玩具

Search documents

北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-22 17:11

Core Viewpoint - The Hong Kong stock market experienced significant net inflows from northbound trading, with notable buying activity in specific stocks such as Pop Mart and Xiaomi, while other stocks like Alibaba faced substantial net selling [2][6]. Group 1: Stock Performance - Pop Mart (09992) received a net inflow of HKD 11.2 billion, with a projected revenue growth of 245%-250% year-on-year for Q3 2025, driven by strong domestic and international sales [6]. - Xiaomi Group-W (01810) saw a net inflow of HKD 4.81 billion, following a share buyback of 10.7 million shares at prices between HKD 45.9 and HKD 46.76, totaling approximately HKD 4.94 billion [6]. - Semiconductor stocks, including Huahong Semiconductor (01347) and SMIC (00981), attracted net inflows of HKD 4.41 billion and HKD 1.28 billion, respectively, amid positive sentiment regarding the semiconductor industry's growth driven by AI [6]. Group 2: Company Earnings and Projections - China Mobile (00941) reported Q3 service revenue of HKD 216.2 billion, a year-on-year increase of 0.8%, with EBITDA declining by 1.7% to HKD 79.4 billion, slightly below market expectations [7]. - China Life (02628) projected a net profit of approximately HKD 156.79 billion to HKD 177.69 billion for the first three quarters, reflecting a year-on-year growth of 50% to 70% [7]. - The report indicated that the net profit for Q3 could grow by 75% to 106% year-on-year, driven by improved investment returns and optimized asset allocation [7]. Group 3: Market Sentiment and Trends - The overall market sentiment showed a divergence in fund flows, with significant net selling in stocks like Alibaba (09988) and Tencent (00700), indicating cautious investor sentiment amid global economic uncertainties [8]. - The report highlighted that the current market volatility is influenced more by emotional factors rather than fundamental reversals, suggesting a need for careful timing in investment strategies [7].

港股通(深)净买入33.25亿港元

Zheng Quan Shi Bao Wang· 2025-10-22 14:29

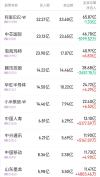

Core Viewpoint - On October 22, the Hang Seng Index fell by 0.94% to close at 25,781.77 points, while southbound funds through the Stock Connect recorded a net purchase of HKD 10.018 billion [1] Group 1: Market Activity - The total trading volume for the Stock Connect on October 22 was HKD 106.582 billion, with a net purchase of HKD 10.018 billion [1] - The Shanghai Stock Connect accounted for HKD 66.693 billion in trading volume, with a net purchase of HKD 6.693 billion, while the Shenzhen Stock Connect had a trading volume of HKD 39.887 billion and a net purchase of HKD 3.325 billion [1] Group 2: Active Stocks - In the Shanghai Stock Connect, Alibaba-W had the highest trading volume at HKD 41.14 billion, followed by SMIC and Innovent Biologics with HKD 34.07 billion and HKD 32.39 billion respectively [1] - The top net purchase stock was the Tracker Fund of Hong Kong (盈富基金) with a net purchase of HKD 12.93 billion, despite a closing price drop of 1.05% [1] - Alibaba-W recorded the highest net sell amount at HKD 1.80 billion, closing down by 1.94% [1] Group 3: Shenzhen Stock Connect Activity - In the Shenzhen Stock Connect, Innovent Biologics led with a trading volume of HKD 26.84 billion, followed by Alibaba-W and Pop Mart with HKD 24.66 billion and HKD 23.36 billion respectively [2] - The Tracker Fund of Hong Kong (盈富基金) also had a net purchase of HKD 7.02 billion, closing down by 1.05% [2] - Innovent Biologics had the highest net sell amount at HKD 2.53 billion, with a closing price drop of 1.96% [2]

