经济刺激计划

Search documents

中国,对日本经济多重要?

凤凰网财经· 2025-11-19 10:13

抛!抛!抛! 日本正面临新一轮的抛售潮。 当地时间19日,日本新发10年期国债收益率升至1.76%,为2008年6月以来新高。日本国债遭投资者抛售,长期利率持续上升。 此前一天,日本股债汇遭"三杀"。 日经225指数昨日收盘跌超3%,创下近期单日最大跌幅。债市紧随其后,日本国债遭遇大规模抛压,超长期品种尤为惨烈。与此同时,日元汇率持续走 弱,欧元对日元盘中再度突破180整数关口,创下自1999年以来二十余年新低。 这场席卷日本股、债、汇三市的抛售风暴,源自日本新任首相高市早苗近期在台湾问题上的一系列错误言论。这些言论不仅严重冲击中日政治互信,更引 发市场对两国经贸关系恶化的强烈担忧,投资者正用脚投票表达对日本经济前景的悲观预期。 作为全球第二大经济体,中国对日本经济具有不可替代的战略意义:从高端制造设备到稀土供应,从汽车出口到零售布局,中日已形成"你中有我、我中有 你"的共生格局。任何挑战这一关系的行动,都将直接反噬日本自身的经济稳定。 01 日本经济复苏不可或缺的一环 2024年的日本经济,宛如一艘装备精良却航速缓慢的巨轮。根据最新《日本经济蓝皮书》显示,日本名义GDP已突破600万亿日元1,创下统计以来最 ...

美媒:高市早苗经济刺激计划引发担忧,日本长期国债价格暴跌加剧

Huan Qiu Wang· 2025-11-18 08:56

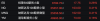

Core Viewpoint - Investors are increasingly concerned that the large-scale economic stimulus plan proposed by Japanese Prime Minister Fumio Kishida will harm Japan's public finances, leading to a further decline in long-term Japanese government bond prices [1][2] Group 1: Bond Market Reaction - The yield on Japan's 40-year government bonds rose by 8 basis points to 3.68%, marking the highest level since its issuance in 2007 [1] - Yields on Japan's 20-year and 30-year government bonds also increased by at least 4 basis points, with the 30-year yield nearing its historical peak [1][2] - On November 17, the Japanese bond market experienced widespread declines, with yields generally rising; the 20-year bond yield increased by 3.2 basis points to 2.748%, and the 30-year bond yield rose by 5 basis points to 3.263% [2] Group 2: Market Comparison - The sharp decline in Japanese long-term bond prices contrasts with slight decreases in yields for U.S. and Australian government bonds on the same day [2] - The Tokyo stock market also continued to decline, with the Nikkei 225 index falling by 0.10% on November 17 and experiencing a further drop of 3.3% on November 18 [2] Group 3: Investor Sentiment - A strategic researcher from Mitsubishi UFJ Morgan Stanley Securities indicated that bond purchases may remain limited until the government unveils its economic stimulus plan, which is scheduled for cabinet approval on November 21 [2]

日本长期国债跌势加剧 市场日益担忧大规模经济刺激方案将冲击财政

智通财经网· 2025-11-18 06:20

Group 1 - Japanese long-term government bonds have declined further, raising concerns about the potential impact of Prime Minister Kishi's upcoming large-scale economic stimulus plan on public finances [1][4] - The yield on Japan's 40-year government bonds has surged by 8 basis points to 3.68%, the highest level since its issuance in 2007; yields on 20-year and 30-year bonds have also increased by at least 4 basis points [1][4] - The government is considering an additional budget of approximately 14 trillion yen (about 91 billion USD) for the current fiscal year, exceeding last year's 13.9 trillion yen, reflecting Kishi's commitment to a "responsible and expansionary fiscal" policy [4] Group 2 - The recent GDP data showing a 1.8% annualized decline in Japan's third quarter supports the push for a large-scale stimulus plan, marking the first negative growth in six quarters [4] - Market participants are closely monitoring the upcoming auction of 20-year government bonds, with expectations of weak demand due to the current volatility in the bond market [4] - Prime Minister Kishi is scheduled to meet with Bank of Japan Governor Ueda, with market attention focused on their statements for clues regarding the timing of the next interest rate hike [5]

刚刚,全线大跌!日本,利空突袭!

