电动化转型

Search documents

暴跌99%、裁员,保时捷连富人都嫌弃了

3 6 Ke· 2025-10-30 02:29

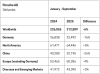

Core Insights - Porsche, once regarded as a "money printing machine" in the luxury sports car sector, is facing significant operational challenges, including a sharp decline in revenue and profitability, leading to strategic restructuring and layoffs [2][3][4] Financial Performance - In the first three quarters, Porsche reported revenue of approximately €26.86 billion, a year-on-year decrease of 6% [2] - Sales profit plummeted from €4.035 billion in the same period last year to €40 million, a staggering drop of 99% [2] - The sales return rate fell from 14.1% to 0.2%, with a third-quarter loss of €966 million (approximately ¥8 billion) [2] Strategic Changes - Porsche has initiated an organizational restructuring, planning to lay off 1,900 employees and cut 2,000 temporary positions by the end of the year [2] - The company has postponed the launch of several electric vehicle models and extended the lifecycle of various fuel and hybrid models, incurring an additional €2.7 billion (approximately ¥22.4 billion) in restructuring costs [2][7] Market Challenges - Porsche's sales in China fell to 32,000 units in the first three quarters of 2025, a 26% decline year-on-year and a 66% drop from the peak of 95,700 units in 2021 [4][6] - The company acknowledged its failure to adapt to changing consumer demands in China, particularly regarding electric vehicles [4][6] Electric Vehicle Strategy - Despite launching models like the Taycan, Porsche's overall electrification progress has lagged, with electric vehicle sales accounting for only 12.7% in 2024, far from the goal of 80% by 2030 [6][11] - The company has faced criticism for its strategic shifts, including the termination of its battery production plan and a renewed focus on internal combustion and hybrid vehicles [7][9] Competitive Landscape - The U.S. market poses additional challenges due to new tariffs, which are expected to result in a loss of approximately €700 million (around ¥5.8 billion) for Porsche [7][8] - Competitors like Tesla and Cadillac are gaining market share in the electric vehicle segment, further complicating Porsche's position [8][9] Leadership Changes - Michael Leiters has been appointed as the new CEO, effective January 1, 2026, ending the dual leadership model with Oliver Blume, who will remain CEO of Volkswagen Group [3][13]

保时捷3个月怒亏223亿,利润暴跌99%!都是电动车惹的祸?

电动车公社· 2025-10-29 18:31

Core Viewpoint - Porsche's operating profit has plummeted dramatically, with a reported drop from €4.035 billion in the same period last year to just €40 million, marking a staggering 99% decline [2][5][37]. Group 1: Financial Performance - In the first nine months of the year, Porsche's operating profit fell to €40 million from €4.035 billion year-on-year, indicating a severe financial downturn [2][18]. - The company experienced a significant loss of €9.66 billion in the third quarter alone, which severely impacted its overall performance [5][15]. - The total global deliveries decreased by approximately 6%, with a notable decline in the Chinese market, which was once Porsche's largest single market [15][61]. Group 2: Market Dynamics - Porsche's deliveries in China dropped by 25.6% year-on-year, with a total of 32,195 vehicles delivered in the first nine months of the year [7][8]. - The European market also saw declines, with Germany's deliveries down by 16.2% and overall European deliveries down by 4.2% [11][12]. - The only market showing growth was North America, where deliveries increased by 4.8%, helping to mitigate some losses [12][15]. Group 3: Electric Vehicle Transition - Porsche has ambitious plans for electrification, aiming for over 50% of new cars to be electric by 2025 and over 80% by 2030 [20][46]. - However, the transition has faced significant challenges, including delays in electric vehicle production and a lack of competitive products in the market [30][32]. - The company has had to scale back its electric vehicle ambitions, with plans to focus on high-performance battery development rather than mass production [32][37]. Group 4: Strategic Adjustments - Porsche announced plans to cut 1,900 jobs by 2029, with an additional 2,000 temporary positions being eliminated this year [39][42]. - The company is shifting back to internal combustion engine vehicles, delaying the launch of new fuel models to maintain profitability [34][42]. - A strategic leadership change is also underway, with a new CEO set to take over in 2026, which may influence future directions [68][70].

保时捷三季度亏损近10亿欧元,沃尔沃股价暴涨41%,车企密集发布三季报:谁在 “阵痛”?谁在 “狂欢”?