美国硬扛关税买中国货,特朗普主动放风:预计下周达成贸易协议

Sou Hu Cai Jing· 2025-10-22 13:07

Core Viewpoint - The U.S. is expected to reach a trade agreement with China during the upcoming APEC summit, as President Trump expresses urgency due to the impending expiration of tariffs and countermeasures on November 10 [1][3]. Group 1: Trade Dynamics - Despite high tariffs, the U.S. maintains a rigid demand for Chinese imports, with daily imports remaining stable at $1 billion, and exports to the U.S. from China exceeding $100 billion from July to September [3][4]. - The import substitution rate for key Chinese products in the U.S. is below 30%, indicating deep integration of supply chains, particularly in sectors like semiconductors where China holds a 45% market share for precision components [4]. Group 2: Economic Pressures - High tariffs have led to increased costs for U.S. businesses and consumers, with the automotive industry warning of rising component costs and declining employment in key manufacturing states [4]. - The deadline for tariff extensions is approaching, creating significant pressure on the U.S. administration to negotiate a new agreement to avoid further economic repercussions [4]. Group 3: Credibility of Negotiations - Trump's history of rapidly changing positions raises doubts about the credibility of his statements regarding the potential trade agreement with China [5]. - The Chinese perspective emphasizes a commitment to diversifying foreign trade and not compromising on principles for a deal, suggesting that U.S. sincerity and action are crucial for any resolution [7].

深度访谈500个男性消费者后,我们发现了这6个男性消费赚钱的秘密........

新消费智库· 2025-10-22 13:03

Core Viewpoint - The article challenges the perception that male consumption power is inferior, particularly among middle-aged men, highlighting that their spending in niche and interest-based categories can be substantial [2][5][25]. Group 1: Male Consumption Insights - Middle-aged men's consumption is often centered around hobbies and interests, which are overlooked by many, indicating a significant market opportunity [18]. - The consumption behavior of middle-aged men can be divided into self-pleasure and social-driven categories, with the former focusing on personal enjoyment and the latter on social status [19][20]. - There is a notable trend where middle-aged men are increasingly investing in items that can appreciate in value, reflecting a desire for financial gain alongside personal enjoyment [21]. Group 2: Market Dynamics - The article suggests that while female consumption often seeks emotional value, male consumption tends to emphasize the demonstration of value and social identity [22][23]. - There is a growing market for male consumption, particularly in overseas markets, leveraging China's manufacturing advantages to tap into this demographic [24]. - Middle-aged men possess both financial resources and leisure time, positioning them as significant players in the consumption market, especially in niche categories like fishing [25]. Group 3: Opportunities for Entrepreneurs - The article identifies video platforms as a promising avenue for male consumption businesses, suggesting that innovative expressions of male interests can lead to substantial market gains [27]. - Combining male consumption trends with international market opportunities presents a unique entrepreneurial landscape, particularly for those targeting affluent middle-aged men [28].

5次筹划并购,5次无疾而终,“玩具第一股”群兴玩具:继续寻找算力优质标的

3 6 Ke· 2025-10-22 13:01

Core Viewpoint - The acquisition plan by Qunxing Toys to purchase a majority stake in Hangzhou Tiankuan Technology has been terminated due to failure to reach agreement on key terms such as transaction price and scheme [1][4]. Group 1: Acquisition Details - Qunxing Toys intended to acquire at least 51% of Tiankuan Technology for a cash consideration, with an estimated valuation of Tiankuan's 100% equity not exceeding 800 million yuan, translating to approximately 400 million yuan for the stake [2][3]. - The termination of the acquisition is stated to not have a significant adverse impact on Qunxing Toys as the transaction was still in the planning stage and no substantial agreement was reached [1][4]. Group 2: Financial Performance - In 2024, Qunxing Toys reported revenue of 370 million yuan and a net loss of 18.4 million yuan, with cash reserves of only 30.2 million yuan, indicating a significant funding gap for the acquisition [2][4]. - The company has faced a continuous decline in performance, transitioning from profit to loss, with a net loss of 17.1 million yuan in the first half of 2025, nearing the total loss for 2024 [4][5]. Group 3: Historical Context - Since its listing in 2011, Qunxing Toys has attempted five major acquisitions across various sectors, including mobile gaming, nuclear power, and new energy, all of which have failed [3][4]. - The company's repeated attempts to pivot towards trending sectors have raised doubts about its strategic direction and execution capabilities [2][3]. Group 4: Future Strategy - Despite the termination of the acquisition, Qunxing Toys maintains that the computing power business remains a key focus, with plans for systematic strategic development in this area [5][7]. - The company has already engaged in contracts for computing power services, including a significant agreement with Tencent worth 113 million yuan, contributing to 10.32% of total revenue in the first half of 2024 [7].

