外贸

Search documents

前三季度全市经济运行稳中有进

Zheng Zhou Ri Bao· 2025-10-31 00:45

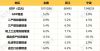

Economic Overview - The city's GDP for the first three quarters reached 11,189.8 billion yuan, with a year-on-year growth of 5.4% [1] - The primary industry added value was 153.1 billion yuan, growing by 2.9%; the secondary industry added value was 4,173.7 billion yuan, growing by 5.6%; and the tertiary industry added value was 6,863.0 billion yuan, growing by 5.3% [1] Industrial Performance - The agricultural sector showed stable growth, with total output value in agriculture, forestry, animal husbandry, and fishery increasing by 3.2% year-on-year [2] - The industrial economy saw an increase of 8.8% in the added value of above-scale industries, surpassing the provincial average by 0.4 percentage points [2] - Key industries such as automotive and electronics experienced significant growth, with respective increases of 19.2% and 11.8%, contributing 5.7 percentage points to the overall industrial growth [2] Service Sector Development - The service sector is developing well, with above-scale service industry revenue increasing by 10.4% year-on-year, exceeding the provincial average by 2.4 percentage points [2] - Nine out of ten major service industry categories reported year-on-year growth, with cultural, sports, and entertainment sectors growing by 12.1% and transportation and logistics by 9.4% [2] Investment and Consumption - Fixed asset investment grew by 4.5% year-on-year, with significant contributions from projects over 100 million yuan, which saw a 12.8% increase [3] - Private investment rose by 9.5%, higher than the provincial average, contributing 5.4 percentage points to overall investment growth [3] - Retail sales of consumer goods reached 4,903.9 billion yuan, with a year-on-year growth of 5.6%, driven by strong demand in sports and cultural products [3] Foreign Trade and Public Spending - The city's import and export volume reached 4,332.5 billion yuan, growing by 25.3% year-on-year, outpacing the provincial growth rate [4] - Public budget expenditures in key areas such as energy conservation and transportation saw significant increases, with growth rates of 71.4% and 49.2% respectively [4] Innovation and New Industries - The city is focusing on integrating technological and industrial innovation, with high-tech industries seeing added value growth of 10.2% [5] - New products such as lithium-ion batteries and electric vehicles have shown substantial production increases, with growth rates of 49.5% and 15.0% respectively [5][6] - E-commerce and new consumption models are rapidly emerging, with online retail sales increasing by 19.8% year-on-year [6]

商务部:增强外贸企业绿色低碳发展意识 加快推动物流绿色低碳发展

智通财经网· 2025-10-30 13:43

Core Viewpoint - The Ministry of Commerce has released implementation opinions to expand green trade, emphasizing the importance of enhancing the awareness and capabilities of foreign trade enterprises in green and low-carbon development [1][3]. Group 1: Enhancing Green Low-Carbon Development Capabilities - Foreign trade enterprises are encouraged to strengthen their awareness of green low-carbon development through training and dissemination of domestic and international legal policies and market dynamics [4][5]. - The implementation opinions promote the adoption of green design and production practices, urging enterprises to utilize renewable energy and reduce carbon emissions through updated equipment and processes [4][5]. - A focus on logistics is highlighted, with recommendations for long-distance transportation to shift from road to rail and water, and the use of environmentally friendly packaging materials [5][6]. Group 2: Expanding Green Low-Carbon Products and Technologies - The opinions call for enhancing the international competitiveness of green low-carbon products, encouraging the use of recycled materials and the development of sustainable fuel trade [6][7]. - There is an emphasis on understanding international market demands for green trade, with support for enterprises to leverage free trade agreements to expand cooperation in green low-carbon sectors [6][7]. - The opinions also advocate for increasing the greenization of exhibitions, promoting the establishment of dedicated green low-carbon exhibition areas at major trade events [7]. Group 3: Creating a Favorable International Environment for Green Trade - The Ministry aims to strengthen international communication and collaboration on green trade rules through participation in global forums [8][9]. - There is a push for the establishment of standards that align with international green low-carbon product and service standards, facilitating mutual recognition [8][9]. - The opinions encourage the development of a robust support system for green trade, including financial policy support and the establishment of carbon footprint databases [9][10]. Group 4: Strengthening Support Systems for Green Trade - Financial institutions are encouraged to develop products and services based on carbon footprint assessments to support green low-carbon product exports [9][10]. - The establishment of a national carbon footprint database is prioritized to assist foreign trade enterprises in calculating their product carbon footprints [9][10]. - The opinions highlight the importance of talent development in green trade, advocating for research and training programs to cultivate expertise in this area [10].