3 6 Ke· 2025-10-29 12:10

Core Insights - The global automotive industry is experiencing a significant market divide, with multinational companies facing contrasting financial results in Q3 2025. Porsche reported a surprising loss of nearly €1 billion, while General Motors and Volvo achieved strong profits due to local innovations and cost management [1][2][4][5]. Group 1: Multinational Companies Performance - Porsche's Q3 financial report revealed an operating income of approximately €26.86 billion, a 6% year-over-year decline, and a Q3 loss of €966 million. Its sales profit for the first three quarters was only €4 million, down 99% from €4.035 billion in the same period last year [4][5]. - General Motors achieved a net income of $48.6 billion in Q3, with a net profit of $1.3 billion and an adjusted EBIT of $3.4 billion, reflecting a 6.9% adjusted EBIT margin. The company has raised its full-year profit forecast to a range of $7.7 billion to $8.3 billion [5]. - Volvo's Q3 revenue was 86.4 billion Swedish Krona, with an operating profit of 6.4 billion Swedish Krona, exceeding analyst expectations. The net profit reached 5.195 billion Swedish Krona, up from 4.21 billion Swedish Krona year-over-year, and the stock price surged by 41% following the report [5][7]. Group 2: Domestic Companies Challenges - Domestic automotive companies are facing a "revenue growth without profit" dilemma, with rising sales costs impacting profitability. For instance, GAC Group reported a total revenue of 24.318 billion Yuan in Q3, while Great Wall Motors achieved a record revenue of 61.247 billion Yuan, a year-over-year increase of 20.51% [8][9]. - Changan Automobile reported a Q3 revenue of 42.236 billion Yuan, a 23.36% year-over-year increase, with a net profit of 0.764 billion Yuan, up 2.13% [8]. - BAIC Blue Valley continues to struggle with declining revenue, reporting a Q3 revenue of 5.867 billion Yuan, down 3.45%, and a net loss of 1.118 billion Yuan [8][9]. - The overall profit margin for the domestic automotive industry was reported at 4.5%, lower than the average of 6% for downstream industrial enterprises, indicating ongoing profitability challenges [11].

保时捷三季度亏损近10亿欧元 沃尔沃股价暴涨41%!车企密集发布三季报:谁在“渡劫”?谁在“狂欢”?

Mei Ri Jing Ji Xin Wen· 2025-10-29 10:17

Group 1: Core Insights - The automotive industry is experiencing a significant market divide, with multinational companies facing contrasting financial results in Q3 2025 [2][3] - Porsche reported an unexpected loss of nearly €1 billion in Q3, with a 99% drop in sales profit for the first three quarters compared to the previous year [3] - General Motors has achieved profitability in China for four consecutive quarters, with Q3 net income of $4.86 billion and a net profit of $1.3 billion [3][4] Group 2: Company Performance - Porsche's revenue for the first three quarters was approximately €26.86 billion, a 6% year-on-year decline, with Q3 losses attributed to product strategy adjustments and increased costs [3] - General Motors has raised its full-year profit forecast to a range of $7.7 billion to $8.3 billion, with adjusted EBIT expected between $12 billion and $13 billion [4] - Volvo's Q3 revenue was 86.4 billion Swedish Krona, with a net profit of 5.195 billion Swedish Krona, exceeding analyst expectations [4][5] Group 3: Domestic Market Challenges - Domestic automakers are facing a "revenue growth without profit" dilemma, with rising sales expenses impacting profitability [6][7] - GAC Group reported a Q3 revenue of 24.318 billion Yuan, while Great Wall Motors achieved a record Q3 revenue of 61.247 billion Yuan, a 20.51% year-on-year increase [6] - BAIC Blue Valley continues to struggle with declining revenue, reporting a Q3 revenue of 5.867 billion Yuan, a 3.45% year-on-year decrease [6][7] Group 4: Industry Trends - The domestic automotive industry's profit margin stands at 4.5%, lower than the average of 6% for downstream industrial enterprises [9] - The ongoing competitive landscape is leading to increased sales expenses across domestic automakers, which is affecting profit margins [7][9] - The trend of "anti-involution" efforts is showing some positive effects on improving industry profitability [9]

雷军的“偶像”,彻底撑不住了!

Sou Hu Cai Jing· 2025-10-29 07:35

Core Viewpoint - Porsche, once considered a luxury "money printing machine," is now facing a significant decline in sales and profits, with a 99% drop in operating profit in the first three quarters of the year compared to the previous year [2][5][7] Financial Performance - In the first three quarters of this year, Porsche's revenue decreased by 6% to €26.864 billion, while operating profit fell to €4 million from €4.035 billion in the same period last year [2][5] - The operating profit margin plummeted to 0.2%, down from 14.1% year-on-year [2][7] Sales Decline - Porsche's delivery volume peaked at 95,700 units in 2021 but is projected to drop to 56,900 units in 2024, representing a 28% year-on-year decline [5][10] - In China, Porsche's sales fell by 26% to 32,000 units, highlighting a significant shift in consumer preferences towards electric vehicles [10][11] Market Challenges - The luxury car market is experiencing a downturn, with competitors like BMW, Mercedes-Benz, and Audi also reporting declines in sales in China [10][11] - Porsche's struggles are attributed to several factors, including product strategy adjustments, challenging market conditions in China, one-time expenses related to battery activities, organizational changes, and increased import tariffs in the U.S. [7][11] Brand Perception and Strategy - Porsche's brand image is under threat as it resorts to discounting strategies, which contradicts its luxury positioning [13][15] - The company is facing a crisis of confidence among existing customers, as the brand's high-end status is compromised by significant price reductions [15][18] Electric Vehicle Transition - Porsche has been proactive in its electric vehicle strategy, launching the Taycan and aiming for 50% of its sales to come from electric and hybrid models by 2025, and over 80% by 2030 [18][19] - However, delays from its partner Volkswagen in developing electric vehicle architecture have hindered Porsche's ability to capitalize on the rapid growth of the electric vehicle market [18][19] Future Plans - Porsche is implementing a "Rui Jing Plan" to upgrade its dealership network and promote digital retail and services, aiming to regain market share in China by 2026 [24]