越秀证券每日晨报-20251022

越秀证券· 2025-10-22 09:14

Market Performance - The Hang Seng Index closed at 26,027, up 0.65% with a year-to-date increase of 29.75% [1] - The Hang Seng Tech Index rose by 1.26% to 6,007, with a year-to-date increase of 34.46% [1] - The Shanghai Composite Index increased by 1.36% to 3,916, with a year-to-date rise of 16.84% [1] - The Dow Jones Index closed at 46,924, up 0.47% with a year-to-date increase of 10.30% [1] Currency and Commodity Trends - The Renminbi Index is at 97.080, showing a 1-month increase of 0.50% but a 6-month decrease of 0.28% [2] - Brent crude oil is priced at $60.970 per barrel, down 7.57% over the past month [2] - Gold is priced at $4,267.53 per ounce, with a 1-month increase of 13.71% and a 6-month increase of 24.42% [2] Industry Insights - The financial sector's GDP grew by 5.2% year-on-year in Q3, while the real estate sector saw a slight decline of 0.2% [12] - The automotive industry reported that in September, the export volume of new energy vehicles doubled year-on-year, with a total of over 60,000 vehicles exported [13] - Bubble Mart's revenue for Q3 increased by 245%-250% year-on-year, with significant growth in both domestic and overseas markets [14][15] Company Performance - China Mobile reported a 1.7% decrease in EBITDA for Q3, while its total revenue increased by 2.5% year-on-year [16] - The stock of China Life Insurance rose by 6.04%, making it the best-performing blue-chip stock in the Hong Kong market [19] - The newly listed company 聚水潭 saw its stock price increase by nearly 24% on its first trading day [4]

AH股下跌:创业板跌超1%,半导体调整,沪金跌超5%,恒科指跌超1%,泡泡玛特逆势涨逾5%,国债反弹

Hua Er Jie Jian Wen· 2025-10-22 04:23

Market Overview - The early trading session saw a continuation of strength in the deep earth economy concept, with companies like CITIC Heavy Industries, Petrochemical Machinery, and ShenKong Co. achieving three consecutive trading limits [1][7] - On October 22, the A-share market opened lower, with all three major indices declining, particularly the ChiNext index which fell over 1% [1][10] - The Hong Kong stock market also opened lower, with the Hang Seng Index dropping over 1% and technology stocks experiencing declines [1][12] A-share Performance - As of the report, the Shanghai Composite Index was down 0.45% at 3898.54, the Shenzhen Component Index fell 0.77% to 12976.03, and the ChiNext Index decreased by 0.82% to 3058.43 [2][11] - The decline in the A-share market was attributed to significant drops in sectors such as gold, non-ferrous metals, and semiconductors, while infrastructure and real estate stocks showed some resilience [11] Hong Kong Market Performance - The Hang Seng Index was reported at 25793.92, down 0.90%, while the Hang Seng Technology Index fell 1.50% to 5918.06 [3][13] - The technology sector in Hong Kong faced widespread pullbacks, with gold stocks experiencing significant losses, particularly Zijin Mining and Shandong Gold, which dropped over 6% [13] Bond Market - The bond market showed a collective rebound, with the 30-year main contract rising by 0.19%, the 10-year contract up by 0.08%, and the 5-year contract increasing by 0.04% [3][4] Commodity Market - Domestic commodity futures mostly rose, with notable increases in indices such as shipping, pulp, lithium carbonate, and aluminum, while gold and silver saw declines exceeding 5% [4][5] - Specific commodities like copper and polysilicon experienced price drops, while soybean meal fell over 1% [5][17] Key Stocks - Bubble Mart saw a significant rise of over 8% in early trading, with third-quarter revenue expected to increase by 245%-250% year-on-year, prompting Jefferies to raise its target price to HKD 383.2 [14]