中三省前三季度GDP总值突破11万亿,齐步跑赢全国

Di Yi Cai Jing· 2025-10-29 03:56

Economic Performance - The GDP of Hunan, Hubei, and Jiangxi provinces reached 110,796.38 billion yuan in the first three quarters, an increase of 7,092.83 billion yuan compared to the same period last year [1] - Hubei's GDP was 44,875.62 billion yuan, growing by 6.0%, which is 0.8 percentage points higher than the national average [1] - Hunan and Jiangxi achieved GDPs of 40,240.56 billion yuan and 25,680.2 billion yuan, respectively, both growing by 5.4%, exceeding the national growth rate by 0.2 percentage points [1] Innovation and High-tech Investment - Hubei's high-tech industry investment grew by 8.3%, outpacing overall investment growth by 1.8 percentage points [2] - The added value of Hubei's high-tech manufacturing and equipment manufacturing increased by 13.5% and 10.9%, respectively [2] - Hunan's high-tech manufacturing added value grew by 13.8%, 6.0 percentage points higher than the overall industrial growth rate [3] - Jiangxi's high-tech manufacturing added value increased by 12.4%, with the new energy vehicle sector growing by 54.1% [3] Consumer Spending - The total retail sales of consumer goods in Hunan, Hubei, and Jiangxi reached 44,285.26 billion yuan, with growth rates exceeding the national average [4] - Hubei's retail sales for new energy vehicles and home appliances grew by 19.9% and 21.6%, respectively [4] - In Hunan, retail sales of smart devices increased significantly, with smart phones growing by 81.6% [4] Trade and Exports - The total import and export value of Hubei, Hunan, and Jiangxi reached 13,663.5 billion yuan, with Hubei's growth rate surpassing the national average by 21.3 percentage points [7] - Hubei's exports of electromechanical products accounted for over 50% of its total exports, reaching 2,191.7 billion yuan, a growth of 19.8% [8] - Jiangxi's exports of photovoltaic products increased by 39.3%, while lithium battery exports surged by 90.5% [8]

冲刺在即,宁波能否再进位?

3 6 Ke· 2025-10-28 02:07

Economic Overview - Ningbo's GDP for the first three quarters of 2025 reached 1,349.29 billion yuan, with a year-on-year growth of 5.0% at constant prices [1] - The primary industry added value was 30.11 billion yuan, growing by 3.6%; the secondary industry added value was 573.65 billion yuan, growing by 4.3%, with industrial output at 526.20 billion yuan, growing by 5.6%; the tertiary industry added value was 745.53 billion yuan, growing by 5.5% [1] Comparative Analysis - Ningbo's GDP growth rate of 5.0% is lower than the national average of 5.2% and the provincial average of 5.7% [2] - The secondary industry's added value growth of 4.3% is also below the national and provincial levels by 0.6 and 0.9 percentage points, respectively [2] - The city's fixed asset investment saw a significant decline of 18.1%, contrasting with a national decrease of 0.5% and a provincial decrease of 3.8% [2] Foreign Trade Performance - Ningbo's total import and export volume exceeded 1 trillion yuan, reaching 1,092.26 billion yuan, with a year-on-year growth of 3.7%, which is below the national growth of 4.0% and provincial growth of 6.2% [3] - The city's foreign trade dependency is notably high at 78.3%, significantly above the national average of 32.5% and the provincial average of 58.4%, indicating greater vulnerability to external shocks [3] Future Outlook - Ningbo aims to achieve a GDP of over 2 trillion yuan by 2025, with a current GDP of 1,814.77 billion yuan in 2024, indicating a close competition with Nanjing [1] - The city faces challenges in maintaining economic momentum and is urged to enhance efforts in stabilizing and improving economic conditions [3]

