稀土磁材

Search documents

本周行业继续调整,产业链价格短期转弱:稀土磁材行业周报-20251116

Xiangcai Securities· 2025-11-16 12:29

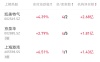

Investment Rating - The industry rating is maintained at "Overweight" [6][43] Core Insights - The rare earth magnetic materials industry experienced a decline of 4.08% this week, underperforming the benchmark (CSI 300) by 3 percentage points [2][10] - The current industry valuation (TTM P/E) has decreased to 73.9x, which is at the 87.2% historical percentile [10] - Short-term price fluctuations are driven by market sentiment, with no significant increase in supply expected before year-end, while demand remains positive [7][42] - The export demand is anticipated to improve following the easing of export controls, which may lead to a recovery in prices and industry sentiment [43][44] Market Performance - The industry has shown relative performance of -18% over the past month, -1% over three months, and +47% over the past year [6] - Absolute performance indicates a decline of -16% over the past month, an increase of +10% over three months, and +61% over the past year [6] Price Trends - Rare earth concentrate prices have shown a slight decline, with mixed carbonate rare earth ore prices dropping by 2.78% [3][12] - Praseodymium-neodymium prices have fluctuated, with an average decrease of 1.8% for praseodymium oxide and 1.03% for praseodymium metal [14][15] - Dysprosium prices have continued to decline, with a decrease of 2.58% for dysprosium oxide [19] - Neodymium-iron-boron sintered block prices have also decreased, with N35 and H35 grades falling by 1.45% and 0.96%, respectively [38] Supply and Demand Dynamics - The supply side is characterized by a tight balance, with expectations of reduced output in November due to lower operating rates [42] - Demand remains stable, with improved foreign orders and good domestic demand, particularly in the magnetic materials sector [42][43] - The overall trend in the industrial sector is positive, although growth in downstream sectors like new energy vehicles and air conditioning is expected to slow [42] Valuation and Performance Outlook - Current absolute and relative valuation levels are supported by loose liquidity and favorable industrial policies, but high valuations may face pressure due to declining market risk appetite [42][43] - The industry is expected to enter a phase of stabilization after recent adjustments, with potential for price recovery and improved sentiment in the near term [43][44]

稀土磁材行业周报:本周行业表现延续弱势,轻重稀土价格走势分化-20251109

Xiangcai Securities· 2025-11-09 13:51

Investment Rating - The industry investment rating is maintained at "Overweight" [3][42] Core Views - The rare earth magnetic materials industry has shown a weak performance, with a decline of 4.05% this week, underperforming the benchmark by 4.87 percentage points [5][12] - The current industry valuation (TTM P/E) has decreased by 3.09 times to 77.22 times, which is at 88.9% of its historical percentile [5][12] - The prices of rare earth concentrates have continued to rise, with specific increases in praseodymium and neodymium prices, while dysprosium prices have declined [6][9][19] - The market sentiment has improved due to favorable policies, but the overall bullish expectations remain weak, leading to a cautious outlook [41][42] Summary by Sections Market Performance - The rare earth magnetic materials industry has experienced a relative return of -1% over the past month, 0% over three months, and 42% over the past year [4] - Absolute returns are 0% for one month, 13% for three months, and 55% for twelve months [4] Price Trends - Domestic mixed rare earth carbonate prices have increased by 5.88%, 3.33%, and 4% for different types of rare earth minerals [9][12] - The average price of praseodymium and neodymium has risen by 4.52% and 5.12% respectively [16] - Dysprosium prices have decreased by 1.27%, while terbium prices have remained stable with a slight increase of 0.76% [19] Supply and Demand Dynamics - The supply side is expected to decrease, while demand is anticipated to increase, leading to a stable outlook for rare earth prices [41][42] - The demand from downstream sectors, particularly in new energy vehicles, is showing signs of marginal decline, but overall industrial trends remain positive [41][42] Valuation and Earnings - Current absolute and relative historical valuation levels are supported by liquidity easing and industry policy, but high valuations face pressure from declining market risk appetite [41][42] - The report suggests that as rare earth prices continue to rise, downstream magnetic material companies are likely to see sustained earnings recovery [43]

