Tai Mei Ti A P P

Search documents

站上世界级科研舞台!逸仙集团发布中国首份美妆创新白皮书

Tai Mei Ti A P P· 2025-10-31 13:41

Core Insights - The Chinese cosmetics industry is currently in a critical phase of innovation-driven development, with a focus on the latest trends in beauty technology and future projections [2] - Yatsen Group has released the "Yatsen Group Beauty Innovation White Paper," marking it as China's first beauty innovation white paper and highlighting China's rising influence in global beauty technology research and development [2][8] - The white paper outlines Yatsen Group's systematic achievements in global research layout, technological innovation, efficacy verification, and sustainable development [2][5] Group 1: Innovation and Research - The white paper serves as a significant milestone in the history of China's beauty industry, showcasing the company's research capabilities and establishing a data-driven innovation model for the industry [2][4] - Yatsen Group revealed its core technology achievements related to the DR.WU PDRN essence, which allows consumers to experience "applicable water light" effects at home, breaking through traditional medical beauty efficacy [2][4] - The company has developed the "Nanoxinfuse™" technology in collaboration with Huazhong University of Science and Technology, enhancing the penetration and stability of active ingredients [4] Group 2: R&D Investment and Strategy - Since its listing on the NYSE in 2020, Yatsen Group has prioritized R&D as its core strategy, investing over 600 million yuan in R&D, with R&D expenses consistently exceeding 3% of total revenue for three consecutive years [5] - The company has established three global R&D centers in Shanghai, Guangzhou, and Toulouse, France, creating an "end-to-end" innovation research and development system [5] - Yatsen Group's skincare business now accounts for over 50% of its total revenue, positioning it among the top ten domestic beauty companies [5] Group 3: Collaborative Innovation - Yatsen Group promotes an open collaborative approach through the Open Lab model, partnering with various universities and hospitals to facilitate the rapid transformation of research outcomes into market applications [6] - The release of the beauty innovation white paper exemplifies the deep integration of industry, academia, and research, showcasing the company's commitment to scientific research and application-oriented development [8] - The founder and CEO of Yatsen Group expressed confidence that world-class beauty innovations can emerge from China, highlighting the potential of Chinese brands on the global stage [8]

半价追平iPad Pro?京东荣耀联手给用户上了一道“真香”配方

Tai Mei Ti A P P· 2025-10-31 09:52

Core Insights - The collaboration between Honor and JD.com represents a significant step in the high-end tablet market, with the launch of the Honor MagicPad3 Pro showcasing the potential of effective partnerships and market direction [2][4][13] Group 1: Product Launch and Market Strategy - Honor's MagicPad3 Pro is the first Android tablet to launch simultaneously with a flagship smartphone, breaking the industry norm of tablets lagging behind smartphones by six months [2][10] - The product was developed in just five months following a strategic meeting that aligned both companies on market trends and consumer needs [2][8] - The tablet features the Qualcomm Snapdragon 8 Gen 2 chip, achieving a performance score that surpasses competitors by 40% [3][10] Group 2: Consumer Insights and Market Trends - JD.com's research indicated a shift in the tablet market from low-cost entertainment devices to higher-priced productivity tools, emphasizing the importance of chip quality, display, and system optimization [2][5][8] - The collaboration allowed for a deep understanding of high-end consumer needs, with feedback highlighting the desire for seamless cross-device functionality and enhanced user experience [6][11] Group 3: Supply Chain and Collaboration - JD.com utilized its C2M (Customer to Manufacturer) model to provide comprehensive support, from strategic direction to product definition and sales guarantees, facilitating Honor's transition to the high-end market [3][10][18] - The partnership exemplifies a shift in the 3C industry towards a more integrated approach, where supply chain capabilities and consumer insights drive product innovation [13][18] Group 4: Future Implications and Industry Impact - The success of the MagicPad3 Pro is seen as a model for future high-end product development across other categories, reinforcing the importance of consumer-centric design and rapid market response [15][17] - This collaboration sets a new standard for high-end tablets, moving the focus from mere specifications to actual user experience and satisfaction [17][18]

