盈利能力

Search documents

火星人(300894):经营承压明显,盈利能力下滑

GOLDEN SUN SECURITIES· 2025-10-29 02:41

Investment Rating - The report maintains a "Buy" investment rating for the company [2][5]. Core Views - The company has experienced significant operational pressure, with a notable decline in profitability. For the first three quarters of 2025, total revenue was 577 million yuan, down 43.03% year-on-year, and the net profit attributable to shareholders was -218 million yuan, a decrease of 1546.12% [1]. - In Q3 2025, the company reported total revenue of 203 million yuan, a year-on-year decline of 35.81%, and a net profit of -95 million yuan, down 265.08% year-on-year [1]. - Despite the decline in revenue, the gross margin improved slightly to 39.44%, an increase of 0.36 percentage points year-on-year [1]. Financial Performance Summary - **Revenue Forecast**: The company is expected to generate revenues of 826 million yuan in 2025, with a year-on-year decline of 40.0%, followed by a slight recovery in 2026 and 2027 [4]. - **Net Profit Forecast**: The projected net profit for 2025 is -155 million yuan, with a significant year-on-year decrease of 1493.8%, but a recovery is anticipated in 2026 and 2027 with profits of 28 million yuan and 30 million yuan, respectively [4]. - **Earnings Per Share (EPS)**: The latest diluted EPS is forecasted to be -0.38 yuan in 2025, with a recovery to 0.07 yuan in 2026 and 2027 [4]. - **Valuation Ratios**: The P/E ratio is projected to be 181.0 in 2026 and 170.4 in 2027, indicating a high valuation relative to earnings [4]. Cash Flow and Financial Health - In Q3 2025, cash received from sales was 199 million yuan, a decrease of 41.87% year-on-year, leading to a negative operating cash flow of -58 million yuan [1]. - The company's financial expenses increased primarily due to the capitalization of bond interest expenses, impacting the overall financial health [1]. Market Context - The company operates in the kitchen and bathroom appliance industry, which is currently facing challenges, contributing to the operational pressures observed [5].

浙江美大(002677):收入持续承压,公司盈利能力下滑

GOLDEN SUN SECURITIES· 2025-10-29 01:03

Investment Rating - The report maintains a "Buy" investment rating for the company [2][5] Core Views - The company has experienced significant revenue decline, with total revenue for Q1-Q3 2025 at 337 million yuan, down 48.52% year-on-year. The net profit attributable to shareholders was 18 million yuan, a decrease of 83.21% year-on-year [1] - In Q3 2025, the company's total revenue was 124 million yuan, down 36.16% year-on-year, and the net profit was 6 million yuan, down 37.91% year-on-year [1] - The gross margin for Q3 2025 decreased by 1.7 percentage points to 39.09% [1] - The company is expected to achieve net profits of 26 million yuan, 32 million yuan, and 35 million yuan for 2025, 2026, and 2027 respectively, reflecting a year-on-year decline of 76.1% in 2025, followed by growth of 23.0% in 2026 and 7.5% in 2027 [2] Financial Summary - For 2025, the company is projected to have total revenue of 483 million yuan, a decrease of 45.0% year-on-year, with a net profit of 26 million yuan [4] - The earnings per share (EPS) for 2025 is estimated at 0.04 yuan, with a projected price-to-earnings (P/E) ratio of 194.5 times [4] - The net asset return rate (ROE) is expected to drop to 1.3% in 2025, with a gradual increase to 2.2% by 2027 [4]

