CPIC(601601)

Search documents

保险Ⅱ行业点评报告保险行业9月保费:寿险单月保费增速回落,财险各险种全面向好

Soochow Securities· 2025-11-02 06:04

Investment Rating - The report maintains an "Overweight" rating for the insurance industry [1] Core Insights - In September, the growth rate of life insurance premiums declined, while all types of property insurance showed improvement [1] - The report anticipates that the high growth pattern of premiums for the year has been largely established, with optimistic expectations for new premium growth in 2026 due to sustained market demand [5] - The health insurance sector saw a positive growth rate in Q3, with September showing an increase compared to August [5] - The property insurance sector reported a year-on-year premium growth of 4.9% for the first nine months of 2025, with significant improvements in both auto and non-auto insurance [5] - The report highlights that both liability and asset sides of the insurance companies are continuously improving, indicating substantial upward valuation potential [5] Summary by Sections Life Insurance - Q3 saw a year-on-year premium growth of 25%, but September's growth rate turned negative at -4.2% due to short-term demand effects from product switching [5] - For the first nine months of 2025, the original premium income for life insurance reached CNY 40,895 billion, a year-on-year increase of 10.2% [5] Health Insurance - Health insurance premiums increased by 2.5% year-on-year for the first nine months, with Q3 showing a positive growth rate of 2.8% [5] - The China Banking and Insurance Regulatory Commission's recent guidelines are expected to stimulate further growth in the health insurance market [5] Property Insurance - Property insurance premiums reached CNY 13,712 billion for the first nine months, with a year-on-year growth of 4.9% [5] - The report notes a significant improvement in non-auto insurance premiums, with September showing a year-on-year increase of 9.6% [5] Market Outlook - The report suggests that the market demand remains strong, with expectations of continued optimization in liability costs and improved profitability for leading companies [5] - Current valuations for the insurance sector are at historical lows, with estimates for 2025E PEV ranging from 0.56 to 0.92 times and PB from 1.07 to 2.07 times [5]

中国太保(601601)9M25业绩点评:利润增速稳步提升 COR同比改善

Ge Long Hui· 2025-11-01 13:15

Core Viewpoint - China Pacific Insurance (CPIC) reported its 9M25 performance, which met expectations, showing a year-on-year increase in net profit and new business value (NBV) [1][2] Financial Performance - The company's net profit attributable to shareholders for 9M25 was 45.7 billion, representing a year-on-year increase of 19.3% [1] - The NBV for the same period was 15.35 billion, with a year-on-year growth of 31.2% on a comparable basis [1] - The net profit for Q3 25 alone was 17.8 billion, reflecting a year-on-year increase of 35.2% [1] - The company's net assets at the end of 9M25 were 284.2 billion, down 2.5% from the beginning of the year, primarily due to bond devaluation [1] Business Growth and Structure - The NBV growth rate for 9M25 was 31.2%, with a slight decline from 1H25's 32.3% due to high base effects [2] - The new business value margin (NBVM) was 17.0%, up 1.1 percentage points year-on-year, attributed to an increase in the proportion of single premium products [2] - The agent channel's new premium income decreased by 1.9% year-on-year, but the proportion of participating insurance in new regular premium income rose to 58.6% [2] - The bancassurance channel saw new single and regular premium income grow by 52.4% and 43.6% year-on-year, respectively [2] Investment Performance - The total investment scale of the company's insurance funds exceeded 2.97 trillion, an increase of 8.8% from the beginning of the year [3] - The non-annualized net investment yield was 2.6%, while the total investment yield was 5.2%, reflecting a year-on-year decrease of 0.3 percentage points and an increase of 0.5 percentage points, respectively [3] - The fair value through other comprehensive income (FVOCI) equity scale increased by 18.5% compared to the beginning of the year, indicating a shift towards high-dividend assets in a low-interest-rate environment [3] Future Outlook - The company is expected to maintain strong growth in NBV and stable investment returns, with projected net profits of 55.4 billion, 60.2 billion, and 64.7 billion for 2025-2027, representing growth rates of 23.2%, 8.6%, and 7.6% respectively [3]