蚌埠沐梵户外用品有限公司成立 注册资本30万人民币

Sou Hu Cai Jing· 2025-10-22 02:48

Core Viewpoint - Recently, a new company named Bengbu Mufan Outdoor Products Co., Ltd. was established, indicating growth in the outdoor and sports equipment sector in China [1] Company Summary - The legal representative of the company is Zhang Wanjun [1] - The registered capital of the company is 300,000 RMB [1] - The company operates in various sectors including outdoor product sales, sports equipment manufacturing, and fitness activities [1] Business Scope - The company’s business scope includes general projects such as: - Sales of outdoor products [1] - Manufacturing of sports equipment and apparatus [1] - Conducting fitness and leisure activities [1] - Wholesale of sports equipment and apparatus [1] - Manufacturing of smart devices for sports consumption [1] - Manufacturing and sales of plastic products [1] - Sales of toys and baby products [1] - Rental services excluding licensed rental services [1] - Production and sales of labor protection products [1] - Retail of sports equipment and apparatus [1] - Internet sales excluding licensed goods [1]

股指期货将震荡整理,黄金、白银期货将震荡偏弱,焦煤、原油期货将偏强震荡,铜、豆粕期货将偏弱震荡

Guo Tai Jun An Qi Huo· 2025-10-22 02:26

Report Industry Investment Rating No relevant content provided. Core View of the Report Through macro - fundamental analysis and technical analysis, the report predicts the trend of various futures contracts on October 22, 2025, including the expected performance of stock index futures, bond futures, precious metal futures, and commodity futures [2]. Summary by Related Catalogs 1. Macro News and Trading Tips - Trump plans to visit China early next year, and the Chinese Foreign Ministry has no specific information to provide [7]. - Chinese Commerce Minister Wang Wentao held video talks with EU officials and had a phone call with the Dutch economic minister, discussing issues such as export controls and the global supply chain [7]. - The Ministry of Commerce held a policy - interpretation round - table for foreign - funded enterprises, emphasizing the importance of export controls and the stability of the global supply chain [7]. - In the first three quarters, domestic tourism increased by 18% in terms of the number of travelers and 11.5% in terms of spending [8]. - European leaders support a cease - fire negotiation in the Russia - Ukraine conflict [8]. - Japan's new Prime Minister, Kōichi Kanasugi, is considering a supplementary budget to address rising prices [8]. - The net financial assets of EU member states have declined [8]. - On October 21, precious metals tumbled, oil prices rose, London base metals mostly increased, the yuan strengthened against the dollar, and the dollar index rose [8][9][10]. 2. Futures Market Analysis and Forecast Stock Index Futures - On October 21, IF2512, IH2512, IC2512, and IM2512 all showed an upward trend, but failed to break through key resistance levels [11][12]. - The A - share market rose strongly on October 21, with over 4600 stocks rising, and the trading volume increased [13]. - Hong Kong stocks rose on October 21, while US stocks were mixed, and European stocks rose slightly [14][15]. - From April to September, investor leverage increased by 32.4%, which may be a risky entry point [15]. - It is expected that in October 2025, IF, IH, IC, and IM will have a wide - range and mostly weak oscillation. On October 22, they will oscillate and consolidate [15][17]. Bond Futures - On October 21, the ten - year and thirty - year bond futures had a slight upward trend, with the central bank conducting reverse repurchase operations and a net capital injection [34]. - It is expected that on October 22, the ten - year and thirty - year bond futures will have a wide - range oscillation [36][40]. Precious Metal Futures - On October 21, the gold futures rose during the day but fell sharply at night. It is expected that in October 2025, it will oscillate strongly and break new highs, and on October 22, it will oscillate weakly [40][41][42]. - On October 21, the silver futures rose during the day but fell at night. It is expected that in October 2025, it will oscillate strongly and break new highs, and on October 22, it will oscillate weakly [49][50]. Commodity Futures - On October 21, copper futures rose slightly, and it is expected that in October 2025, it will oscillate strongly, and on October 22, it will oscillate weakly [53]. - On October 21, aluminum futures rose slightly, and it is expected that in October 2025, it will oscillate strongly, and on October 22, it will oscillate and consolidate [59][60]. - On October 21, alumina futures fell slightly, and it is expected that in October 2025, it will oscillate weakly, and on October 22, it will oscillate strongly [63]. - On October 21, rebar futures rose slightly, and it is expected that in October 2025, it will oscillate widely, and on October 22, it will oscillate and consolidate [67]. - On October 21, hot - rolled coil futures rose slightly, and it is expected that on October 22, it will oscillate and consolidate [70]. - On October 21, iron ore futures rose slightly, and it is expected that in October 2025, it will oscillate widely, and on October 22, it will oscillate strongly [74]. - On October 21, coking coal futures fell, and it is expected that in October 2025, it will oscillate strongly, and on October 22, it will oscillate strongly [78][79]. - On October 21, glass futures fell, and it is expected that in October 2025, it will oscillate weakly, and on October 22, it will oscillate widely [82]. - On October 21, soda ash futures fell, and it is expected that in October 2025, it will oscillate weakly, and on October 22, it will oscillate strongly [86]. - On October 21, crude oil futures rose slightly, and it is expected that in October 2025, it will oscillate weakly, and on October 22, it will oscillate strongly [90]. - On October 21, PTA futures rose slightly, and it is expected that on October 22, it will oscillate strongly [95][96]. - On October 21, methanol futures rose slightly, and it is expected that on October 22, it will oscillate weakly [98]. - On October 21, soybean meal futures fell slightly, and it is expected that on October 22, it will oscillate weakly [101].