北京人力(600861):费用控制优异 收入承压

Xin Lang Cai Jing· 2025-10-29 00:27

Core Insights - The company reported a revenue of 11.116 billion yuan in Q3 2025, a year-over-year decrease of 1.74%, and a net profit attributable to shareholders of 194 million yuan, down 6.58% year-over-year [1] - For the first three quarters of 2025, the company achieved a revenue of 33.807 billion yuan, an increase of 1.89% year-over-year, and a net profit attributable to shareholders of 1.007 billion yuan, up 57.02% year-over-year [1] Financial Performance - In Q3 2025, the company's gross margin was 5.71%, a decrease of 0.17 percentage points year-over-year [1] - The expense ratios for sales, management, and R&D were 1.09%, 1.89%, and 0.14% respectively, with year-over-year changes of -0.13, -0.35, and +0.04 percentage points [1] - The net profit margin for Q3 2025 was 1.74%, down 0.09 percentage points year-over-year [1] Year-to-Date Performance - For the first three quarters of 2025, the gross margin was 5.46%, a decrease of 0.27 percentage points year-over-year [1] - The expense ratios for sales, management, and R&D were 1.07%, 1.83%, and 0.08% respectively, with year-over-year changes of -0.15, -0.27, and -0.01 percentage points [1] - The net profit margin for the first three quarters of 2025 was 2.98%, an increase of 1.05 percentage points year-over-year [1] Investment Outlook - The company is expected to achieve net profits attributable to shareholders of 1.163 billion yuan, 993 million yuan, and 1.124 billion yuan for the years 2025, 2026, and 2027 respectively [2] - The current market capitalization corresponds to a price-to-earnings ratio of 9X, 11X, and 9X for the years 2025, 2026, and 2027 [2] - The investment rating is maintained at "Accumulate" [2]

三冲港交所!海辰储能的上市决心

Sou Hu Cai Jing· 2025-10-28 14:17

Core Viewpoint - The repeated submission of the prospectus by the company reflects a shift in the energy storage industry from scale expansion to value cultivation, indicating a more mature market environment [2][3]. Financial Performance - In the first half of 2025, the company achieved a revenue of 6.971 billion yuan, representing a year-on-year growth of 224.5%, and a net profit of 213 million yuan [3][4]. - The company's gross margin for energy storage systems stands at 29.7%, significantly higher than the 9.7% margin for battery manufacturing, highlighting a trend towards higher profitability in system integration and solutions [6]. Market Position and Strategy - The company holds an 11% share of the global lithium-ion energy storage battery market, demonstrating the viability of its specialized approach amidst competition from major players like CATL and BYD [6]. - The establishment of a production base in Texas is a strategic move to adapt to changing global trade dynamics, particularly in response to trade barriers against Chinese energy storage products [3][6]. Industry Trends - The energy storage industry is transitioning from a price war to a value war, with technological advancements becoming crucial for differentiation and competitive advantage [5][7]. - The entry of institutional investors, such as China Life and Financial Street Capital, indicates a shift in investment logic from purely financial to industrial collaboration, marking a new phase of deep integration between capital and industry [5][6]. Challenges and Future Outlook - The upcoming expiration of the U.S. tariff exemption policy poses uncertainties for overseas markets, which is a challenge for the company and the broader Chinese energy storage sector [6]. - The company’s cash reserves of 3.9 billion yuan may not be sufficient against a backdrop of a planned capacity of 64.4 GWh, emphasizing the need for continuous investment in the energy storage sector [6][7]. - The capital market's valuation of energy storage companies is undergoing reconstruction, with a focus shifting from installed capacity and revenue scale to technological barriers, profitability, and global capabilities [6][7].