广州越秀:靶向精准服务 支持外贸企业逐浪前行

Sou Hu Cai Jing· 2025-10-28 00:20

Group 1 - The 138th China Import and Export Fair (Canton Fair) is being held from October 23 to 27, focusing on the theme of "Quality Home Furnishings," with an exhibition area of 515,000 square meters and over 10,000 participating companies, including nearly 3,000 high-quality enterprises [1] - The Guangzhou Yuexiu district has implemented measures such as expedited export tax refunds and smart tax services to support the high-quality development of foreign trade enterprises [1] - Guangzhou Light Export Group, established in 1956, has diversified its business and achieved an annual export volume of approximately $200 million, leveraging the Canton Fair to deepen its market presence in Southeast Asia [3] Group 2 - The average processing time for export tax refunds for AEO-certified enterprises has been reduced to within three working days, significantly enhancing cash flow and reducing financing needs for companies [3] - Guangdong Overseas Ousheng Company, a leading player in the toy industry, has benefited from expedited tax refunds, with a reported refund of over 3.1 million yuan this year, which has improved its credibility and attracted more quality suppliers [5] - The tax authorities have established a "Chief Tax Service Officer" team to provide one-on-one services during the Canton Fair, ensuring efficient resolution of tax-related issues for participating companies [5]

稳坐“浙江第一” 杭州余杭三季度经济数据出炉

Sou Hu Cai Jing· 2025-10-27 07:10

Economic Performance - In the first three quarters, Yuhang District achieved a GDP of 271.32 billion yuan, with a year-on-year growth of 7.0% [1] - The total fiscal revenue reached 68.11 billion yuan, and general public budget revenue was 35.91 billion yuan, maintaining the top position in Zhejiang Province [1] Technological Innovation - Yuhang District has enhanced its technological innovation capabilities by focusing on "large scientific devices + major scientific plans + key laboratories + new R&D institutions" [2] - The core equipment of the supergravity centrifuge simulation and experimental device has been officially launched, providing critical technical support for major engineering and cutting-edge research [2] - The world's first brain-like computer with over 2 billion neurons has been successfully developed in the district, showcasing its advantages in the intersection of brain science and artificial intelligence [2] Technology Transfer and Service Industry - The district has accelerated the pace of technology transfer, with 120 technology transfer projects established this year [4] - The service industry, centered on information software, saw a value-added growth of 7.3%, ranking first in Hangzhou [4] - From January to August, the revenue of the above-scale service industry grew by 12.4% [4] - A total of 55,600 new market entities were registered this year, a year-on-year increase of 26.25%, leading in both total and incremental numbers in Hangzhou [4] Foreign Trade - Yuhang District's foreign trade demonstrated strong resilience, with total imports and exports growing by 15.1% in the first three quarters [5] - Exports increased by 11.2%, while imports surged by 70.2% [5] - Notable performances include Saturn Power's all-terrain vehicle, which attracted significant overseas interest, and Tanglian's dashcam products leading sales on Amazon in multiple countries [5] Industrial Development - The industrial sector maintained steady growth, with above-scale industrial value-added increasing by 6.3% [6] - Strategic emerging industries saw an 8.9% increase in value-added, while equipment manufacturing grew by 7.4% [6] Cultural and Tourism Integration - The Liangzhu 5000+ Art Creation Park has become a popular destination, featuring over 200 domestic and international cultural institutions and brands [7] - The district has promoted deep integration of culture, sports, and tourism, issuing 5 million yuan in consumption vouchers to stimulate related consumption [7] - Social retail sales increased by 11.0% year-on-year, with policies like trade-in programs driving over 12 billion yuan in related consumption [7] Cultural Industry Support - New support policies have been introduced to enhance cultural exports and the gaming and e-sports sectors, facilitating the deep integration of cultural industries with the digital economy [9] - Yuhang District is actively expanding new growth areas while stabilizing the service industry, laying a solid foundation for achieving annual economic and social development goals [9]