稀土磁材行业周报:本周板块小幅下跌,产业链价格回升-20251103

Xiangcai Securities· 2025-11-03 03:28

Investment Rating - The industry investment rating is maintained at "Overweight" [3][46] Core Views - The rare earth magnetic materials sector experienced a slight decline of 0.21% this week but outperformed the benchmark (CSI 300) by 0.22 percentage points [5][12] - The industry valuation (TTM P/E) has decreased to 80.31x, influenced by third-quarter earnings, currently at the 90.8% historical percentile [5][12] - The prices of rare earth minerals have shown a significant rebound, with domestic mixed rare earth carbonate, Sichuan fluorocarbon cerium ore, and Shandong fluorocarbon cerium ore prices increasing by 9.68%, 11.11%, and 13.64% respectively [9][15] - The market sentiment is improving, with expectations of stable demand and potential recovery in export demand, despite short-term price pressures [44][46] Summary by Sections Market Performance - The rare earth magnetic materials sector slightly declined by 0.21% this week but outperformed the CSI 300 benchmark by 0.22 percentage points [5][12] - Over the past 12 months, the sector has shown a relative return of 76% compared to the CSI 300 [4] Price Trends - Prices for rare earth minerals have rebounded significantly, with notable increases in various categories, including a 5.99% rise in praseodymium-neodymium oxide prices [9][18] - Dysprosium prices have shown a slight recovery, while terbium prices continue to decline [21] Supply and Demand Dynamics - The supply side is expected to tighten due to regulatory measures and a potential reduction in production from separation enterprises, while demand remains stable [44] - The demand from downstream sectors, particularly in new energy vehicles and wind power, is showing signs of marginal decline, but overall industrial trends remain positive [44] Investment Recommendations - The report suggests maintaining an "Overweight" rating, focusing on upstream rare earth resource companies and downstream magnetic material enterprises with strong customer structures and growth potential [46][10]

有色金属ETF(512400.SH)涨2.82%,北方稀土涨4.30%

Sou Hu Cai Jing· 2025-10-27 09:37

Group 1 - A-share market experienced a broad increase, with rare earth and lithography machine sectors leading the gains, as evidenced by the 2.82% rise in the non-ferrous metal ETF (512400.SH) and a 4.30% increase in Northern Rare Earth [1] - The U.S. September CPI data came in below expectations, alongside tightening dollar liquidity and renewed regional banking risks, which strengthened market expectations for a Federal Reserve interest rate cut [1] - China's decision to postpone the implementation of rare earth export restrictions by one year signals a temporary easing, which is expected to stabilize global key mineral supply chain expectations and support the upward movement of industrial metal prices [1] Group 2 - Precious metals saw significant volatility this week, with spot gold experiencing its largest single-day drop in nearly a decade, primarily due to profit-taking and a temporary strengthening of the dollar [2] - Industrial metals are expected to maintain strong prices due to improved macro sentiment, frequent supply disruptions, and seasonal demand recovery [2] - The lithium battery supply chain is experiencing a tightening supply-demand balance, as indicated by the surge in hexafluorophosphate lithium prices and new highs in lithium carbonate futures, reflecting a continued recovery in the lithium battery industry [2] - Rare earth materials remain a core investment theme due to their long-term scarcity and strategic value in international competition, with leading companies accelerating integration and optimizing supply chains during the policy buffer period [2]

