芯片制造

Search documents

我国芯片领域,取得新突破

21世纪经济报道· 2025-10-25 23:31

Core Viewpoint - The research team from Peking University has successfully utilized cryo-electron tomography to analyze the micro-3D structure, interfacial distribution, and entanglement behavior of photoresist molecules in a liquid environment, leading to a significant reduction in lithography defects [1][4]. Group 1: Research Significance - The introduction of cryo-electron tomography in the semiconductor field allows for real-time, high-resolution observation of photoresist behavior in developing solutions, addressing the limitations of traditional methods [4][5]. - This advancement is expected to enhance defect control and yield improvement across various critical manufacturing processes in the chip industry, paving the way for the next generation of more powerful and reliable chips [5]. Group 2: Market Insights - The photoresist market in China is projected to grow from approximately 10.92 billion yuan in 2023 to over 11.4 billion yuan in 2024, with expectations to reach 12.3 billion yuan by 2025, driven by the acceleration of domestic substitution for mid-to-high-end products like KrF photoresists [5]. - Lithography is identified as the most time-consuming and challenging process in integrated circuit manufacturing, accounting for about 50% of the manufacturing time and approximately one-third of production costs [5]. Group 3: Domestic Equipment Development - The domestic lithography machine industry is progressing, although it still faces technological limitations compared to international standards, particularly in high-end lithography machines [7]. - The domestic supply chain for lithography machines includes upstream equipment and materials, midstream system integration and production, and downstream applications [7].

英国央行发文:All in芯片!AI相关资产估值崩塌是否会引发金融稳定性后果?

美股IPO· 2025-10-25 05:14

英国央行最新报告表示,AI估值接近互联网泡沫水平,若技术进展或盈利不及预期,可能引发资产价格回调从而影响金融稳定性。当前,AI繁荣体现在 股市,虽然尚未影响金融稳定性,但风险传导路径包括:万亿级债务融资的基础设施投资、大宗商品市场波动及金融体系隐藏杠杆。同时,随着债务驱动 投资规模扩大,银行通过直接信贷敞口与间接融资形成双重风险暴露,金融稳定威胁可能显著上升。 10月24日,英国央行在其Bank Overground博客中表示:多种因素可能引发市场对AI进行重估,包括AI能力进展不及预期,或是AI公司盈利能力低于预 期。同时, 随着融资规模扩大,银行业对AI企业的直接和间接信贷敞口都将增加,金融稳定风险值得持续关注。 AI股票推高美股估值至互联网泡沫以来最高水平 英央行指出,标普500指数的周期调整市盈率(CAPE)已接近互联网泡沫时期高峰。临近10月初,AI股票的中位数未来12个月预期市盈率占31倍,而标 普500指数整体为19倍。 同时,AI资产价格故事不仅涉及大型AI模型产业。 了解AI驱动事件对资产价格和金融稳定的全面影响,需要了解AI产业链关键依赖关系。这包括超大规 模云服务事业、AI模型制造商、专 ...

江苏发现500千吨大型锶矿有啥用?为啥媒体都炸了?

Sou Hu Cai Jing· 2025-10-24 12:37

Core Insights - The discovery of a large strontium mine in Lishui District, Nanjing, Jiangsu, with an estimated resource of 545.55 thousand tons and an average grade of 48.65%, has significant implications for various high-tech industries [1][18]. Industry Significance - Strontium, while not a rare earth element, plays a crucial role in high-tech sectors such as electric vehicles, semiconductors, military applications, and medical treatments [2][4]. - The United Nations has classified strontium as a "green rare metal," highlighting its importance in advanced manufacturing and technology [4][22]. Resource Distribution - Global strontium resources are concentrated in three main countries: Mexico (20 million tons), China (approximately 15 million tons), and Spain [6]. - Despite China's substantial reserves, challenges exist due to lower ore grades and higher extraction costs compared to countries like Iran, which has high-grade strontium ores [8]. Economic Impact - The new discovery in Jiangsu enhances China's self-sufficiency in strontium, reducing reliance on imports, which totaled 12,000 tons of high-purity strontium carbonate in 2024 at a price of 27,500 yuan per ton [8][12]. - The mining operation's efficiency is expected to improve by 30% due to the simultaneous extraction of multiple metals, including copper and zinc, using a new multi-metal exploration approach [10][12]. Strategic Advantages - The discovery strengthens China's bargaining power in the strontium market, allowing for greater control over supply chains in critical industries [12][20]. - The development of smart mining technologies and sustainable practices is underway, aiming to reduce waste and improve the overall efficiency of strontium extraction [16]. Future Outlook - The strategic importance of strontium is recognized as a key factor in enhancing China's position in the global high-tech supply chain [18][20]. - The recent find is seen as a stepping stone for China's manufacturing sector, positioning the country as a significant player in the global resource competition [20].

