股强债弱

Search documents

【债市观察】股强债弱收益率“N”形走高 MLF加量续做维持流动性充裕

Xin Hua Cai Jing· 2025-10-27 02:10

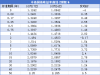

Core Viewpoint - The financial market experienced a balanced and slightly loose liquidity environment, with the stock market continuing to strengthen, as the Shanghai Composite Index reached a new high in over ten years. The bond market saw an overall pullback, with the 10-year government bond yield rising by 2.4 basis points to 1.85% [1] Market Overview - The bond market saw fluctuations in yields across various maturities, with the 1-year, 2-year, 3-year, 5-year, 7-year, 10-year, 30-year, and 50-year government bond yields changing by 2.82 BP, -0.17 BP, 1.54 BP, 2.75 BP, 3.72 BP, 2.4 BP, 1.24 BP, and 3.5 BP respectively from October 17 to October 24, 2025 [2] - The 10-year government bond yield experienced a notable increase, particularly on October 20, where it rose by 2.05 BP to 1.768% due to poor auction results [2][3] Monetary Policy - The central bank announced that it would continue to inject liquidity into the market, maintaining a supportive monetary policy stance, with the MLF (Medium-term Lending Facility) being increased for the eighth consecutive month [1][11] - The central bank's operations included a total of 867.2 billion yuan in 7-day reverse repos, indicating ongoing efforts to manage liquidity [11] Economic Indicators - The third quarter GDP growth was reported at 5.2%, with the primary, secondary, and tertiary industries showing growth rates of 3.8%, 4.9%, and 5.4% respectively [13] - The total balance of RMB loans by financial institutions reached 270.39 trillion yuan, reflecting a year-on-year growth of 6.6% [14] International Market - The U.S. Treasury yields exhibited a V-shaped trend, with the 10-year yield stabilizing at 4.01% after a decline earlier in the week [8] - The U.S. federal government debt surpassed 38 trillion dollars, highlighting ongoing fiscal challenges [10] Institutional Insights - Analysts suggest that the bond market may continue to experience a range-bound trading pattern due to uncertainties surrounding U.S.-China trade negotiations and monetary policy adjustments [15][16] - There is a growing interest in credit bonds, which are perceived to offer some protection against interest rate fluctuations, although institutional investors remain cautious due to market conditions [17]

可转债周度追踪:新一轮宏观事件主导期-20251012

ZHESHANG SECURITIES· 2025-10-12 13:06

Report Summary 1. Report Industry Investment Rating The document does not provide the industry investment rating. 2. Core Viewpoints - Short - term equity markets are expected to adjust due to Sino - US relations, but the long - term trend of stronger stocks and weaker bonds may not reverse. The adjustment of the equity market will determine the subsequent trend of convertible bonds, which are likely to show resilience. [1][2][11] - Structural opportunities in convertible bonds are better than overall market conditions. Low - premium varieties are more resilient, and mid - and low - priced convertible bonds have strong gaming value. Investors can select varieties with "double - low" (low price + low premium) or "low price + high elasticity" potential. [2][11] - Convertible bonds in a high - valuation state show stagnation and vulnerability. However, there are positive signals on the supply side, and the market may improve marginally in 2026. The recent tariff issue is likely to be a one - time shock rather than a trend - setting impact. [4][9][10] 3. Summary by Directory 3.1 1. Convertible Bond Weekly Thinking - High - valuation convertible bonds show stagnation and vulnerability. ETF and "fixed - income +" funds have small net outflows, but the pace has slowed. [9] - There are positive signals on the supply side, with an increase in issuance plans and faster regulatory approvals, which may alleviate the "few bonds and high prices" situation. [4][10] - The recent tariff issue is more of a threat than an actual operation, and the market may view it as a one - time shock. [4][10] - Short - term equity market adjustment is expected, but convertible bonds are likely to be resilient. Structural opportunities are better, and specific convertible bonds are recommended for October. [11][12] 3.2 2. Convertible Bond Market Tracking - **2.1 Convertible Bond Market Conditions**: The document provides the performance of various convertible bond indices in different time periods, such as the WanDe Convertible Bond Energy Index, WanDe Convertible Bond Materials Index, etc. [17] - **2.2 Convertible Bond Individual Securities**: The document does not provide specific summarized content for this part. - **2.3 Convertible Bond Valuation**: The document shows the valuation trends of different types of convertible bonds, including bond - type, balanced, and stock - type convertible bonds. [21][23][25] - **2.4 Convertible Bond Price**: The document presents the proportion trend of high - price bonds and the median price trend of convertible bonds. [32][34]

