传媒

Search documents

浙商早知道-20251028

ZHESHANG SECURITIES· 2025-10-27 23:34

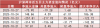

Market Overview - On October 27, the Shanghai Composite Index rose by 1.18%, the CSI 300 increased by 1.19%, the STAR 50 gained 1.5%, the CSI 1000 was up by 1.03%, the ChiNext Index rose by 1.98%, and the Hang Seng Index increased by 1.05% [3][4] - The best-performing sectors on October 27 were telecommunications (+3.22%), electronics (+2.96%), comprehensive (+2.68%), non-ferrous metals (+2.39%), and steel (+1.92%). The worst-performing sectors were media (-0.95%), food and beverage (-0.2%), and real estate (-0.11%) [3][4] - The total trading volume for the A-share market on October 27 was 23,566 billion yuan, with a net inflow of 2.873 billion Hong Kong dollars from southbound funds [3][4] Key Insights - The report focuses on the real estate sector, emphasizing a preference for "light" and "good" investments [5] - The market view indicates that developer valuations may fluctuate due to policy impacts [5] - There is a shift in recommendation for 2026, moving away from developers to favor management and property operation businesses [5] - The driving factors include ongoing pressure on the real estate industry's fundamentals, with companies having low debt and strong cash flow presenting a higher safety margin [5] - The report suggests a divergence from the market's focus on residential development, advocating for investment opportunities in sub-sectors of real estate [5]

A股市场大势研判:沪指高开高走涨超1%,再创10年新高

Dongguan Securities· 2025-10-27 23:34

Market Overview - The Shanghai Composite Index closed at 3996.94, up 1.18%, marking a new 10-year high [1] - The Shenzhen Component Index rose by 1.51% to 13489.40, while the ChiNext Index increased by 1.98% to 3234.45 [1] Sector Performance - The top-performing sectors included Communication (up 3.22%), Electronics (up 2.96%), and Non-ferrous Metals (up 2.39%) [2] - Conversely, sectors such as Media (-0.95%), Food and Beverage (-0.20%), and Real Estate (-0.11%) lagged behind [2] Market Sentiment and Technical Analysis - The market showed a strong upward trend with a total trading volume of 2.34 trillion, an increase of 365.9 billion from the previous trading day [5] - The market sentiment is stabilizing, with active funds' reduction nearing its end, indicating a gradual recovery in investor confidence [5] Future Outlook - The report anticipates that despite potential supply and demand pressures in the spring of next year, the resonance between economic and market bottoms will strengthen, potentially driving a new market rally [5] - Key sectors to focus on include dividends, TMT (Technology, Media, and Telecommunications), Non-ferrous Metals, and New Energy [5] Upcoming Events - The 2025 Financial Street Forum will take place from October 27 to 30 in Beijing, focusing on global financial development under the themes of innovation, transformation, and reshaping [4]

开源晨会-20251027

KAIYUAN SECURITIES· 2025-10-27 14:41

Core Insights - The report emphasizes the importance of high-quality development and technological self-reliance as key goals for the upcoming "15th Five-Year Plan" period, projecting a market space increase of approximately 10 trillion yuan over the next five years [6][7][8] - The retail banking sector is experiencing a manageable level of risk despite rising non-performing loan rates, with a focus on credit de-collateralization strategies [17][19][20][22] - The food and beverage industry shows mixed performance, with companies like Fuling Zhacai maintaining steady growth while others like Qiaqia Foods face short-term operational pressures [35][41] Macro Economic Overview - The "15th Five-Year Plan" aims for significant advancements in high-quality development, technological independence, and comprehensive reforms, with a focus on enhancing the quality of key industries [6][7] - Recent monetary policy discussions highlight the need for a stable and effective monetary policy framework to support financial market stability [7][8] Retail Banking Sector - Retail non-performing loan rates are high, but risks are considered manageable due to supportive policies and the nature of retail loans [19][20] - The transition period for new risk regulations is approaching its end, which may lead to an increase in reported non-performing loans for some banks [20][22] - The trend of de-collateralization in retail banking is evident, with banks shifting towards non-collateralized loans to mitigate risks [21][22] Food and Beverage Industry - Fuling Zhacai reported a steady revenue growth of 1.8% year-on-year for the first three quarters of 2025, with a focus on expanding product lines and market channels [35][36][38] - Qiaqia Foods experienced a significant decline in revenue and profit, with a 5.9% drop in Q3 revenue and a 72.6% decrease in net profit, attributed to increased competition and rising costs [41][43] - The overall food and beverage sector is adapting to market pressures by exploring new channels and product innovations to sustain growth [41][44] Agricultural Sector - Juxing Agriculture reported a steady increase in pig production, with a revenue growth of 42.57% year-on-year for the first three quarters of 2025, despite facing challenges from declining pork prices [56][57]

