经济韧性

Search documents

2025年10月PMI数据解读:10月PMI:供需均有所放缓,新动能延续扩张

ZHESHANG SECURITIES· 2025-10-31 10:27

Group 1: PMI Overview - The manufacturing Purchasing Managers' Index (PMI) for October is 49.0%, a decrease of 0.8 percentage points from the previous month, indicating an economic slowdown[1] - The composite PMI output index stands at 50.0%, suggesting overall stability in production and business activities[1] - High-tech manufacturing and equipment manufacturing PMIs are at 50.5% and 50.2%, respectively, indicating continued expansion and support for the manufacturing sector[1] Group 2: Supply and Demand Dynamics - The production index for October is 49.7%, down 2.2 percentage points, reflecting a slowdown in manufacturing production[2] - New orders index recorded at 48.8%, a decline of 0.9 percentage points, indicating reduced demand in the manufacturing sector[3] - New export orders fell to 45.9%, significantly lower than seasonal expectations, influenced by ongoing trade tensions[3] Group 3: Price Index and Economic Resilience - The manufacturing purchase price index is at 52.5%, down 0.7 percentage points, while the factory price index is at 47.5%, also down 0.7 percentage points, indicating a general decline in price levels[7] - Despite the price index decline, new momentum-related industries show positive price trends, with equipment manufacturing prices rising for three consecutive months[7] - The composite PMI output index indicates economic resilience, with a slight decline of 0.6 percentage points, suggesting a convergence towards potential growth[10]

以色列央行原行长独家专访:控通胀如何铸就“创业国家”传奇

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-30 11:44

Core Viewpoint - The independence of central banks is crucial for economic stability, especially in the current international context where political pressures can undermine effective monetary policy [1][14]. Group 1: Central Bank Independence - Central bank independence is essential for implementing necessary and sometimes difficult decisions, as political systems tend to focus on short-term goals [1][14]. - The independence of central banks allows for a long-term perspective in monetary policy, which is vital for sustainable economic outcomes [14][15]. Group 2: Israel's Economic Transformation - Israel's economic success in the 1990s was attributed to a comprehensive strategy that included stabilizing inflation, reducing budget deficits, developing capital markets, and enhancing exchange rate flexibility [2][12]. - The influx of highly skilled immigrants and improved geopolitical conditions contributed to Israel's transformation into a "startup nation," with high-tech exports accounting for over half of its total exports [2][12]. Group 3: Global Economic Governance - The shift from globalization to fragmentation is concerning, as countries are increasingly competing rather than cooperating, which can lead to unhealthy economic practices [6][8]. - China is recognized as a vital player in the global economy and should take on a larger role in global governance, responding to traditional systems' inadequacies [3][8]. Group 4: Emerging Markets Representation - Emerging markets have shown resilience and performed better than developed countries in recent years, but their representation in international institutions like the IMF does not reflect their economic weight [7][8]. - There is a growing recognition of the need to enhance the representation of emerging markets in global governance structures [7]. Group 5: Debt and Economic Stability - The accumulation of public debt is a long-term issue resulting from persistent budget and current account deficits, which can lead to systemic risks [9][10]. - Responsible government behavior and the development of robust capital markets are essential to manage high debt levels and maintain economic stability [10]. Group 6: Lessons from Israel - The experience of Israel in achieving price stability and economic openness can serve as a model for other emerging or middle-income economies [14][15]. - Effective public communication and building public support for monetary policy are critical for central banks to maintain their independence and achieve economic stability [15].

10月美联储议息会议点评:鲍威尔为12月降息泼冷水

CMS· 2025-10-30 01:20

Monetary Policy - The Federal Reserve lowered the interest rate by 25 basis points to a target range of 3.75%-4.00% and will end balance sheet reduction on December 1[1] - Powell's hawkish tone dampened market expectations for a December rate cut, emphasizing that it is "far from a done deal" and highlighting internal divisions within the Fed regarding the December decision[1][8] - The end of balance sheet reduction aims to alleviate liquidity pressure and shift from quantity control to structural adjustments, helping to stabilize the Treasury holdings[9] Economic Outlook - Economic activity is showing resilience, particularly in consumer spending and data center investments, despite a weak real estate sector[3] - Employment market risks are increasing, with signs of a gradual cooling in job demand and a decline in labor force participation[5] - Inflation risks are perceived to be decreasing, with current inflation at 2.8% and potential increases from tariffs expected to be one-time adjustments[5] Market Reactions - Following the Fed's announcement, the S&P 500, Nasdaq, and Dow Jones indices showed mixed movements, with changes of 0.00%, 0.55%, and -0.16% respectively[9] - The 2-year Treasury yield rose by 12 basis points to 3.59%, while the 10-year yield increased by 9 basis points to 4.08%[9] - The current CAPE ratio for the S&P 500 is at 41.18, compared to 44.19 before the 2000 Nasdaq bubble burst, indicating potential paths for the market[9] Investment Strategy - Short-term volatility in risk assets is expected, but the medium-term outlook for U.S. equities remains positive, supported by AI investments[2][9] - Two potential scenarios for the U.S. stock market: a 10-20% short-term correction leading to more Fed easing, or accelerated bubble formation transitioning to a bear market by mid-next year[2][9] - Caution is advised regarding the potential negative impact on domestic equities if December rate cut expectations continue to cool[2][9]

冲刺在即,宁波能否再进位?