持续增厚股东回报,三七互娱拟三季度分红4.62亿元

Jing Ji Guan Cha Wang· 2025-10-28 09:12

Core Viewpoint - Sanqi Interactive Entertainment reported strong financial performance for Q3 2025, with significant year-on-year growth in both revenue and net profit, reflecting the company's robust operational strategy and commitment to shareholder returns [2][3]. Financial Performance - For the first nine months of 2025, the company achieved a revenue of 12.461 billion yuan and a net profit of 2.345 billion yuan, marking a year-on-year increase of 23.57% [2]. - In Q3 2025 alone, the company generated a revenue of 3.975 billion yuan and a net profit of 944 million yuan, with a remarkable year-on-year growth of 49.24% [2]. Dividend Policy - The company announced a cash dividend distribution plan for Q3 2025, proposing a payout of 2.10 yuan per 10 shares, which translates to an expected total cash dividend of 462 million yuan [2]. - Cumulatively, the total dividend amount for the year is projected to reach 1.386 billion yuan, representing approximately 59% of the net profit attributable to shareholders, significantly higher than the industry average [2]. - The company has progressively increased its dividend payout ratio from 5.2 yuan per 10 shares in 2021 to 10 yuan per 10 shares in 2024, and has shifted from biannual to quarterly dividend distributions [3]. Shareholder Engagement - The company’s commitment to enhancing shareholder returns is evident through its consistent increase in dividend amounts, with total cash dividends of 1.772 billion yuan, 1.806 billion yuan, and 2.200 billion yuan for the years 2022 to 2024, respectively, totaling 5.778 billion yuan over three years [3]. - This focus on shareholder returns aligns with the broader market trend where dividend policies are a key metric for investors assessing the investment value of listed companies [3].

拨备覆盖率失守监管红线 厦门国际银行风险缓冲垫告急

Jing Ji Guan Cha Wang· 2025-10-27 11:28

Core Viewpoint - Xiamen International Bank is facing significant challenges, including deteriorating asset quality, declining capital adequacy, and fluctuating profitability, as evidenced by rising non-performing loan ratios and decreasing provision coverage rates [1][2][10]. Asset Quality - The non-performing loan ratio has increased from 1.26% at the end of 2022 to 2.11% by mid-2025, marking an increase of 85 basis points, or over 67% [2][5]. - The provision coverage ratio has dropped from 168.42% at the end of 2022 to 103.94% by mid-2025, falling below the regulatory requirement of 150% [3][4]. - The proportion of special mention loans has risen from 2.32% at the end of 2022 to 5.29% by mid-2025, indicating potential future increases in non-performing loans [4][5]. Profitability - The bank's net profit plummeted from 58.79 billion yuan in 2022 to 9.72 billion yuan in 2023, a decline of over 83%, with a slight recovery to 15.04 billion yuan in 2024 [7][8]. - Interest income has significantly decreased from 127.31 billion yuan in 2022 to 77.15 billion yuan in 2023, and further to 65.44 billion yuan in 2024, nearly halving over two years [8][9]. - Non-interest income has also shown volatility, with investment income rising from 4.62 billion yuan in 2023 to 6.48 billion yuan in 2024, but dropping back to 1.34 billion yuan in the first half of 2025 [9][10]. Capital Adequacy - The core Tier 1 capital adequacy ratio has declined from 9.03% at the end of 2022 to 8.72% by mid-2025, indicating a downward trend in capital accumulation capacity [10][11]. - The bank has issued a total of 560 billion yuan in outstanding capital bonds and financial bonds to bolster its capital base, with a new issuance of up to 70 billion yuan planned [12][13]. Risk Management Challenges - The bank's credit asset quality is under pressure due to economic conditions and the performance of its overseas subsidiaries, which have seen significant profit declines [1][12]. - The bank's reliance on traditional lending while attempting to stabilize earnings through market transactions exposes it to greater market volatility [10][12]. - The ongoing challenges in managing asset quality, profitability, and capital adequacy create a negative cycle that the bank must address to ensure sustainable operations [16][17].

Integer: Buy ITGR Stock At $75?