券商中国· 2025-11-17 04:52

Core Viewpoint - Japanese retail stocks have faced significant declines due to a warning from China's Ministry of Culture and Tourism advising Chinese tourists to avoid traveling to Japan, coupled with negative economic data indicating a contraction in Japan's GDP [1][4][6]. Group 1: Stock Market Impact - The Japanese stock market experienced a broad decline, with the Nikkei 225 index falling by 0.7% and the Tokyo Stock Exchange index dropping by 0.8% [3]. - Notable retail and tourism-related stocks saw substantial drops, including Shiseido, which fell over 11%, and Mitsukoshi Isetan, which plummeted more than 12% [3][4]. - Fast Retailing, the parent company of Uniqlo, saw its stock price decrease by nearly 7% [4]. Group 2: Economic Data - Japan's Cabinet Office reported a 1.8% year-on-year decline in real GDP for the third quarter, marking a return to negative growth since the first quarter of 2024 [6][7]. - The GDP decreased by 0.4% quarter-on-quarter, with exports of goods and services falling by 1.2% due to the impact of U.S. tariffs [7]. - Domestic consumption, which constitutes over half of Japan's economy, showed only a slight increase of 0.1% in the same period, indicating weak internal demand [7]. Group 3: Tourism and Economic Forecast - The decline in Chinese tourists, who account for approximately 25% of foreign visitors to Japan, is expected to significantly impact the tourism sector [5]. - Analysts estimate that a substantial drop in Chinese visitors could reduce Japan's GDP by 0.36%, leading to an economic loss of approximately 2.2 trillion yen (about 101.16 billion RMB) [5]. - The Japanese government has revised its economic growth forecast for the fiscal year 2025 from 1.2% to 0.7% due to ongoing economic pressures [7]. Group 4: Government Response - The Japanese government is considering a stimulus plan worth approximately 17 trillion yen (around 110 billion USD) to counteract economic downturns [8].

GDP六个季度来首降 日本大规模经济刺激计划呼之欲出

智通财经网· 2025-11-17 02:32

Core Viewpoint - Japan's economy is experiencing a contraction, which may prompt Prime Minister Kishida to implement a large-scale stimulus plan, despite the Bank of Japan's intention to raise interest rates in the coming months [1][3]. Economic Performance - Japan's real GDP contracted at an annualized rate of 1.8% for the third quarter, marking the first decline in six quarters, although this was better than economists' median forecast of -2.4% [1][3]. - Private residential investment and exports were the main factors dragging down overall output, aligning with market expectations [3]. - Consumer spending, which accounts for the largest share of GDP, remained nearly flat and failed to offset the economic weakness [3]. Government Response - The GDP data may strengthen the Kishida administration's position to boost fiscal spending to stimulate the economy, with an economic plan expected to be announced soon [3][6]. - Economists anticipate that the scale of the economic stimulus will slightly exceed last year's 13.9 trillion yen (approximately 89.9 billion USD) [6]. Inflation and Consumer Behavior - Private consumption, which constitutes over half of the economy, only increased by 0.1%, indicating that households are controlling discretionary spending amid high living costs and stagnant real wages [6]. - Core inflation in Japan has consistently met or exceeded the Bank of Japan's 2% target for three and a half years [6]. Business Investment - Despite pressures from tariffs leading to lower profit expectations, large enterprises plan to increase capital investment this year, with capital spending growing by 1.0%, surpassing expectations of a slight decline [6]. - The strong capital spending reflects robust corporate confidence amid labor shortages and market competition, suggesting that wage growth momentum is likely to remain stable [6]. Monetary Policy Outlook - The Bank of Japan is expected to announce its next policy decision on December 19, with half of the observers anticipating a rate hike, and nearly all economists predicting action by January at the latest [7]. - The economic outlook from the Bank of Japan is not expected to change significantly, with a baseline expectation of a rate hike in December, although a delay until January is possible [7].