3 6 Ke· 2025-10-28 02:07

Economic Overview - Ningbo's GDP for the first three quarters of 2025 reached 1,349.29 billion yuan, with a year-on-year growth of 5.0% at constant prices [1] - The primary industry added value was 30.11 billion yuan, growing by 3.6%; the secondary industry added value was 573.65 billion yuan, growing by 4.3%, with industrial output at 526.20 billion yuan, growing by 5.6%; the tertiary industry added value was 745.53 billion yuan, growing by 5.5% [1] Comparative Analysis - Ningbo's GDP growth rate of 5.0% is lower than the national average of 5.2% and the provincial average of 5.7% [2] - The secondary industry's added value growth of 4.3% is also below the national and provincial levels by 0.6 and 0.9 percentage points, respectively [2] - The city's fixed asset investment saw a significant decline of 18.1%, contrasting with a national decrease of 0.5% and a provincial decrease of 3.8% [2] Foreign Trade Performance - Ningbo's total import and export volume exceeded 1 trillion yuan, reaching 1,092.26 billion yuan, with a year-on-year growth of 3.7%, which is below the national growth of 4.0% and provincial growth of 6.2% [3] - The city's foreign trade dependency is notably high at 78.3%, significantly above the national average of 32.5% and the provincial average of 58.4%, indicating greater vulnerability to external shocks [3] Future Outlook - Ningbo aims to achieve a GDP of over 2 trillion yuan by 2025, with a current GDP of 1,814.77 billion yuan in 2024, indicating a close competition with Nanjing [1] - The city faces challenges in maintaining economic momentum and is urged to enhance efforts in stabilizing and improving economic conditions [3]

城市24小时 | 冲刺在即,宁波能否再进位?

Mei Ri Jing Ji Xin Wen· 2025-10-27 15:54

Economic Overview - Ningbo's GDP for the first three quarters of 2023 reached 1,349.29 billion yuan, with a year-on-year growth of 5.0% at constant prices [1] - The primary industry added value was 30.11 billion yuan, growing by 3.6%; the secondary industry added value was 573.65 billion yuan, growing by 4.3%, with industrial output at 526.20 billion yuan, growing by 5.6%; the tertiary industry added value was 745.53 billion yuan, growing by 5.5% [1] Comparative Analysis - Ningbo's economic performance has seen it rise from 16th to 11th in national rankings since joining the "trillion GDP club" in 2017, surpassing cities like Foshan and Changsha [1] - The city aims to achieve a GDP of over 2 trillion yuan by 2025, positioning itself to enter the top 10 cities nationally, with a current GDP of 1,814.77 billion yuan in 2024, closely trailing Nanjing's 1,850.08 billion yuan [1] Industry Performance - The secondary industry in Ningbo grew by 4.3%, lagging behind national and provincial averages by 0.6 and 0.9 percentage points, respectively [4] - Ningbo's industrial output increased by 5.4%, also below national and provincial growth rates [4] - The city's foreign trade, a significant sector, saw total imports and exports reach 1,092.26 billion yuan, growing by 3.7%, but still underperforming compared to national and provincial averages [4] Economic Challenges - Ningbo's economy is heavily reliant on foreign trade, with a dependency rate of 78.3%, significantly higher than the national average of 32.5% [4] - The city faces considerable risks and challenges due to external uncertainties, impacting its economic recovery [4] - The local government emphasizes the need for enhanced efforts to stabilize and improve economic conditions [4]

科法斯维持对摩洛哥风险评估B级评级

Shang Wu Bu Wang Zhan· 2025-10-23 04:33

Group 1 - The core viewpoint of the article is that Morocco maintains a "B" rating from Coface, indicating controllable risks and economic stability despite regional vulnerabilities [1] - The "B" rating reflects Morocco's ability to operate smoothly even amidst institutional or external vulnerabilities, highlighting its resilient production sector supported by targeted public policies in energy, industry, and infrastructure [1] - Morocco's economic balance remains robust in the context of international tensions and global economic turmoil, with a focus on industry diversification and a favorable business environment [1] Group 2 - Morocco's economic vulnerabilities include a high reliance on agriculture, which accounts for 11% of GDP and 30% of employment, as well as low resilience to natural risks such as drought [2] - The youth unemployment rate in Morocco is notably high at 35.8%, indicating significant labor market challenges [2] - To enhance economic resilience, Morocco needs to pursue structural reforms, improve human resources, reduce the informal economy, increase productivity, and expand access to non-European markets [2]

