EOPTOLINK(300502)

Search documents

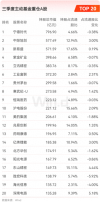

AI驱动算力高增长 产业链公司“大丰收”

Shang Hai Zheng Quan Bao· 2025-10-30 18:29

Core Insights - The A-share computing power industry chain is experiencing significant growth, with 143 out of 147 listed companies reporting profits in the first three quarters of the year, driven by the global AI wave and accelerated domestic infrastructure deployment [2][3] Group 1: Company Performance - Among the 143 companies, 118 achieved profitability, with 32 companies doubling their profits year-on-year [2] - Industrial Fulian emerged as the "profit king" with a net profit of 22.487 billion yuan, a year-on-year increase of 48.52% [2][10] - Zhongji Xuchuang reported a net profit of 7.132 billion yuan, marking a remarkable growth of 90.05% [2][10] - Han's Semiconductor turned a loss of 724 million yuan last year into a profit of 1.605 billion yuan, with revenue soaring by 2386.38% to 4.607 billion yuan [4][10] - New Yisheng's revenue reached 16.505 billion yuan, up 221.70%, with a net profit of 6.327 billion yuan, increasing by 284.38% [6][10] Group 2: Sector Analysis - The server sector is the main driver of growth, with Industrial Fulian's revenue reaching 243.172 billion yuan, a 42.81% increase, and a net profit of 10.373 billion yuan, up 62.04% [3][10] - The PCB industry is also witnessing growth, with Shenghong Technology's revenue increasing by 83.40% to 14.117 billion yuan and net profit soaring by 324.38% to 3.245 billion yuan [7][10] - The light module sector is experiencing a positive cycle of "technological breakthroughs, product volume, and performance realization," with Zhongji Xuchuang's revenue growing by 44.43% to 25.005 billion yuan [5][10] Group 3: Market Trends - The demand for AI computing power is expected to remain high, with light module companies like New Yisheng anticipating continued growth in 1.6T products [6][8] - The PCB industry is moving towards high-end products, driven by AI data center construction needs, with increased technical barriers and capital requirements [8]

押对"易中天" 永赢这只基金9个月收益超200%,新人任桀进阶百亿经理

Sou Hu Cai Jing· 2025-10-30 16:12

Core Insights - The technology sector has taken the lead in the stock market, driven by the explosive growth of AI-related industries, resulting in significant returns for actively managed equity funds that invested early in AI and computing themes [2][4] - As of October 30, the communication and electronics sectors have seen year-to-date gains of 68.75% and 52.77%, respectively, ranking second and third in index performance [2] - Over 50 funds have achieved doubling returns this year, with the Yongying Technology Select Fund leading at a total return of 219.37%, making it the only equity fund with over 200% return this year [2][4] Fund Performance - The Yongying Technology Select Fund's high returns are primarily attributed to its focus on the computing sector, particularly on stocks related to optical modules, which have significantly contributed to its performance [4][6] - The fund's net asset value nearly doubled in the third quarter, achieving a 99.74% increase, driven by substantial gains in its top holdings [4][6] Fund Manager Insights - The fund manager, Ren Jie, has made frequent adjustments to the fund's portfolio, with significant changes in the top ten holdings throughout the year [4][6] - In the third quarter, Ren Jie increased positions in top-performing stocks such as Xinyiseng, Zhongji Xuchuang, and Tianfu Communication, which saw respective increases of 188%, 177%, and 111% [4][5] - The fund's assets surged from 1.166 billion yuan at the end of the second quarter to 11.521 billion yuan by the end of the third quarter, marking a nearly ninefold increase [5][6] Market Trends - The global AI computing investment landscape is evolving, with leading model manufacturers creating new markets through collaborations, posing challenges to traditional industry giants [6] - The shift towards debt-financed investments by new cloud companies and mutual investments between chip and model manufacturers is expected to elevate global AI computing investments [6]