日本三季度GDP按年率计算下降1.8% 六个季度以来首次萎缩

Zhong Guo Xin Wen Wang· 2025-11-17 01:57

Core Viewpoint - Japan's GDP contracted by 1.8% on an annualized basis in Q3 2025, marking the first economic shrinkage in six quarters [1] Economic Data - Japan's real GDP decreased by 0.4% compared to the previous quarter [1] - The annualized decline of 1.8% indicates a significant downturn in economic performance [1] Trade Relations - In September, a trade agreement was reached between the US and Japan, resulting in a 15% baseline tariff on nearly all Japanese products entering the US [1] Government Response - The Japanese government is formulating a stimulus plan to alleviate the impact of rising living costs on households [1] - The recent GDP data may complicate the Bank of Japan's plans for further interest rate hikes [1]

日本人扛不住了!高市早苗对央行下手,日元狂跌,丰田却多赚百亿

Sou Hu Cai Jing· 2025-11-15 08:14

Core Viewpoint - The depreciation of the Japanese yen, which has fallen below 155 against the US dollar for the first time since February, is primarily driven by the lack of commitment to interest rate hikes from the Bank of Japan amid a new economic stimulus plan proposed by Prime Minister Kishi Sanae [1][3][5]. Group 1: Economic Policy and Currency Impact - The meeting between Prime Minister Kishi Sanae and Bank of Japan Governor Ueda Kazuo did not yield any signals for interest rate hikes, leading to a significant drop in the yen's value [3][5]. - Kishi's economic stimulus plan of 14 trillion yen aims to increase spending and printing money, which conflicts with the need for interest rate increases to stabilize the currency [6][11]. - The yen's depreciation is exacerbated by global investors favoring the US dollar, especially after the US government resolved a budget crisis, prompting a sell-off of the yen [7][11]. Group 2: Impact on Businesses and Consumers - Export-oriented companies like Toyota and Sony benefit from the weaker yen, as it increases their profits when converting foreign sales back to yen [9][10]. - Conversely, ordinary Japanese consumers face rising prices for imported goods, with significant increases in the cost of essentials like beef and gasoline due to the yen's depreciation [9][10]. - Small and medium-sized enterprises are struggling with increased costs for imported materials, leading to potential layoffs and price hikes that ultimately affect consumers [10][11]. Group 3: Central Bank's Dilemma - The Bank of Japan is caught in a difficult position, needing to balance between not raising interest rates to support economic growth and the pressure of rising inflation and a depreciating currency [11][13]. - Internal disagreements within the Bank of Japan highlight the urgency for action, with some members advocating for immediate interest rate hikes to combat inflation [11][13]. - The upcoming December meeting of the Bank of Japan is critical, as it will determine the future direction of monetary policy and its impact on the economy and the yen [11][13].

每日债市速递 | 央行公开市场单日净投放1300亿

Wind万得· 2025-11-12 22:32

Market Overview - The central bank conducted a reverse repurchase operation of 195.5 billion yuan for 7 days at a fixed rate of 1.40%, with a net injection of 130 billion yuan after accounting for 65.5 billion yuan maturing that day [3][4]. Funding Conditions - The interbank market saw a balanced improvement in funding conditions, with overnight repurchase rates dropping by 9 basis points to around 1.41%. The overnight quotes on the anonymous X-repo system also fell to 1.43% [5][6]. Interbank Certificates of Deposit - The latest transaction rate for one-year interbank certificates of deposit among major banks remained stable at approximately 1.63% [7]. Government Bond Futures - The closing prices for government bond futures showed slight increases: 30-year contracts rose by 0.09%, 10-year by 0.02%, 5-year by 0.03%, and 2-year by 0.01% [11]. Government Procurement - The Ministry of Finance announced that the national government procurement scale for 2024 is projected to be 3,375.043 billion yuan, with goods, engineering, and services accounting for 23.54%, 41.01%, and 35.45% respectively [12]. Global Macro Developments - Japan's Prime Minister is set to propose a significant economic stimulus plan, indicating potential substantial spending to support the economy [14]. - South Korea's M2 money supply reached 4,430.5 trillion won (approximately 3.02 trillion USD) in September, marking a 0.7% month-on-month increase and an 8.5% year-on-year surge [14]. Bond Issuance Events - The China Development Bank plans to issue up to 19 billion yuan in three phases of fixed-rate bonds on November 13 [16]. - The Japanese Ministry of Finance will auction 800 billion yen of 20-year government bonds on November 19 [16]. Negative Events in Bond Market - Several companies, including Aerospace Hongtu and Zhejiang Yitian, have seen downgrades in their credit ratings or outlooks, indicating potential risks in the bond market [17]. Non-Standard Asset Risks - Various non-standard assets have been flagged for risk, including trust plans and private equity funds, highlighting ongoing concerns in the investment landscape [18].

