VeriSilicon(688521)

Search documents

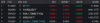

存储芯片爆发!华虹公司涨超7%,科创芯片50ETF(588750)放量涨2%,资金连续2日涌入!全球芯片共振,英特尔业绩超预期,AI引爆需求

Xin Lang Cai Jing· 2025-10-24 02:56

Core Viewpoint - The global chip supercycle is emerging, with significant inflows into the A-share technology innovation chip sector, particularly the Science and Technology Innovation Board's chip ETF, which saw a rise of over 2% on October 24, 2023, with cumulative net inflows exceeding 50 million yuan [1][3]. Market Performance - The Science and Technology Innovation Chip 50 ETF (588750) saw nearly all component stocks surge, with notable increases in storage chip concepts, including Bawei Storage up over 5%, Huahong Semiconductor up over 7%, and others like Lanke Technology and Chipone Technology also showing gains of over 5% [3][4]. - As of 9:47 AM, major memory suppliers like Samsung and SK Hynix are expected to raise DRAM and NAND flash prices by up to 30% in Q4 2023 due to surging AI-driven storage chip demand [5]. Supply and Demand Dynamics - The storage chip sector is anticipated to experience both volume and price increases due to a combination of supply shortages and growing AI demand, with the semiconductor sector's overall health being bolstered by these trends [6]. - The ongoing trade tensions and supply chain disruptions are exacerbating the shortage of storage chips, leading to a tightening supply situation and further price increases across various applications, including servers, mobile devices, and PCs [7]. Index Characteristics - The Science and Technology Innovation Chip Index focuses on high-end upstream and midstream segments of the chip industry, with a core segment representation of 95%, which is higher than other indices [9][10]. - The index is designed to reflect the performance of the chip industry, with a strong emphasis on companies listed on the Science and Technology Innovation Board, which has seen over 90% of chip companies choose this platform for listing in the past three years [8][12]. Growth Potential - The Science and Technology Innovation Chip Index is projected to have a net profit growth rate of 71% in the first half of 2025 and an annual growth rate of 100%, significantly outpacing similar indices [12]. - The index has demonstrated strong upward elasticity, with a maximum increase of 186.5% since September 2023, indicating robust performance relative to peers [13][14].

国内AI人工智能板块正在爆发,AI人工智能ETF(512930)盘中涨超2.4%

Xin Lang Cai Jing· 2025-10-24 02:46

Group 1 - The user base of generative AI in China is rapidly increasing, expected to reach 515 million by June 2025, doubling in six months with a penetration rate of 36.5% [1] - The usage of Doubao large model tokens surged from 120 billion in May 2024 to over 30 trillion by September 2025, marking a 253-fold increase [1] - The policy support for computing power and data is advancing, with over 50 standards to be revised or established by 2027 to enhance the computing power standard system [1] Group 2 - The domestic AI ecosystem is continuously improving, with the AI industry chain accelerating, indicating a potential spiral growth in large models, computing power, and applications [2] - As of October 22, 2025, the CSI Artificial Intelligence Theme Index accounted for 6.3% of the total A-share trading volume, showing a recovery in trading density [2] - The CSI Artificial Intelligence Theme Index (930713) rose by 2.63% on October 24, 2025, with significant gains in constituent stocks such as Huida Technology (up 10.00%) and Beijing Junzheng (up 7.11%) [2] Group 3 - The AI Artificial Intelligence ETF has the lowest management fee of 0.15% and a custody fee of 0.05% among comparable funds [3] - As of October 23, 2025, the AI Artificial Intelligence ETF had a tracking error of 0.009% over the past three months, the highest tracking accuracy among comparable funds [3] - The CSI Artificial Intelligence Theme Index includes 50 listed companies that provide essential resources, technology, and application support for AI, with the top ten stocks accounting for 61.36% of the index [3] Group 4 - The top ten weighted stocks in the CSI Artificial Intelligence Theme Index include companies like Xinyi Sheng (6.52%), Zhongji Xuchuang (6.71%), and Hanwujing (6.45%), reflecting their significant influence on the index [5] - The AI Artificial Intelligence ETF is connected to various fund classes, enhancing its accessibility to investors [5]

