自主可控

Search documents

国泰海通|固收:不惧扰动,保持定力

国泰海通证券研究· 2025-10-21 11:58

Core Viewpoint - The convertible bond market is experiencing significant short-term valuation compression, but given the resilience of the equity market, convertible bonds still present investment opportunities, particularly through a low premium strategy [1][2]. Group 1: Market Performance - The Shanghai Composite Index declined by 1.47% last week, while the China Convertible Bond Index fell by 2.35%, indicating a notable compression in convertible bond valuations [1]. - Institutional profit-taking is a major factor influencing short-term valuations in the convertible bond market, although long-term trends remain positive as long as the equity market continues its upward trajectory [1][2]. Group 2: Valuation and Risks - As of October 17, the average parity of convertible bonds was 97.34 yuan, with an average conversion premium rate of 39.99%. High premium convertible bonds have seen significant compression in their conversion premium rates due to increased expectations of forced redemptions [1]. - Large-scale convertible bonds with high premiums face risks related to forced redemptions, particularly when conversion premium rates are elevated, which could lead to dilution of the underlying stock [1]. Group 3: Investment Strategy - Despite external disturbances, the equity market's upward trend is expected to continue, providing a favorable environment for convertible bonds, which exhibit resilience and potential for both appreciation and downside protection [2]. - In a sustained bull market, a low premium strategy is recommended as it allows for better participation in the underlying stock's gains while minimizing valuation compression risks. The technology sector, particularly semiconductor stocks and TMT industries benefiting from increased AI capital expenditure, is highlighted as a key area for investment [2].

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

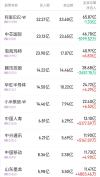

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]

北水动向|北水成交净买入11.71亿 泡泡玛特(09992)盘后发布盈喜 北水全天抢筹超11亿港元

智通财经网· 2025-10-21 09:59

智通财经APP获悉,10月21日港股市场,北水成交净买入11.71港元,其中港股通(沪)成交净买入25.24亿港元,港股通(深)成 交净卖出13.53亿港元。 港股通(深)活跃成交股 泡泡玛特(09992)获净买入11.2亿港元。消息面上,今日盘后,泡泡玛特发布三季度最新业务状况公告,2025年第三季度整体 收益同比增长245%-250%。其中,中国收益同比增长185%-190%,海外收益同比增长365%-370%。小摩预计,泡泡玛特未来 催化剂包括:圣诞强劲销售,"Labubu&Friends"动画预期在12月发布,Labubu4.0料在明年3至4月出炉。 小米集团-W(01810)获净买入4.81亿港元。消息面上,小米集团披露,10月17日,公司回购1070万股,每股作价45.9港元至 46.76港元,涉及总额约4.94亿港元。今年以来该股累计进行12次回购,合计回购3412.52万股,累计回购金额15.37亿港元。 内资重新加仓芯片股,华虹半导体(01347)、中芯国际(00981)分别获净买入4.41亿、1.28亿港元。消息面上,华金证券表示, 持续看好人工智能推动半导体超级周期,建议关注半导体全产业 ...

中航西飞(000768.SZ):公司主营业务不受中美关系波动及外部政策变化的直接影响

Ge Long Hui A P P· 2025-10-21 07:44

Core Viewpoint - The company focuses on the military aviation industry in the domestic market, which is not directly affected by fluctuations in China-U.S. relations or external policy changes [1] Group 1: Business Focus - The company's main business is in the military aviation sector, with a minimal impact from the civil aviation sector related to the U.S., which constitutes a small portion of total revenue [1] - The company has developed and is implementing a systematic, multi-layered response plan to effectively prevent and mitigate various external risks [1] Group 2: Strategic Initiatives - The company emphasizes "self-controllability" as a key principle and aims to flexibly respond to complex situations [1] - Through years of strategic investment in independent innovation and supply chain management, the company ensures stable and sustainable production and operations [1] Group 3: Future Outlook - The company is committed to minimizing the adverse effects of changes in the external environment to achieve high-quality development [1]