金工ETF点评:跨境ETF单日净流入24.28亿元,通信、银行拥挤变动幅度较大

Tai Ping Yang Zheng Quan· 2025-10-27 14:11

- The report constructs an industry congestion monitoring model to monitor the congestion levels of Shenwan First-Level Industry Indexes on a daily basis[3] - The report constructs a Z-score model based on premium rates to screen ETF products for potential arbitrage opportunities[4] Quantitative Models and Construction Methods 1. **Model Name: Industry Congestion Monitoring Model** - **Model Construction Idea:** Monitor the congestion levels of Shenwan First-Level Industry Indexes daily[3] - **Model Construction Process:** The model calculates the congestion levels of various industries based on the flow of main funds. It identifies industries with high and low congestion levels and tracks the changes in congestion levels over time[3] - **Model Evaluation:** The model effectively identifies industries with significant changes in congestion levels, providing valuable insights for investment decisions[3] 2. **Model Name: Premium Rate Z-score Model** - **Model Construction Idea:** Screen ETF products for potential arbitrage opportunities based on the premium rate Z-score[4] - **Model Construction Process:** The model calculates the Z-score of the premium rates of various ETF products through rolling measurements. It identifies ETFs with potential arbitrage opportunities and warns of possible pullback risks[4] - **Model Evaluation:** The model provides a systematic approach to identify ETFs with potential arbitrage opportunities, aiding investors in making informed decisions[4] Model Backtesting Results 1. **Industry Congestion Monitoring Model** - **Congestion Levels:** Coal, Environmental Protection, and Petrochemical industries had high congestion levels, while Food & Beverage and Computer industries had low congestion levels[3] - **Main Fund Flows:** Main funds flowed into Coal and Media industries, and flowed out of Machinery and Pharmaceutical & Biological industries in the previous trading day[3] - **Three-Day Fund Allocation:** Main funds reduced allocation in Pharmaceutical, Electric Power Equipment, and increased allocation in Media over the past three days[3] 2. **Premium Rate Z-score Model** - **ETF Fund Flows:** - **Broad-based ETFs:** Net outflow of 15.91 billion yuan in a single day[5] - **Industry-themed ETFs:** Net inflow of 9.14 billion yuan in a single day[5] - **Style Strategy ETFs:** Net outflow of 2.85 billion yuan in a single day[5] - **Cross-border ETFs:** Net inflow of 24.28 billion yuan in a single day[5] Quantitative Factors and Construction Methods 1. **Factor Name: Congestion Level Factor** - **Factor Construction Idea:** Measure the congestion levels of various industries based on main fund flows[3] - **Factor Construction Process:** Calculate the congestion levels by analyzing the flow of main funds into and out of different industries. Identify industries with high and low congestion levels and track changes over time[3] - **Factor Evaluation:** The factor effectively highlights industries with significant congestion level changes, providing valuable insights for investment decisions[3] 2. **Factor Name: Premium Rate Z-score Factor** - **Factor Construction Idea:** Identify potential arbitrage opportunities in ETF products based on the premium rate Z-score[4] - **Factor Construction Process:** Calculate the Z-score of the premium rates of various ETF products through rolling measurements. Identify ETFs with potential arbitrage opportunities and warn of possible pullback risks[4] - **Factor Evaluation:** The factor provides a systematic approach to identify ETFs with potential arbitrage opportunities, aiding investors in making informed decisions[4] Factor Backtesting Results 1. **Congestion Level Factor** - **Congestion Levels:** Coal, Environmental Protection, and Petrochemical industries had high congestion levels, while Food & Beverage and Computer industries had low congestion levels[3] - **Main Fund Flows:** Main funds flowed into Coal and Media industries, and flowed out of Machinery and Pharmaceutical & Biological industries in the previous trading day[3] - **Three-Day Fund Allocation:** Main funds reduced allocation in Pharmaceutical, Electric Power Equipment, and increased allocation in Media over the past three days[3] 2. **Premium Rate Z-score Factor** - **ETF Fund Flows:** - **Broad-based ETFs:** Net outflow of 15.91 billion yuan in a single day[5] - **Industry-themed ETFs:** Net inflow of 9.14 billion yuan in a single day[5] - **Style Strategy ETFs:** Net outflow of 2.85 billion yuan in a single day[5] - **Cross-border ETFs:** Net inflow of 24.28 billion yuan in a single day[5]

