Zhujiang Brewery(002461)

Search documents

珠江啤酒(002461):利润稳增长,成本改善较好

Xinda Securities· 2025-10-27 08:05

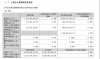

Investment Rating - The investment rating for the company is "Buy" [1] Core Insights - The company reported a revenue of 5.073 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 3.81%. The net profit attributable to the parent company reached 944 million yuan, up 17.05% year-on-year [1][3] - The report highlights that despite a slight revenue pressure in Q3 due to adverse weather conditions in Guangdong, the company has maintained a good growth trend in its product offerings, particularly the 97 Pure Draft beer [3] - Cost improvements have led to a gross margin increase, with the gross margin rising by 1.16 percentage points to 50.93% in Q3 2025 [3] - The company is optimistic about its long-term growth potential, particularly in the regional market, and is actively developing new product categories [3] Financial Performance Summary - For 2023A, the total revenue is projected at 5.378 billion yuan, with a year-on-year growth rate of 9.1%. The net profit attributable to the parent company is expected to be 624 million yuan, with a growth rate of 4.2% [2] - The gross margin is expected to improve from 42.8% in 2023A to 51.6% by 2027E, indicating a positive trend in profitability [2] - The earnings per share (EPS) for 2025E is projected to be 0.43 yuan, with a corresponding price-to-earnings (P/E) ratio of 22.56 [2][4]

青岛啤酒收购即墨黄酒告吹,茅台换帅

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 03:53

Group 1: Qingdao Beer Acquisition Termination - Qingdao Beer announced the termination of its acquisition of a 100% stake in Jimo Huangjiu due to unmet conditions in the share transfer agreement [2][4] - The acquisition was initially valued at 665 million yuan and was part of a trend where the capital market showed interest in Huangjiu [4] - The company stated it would not bear any liability for the termination of the share transfer agreement [4] Group 2: Leadership Changes in Major Alcohol Companies - Moutai Group appointed Chen Hua, the former director of the Guizhou Provincial Energy Bureau, as the new chairman, replacing Zhang Deqin after only a year and a half [10] - Xi Feng Wine announced the promotion of Zhang Yong to general manager of its marketing company, replacing Zhou Yanhua, who retired at the age of 55 [11] - Huichuan Beer appointed Yi Wenxin as the new general manager following the resignation of Liu Xiangyu and Chen Jiting [12][13] Group 3: Financial Performance of Alcohol Companies - Jin Hui Wine reported a revenue of 2.305 billion yuan and a net profit of 324 million yuan for the first three quarters, with a significant decline in Q3 net profit by 33% [15][16] - Yanjing Beer and Zhujiang Beer both reported slower growth in Q3, with Yanjing's revenue at 4.875 billion yuan, a 1.55% increase, and Zhujiang's revenue at 1.875 billion yuan, a 1.34% decline [17] - Heineken's Q3 net revenue decreased by 0.3%, with a 4.3% decline in organic sales volume, leading to a downward revision of its annual sales forecast [19][20] Group 4: Market Trends and Consumer Behavior - The National Bureau of Statistics reported a 1.6% year-on-year growth in the tobacco and alcohol sector for September, with a 4% increase for the first nine months of 2025 [23]

青岛啤酒收购即墨黄酒告吹,茅台换帅|观酒周报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 02:46

Group 1: Company Developments - Qingdao Beer announced the termination of its acquisition of the equity in Jimo Huangjiu due to unmet conditions in the share transfer agreement, which was initially valued at 665 million yuan [2] - Moutai Group has appointed Chen Hua, the former director of the Guizhou Provincial Energy Bureau, as the new chairman, replacing Zhang Deqin after only a year and a half [6] - Xifeng Wine has appointed Zhang Yong as the new general manager of its marketing company, succeeding Zhou Yanhua, who retired at the age of 55 [7] Group 2: Financial Performance - Jin Hui Wine reported a revenue of 2.305 billion yuan and a net profit of 324 million yuan for the first three quarters, with a significant decline in Q3 net profit by 33% year-on-year [11] - Yanjing Beer and Zhujiang Beer both reported slower growth in their Q3 results, with Yanjing's revenue at 4.875 billion yuan, a 1.55% increase, while Zhujiang's revenue fell by 1.34% to 1.875 billion yuan [12][13] - Heineken's Q3 net revenue decreased by 0.3%, with a projected decline in annual sales due to worsening macroeconomic challenges [14] Group 3: Market Trends - The National Bureau of Statistics reported a 1.6% year-on-year growth in the tobacco and alcohol sector for September, with a 4% increase in the first nine months of 2025 [16]