光模块三剑客三季报出炉 中际旭创Q3净利润环比增长30%

Xin Lang Cai Jing· 2025-10-30 13:48

Core Viewpoint - The report highlights the strong financial performance of several optical module companies in their third-quarter results, indicating significant growth in net profits for key players in the industry [1]. Group 1: Company Performance - Zhongji Xuchuang reported a third-quarter net profit of 3.137 billion yuan, representing a quarter-on-quarter increase of 30.06% [1]. - Xinyi Technology achieved a net profit of 6.327 billion yuan in the first three quarters, marking a year-on-year growth of 284.37% [1]. - Shijia Photon recorded a net profit of 300 million yuan for the first three quarters, with a remarkable year-on-year increase of 727.74% [1]. Group 2: Industry Overview - Multiple optical module companies, including Zhongji Xuchuang, Xinyi Technology, and Shijia Photon, have disclosed their third-quarter reports, showcasing robust financial results [1]. - The overall performance of the optical module sector appears to be strong, with significant profit growth across various companies [1].

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].

新易盛的前世今生:2025年三季度营收165.05亿行业第四,净利润63.27亿行业第二

Xin Lang Zheng Quan· 2025-10-30 12:50

Core Viewpoint - New Yisong is a leading domestic optical module supplier with strong R&D and production capabilities, primarily serving data centers and 5G applications [1] Group 1: Business Performance - In Q3 2025, New Yisong achieved a revenue of 16.505 billion, ranking fourth among 36 peers, significantly above the industry average of 6.434 billion and median of 1.184 billion [2] - The company's net profit for the same period was 6.327 billion, ranking second in the industry, exceeding the average of 668 million and median of 80.78 million [2] Group 2: Financial Ratios - As of Q3 2025, New Yisong's debt-to-asset ratio was 31.99%, higher than the previous year's 27.88% but lower than the industry average of 38.12% [3] - The gross profit margin for the same period was 47.25%, an increase from 42.34% year-on-year, and above the industry average of 30.08% [3] Group 3: Shareholder Information - As of September 30, 2025, the number of A-share shareholders increased by 58.46% to 155,300, while the average number of circulating A-shares held per shareholder decreased by 36.78% to 5,700.48 [5] - Major shareholders include Hong Kong Central Clearing Limited, holding 35.8472 million shares, a decrease of 14.7275 million shares from the previous period [5] Group 4: Future Outlook - The company is expected to see significant growth in revenue and net profit from 2025 to 2027, with projected net profits of 8.775 billion, 15.021 billion, and 17.963 billion respectively [5] - Analysts note that the growth momentum remains strong despite a short-term decline in Q3 2025 revenue due to customer order patterns, with expectations for a rebound in future quarters [6]

2025年三季报公募基金十大重仓股持仓分析

Huachuang Securities· 2025-10-30 12:50

Market Performance - Since July 2025, major indices have risen significantly, with the ChiNext 50, ChiNext Index, and Sci-Tech 50 increasing by over 45%[1] - The Shanghai Composite Index, CSI 300, CSI 500, CSI 1000, and CSI 2000 have risen by 15.79%, 19.20%, 24.10%, 17.67%, and 14.89% respectively[1] Fund Establishment and Holdings - A total of 90 equity-oriented active funds were established in Q3 2025, with a total share of 554.04 billion[2] - The average stock position of various types of equity-oriented active funds increased compared to Q2 2025[3] Industry Distribution - The industries with increased holdings of over 100 billion include electronics, communication, power equipment and new energy, computer, non-ferrous metals, machinery, pharmaceuticals, and media[4] - The electronics sector saw a holding increase of 5.17%, while communication increased by 3.95%[4] Individual Stock Distribution - The top five stocks with the largest increase in holdings are Zhongji Xuchuang, Xinyi Sheng, Industrial Fulian, CATL, and Cambricon[5] - The largest holdings in A-shares are CATL, Xinyi Sheng, Zhongji Xuchuang, Luxshare Precision, and Industrial Fulian[5] Large Fund Holdings Analysis - As of October 28, 2025, there are 34 equity-oriented active funds with holdings exceeding 100 billion, an increase of 10 from the previous quarter[6] - The stocks with the most significant changes in holdings among large funds include Zhongji Xuchuang, Xinyi Sheng, Luxshare Precision, CATL, and Industrial Fulian[6] Hong Kong Stock Holdings - The top six Hong Kong stocks held by funds in Q3 2025 include Tencent Holdings, Alibaba-W, SMIC, Innovent Biologics, Pop Mart, and Xiaomi Group-W, each with a market value exceeding 10 billion[7]