【27日资金路线图】电子板块净流入逾34亿元居首 龙虎榜机构抢筹多股

Zheng Quan Shi Bao· 2025-10-27 13:54

Market Overview - The A-share market experienced an overall increase on October 27, with the Shanghai Composite Index closing at 3996.94 points, up 1.18%, the Shenzhen Component Index at 13489.4 points, up 1.51%, and the ChiNext Index at 3234.45 points, up 1.98%. The North Star 50 Index decreased by 0.2%. Total trading volume reached 23,567.99 billion yuan, an increase of 3,649.94 billion yuan compared to the previous trading day [1]. Capital Flow - The A-share market saw a net outflow of 75.9 billion yuan in main funds, with an opening net outflow of 19.28 billion yuan and a closing net inflow of 1.68 billion yuan [2]. - The CSI 300 index recorded a net outflow of 37.83 billion yuan, while the ChiNext saw a net outflow of 49.68 billion yuan, and the Sci-Tech Innovation Board had a net inflow of 11.01 billion yuan [4]. Sector Performance - Among the 14 sectors, the electronics industry led with a net inflow of 34.32 billion yuan, followed by public utilities with 28.22 billion yuan and non-ferrous metals with 21.67 billion yuan. The power equipment sector experienced the largest net outflow at -50.06 billion yuan [6][7]. Individual Stock Highlights - Shenghong Technology topped the list with a net inflow of 9.47 billion yuan [8]. - Institutions showed significant interest in several stocks, with notable net purchases in Jingzhida and others, while stocks like Demingli saw net selling [10]. Institutional Focus - Recent institutional ratings highlighted several stocks with potential upside, including Tian Nai Technology with a target price of 78.00 yuan, representing a 39.73% upside from the latest closing price [12].

每日复盘-20251027

Guoyuan Securities· 2025-10-27 13:13

Market Performance - On October 27, 2025, the Shanghai Composite Index rose by 1.18%, approaching 4000 points, while the Shenzhen Component Index increased by 1.51% and the ChiNext Index by 1.98%[3] - The total market turnover reached 23,565.88 billion yuan, an increase of 3,649.71 billion yuan compared to the previous trading day[3] - A total of 3,361 stocks rose, while 1,862 stocks fell across the market[3] Sector and Style Analysis - All 30 sectors in the CITIC first-level industry index experienced gains, with the top performers being Communication (3.45%), Electronics (2.61%), and Non-ferrous Metals (2.39%) while Media (-0.79%), Food and Beverage (-0.23%), and Real Estate (-0.07%) lagged behind[3][21] - Growth stocks outperformed value stocks, with mid-cap growth leading small-cap growth, followed by large-cap growth[21] Fund Flow and ETF Activity - On October 27, 2025, the net outflow of main funds was 1.36 billion yuan, with large orders seeing a net outflow of 71.99 billion yuan and small orders a net inflow of 86.31 billion yuan[4][25] - Major ETFs like the Huaxia SSE 50 ETF and the Huatai-PB CSI 300 ETF saw changes in turnover, with the former increasing by 8.73 billion yuan to 30.43 billion yuan[4][29] Global Market Trends - Major Asia-Pacific indices closed higher, with the Hang Seng Index up 1.05% and the Nikkei 225 Index up 2.46%[5][33] - In the U.S., the Dow Jones Industrial Average rose by 1.01%, while the S&P 500 and Nasdaq Composite increased by 0.79% and 1.15%, respectively[6][34]

引力传媒:关于股票期权激励计划限制行权期间的提示性公告

Zheng Quan Ri Bao Zhi Sheng· 2025-10-27 12:10

Core Points - The company announced its "2024 Restricted Stock and Stock Option Incentive Plan," with the first exercise period for stock options set from August 28, 2025, to August 7, 2026 [1] - The company has imposed restrictions on the exercise of stock options during the self-exercise period, specifically from October 26, 2025, to October 30, 2025 [1] - The company will apply to the China Securities Depository and Clearing Corporation Limited Shanghai Branch for the necessary procedures regarding the restriction on exercising stock options [1]

