EOPTOLINK(300502)

Search documents

万亿龙头股,大涨!主力资金净流入,A股第一

Zhong Guo Zheng Quan Bao· 2025-10-21 08:34

Market Overview - The A-share market saw a collective rise in the three major indices, with the Shanghai Composite Index increasing by 1.36% to surpass 3900 points, the Shenzhen Component rising by 2.06%, and the ChiNext Index up by 3.02% [1] - The total market turnover reached 1.8927 trillion yuan, an increase of 141.4 billion yuan compared to the previous trading day, with over 4600 stocks rising [1] Sector Performance - The computing power sector reignited market enthusiasm, particularly the CPO (Co-Packaged Optics) segment, which showed significant activity [2] - Leading stock Yuanjie Technology hit the daily limit, achieving a historical high, while Industrial Fulian topped the net inflow list with 2.207 billion yuan, marking a 9.57% increase in stock price [2] - Other notable stocks included New Yisheng and Luxshare Precision, with net inflows of 1.792 billion yuan and 1.52 billion yuan respectively [2] Technological Advancements - Alibaba Cloud's Aegaeon system was recognized at the top international systems conference, showcasing its ability to reduce model switching costs by 97% and improve request processing capacity by 2-2.5 times [3] - The system supports multiple models on a single GPU, enhancing throughput by 1.5 to 9 times compared to existing solutions [3] Industry Outlook - CITIC Securities highlighted the rapid iteration of domestic large models and the seamless adaptation of domestic computing chips, which are expected to drive the continuous development of domestic AI [4] - Guosheng Securities reported that the optical module market is experiencing rapid growth driven by AI computing power demand, with leading companies expected to maintain strong profitability and competitive advantages [5] Power Sector Insights - The power sector saw significant gains, with stocks like Shanghai Electric and Hengsheng Energy hitting the daily limit [7] - According to CITIC Jin Invest, the global demand for electrical equipment is on the rise, driven by increased electricity consumption due to AI, leading to a surge in infrastructure investment [9]

通信设备板块10月21日涨5.9%,仕佳光子领涨,主力资金净流入62.02亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:28

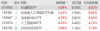

Core Insights - The communication equipment sector experienced a significant increase of 5.9% on October 21, with Shijia Photon leading the gains [1] - The Shanghai Composite Index closed at 3916.33, up 1.36%, while the Shenzhen Component Index closed at 13077.32, up 2.06% [1] Stock Performance - Shijia Photon (688313) saw a closing price of 67.71, with a rise of 15.00% and a trading volume of 434,100 shares, amounting to a transaction value of 2.768 billion [1] - Xinyi Technology (300502) closed at 365.42, up 10.99%, with a trading volume of 614,700 shares, resulting in a transaction value of 21.641 billion [1] - Zhongji Xuchuang (300308) closed at 441.50, increasing by 9.55%, with a trading volume of 565,200 shares [1] - Other notable performers included XD Dekeli (688205) with a 7.89% increase, Changfei Fiber (601869) up 6.86%, and Lian Te Technology (301205) up 6.55% [1] Fund Flow Analysis - The communication equipment sector saw a net inflow of 6.202 billion in main funds, while retail funds experienced a net outflow of 2.659 billion [2] - Major stocks like Xinyi Technology and Zhongji Xuchuang had significant net inflows from main funds, indicating strong institutional interest [3] - Conversely, retail investors showed a tendency to withdraw from several stocks, reflecting a cautious sentiment in the market [3]

今天这批领涨股的信号

猛兽派选股· 2025-10-21 07:58

Group 1 - The adjustment rhythm is closely related to the leading technology stocks, with companies like Xinyiseng, Shenghong, Fulin, and Hanwu showing limited pullback but extended pullback duration, causing a convex curve in moving averages [1] - Leading stocks are showing pivot point signals, indicating potential market movements, but it is not yet confirmed that the base has ended [2] - Shenghong has experienced a pullback of 27.6%, which is within the acceptable range for quality bases, and recent mild volume increase along with today's pivot point signal suggests cautious bullish sentiment [3] Group 2 - Fulin shows the best status with a pullback of only 15.7%, indicating a potential for renewed volume and new highs, similar to companies like Yuanjie Technology [5] - Overall, the signals from leading technology stocks are positive, but attention should be paid to subsequent changes and confirmation signals, particularly regarding the 20-day moving average [6] - The average stock price index has not yet exited the pullback structure, and the possibility of new lows remains significant [6]