中国太保再度荣膺中国人民银行金融科技发展奖

Cai Jing Wang· 2025-11-01 07:02

Core Insights - The People's Bank of China announced the winners of the "2024 Financial Technology Development Award," with China Pacific Insurance (CPIC) receiving two second-place awards for "AI+ Digital Empowerment Based on Large Models" and "Data Asset Management System Construction," and a third-place award for "Insurance Full-Scenario Application Database Innovation" [1] Group 1: AI+ Digital Empowerment - The "AI+ Digital Empowerment" project, jointly submitted by CPIC and Taibao Technology, focuses on leveraging cutting-edge AI technologies to address cost structure challenges and risks associated with digital upgrades in the insurance industry [2] - The project has achieved significant results, including personalized training for 180,000 agents through the "Gold Coach" program, processing over 400,000 claims annually with a 96% accuracy rate, and analyzing millions of images for fraud detection [2] - The project is set to launch in two phases in December 2023, covering four major areas and nine application scenarios, marking a transformative shift in traditional insurance practices [2] Group 2: Data Asset Management System - The "Data Asset Management System Construction" project aims to establish an enterprise-level data asset management framework through data governance and DCMM Level 5 certification [3] - The project involves clear division of responsibilities among CPIC Group, property and life insurance subsidiaries, and Taibao Technology, ensuring effective collaboration and implementation [3] - The initiative successfully created a standardized data asset management system across the group, addressing fragmented data management issues and enhancing data-driven operational capabilities [3] Group 3: Insurance Full-Scenario Application Database Innovation - The "Insurance Full-Scenario Application Database Innovation" project responds to the financial technology planning requirements set by the People's Bank of China, employing a strategy of tackling difficult challenges first [4] - The project introduced five innovations, including a heterogeneous transformation pre-assessment tool and distributed decision models, effectively addressing challenges related to Oracle adaptation and high-risk SQL identification [4] - As of December 2024, 329 systems have completed the transformation, producing books and patents, and providing practical pathways for the financial industry's innovation [4] Future Directions - CPIC plans to accelerate the implementation of its "AI+" strategy, focusing on deep AI applications and value transformation to reshape business processes and innovate models [4] - The company aims to establish a secure, efficient, and intelligent digital financial ecosystem, injecting new momentum into the high-quality development of the financial industry [4]

赵宇龙任保险业协会党委书记;邱智坤拟接任董事长;赵雪军辞任总经理;第四套生命表自2026年1月1日起实施;|13精周报

13个精算师· 2025-11-01 04:03

Regulatory Dynamics - Five departments are promoting the implementation of a long-term care insurance system, supporting the inclusion of qualified medical and nursing institutions as designated service providers [6] - As of the end of September, the cumulative balance of three social insurance funds reached 9.85 trillion yuan, with total income of 6.69 trillion yuan and total expenditure of 6.04 trillion yuan for the first nine months [7] - The Financial Regulatory Bureau announced that the fourth set of life tables will be implemented starting January 1, 2026, which includes various tables for different insurance products [9] - The Financial Regulatory Bureau supports domestic insurance companies in issuing "sidecar" insurance-linked securities in the Hong Kong market [10] - The Financial Regulatory Bureau expects insurance premium income to reach 6 trillion yuan this year [24] Company Dynamics - Ping An Life increased its stake in China Merchants Bank H-shares to 18.02% [30] - China Life plans to invest 2 billion yuan in a private equity investment plan focusing on semiconductors, digital energy, and smart electric vehicles [31] - China Life reported a strong growth of 41.8% in new business value for the first three quarters [32] - China Ping An's net profit attributable to shareholders grew by 45.4% year-on-year in the third quarter [33] - China Reinsurance achieved a net profit of 51.97 billion yuan, a significant increase of 131.49% year-on-year [39] - AIA Group's new business value rose by 25% to 1.476 billion USD in the third quarter [40] Industry Dynamics - The five major insurance companies in A-shares collectively earned over 426 billion yuan in net profit for the first three quarters, a year-on-year increase of 33.5% [53][54] - The first report on reinsurance business in China showed that the ceded business exceeded 200 billion yuan, covering 14 countries and regions [55] - The insurance industry is expected to see a gradual stabilization or decrease in premium rates for new energy vehicle insurance in the short to medium term [26] - The insurance sector is exploring a comprehensive grading system for insurance models to reduce costs across the entire lifecycle of vehicles [26] - The comprehensive expense ratio of the property insurance industry reached a 20-year low, while the comprehensive cost ratio hit a 10-year low in the first nine months of this year [27]

