [2]. Shareholder Information - As of June 30, 2025, the number of shareholders for New E-Sun was 98,000, a decrease of 16.98% from the previous period. The average number of tradable shares per shareholder increased by 68.91% to 9,016 shares [2]. - The largest circulating shareholder is Hong Kong Central Clearing Limited, holding 50.575 million shares, an increase of 37.007 million shares from the previous period [3]. Dividends - Since its A-share listing, New E-Sun has distributed a total of 0.775 billion CNY in dividends, with 0.493 billion CNY distributed over the last three years [3]. Industry Classification - New E-Sun is classified under the communication industry, specifically in the communication equipment sector, focusing on communication network devices and components. The company is associated with several concept sectors, including LiDAR, CPO, overseas expansion, optical communication, and IDC (data center) [2].

53只权益基金前三季度净值增长率超100%

Zheng Quan Ri Bao· 2025-10-23 19:15

Core Insights - The equity market has shown strength in the first three quarters of the year, with 53 public funds achieving a net value growth rate exceeding 100%, highlighting a focus on technology and innovative pharmaceuticals [1][2] Group 1: Fund Performance - Yongying Technology Smart Mixed Fund A achieved a remarkable net value growth rate of 194.49%, leading the market, followed by Huatai-PineBridge Hong Kong Advantage Selection Mixed Fund A at 161.10% and China Europe Digital Economy Mixed Fund A at 140.86% [1] - The Longview Pharmaceutical Industry Selection A Fund also performed well, with a net value growth rate of 102.02%, ranking 45th in the market [3] Group 2: Investment Strategies - Yongying Technology Smart Mixed Fund A employed a high industry concentration strategy, focusing on the global cloud computing sector, with a stock position of 91.59% as of the end of Q3 [2] - The top three holdings of Yongying Technology Smart Mixed Fund A include Xinyi Technology, Zhongji Xuchuang, and Tianfu Communication, each with a market value exceeding 1 billion [2] Group 3: Fund Growth and Capital Inflows - The net asset value of Yongying Technology Smart Mixed Fund A surged from 1.166 billion to 11.521 billion, with shares increasing from 700 million to 3.466 billion [2] - Longview Pharmaceutical Industry Selection A Fund's size grew from 1.132 billion to 1.790 billion during the same period [3]

寒武纪、“易中天”等多股又遭袭扰!传言扰动明星股套路大揭秘

Di Yi Cai Jing· 2025-10-23 12:00

Core Viewpoint - The stock price of Cambrian (688256.SH) surged over 7% due to rumors that major telecom operators would order 10,000 chips monthly from the company next year, although the company later clarified that such claims should be verified through official announcements [2][4][5] Group 1: Impact of Rumors on Stock Prices - Cambrian's stock has previously experienced significant price increases due to similar unfounded rumors, occurring in March and August of this year [2][11] - Other companies, including Sanhua Intelligent Control (002050.SZ) and Wanrun Technology (002654.SZ), have also seen their stock prices rise sharply due to rumors, indicating a broader trend in the market [2][6] - The stock price of Cambrian reached a high of 1,468 CNY before closing at 1,429.5 CNY, marking a daily increase of 4.42% [4][5] Group 2: Mechanisms Behind Rumor Propagation - The spread of rumors is often facilitated by a network of social media platforms and stock communities, where unverified information can quickly gain traction [5][8] - Professional writers adept at information dissemination create these rumors, combining real and fictitious elements to manipulate market sentiment [13][16] - The rumors typically fall into three categories: performance speculation, asset restructuring, and absurd gossip, each designed to trigger investor interest [13][14] Group 3: Role of Quantitative and Speculative Trading - The activation of quantitative trading models by market sentiment plays a crucial role in the stock price movements following rumors [3][19] - Significant capital from speculative traders often amplifies the effects of these rumors, leading to rapid price increases [18][20] - The phenomenon creates a cycle where quantitative funds initiate buying, followed by speculative traders, ultimately attracting retail investors [19][20] Group 4: Regulatory and Market Implications - The prevalence of these rumors disrupts normal market operations, posing challenges for regulatory bodies to maintain order [20] - There is a call for improved information disclosure and timely clarifications from companies to combat the spread of misinformation [20]