20cm速递|存储行业进入超级周期,创业板50ETF华夏(159367)上涨3.71%

Mei Ri Jing Ji Xin Wen· 2025-10-21 07:04

Group 1 - The core viewpoint of the article highlights a significant surge in memory prices in 2025, particularly DDR4 memory, which has more than doubled in price, with 16GB modules exceeding 500 yuan, making them a popular investment choice among industry professionals and gamers [1] - Morgan Stanley indicates that the "memory hunger" trend is driving the industry into a structural growth phase, with the DRAM market entering an unprecedented four-year pricing upcycle from 2024 to 2027, and the global storage market is expected to reach nearly $300 billion by 2027 [1] - The ChiNext 50 Index selects the top 50 stocks from the top 100 by market capitalization and liquidity on the ChiNext board, representing high-growth potential companies across various sectors, including batteries, securities, and communication equipment, reflecting innovation and new technologies [1] Group 2 - The ChiNext 50 ETF (159367) has two core advantages: a 20% price fluctuation limit, providing greater trading flexibility compared to traditional broad-based indices, and low management fees of 0.15% and custody fees of 0.05%, which effectively reduce investment costs [1]

CPO光模块概念领涨大市,云计算50ETF(516630)午后涨近4%

Mei Ri Jing Ji Xin Wen· 2025-10-21 06:56

Group 1 - The core viewpoint of the articles highlights the strong performance of various indices and sectors, particularly in the context of AI and cloud computing investments, with significant movements in stocks related to CPO (Co-Packaged Optics) technology [1][2] - The CPO concept stocks, including Shijia Photonics, Xinyisheng, Zhongji Xuchuang, and Tianfu Communication, have shown strong upward trends, indicating a growing interest and investment in this technology [1] - Google plans to invest $15 billion in Andhra Pradesh, India, over the next five years to build the largest AI data center hub outside the U.S., which is expected to enhance its global AI computing power network [1] Group 2 - The Cloud Computing 50 ETF (516630) tracks an index with a high AI computing power content, covering popular concepts such as optical modules, computing leasing, data centers, AI servers, and liquid cooling [2] - This ETF is noted for having the lowest total expense ratio among ETFs tracking this index, making it an attractive option for investors [2] - The report from Guojin Securities emphasizes the potential growth in server and IDC sectors driven by domestic AI development, as well as the overseas AI development boosting the server and optical module sectors [1]

算力硬件股持续走强,5GETF、5G通信ETF、创业板人工智能ETF大涨

Ge Long Hui· 2025-10-21 06:44

Group 1: Market Performance - The computing hardware stocks continue to perform strongly, with NewEase rising over 11%, Zhongji Xuchuang up over 9%, and Tianfu Communication increasing over 5% [1] - Communication ETFs, including 5G ETFs, have also seen gains of over 6% [1] - The top ten weighted stocks in the 5G communication index include NewEase, Zhongji Xuchuang, Luxshare Precision, and others [1] Group 2: AI and Optical Module Demand - Over 70% of the positions in the ChiNext AI ETF are allocated to computing power, with over 20% focused on AI applications, capturing the AI theme market effectively [2] - Demand for 1.6T optical modules is being continuously revised upwards, with overseas clients increasing their procurement plans significantly from 1 million to 2 million units by 2026 [2] - Citibank noted that the GPU ratio for the 1.6T optical module may improve, indicating a potential increase in industry demand from 8 million to over 20 million units by 2026 [2] Group 3: Growth Projections - Guosheng Securities believes that the optical module market is experiencing rapid growth driven by AI computing demand, with price changes reflecting technological advancements and cost control [3] - Huatai Securities projects a 167% year-on-year growth in net profit for the optical communication sector in Q3 2025, with continued strong performance expected from leading companies [3] - The demand for domestic 400G optical modules is also anticipated to grow rapidly, benefiting companies like Huagong Technology [3] Group 4: AI Application and Domestic Production - First Shanghai strongly supports the sustained high growth of computing power driven by AI applications, with a breakthrough expected in domestic computing capacity by 2026 [4] - The acceleration of commercialization by overseas AI companies like OpenAI is expected to maintain high demand for computing hardware [4] - Despite rising US-China tensions, the trend in the AI industry remains positive, suggesting investment opportunities in core domestic computing industry companies [4]

光模块强势反弹,高“光”ETF盘中涨超6%,算力重回主线?