国信证券晨会纪要-20251027

Guoxin Securities· 2025-10-27 01:41

Group 1: Company Analysis - The report highlights the strong performance of Dongfang Caifu (300059.SZ), with a revenue of 11.589 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 58.7%, and a net profit attributable to shareholders of 9.097 billion yuan, up 50.6% year-on-year [9][10] - The company's return on equity (ROE) stands at 10.74%, an increase of 2.60 percentage points compared to the previous year [9] - The significant growth in the company's securities business, particularly in brokerage and margin financing, is attributed to the active trading environment in the capital market since Q4 2024 [9][10] Group 2: Industry Insights - The report discusses the recovery of the fund distribution business, noting that Dongfang Caifu's fund distribution scale is leading in the industry, with a total of 1.0572 trillion yuan in fund sales for the first half of 2025 [11] - The report emphasizes the resilience of the export market, with a surprising export growth rate of 6.6% in Q3 2025, indicating a robust recovery despite expectations of a decline [15] - The media industry is identified as having a favorable seasonal effect, particularly in November, suggesting a good opportunity for investment in this sector [33]

白酒指数周跌1.23%!啤酒三季报不及预期,燕京、珠江双双大跌超5%丨酒市周报

Mei Ri Jing Ji Xin Wen· 2025-10-26 10:40

Group 1 - The core viewpoint of the articles indicates that the liquor industry is currently in a state of "low expectations, weak reality," with significant declines in stock performance, particularly in the white liquor sector [1][4] - The Wind white liquor index fell by 1.23% this week, closing at 59,343.67 points, with Shanxi Fenjiu experiencing the largest drop of 5.88% [1][4] - The upcoming third-quarter reports for the liquor industry are expected to validate the current market conditions, with concerns about potential further declines in performance [4] Group 2 - The beer sector is also facing challenges, with regional beer companies reporting lower-than-expected earnings, despite maintaining stable growth overall [4][5] - Zhujiang Beer reported a 17.05% year-on-year increase in net profit for the first three quarters, but its third-quarter revenue saw a decline of 1.34%, marking the first such drop since 2018 [4][5] - Yanjing Beer achieved a revenue of 4.875 billion yuan in the third quarter, a year-on-year growth of approximately 1.55%, but faced pressure in market expansion due to weak consumer demand [5]

珠江啤酒(002461):三季度行业需求疲弱致收入小幅下滑,盈利能力延续提升

Guoxin Securities· 2025-10-26 09:47

Investment Rating - The investment rating for the company is "Outperform the Market" [5][8][11] Core Views - The company reported a slight decline in revenue due to weak industry demand in Q3 2025, with total revenue at 1.88 billion yuan, down 1.3% year-on-year. However, net profit attributable to shareholders increased by 8.2% year-on-year to 330 million yuan [1][7] - The company is focusing on marketing reforms, product structure optimization, brand promotion, and management improvements to counteract the weak demand in the beer industry and adverse weather conditions in Guangdong [1][8] - The company is actively expanding its mid-to-high-end product lines and enhancing its digital transformation efforts, which are expected to improve operational efficiency and long-term profitability [2][8] Financial Performance Summary - Q3 2025 financial highlights include: - Total revenue: 1.88 billion yuan, down 1.3% year-on-year - Net profit: 330 million yuan, up 8.2% year-on-year - Non-recurring net profit: 310 million yuan, up 7.1% year-on-year - Sales volume decreased by 2.9% year-on-year, while revenue per thousand liters increased by 1.6% [1][7] - The gross profit margin improved by 1.2 percentage points year-on-year, driven by product structure enhancement and lower raw material costs [1][7] - The net profit margin increased by 1.6 percentage points to 17.7% [1][7] Earnings Forecast and Investment Recommendations - The company is expected to achieve total revenue of 5.98 billion yuan, 6.31 billion yuan, and 6.61 billion yuan for 2025, 2026, and 2027 respectively, with year-on-year growth rates of 4.3%, 5.6%, and 4.7% [2][8] - The forecast for net profit attributable to shareholders is 960 million yuan, 1.09 billion yuan, and 1.18 billion yuan for the same years, with growth rates of 18.5%, 13.5%, and 8.4% respectively [2][8] - The current price-to-earnings ratio (PE) is projected to be 22, 20, and 18 for 2025, 2026, and 2027 respectively, indicating a reasonable valuation within the beer industry [2][8]