中国太保(601601):9M25业绩点评:利润增速稳步提升 COR同比改善

Xin Lang Cai Jing· 2025-10-31 12:29

Core Insights - China Pacific Insurance (CPIC) reported a net profit of 45.7 billion yuan for the first nine months of 2025, reflecting a year-on-year increase of 19.3% [1] - The company's new business value (NBV) reached 15.35 billion yuan, up 31.2% year-on-year, indicating strong growth in insurance services [1][2] - The company's combined ratio (COR) improved to 97.6%, a decrease of 1.0 percentage points year-on-year, suggesting better underwriting performance [2] Financial Performance - The net profit for Q3 2025 was 17.8 billion yuan, showing a significant year-on-year increase of 35.2%, driven by capital market gains and improved insurance service performance [1] - The total net assets at the end of September 2025 were 284.2 billion yuan, down 2.5% from the beginning of the year, primarily due to bond devaluation [1] - The non-annualized net investment return was 2.6%, while the total investment return was 5.2%, reflecting a year-on-year decline of 0.3 percentage points and an increase of 0.5 percentage points, respectively [1][3] Product and Channel Performance - The NBV growth rate of 31.2% year-on-year was impacted by a high base from the previous year, with a slight decline in new single premium from agent channels [2] - The proportion of participating insurance in new regular premium increased to 58.6%, indicating a shift towards more profitable product lines [2] - The insurance premium income from non-auto insurance decreased by 2.6% year-on-year, while auto insurance premiums grew by 2.9% [2] Investment Strategy - The company's investment scale exceeded 2.97 trillion yuan, an increase of 8.8% from the beginning of the year, with a focus on high-dividend assets in a low-interest-rate environment [3] - The fair value of equity investments increased by 18.5% compared to the beginning of the year, indicating a strategic shift towards equities amid favorable market conditions [3] Future Outlook - The company is expected to maintain strong growth in NBV and underwriting profits, with projected net profits of 55.4 billion, 60.2 billion, and 64.7 billion yuan for 2025-2027, representing growth rates of 23.2%, 8.6%, and 7.6% respectively [3]

中国太保:选举路巧玲为副董事长

Cai Jing Wang· 2025-10-31 12:27

Core Viewpoint - China Pacific Insurance (Group) Co., Ltd. has elected Lu Qiaoling as the vice chairman of its 10th board of directors, pending regulatory approval, with a term lasting until the current board's term ends [1] Group 1: Company Announcement - The board of directors of China Pacific Insurance has approved the election of Lu Qiaoling as the vice chairman [1] - The term of the newly elected vice chairman will commence upon the approval of the company's articles of association by regulatory authorities [1] Group 2: Lu Qiaoling's Background - Lu Qiaoling, born in March 1966, is currently a non-executive director at China Pacific Insurance and serves as a director at Huabao (Shanghai) Equity Investment Fund Management Co., Ltd. [2] - Lu has held various significant positions, including chief accountant at Hebei Petroleum and Chemical Supply and Marketing Corporation, and has extensive experience in auditing and finance within major state-owned enterprises [2] - Lu holds a master's degree and possesses senior accountant, certified public accountant, and auditor qualifications [3]

11月十大金股推荐

Ping An Securities· 2025-10-31 11:01

Group 1: Market Outlook - The "14th Five-Year Plan" signals increased reform and innovation, suggesting medium-term upward momentum in the market, despite short-term liquidity concerns at year-end[3] - Focus on sectors aligned with the "14th Five-Year" industrial guidance and Q3 performance, particularly technology growth (AI, semiconductors, innovative pharmaceuticals) and advanced manufacturing (new energy)[3] Group 2: Recommended Stocks - Dongcheng Pharmaceutical (002675.SZ) has a market cap of 12.2 billion CNY, with a TTM PE of 73.3, driven by ongoing innovation and clinical trials[4] - Zhongwei Company (688012.SH) leads in high-end semiconductor equipment with a market cap of 187.9 billion CNY and a TTM PE of 98.2, benefiting from increased product delivery[11] - Haiguang Information (688041.SH) has a market cap of 553.7 billion CNY and a TTM PE of 233.9, positioned well in the AI and domestic substitution trends[19] - Industrial Fulian (601138.SH) focuses on AI, with a market cap of 1548.3 billion CNY and a TTM PE of 50.7, showing strong revenue growth of 38.4% YoY[27] - Penghui Energy (300438.SZ) leads in small-scale energy storage with a market cap of 24.5 billion CNY, benefiting from rising demand and price improvements[35] - Jinfeng Technology (002202.SZ) has a market cap of 66.2 billion CNY and a TTM PE of 26.1, with improving margins in wind turbine manufacturing[42] - Luoyang Molybdenum (603993.SH) has a market cap of 369.8 billion CNY and a TTM PE of 19.3, with copper prices expected to rise[50] - Huaxin Cement (600801.SH) has a market cap of 40.6 billion CNY and a TTM PE of 13.5, with significant growth in overseas operations[57] - China Pacific Insurance (601601.SH) has a market cap of 342.5 billion CNY and a TTM PE of 7.6, noted for its high dividend yield and resilient asset performance[64] - Shanghai Bank (601166.SH) has a market cap of 13.4 billion CNY and a TTM PE of 5.6, recognized for its stable asset quality and dividend value[73]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

