MANGO(300413)

Search documents

芒果超媒(300413):微短剧战略深化,头部综艺或驱动业绩继续回暖

KAIYUAN SECURITIES· 2025-10-27 05:13

Investment Rating - The investment rating for the company is "Buy" (maintained) [1] Core Views - The company is expected to see a recovery in performance driven by its strategic focus on micro-short dramas and popular variety shows [4][6] - Despite a decline in revenue and net profit in the first three quarters of 2025, the long-term growth potential of the company's variety shows is viewed positively [4] - The company has maintained a healthy operating cash flow, with a significant increase in cash reserves, providing a solid foundation for future investments [5] Financial Performance Summary - For Q1-Q3 2025, the company achieved revenue of 9.06 billion yuan, a year-on-year decrease of 11.8%, primarily due to a decline in e-commerce revenue [4] - The net profit attributable to the parent company was 1.02 billion yuan, down 29.7% year-on-year, mainly due to increased content and R&D investments [4] - Q3 revenue was 3.10 billion yuan, a year-on-year decrease of 6.6%, with a net profit of 250 million yuan, down 33.5% year-on-year [4] - Revenue forecasts for 2025-2027 have been adjusted to 14 billion, 15.1 billion, and 16 billion yuan respectively, with net profit forecasts of 1.53 billion, 1.86 billion, and 2.13 billion yuan [4] User Engagement and Advertising - Monthly active users of Mango TV increased by 11% year-on-year, and advertising revenue showed growth in Q3 [5] - The launch of the "AIGC Micro-Short Drama Creator Ecosystem Plan" is expected to enhance content supply and boost membership revenue [6] - The revival of the talent show "Voice of China 2025" is anticipated to drive further advertising revenue growth [6]

路行镜头被“一剪没”,《再见爱人5》切割争议嘉宾!芒果超媒苦熬寒冬期

Hua Xia Shi Bao· 2025-10-27 01:35

Core Viewpoint - Mango TV is facing challenges due to a decline in revenue and profit, attributed to strategic shifts in its traditional e-commerce business and increased investments in quality content and technology [3][6][8] Financial Performance - In Q3 2025, Mango TV reported revenue of 3.099 billion yuan, a year-on-year decrease of 6.58%, and a net profit of 252 million yuan, down 33.47% [3][6] - For the first three quarters of 2025, total revenue was 9.063 billion yuan, a decline of 11.82%, with a net profit of 1.016 billion yuan, down 29.67% [6] - The decline in revenue is primarily due to a strategic reduction in traditional e-commerce operations, while the core Mango TV platform's revenue remained stable [6][8] User Engagement - From January to September 2025, the average monthly active users of Mango TV increased by approximately 11.08% [3][7] - As of August 2025, the total user base reached 750 million, with significant growth in both app and OTT platforms [7] Advertising and Content Strategy - The advertising business showed signs of recovery in Q3, with revenue growth compared to previous periods [3][7] - Mango TV's strong content IP continues to attract brands, with notable collaborations in various popular shows [7][8] Industry Context - The challenges faced by Mango TV are reflective of broader issues within the long video consumption landscape, rather than being unique to the company [6] - The company is strategically refocusing on its core business while navigating the competitive e-commerce landscape [8]