保时捷三季度巨亏10亿欧元:推迟电动化、精简人员能否破局?

Jing Ji Guan Cha Wang· 2025-10-28 10:15

Core Insights - Porsche, as a significant profit contributor to Volkswagen Group, reported a shocking loss of €966 million in Q3 2023, compared to a profit of €974 million in the same period last year [2][3] - The company's operating profit for the first nine months of 2023 was only €40 million, a drastic decline from €4.035 billion in the same period last year, with the operating profit margin plummeting from 14.1% to 0.2% [2][3] Financial Performance - In Q3 2023, Porsche's operating profit margin reached a record low of 18% in 2022 but fell significantly in 2023 [2] - The total special expenses for the year are expected to reach €3.1 billion, primarily due to strategic restructuring costs and increased tariffs [2][3] Strategic Challenges - The decline in performance is attributed to multiple factors, including product strategy restructuring, challenges in the Chinese luxury car market, and rising import tariff costs in the U.S. [2][3] - Porsche's strategic restructuring led to €1.8 billion in costs due to delays in electric vehicle launches and extended lifecycles for combustion and hybrid models [2][3] Market Dynamics - The Chinese market, Porsche's second-largest market after North America, is facing significant challenges, with a projected 3% decline in global sales to 311,000 units in 2024 and a 28% drop in sales in China [3][4] - The competitive landscape in China is intensifying, with domestic brands increasingly encroaching on the luxury segment [4] Cost Management - Porsche's gross margin per vehicle fell to 13.2% in Q3 2023, the lowest for the year, influenced by price wars and increased costs [5] - To mitigate these challenges, Porsche has initiated a layoff plan, cutting 2,000 temporary positions and planning to reduce 1,900 permanent roles in the coming years [5] Future Outlook - Porsche anticipates a maximum sales return rate of only 2% for the year, significantly lower than the 14% expected for 2024 [6] - The CFO forecasts a rebound in profit margins to "high single digits" (8%-9%) by 2026, with 2025 expected to be a low point [6]

利润暴跌99%,保时捷为什么不香了?

Xin Jing Bao· 2025-10-28 07:23

Core Insights - Porsche's profit plummeted by 99% in the first three quarters, facing multiple challenges including layoffs, management changes, and incidents of self-ignition [1] - The brand's premium pricing is losing effectiveness amid the transition to electric vehicles, leading to a misalignment in strategy [1] - The company's smart experience in the Chinese market is not resonating well, contributing to its difficulties [1] Financial Performance - The drastic decline in profit indicates severe financial distress, highlighting the impact of external and internal challenges [1] - The transition to electric vehicles has not been smooth, affecting the brand's traditional luxury appeal [1] Market Challenges - The collision of traditional luxury with the rapid iteration of new energy vehicles presents significant hurdles for Porsche [1] - The company's historical "engine sentiment" is insufficient to support its financial performance in the current market landscape [1]

欧洲9月汽车销量飙升:比亚迪销量暴增398%,特斯拉销量下滑10%

Hua Er Jie Jian Wen· 2025-10-28 07:01

Core Insights - The European automotive market experienced its third consecutive month of growth in September, driven primarily by the demand for more affordable electric vehicle models [1][2] - New car registrations in Europe rose by 11% year-on-year, reaching 1.24 million units, with strong performances from fully electric and plug-in hybrid vehicles [1][2] - Despite the positive September data, the growth momentum may be difficult to sustain due to multiple challenges facing the industry [1][3] Electric Vehicle Growth - The acceleration of electrification, particularly the popularity of affordable models, was the main driver of growth in the European car market [1] - Sales of fully electric vehicles (EVs) increased by 22%, while plug-in hybrid electric vehicles (PHEVs) saw a significant rise of 62%, together accounting for nearly one-third of new car registrations in the region [1] Market Performance by Manufacturer - BYD emerged as the biggest winner with a staggering 398% increase in sales, raising its market share from 0.4% to 2% [2] - Renault Group and Stellantis also showed solid performance with sales growth of 15.2% and 11.5%, respectively, while Volkswagen Group grew by 9.7% [2] - In contrast, Tesla's sales declined by 10%, with its market share shrinking from 4.0% to 3.2% [2] Challenges Facing the Industry - The pace of electric vehicle adoption, particularly in the high-end segment, has not met expectations, leading to production cuts by manufacturers like Volkswagen and Stellantis [3] - Policy uncertainties surrounding the EU's plan to phase out internal combustion engine vehicles by 2035 are dampening electric vehicle adoption [3] - Geopolitical risks and trade tensions, including the impact of former U.S. President Trump's tariff policies, are adding pressure to the European automotive industry [3]