新能源及有色金属日报:金属板块走势偏强,沪镍不锈钢收涨-20251022

Hua Tai Qi Huo· 2025-10-22 02:54

Report Summary 1. Report Industry Investment Rating No investment rating for the industry is provided in the report. 2. Core Views - For the nickel market, due to high inventory and persistent supply surplus, nickel prices are expected to remain in low - level oscillations [4]. - For the stainless - steel market, with weak demand growth, inventory accumulation, and weakening cost support, stainless - steel prices are also expected to stay in a low - level oscillation [6]. 3. Summary by Related Catalogs Nickel Variety - **Market Analysis** - **Futures**: On October 21, 2025, the main contract of Shanghai nickel (2511) opened at 121,000 yuan/ton and closed at 121,180 yuan/ton, a 0.36% change from the previous trading day. The trading volume was 60,391 (- 8,453) lots, and the open interest was 50,388 (+ 2,520) lots. The main contract was about to change, showing a volatile and slightly stronger trend. The strengthening expectation of the Fed's interest - rate cut and China's strong economic resilience in Q3 were the main reasons for the strong performance of the metal sector [2]. - **Nickel Ore**: The trading atmosphere in the nickel - ore market was fair, and prices remained stable. The 1.4% nickel - ore tender of the Philippines' Eramen mine was settled at CIF43. In the Philippines, the shipping volume from the Surigao mining area was decreasing, and northern mines were mostly tendering for shipment. Downstream iron plants' profits were affected, and they maintained cautious procurement. In Indonesia, the supply of the nickel - ore market remained in a loose pattern. The domestic trade benchmark price in October (Phase II) increased by 0.06 - 0.11 US dollars, and the current mainstream premium was + 26, with the premium range mostly between + 25 - 27. Due to the approaching rainy season in local mining areas and production preparations for next year, Indonesian factories started raw - material procurement [3]. - **Spot**: Jinchuan Group's sales price in the Shanghai market was 123,900 yuan/ton, a 500 - yuan increase from the previous trading day. Spot trading was average, and the spot premiums of each brand were basically stable. Jinchuan nickel's premium remained unchanged at 2,450 yuan/ton, imported nickel's premium remained at 400 yuan/ton, and nickel - bean premium was 2,450 yuan/ton. The previous trading day's Shanghai nickel warehouse receipts were 27,026 (+ 158) tons, and LME nickel inventory was 250,476 (0) tons [3]. - **Strategy** - Unilateral: Mainly conduct range operations. - Others: No operations for inter - period, cross - variety, spot - futures, and options [4]. Stainless - Steel Variety - **Market Analysis** - **Futures**: On October 21, 2025, the main contract of stainless steel (2512) opened at 12,600 yuan/ton and closed at 12,665 yuan/ton. The trading volume was 126,078 (+ 1,298) lots, and the open interest was 188,332 (- 4,171) lots. Driven by the strength of Shanghai nickel and the metal sector, the main contract of stainless steel showed a volatile and stronger trend. The price center shifted slightly upward compared with the previous few trading days but did not break through the key resistance level. The trading volume increased moderately compared with the previous day, but short - term capital inflow was limited, and the rebound lacked real momentum [4]. - **Spot**: Downstream inquiries increased, and quotes rose slightly, but actual transactions were mainly for low - priced goods, and the overall trading situation improved slightly. The stainless - steel price in the Wuxi market was 13,000 (+ 0) yuan/ton, and in the Foshan market, it was also 13,000 (+ 0) yuan/ton. The 304/2B premium was between 355 and 655 yuan/ton. According to SMM data, the ex - factory tax - included average price of high - nickel pig iron changed by - 2.00 yuan/nickel point to 936.0 yuan/nickel point [4]. - **Strategy** - Unilateral: Neutral. - Others: No operations for inter - period, cross - variety, spot - futures, and options [6].