美股异动丨英特尔盘前大涨超8% Q3业绩增长超预期且实现扭亏为盈

Ge Long Hui A P P· 2025-10-24 09:07

Core Insights - Intel's stock surged by 8.44% to $41.38 in pre-market trading following the release of its Q3 earnings report [1] - The company reported Q3 revenue of $13.65 billion, marking a year-over-year increase of 2.8% [1] - Data center and AI revenue for Q3 reached $4.12 billion, exceeding analyst expectations of $3.97 billion [1] - Client computing revenue for Q3 was $8.54 billion, also surpassing analyst forecasts of $8.15 billion [1] - Adjusted earnings per share for Q3 were $0.23, a turnaround from a loss in the same period last year [1] - This marks the first year-over-year revenue growth for Intel in a year and a half, following two consecutive quarters of zero growth [1] Revenue Guidance - Intel's optimistic revenue guidance for Q4, excluding Altera business, has raised hopes for a company turnaround [1] - Analysts view the guidance as a positive indicator for Intel's future performance [1] Political Support - There are expectations that the Trump administration may provide greater support to Intel as the U.S. midterm elections approach, which could be a long-term benefit for the company [1]

贸易紧张情绪缓解,美股期货集体上涨,亚洲科技股迎来狂欢,金银油震荡回落

Hua Er Jie Jian Wen· 2025-10-24 08:08

Market Overview - Trade tensions are easing, contributing to a significant recovery in market sentiment, with Asian stocks rising and technology stocks leading the gains [1] - US stock index futures are collectively up, with S&P 500 futures rising by 0.26%, Nasdaq 100 futures up over 0.4%, and Dow Jones futures increasing by nearly 0.16% [1][5] - The Korean Composite Stock Price Index surged over 2%, reaching a new high of 3941.59 points, driven by gains in technology stocks, particularly Samsung Electronics and SK Hynix [2] Currency and Commodity Movements - The Japanese yen continues to weaken against the US dollar, with the exchange rate at 152.81, marking the sixth consecutive day of decline [4] - Recent economic data indicates persistent inflation in Japan, with the core CPI rising by 2.9% in September, above the Bank of Japan's 2% target [4] - Gold prices have dropped nearly 0.9%, currently at $4089 per ounce, ending a nine-week upward trend as the market reassesses previous gains [8] Company Performance - Intel shares rose by 8% in pre-market trading after the company reported a return to profitability in Q3 and optimistic revenue guidance [5] - Chinese concept stocks showed mixed performance in pre-market trading, with Bilibili and Xiaoma Zhixing up by 1%, while companies like Li Auto and NIO saw declines of 1% [5]

AI泡沫警报响起!投资者重启互联网泡沫时期“生存策略”