QFII最新调仓路径浮现

财联社· 2025-10-25 12:52

Core Insights - The article discusses the recent adjustments in QFII (Qualified Foreign Institutional Investor) holdings in A-shares as companies disclose their Q3 reports, highlighting a clear trend in foreign investment strategies [1][2]. Group 1: Sovereign Wealth Fund Adjustments - Sovereign wealth funds like the Abu Dhabi Investment Authority (ADIA) and the Monetary Authority of Macao have shown distinct trading behaviors, with ADIA significantly increasing its holdings in cyclical resource stocks, particularly Baofeng Energy, which now has a market value exceeding 790 million yuan [3][4]. - In contrast, the Monetary Authority of Macao has adopted a more defensive and stable investment strategy, focusing on resource, environmental, and manufacturing sectors, with a total market value of 1.14 billion yuan across six stocks [3][4]. - The Hong Kong Monetary Authority has reduced its holdings in Chengde Lolo, now holding 9.3 million shares, indicating a cautious approach compared to ADIA's aggressive positioning [4]. Group 2: Traditional Foreign Banks' Strategies - Major foreign banks like Morgan Stanley, UBS, and Goldman Sachs have shown a trend towards concentrated investments in high-certainty sectors, with Morgan Stanley holding 42 A-shares valued at 2.874 billion yuan, focusing on electric power equipment and digital infrastructure [5][6]. - Morgan Chase has the largest coverage with 71 A-shares, significantly increasing its stake in China West Electric from 56.82 million shares to 130 million shares, reflecting a strategic shift towards high-potential stocks [5]. - UBS has diversified its holdings across 55 A-shares, emphasizing mid-to-small-cap growth stocks, while Goldman Sachs has concentrated on resource and chemical stocks, indicating varied investment philosophies among these institutions [5][6]. Group 3: Common Holdings Among Foreign Institutions - Several stocks have emerged as "foreign consensus stocks," held by three or more foreign institutions, indicating strong compatibility in valuation, fundamentals, and policy direction [7][8]. - Notable examples include Chengfei Integration, which is held by multiple institutions with a total market value exceeding 132 million yuan, and Innovation Medical, favored by four foreign entities [7][8]. - Other stocks like Lianhuan Pharmaceutical and Xingwang Yuda have also gained traction among foreign investors, showcasing a trend towards core assets in advanced manufacturing, healthcare, TMT, and military materials sectors [8].

吃喝板块逆市下挫,白酒股集体“醉倒”!食品ETF(515710)跌超1%,机构高呼看好四季度行情!

Xin Lang Ji Jin· 2025-10-24 11:43

Group 1 - The food and beverage sector experienced a decline on October 24, with the Food ETF (515710) closing down 1.13% after fluctuating near the surface at the opening [1] - Key stocks in the sector, particularly in the liquor category, saw significant drops, with Zhujiang Beer down 5.23%, and both Luzhou Laojiao and Shede Distillery falling over 4% [1] - The overall performance of the sector was negatively impacted by declines in several stocks, including Miaokelando and New Dairy, which dropped over 3% and 2% respectively [1] Group 2 - Guosen Securities noted that as the impact of second-quarter consumption policies weakens, the restaurant supply chain is gradually recovering, with positive signals from the supply side, such as frequent mergers among leading companies [2] - The food and beverage sector is currently at a low valuation, with the food ETF's price-to-earnings ratio at 20.49, which is at the 7.06% percentile of the past decade, indicating a favorable configuration opportunity [2] - Historical trends suggest that any changes in supply and demand could catalyze stock price increases, especially in the fourth quarter when macro policies are expected to be active [2] Group 3 - Future outlook indicates that the food and beverage industry will focus on growth, with beverage leaders maintaining structural prosperity driven by major products, while companies in food raw materials and health products are expected to see accelerated performance [3] - The white liquor industry is currently in a "low expectation, weak reality" state, with the third-quarter reports being a crucial observation window as external factors diminish and liquor companies adjust strategies [3] - There is a mixed performance in consumer goods, with snacks, beverages, and health products showing good demand, while traditional products like dairy and beer are experiencing flat demand [3] Group 4 - Major liquor brands such as Luzhou Laojiao and Yanghe have launched new products recently, indicating ongoing innovation in the sector [4] - Luzhou Laojiao's new product was launched on Douyin, while Yanghe's new offering was showcased during the Nanjing Autumn Sugar event [4] Group 5 - The Food ETF (515710) focuses on core assets in the food and beverage sector, with approximately 60% of its portfolio allocated to high-end and mid-range liquor leaders, and nearly 40% to leading stocks in beverages, dairy, and condiments [5] - The top ten weighted stocks in the ETF include well-known brands such as Moutai, Wuliangye, and Yili [5] - Investors can also access the core assets of the food and beverage sector through the Food ETF linked funds [5]