中泰证券:海外降息落地不改变“股强债弱”的趋势

Xin Lang Cai Jing· 2025-09-21 23:36

Group 1 - The bond market risks have not been resolved, and there is still room for adjustment within the year, with an upper limit potentially exceeding 1.8% [1] - Market expectations regarding monetary policy provide some support at key levels, but these expectations can eventually lead to either a positive or negative outcome [1] - The trend of "strong stocks and weak bonds" remains unchanged despite overseas interest rate cuts [1] Group 2 - The equity market is currently in a phase of risk appetite increase, and overseas interest rate cuts may provide emotional support [1] - Institutional reallocation between equity and bond assets continues, making it easier for bond rates to rise but harder for them to fall [1] - Recent rebounds in domestic commodities driven by policy expectation speculation may face a phase of correction [1]

策略日报:蓄势-20250916

Tai Ping Yang Zheng Quan· 2025-09-16 14:42

Group 1: Macro Asset Tracking - The bond market showed a low opening and high closing trend, with a slight increase. The expectation is that the bond market will hit a new low for the year, targeting the low point around September 30, 2024, when the policy shifted last year [1][11] - The A-share market is maintaining a bullish trend, with a significant increase in trading volume and volatility after breaking the high point from October 8 last year. The outlook suggests that the stock market will continue to outperform the bond market [1][11] - The overall market is experiencing a V-shaped reversal, with the ChiNext index leading the gains among the three major indices. The total trading volume reached 2.36 trillion, with over 3,500 stocks rising, indicating a strong market consolidation at high levels [2][14] Group 2: A-Share Market Insights - The current Equity Risk Premium (ERP) for the A-share market is at 4.02%, which is significantly lower than historical lows observed in 2008, 2015, and 2021, indicating potential for further declines [2][14] - The ratio of total A-share market capitalization to GDP is currently at 0.75, which is 77% and 43% lower than the historical peaks in January 2008 and June 2015, respectively, suggesting room for growth in market capitalization relative to the economy [2][14] - The ratio of household deposits to A-share market capitalization is at 1.7, indicating that the process of reallocating household funds into the stock market may still be ongoing [2][14] Group 3: U.S. Market Overview - The U.S. stock market saw all three major indices rise, with the Nasdaq increasing by 0.94%, the Dow Jones by 0.11%, and the S&P 500 by 0.47%. The weak employment data has set the stage for a rate cut in September, although the market's pricing of a 50 basis point cut may be overly optimistic [3][17] - The U.S. economy remains robust, with second-quarter GDP growth revised upward, supporting a stable employment market. The labor market's slowdown provides a basis for the Federal Reserve's dovish stance [3][17] Group 4: Currency Market Analysis - The onshore RMB against the USD was reported at 7.1151, down 83 basis points from the previous close. The weak non-farm data has led to a decline in the dollar, while the offshore RMB has returned to an upward trend [4][23] - The recommendation is to short the dollar with a stop loss at the 99 level, while also suggesting that investing in A-shares, Hong Kong stocks, or precious metals like gold and silver may be better options compared to shorting the dollar [4][23] Group 5: Commodity Market Trends - The Wenhua Commodity Index rose by 0.66%, with coal and construction materials leading the gains, while corn and live pig sectors lagged. The index is supported at the intersection of the 60-day and half-year moving averages [5][26] - Despite the potential for a breakdown below support levels, the strong stock market and weak bond market combination suggests a bullish outlook for commodities, with a focus on long positions while managing risk [5][26] Group 6: Important Policies and News - The Ministry of Commerce and nine other departments released measures to expand service consumption, proposing 19 initiatives to stimulate consumer activity [6][29] - The People's Bank of China emphasized the need for global financial governance reform in response to new challenges in the financial stability framework [6][29] - Guangdong province is promoting AI integration in the toy industry, exploring new market opportunities through the combination of AI, toys, and robotics [6][29]

