就业

Search documents

December 1 end of quantitative tightening gives markets some time to adapt, says Fed Chair Powell

Youtube· 2025-10-29 19:10

Core Viewpoint - The discussions regarding economic assessments and monetary policy decisions are ongoing, with no predetermined conclusions for the upcoming December meeting, highlighting diverse opinions among participants [4]. Economic Assessment - Current economic assessments indicate that inflation risks are skewed to the upside, while employment risks are to the downside, suggesting a complex economic landscape that cannot be addressed simultaneously with existing tools [2]. - Different forecasts exist among participants, reflecting varying levels of risk aversion towards inflation and employment outcomes [3]. Monetary Policy and Balance Sheet Management - The committee has indicated a gradual tightening in money market conditions, with significant tightening observed in recent weeks [8]. - The balance sheet is currently shrinking at a slow pace, with a decision to freeze its size effective December 1, allowing markets time to adapt [9]. - The reduction of reserves will continue as non-reserve liabilities grow, indicating a strategic approach to balance sheet management [7].

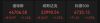

人社部:三项社会保险基金9月底累计结余9.85万亿元

Zheng Quan Ri Bao Wang· 2025-10-29 13:44

Employment Situation - The employment situation remains generally stable, with 10.57 million new urban jobs created in the first nine months, achieving 88% of the annual target [1] - The urban surveyed unemployment rate in September was 5.2%, a decrease of 0.1 percentage points from the previous month [1] Social Security - As of the end of September, the number of participants in basic pension, unemployment, and work injury insurance reached 1.074 billion, 248 million, and 304 million respectively [1] - The total income of the three social insurance funds in the first nine months was 6.69 trillion yuan, with total expenditures of 6.04 trillion yuan, resulting in a cumulative surplus of 9.85 trillion yuan by the end of September [1] - The scale of entrusted investment in the basic pension insurance fund exceeded 2.72 trillion yuan, while the investment operation scale of enterprise (occupational) annuities surpassed 7.7 trillion yuan [1] Pension System Adjustments - The Ministry of Human Resources and Social Security issued a notice regarding personal pension withdrawals, clarifying operational methods to meet diverse needs [2] - The basic pension standard for urban and rural residents was increased by 20 yuan starting July 1, with 13 provinces further raising local basic pension standards [2] Talent Development - The Ministry has developed 95 national occupational standards to meet the rapid development of new occupations and urgent talent needs in key areas [2][3] - New occupational standards include roles such as drone swarm flight planners and intelligent manufacturing system operators, reflecting the growing demand in emerging fields [3] - A total of 37 of the new standards belong to key areas, including 19 in advanced manufacturing and 6 in the digital economy [3] Future Plans - The Ministry aims to enhance the employment support system, implement targeted measures for key groups, and conduct large-scale vocational skills training [4] - There will be a continued deepening of social security system reforms, including nationwide coordination of basic pension insurance and expansion of occupational injury protection trials [4] - The Ministry plans to improve talent evaluation mechanisms and strengthen the construction of professional and skilled talent teams [4]

取消外卖和关闭电商,恢复市面繁荣,这种做法你同意吗?

Sou Hu Cai Jing· 2025-10-28 07:16

Core Insights - The rapid growth of China's e-commerce and food delivery sectors has significantly boosted the national economy, with e-commerce transactions reaching 43.8 trillion yuan in 2022, a year-on-year increase of 16.5%, and the food delivery market size hitting 1.1 trillion yuan, growing by 18.6% [1] - The rise of e-commerce and food delivery has posed unprecedented challenges to traditional brick-and-mortar stores, which saw a decline in revenue to 38.1 trillion yuan in 2022, down 3.9% year-on-year, raising widespread concern [1] Group 1 - Some voices suggest canceling food delivery and closing e-commerce to revive traditional markets, but this approach may backfire and lead to economic decline and increased unemployment [2] - The food delivery and e-commerce sectors employ millions, with 4 million in food delivery and 60 million in e-commerce in 2022, making them crucial for job creation [3] - The decline in brick-and-mortar sales is not solely due to e-commerce competition; post-pandemic consumer demand has decreased, and physical stores face intense competition and rising rental costs [5] Group 2 - Food delivery has become a vital revenue source for restaurants, with about one-third of their sales coming from delivery orders, meaning that canceling food delivery could further weaken their profitability [5] - Consumer reliance on food delivery and e-commerce has increased post-pandemic, and eliminating these services would cause significant inconvenience for those unable to cook, such as young people and the elderly [7] - To restore market vitality, a comprehensive approach is needed, focusing on enhancing the competitiveness of physical stores, improving the consumer environment, and stimulating demand rather than resorting to blanket cancellations of food delivery and e-commerce [7]