对话四维图新CEO程鹏:智驾行业整合是必然的,但不会只剩两三家

Tai Mei Ti A P P· 2025-10-31 09:07

Group 1: Industry Trends - The era of rapid growth for autonomous driving startups is ending, with a trend towards consolidation in the industry, as evidenced by significant investments and acquisitions by major players like FAW, Mercedes-Benz, and Four-dimensional Map [2][3][4] - The market share of third-party autonomous driving suppliers is heavily concentrated, with Momenta and Huawei holding nearly 90% of the market, leading to predictions that only two or three players may remain in the future [3][4] - The integration trend in the autonomous driving sector is partly driven by a challenging capital exit environment, making it more likely for companies to consolidate before going public [2][5] Group 2: Company Strategies - Four-dimensional Map's CEO Cheng Peng emphasizes the need for cost reduction in technology and ecosystem, advocating for collaboration rather than competition in developing autonomous driving solutions [2][6] - The company aims to position itself as a "new Tier 1" supplier, leveraging its capabilities in mapping, positioning, chips, and cockpit software to drive growth in autonomous driving [6][8] - Four-dimensional Map has secured 5.85 million sets of autonomous driving solutions for over 20 mainstream automakers, with plans for high-level autonomous driving solutions to enter mass production within two years [7][8] Group 3: Market Opportunities - The Chinese automotive industry is experiencing a significant increase in exports, with projections of reaching 7 million units in 2024, creating new opportunities for supply chain companies [10][11] - The company has developed a comprehensive compliance service covering over 100 projects for more than 30 major automakers, facilitating global market entry [11][12] - The focus on achieving high cost-performance ratios is crucial for both domestic and international markets, with an emphasis on technological innovation and ecosystem collaboration [12][13]

Barron's巴伦中国驻港办公地开业暨2026全球加密量化大赛发布会将于11月5日进行

Tai Mei Ti A P P· 2025-10-31 08:30

Core Insights - The Crypto Quant Championship 2026, co-hosted by Barron's China and DeAI Expo 2026, will officially launch on November 5 in Hong Kong, coinciding with the opening ceremony of Barron's Hong Kong office [1] - By 2030, AI is projected to create an incremental value of $200 billion to $340 billion for the global financial industry, with approximately 50-60% of global trading volume executed through quantitative or algorithmic strategies [1] - The event focuses on the new paradigm of "AI × Quant × Compliance," bringing together asset management giants, quantitative trading teams, private fund managers, Web3 investment institutions, and top crypto project executives to discuss trends in crypto asset allocation, value growth strategies, and AI-driven investment logic and risk management [1] Event Overview - The Crypto Quant Championship is the world's first digital asset quantitative trading competition utilizing a "long cycle + real trading mechanism," lasting three months and emphasizing "real funds, real data, real competition" [2] - Participants will trade on major international platforms like Binance and OKX, competing on strategy returns, risk control, and innovation capabilities [2] - The event aims to connect traditional finance with the emerging crypto world, gathering global asset management institutions, fund managers, AI researchers, regulators, and investors to explore the future of capital allocation, quantitative investment, risk management, and compliance systems [2] Agenda Highlights - The event will feature a registration period, opening remarks, keynote speeches on cutting-edge crypto asset management, and the official launch of the Crypto Quant Championship [3] - The competition will include a comprehensive evaluation system with 50% for returns, 40% for risk control, and 10% for participation, alongside prohibited behaviors such as fund deposits and withdrawals [3] - Roundtable discussions will cover trends in crypto asset allocation, effective trading strategies, and the evolution of regulatory frameworks across jurisdictions [3] Mission and Future Events - The mission of the championship is to cultivate a global quantitative trading ecosystem, connecting innovators, institutions, and technology to advance smart finance and promote transparency, fairness, and talent discovery [4] - This event marks the beginning of the DAM (Digital Asset Management) GLOBAL FORUM, which will include a series of events from December 2025 in Dubai to a concluding summit and awards ceremony in Hong Kong in April 2026 [5]