智通财经网· 2025-10-24 07:29

Core Viewpoint - Investors are shifting strategies reminiscent of the late 1990s internet bubble, moving away from overhyped AI stocks to seek potential "next winners" in the market [1][2] Group 1: Market Trends - Nvidia's market capitalization has surpassed $4 trillion, benefiting significantly from the current AI boom [1] - There are signs of irrational exuberance in Wall Street, particularly with high-risk options trading around major AI stocks [1] - Investors are looking for opportunities in sectors like software, robotics, and Asian technology that have not yet been fully recognized by the market [2] Group 2: Investment Strategies - The strategy involves selling overvalued stocks and reallocating profits into lesser-known companies with growth potential [3] - Historical data shows that hedge funds during the internet bubble avoided direct shorting and instead outperformed the market by an average of 4.5% quarterly from 1998 to 2000 [3] - Investors are focusing on IT consulting firms and Japanese robotics companies that could benefit from AI giants, following a "gold rush" pattern [4] Group 3: Risk Management - Investors are attempting to gain from the substantial investments in AI data centers and advanced chips while minimizing direct exposure to major tech companies [5] - Concerns exist regarding potential overcapacity in data center construction, reminiscent of the telecom industry's fiber optic cable expansion bubble [5] - Some investors are using European and healthcare assets to hedge against potential downturns in U.S. tech stocks [6] Group 4: Market Sentiment - There is uncertainty about how long the current AI enthusiasm will last, with the sentiment that the peak of the bubble can only be identified in hindsight [7]

北水成交净买入53.45亿 欧美加码制裁俄油 北水加仓中海油近10亿港元

Zhi Tong Cai Jing· 2025-10-24 05:30

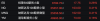

Group 1: Market Overview - On October 23, the Hong Kong stock market saw a net inflow of 5.345 billion HKD from northbound trading, with 4.77 billion HKD from Shanghai and 575 million HKD from Shenzhen [2] - The most bought stocks included China National Offshore Oil Corporation (00883), Pop Mart (09992), and Meituan-W (03690), while the most sold stocks were Hua Hong Semiconductor (01347), Innovent Biologics (01801), and Xiaomi Group-W (01810) [2] Group 2: Individual Stock Performance - Alibaba-W (09988) had a net inflow of 2.68 billion HKD, with total trading volume of 4.975 billion HKD [3] - Pop Mart (09992) recorded a net inflow of 5.38 billion HKD, with total trading volume of 4.666 billion HKD [3] - Semiconductor stocks showed divergence, with SMIC (00981) receiving a net inflow of 4.25 billion HKD, while Hua Hong Semiconductor (01347) faced a net outflow of 10.14 billion HKD [7] Group 3: Company-Specific News - China National Offshore Oil Corporation (00883) received a net inflow of 9.79 billion HKD, driven by rising international oil prices due to sanctions on Russian oil companies [6] - Pop Mart (09992) saw a net inflow of 7.93 billion HKD, with Morgan Stanley reporting a sales growth of 245% to 250% in Q3, exceeding expectations [6] - Meituan-W (03690) had a net inflow of 5.24 billion HKD, with strategic moves to enhance its overseas business [7] - SMIC (00981) is expected to benefit from increased demand for advanced wafer foundry services due to the growth of AI applications, leading to an upgrade in its rating and target price by Morgan Stanley [7] - Innovent Biologics (01801) and Xiaomi Group-W (01810) faced net outflows of 140 million HKD and 57.32 million HKD, respectively [8]

英特尔第四财季营收展望乐观 股价盘后大涨

Xin Lang Cai Jing· 2025-10-24 05:04

Core Viewpoint - Intel has provided an optimistic revenue outlook driven by a recovery in personal computer demand, boosting confidence in the company's turnaround efforts [1][2] Group 1: Revenue Outlook - Intel expects fourth-quarter revenue to be between $12.8 billion and $13.8 billion, with a midpoint of $13.3 billion, slightly below analysts' average estimate of $13.4 billion [1] - The revenue forecast does not include income from Intel's recently spun-off business unit, which may have influenced some analysts' predictions [1][2] Group 2: Stock Performance - Intel's stock price closed at $38.16 on October 23, with a nearly 7% increase in after-hours trading following the earnings outlook [1] - The stock has surged approximately 90% year-to-date, ranking among the top performers in the Philadelphia Semiconductor Index [1] Group 3: Financial Performance - Intel achieved quarterly profitability for the first time since the end of 2023, reporting a third-quarter earnings per share of $0.23, significantly above the analysts' average estimate of $0.01 [2] - Revenue for the third quarter grew by 3% to $13.7 billion, exceeding expectations [2] Group 4: Business Developments - The recent spin-off of Intel's programmable chip division, Altera, has reduced the fourth-quarter revenue forecast by approximately $400 million to $500 million [2] - Intel's CFO, Dave Zinsner, indicated that excluding Altera's revenue, the company's outlook would appear more favorable compared to market estimates [2]