集成电路ETF(562820)盘中涨近3%,普冉股份涨超18%领涨成分股

Sou Hu Cai Jing· 2025-10-24 02:37

Group 1 - The integrated circuit ETF has seen a turnover of 6.11% during trading, with a transaction volume of 7.787 million yuan, and has attracted a total of 29.8883 million yuan over the past 16 trading days [2] - As of October 23, the integrated circuit ETF has achieved a net value increase of 54.14% over the past year, ranking 173 out of 3078 index equity funds, placing it in the top 5.62% [2] - The highest monthly return since the inception of the integrated circuit ETF was 31.86%, with the longest consecutive monthly increase being 4 months and the longest increase percentage being 58.99%, averaging a monthly return of 9.89% during rising months [2] Group 2 - The top ten weighted stocks in the CSI All-Share Integrated Circuit Total Return Index as of September 30, 2025, include SMIC, Cambricon, Haiguang Information, Lanke Technology, Zhaoyi Innovation, OmniVision, Chipone, Changdian Technology, Unisoc, and Tongfu Microelectronics, collectively accounting for 55.71% of the index [2] - The stock performance of key companies includes SMIC with a 2.34% increase and a weight of 9.96%, Haiguang Information with a 2.33% increase and a weight of 7.45%, and Cambricon with a 1.78% increase and a weight of 7.13% [4] - The AI-driven "super cycle" is characterized by structural features that drive rapid growth in data center storage demand, alongside increased penetration of smart terminals, fostering innovation in storage technology and market expansion [4] Group 3 - The domestic advanced production lines are expected to have continuous expansion needs in the context of the AI wave and domestic substitution, with semiconductor equipment being a cornerstone for wafer foundry expansion and an important aspect of achieving self-controllable industrial chains [5] - Domestic semiconductor equipment manufacturers are poised for development opportunities as their R&D and technology improve, allowing them to gradually penetrate the high-end equipment sector [5] - Investors without stock accounts can still access investment opportunities in the sector through the integrated circuit ETF linked fund (022350) [5]

五年规划释放关键信号!科技自主可控强势崛起!国产AI产业链的——科创人工智能ETF(589520)盘中涨超2.8%

Xin Lang Ji Jin· 2025-10-24 01:57

Core Insights - The technology sector, particularly the domestic AI industry chain, is experiencing significant growth, with the Sci-Tech Innovation Artificial Intelligence ETF (589520) seeing a jump of over 2.8% in intraday trading, currently up by 2.66% [1] - Key stocks driving this growth include Lanke Technology, which rose over 5%, and other companies like Hengxuan Technology and Hongsoft Technology, which increased by more than 4% [1] Policy and Market Trends - A recent major conference has highlighted the importance of high-quality development and the acceleration of self-reliance in technology, which is expected to be a central theme in upcoming policies [2] - The urgency for domestic computing power replacement is increasing due to U.S. restrictions on advanced chip exports to China, with expectations for continued breakthroughs in domestic computing capabilities [3] Investment Highlights - The Sci-Tech Innovation Artificial Intelligence ETF (589520) and its linked funds are positioned to benefit from several key factors: 1. Policy support is igniting AI growth, with the sector expected to lead the current market rally [4] 2. The focus on domestic alternatives and self-control in technology is becoming increasingly important amid rising tech tensions [4] 3. The ETF offers high elasticity with a 20% price fluctuation limit, allowing for efficient investment during market surges [4] Top Holdings - As of September 30, 2025, the top ten holdings of the Sci-Tech Innovation Artificial Intelligence Index account for over 71.90% of the total weight, with the semiconductor sector being the largest, comprising 52.6% [5]

寒武纪、“易中天”等多股又遭袭扰!传言扰动明星股套路大揭秘

Di Yi Cai Jing· 2025-10-23 12:00

Core Viewpoint - The stock price of Cambrian (688256.SH) surged over 7% due to rumors that major telecom operators would order 10,000 chips monthly from the company next year, although the company later clarified that such claims should be verified through official announcements [2][4][5] Group 1: Impact of Rumors on Stock Prices - Cambrian's stock has previously experienced significant price increases due to similar unfounded rumors, occurring in March and August of this year [2][11] - Other companies, including Sanhua Intelligent Control (002050.SZ) and Wanrun Technology (002654.SZ), have also seen their stock prices rise sharply due to rumors, indicating a broader trend in the market [2][6] - The stock price of Cambrian reached a high of 1,468 CNY before closing at 1,429.5 CNY, marking a daily increase of 4.42% [4][5] Group 2: Mechanisms Behind Rumor Propagation - The spread of rumors is often facilitated by a network of social media platforms and stock communities, where unverified information can quickly gain traction [5][8] - Professional writers adept at information dissemination create these rumors, combining real and fictitious elements to manipulate market sentiment [13][16] - The rumors typically fall into three categories: performance speculation, asset restructuring, and absurd gossip, each designed to trigger investor interest [13][14] Group 3: Role of Quantitative and Speculative Trading - The activation of quantitative trading models by market sentiment plays a crucial role in the stock price movements following rumors [3][19] - Significant capital from speculative traders often amplifies the effects of these rumors, leading to rapid price increases [18][20] - The phenomenon creates a cycle where quantitative funds initiate buying, followed by speculative traders, ultimately attracting retail investors [19][20] Group 4: Regulatory and Market Implications - The prevalence of these rumors disrupts normal market operations, posing challenges for regulatory bodies to maintain order [20] - There is a call for improved information disclosure and timely clarifications from companies to combat the spread of misinformation [20]