晨会纪要:对近期重要经济金融新闻、行业事件、公司公告等进行点评-20251027

Xiangcai Securities· 2025-10-27 01:08

Macro Strategy - The 20th Central Committee's Fourth Plenary Session defined the "15th Five-Year Plan" as a critical period for comprehensive efforts, emphasizing its role in the modernization process leading up to 2035 [3][4] - The strategic focus has shifted from "dual circulation" to a "new quality productivity system," highlighting the importance of technological self-reliance and advanced manufacturing [5][6] - The session emphasized the need for a balance between an active government and an effective market, aiming to enhance macroeconomic governance efficiency [7] Social Development - The focus has shifted from basic poverty alleviation to a path towards common prosperity, with an emphasis on improving quality of life and social mobility [8] - The housing policy has transitioned to promoting high-quality development in real estate, moving away from the previous "housing is for living, not for speculation" stance [8] Security Framework - The security architecture has been restructured to focus on practical defense and modernization of the national security system, with an emphasis on enhancing public safety governance [9] - The military modernization strategy aims to achieve high-quality advancements in defense capabilities, aligning with the centenary goals of the armed forces [9] Investment Recommendations - The "15th Five-Year Plan" is positioned as a transitional phase towards modernization, with a dual focus on "new quality productivity" and national security driving high-quality development [10] - Short-term market fluctuations are anticipated due to U.S.-China trade tensions, with recommendations to focus on financial sectors and environmentally sustainable industries [10] New Materials Industry - The rare earth magnetic materials sector experienced a decline of 2.06%, underperforming against the benchmark by 5.3 percentage points, with a current valuation of 91.83 times earnings [17][18] - Prices for heavy rare earth minerals continue to decline, with significant drops in praseodymium and dysprosium prices, indicating a weak demand environment [19][20] - The overall industry outlook suggests limited further price declines due to approaching cost lines for some companies, with a cautious stance on future demand recovery [20][21]

湘财证券晨会纪要-20251023

Xiangcai Securities· 2025-10-23 02:08

Automotive Industry - The core point of the report highlights the impressive performance of the Chinese automotive industry in the first three quarters of 2025, with strong growth in new energy vehicles (NEVs) [3][4] - In the first three quarters of 2025, production and sales of NEVs exceeded 11.24 million units, representing a year-on-year growth of 35.2% and 34.9% respectively, with a penetration rate of 46.1% [4] - In September 2025, NEV production and sales reached 1.617 million and 1.604 million units, showing a month-on-month increase of 16.3% and 15%, and a year-on-year increase of 23.7% and 24.6% [4] - The export volume of automobiles in the first three quarters of 2025 increased by 14.8% year-on-year, with a total export of 4.95 million vehicles [4] - The report suggests focusing on leading companies in the NEV supply chain and those with overseas market presence, as the increasing penetration rate of NEVs will drive the collaborative development of the entire industry chain [4][5] Investment Recommendations - The report indicates that the automotive sector is experiencing a resonance phase between new product cycles and technological advancements, particularly in smart driving and smart cockpit technologies, which are expected to drive continuous sales growth [5] - Continuous policy support for automotive consumption and the rising penetration rate of NEVs provide a broad market space for vehicle manufacturers [5] - In the components sector, the rapid increase in the penetration of smart components such as smart cockpits and electric drive systems is expected to benefit related companies [5] - The report maintains an "overweight" rating for the automotive industry, recommending attention to quality companies in the sector, such as Shuanghuan Transmission and Beite Technology [5] New Materials - The report notes a slight increase of 0.05% in the rare earth magnetic materials industry, outperforming the benchmark by 2.27 percentage points [7] - The prices of rare earth concentrates have accelerated their decline, with specific price drops reported for various rare earth minerals [9] - The report highlights the need to monitor the demand side closely, as the market's just-in-time transactions are primarily driven by basic needs, with expectations for demand to improve in the coming months [10] Medical Services - The report indicates a decline of 2.48% in the pharmaceutical and biological sector, with the medical services sub-sector experiencing a significant drop of 5.21% [11][12] - The current PE ratio for the medical services sector is 34.96, with a recent decrease of 1.96 from the previous week [13][14] - The report emphasizes the potential of ADC (Antibody-Drug Conjugates) and CDMO (Contract Development and Manufacturing Organization) in the innovative drug sector, projecting significant growth in the ADC outsourcing market [15][16] - The report maintains a "buy" rating for the medical services industry, recommending attention to high-growth companies and those with improving expectations, such as WuXi AppTec and Aier Eye Hospital [17] ETF Market Overview - As of October 17, 2025, there are 1,328 ETFs in the Shanghai and Shenzhen markets, with a total asset management scale of 55,264.48 billion [19] - The report notes that the average weekly change in shares for stock ETFs was an increase of 27.63 million shares, with significant increases in bank and brokerage ETFs [20] - The report recommends focusing on the automotive, coal, and agriculture sectors within the PB-ROE framework for ETF rotation strategies, highlighting the potential for these sectors to outperform [24]