管涛:年内宏观政策或需适时加力 | 立方大家谈

Sou Hu Cai Jing· 2025-10-26 12:50

Core Insights - China's economy has shown overall stability in 2023, with GDP growth of 5.2% year-on-year in the first three quarters, which is 0.4 percentage points higher than the same period last year, laying a solid foundation for achieving the annual growth target of around 5% and the successful completion of the 14th Five-Year Plan [2][10] - There are notable strengths in both production and demand, but since the third quarter, there has been a clear weakening in both consumption and investment, highlighting insufficient internal growth momentum [1][6] Economic Performance - Industrial production has improved, with the value-added of industrial enterprises above a designated size increasing by 6.2% year-on-year in the first three quarters, and high-tech manufacturing growing by 9.6% [2][3] - The retail sales of consumer goods increased by 4.5% year-on-year, with significant growth in categories like home appliances and furniture, indicating a recovery in consumer spending [4][7] External Trade and Policy Response - Despite external pressures, China's exports have shown resilience, with a 6.1% year-on-year increase in the first three quarters, even as exports to the U.S. fell by 16.9% [3][10] - The government has implemented proactive macroeconomic policies to support external trade and stabilize economic growth, including a broad deficit rate of 8.7% and a macro leverage ratio increase of 9.1 percentage points [3][10] Consumption and Investment Trends - Consumption recovery is fragile, with retail sales growth slowing to 3% in September, the lowest since December of the previous year, reflecting the diminishing effects of previous policies and weak consumer confidence [7][8] - Fixed asset investment has been declining, with a 0.5% year-on-year decrease in September, marking the first negative growth since September 2020, particularly in real estate development, which fell by 13.9% [8][9] Future Outlook and Policy Adjustments - The fourth quarter is traditionally a peak season for consumption, and the government is expected to enhance policies to stimulate consumption and investment, including the issuance of special bonds and financial tools [11][12] - The recent Central Committee meeting emphasized the need for sustained macroeconomic policy efforts to stabilize employment, businesses, and market expectations, indicating a focus on maintaining economic momentum [12][13]

中国三大经济区外贸“成绩单”亮眼 规模与结构双提升

Yang Shi Wang· 2025-10-26 02:24

Core Insights - The foreign trade in major economic regions of China, including the Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area, and Beijing-Tianjin-Hebei, has shown resilience and vitality in the first three quarters of this year [1] Group 1: Yangtze River Delta - The Yangtze River Delta region's import and export volume reached 12.62 trillion yuan, a year-on-year increase of 6.6%, marking a historical high for the same period [3] - Exports from the region amounted to 8.04 trillion yuan, growing by 10%, while imports were 4.58 trillion yuan, with a growth of 1% [3] - Private enterprises contributed 7.05 trillion yuan to the region's foreign trade, accounting for 55.9% of the total, with a growth rate of 10.7%, indicating their significant role as the main force in foreign trade [3] Group 2: Guangdong-Hong Kong-Macao Greater Bay Area - The import and export volume of the nine cities in the Guangdong-Hong Kong-Macao Greater Bay Area reached 6.77 trillion yuan, reflecting a year-on-year growth of 4.1% [5] - Exports of high-tech products and "new three types" products increased by 10.6% and 30.6% respectively, showcasing a shift towards high value-added and green products [5] Group 3: Beijing-Tianjin-Hebei - The Beijing-Tianjin-Hebei region maintained stable trade relations with over 240 countries and regions, with an import and export volume of 3.51 trillion yuan [7] - Exports reached 1.07 trillion yuan, a historical high for the same period, with a year-on-year growth of 5.2%, continuing to grow for six consecutive months [7] - Exports to countries involved in the Belt and Road Initiative accounted for over 50% of the region's total exports, with significant growth in emerging markets such as Latin America, Africa, and Central Asia, increasing by 15.2%, 31%, and 40.8% respectively [7]

