EOPTOLINK(300502)

Search documents

新易盛(300502):Q3环比暂歇不改大势 1.6T与硅光放量驱动成长提速

Xin Lang Cai Jing· 2025-10-31 04:42

Core Insights - The company reported a revenue of 6.07 billion yuan for Q3 2025, representing a year-on-year increase of 152.5% but a quarter-on-quarter decline of 5% [1] - The net profit attributable to shareholders for the same quarter was 2.38 billion yuan, showing a year-on-year growth of 205.4% and a quarter-on-quarter increase of 0.6% [1] - The company maintained a gross margin of 47% and a net margin of 39.3%, achieving a historical high for the quarter [1] Company Performance - The decline in quarter-on-quarter revenue was attributed to adjustments in the delivery schedules of certain customers, but the company has returned to normal operations in Q4 [1] - The increase in profit margins was driven by a higher shipment volume and sales proportion of 800G products, along with the ramp-up of 1.6T products [1] Industry Trends - There is a continuous upward adjustment in global demand for optical modules, with a clear trend towards 800G/1.6T and silicon photonics upgrades [2] - The ongoing development of large models and the rapid growth in token consumption are driving an increase in global computing power demand [2] - The company is expected to focus on 800G and 1.6T products in future shipments, with significant growth anticipated in the shipment of silicon photonics products [2] Investment Outlook - The company’s long-term development trend remains unchanged despite short-term fluctuations, supported by its advantages in R&D, supply chain, and delivery [2] - The profit forecast for the company is projected to reach 9.52 billion, 18.82 billion, and 27.22 billion yuan for the years 2025, 2026, and 2027, respectively, with corresponding PE ratios of 42.4, 21.5, and 14.8 [2]

新易盛获融资资金买入近54亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 04:08

Market Overview - The Shanghai Composite Index fell by 0.73% to close at 3986.9 points, with a daily high of 4025.7 points [1] - The Shenzhen Component Index decreased by 1.16% to 13532.13 points, reaching a maximum of 13700.25 points [1] - The ChiNext Index dropped by 1.84% to 3263.02 points, with a peak of 3331.86 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24911.76 billion yuan, with a financing balance of 24732.7 billion yuan and a securities lending balance of 179.06 billion yuan, reflecting a decrease of 75.56 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12657.39 billion yuan, down by 39.35 billion yuan, while the Shenzhen market's balance was 12254.37 billion yuan, decreasing by 36.21 billion yuan [2] - A total of 3456 stocks had financing funds for purchase, with the top three being Xinyi Technology (53.65 billion yuan), Zhongji Xuchuang (46.23 billion yuan), and Sunshine Power (36.47 billion yuan) [2] Fund Issuance - Four new funds were issued yesterday, including two mixed funds and two stock funds, all launched on October 30, 2025 [3][4] Top Trading Activities - The top ten net buying amounts on the Dragon and Tiger List included Jiangte Electric (27681.86 million yuan), Tianji Shares (20137.13 million yuan), and Guodun Quantum (16408.1 million yuan) [5] - The highest price increase was seen in Jiangte Electric with a rise of 9.98%, followed by Tianji Shares with a 10.0% increase [5]

A股CPO概念连续第二日集体回调,天孚通信跌超4%,光库科技、德科立、新易盛、联特科技、中际旭创、长飞光纤跌超3%

Ge Long Hui· 2025-10-31 02:37

Market Overview - The CPO concept has experienced a collective pullback for the second consecutive day, with notable declines in several companies including Tianfu Communication, which fell over 4%, and others like Guangku Technology, Dekeli, Xinyi Sheng, Lian Te Technology, Zhongji Xuchuang, and Changfei Fiber, all dropping over 3% [1]. Company Performance - Zhongji Xuchuang reported Q3 2025 revenue of 10.216 billion, a year-on-year increase of 56.83%, and a net profit of 3.137 billion, up 124.98% year-on-year. For the first three quarters, revenue reached 25.005 billion, growing 44.43%, with net profit at 7.132 billion, a 90.05% increase [2]. - Xinyi Sheng disclosed Q3 2025 revenue of 6.068 billion, marking a year-on-year growth of 152.53%, but a quarter-on-quarter decline of 5%. The net profit was 2.385 billion, up 205.38% year-on-year, with a slight quarter-on-quarter increase of 0.63%. For the first three quarters, revenue totaled 16.505 billion, a 221.70% increase, and net profit was 6.327 billion, up 284.37% [3]. Analyst Insights - Citigroup noted that Xinyi Sheng's Q3 net profit fell short of investor expectations, predicting a negative market reaction. However, this may be a one-time event, with expectations for significant net profit growth in Q4 due to the delivery of 1.6T product orders and the recognition of delayed order revenues. Citigroup maintains a buy rating on the stock [3].