产品为王,保时捷也不能例外

Zhong Guo Jing Ji Wang· 2025-10-28 06:10

Core Insights - Porsche reported a significant loss of €966 million (approximately ¥8 billion) in Q3, with profits plummeting 99% from €4 billion in the same period last year to just €40 million [1][3] - The decline in sales and profits has raised concerns about Porsche's market position, leading to discussions about its ability to recover through new product launches [1][3] Financial Performance - Q3 sales revenue was €8.7 billion, below market expectations of €9 billion, with a total revenue of approximately €26.86 billion for the first three quarters, a 6% year-on-year decline [1][3] - Deliveries in the first three quarters totaled 212,509 units, a 6% decrease compared to the previous year, with notable declines in key markets such as China, where sales dropped 26% [2][4] Strategic Challenges - Porsche's losses are attributed to past strategic decisions, including the postponement of electric vehicle launches and the extension of the lifecycle for several fuel and hybrid models, resulting in additional costs of approximately €2.7 billion [3][4] - The U.S. tariff policy has further pressured Porsche's performance, with an estimated additional cost of €300 million in the first three quarters of 2025, leading to a projected total loss of €700 million for the year [4] Market Dynamics - Despite the challenges, Porsche achieved record delivery numbers in the U.S. market, with sales increasing by 5% to 64,446 units, contrasting with a 26% decline in China [4][5] - The company is facing intense competition in the entry-level segment, with competitors offering superior price, quality, and emotional value, leading to a loss of younger customers [7][10] Product Development and Innovation - Porsche has not introduced a new flagship model in over a decade, leading to concerns about its product lineup and market appeal [5][11] - The electric vehicle strategy has been inconsistent, with the flagship electric model Taycan experiencing a 10% decline in sales, and the new electric Macan facing delays and challenges in the competitive Chinese market [8][10] Future Outlook - Porsche plans to optimize its organizational structure, with plans to lay off 1,900 employees and cut 2,000 temporary positions by 2025 [4][11] - The company anticipates that its performance will hit bottom this year, with expectations of significant improvement starting in 2026, although this is still far from its historical profit margins of 15% [4][11]

保时捷营业利润暴跌99%,上市三年股价腰斩|首席资讯日报

首席商业评论· 2025-10-28 04:37

Group 1 - Porsche's operating profit plummeted by 99%, with sales revenue at €26.86 billion, a 6% year-on-year decline, and an operating profit of €40 million compared to €4.035 billion last year, resulting in an operating profit margin of 0.2% down from 14.1% [2] - The former CEO of Stellantis, Carlos Tavares, suggested that Tesla may not exist in ten years due to competition from BYD, which is gaining market share with more efficient and economical vehicles [3] - The esports industry in China generated revenue of ¥12.761 billion in the first half of the year, marking a 6.1% year-on-year growth, with the user base reaching 493 million [3] Group 2 - Changes in management at XPeng Motors occurred, with He Xiaopeng transitioning from General Manager and Executive Director to Manager and Director [4][5] - Shanghai Die Paper Technology Co., Ltd. saw a change in legal representative, with Yao Runhao stepping down and Yao Fei taking over [6] - From January to September, profits of industrial enterprises above designated size in China increased by 3.2%, totaling ¥537.32 billion [7] - Chengdu's GDP for the first three quarters reached ¥1.82269 trillion, reflecting a year-on-year growth of 5.8% [8] Group 3 - WuXi AppTec announced a deal to transfer clinical research service assets to a company under Hillhouse Capital for a base price of ¥2.8 billion, which is expected to positively impact the company's net profit for 2025 [9] - Yuexiu Property's subsidiary plans to issue green notes worth ¥2.85 billion, with proceeds intended for refinancing certain medium to long-term offshore debts due within a year [10] - Ferrari is set to launch a digital token named "Token Ferrari499P" for auctioning Le Mans race cars, aimed at attracting young tech-savvy wealthy clients [11] - The founder of Xinquan Co., Ltd., Tang Ao Qi, passed away at the age of 80, with his shares to be inherited according to legal regulations, but the company’s operations are expected to continue normally [12]