Forbes· 2025-10-24 13:30

Core Viewpoint - Integer's stock experienced a significant decline of 32% on October 23, 2025, primarily due to updated financial projections indicating slower-than-expected product uptake, overshadowing otherwise strong Q3 earnings [1] Financial Performance - Integer's revenues increased by 9.6% over the last 12 months, rising from $1.6 billion to $1.8 billion, compared to a 5.1% growth for the S&P 500 [13] - The company recorded quarterly revenues of $476 million, an 11.4% increase from $428 million a year prior, while the S&P 500 saw a 6.2% increase [13] - Operating income for the past four quarters was $236 million, with a moderate operating margin of 13.1%, compared to 18.6% for the S&P 500 [13] - Net income stood at $83 million, indicating a poor net income margin of 4.6%, versus 12.7% for the S&P 500 [13] Valuation Metrics - Integer's price-to-sales (P/S) ratio is 1.4, compared to 3.2 for the S&P 500 [7] - The price-to-earnings (P/E) ratio is 31.3 against the benchmark's 24.2 [7] - The price-to-free cash flow (P/FCF) ratio is 21.5, slightly above the S&P 500's 21.1 [7] Financial Stability - Integer's balance sheet is described as fragile, with total debt of $1.3 billion and a market capitalization of $2.6 billion, leading to a moderate debt-to-equity ratio of 51.0% compared to 21.1% for the S&P 500 [9][13] - Cash and cash equivalents amount to $23 million of the total assets of $3.4 billion, resulting in a very poor cash-to-assets ratio of 0.7%, while the S&P 500 has a ratio of 7.0% [13] Resilience in Downturns - ITGR stock has historically performed worse than the S&P 500 during several downturns, indicating weak resilience [10] - The stock has experienced significant declines in past crises, including a 54.9% drop from July 2007 to May 2008, compared to a 56.8% decline for the S&P 500 [14] Overall Assessment - Integer's operational performance and financial condition are assessed as moderate, with strong growth but weak profitability and financial stability [15]

Deckers(DECK) - 2026 Q2 - Earnings Call Transcript

2025-10-23 21:32

Financial Data and Key Metrics Changes - The company reported a revenue increase of 9% in the second quarter, with total revenue for the first half growing by 12% [7][26] - Diluted earnings per share (EPS) increased by 14% in the second quarter and by 17% in the first half [7][30] - Gross margin for the second quarter was 56.2%, up 30 basis points from 55.9% in the previous year [28][29] Business Line Data and Key Metrics Changes - HOKA revenue increased by 15% in the first half, driven by updates to major road-running franchises and strong international performance [10][20] - UGG revenue rose by 12% in the first half, with men's footwear growing at twice the rate of the overall brand [20][21] - HOKA's wholesale channel grew by 13% in the second quarter, while DTC (Direct-to-Consumer) grew by 8% [26][27] Market Data and Key Metrics Changes - International regions were the primary growth drivers for both HOKA and UGG, with UGG and HOKA revenue in international markets increasing by 38% year-over-year [7][20] - HOKA gained two points of market share in the U.S. road-running category and outpaced competition in Europe [11][15] Company Strategy and Development Direction - The company aims for continued international expansion and a balanced approach between DTC and wholesale channels, targeting a 50/50 split [9][18] - The focus remains on building brand awareness and consumer engagement through strategic marketing initiatives [8][19] - The company is committed to sustainable growth and long-term value creation for both HOKA and UGG brands [36][37] Management's Comments on Operating Environment and Future Outlook - Management expressed caution regarding consumer sentiment in the U.S. due to macroeconomic pressures, but remains optimistic about brand positioning for the holiday season [40][43] - The company anticipates a more challenging environment in the second half due to tariff impacts and shifts in consumer preferences [34][35] Other Important Information - The company repurchased approximately $282 million worth of shares during the second quarter, with $2.2 billion remaining authorized for share repurchases [31] - The guidance for fiscal year 2026 includes total revenue expectations of approximately $5.35 billion, with HOKA projected to grow in the low teens and UGG in the low to mid-single digits [32][33] Q&A Session Summary Question: Guidance reinstatement and growth expectations for HOKA and UGG - Management indicated that the guidance reflects a cautious outlook due to anticipated consumer behavior changes and tariff impacts, but remains confident in brand strength [40][42][43] Question: DTC and wholesale channel dynamics - Management explained that while wholesale growth has been strong, DTC is expected to improve in the back half of the year as inventory dynamics normalize [56][57] Question: Long-term margin structure and tariff impacts - Management acknowledged that while tariff pressures will continue, they are committed to maintaining strong operating margins above 20% in the long term [58][60] Question: Price actions and consumer demand - Management noted that price increases have not negatively impacted demand, with strong sell-throughs for key styles [68][70] Question: Order book health and consumer behavior - Management expressed satisfaction with the order book for spring/summer 2026 and noted that consumer behavior has shown deeper valleys and higher peaks due to uncertainty [80][84]