两市主力资金净流出1.36亿元,沪深300成份股资金净流入

Zheng Quan Shi Bao Wang· 2025-10-27 10:21

Market Overview - On October 27, the Shanghai Composite Index rose by 1.18%, the Shenzhen Component Index increased by 1.51%, the ChiNext Index climbed by 1.98%, and the CSI 300 Index gained 1.19% [1] - Among the tradable A-shares, 3,361 stocks rose, accounting for 61.89%, while 1,862 stocks declined [1] Capital Flow - The main capital saw a net outflow of 136 million yuan for the day [1] - The ChiNext experienced a net outflow of 4.2 billion yuan, while the STAR Market had a net outflow of 241 million yuan [1] - The CSI 300 constituent stocks had a net inflow of 1.492 billion yuan [1] Industry Performance - Out of the 28 first-level industries classified by Shenwan, the top-performing sectors were Communication and Electronics, with increases of 3.22% and 2.96%, respectively [1] - The sectors with the largest declines included Media, Food & Beverage, and Real Estate, with decreases of 0.95%, 0.20%, and 0.11% [1] Industry Capital Inflows and Outflows - The Electronics industry led with a net inflow of 6.112 billion yuan and a daily increase of 2.96% [1] - The Non-ferrous Metals sector followed with a net inflow of 2.529 billion yuan and a daily increase of 2.39% [1] - The Power Equipment industry had the largest net outflow, totaling 3.354 billion yuan, despite a daily increase of 0.73% [1] - The Automotive sector also saw a significant net outflow of 2.176 billion yuan, with a daily increase of 0.66% [1] Individual Stock Performance - A total of 2,207 stocks experienced net inflows, with 875 stocks having inflows exceeding 10 million yuan [2] - The stock with the highest net inflow was Industrial Fulian, which rose by 8.19% with a net inflow of 1.915 billion yuan [2] - Other notable stocks with significant inflows included Zhaoyi Innovation and Hengbao Co., both with net inflows of 953 million yuan [2] - Conversely, 105 stocks had net outflows exceeding 100 million yuan, with CITIC Securities, Kehua Data, and Dongfang Wealth leading the outflows at 1.702 billion yuan, 919 million yuan, and 906 million yuan, respectively [2]

长城基金汪立:把握“十五五”规划投资新线索

Xin Lang Ji Jin· 2025-10-27 09:41

Group 1 - The A-share market saw mixed performance last week, with major indices showing more declines than gains, while growth styles dominated, and the average daily trading volume across the market was 17,973 billion [1] - Key sectors that performed well included telecommunications, electronics, and power equipment, while agriculture, media, and automotive sectors lagged behind [1] Group 2 - The "14th Five-Year Plan" emphasizes technological leadership and boosting domestic demand, marking a critical period for foundational strengthening and comprehensive efforts [2] - Recent macroeconomic events include the 20th Central Committee's Fourth Plenary Session, which approved the guidelines for the "14th Five-Year Plan," focusing on advanced manufacturing and quality services [2] - The recent US inflation data showed a lower-than-expected increase, contributing to reduced inflation risk concerns, while China's economic growth in the first three quarters exceeded annual targets but still faces pressures from domestic and external demand [3] Group 3 - Investment strategies suggest focusing on potential beneficiaries of the "14th Five-Year Plan," with expectations for market upward movement due to reduced external disturbances and policy expectations [4] - The market is anticipated to experience fluctuations due to changes in trading sentiment and event impacts, but upcoming policy windows may provide good investment opportunities [4] - Long-term outlook remains positive for the stock market, supported by declining risk-free rates, ample liquidity, and improving profit expectations [5] Group 4 - Specific investment themes include focusing on advanced manufacturing, global competitiveness in Chinese manufacturing, and consumption promotion as key areas for structural economic transformation [5] - Emerging technologies and regional economic development strategies are highlighted as core investment themes to watch during the "14th Five-Year Plan" period [5]

【盘中播报】沪指涨0.92% 电子行业涨幅最大

Zheng Quan Shi Bao Wang· 2025-10-27 07:25

Market Overview - The Shanghai Composite Index increased by 0.92% today, with a trading volume of 1,118.09 million shares and a transaction value of 19,287.88 billion yuan, representing a 22.50% increase compared to the previous trading day [1] Industry Performance - The top-performing sectors included Electronics (up 2.48%), Comprehensive (up 2.42%), and Steel (up 2.20%) [1] - The sectors with the largest declines were Media (down 1.07%), Food & Beverage (down 0.32%), and Real Estate (down 0.23%) [2] Leading Stocks - In the Electronics sector, Jingrui Electric Materials led with a gain of 15.77% [1] - In the Comprehensive sector, Zhangzhou Development rose by 9.95% [1] - In the Steel sector, Changbao Co. also increased by 9.95% [1] Detailed Industry Data - Electronics: 4,176.85 billion yuan in transaction value, up 21.86% from the previous day [1] - Comprehensive: 42.33 billion yuan in transaction value, up 20.03% from the previous day [1] - Steel: 144.44 billion yuan in transaction value, up 39.07% from the previous day [1] - Media: 367.83 billion yuan in transaction value, down 1.07% [2] - Food & Beverage: 206.19 billion yuan in transaction value, down 0.32% [2] - Real Estate: 217.64 billion yuan in transaction value, down 0.23% [2]