寒武纪、“易中天”等多股又遭袭扰!传言扰动明星股套路大揭秘

第一财经· 2025-10-23 11:39

Core Viewpoint - The article discusses the impact of rumors on stock prices, particularly focusing on companies in hot sectors like AI chips and robotics, highlighting how these rumors can lead to significant price fluctuations and market manipulation [3][12][14]. Group 1: Rumors and Stock Price Movements - A rumor about Cambricon (寒武纪) receiving monthly orders for 10,000 chips from three major telecom operators led to a stock price surge of over 7% [3][6]. - Cambricon's stock has previously experienced similar spikes due to unfounded rumors, indicating a pattern of market manipulation through misinformation [3][12]. - Other companies, such as Sanhua Intelligent Control (三花智控) and Wanrun Technology (万润科技), have also seen their stock prices dramatically affected by similar rumors [8][12]. Group 2: Mechanisms Behind Rumor Spread - The spread of rumors is often facilitated by quantitative trading models and speculative funds that react to market sentiment, amplifying the effects of these rumors [4][26]. - The article notes that the recent surge in rumors is characterized by targeting popular companies in trending industries, which makes them more susceptible to market manipulation [13][14]. - A systematic approach to rumor creation involves blending real and fabricated information to create a compelling narrative that attracts investor attention [16][17]. Group 3: Types of Rumors - Rumors can be categorized into three main types: performance speculation, asset restructuring, and absurd gossip, each designed to exploit investor psychology [17][18]. - Performance speculation often involves exaggerated claims about large orders or revenue growth, while asset restructuring rumors may mix factual elements with falsehoods to create confusion [17][18]. - Absurd gossip can generate significant market interest despite having little to no basis in reality, as seen in the case of a rumor involving a personal relationship affecting a company's stock [19]. Group 4: Regulatory Challenges - The article highlights the difficulty of regulating the spread of rumors, as they often utilize viral marketing techniques that obscure their origins [23][24]. - The lack of a robust regulatory framework allows these "small essays" to proliferate unchecked, leading to significant market disruptions [23][24]. - The need for improved information disclosure and timely clarifications from companies is emphasized as a way to combat the negative effects of these rumors [27].

寒武纪、“易中天”等多股频遭袭扰 传言扰动明星股套路揭密

Di Yi Cai Jing· 2025-10-23 11:34

Core Viewpoint - The stock price of Cambrian (688256.SH) surged over 7% due to rumors that major telecom operators would order 10,000 chips monthly from the company next year, but the company later clarified that such claims should be verified through official announcements [1][3][5]. Group 1: Cambrian's Stock Movement - Cambrian's stock initially opened lower but later surged to a high of 1,468 CNY, closing at 1,429.5 CNY, marking a daily increase of 4.42% [2]. - The company has previously experienced similar stock price spikes due to unfounded rumors, occurring in March and August of this year [1][10]. - Following the rumor's spread, Cambrian's stock opened lower the next day, dropping nearly 4% in early trading [3]. Group 2: Market Impact of Rumors - Other companies, including Sanhua Intelligent Control (002050.SZ) and Wanrun Technology (002654.SZ), also saw significant stock price fluctuations due to similar rumors [5][9]. - A notable example involved Sanhua Intelligent Control, which experienced a stock price surge after a rumor about securing a $685 million order from Tesla, only to see a sharp decline after the company denied the claims [5][11]. - The recent surge in rumors has predominantly targeted popular sectors and companies, indicating a trend where misinformation is strategically aimed at high-interest stocks [9][10]. Group 3: Mechanisms Behind Rumor Spread - The spread of rumors is often facilitated by a network of social media and stock community platforms, where unverified information can quickly gain traction [7][15]. - The rumors typically exploit investor psychology, leveraging themes of significant orders or partnerships to create a sense of urgency and excitement [12][18]. - A systematic approach to rumor creation involves blending factual elements with fabricated details to enhance credibility and market impact [12][15]. Group 4: Role of Quantitative and Speculative Trading - The involvement of quantitative trading models and speculative funds plays a crucial role in amplifying the effects of these rumors, as they react to market sentiment rather than the veracity of the information [17][18]. - The rapid price movements triggered by rumors often attract retail investors, creating a cycle of buying and selling that benefits those who initiated the rumors [18][19]. - The current market environment, characterized by investor fragility, allows for the manipulation of stock prices through misinformation, highlighting the need for regulatory oversight [11][19].