金力永磁前三季度 净利润同比增长162%

Zheng Quan Shi Bao· 2025-10-20 17:21

Core Insights - Jinli Permanent Magnet reported a net profit increase of 161.81% year-on-year for the third quarter, with a steady rise in gross margin [1] - The company achieved a revenue of 5.373 billion yuan, a 7.16% increase year-on-year, and a net profit of 515 million yuan, reflecting strong operational performance [1] - The gross margin for the first three quarters of 2025 was 19.49%, up 9.46 percentage points from the previous year, indicating improved profitability [1] Financial Performance - Revenue for the third quarter reached 5.373 billion yuan, marking a 7.16% year-on-year growth [1] - Net profit for the same period was 515 million yuan, showing a significant increase of 161.81% year-on-year [1] - The company's net profit growth outpaced revenue growth, with a non-recurring net profit of 430 million yuan, up 381.94% year-on-year [1] Market and Industry Trends - The company operates in the high-performance rare earth permanent magnet materials sector, focusing on the research, production, and sales of neodymium-iron-boron magnetic steel [1] - The prices of rare earth materials have started to recover since the fourth quarter of 2024, driven by a tightening supply in the upstream market [1] - Jinli Permanent Magnet has implemented flexible inventory strategies to mitigate risks associated with rising raw material prices, ensuring stable delivery capabilities [2] Product Applications and Sales - The company's products are widely used in various sectors, including new energy vehicles, energy-efficient variable frequency air conditioners, wind power generation, robotics, and industrial servo motors [3] - In the new energy vehicle sector, sales revenue reached 2.615 billion yuan, with a year-on-year sales volume increase of 23.46% [3] - The energy-efficient variable frequency air conditioner sector generated 1.446 billion yuan in sales revenue, with a year-on-year sales volume increase of 18.48% [3] Future Outlook - The company has a strong order backlog for the fourth quarter, indicating continued demand and growth potential [3] - Jinli Permanent Magnet's stock price has increased by 125% this year, with a current market capitalization exceeding 55 billion yuan [3]

稀土磁材行业周报:精矿价格加速下行,稀土及磁材价格延续弱势-20251019

Xiangcai Securities· 2025-10-19 12:39

Investment Rating - The industry investment rating is maintained at "Overweight" [3][9] Core Insights - The rare earth magnetic materials industry experienced a slight increase of 0.05% this week, outperforming the benchmark (CSI 300) by 2.27 percentage points [5][11] - The industry valuation (TTM P/E) has slightly decreased to 95.79x, currently at 96.1% of its historical percentile [5][11] - The report indicates a downward trend in rare earth concentrate prices, with significant declines in various rare earth mineral prices [6][8][39] Market Performance - Over the past month, the industry has shown a relative return of 4%, a 3-month return of 33%, and a 12-month return of 117% [4] - Absolute returns for the same periods are 3%, 45%, and 136% respectively [4] Price Trends - Domestic mixed rare earth carbonate prices fell by 13.89%, 12.9%, and 15.38% for different types of rare earth minerals [8][12] - The average price of praseodymium and neodymium oxide decreased by 6.11%, while the metal price dropped by 6.63% [8][15] - Dysprosium oxide prices saw a slight increase of 0.62%, while terbium oxide prices declined by 0.57% [18] Investment Recommendations - The report suggests that the supply side of rare earths has limited short-term growth, with stable output from major manufacturers and limited increases in scrap supply [39][40] - It is recommended to focus on upstream rare earth resource companies due to expected supply contraction and strategic value positioning [9][42] - Downstream magnetic material companies are also highlighted for potential profit recovery as rare earth prices are expected to rise [9][42]

