Cambricon(688256)

Search documents

投中“宁王”“寒王”后,谢诺投资为什么最看好这个AI+赛道?

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-20 01:04

Group 1: Core Insights - The AIR (Artificial Intelligence and Robotics) industry is becoming a central field in global technological competition and industrial transformation, reshaping human production and lifestyle paradigms [1] - Financial empowerment is crucial for the development of the AIR industry, requiring a robust financial support system that includes long-term capital supply and strategic capital efficiency [1] - Guangdong province is leading in technological innovation and has a solid industrial foundation, serving as a model for high-quality development in the AIR industry through the "new industrial finance research" initiative [1] Group 2: Investment Focus - Xie Nuo Investment has achieved significant returns by investing in leading companies like Ningde Times and Cambricon, focusing on the "AI + healthcare" sector as their most promising investment area [3][4] - The firm emphasizes that healthcare has strong social and commercial value potential, with AI technology expected to resolve the longstanding dilemma of low-cost and high-quality medical services [3][9] - Xie Nuo's investment strategy involves deep research and a focus on breakthrough technology startups, with a history of successful investments in over 60 companies, 18 of which have gone public [5][6] Group 3: AI + Healthcare Sector - The integration of AI in healthcare is seen as a "golden track" that can break the cost-quality paradox, providing both social benefits and explosive commercial value [9][12] - AI technologies can significantly reduce drug development timelines and optimize medical processes, enhancing patient care efficiency [8][12] - Xie Nuo's investment approach includes a focus on hardware and application layers within the AI sector, with a particular interest in the hardware layer benefiting from the current industrial revolution [10][11] Group 4: Investment Methodology - Xie Nuo's investment philosophy is characterized by a cautious approach, focusing on high-quality selections through extensive research, while also being willing to make substantial investments in promising companies [7][11] - The firm has developed a multi-dimensional AI healthcare ecosystem through investments in various AI-driven medical companies, demonstrating a commitment to long-term, patient capital [10][11] - The investment methodology is summarized by three key principles: high vision with practical execution, a combination of hardware and software, and adaptability to market trends [12][13] Group 5: Role of Public Investment - Public investment funds, particularly state-owned capital, are crucial for nurturing emerging industries and should adopt a more proactive investment stance to support technological breakthroughs [13][14] - Collaboration between public investment institutions and market-oriented investment firms is essential for enhancing investment efficiency and effectiveness [15][17] - Strengthening partnerships with academic and research institutions can improve investment decision-making and increase the likelihood of successful outcomes [18][19]

寒武纪前三季大赚16亿增逾3倍 牛散章建平再加仓累计浮盈36亿

Chang Jiang Shang Bao· 2025-10-19 23:34

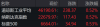

长江商报消息 ●长江商报记者 沈右荣 "寒王"寒武纪(688256.SH)经营业绩大爆发。 10月17日晚,寒武纪披露2025年三季度报告。前三季度,公司实现营业收入约46亿元,同比暴增接近24 倍;归母净利润约16亿元,同比增幅超过3倍。 寒武纪表示,公司持续拓展市场,积极助力人工智能应用落地,使得报告期内收入较上年同期大幅增 长,带动公司归母净利润实现了扭亏为盈。 长江商报记者发现,2025年以来,寒武纪似乎进入了收获期,自第一季度开始,公司持续盈利。 专注于人工智能芯片领域,寒武纪曾被市场称为国产英伟达。2025年前三季度,公司研发投入7.15亿 元,继续保持增长。公司刚刚完成一轮定增,募资近40亿元加码研发。 二级市场上,备受资金追捧的寒武纪表现十分出色。2025年8月,公司股价一度超过1500元/股,超过多 年的A股"一哥"贵州茅台。 知名牛散章建平坚定看好寒武纪。2025年第三季度,章建平加仓32.02万股,以1.58%的持股比跻身寒武 纪第四大股东。 营收、净利连续三个季度倍增 超出预期,寒武纪的经营业绩大幅倍增。 根据最新披露的三季度报告,2025年前三季度,寒武纪实现营业收入46.07亿元, ...