A股异动丨CPO概念连续第二日集体回调,中际旭创绩后跌超3%

Ge Long Hui A P P· 2025-10-31 02:37

Core Insights - The CPO concept has experienced a collective pullback for the second consecutive day, with notable declines in stocks such as Tianfu Communication, Guangku Technology, and others [1] - Zhongji Xuchuang reported a revenue of 10.216 billion yuan for Q3 2025, marking a year-on-year increase of 56.83%, and a net profit of 3.137 billion yuan, up 124.98% [1] - Xinyi Sheng's Q3 2025 revenue reached 6.068 billion yuan, reflecting a year-on-year growth of 152.53%, while net profit surged by 205.38% to 2.385 billion yuan [1] - Citigroup noted that Xinyi Sheng's Q3 net profit fell short of investor expectations, but anticipated a significant rebound in Q4 due to order deliveries [1] Company Performance - Zhongji Xuchuang's revenue for the first three quarters of 2025 was 25.005 billion yuan, a 44.43% increase year-on-year, with net profit at 7.132 billion yuan, up 90.05% [1] - Xinyi Sheng's total revenue for the first three quarters reached 16.505 billion yuan, a remarkable year-on-year growth of 221.70%, with net profit soaring to 6.327 billion yuan, up 284.37% [1] Market Reaction - Citigroup expects a negative market reaction to Xinyi Sheng's Q3 results but views any resulting stock price decline as a potential buying opportunity, citing management's comments on delayed customer orders impacting performance [1] - The stock performance of various companies in the CPO sector has shown significant declines, with Tianfu Communication down 4.69% and Xinyi Sheng down 3.66% [2]

通信概念股早盘走低,5G、通信相关ETF跌约3%

Mei Ri Jing Ji Xin Wen· 2025-10-31 02:20

Group 1 - Communication concept stocks declined in early trading, with New Yisheng and Tianfu Communication dropping over 5%, and Zhongji Xuchuang and Industrial Fulian falling over 4% [1] - 5G and communication-related ETFs fell approximately 3% [1] Group 2 - Specific ETF performance includes: - Wang Communication ETF at 2.769, down 0.100 or 3.49% - Main Communication Equipment ETF at 2.189, down 0.079 or 3.48% - Main 5G50 ETF at 2.203, down 0.069 or 3.04% - 5G ETF Main at 1.761, down 0.053 or 2.92% - Main 5G Communication ETF at 2.156, down 0.065 or 2.93% [2] Group 3 - Some brokerages indicate that AI may represent the largest industrial opportunity since cloud computing, with hardware growth driven by GPUs and ASICs expected to become a second growth engine next year [2] - The North American computing industry chain is anticipated to maintain high growth rates in the coming quarters, supported by the resonance of cloud revenue growth and capital expenditure from North American cloud companies [2]

算力硬件股多股下挫,中际旭创等股跌超4%

Mei Ri Jing Ji Xin Wen· 2025-10-31 02:12

Group 1 - Multiple stocks in the computing hardware sector experienced declines, with Zhongji Xuchuang, Xinyi Sheng, and Shenghong Technology dropping over 4% [1] - Other companies such as Tianfu Communication, Jianqiao Technology, and Shengyi Electronics also followed the downward trend [1]