主动权益基金2025年三季报:股票仓位抬升,重点增持科技和新能源行业

Ping An Securities· 2025-10-30 12:35

Group 1 - The core view of the report indicates that active equity funds have increased their stock positions, with a focus on enhancing holdings in the technology and new energy sectors [4][12][20] - As of the end of Q3 2025, the number of active equity funds reached 4,626, a 1.58% increase from the previous quarter, while the total fund size rose to 4.12 trillion yuan, marking a 19.68% increase [4][7][9] - The issuance of new active equity funds in Q3 2025 totaled 561.10 billion yuan, representing a 53% increase compared to the previous quarter [9][10] Group 2 - The performance of active equity funds was strong in Q3 2025, with significant gains in the A-share market, particularly in mid-cap and growth-style funds [12][15] - The telecommunications, electronics, and power equipment sectors saw the highest increases, while the banking sector experienced significant declines [17][18] - The report highlights that technology, new energy, and cyclical theme funds had substantial gains, with median returns of 44.97%, 39.13%, and 35.76% respectively [20][21] Group 3 - As of the end of Q3 2025, the median stock position of active equity funds was 91.23%, an increase of 1.12 percentage points from the previous quarter [25][26] - The concentration of holdings increased, with the median position in the top ten stocks rising to 48.39%, up 3.39 percentage points from the previous quarter [27][28] - The report notes a significant increase in holdings in the electronics, telecommunications, and power equipment sectors, while reductions were seen in the banking and food and beverage sectors [29][31] Group 4 - The top holdings included Ningde Times, which regained its position as the largest holding with a total value of 73.57 billion yuan, followed by significant increases in Industrial Fulian and SMIC [33][34] - The report indicates that stocks such as Zhongji Xuchuang and Xinyi Sheng saw the largest increases in holdings, while Xiaomi Group-W and China Merchants Bank were among the most reduced [35][36] - The median position in Hong Kong stocks for active equity funds was 26.67%, a slight decrease of 0.36% from the previous quarter, while Hong Kong theme funds increased their median position to 85.02%, up 1.22% [40][41] Group 5 - The report highlights that the media sector remains the largest holding in Hong Kong theme funds, with a holding ratio of 16.77%, while significant increases were noted in the retail and non-ferrous metal sectors [43][44] - The report also mentions that the top increases in individual stocks for Hong Kong theme funds were seen in Alibaba-W and Tencent Holdings, while Meituan-W and China Construction Bank were reduced [45]