“胖东来效应”难抵行业寒潮:酒鬼酒三季报续亏,现金流骤降六成|看财报

Tai Mei Ti A P P· 2025-10-31 08:17

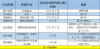

Core Viewpoint - The financial performance of JiuGuiJiu (000799.SZ) in the first three quarters of 2023 has been significantly poor, with a revenue decline of 36.19% year-on-year and a net loss of 9.81 million yuan, marking a shift from profit to loss [2][3]. Financial Performance - Revenue for the first three quarters reached 760 million yuan, a decrease of 36.19% year-on-year, while net profit turned negative at -9.81 million yuan [2]. - The company has experienced a continuous decline in revenue and net profit for three consecutive years, with projected revenue growth rates of -50.68%, -87.89%, and -36.19% for 2023 to 2025 [2]. - Sales expenses were reduced by 47% to 252 million yuan, but the expense ratio remained high at 33%, significantly above the industry average [3]. Product Performance - The launch of the co-branded product "JiuGui·Free Love" in July provided a temporary boost, leading to a slight revenue increase of 0.78% in Q3, with a net loss of 18.76 million yuan, a 70.93% improvement from the previous year [3][4]. - Despite the positive impact of the new product, the main product lines, including Neican, JiuGui, and Xiangquan, are experiencing significant declines, with revenue drops of 35.81%, 51.01%, and 35.87% respectively [4]. Inventory and Production Capacity - The company is expanding production capacity despite high inventory levels, with construction projects amounting to 862 million yuan, which will increase total capacity from 15,000 tons to 22,800 tons [5]. - The actual production volume was only 2,984 tons, resulting in a capacity utilization rate of less than 40%, indicating inefficiency [5]. - Finished goods inventory reached 5,370 tons, while base liquor inventory was as high as 49,827 tons, equivalent to nearly 3.3 years of current production [5]. Market Dynamics - The inventory turnover days in the liquor industry have reached 900 days, raising concerns about the company's expansion plans, which do not align with the current market demand [6]. - The company’s cash flow situation is concerning, with cash reserves dropping from 1.25 billion yuan to 540 million yuan, a decrease of 56.98% [6]. - Accounts receivable surged from 13,400 yuan at the beginning of the year to 47.58 million yuan, deviating from industry norms and potentially increasing cash flow pressure and bad debt risks [7].

“抗癌神药”三季度创收仅1018万元,海创药业商业化“首考”遭市场用脚投票 | 看财报

Tai Mei Ti A P P· 2025-10-31 07:31

Core Viewpoint - Haichuang Pharmaceutical's first innovative drug, Deuteroenzalutamide soft capsule, reported a revenue of 10.18 million yuan for the quarter, a 22.65% decrease from the previous quarter, and a net loss of 37.29 million yuan, down 25.35% quarter-on-quarter but narrowed by 30% year-on-year [2][3][4]. Financial Performance - Revenue for the quarter was 10.18 million yuan, a significant drop from 13.16 million yuan in June, indicating a failure to maintain growth [4]. - The total profit for the period was -37.29 million yuan, with a basic earnings per share of -0.38 yuan [5][8]. - Cash flow from operating activities showed a net outflow of 32.28 million yuan, primarily due to employee payments and market promotion expenses [8]. Cost Structure - Sales expenses reached 15.19 million yuan, a 218.68% increase year-on-year, leading to a high expense ratio of 606.44% [6]. - Despite a decrease in R&D expenses, the overall cost structure remains burdensome, impacting profitability [6]. Market and Product Pipeline - The company has strategically adjusted its pipeline, halting further development of the HP501 project due to intense competition in the URAT1 target market [10][11]. - The ongoing clinical trial for HP515 is expected to face significant market challenges, similar to those encountered by the abandoned HP501 project [11]. - The competitive landscape for Deuteroenzalutamide is intense, with the prostate cancer treatment market in China valued at 8.1 billion yuan in 2022, dominated by other established drugs [12][13]. Future Outlook - Analysts predict that Haichuang Pharmaceutical may not achieve profitability until 2027, with a consensus net loss forecast of 219 million yuan for 2025 [13].

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

陈天桥罕见公开演讲:投入超10亿美金发展“发现式智能”——“这才是AGI”

Tai Mei Ti A P P· 2025-10-31 04:37

Core Insights - The AI-driven scientific symposium held in San Francisco gathered top scholars and industry leaders to discuss how AI can drive scientific discovery [1][3] - Chen Tianqiao, founder of the Tianqiao Brain Science Research Institute, introduced the concept of "Discoverative Intelligence," which he argues represents true general artificial intelligence [1][4] Group 1: Discoverative Intelligence - Discoverative Intelligence is defined as the ability to ask questions and understand principles, rather than merely predicting outcomes [6][7] - This form of intelligence is seen as essential for human evolution, emphasizing AI's role in helping humans discover the unknown [6][8] Group 2: Paths to Discoverative Intelligence - Two main paths to achieving Discoverative Intelligence are identified: the "scale path," which focuses on the size of models and data, and the "structure path," which emphasizes cognitive mechanisms akin to human brain functions [8][10] - The scale path has led to significant advancements in AI applications, while the structure path is emerging as a necessary complement to achieve deeper understanding and discovery [8][13] Group 3: Time Structure Analysis - The concept of "time structure" refers to the brain's ability to process information dynamically over time, contrasting with the static nature of current AI models [9][10] - Five core capabilities are essential for managing information over time: neural dynamics, long-term memory, causal reasoning, world modeling, and metacognition [10][11] Group 4: Opportunities for Young Researchers - The company plans to invest over $1 billion in dedicated computing clusters to support young scientists in exploring new theories and algorithms [13][14] - A new benchmark will be established to measure AI's ability to "discover," focusing on the five core capabilities necessary for true intelligence [13][14]