新易盛:2025 年第三季度投资者电话会议要点:业绩不及预期但 2025 年第四季度展望向好;存在抄底机会

2025-10-31 01:53

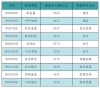

Eoptolink Technology (300502.SZ) 3Q25 Investor Call Summary Company Overview - **Company**: Eoptolink Technology - **Industry**: Optical Communication Technology Key Financial Highlights - **3Q25 Revenue**: Rmb 6.1 billion, up 153% YoY but 18% below Bloomberg consensus [1][6] - **3Q25 Gross Profit**: Rmb 2.8 billion, up 185% YoY, 14% below consensus, with a gross margin of 46.9%, a 5.4 percentage points increase YoY [1][6] - **3Q25 Operating Profit**: Rmb 2.6 billion, up 196% YoY, 18% below consensus [1][6] - **3Q25 Net Profit**: Rmb 2.4 billion, up 205% YoY, 18% below consensus and below investor expectations of Rmb 3.0 billion [1][6] Management Insights - **Order Delays**: Management indicated that delays in customer order pull-ins impacted 3Q25 results but expect fulfillment in 4Q25, leading to a rebound [2] - **Demand Outlook**: Strong demand for 4Q25 and 2026 is anticipated, with management ramping up capacity to meet this demand [2][3] - **Capacity Expansion**: Capacity ramp-up is on track, with expectations for continued growth in 2026 and 2027 to fulfill customer demand [3] Market Position and Future Outlook - **Market Demand**: Management noted robust demand for SiPh products, particularly in the 800G and 1.6T segments, which are expected to see significant YoY increases [3] - **Investment Recommendation**: Despite the disappointing 3Q25 results, the company is viewed as a potential bottom-fishing opportunity with a robust demand setup for 2026 and 2027 [1] Valuation Metrics - **Current Price**: Rmb 406.10 [4] - **Target Price**: Rmb 472.00, implying a potential upside of 16.2% [4] - **Market Capitalization**: Rmb 403.65 billion (approximately US$ 56.86 billion) [4] Risks to Consider - **Investment Risks**: Potential risks include slower-than-expected data center investments, lower optical network capex by telecoms, margin pressures from price competition, and geopolitical tensions affecting technology sectors [9] Conclusion Eoptolink Technology's 3Q25 results were below expectations primarily due to order delays, but management's outlook for 4Q25 and beyond remains positive, supported by strong demand and capacity expansion plans. The stock is recommended for investors looking for potential recovery opportunities in the optical communication sector.

2025Q3基金仓位解析:三季度基金调仓五大看点

GOLDEN SUN SECURITIES· 2025-10-31 00:37

Key Insights - The report highlights significant changes in fund allocation during Q3 2025, with a notable increase in equity positions and a shift towards AI and new energy sectors, while consumer sectors faced reductions [8][9][10] - The performance of various industries shows a mixed trend, with coal and machinery sectors experiencing fluctuations in revenue and profit margins, while technology and communication sectors demonstrate robust growth [24][26][29][35][40] Fund Allocation Insights - Fund sizes increased significantly, with a 20% rise in active fund products, driven by a strong A-share market performance, particularly a 20% increase in the CSI 800 index [8] - There is a reinforced trend of reducing mainboard allocations while increasing investments in emerging sectors, with the STAR Market allocations reaching new highs [9] - AI and new energy sectors are leading the allocation trends, while consumer sectors like home appliances and automobiles are seeing widespread reductions [9][10] Industry Performance Insights - The coal industry is facing challenges, with companies like Pingmei and Lu'an reporting significant declines in revenue and profit due to structural changes in sales, although Q4 is expected to see recovery due to rising coal prices [35][44] - The machinery sector, represented by companies like Rongzhi Rixin, is experiencing substantial growth, with a 13.9% increase in revenue and an impressive 890% rise in net profit year-on-year [26] - The communication sector, particularly companies like New Yisheng, reported a 152.5% year-on-year revenue increase, driven by strong demand for optical communication products [24] Company-Specific Insights - Bull Group's revenue decline is narrowing, with healthy cash flow, and the company is expected to maintain a "buy" rating based on future profit projections [20] - Hikvision is showing signs of recovery with stable profits and cash flow, supported by advancements in AI technology [47] - Huabao New Energy is facing short-term profit pressure due to tariffs but maintains strong growth potential with a projected increase in net profit over the next few years [29]