四季度消费增长有哪些发力点?解读梳理↓

Yang Shi Wang· 2025-10-23 05:52

Core Insights - The article discusses the role of consumption as a key driver of economic growth in the first three quarters of 2025 and explores potential growth points for consumption in the fourth quarter. Group 1: Consumption Policies - The "old-for-new" policy is expected to have both short-term and long-term effects, stabilizing growth while promoting industrial upgrades and green transformation across society [3][4]. - The introduction of new scenarios and business formats aims to stimulate new consumption dynamics and innovation, enhancing the experience of traditional goods and services [5]. Group 2: Economic Support Mechanisms - Maintaining employment and increasing income are crucial for creating a supportive environment for consumption, requiring a coordinated policy effort across all levels of society [7]. - Establishing a virtuous cycle among employment, income, and consumption is essential for sustaining economic growth [8].

我国2025年三季度成绩单究竟如何?|宏观经济

清华金融评论· 2025-10-21 10:56

Core Viewpoint - The article discusses the economic performance of China in the third quarter of 2025, highlighting a slight decline in GDP growth, a recovery in consumption, and ongoing challenges in manufacturing and infrastructure investment [4][6][12]. Economic Growth - In Q3 2025, China's GDP grew by 4.8% year-on-year, slightly lower than the previous quarter, with nominal GDP growth at 3.7% [6][10]. - The total GDP for Q3 reached 354.5 trillion yuan, with a quarter-on-quarter growth of 1.1% [6][10]. - For the first three quarters of 2025, GDP growth was 5.2%, exceeding the annual target of 5% [6][12]. Consumption Trends - Overall consumption growth was slightly below expectations, with retail sales increasing by 3.0% in September, down from 3.4% [16][24]. - The retail sector showed structural differentiation, with categories like communication equipment and furniture experiencing significant growth, while home appliances and cultural products saw declines [20][24]. - Consumer spending growth lagged behind income growth, indicating a weak recovery in consumer confidence [24]. Investment Insights - Fixed asset investment for the first three quarters of 2025 totaled 371.5 trillion yuan, down 0.5% year-on-year, with infrastructure investment growing by only 1.1% [29][44]. - Manufacturing investment saw a significant decline, with a 1.1 percentage point drop to 4% year-on-year, marking six consecutive months of decline [33][34]. - Real estate investment dropped by 13.9%, with new housing sales down 5.5% in the first nine months [50][60]. Industrial Production - Industrial value-added saw a substantial rebound in September, growing by 6.5% year-on-year, driven by seasonal production increases and strong export performance [63][69]. - The "golden September and silver October" period contributed to this growth, alongside policies aimed at boosting domestic demand [69][70]. Employment Situation - The urban unemployment rate averaged 5.2% in the first three quarters, with a slight decrease in September [75][76]. - Youth unemployment remains a concern, with rates for individuals aged 18-24 reaching 18.9%, indicating ongoing pressures in the job market [77].