盘前必读丨党的二十届四中全会今日召开;寒武纪前三季度营收同比增逾23倍

Di Yi Cai Jing· 2025-10-19 23:29

Economic Data and Policy Updates - The National Bureau of Statistics released data on the national economy for the first three quarters, indicating ongoing economic trends [1] - The State Council emphasized the importance of developing green trade to optimize trade and achieve carbon neutrality goals [3] - The Ministry of Finance announced a VAT policy adjustment for offshore wind power products, effective from November 1, 2025, to December 31, 2027, allowing a 50% VAT refund [4] Stock Market Performance - Major U.S. stock indices rebounded, with the Dow Jones up 0.52%, Nasdaq up 0.52%, and S&P 500 up 0.53% [2] - Notable tech stocks showed mixed results, with Tesla rising 2.5% and Amazon falling 0.7% [2] - The Nasdaq Golden Dragon China Index decreased by 0.14%, with New Oriental up 2.3% and Alibaba up 1.2% [2] Corporate Earnings and Developments - Cambrian reported a revenue of 4.607 billion yuan for the first three quarters of 2025, a year-on-year increase of 2386.38% [9] - Zijin Mining's net profit for the third quarter was 14.572 billion yuan, up 57.14% year-on-year [9] - China Life expects a net profit increase of approximately 50% to 70% year-on-year for the first three quarters [10] Regulatory Changes - The China Securities Regulatory Commission revised the Corporate Governance Standards for listed companies, effective January 1, 2026, focusing on management and accountability [5] - The National Internet Information Office and the State Administration for Market Regulation announced a personal information export certification method, effective January 1, 2026, to enhance data protection [6] Industry Insights - The Ministry of Commerce and nine other departments issued guidelines to promote high-quality development in the accommodation industry, focusing on brand building and green development [7] - Nvidia's CEO stated that the company's market share in China has dropped from 95% to 0% due to U.S. policies, highlighting the impact of geopolitical factors on market dynamics [7]

音频 | 格隆汇10.20盘前要点—港A美股你需要关注的大事都在这

Ge Long Hui A P P· 2025-10-19 23:23

Group 1 - China's corporate income tax from January to September increased by 0.8% year-on-year, while personal income tax rose by 9.7% [2] - The stamp duty on securities transactions in China reached 144.8 billion yuan from January to September, a year-on-year increase of 103.4% [2] - Zijin Mining reported a net profit of 17.056 billion yuan for the third quarter, a year-on-year increase of 52.25% [2] - Zijin Mining's net profit for the first three quarters was 37.864 billion yuan, reflecting a year-on-year growth of 55.45% [3] - China Life Insurance expects a net profit increase of 50%-70% year-on-year for the first three quarters [2] Group 2 - Silan Microelectronics plans to invest 20 billion yuan to build a 12-inch high-end analog integrated circuit chip manufacturing line [2] - The investment in silver bars is in high demand, leading to some stores in China's "Silver Capital" running out of stock [2] - Meituan saw net buying from southbound funds, while Alibaba experienced significant net selling, and there was a continued reduction in holdings of SMIC [2]

【早报】中美同意尽快举行新一轮经贸磋商;芯片领域现200亿大手笔投资

财联社· 2025-10-19 23:09

Industry News - The Ministry of Finance and other three departments announced a 50% immediate VAT refund policy for electricity products generated from offshore wind power, effective from November 1, 2025, to December 31, 2027 [4] - A new round of interest rate cuts has begun among small and medium-sized banks, with expectations for further reductions in the fourth quarter, potentially including a 10 basis point cut [4] - The China Securities Regulatory Commission (CSRC) released new corporate governance guidelines for listed companies, effective January 1, 2026, aimed at regulating the behavior of controlling shareholders and enhancing transparency [3] Company News - Silan Microelectronics announced plans to invest 20 billion yuan in a joint project to build a 12-inch high-end analog integrated circuit chip manufacturing line [8] - Zijin Mining reported a 55% year-on-year increase in net profit attributable to shareholders for the first three quarters [8] - Hanwei Technology plans to acquire equity in Chongqing Stabao and include it in its consolidated financial statements, with Stabao set to produce the first domestic production line for 10 million thin-film platinum resistance temperature sensors annually [8] - China Life Insurance expects a 50%-70% year-on-year increase in net profit for the first three quarters [10]