智能制造行业周报:通用机器人自主性增强,工业场景加速渗透-20251021

Shanghai Aijian Securities· 2025-10-21 07:37

Investment Rating - The report rates the mechanical equipment industry as "stronger than the market" [1]. Core Views - The mechanical equipment sector underperformed the CSI 300 index, with a decline of 5.84% compared to the index's drop of 2.22% during the week of October 13-17, 2025 [9][10]. - The overall PE-TTM valuation for the mechanical equipment sector decreased by 5.73%, with the robotics sub-sector experiencing the largest decline of 9.81% [17][16]. - Key investment opportunities are identified in platform-type semiconductor equipment manufacturers and leading robot manufacturers, which are expected to benefit from the trend of independent control and cost reduction [3]. Summary by Sections Industry Performance - The mechanical equipment sector ranked 27th out of 31 in the Shenwan industry classification during the week, with engineering machinery being the best-performing sub-sector, down only 2.14% [9][10]. - The PE-TTM for the mechanical equipment sector is currently at 36.0x, with the robotics sub-sector having the highest valuation at 177.6x [16][17]. Investment Recommendations - Focus on platform-type semiconductor equipment manufacturers such as North Huachuang, Zhongwei Company, and Tuo Jing Technology, which are expected to gain from the independent control trend [3]. - Attention is also recommended for leading robot manufacturers and their core component suppliers, such as Dechang Electric and Zhongdali De [3]. Industry Updates - The humanoid robot sector is seeing advancements in autonomy and operational capabilities, with companies like UBTECH winning significant contracts for intelligent data collection projects [4][8]. - The controlled nuclear fusion industry is experiencing growth, with over 40 countries advancing fusion plans and significant private investments exceeding $10 billion [4].

国泰海通晨报:证券研究报告-20251021

GUOTAI HAITONG SECURITIES· 2025-10-21 06:08

Group 1: Market Strategy - The report emphasizes that external disturbances will not end the upward trend, and market adjustments present opportunities to increase holdings in Chinese assets [2][28] - The current market volatility is attributed to concerns over major power dynamics, but the report maintains a more optimistic outlook compared to consensus [28] - The report suggests that the current adjustment in the A-share technology sector is nearing historical averages, indicating potential for market structure improvement [28][30] Group 2: Earnings Insights - The report highlights the importance of the upcoming Q3 earnings reports, noting that performance during this period significantly impacts stock prices [30] - It identifies sectors with high earnings growth potential, particularly in the AI industry chain, equipment manufacturing, and certain resource sectors [30] Group 3: Industry Comparisons - The report asserts that there will be no style switch in investment focus, with emerging technology remaining the main line and cyclical finance as a dark horse [31] - It recommends focusing on sectors such as internet, semiconductor, defense, and robotics, as well as financial stocks like brokers and banks [31] Group 4: Company Focus - Lepu Biopharma - Lepu Biopharma is recognized as a leading domestic innovative drug company in the ADC combined IO layout, with expectations for rapid market penetration following the approval of MRG003 [10][12] - The company has a robust pipeline of oncology products covering immunotherapy, ADC targeted therapy, and oncolytic virus drugs, positioning it well for future growth [10][12]

第二十七届软博会隆重启幕 中建材信息再获“软件和信息技术服务竞争力百强企业”称号

Cai Fu Zai Xian· 2025-10-21 05:28

Core Viewpoint - The 27th China International Software Expo highlights the continuous progress of China's software industry, with Zhongjin Material Information Technology Co., Ltd. recognized as one of the top 100 enterprises in software and information technology services for the second consecutive year, reflecting its strong innovation capability and comprehensive competitiveness [1][3]. Group 1: Company Achievements - Zhongjin Material Information has been selected as one of the "Top 100 Enterprises in Software and Information Technology Services" at the 2025 annual innovation results release conference, showcasing its excellence in the industry [1]. - The company has maintained its position in the top 100 list for two consecutive years, indicating broad recognition of its innovation and competitiveness [1][3]. Group 2: Evaluation Criteria - The evaluation of the "Top 100 Enterprises" is guided by the Ministry of Industry and Information Technology and organized by the China Electronic Information Industry Association, assessing companies based on operational scale, economic benefits, R&D investment, technological innovation, product quality, and social responsibility [3]. Group 3: Strategic Focus - Zhongjin Material Information is focusing on consolidating its leading position in the ICT sector, promoting product diversification, and providing comprehensive solutions to partners, while seizing opportunities in domestic substitution and self-controllable development [3]. - The company is committed to deepening its engagement in emerging businesses such as intelligent machinery and new energy, while enhancing its own brand development [3]. Group 4: Technological Innovation - As an early adopter of artificial intelligence technology, Zhongjin Material Information integrates cutting-edge technologies like cloud computing, big data, IoT, and AI to enhance its core technical capabilities in self-developed digital products [3]. - The company is actively developing a digital foundation based on large models, focusing on core scenarios such as safety production, intelligent manufacturing, human resources, and data governance, providing "full-stack intelligence + scenario deep cultivation" solutions for digital transformation [3]. Group 5: Industry Outlook - The Software Expo serves as a significant platform for high-level exchanges and cooperation in the software industry, showcasing advancements in open-source software, fintech, manufacturing services, and digital transformation for SMEs [5]. - Zhongjin Material Information plans to continue responding to national strategies for high-quality software industry development, leveraging its digital ecological service platform to deepen partnerships and contribute to the integration of the digital economy with the real economy [5].