独家|人工智能专家周舒畅加入小鹏汽车,强化世界基座模型研发

Tai Mei Ti A P P· 2025-10-31 03:00

Core Insights - The article highlights the strategic hiring of Zhou Shuchang, an AI expert, by XPeng Motors to enhance its autonomous driving algorithms and deepen the training of its foundational models, indicating an expansion of its "Physical AI" strategy [2][4]. Group 1: Talent Acquisition - Zhou Shuchang, a prominent AI scientist with experience at Google and other tech firms, has joined XPeng as the Senior Director of Autonomous Driving Algorithms, reporting to Liu Xianming [3][4]. - The recruitment of Zhou is seen as a significant step in strengthening XPeng's capabilities in large model reinforcement and improving its autonomous driving algorithm stack [4]. - XPeng has been actively recruiting AI talent from major companies and universities, building a team that focuses on multimodal foundational models and reinforcement learning [4]. Group 2: Investment in AI - XPeng's CEO, He Xiaopeng, has outlined a long-term investment plan of approximately 500 billion yuan, with 300 billion yuan allocated to AI and 200 billion yuan to hardware and software [6]. - The company has established the first AI computing cluster in the domestic automotive industry, with an expected investment of 4.5 billion yuan in AI and autonomous driving by 2025 [6]. - XPeng's large-scale autonomous driving model, with 72 billion parameters, integrates visual, language, and behavioral modalities, showcasing its advanced AI capabilities [6]. Group 3: Upcoming Developments - XPeng is set to unveil key breakthroughs in its "Physical AI" strategy during its Technology Day on November 5, with a focus on a foundational model capable of simulating the physical world [7][8]. - The internal code name for this model is "World Model," which is considered crucial for achieving Level 4 autonomous driving [7]. - The company aims to redefine the competitive landscape in smart driving through high salaries to attract top AI scientists and a systematic engineering approach [8].

乐舒适冲刺“非洲消费品制造第一股”凭什么?

Tai Mei Ti A P P· 2025-10-30 15:08

Core Insights - The article highlights the rapid rise of Leshushi, a Chinese hygiene product company operating in Africa, which has achieved an annual revenue of 3.2 billion yuan from selling diapers and other hygiene products [1][4] - The company has established a significant presence in the African market over 15 years, with a production capacity that includes 8 factories and 51 production lines across 8 African countries [4][8] - Leshushi is set to become the first African consumer goods manufacturer to list on the Hong Kong Stock Exchange, reflecting its growth and recognition in the market [8][12] Market Performance - Leshushi sold nearly 6 billion hygiene products in a year, generating over 3 billion yuan in revenue and nearly 700 million yuan in net profit [4][5] - The company has seen substantial growth in sales, with a year-on-year increase of 22.1% in diaper sales and 55.7% in wet wipes sales from May to August [4][12] - Leshushi holds a leading market share in Africa, with 20.3% in baby diapers and 15.6% in sanitary napkins [5][12] Market Potential - Africa's population dynamics present a significant opportunity, with over 36.5% of global births occurring in Africa in 2024, indicating a strong demand for baby products [11][14] - The penetration rates for baby diapers and sanitary napkins in Africa are low, at 20% and 30% respectively, compared to much higher rates in developed markets, suggesting substantial growth potential [11][12] - The African hygiene product market is projected to grow significantly, with the baby diaper market expected to reach $2.59 billion by 2024 and the sanitary napkin market projected to grow to $1.41 billion by 2029 [14][12] Business Strategy - Leshushi has adopted a multi-tiered pricing strategy to cater to different consumer segments, from low-income to middle-class consumers, ensuring broad market coverage [16][17] - The company has built a robust distribution network by partnering with local distributors and establishing a direct presence in communities, which has proven effective in reaching rural consumers [20][22] - Localized production has been a key focus, with factories established in multiple African countries to reduce costs and improve responsiveness to market demands [27][28] Future Expansion - Leshushi plans to use the funds from its upcoming IPO to expand production capacity in Africa and explore new markets in Latin America, leveraging its successful business model [33][34] - The company aims to replicate its African success in Latin America, where similar demographic and economic conditions exist, indicating potential for growth [34][36] - By focusing on local production and tailored marketing strategies, Leshushi seeks to strengthen its market position and drive further growth in emerging markets [36][37]