国际金融市场早知道:11月11日

Xin Hua Cai Jing· 2025-11-11 00:17

Group 1 - China's gold consumption in the first three quarters reached 682.73 tons, a year-on-year decrease of 7.95% [1] - Domestic gold ETF holdings increased by 79.015 tons, a year-on-year growth of 164.03%, with total holdings reaching 193.749 tons by the end of September [1] - Hong Kong plans to launch a multi-currency digital bond issuance for the third time in 2023, with previous issuances totaling 6.8 billion HKD [1] Group 2 - The U.S. Senate passed a temporary funding bill to end the government shutdown, providing funding until January 30, 2026 [1] - The U.S. Treasury Secretary stated that President Trump's proposal for a $2,000 tariff refund for each American could be implemented through tax relief measures in existing economic legislation [1] - The U.S. and Thailand reached a trade framework agreement, with Thailand eliminating 99% of tariffs on U.S. goods while the U.S. maintains a 19% tariff on Thai products [1] Group 3 - The Federal Reserve Governor advocates for a faster pace of interest rate cuts, suggesting a reduction of at least 25 basis points to address economic downturn risks [2] - The San Francisco Fed President noted that while demand may weaken, inflation caused by tariffs is manageable, recommending an open approach to further rate cuts [2] - October container imports in the U.S. fell by 7.5% year-on-year, with expectations of significant declines in November and December [2] Group 4 - COMEX gold futures rose by 2.83% to $4,123.40 per ounce, while silver futures increased by 4.70% to $50.41 per ounce [4] - U.S. oil futures increased by 0.5% to $60.05 per barrel, and Brent crude rose by 0.5% to $63.95 per barrel [4] - The U.S. dollar index rose by 0.07% to 99.62, with various currency pairs showing mixed performance against the dollar [4]

贸易紧张情绪缓解,美股期货集体上涨,亚洲科技股迎来狂欢,金银油震荡回落

Hua Er Jie Jian Wen· 2025-10-24 08:08

Market Overview - Trade tensions are easing, contributing to a significant recovery in market sentiment, with Asian stocks rising and technology stocks leading the gains [1] - US stock index futures are collectively up, with S&P 500 futures rising by 0.26%, Nasdaq 100 futures up over 0.4%, and Dow Jones futures increasing by nearly 0.16% [1][5] - The Korean Composite Stock Price Index surged over 2%, reaching a new high of 3941.59 points, driven by gains in technology stocks, particularly Samsung Electronics and SK Hynix [2] Currency and Commodity Movements - The Japanese yen continues to weaken against the US dollar, with the exchange rate at 152.81, marking the sixth consecutive day of decline [4] - Recent economic data indicates persistent inflation in Japan, with the core CPI rising by 2.9% in September, above the Bank of Japan's 2% target [4] - Gold prices have dropped nearly 0.9%, currently at $4089 per ounce, ending a nine-week upward trend as the market reassesses previous gains [8] Company Performance - Intel shares rose by 8% in pre-market trading after the company reported a return to profitability in Q3 and optimistic revenue guidance [5] - Chinese concept stocks showed mixed performance in pre-market trading, with Bilibili and Xiaoma Zhixing up by 1%, while companies like Li Auto and NIO saw declines of 1% [5]