寒武纪:人工智能生态系统持续扩张;2025 年第三季度营收保持高位,带动 2025 年前三季度接近 2025 年指引下限;买入

2025-10-19 15:58

Summary of Cambricon's Conference Call Company Overview - **Company**: Cambricon (688256.SS) - **Industry**: AI Chip Manufacturing Key Points Financial Performance - **3Q25 Revenue**: Rmb1.7 billion, up 1333% YoY, consistent with 2Q25 levels, and close to Bloomberg consensus estimates [4][8] - **9M25 Revenue**: Rmb4.6 billion, nearing the low-end of the 2025 revenue guidance of Rmb5 billion [1] - **4Q25 Revenue Projection**: If high-end guidance of Rmb7 billion is achieved, 4Q25 revenues could increase by 39% QoQ to Rmb2.4 billion [1] - **Gross Margin (GM)**: Decreased to 54% in 3Q25 from 56% in 2Q25, reflecting a shift in product mix from government projects to enterprise clients [4][10] - **Operating Expenses (Opex)**: Ratio improved to 21%, better than consensus estimates, with R&D expenses increasing by 12% QoQ [7][10] Strategic Partnerships - **Sensetime Cooperation**: A strategic agreement signed in October 2025 to leverage technical advantages in AI chips and foundation models, aiming to enhance product compatibility and accelerate AI deployment [2] - **Zhipu Collaboration**: Zhipu's new GLM-4.6 model successfully deployed on Cambricon's AI chips, marking a significant achievement in local chip production [3] Market Dynamics - **Contract Liability**: Reduced to Rmb80 million in 3Q25 from Rmb543 million in 2Q25, indicating improved cash flow management [1] - **Inventory Increase**: Inventory rose by 39% QoQ, suggesting strong market demand and effective wafer supply management [1] Future Outlook - **Revenue Guidance**: Analysts have raised 2025E net income estimates by 8% due to better-than-expected cost control [10] - **Target Price**: Maintained at Rmb2,104, reflecting a 68.6% upside potential from the current price of Rmb1,247.68 [16][14] Risks - **Supply Chain Risks**: Potential wafer supply restrictions due to Cambricon being added to the US Entity List in December 2022 [15] - **Competition**: Increased competition in the cloud chips market could impact future growth [15] Additional Insights - **R&D Capability**: Recognition of Cambricon's strong R&D capabilities, as evidenced by passing compatibility tests with other leading AI models [3] - **Cost Control**: Effective cost management strategies have led to a significant improvement in operating income, exceeding analyst expectations [7][10] This summary encapsulates the essential insights from Cambricon's conference call, highlighting its financial performance, strategic partnerships, market dynamics, future outlook, and associated risks.

英伟达跌倒寒武纪吃饱

Xin Lang Cai Jing· 2025-10-19 13:55

Core Insights - Nvidia, the dominant player in the global AI chip market, has seen its market share in China plummet from 95% to 0% due to tightening U.S. export controls [1] - The exit of Nvidia from the Chinese AI chip market has created significant opportunities for local companies, with Cambricon reporting a staggering 1332.52% year-over-year revenue increase in Q3 2025 [1] - The competitive landscape is shifting, with Huawei's Ascend series chips and AMD's MI300 series actively seeking to fill the void left by Nvidia's absence in the Chinese market [1] Market Dynamics - Nvidia's market share in China has effectively "returned to zero," highlighting the impact of U.S. export restrictions on its operations [1] - Cambricon's Q3 2025 revenue reached 1.727 billion yuan, a dramatic increase compared to a loss of 194 million yuan in the same period last year [1] - The exit of Nvidia has transitioned the market from a single-player dominance to a more competitive environment with multiple players vying for market share [1]

英伟达“跌倒”,寒武纪“吃饱”?

经济观察报· 2025-10-19 12:35

Core Viewpoint - Nvidia, the dominant player in the global AI chip market, has seen its market share in China drop from 95% to 0% due to tightening U.S. export controls, prompting the company to make various adjustments to its product offerings and strategies [2][5][10]. Group 1: Market Dynamics - Nvidia's market share in China's AI chip market was approximately 85% in 2022, with over 90% in the core area of large model training [5][6]. - The introduction of U.S. export controls in October 2022 marked a turning point, leading Nvidia to release adjusted versions of its chips, such as the A800 and H800, to maintain market presence [6][8]. - By 2023, further restrictions included the A800 and H800, forcing Nvidia to launch even lower-performance chips like the H20, which were referred to as "the most stripped-down version" [8][10]. Group 2: Financial Performance - Cambrian (寒武纪) reported a staggering 1332.52% year-on-year increase in revenue for Q3 2025, reaching 1.727 billion yuan, and a net profit of 567 million yuan, compared to a loss of 194 million yuan in the same period last year [3][17]. - For the first three quarters of 2025, Cambrian achieved a total revenue of 4.607 billion yuan, a 2386.38% increase from 185 million yuan in the same period last year [17][19]. Group 3: Competitive Landscape - The absence of Nvidia's high-end products has created a significant market vacuum, allowing domestic companies like Cambrian and Huawei's Ascend series chips to emerge as strong alternatives [17][20]. - AMD is also actively seeking opportunities in the Chinese market with its MI300 series AI chips, indicating a shift towards a more competitive landscape with multiple players [20]. Group 4: Strategic Shifts - Nvidia's global strategy is shifting, with a focus on domestic manufacturing in the U.S. and rapid iteration of its AI chip products, such as the new Blackwell platform, which boasts 208 billion transistors [14][12]. - Despite the advancements in product development, Nvidia's latest offerings appear to be increasingly isolated from the Chinese market due to ongoing export restrictions [14][15].