品牌工程指数 上周涨4.14%

Zhong Guo Zheng Quan Bao· 2025-10-26 22:33

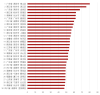

Market Performance - The market experienced a rebound last week, with the CSI Xinhua National Brand Index rising by 4.14% to 2037.67 points [1][2] - The Shanghai Composite Index increased by 2.88%, the Shenzhen Component Index by 4.73%, the ChiNext Index by 8.05%, and the CSI 300 Index by 3.24% [2] Strong Stock Performances - Notable strong performers included: - Zhongji Xuchuang (up 32.23%) - Shiyuan Technology (up 14.54%) - Sunshine Power (up 14.37%) [2] - Other stocks with significant gains included: - Anji Technology and Wowo Bio (both up over 10%) - SMIC and Zhaoyi Innovation (both up over 9%) [2] Year-to-Date Stock Performance - Since the beginning of the second half of the year, Zhongji Xuchuang has surged by 239.03%, leading the gains [3] - Sunshine Power has increased by 145.06%, while other stocks like Lanke Technology and Yiwei Lithium Energy have risen over 70% [3] Market Outlook - According to Fangzheng Fubang Fund, liquidity remains a crucial driver for market development, and future capital inflow will significantly impact market trends [4] - The fund suggests focusing on sectors with solid fundamentals and reasonable valuations, rather than chasing high-performing stocks with poor earnings [4] - Long-term investment opportunities may lie in technology companies with real technological barriers that align with national strategies [4] - Kangmand Capital anticipates a volatile market in the short term due to uncertainties, but the core logic for an upward trend remains unchanged [4] - Xingshi Investment notes that positive incremental information could stabilize market expectations and emotions, with a potential shift in economic momentum towards technology and consumption [4]

节目延播、内容缩水 《再见爱人5》引退费风波

Bei Jing Shang Bao· 2025-10-26 15:50

Core Viewpoint - The recent delay and content reduction of "Goodbye Lover 5" on Mango TV have led to significant dissatisfaction among subscribers, prompting refund requests due to perceived service changes [1][2][7] Group 1: Program Delay and Content Reduction - "Goodbye Lover 5" second episode was delayed and subsequently released with a total runtime of only 137 minutes and 22 seconds, a reduction of over 50% compared to the first episode's 309 minutes and 50 seconds [2] - The delay and content shrinkage have resulted in numerous subscriber complaints and refund requests, with some expressing feelings of having wasted their subscription fees [2][3] Group 2: Subscriber Complaints and Refund Issues - Subscribers have reported dissatisfaction with the membership model, which requires different levels of membership for various viewing experiences, leading to confusion and frustration [2][5] - Legal experts suggest that the refusal to refund based on "membership already credited" may not hold up legally, as consumers could be entitled to partial refunds or compensation due to substantial service changes [7][8] Group 3: Financial Performance and Membership Growth - Mango TV reported a membership scale of 73.31 million by the end of last year, with annual membership revenue reaching 5.148 billion yuan, marking a year-on-year growth of 19.3% [5][6] - The rapid growth in membership is attributed to a steady supply of quality content and an innovative membership rights system, which includes exclusive benefits and interactive products to enhance user engagement [6] Group 4: Legal and Regulatory Considerations - Legal professionals highlight that the terms in Mango TV's membership agreement may be seen as unfair, particularly clauses that allow the platform to unilaterally determine refund eligibility [7][8] - The ongoing disputes regarding membership fees and service delivery may lead to regulatory scrutiny under consumer protection laws, emphasizing the need for fair treatment of subscribers [8][9]

AI入口争夺更明显,游戏关注华通点点和哔哩哔哩:——互联网传媒周报20251020-20251024-20251026

Shenwan Hongyuan Securities· 2025-10-26 12:52

Investment Rating - The industry investment rating is "Overweight" indicating a positive outlook for the sector compared to the overall market performance [10]. Core Insights - The report emphasizes that the valuation reassessment of AI in the internet sector (including cloud computing, chips, and applications) is ongoing, driven by both domestic and global factors [3]. - The competition for entry points in the AI application market is intensifying, which is crucial for the monetization of AI applications [3]. - Key recommendations include major players like Tencent, Alibaba, Baidu, and Bilibili, focusing on their AI capabilities and growth potential [3]. Summary by Relevant Sections AI and Internet Sector - The report highlights the importance of self-reliance in AI technology as emphasized in the recent political meetings in China [3]. - Upcoming earnings reports from major US tech companies are expected to influence global AI investment narratives [3]. - The strategic expansion of OpenAI and ByteDance into various applications is noted as a significant trend [3]. Gaming Sector - The gaming sector has seen a correction, with previous high expectations now adjusted, making valuations more attractive [3]. - Companies like Huya and Bilibili are highlighted for their growth potential in the gaming market, with specific titles performing well [3]. - The report notes the long lifecycle and profitability of SLG games, with cash flow supporting new business explorations [3]. E-commerce and Entertainment - Pop Mart's stock price volatility reflects differing views on IP lifecycle management, with expectations for sales growth in North America [3]. - Mango TV is seen as stabilizing, with upcoming content expected to drive revenue growth [3]. - The report anticipates potential for increased membership and advertising revenues driven by popular content [3]. Valuation Table - A detailed valuation table is provided, showing market capitalizations and revenue projections for key companies in the gaming, cloud computing, and entertainment sectors [5]. - For instance, Tencent's projected revenue for 2025 is 74.64 billion RMB, with a net profit of 25.56 billion RMB, reflecting a year-on-year growth of 15% [5]. Key Recommendations - The report recommends focusing on companies with strong AI capabilities and growth potential, including Tencent, Alibaba, Baidu, and Bilibili, among others [3]. - It also suggests monitoring the gaming sector for emerging opportunities, particularly in companies like Huya and Bilibili [3].