Sou Hu Cai Jing· 2025-10-21 06:25

Market Overview - A-shares showed a warming sentiment with strong performance in sectors like optical modules CPO and consumer electronics, leading the market [1] - The ChiNext Index, heavily weighted in artificial intelligence, saw a rise of over 5% during trading [1] ETF Performance - The 5G Communication ETF (515050) increased by over 6%, while the lowest fee artificial intelligence ETF, Huaxia (159381), rose by over 5% [1] - Other notable ETFs included the Growth ETF (159967) with a 4.78% increase and the AI ETF (515070) with a 4.25% rise [1] Optical Module Market Insights - The core manufacturers of optical modules are expected to maintain high growth in Q3, with companies like Zhongji Xuchuang and Tianfu Communication projected to achieve over 100% year-on-year net profit growth [2][3] - New Yi Sheng is anticipated to see a staggering 300% increase in net profit for Q3 [3] Supply and Demand Dynamics - There is a significant supply-demand gap in the optical module market, with the value of 1.6T optical modules doubling due to increasing AI chip performance [6] - IDC forecasts the global AI server market to reach $125.1 billion in 2024, growing to $222.7 billion by 2028, indicating robust demand for optical modules [6] - McKinsey predicts that by 2027, the production capacity for 800Gbps optical transceivers will fall short of market demand by 40% to 60% [6] ETF Selection Criteria - The ChiNext Artificial Intelligence ETF (159381) focuses on the optical module CPO sector, with a weight of 51.8% in its index, and includes major stocks like Zhongji Xuchuang and New Yi Sheng [7] - The 5G Communication ETF (515050) tracks the 5G communication theme index, covering a significant portion of the optical module and AI computing infrastructure [7]

创业板人工智能概念股走强,相关ETF涨超5%。

Sou Hu Cai Jing· 2025-10-21 05:39

Core Viewpoint - The AI concept stocks in the ChiNext market have shown strong performance, with significant gains in several key companies, indicating a positive trend in the AI sector [1]. Group 1: Stock Performance - New Yi Sheng's stock rose over 12%, Zhong Ji Xu Chuang increased by over 9%, and Tian Fu Communication gained over 5% [1]. - The ChiNext AI-related ETFs experienced an approximate increase of 5% [1]. Group 2: ETF Details - The following ETFs showed notable performance: - Huabao ChiNext AI ETF: Current price 0.850, up 0.045, an increase of 5.59% [2]. - Hu'an ChiNext AI ETF: Current price 0.977, up 0.051, an increase of 5.51% [2]. - Fuguo ChiNext AI ETF: Current price 1.606, up 0.083, an increase of 5.45% [2]. - Huaxia ChiNext AI ETF: Current price 1.604, up 0.081, an increase of 5.32% [2]. - Dacheng ChiNext AI ETF: Current price 1.435, up 0.071, an increase of 5.21% [2]. - Guotai ChiNext AI ETF: Current price 1.740, up 0.087, an increase of 5.26% [2]. - Nanfang ChiNext AI ETF: Current price 1.822, up 0.090, an increase of 5.20% [2]. Group 3: Market Insights - Analysts indicate that the AI application ecosystem is becoming increasingly robust, with rapid penetration of large model technologies in vertical sectors such as finance, healthcare, and education, surpassing market expectations [2]. - With increased policy support and accelerated domestic computing power construction, leading companies in the AI industry chain are expected to continue benefiting [2].

CPO等算力硬件股午后走强

Mei Ri Jing Ji Xin Wen· 2025-10-21 05:20

每经AI快讯,CPO等算力硬件股午后走强,新易盛、中际旭创涨超10%,天孚通信、工业富联涨超 6%,胜宏科技、景旺电子涨超5%。 (文章来源:每日经济新闻) ...