沐曦股份IPO上会在即,国产GPU迎历史性机遇,半导体产业ETF(159582)盘中涨近3%

Sou Hu Cai Jing· 2025-10-24 02:14

Group 1: Semiconductor Industry Performance - The China Securities Semiconductor Industry Index rose by 2.79% as of October 24, 2025, with notable gains from stocks like Jingrui Electric Materials (up 11.67%) and Tuojing Technology (up 6.69%) [2] - The Semiconductor Industry ETF (159582) increased by 2.80%, reaching a latest price of 2.17 yuan, and has seen a cumulative increase of 43.47% over the past three months [2] - The average daily trading volume for the Semiconductor Industry ETF over the past month was 75.01 million yuan [2] Group 2: Chip Sector Developments - The Shanghai Stock Exchange Sci-Tech Innovation Board Chip Index surged by 2.88%, with significant increases from Huahong Semiconductor (up 7.23%) and Tuojing Technology (up 6.69%) [2] - The Bosera Sci-Tech Chip ETF (588990) rose by 2.77%, with a latest price of 2.53 yuan, and has experienced a 51.29% increase over the last three months [2] - The average daily trading volume for the Bosera Sci-Tech Chip ETF over the past month was 155 million yuan [2] Group 3: New Materials Sector Performance - The Shanghai Stock Exchange Sci-Tech Innovation Board New Materials Index increased by 1.69%, with stocks like Sree New Materials (up 6.41%) and Shen Gong Co. (up 5.42%) showing strong performance [4] - The Bosera Sci-Tech New Materials ETF (588010) rose by 1.50%, with a latest price of 0.81 yuan, and has seen a cumulative increase of 24.15% over the past three months [4] - The average daily trading volume for the Bosera Sci-Tech New Materials ETF over the past month was 31.53 million yuan, ranking first among comparable funds [4] Group 4: Major Events in Technology - Google announced the achievement of the world's first verifiable "quantum advantage" algorithm on its self-developed Willow chip, running 13,000 times faster than the world's strongest supercomputer [5] - Anthropic confirmed a multi-billion dollar partnership with Google Cloud, acquiring up to 1 million TPU chips and over 1 gigawatt of computing power for training the next generation of Claude models [5] - Domestic GPU manufacturer Muxi Integration is set to hold an IPO meeting on October 24, 2025, attracting market attention as a key player in the domestic GPU sector [5] Group 5: Price Adjustments in Capacitor Market - Yageo Group announced a price increase for multiple series of polymer tantalum capacitors starting November 1, driven by surging AI demand leading to supply-demand imbalances [6] - Major players like KEMET, AVX, and Vishay are also experiencing extended delivery cycles, indicating a potential continuation of the price increase trend for tantalum capacitors [6] Group 6: Institutional Insights - The market is characterized by a dual-driven pattern of "computing power technology breakthroughs + supply chain price increases," with Google's quantum algorithm validation enhancing global focus on high-end computing chips and quantum hardware ecosystems [7] - The substantial procurement by Anthropic reinforces the ongoing expansion phase of AI computing power, providing valuation support for domestic GPU, storage, and power device sectors [7] - The overall sentiment in the sector is expected to remain strong in the short term, with a focus on the sustainability of the "domestic computing power chain" and the transmission space of the price increase cycle [7]

刚刚,安世发布致客户信

芯世相· 2025-10-23 05:43

Core Viewpoint - Nexperia China entities emphasize their commitment to customer interests and legal compliance while facing challenges from Nexperia Netherlands management, which is allegedly spreading misinformation about product compliance and quality standards [1][2]. Group 1: Company Operations - Nexperia China operates legally and independently, prioritizing customer interests and ensuring supply chain stability amid complex external conditions [2][3]. - The company assures that all products manufactured and delivered in China comply with local laws and meet established technical and quality standards [3][4]. Group 2: Management and Communication - The current management at Nexperia Netherlands is accused of disregarding the rights of Nexperia China and attempting to disrupt its operations by spreading false information [1][2]. - Nexperia China commits to communicating any changes in product supply, production processes, or technical standards to customers in a timely manner [3][4].