广东经济三季报:“稳”与“升”交织中释放新结构性潜能

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 14:15

Economic Overview - Guangdong's GDP for the first three quarters reached 10,517.698 billion yuan, with a year-on-year growth of 4.1%, showing a stable economic performance [2] - The primary industry added value was 383.85 billion yuan (4.5% growth), the secondary industry 3,927.075 billion yuan (2.7% growth), and the tertiary industry 6,206.773 billion yuan (4.9% growth) [2] Industrial Growth - Guangdong's industrial production growth rate increased to 3.5% year-on-year, up 1.3 percentage points from January to August [4] - Advanced manufacturing and high-tech manufacturing sectors saw value-added growth of 5.4% and 6.4%, respectively, accounting for 55.5% and 33.8% of total industrial value-added [4] - Notable increases in production for industrial robots (33.7%), service robots (15.2%), civilian drones (44.8%), and 3D printing equipment (40.3%) were reported [4] New Product Development - New products such as robots, drones, 3D printing equipment, and electric vehicles maintained double-digit growth rates in production [3] - Investment in research and experimental development, internet services, and software and IT services grew by 12.7%, 81.2%, and 23.5%, respectively [3][7] Service Sector Performance - The service sector's value-added increased by 4.9%, with financial services growing by 9.8% [5] - Key service industries such as information transmission, software and IT services, and transportation saw revenue growth of 9.5%, 6.6%, and 8.3%, respectively [5] Consumption and Investment Trends - Retail sales of consumer goods grew by 2.8%, with online sales increasing by 16.2%, indicating a shift towards e-commerce [7] - Fixed asset investment decreased by 14.1%, with real estate development investment down by 20.6% [7] Foreign Trade Dynamics - Guangdong's foreign trade reached 7.02 trillion yuan, accounting for 20.9% of the national total, with a year-on-year growth of 3.8% [9] - The province is diversifying its trade markets and enhancing support for enterprises to maintain export growth amid global uncertainties [9] Future Outlook - The Guangdong provincial government emphasizes the need for confidence and proactive measures to address economic challenges and ensure a strong finish to the year [10]

跨国采购决策智能提效 中国制造网发布AI采购助手

Jing Ji Wang· 2025-10-23 08:10

Core Insights - The "2025 Global Business Conference" hosted by MIC International Station in Guangzhou focused on "Innovation and Connection," bringing together over a hundred global buyers and suppliers [1] - The event marked the launch of the AI procurement assistant SourcingAI 2.0, indicating a new phase of AI empowerment in foreign trade [1][7] Group 1: Event Overview - The conference upgraded the traditional trade fair model by integrating the 138th Canton Fair and Hong Kong MEGA SHOW, creating a seamless connection for buyers and suppliers [3] - The atmosphere at the conference was vibrant, with active trade exchanges between over a hundred overseas buyers from countries like France, Belgium, Italy, and Canada, and more than 50 selected suppliers [5] Group 2: Buyer Experience - Buyers reported high efficiency in procurement processes, with one Belgian buyer noting the seamless transition from the Hong Kong event to Guangzhou, which facilitated effective negotiations [6] - The event was part of MIC International Station's "New Maritime Plan," aimed at enhancing buyer services through targeted traffic promotion and multilingual support [6] Group 3: AI Integration - The launch of SourcingAI 2.0 represents a significant advancement in AI technology application in foreign trade, enhancing the procurement process from search to decision-making [7][9] - SourcingAI 2.0 improves procurement efficiency by 35% by providing a comprehensive AI-assisted decision-making process [9][10] - The dual AI strategy of "AI Maike" for sellers and SourcingAI 2.0 for buyers creates a closed-loop ecosystem for enhancing trade efficiency [10] Group 4: Market Performance - MIC International Station reported impressive performance in diverse markets, with traffic from the Middle East increasing by 45% year-on-year, and over 30% growth in Latin America, Africa, and Europe [6]