中国太保:第三季度净利润178.15亿元,同比增长35.2%

Ge Long Hui A P P· 2025-10-31 10:06

Core Viewpoint - China Pacific Insurance reported strong financial results for the third quarter and the first three quarters of the year, indicating robust growth in both revenue and net profit [1] Group 1: Third Quarter Performance - The company achieved a revenue of 144.408 billion yuan in the third quarter, representing a year-on-year increase of 24.6% [1] - Net profit for the third quarter reached 17.815 billion yuan, showing a year-on-year growth of 35.2% [1] Group 2: Year-to-Date Performance - For the first three quarters, the company reported a total revenue of 344.904 billion yuan, which is an 11.1% increase compared to the same period last year [1] - The net profit for the first three quarters was 45.7 billion yuan, reflecting a year-on-year growth of 19.3% [1]

中国太保(02601) - 2025 Q3 - 季度业绩

2025-10-31 09:50

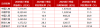

Financial Performance - For Q3 2025, the company reported operating revenue of RMB 144,408 million, an increase of 24.6% compared to Q3 2024[6] - The total profit for Q3 2025 reached RMB 27,887 million, reflecting a significant growth of 85.7% year-over-year[6] - Net profit for Q3 2025 was RMB 17,815 million, up by 35.2% from the same period last year[6] - The net profit excluding non-recurring gains and losses for Q3 2025 was RMB 17,868 million, representing a 35.6% increase year-over-year[6] - The basic earnings per share for Q3 2025 was RMB 1.85, up by 35.2% compared to Q3 2024[6] - The company reported a net profit of RMB 34.57 billion, reflecting a year-on-year growth of 19.3%[14] - Net profit attributable to shareholders of the parent company was RMB 45,700 million, up 19% from RMB 38,310 million in the previous year[31] - Net profit for the first nine months of 2025 was RMB 11,875 million, up 12.94% compared to RMB 10,514 million in the same period of 2024[38] Revenue and Premiums - In the first three quarters of 2025, the company achieved insurance service revenue of RMB 216.894 billion, a year-on-year increase of 3.6%[14] - The scale premium for the life insurance segment reached RMB 263.863 billion, up 14.2% year-on-year[19] - The bancassurance channel achieved scale premiums of RMB 58.310 billion, a significant increase of 63.3% year-on-year[19] - The company’s property insurance segment reported a premium income of RMB 160.206 billion, a slight increase of 0.1% year-on-year[22] - The motor vehicle insurance premium income was RMB 80.461 billion, reflecting a year-on-year growth of 2.9%[22] Assets and Liabilities - The company's total assets as of September 30, 2025, were RMB 3,077,640 million, an increase of 8.6% from the end of 2024[6] - Total assets as of September 30, 2025, amount to RMB 3,077,640 million, up from RMB 2,834,907 million as of December 31, 2024[30] - Total liabilities as of September 30, 2025, are RMB 2,761,927 million, compared to RMB 2,516,426 million at the end of 2024[30] - Insurance contract liabilities rose to RMB 2,463,651 million from RMB 2,229,514 million year-over-year[30] - The company's equity attributable to shareholders decreased to RMB 284,185 million from RMB 291,417 million as of December 31, 2024[30] Cash Flow and Investments - The net cash flow from operating activities for the first nine months of 2025 was RMB 169,397 million, a 31.6% increase year-over-year[9] - Cash inflow from investment activities totaled RMB 570,493 million, while cash outflow was RMB 729,181 million, resulting in a net cash flow of RMB -158,688 million from investment activities[34] - The company issued bonds, generating cash inflow of RMB 14,242 million, contributing to its financing activities[34] - Cash flow from investing activities generated a net inflow of RMB 13,295 million in the first nine months of 2025, compared to RMB 10,339 million in the same period of 2024[40] Investment Performance - The company’s investment assets totaled RMB 2,974.784 billion, an increase of 8.8% from the previous year[23] - The total investment return rate was 5.2%, up 0.5 percentage points year-on-year[23] - Net investment return rate for the nine months ended September 30, 2025, is 2.6%, a decrease of 0.3 percentage points compared to 2024[24] - Investment income surged to RMB 39,228 million, a significant increase from RMB 14,595 million in the same period last year[31] - Investment income increased to RMB 11,242 million in the first nine months of 2025, a 16.86% rise from RMB 9,617 million in the same period of 2024[38] Shareholder Information - The company recorded a total of 102,000 shareholders at the end of the reporting period, with 98,287 being A-share shareholders[11] Other Financial Metrics - The weighted average return on equity for Q3 2025 was 6.3%, an increase of 1.4 percentage points compared to the previous year[6] - The company maintained a comprehensive underwriting cost ratio of 97.6%, a decrease of 1.0 percentage point year-on-year[20] - The company reported a fair value change gain of RMB 870 million in the first nine months of 2025, compared to RMB 790 million in the same period of 2024[38] - The company experienced a decrease in foreign exchange losses, reporting a loss of RMB 111 million compared to RMB 254 million in the previous year[31] - The company emphasizes the importance of monitoring solvency information, which is available on various stock exchange websites[25]