印尼总统普拉博沃晒执政一周年成绩单

Zhong Guo Xin Wen Wang· 2025-10-21 03:40

Core Insights - Indonesian President Prabowo showcased achievements during his first year in office, highlighting economic stability and growth despite global uncertainties [2] Economic Performance - Indonesia's economic growth rate remains around 5%, ranking among the top in the G20 [2] - Inflation is controlled at approximately 2%, making Indonesia one of the countries with the lowest inflation in the G20 [2] - Actual investment in Indonesia reached IDR 1,434 trillion in the first nine months of the year, a year-on-year increase of 13.7%, creating about 1.9 million jobs [2] - The Jakarta Composite Index surpassed 8,000 points for the first time, marking a historical high [2] Social Development - The national poverty rate has decreased to 8.47%, the lowest in Indonesia's history [2] - The unemployment rate has dropped to 4.76%, the lowest since the 1998 Asian financial crisis [2] - Prabowo emphasized the need to continue expanding job opportunities to address ongoing global challenges [2] Key Social Programs - The "Free Nutritional Meals" program has benefited 36.7 million people, including schoolchildren, infants, pregnant women, and nursing mothers [3] - The "People's School" initiative aims to provide educational opportunities for approximately 500,000 impoverished children, helping to break the cycle of poverty through education [3] International Engagement - Indonesia joined the BRICS cooperation mechanism as a formal member in January [3] - In September, Indonesia signed a comprehensive economic partnership agreement with the European Union [3] - Prabowo attended the 80th United Nations General Assembly for the first time as president, indicating an increase in Indonesia's global influence [3]

50:43,仍未通过!美政府停摆第20天,美核武器储存管理关键机构开始强制休假

Mei Ri Jing Ji Xin Wen· 2025-10-21 01:41

Government Shutdown Impact - The U.S. Senate failed to pass a government funding bill, resulting in the continuation of the government shutdown that began on October 1 [1][2] - The funding bill aimed to extend government funding until November 21 but fell short of the required 60 votes, receiving only 50 in favor [2] - The shutdown has led to the forced unpaid leave of approximately 1,400 employees at the National Nuclear Security Administration, marking the first such occurrence since its establishment in 2000 [4][5] Economic Data and Federal Reserve - The government shutdown has caused a halt in the release of key economic data, complicating the Federal Reserve's assessment of the economy during its upcoming policy meeting [2][6] - There is a widespread expectation that the Federal Reserve will lower the benchmark interest rate by 25 basis points to a range of 3.75%–4.00% at its meeting on October 28-29 [7] - The lack of official employment data has created uncertainty regarding the labor market, with average monthly non-farm job additions from June to August being only 29,000, significantly below pre-pandemic levels [7][8] Stock Market Performance - U.S. stock markets experienced significant gains, with major indices rising over 1%, driven by optimism from quarterly earnings reports and improved risk appetite [3][9] - Apple Inc. saw its stock price reach a historic high of $262.24, with a market capitalization of $3.89 trillion, reflecting a one-day increase of $147.6 billion [12][14] - The strong sales performance of the iPhone 17 series, which outperformed the iPhone 16 series by 14% in early sales, has contributed to positive market sentiment towards Apple [14]