业绩失速的布鲁可,难成下一个泡泡玛特

3 6 Ke· 2025-10-22 02:10

Core Viewpoint - After years of consecutive losses, the company known as the "Chinese version of LEGO," Blokus, has finally achieved profitability [1] Financial Performance - In the first half of this year, Blokus reported revenue of 1.338 billion RMB, a year-on-year increase of 27.9%, and an adjusted net profit of 320 million RMB, up 9.6%, marking the end of four years of net losses [2][12] - The revenue growth is primarily supported by non-recurring income, including government subsidies, rather than improved market performance [2][13] - Despite a significant increase in product sales, the revenue growth rate has noticeably slowed, indicating that the low-price marketing strategy may be backfiring [2][10] Market Expansion - Blokus's overseas business revenue surged nearly 900% year-on-year in the first half of this year, possibly inspired by the success of Pop Mart in international markets [3][21] - However, the contribution of overseas markets to Blokus's total revenue remains low at only 8.3% [21] Product Strategy - Blokus has heavily relied on licensed IPs, with over 80% of its revenue coming from them, particularly from Ultraman, which contributes nearly 60% [16] - The company has expanded its IP matrix by signing contracts for 13 new IPs and launching 273 SKUs, but this has led to high licensing costs, resulting in continued losses [16][17] Competitive Landscape - The domestic market for building block toys is highly competitive, with brands like LEGO and other local companies also vying for market share [17] - Blokus's market share in the global building block toy market is only 6.3%, while LEGO and Bandai Namco together hold over 75% [21] Future Directions - To sustain growth, Blokus may need to either develop its own IPs or enhance brand influence, as relying solely on external licenses is not sustainable [22] - The company plans to improve its product design and development capabilities to create proprietary IPs, which could help mitigate risks associated with third-party licensing [22][23]