2025Q3公募基金及陆股通持仓分析:内外资成长仓位均历史性抬升

Huaan Securities· 2025-10-30 12:30

Group 1 - In Q3 2025, the total market value of public actively managed equity funds and Stock Connect holdings in A-shares significantly increased, with public equity funds holding A-shares worth 3.56 trillion, a substantial increase of 21.5% from the previous quarter, and Stock Connect holdings reaching 2.59 trillion, up 12.9% [5][18][124] - The overall position of public actively managed equity funds continued to rise, with an overall position of 85.77%, an increase of 1.31 percentage points from the previous quarter, and over 40% of funds now have a high position of over 90% [5][25][31] - The concentration of heavily held stocks in public funds has increased, with CR10, CR20, and CR50 concentration rising by 1.64, 2.21, and 1.68 percentage points respectively [5][107] Group 2 - Both public funds and foreign capital through Stock Connect showed a high degree of consensus in style selection, significantly increasing their holdings in the growth sector (domestic +8.68%, foreign +10.52%) while reducing their positions in the financial sector (domestic -4.07%, foreign -6.17%) and consumer sector (domestic -4.17%, foreign -3.62%) [6][130] - In the consumer sector, both domestic and foreign investors continued to significantly reduce their holdings in food and beverage (domestic -1.67%, foreign -2.08%), as well as in automobiles (domestic -1.54%, foreign -0.30%) and home appliances (domestic -0.89%, foreign -0.79%) [6][51] - In the growth sector, both domestic and foreign investors significantly increased their holdings in electronics (domestic +3.79%, foreign +4.86%) and electrical equipment (domestic +2.01%, foreign +4.87%) [6][65] Group 3 - The financial sector saw a significant reduction in holdings, with both domestic and foreign investors heavily reducing their positions in banks (domestic -3.96%, foreign -4.38%) [6][97] - In the cyclical sector, there was a high degree of consensus, with both domestic and foreign investors significantly increasing their holdings in non-ferrous metals (domestic +1.42%, foreign +1.21%) while reducing their positions in public utilities [6][75] - The overall position in the cyclical sector continued to decline slightly, with more than half of the industries being reduced, particularly in public utilities and transportation [6][76]

突发跳水!光模块、创新药大调整,资金借道ETF大举吸筹!锂矿带飞有色龙头,159876逆市涨逾1%逼近前高

Xin Lang Ji Jin· 2025-10-30 11:26

Market Overview - A-shares experienced fluctuations with all three major indices showing declines, particularly the ChiNext Index which fell nearly 2% and the Shanghai Composite Index dropped below 4000 points [1] - The trading volume in the Shanghai and Shenzhen markets reached 2.42 trillion yuan, an increase of 165.6 billion yuan compared to the previous trading day [1] - The Hong Kong stock market also saw significant volatility, with indices initially declining before recovering towards the end of the trading session [1] Sector Performance - The optical module and innovative drug sectors, previously popular, saw significant declines, with leading companies like Xinyi and Tianfu Communications experiencing sharp drops [1][8] - Conversely, the lithium mining sector surged, with stocks like Yongxing Materials hitting the daily limit and Tianqi Lithium reaching its upper limit [3] - The Green Energy ETF (562010) rose by 1.76%, while the Nonferrous Metal ETF (159876) also increased by over 1% [2][3] ETF Insights - The Nonferrous Metal ETF (159876) saw a trading volume of 68.73 million yuan, with a net inflow of 113.17 billion yuan into the nonferrous metal sector, indicating strong institutional interest [4][5] - The Hong Kong Innovation Drug ETF (520880) fell by 2.54%, reaching a three-month low, but there are indications of potential buying opportunities as funds continue to flow into the sector [8][10] - The ChiNext Artificial Intelligence ETF (159363) experienced a decline of over 3%, but there was significant buying interest with a net purchase of 1.08 million units [1][16] Future Outlook - Analysts from Huatai Securities suggest that after the end of October US-China negotiations, negative market factors may dissipate, potentially leading to a market recovery [2] - The upcoming policy announcements and event-driven opportunities are expected to be significant in the near term [2] - The nonferrous metal sector is anticipated to benefit from the Federal Reserve's recent interest rate cuts, which could lead to increased demand for industrial metals [4][5]

新易盛:三季度受部分产品出货节奏变化的影响销售收入环比略降

Xin Lang Cai Jing· 2025-10-30 11:15

Core Viewpoint - The company has reported a slight decrease in sales revenue for Q3 2025 compared to Q2 2025 due to changes in the shipment schedule of certain products, but expects sustained high demand in Q4 2025 and the following year [1] Group 1: Sales Performance - Sales revenue for Q3 2025 has decreased slightly compared to Q2 2025 due to the phased shipment schedule of some products [1] - The overall demand for optical modules is expected to continue increasing next year, indicating a positive market outlook [1] Group 2: Production and Supply - The company is accelerating its production capacity in response to market demand [1] - The 1.6T product line is anticipated to enter a phase of continuous volume increase from Q4 2025 to the following year [1] - The company's silicon photonics products have already begun bulk shipments [1]