芒果超媒(300413):内容与研发投入加大,四季度内容表现值得期待

GOLDEN SUN SECURITIES· 2025-10-26 11:28

Investment Rating - The report maintains a "Buy" rating for the company [4][6]. Core Insights - The company has increased its investment in content and technology, which has impacted short-term performance but is expected to drive long-term growth due to its unique state-owned platform advantages and strong content output capabilities [4]. - The company achieved a revenue of 9.063 billion yuan in the first three quarters of 2025, a decrease of 11.82% year-on-year, with a net profit of 1.016 billion yuan, down 29.67% [1]. - In Q3 2025, the company launched 28 new seasonal variety shows, maintaining the highest market share in the industry, with several shows ranking in the top 10 for effective views [2]. - The membership business showed resilience with a year-on-year increase of approximately 11.08% in average monthly active users [3]. Summary by Sections Financial Performance - For Q3 2025, the company reported revenue of 3.099 billion yuan, a decrease of 6.58% year-on-year, and a net profit of 252 million yuan, down 33.47% [1]. - The company expects net profits for 2025-2027 to be 1.182 billion yuan, 1.611 billion yuan, and 1.735 billion yuan, reflecting year-on-year changes of -13.4%, +36.3%, and +7.7% respectively [4]. Content and IP Development - The company has a rich content reserve, including nearly 100 film and television projects and several high-performing IP adaptations [2]. - The launch of the "Thousand IP Joint Creation Ecological Plan" aims to collaborate with leading copyright platforms to develop short dramas [2]. Business Segments - The advertising business showed signs of recovery, with Q3 advertising revenue growth returning to positive territory [3]. - The company is expanding its e-commerce segment, leveraging its content IP and artist resources [3].

“SVIP白买了!”《再见爱人5》节目延播、内容缩水,想退费却投诉无果?律师发声…

Bei Jing Shang Bao· 2025-10-26 06:17

Core Points - The recent adjustments to the broadcast schedule and content reduction of "Goodbye Lover 5" have led to significant dissatisfaction among subscribers, prompting refund requests [2][3][4] Group 1: Broadcast Changes - The second episode of "Goodbye Lover 5" was delayed and subsequently aired with a total runtime of only 137 minutes and 22 seconds, a reduction of over 50% compared to the first episode's 309 minutes and 50 seconds [3][4] - The announcement of the delay and content reduction has resulted in a wave of complaints from subscribers, many of whom feel that their paid membership is no longer justified [4][9] Group 2: Subscriber Rights and Complaints - Subscribers have expressed frustration over the inability to receive refunds for their memberships, with the official response from Mango TV stating that while they can assist in canceling renewals, they do not support refunds for already credited services [2][9] - Legal experts have indicated that the refusal to refund based on the "membership already credited" rationale may be questionable, especially if there are substantial changes to the service content [10][11] Group 3: Membership Revenue and Growth - As of the end of 2024, Mango TV reported a membership scale of 73.31 million, with annual membership revenue reaching 5.148 billion yuan, marking a year-on-year growth rate of 19.3% [7][8] - The rapid growth in membership revenue is attributed to a combination of high-quality content offerings and an innovative membership rights system, which includes exclusive benefits and interactive products [8]

《再见爱人5》节目延播、内容缩水,想退费却投诉无果?