寒武纪、“易中天”等多股又遭袭扰!传言扰动明星股套路大揭秘

第一财经· 2025-10-23 11:39

Core Viewpoint - The article discusses the impact of rumors on stock prices, particularly focusing on companies in hot sectors like AI chips and robotics, highlighting how these rumors can lead to significant price fluctuations and market manipulation [3][12][14]. Group 1: Rumors and Stock Price Movements - A rumor about Cambricon (寒武纪) receiving monthly orders for 10,000 chips from three major telecom operators led to a stock price surge of over 7% [3][6]. - Cambricon's stock has previously experienced similar spikes due to unfounded rumors, indicating a pattern of market manipulation through misinformation [3][12]. - Other companies, such as Sanhua Intelligent Control (三花智控) and Wanrun Technology (万润科技), have also seen their stock prices dramatically affected by similar rumors [8][12]. Group 2: Mechanisms Behind Rumor Spread - The spread of rumors is often facilitated by quantitative trading models and speculative funds that react to market sentiment, amplifying the effects of these rumors [4][26]. - The article notes that the recent surge in rumors is characterized by targeting popular companies in trending industries, which makes them more susceptible to market manipulation [13][14]. - A systematic approach to rumor creation involves blending real and fabricated information to create a compelling narrative that attracts investor attention [16][17]. Group 3: Types of Rumors - Rumors can be categorized into three main types: performance speculation, asset restructuring, and absurd gossip, each designed to exploit investor psychology [17][18]. - Performance speculation often involves exaggerated claims about large orders or revenue growth, while asset restructuring rumors may mix factual elements with falsehoods to create confusion [17][18]. - Absurd gossip can generate significant market interest despite having little to no basis in reality, as seen in the case of a rumor involving a personal relationship affecting a company's stock [19]. Group 4: Regulatory Challenges - The article highlights the difficulty of regulating the spread of rumors, as they often utilize viral marketing techniques that obscure their origins [23][24]. - The lack of a robust regulatory framework allows these "small essays" to proliferate unchecked, leading to significant market disruptions [23][24]. - The need for improved information disclosure and timely clarifications from companies is emphasized as a way to combat the negative effects of these rumors [27].

寒武纪、“易中天”等多股频遭袭扰 传言扰动明星股套路揭密

Di Yi Cai Jing· 2025-10-23 11:34

Core Viewpoint - The stock price of Cambrian (688256.SH) surged over 7% due to rumors that major telecom operators would order 10,000 chips monthly from the company next year, but the company later clarified that such claims should be verified through official announcements [1][3][5]. Group 1: Cambrian's Stock Movement - Cambrian's stock initially opened lower but later surged to a high of 1,468 CNY, closing at 1,429.5 CNY, marking a daily increase of 4.42% [2]. - The company has previously experienced similar stock price spikes due to unfounded rumors, occurring in March and August of this year [1][10]. - Following the rumor's spread, Cambrian's stock opened lower the next day, dropping nearly 4% in early trading [3]. Group 2: Market Impact of Rumors - Other companies, including Sanhua Intelligent Control (002050.SZ) and Wanrun Technology (002654.SZ), also saw significant stock price fluctuations due to similar rumors [5][9]. - A notable example involved Sanhua Intelligent Control, which experienced a stock price surge after a rumor about securing a $685 million order from Tesla, only to see a sharp decline after the company denied the claims [5][11]. - The recent surge in rumors has predominantly targeted popular sectors and companies, indicating a trend where misinformation is strategically aimed at high-interest stocks [9][10]. Group 3: Mechanisms Behind Rumor Spread - The spread of rumors is often facilitated by a network of social media and stock community platforms, where unverified information can quickly gain traction [7][15]. - The rumors typically exploit investor psychology, leveraging themes of significant orders or partnerships to create a sense of urgency and excitement [12][18]. - A systematic approach to rumor creation involves blending factual elements with fabricated details to enhance credibility and market impact [12][15]. Group 4: Role of Quantitative and Speculative Trading - The involvement of quantitative trading models and speculative funds plays a crucial role in amplifying the effects of these rumors, as they react to market sentiment rather than the veracity of the information [17][18]. - The rapid price movements triggered by rumors often attract retail investors, creating a cycle of buying and selling that benefits those who initiated the rumors [18][19]. - The current market environment, characterized by investor fragility, allows for the manipulation of stock prices through misinformation, highlighting the need for regulatory oversight [11][19].

主力动向:10月23日特大单净流出184.30亿元

Zheng Quan Shi Bao Wang· 2025-10-23 10:15

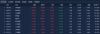

Core Points - The net outflow of large orders in the two markets reached 18.43 billion yuan, with 24 stocks seeing net inflows exceeding 200 million yuan, led by China Nuclear Engineering with a net inflow of 815 million yuan [1][2] - The Shanghai Composite Index closed up 0.22%, while 1,682 stocks experienced net inflows and 2,971 stocks saw net outflows [1] - Among the 10 industries with net inflows, coal had the largest inflow of 1.34 billion yuan, followed by media with 603 million yuan [1] Industry Summary - The coal industry saw a net inflow of 1.34 billion yuan, with an index increase of 1.75% [1] - The media industry had a net inflow of 603 million yuan, with a 0.90% increase [1] - Other industries with significant net inflows included non-ferrous metals and social services [1] Stock Summary - The top stocks with net inflows over 200 million yuan included: - China Nuclear Engineering: 815 million yuan, closing price 12.42 yuan, up 10.01% [2] - Dofluorid: 588 million yuan, closing price 21.40 yuan, up 8.91% [2] - SMIC: 584 million yuan, closing price 128.30 yuan, up 1.17% [2] - Stocks with the largest net outflows included: - ZTE Corporation: 951 million yuan, closing price 48.19 yuan, down 3.50% [4] - NewEase: 577 million yuan, closing price 347.76 yuan, down 4.15% [4] - CITIC Heavy Industries: 471 million yuan, closing price 7.15 yuan, down 5.80% [4] - Stocks with net inflows over 200 million yuan saw an average increase of 7.50%, outperforming the Shanghai Composite Index [2]