美国经济藏猫腻?GDP涨就业跌,美联储还敢降息,这盘棋咋下的

Sou Hu Cai Jing· 2025-10-18 07:44

Economic Overview - The U.S. economy is experiencing a paradox with a 3.8% annualized GDP growth in Q2 and predictions to maintain this level in Q3, while private sector employment decreased by 32,000 in September [1][3] - The divergence between GDP growth and employment is attributed to the impact of AI on job displacement, with AI spending contributing 0.9% to GDP growth in 2023 [3][5] AI Impact on Employment - Businesses are increasingly investing in AI, with expenditures on AI data centers reaching $40.4 billion in Q2, a fourfold increase since early 2020, contributing 0.77 percentage points to GDP [5][7] - The demand for labor is generally low across industries, with many employers resorting to layoffs or hiring freezes due to increased investment in AI [5][7] Federal Reserve's Monetary Policy - The Federal Reserve is expected to lower interest rates by 25 basis points in its remaining meetings this year, reflecting a consensus among market participants [9][11] - The Fed's decision-making is influenced by the rising risks in the employment sector, with a focus on stabilizing the job market over inflation concerns [11][21] Automotive Industry Challenges - The automotive sector is facing significant challenges, highlighted by a 40% profit drop for CarMax and a 20% decline in its stock price [16] - The delinquency rate for auto loans has reached a five-year high, with over 5% of loans being 90 days overdue, indicating financial strain among consumers [17][19] Consumer Spending and Economic Health - Consumer spending is primarily supported by high-income groups, while middle and low-income individuals struggle with job availability and stagnant wages, leading to reduced purchasing power [19][21] - The combination of high tariffs, vehicle prices, and interest rates is making it difficult for average consumers to afford major purchases like cars, exacerbating industry issues [19][21] Long-term Economic Outlook - The Fed's potential interest rate cuts are seen as a temporary measure to support the weak job market and consumer spending, but they do not address the underlying structural issues in the economy [21][24] - The ongoing effects of AI on employment and the cost pressures from tariffs indicate that the challenges facing middle and low-income groups will persist beyond short-term monetary policy adjustments [22][24]

闪评 | 鲍威尔:通胀与就业9月来无变化 美联储下一步如何走?

Sou Hu Cai Jing· 2025-10-15 10:47

Core Viewpoint - Federal Reserve Chairman Jerome Powell indicated that there has been little change in the U.S. employment and inflation outlook since the September meeting, emphasizing a cautious approach to monetary policy based on evolving economic conditions [1][4]. Economic Status - The U.S. economy is facing a dual challenge: a rising unemployment rate, which reached 4.3% in August, the highest in four years, and persistent inflation expectations among consumers, which have increased to the highest level since May due to trade tensions and Fed policies [4]. - The current economic environment is described as a "soft landing" scenario, where growth is slowing but not in recession, and inflation remains sticky [4]. Fed's Dilemma - Powell stated that there is no risk-free path for the Fed's interest rate policy, highlighting the inherent trade-offs in economic decision-making [5]. - The Fed's dilemma involves balancing the risks of premature rate cuts, which could exacerbate inflation, against the risks of delayed cuts, which could hinder economic growth and employment [6][7]. Upcoming Fed Meeting - The Federal Open Market Committee is set to meet on October 28-29, with Powell's recent comments signaling a cautious approach to future rate decisions [10]. - Analysts suggest that while there is speculation about a potential rate cut, the uncertainty created by ongoing trade issues may lead the Fed to maintain a cautious stance, possibly delaying any cuts until December [10].

鲍威尔最新发声:美国经济比预期更稳,缩表或将接近尾声

Sou Hu Cai Jing· 2025-10-15 10:02

当地时间10月14日,美联储主席鲍威尔出席美国商业经济学会第67届年会时表示,自9月议息会议以来,美国的就业与通胀前景并未出现明显变化,但最新 数据显示,经济增长依然保持在一个"高于预期的稳健水平"。 鲍威尔表示,美联储在9月会议上选择维持中性政策立场,是基于对风险平衡的重新评估。"在通胀与就业目标之间寻找平衡,本身就不存在无风险的选择。 我们会根据经济前景的变化动态调整政策,而不是按既定路线前行。" 关于市场关注的"缩表"进展,鲍威尔透露,美联储或已接近缩表终点。"我们计划在准备金规模略高于'充足'水平时停止缩表。现在看来,这个时点可能就在 未来几个月。"他说,目前,美联储正密切关注多项指标,以确保这一决策的时机恰当。 他提到,在美国政府因预算分歧而短暂"停摆"前,相关经济数据已经显示出一定的韧性。由于政府关门,9月非农就业等关键数据的发布被迫推迟,但现有 迹象仍表明——企业裁员和招聘活动都维持在低位,劳动力市场虽然热度下降,却依旧处于相对健康区间。 鲍威尔指出,劳动力市场的活力正在减弱,招聘难度下降,意味着就业可能面临一定的下行压力。"这种变化让我们在评估风险时更加谨慎,"他说。 在通胀方面,他认为,近期 ...