锐财经丨经济运行总体平稳稳中有进

Ren Min Ri Bao Hai Wai Ban· 2025-10-21 01:39

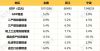

Economic Growth - China's GDP grew by 5.2% year-on-year in the first three quarters, ranking among the top major economies [1][2] - The economic increment reached 39,679 billion yuan, an increase of 1,368 billion yuan compared to the previous year [1][2] Employment and Prices - The average urban unemployment rate for the first three quarters was 5.2%, consistent with the first half of the year [4] - The Consumer Price Index (CPI) slightly decreased by 0.1%, while the core CPI, excluding food and energy, rose by 0.6% [4] International Trade - China's foreign trade showed strong resilience, with import and export volumes reaching historical highs, and foreign exchange reserves maintained above 3.3 trillion USD [4][5] - The total value of goods imports and exports increased by 6.0% year-on-year in the third quarter [9] Industrial Development - The proportion of added value from high-tech manufacturing and equipment manufacturing reached 16.7% and 35.9%, respectively [4] - Investment in equipment and tools increased by 14.0% year-on-year, significantly contributing to overall investment growth [6] New Economic Drivers - Industries such as lithium-ion battery manufacturing and electric vehicle production saw substantial growth, with increases of 29.8% and 29.7%, respectively [7] - The production of new energy vehicles and related products also experienced double-digit growth [7] Policy Impact - A series of policies have effectively stabilized the economy and supported long-term development, with consumer spending contributing 53.5% to economic growth [6] - The government has issued 300 billion yuan in special bonds to stimulate consumer demand through programs like "old for new" [6]

数据点评 | 三季度经济:“韧性”的来源?(申万宏观·赵伟团队)

赵伟宏观探索· 2025-10-20 16:03

Core Viewpoint - The economic growth in the third quarter is supported by short-term factors and medium-term resilience, maintaining reasonable growth [2][8][42] GDP - The GDP growth rate for the third quarter is 4.8%, matching expectations, with contributions from service consumption, improved external demand, and strong construction activity [2][44] - Service consumption remains resilient, contributing 2.7 percentage points to GDP [2][8] - External demand has improved, with net exports contributing 1.2 percentage points to GDP [2][8] - Construction activity surged in September, with a 22.9% increase, boosting property sales and supporting capital formation in GDP [2][8] Production - Industrial value-added growth increased to 6.5% in September, driven by specific industries like automotive production [2][13] - The automotive sector saw a 7.6% increase in value-added, contributing to an overall production growth of 0.4% [2][13] - Downstream production showed significant improvement, while upstream production remained weak due to declining investments [2][14] Retail Sales - Retail sales below the quota showed a decline, but service consumption continued to grow at a rate of 5.2% [3][20] - Retail sales of automobiles improved due to anticipated adjustments in subsidy policies, while home appliances saw a decline [3][20] - The overall retail sales growth in September was 3.0%, down 0.4 percentage points from the previous month [3][20] Real Estate - The "guarantee delivery" and "existing home sales policy" have been implemented, leading to a significant increase in construction activity [3][24] - Property prices in 70 cities showed a slight year-on-year increase, but still negative on a month-on-month basis [3][24] - The construction growth rate surged to 1.5% in September, driven by policy support [3][24] Investment - Fixed asset investment growth remains low, with a year-on-year decline of 6.5% in September [4][33] - Other expenses saw a significant increase, while construction and installation investment dropped sharply [4][33] - The acceleration of debt repayment has occupied funds for fixed investment, contributing to the ongoing decline in investment growth [4][33] Summary - Economic pressures are increasing, but policies are actively countering these effects, with expectations for resilience in the fourth quarter [4][42] - Short-term factors like "production rush" may fade, leading to potential downward pressure on industrial production [4][42] - The implementation of 500 billion yuan in local special bond quotas is expected to alleviate the impact of debt repayment on fixed asset investment [4][43]

9月经济数据点评:三季度经济:“韧性”的来源?

Shenwan Hongyuan Securities· 2025-10-20 13:11

Economic Performance - Q3 GDP growth was 4.8%, matching expectations but down from 5.2% in the previous quarter[1] - In September, industrial added value increased by 6.5%, exceeding the expected 5.2%[1] - Fixed asset investment showed a cumulative year-on-year decline of 0.5%, against an expectation of 0%[1] Consumption and Retail - Retail sales in September grew by 3.0%, slightly below the expected 3.1%[1] - Service consumption remained resilient, with service retail growth rising by 0.1 percentage points to 5.2%[3] - Below-limit retail sales weakened, dropping by 0.5 percentage points to 3.8%[3] Investment Trends - Fixed asset investment in September saw a slight recovery, up 0.7 percentage points to -6.5% year-on-year[4] - Real estate development investment continued to decline, with a cumulative year-on-year drop of 13.9%[4] - Manufacturing investment showed a slight increase, with a monthly year-on-year growth of -1.5%[4] Real Estate Market - The completion rate surged by 22.9 percentage points in September, reaching 1.5%[3] - New housing sales area saw a year-on-year decline of 5.5%[1] - Housing prices in 70 cities showed a slight recovery, but remained negative on a month-on-month basis[3] Outlook and Risks - Economic pressures are increasing, but policies are actively countering these effects, suggesting resilience in Q4[4] - Potential risks include external environment changes and slower-than-expected implementation of growth stabilization policies[4]