科创板首批三季报出炉,前沿赛道企业引领增长

Di Yi Cai Jing· 2025-10-19 12:27

Core Insights - The performance of several companies listed on the Sci-Tech Innovation Board has shown significant growth, particularly in emerging industries such as AI computing chips and optical communication, highlighting the board's role in fostering strategic emerging and future industries [1] Group 1: AI and Chip Design - The domestic ecosystem in chip design is becoming increasingly robust, with AI commercialization accelerating [2] - Haiguang Information reported a total revenue of 9.49 billion yuan for the first three quarters, a year-on-year increase of 54.65%, and a net profit of 1.961 billion yuan, up 28.56% [2] - Cambrian, a leading AI chip company, achieved a staggering revenue of 4.607 billion yuan, a year-on-year increase of 2300%, and a net profit of 1.605 billion yuan, up 321.49% [2] Group 2: Optical Communication - Optical communication is identified as a key infrastructure for future information industries, with optical chip technology being crucial for high-speed information transmission [3] - Shijia Photon reported a revenue of 1.56 billion yuan for the first three quarters, a year-on-year increase of 113.96%, and a net profit of 299 million yuan, up 727.74% [3] - Tengjing Technology achieved a revenue of 425 million yuan, a year-on-year increase of 28.11%, and a net profit of 64 million yuan, up 15.00% [3] Group 3: Frontier Technologies - Companies are strategically positioning themselves in frontier technologies, with significant growth in quantum technology and future energy sectors [4] - GuoDun Quantum reported a revenue of 190 million yuan, a year-on-year increase of 90.27%, and a net loss of 26 million yuan, a reduction of 51.98% [4] - The company successfully mass-produced the world's first engineering-grade four-channel ultra-low noise semiconductor single-photon detector, marking a significant achievement in single-photon detection technology [4] Group 4: Next-Generation Energy Materials - Rongbai Technology announced advancements in solid-state battery materials, becoming a primary supplier for several leading solid-state battery companies [5] - The company has achieved ten-ton level shipments of high-nickel and ultra-high-nickel solid-state cathode materials, serving major domestic and international battery manufacturers [5] - The performance of sulfide electrolyte materials is leading in the industry, with plans for pilot line construction expected to commence production in the first half of 2026 [5]

英伟达“跌倒”,寒武纪“吃饱”?

Jing Ji Guan Cha Wang· 2025-10-19 11:49

Core Insights - Nvidia's market share in China's AI chip sector has plummeted from 95% to 0% due to U.S. export controls [2][3] - The emergence of domestic competitors like Cambricon, which reported a staggering 1332.52% revenue increase in Q3 2025, highlights the significant market opportunity left by Nvidia's exit [3][20] - The shift in market dynamics indicates a transition from Nvidia's dominance to a more competitive landscape with multiple players [25] Nvidia's Market Position - Nvidia previously held approximately 85% of the AI accelerator card market in China, with over 90% in the large model training segment [6] - The introduction of adjusted performance chips like A800 and H800 initially helped Nvidia maintain some market presence, but these too were later restricted [9][10] - The company's latest chip, Blackwell, represents a shift towards U.S. domestic manufacturing, distancing itself from the Chinese market [18][19] Financial Performance of Competitors - Cambricon's Q3 2025 revenue reached 1.727 billion yuan, a 1332.52% increase year-over-year, with a net profit of 567 million yuan compared to a loss of 194 million yuan in the previous year [20][21] - For the first three quarters of 2025, Cambricon's total revenue was 4.607 billion yuan, a 2386.38% increase from 1.85 billion yuan in the same period last year [20] - Despite significant revenue growth, Cambricon reported a negative cash flow from operating activities of -29 million yuan [23] Market Dynamics and Future Outlook - The absence of Nvidia's high-end products has created a substantial market vacuum, allowing domestic companies to fill the gap [22][24] - The AI chip market is evolving, with a shift from training to inference, where domestic chips are gaining a competitive edge [23] - The competitive landscape is diversifying, with companies like Huawei and AMD also positioning themselves as viable alternatives in the market [24][25]