如何抓住美股“十倍股”,必读

3 6 Ke· 2025-10-22 03:18

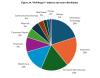

Core Insights - The article discusses the characteristics of "tenbagger" stocks, which have increased in value by ten times or more over a period from 2000 to 2024, highlighting the importance of identifying these stocks before they soar [1][2]. Group 1: Characteristics of Tenbagger Stocks - Market capitalization is a decisive factor for tenbagger potential, with most tenbagger stocks starting as small-cap stocks, benefiting from a "low base effect" [3][6]. - Many tenbagger stocks exhibit undervaluation at their inception, where the book value significantly mismatches the stock price, leading to price appreciation as earnings grow and market sentiment improves [3][6]. - A combination of value and profitability is crucial, with companies showing high book-to-market ratios and stable profitability metrics (ROE, net profit margin) outperforming the market [6][8]. Group 2: Investment Signals and Patterns - High free cash flow yield is a hidden signal for potential tenbagger stocks, indicating the ability to reinvest or return capital to shareholders without relying on financing [8]. - Tenbagger stocks often exhibit rapid price increases followed by sharp declines, indicating a "complex momentum effect" that requires careful timing for entry and exit [8][10]. - The macroeconomic environment, particularly the Federal Reserve's interest rate policies, significantly influences the emergence of tenbagger stocks, with low rates favoring growth stock valuations [10][12]. Group 3: Investment Strategy - Investors should focus on small-cap companies with value advantages and profitability, while also considering high free cash flow and reasonable capital expenditure patterns [14]. - Patience is essential, as short-term volatility can lead to premature exits from promising investments [14]. - The research challenges the notion that high EPS growth is a necessary condition for tenbagger status, suggesting a multi-dimensional approach to investment analysis [13][14].

不良资产加速“甩卖”背后:资产质量与盈利压力下中小银行谋求主动优化

Zhong Guo Zheng Quan Bao· 2025-10-15 20:15

Core Viewpoint - In the fourth quarter, several banks are accelerating the disposal of high capital-occupying and low liquidity non-performing assets, with large-scale debt asset transfers becoming frequent, indicating a significant market potential for non-performing asset disposal [1][3]. Group 1: Asset Transfer Activities - Bohai Bank plans to publicly transfer approximately 700 billion yuan of debt assets, primarily loans, with a book value of about 483.1 billion yuan [2]. - Guangzhou Rural Commercial Bank announced the transfer of credit assets with a book value of 121.32 billion yuan, mainly from the leasing, real estate, and wholesale and retail sectors [2]. - As of mid-October, there have been 25 announcements of non-performing loan transfers from various banks and financial institutions, indicating a broad participation in the market [2]. Group 2: Market Trends and Statistics - In the second quarter of this year, the scale of non-performing loan transfers saw significant growth, with the total unpaid principal amount reaching 667 billion yuan, a year-on-year increase of 108.8% [3]. - The main participants in non-performing loan transfers are joint-stock banks, with increased efforts from city commercial banks and consumer finance companies [3]. - The demand for non-performing asset disposal is urgent, as it can directly lower banks' non-performing loan ratios and improve asset quality [3][4]. Group 3: Impact on Capital Adequacy and Profitability - Transferring non-performing assets can enhance banks' capital adequacy ratios and liquidity by reducing the risk-weighted assets in their calculations [4]. - The transfer of illiquid assets allows banks to utilize funds for other projects, improving operational flexibility and potentially enhancing profitability [5]. - The financial impact of asset transfers can be positive if the transfer price exceeds the book value, leading to gains in financial statements [6]. Group 4: Future Directions and Strategies - The non-performing asset disposal market is expected to grow steadily, with banks shifting from passive risk disposal to proactive asset management [6]. - Banks are encouraged to explore diversified and specialized asset disposal models to improve their capital adequacy and competitive edge [6][8]. - Analysts suggest that banks should enhance their asset value management capabilities throughout the asset lifecycle, utilizing data analytics and AI for better risk prediction and management [8].