突然,集体飙升!外围,传来大消息!

券商中国· 2025-10-21 04:40

Core Viewpoint - The article highlights a significant surge in Apple-related stocks, driven by positive market sentiment and strong early sales of the iPhone 17 series, indicating a potential recovery in the consumer electronics sector [1][2][4]. Group 1: Market Performance - On October 21, Apple concept stocks experienced a collective rise, with related indices increasing nearly 3%. Notable gains included Fuliwang rising over 12% and Huanxu Electronics hitting the daily limit [1]. - Following a strong performance in the U.S. market, where Apple shares rose approximately 4% to a record high of $262.24 per share, the total market capitalization reached $3.89 trillion, surpassing Microsoft [4]. Group 2: Sales Data and Analyst Insights - Counterpoint Research reported that early sales of the iPhone 17 series in China and the U.S. were robust, with sales 14% higher than the iPhone 16 series. The basic model saw nearly double the sales in China, while the iPhone 17 Pro Max experienced rapid demand growth in the U.S. [2][4]. - Melius Research analysts noted that Apple has one of its strongest long-term product roadmaps in years, with expectations for new product categories to drive revenue and profit growth [5]. Group 3: Market Sentiment and Structural Changes - Analysts observed a shift in market sentiment due to easing trade tensions, leading to a notable recovery in risk appetite. This was reflected in the performance of various indices, with the ChiNext Index rising over 3% [7]. - The article discusses the potential for a structural change in the market, suggesting that the recent adjustments may not solely be due to trade relations but also reflect deeper economic factors [8][9].

百亿金融科技ETF(159851)涨逾1%,资金抢筹5400万份!高交投环境下,关注板块强贝塔属性

Xin Lang Ji Jin· 2025-10-21 03:32

Group 1 - The financial technology sector experienced a broad increase, with the China Securities Financial Technology Theme Index rising over 1% during the morning session on the 21st [1] - Key stocks leading the gains included Yinzhijie, Shuiyou Co., and Geling Shentong, each rising over 3%, while several others, such as Caifu Trend and Zhongke Soft, increased by over 2% [1] - The financial technology ETF (159851), which has a scale exceeding 10 billion, continued to rebound by over 1% with significant premium and real-time net subscriptions of 54 million units [1][3] Group 2 - The financial IT sector combines financial and technological attributes, benefiting from increased market participation and improved institutional performance, which enhances IT budgets [3] - The financial technology ETF (159851) and its linked funds are recommended, as the index primarily consists of computer-related stocks, aligning with current investment trends towards self-sufficiency and domestic substitution [3] - As of October 20, the financial technology ETF (159851) had a scale exceeding 10 billion, with an average daily trading volume of 800 million over the past month, leading in scale and liquidity among seven ETFs tracking the same index [3]

“申”度解盘 | 市场震荡加大,热点有所切换

申万宏源证券上海北京西路营业部· 2025-10-21 02:52

Market Overview - The A-share market experienced significant fluctuations this week, with technology stocks undergoing corrections and some funds flowing back into consumer and dividend sectors [7] - The market opened sharply lower due to escalating Sino-U.S. trade tensions but stabilized later, driven by sectors such as self-sufficiency, rare earth permanent magnets, and banking [8] - The AI industry chain showed signs of stabilization in the latter half of the week, influenced by optimistic expectations for the industry's future from the 2025 OCP Global Summit, although individual stock performances varied [8][10] Sector Performance - The solid-state battery and nuclear fusion sectors saw rebounds this week, indicating a recovery in new energy technology stocks [8] - The robotics sector was notably active, with rumors of a major order for humanoid robots from a core supplier in Tesla, leading to a significant rise in the sector despite subsequent clarifications from listed companies [8] - The banking sector performed well, with Agricultural Bank's stock price returning to historical highs near early September levels [9] Investment Outlook - Investors are advised to monitor the progress of Sino-U.S. trade negotiations, as the index has accumulated a certain level of gains since the beginning of the year [10] - The upcoming third-quarter report disclosures at the end of October are expected to influence market performance, with the banking sector likely to lead the Shanghai Composite Index in the short term [10] - In the medium term, sectors such as AI, new energy, and innovative pharmaceuticals are anticipated to remain the main themes for future market trends [10]