Bei Jing Shang Bao· 2025-10-26 06:10

Core Viewpoint - Mango TV's show "Goodbye Lover" faced backlash due to the postponement of its fifth season's second episode and the withdrawal of guest Deng Sha, leading to content reduction and refund requests from dissatisfied members [1][2][4] Group 1: Program Changes and Member Reactions - The second episode of "Goodbye Lover 5" was delayed and subsequently released with a significantly reduced runtime of 137 minutes and 22 seconds, compared to the first episode's total of 309 minutes and 50 seconds, marking a decrease of over 50% [2] - Many members expressed their dissatisfaction and requested refunds, feeling that the value of their SVIP membership was compromised due to the content reduction [4][15] - Legal experts indicated that the refusal to refund based on the argument of "membership already credited" is questionable, as consumers may have the right to request partial refunds or compensation when there are substantial changes to the service [2][16] Group 2: Membership Structure and Complaints - Mango TV's membership structure requires different levels of membership for various viewing experiences, with SVIP members needing to pay more to access full content [6] - Previous complaints have been lodged against Mango TV regarding additional fees for accessing different versions of shows, indicating a pattern of consumer dissatisfaction with the platform's pricing strategy [8][10] - As of the end of 2024, Mango TV reported a membership scale of 73.31 million and a membership revenue of 5.148 billion yuan, reflecting a year-on-year growth rate of 19.3%, highlighting the importance of membership revenue for the company's performance [11][12]

节目延播、内容缩水 会员喊话《再见爱人5》退费:权益损失为何要由消费者买单

Bei Jing Shang Bao· 2025-10-26 06:05

Core Viewpoint - The recent delay and content reduction of "Goodbye Lover 5" on Mango TV have led to significant dissatisfaction among subscribers, prompting refund requests due to perceived loss of value in their membership [1][2][7] Group 1: Program Changes and Subscriber Reactions - The second episode of "Goodbye Lover 5" was delayed and subsequently released with a total runtime of only 137 minutes and 22 seconds, a reduction of over 50% compared to the first episode's total of 309 minutes and 50 seconds [2] - Subscribers expressed frustration over the content reduction and the inability to receive refunds, with many questioning the value of their SVIP memberships [2][6] - Legal experts indicated that consumers may have the right to request partial refunds or compensation if there are substantial changes to the service content [8][9] Group 2: Membership and Revenue Insights - As of the end of 2024, Mango TV's membership reached 73.31 million, with annual membership revenue surpassing 5.148 billion yuan, marking a year-on-year growth rate of 19.3% [6] - The rapid growth in membership revenue is attributed to a combination of high-quality content offerings and an innovative membership rights system, which includes exclusive benefits for higher-tier members [6] Group 3: Customer Service and Legal Implications - Mango TV's customer service has been criticized for refusing refunds based on the argument that membership fees are non-refundable once credited, raising questions about the fairness of such policies [7][8] - Legal professionals highlighted that the terms in Mango TV's membership agreement could be seen as unfair, potentially allowing consumers to challenge the validity of such clauses [9]

文化生产力指数高居全国第四!开福区跻身全国文化产业竞争力百强区Top30

Chang Sha Wan Bao· 2025-10-25 09:56

Core Insights - The "China Cultural Industry Competitiveness Top 100 District Index (2025)" was released, highlighting the strong cultural industry performance of Changsha, with four districts ranked in the top 30 [1][3] - Among these, Kaifu District ranked 5th nationally in the comprehensive index, showcasing its robust cultural soft power [1][4] Group 1: Cultural Industry Competitiveness - The index evaluates cultural industry development at the district level based on productivity, influence, and driving force [3] - Kaifu District achieved a high cultural productivity index, ranking 4th nationally, and an influence index ranking 5th [1][4] Group 2: Integration of Culture and Technology - Kaifu District is implementing a "Cultural + Technology" development model, forming a digital cultural industry ecosystem characterized by high-tech video [6][8] - The district has established a global influence in the digital video industry, integrating content creation, production, storage, broadcasting, and trading [8] Group 3: Cultural and Tourism Integration - The district promotes a "Cultural + Tourism" strategy, enhancing the quality of the tourism industry through cultural initiatives [9] - Plans include a comprehensive cultural tourism development strategy and actions to expand cultural product offerings [9]