公募机构年内豪掷超300亿元掘金定增市场

Zheng Quan Ri Bao· 2025-10-22 16:41

Core Insights - Public institutions have shown increasing enthusiasm for participating in the private placement of listed companies, with a total subscription amount of 30.29 billion yuan in 2023, representing a 28.50% increase compared to 23.57 billion yuan in the same period last year [1][2] Group 1: Participation and Performance - A total of 37 public institutions participated in 74 private placement projects across 18 industries, with notable interest in the electronics and pharmaceutical sectors [1][2] - The floating profit amount from public institutions' participation in private placements has reached 10.84 billion yuan, indicating significant profit potential [1] - 59 companies had private placement projects that attracted over 100 million yuan from public institutions, with six companies receiving over 1 billion yuan [1] Group 2: Industry Preferences - The electronics and pharmaceutical industries are particularly favored by public institutions, with total subscriptions of 8.99 billion yuan and 4.52 billion yuan respectively [2] - Specific companies like Cambrian and Semiconductor Manufacturing International Corporation have attracted substantial investments, with Cambrian receiving 2.53 billion yuan from eight public institutions [1][2] Group 3: Institutional Insights - Among the 37 participating public institutions, 27 had total subscriptions exceeding 100 million yuan, with five institutions surpassing 1 billion yuan [2] - Nord Fund led with a subscription total of 8.90 billion yuan, participating in 70 companies' private placements [2] - The active participation of public institutions reflects their ability to capture market opportunities and indicates an optimized ecosystem in the private placement market [3]

芯原股份:更换持续督导保荐代表人

Zheng Quan Ri Bao Wang· 2025-10-22 13:13

Group 1 - The company, Chip Origin Co., announced a change in the designated representatives for the ongoing supervision of its stock issuance to specific targets, appointing Mr. Xu Xiaosong and Mr. Wu Kaicheng as the new representatives [1] - The ongoing supervision period will last until the obligations set by the China Securities Regulatory Commission and the Shanghai Stock Exchange are fulfilled [1]

强者恒强,银行ETF逆市10连阳,“AI双子星”盘中脉冲!BD“新王”诞生,港股通创新药ETF(520880)放量溢价

Xin Lang Ji Jin· 2025-10-22 11:43

Market Overview - The market experienced a day of low trading volume with all three major indices retreating, while the Shanghai Composite Index slightly fell by 0.07% but managed to hold above the 3900-point mark [1] - A-shares saw a trading volume of less than 1.7 trillion yuan, marking the lowest level since August 6 [1] - The banking sector showed resilience, with Agricultural Bank of China rising by 2.66%, achieving a 14-day consecutive increase and setting a new historical high [1][3] Banking Sector - The double-hundred billion bank ETF (512800) recorded a strong performance with a 10-day consecutive rise, closing up 0.85% with a trading volume of 1.189 billion yuan [5][7] - A total of 42 bank stocks in A-shares saw 39 gainers and 3 losers, indicating strong sector performance [3] - The banking sector's price-to-book ratio (PB) is at 0.71, which is in the lower range of the past decade, and the dividend yield stands at 4.04%, enhancing its attractiveness amid rising market uncertainties [6][7] AI Sector - The AI sector showed signs of activity with the "AI twins" - the ChiNext AI ETF (159363) and the Sci-Tech Innovation AI ETF (589520) both experiencing intraday gains exceeding 1% [1] - The total market capitalization of Cambricon Technologies has returned to 600 billion yuan, with its stock rising over 4% [9] - The Sci-Tech Innovation AI ETF (589520) saw a maximum intraday increase of 1.33%, reflecting strong interest in the domestic AI industry chain [11] Innovative Drug Sector - A significant milestone was reached with Innovent Biologics securing a record-breaking 11.4 billion USD business development deal, marking a new high for Chinese innovative drug BD transactions [3][19] - Despite the overall market retreat, the Hong Kong Stock Connect innovative drug ETF (520880) experienced strong buying interest, with a trading volume of 374 million yuan, indicating a potential "bottom-fishing" sentiment [17][19] - The innovative drug sector is expected to remain active, especially in the fourth quarter, which historically sees concentrated BD transactions [19]