珠江啤酒发三季报:前九个月营收净利双增,第三季度增速放慢

Nan Fang Du Shi Bao· 2025-10-24 10:56

Core Viewpoint - Zhujiang Beer reported a steady growth in revenue, net profit, and sales volume for the first three quarters of the year, achieving historical highs in both revenue and net profit [1][2]. Financial Performance - Revenue for the first nine months reached approximately 5.073 billion yuan, a year-on-year increase of 3.81% [2]. - Net profit attributable to shareholders was 944 million yuan, reflecting a year-on-year growth of 17.05% [2]. - Beer sales volume was 1.2035 million tons, up 1.83% year-on-year [1]. Quarterly Analysis - In the third quarter, revenue was approximately 1.875 billion yuan, a decrease of 1.34% compared to the same period last year [2][3]. - Net profit for the third quarter was 332 million yuan, an increase of 8.16% year-on-year [2][3]. - Sales volume in the third quarter was 469,400 tons, down 2.89% from 483,400 tons in the same quarter last year [3]. Product Strategy - The company is implementing a "3+N" product strategy, focusing on products like Xuebao, Pure Draft, and other specialty products, with a notable performance from the 8 yuan price segment [3][5]. - The 8 yuan price segment has benefited from consumer shifts, effectively replacing the traditional 3-5 yuan price range [3]. Competitive Landscape - Increased competition in the 8 yuan price segment from companies like China Resources Beer and Qingdao Beer, as well as the introduction of larger packaging products, is putting pressure on Zhujiang Beer’s growth [3]. Future Outlook - Zhujiang Beer plans to enhance its product structure and innovation across five areas: product, business, promotion, brand communication, and management to sustain high growth [4]. - The company is also focusing on high-end product development, aligning with industry trends such as "tea beer" and "fruit beer" [5]. Market Performance - On October 24, Zhujiang Beer’s stock closed at 9.61 yuan per share, down 5.23% [6].

非白酒板块10月24日跌1.11%,珠江啤酒领跌,主力资金净流出6533.89万元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:29

Market Overview - The non-liquor sector experienced a decline of 1.11% on the trading day, with Zhujiang Beer leading the drop [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Stock Performance - Key stocks in the non-liquor sector showed varied performance, with *ST Yedao rising by 5.00% to a closing price of 6.51, while Zhujiang Beer fell by 5.23% to 9.61 [2] - Other notable movements included ST Xifa increasing by 2.48% and Zhangyu A slightly declining by 0.09% [2] Trading Volume and Value - The trading volume for *ST Yedao reached 158,100 shares, with a transaction value of 102 million yuan [2] - Zhujiang Beer had a trading volume of 236,000 shares and a transaction value of 228 million yuan [2] Capital Flow Analysis - The non-liquor sector saw a net outflow of 65.34 million yuan from main funds, while retail funds experienced a net outflow of 13.25 million yuan [2] - Speculative funds, however, recorded a net inflow of 78.59 million yuan [2] Individual Stock Capital Flow - *ST Yedao had a main fund net outflow of 21.99 million yuan, while speculative funds saw a net inflow of 8.97 million yuan [3] - Zhujiang Beer experienced a significant main fund net outflow of 21.99 million yuan, with retail funds also showing a net outflow [3]