晨会纪要:对近期重要经济金融新闻、行业事件、公司公告等进行点评-20251017

Xiangcai Securities· 2025-10-17 01:47

Macro Strategy - In September, CPI decreased by 0.3% year-on-year and increased by 0.1% month-on-month, with food prices rising by 0.7% and pork prices falling by 17.0%, contributing to a 0.26 percentage point decline in CPI [2][4] - By the end of September, M2 balance reached 335.38 trillion yuan, growing by 8.4% year-on-year, while the total social financing stock was 437.08 trillion yuan, up 8.7% year-on-year [2][4] Healthcare Services Industry - The pharmaceutical and biological sector fell by 1.20%, ranking 25th among 31 primary industries, with the medical services sub-sector dropping 3.37% [6][9] - WuXi AppTec is highlighted as a CRDMO integrated platform company, with its R&D segment driving growth and D&M capacity release significantly increasing revenue per capita from 542,000 yuan in 2018 to an expected 1,118,000 yuan in 2025 [7][8] - The long-term development trend of the healthcare services industry remains positive despite recent geopolitical tensions, with a "buy" rating maintained for the sector [9] Securities Industry - The securities sector showed active performance post-holiday, with the brokerage index rising by 0.5%, outperforming the CSI 300 index by 1 percentage point [11][15] - Daily average stock trading volume reached 25.87 trillion yuan, a 19% increase from the previous period, indicating a significant recovery in trading activity [12][13] - The investment recommendation for the securities industry is to maintain an "overweight" rating, focusing on internet brokerages and firms with strong performance certainty [15] Electronic Industry - OpenAI's release of Sora 2.0 marks a significant milestone in AI applications, with the new video generation model achieving high realism and user engagement [17][19] - The electronic industry is expected to benefit from ongoing recovery in consumer electronics and AI technology advancements, maintaining an "overweight" rating [19] New Materials Industry - The rare earth magnetic materials sector increased by 10.44%, outperforming the benchmark by 8.97 percentage points, while rare earth prices showed mixed trends [21][24] - The investment outlook remains cautious, with a recommendation to maintain an "overweight" rating, focusing on upstream rare earth resource companies and downstream magnetic material firms [25] Banking Industry - Social financing growth slowed to 8.7% in September, with improvements in credit structure, particularly in long-term loans supported by policy measures [28][32] - The banking sector is expected to maintain stable performance, with a recommendation to focus on state-owned banks and regional banks for their investment value [32]

龙虎榜复盘 | 稀土分化,eSIM异动

Xuan Gu Bao· 2025-10-14 10:36

Group 1: Institutional Trading Insights - On the institutional trading leaderboard, 42 stocks were listed, with 26 experiencing net buying and 16 facing net selling [1] - The top three stocks with the highest net buying by institutions were: KaiMeiTeQi (2.68 billion), JingQuanHua (1.81 billion), and Shanghai GangWan (1.43 billion) [1] Group 2: Company Highlights - KaiMeiTeQi's electronic specialty gas project produces ultra-pure gases and photolithography products essential for chip manufacturing, achieving high quality and certifications from leading international companies [2] - NewLaiFu's acquisition of JinNan Magnetic Materials for 10.54 billion focuses on key components for micro-special motors, holding over 60% global market share in motor magnetic strips [2] - AnTai Technology specializes in high-end powder metallurgy materials, advanced functional materials, and environmental engineering materials [2] Group 3: eSIM Market Developments - DongXinHePing's eSIM products and management platform are applied in various fields including vehicle networking and smart homes, with multiple GSMA certifications [3] - China Unicom announced the opening of eSIM reservation channels, indicating a growing trend in eSIM applications alongside the proliferation of 5G technology [4] - The eSIM market is projected to expand significantly, becoming a key technology in the IoT sector, with applications in smart transportation, smart cities, wearables, and more [4]