A股三季报勾勒产业新图景 电子、有色、储能行业业绩亮眼

Zhong Guo Zheng Quan Bao· 2025-10-30 22:10

Core Insights - The A-share market's Q3 2025 reports reveal significant growth across multiple industries, with notable reversals in performance for some sectors, particularly electronics, non-ferrous metals, and energy storage [1] Electronics Industry - The electronics sector, led by major player Industrial Fulian, reported a revenue of 603.93 billion yuan for the first three quarters, marking a 38.4% year-on-year increase, and a net profit of 22.49 billion yuan, up 48.52% [2] - AI-driven demand has significantly boosted growth in various electronic applications, including servers and communication devices, with companies like Zhongji Xuchuang and Xinyi achieving revenue increases of 44.43% and 221.7% respectively [2] - PCB companies also showed strong performance, with Shengyi Electronics reporting a staggering 497.61% increase in net profit [2] Non-Ferrous Metals Industry - The non-ferrous metals sector experienced substantial growth due to rising product prices and increased downstream demand, with several rare earth companies reporting over 100% growth in net profit [4] - For instance, Shenghe Resources achieved a net profit growth rate of 748.07%, driven by favorable market conditions and effective management strategies [4] - Other companies like Zijin Mining and Baiyin Nonferrous Metals also reported significant revenue increases, with Zijin Mining's revenue reaching approximately 254.2 billion yuan, up 10.33% [4] Energy Storage Industry - The energy storage sector is witnessing robust demand, with global lithium battery storage installations exceeding 170 GWh, reflecting a 68% year-on-year growth [5] - Companies like Sungrow Power reported a revenue of 66.40 billion yuan, up 32.95%, with a notable 70% increase in energy storage shipments [6] - Kelu Electronics also experienced growth, with a revenue increase of 23.42% and a net profit surge of 251.1%, highlighting the expanding applications and technological advancements in the energy storage market [6]

电子、有色、储能行业业绩亮眼

Zhong Guo Zheng Quan Bao· 2025-10-30 21:11

Core Insights - The A-share market's Q3 2025 reports reveal significant growth across multiple industries, particularly in electronics, non-ferrous metals, and energy storage, driven by strong downstream demand [1] Electronics Industry - The electronics sector, led by major player Industrial Fulian, reported a revenue of 603.93 billion yuan for the first three quarters, marking a 38.4% year-on-year increase, with net profit rising by 48.52% to 22.49 billion yuan [1] - The growth in cloud computing is attributed to the large-scale delivery of AI cabinet products and sustained demand for AI computing power, positively impacting various electronic applications [1] - In the optical module sector, companies like Zhongji Xuchuang and Xinyi Sheng reported substantial revenue increases of 44.43% and 221.7%, respectively, with net profits soaring by 90.05% and 284.37% [2] - PCB companies, including Shenghong Technology and Shunyi Electronics, also experienced significant profit growth, with Shengyi Electronics' net profit increasing by 497.61% [2] - Dongwei Technology, specializing in PCB plating equipment, reported a net profit of 85.37 million yuan, up 24.8%, with Q3 net profit surging by 236.93% [2] Non-Ferrous Metals Industry - The non-ferrous metals sector saw substantial profit growth, with companies like Northern Rare Earth and China Rare Earth reporting over 100% year-on-year increases in net profit, and Shenghe Resources achieving a remarkable 748.07% growth [3] - Silver Industry's Q3 revenue reached 72.64 billion yuan, a 5.21% increase, with Q3 alone showing a 70.72% rise [3] - Zijin Mining reported approximately 254.2 billion yuan in revenue, up 10.33%, and a net profit of 37.86 billion yuan, reflecting a 55.45% increase [3] Energy Storage Industry - The global lithium battery energy storage installations exceeded 170 GWh in the first three quarters of 2025, representing a 68% year-on-year growth, indicating a robust market expansion [4] - Sunshine Power achieved a revenue of 66.40 billion yuan, a 32.95% increase, with net profit rising by 56.34% to 11.88 billion yuan, driven by strong performance in photovoltaic inverters and energy storage [4] - Kelu Electronics reported a revenue of 3.59 billion yuan, up 23.42%, with net profit soaring by 251.1% to 23.2 million yuan, benefiting from the growing share of renewable energy in the new power system [4] - Hunan Yuren, a supplier of lithium-ion battery cathode materials, reported revenue and net profit growth rates of 46.27% and 31.51%, respectively, due to increased demand in the energy storage sector [5]