经济读数平淡

ZHONGTAI SECURITIES· 2025-09-15 11:31

Group 1: Summary of the Core View - The current economic readings are rather dull, with the overall production growth slowing down in August. The single - month economic data is prone to fluctuations, but the internal economic momentum continues to recover [4][5][7] - The contradiction in current asset pricing does not lie in the fundamentals. The "stock - strong, bond - weak" situation is the result of institutional re - allocation of stock and bond assets, and single - month data fluctuations will not change the current risk - preference environment or the expected direction of institutional asset re - allocation [6] - When dealing with the bond market, one should adopt a trading - based approach, focus on the opportunities of structural term spreads and variety spreads, as the bond market remains a "weak asset" and single - month economic data is unlikely to change the trend [9] Group 2: Industry Data Analysis Industrial Industry - In the upstream of the industrial industry, the production of non - ferrous metal processing, non - metallic products, and chemical raw material products has accelerated year - on - year. In the mid - and downstream equipment and consumer goods manufacturing, the output growth of the pharmaceutical and special equipment production has accelerated. The growth rate of industrial added value in other industries has declined compared with last month [4] - In August, the industrial added value increased by 5.2% year - on - year, with a growth rate 0.5 percentage points lower than that of last month. Among the three major sectors, the production growth rate of the mining industry has rebounded, while the year - on - year growth rates of the manufacturing and the production and supply of electricity, heat, gas, and water have declined [7] Service Industry - The growth rate of service industry production has slowed down. In August, the service industry production index increased by 5.6% year - on - year, with a growth rate 0.2 percentage points lower than that of last month. The prosperity of producer services such as information technology, finance, and leasing is higher than the overall service industry [4] Investment - The growth rate of fixed - asset investment has slowed down. In August, the completed amount of fixed - asset investment decreased by 7.15% year - on - year, 1.81 percentage points lower than that of last month. Among them, real estate, infrastructure, and manufacturing investments decreased by 19.5%, 6.4%, and 1.3% year - on - year respectively [8] - Real estate sales and investment continue to bottom out, with the decline in sales prices narrowing. In August, the sales volume and sales area of commercial housing decreased by 14% and 10.6% year - on - year respectively. The real estate new construction area and completion area decreased by 20.3% and 21.4% year - on - year respectively [8] Consumption - In terms of consumption, catering consumption is recovering, while commodity consumption has slowed down, which may be affected by the "national subsidy" rhythm adjustment in some provinces. In August, the total retail sales of consumer goods increased by 3.4% year - on - year, with a growth rate 0.3 percentage points lower than that of last month [8] - Among commodity consumption, the year - on - year growth rates of gold and silver jewelry, household appliances, and communication equipment have changed significantly compared with last month. The sales volume of gold and silver jewelry may be related to the rapid rise in precious metal prices, while the slowdown of household appliances and communication equipment may be affected by the "national subsidy" rhythm adjustment after the "618" promotion [8] Group 3: Impact of Economic Data - After the release of economic data, bond yields first declined and then rose. The bond market has experienced an oversold rebound recently. After the release of economic data, the long - term bond yields rebounded, but then rose again [7] - Single - month economic data is affected by policy rhythm changes and structural transformation, and its fluctuations are unlikely to change the overall trend. Although the overall economic data in August is not outstanding, the internal economic momentum continues to recover [5][6]

近5日连续“吸金”超15亿,30年国债ETF(511090)交投活跃,盘中成交超60亿!

Sou Hu Cai Jing· 2025-09-11 04:26

Core Viewpoint - The 30-year Treasury ETF has shown active trading and significant net inflows, indicating investor interest despite recent declines in bond prices due to inflation data [1] Group 1: Market Performance - As of September 11, 2025, the 30-year Treasury ETF is priced at 118.16 yuan, with a trading volume of 60.84 billion yuan and a turnover rate of 19.46% [1] - The average daily trading volume for the past month is 108.25 billion yuan, reflecting a vibrant market activity [1] Group 2: Fund Size and Inflows - The latest size of the 30-year Treasury ETF is 31.252 billion yuan, with a total net inflow of 15.97 billion yuan over the past five days, averaging 3.19 billion yuan per day [1] - The highest single-day net inflow recorded was 5.12 billion yuan [1] Group 3: Economic Indicators - On September 10, the national statistics bureau reported a 0.4% year-on-year decline in the Consumer Price Index (CPI) for August, which contributed to the adjustment in the bond market [1] - The Producer Price Index (PPI) showed a 2.9% year-on-year decline, ending an eight-month downward trend, which has drawn significant market attention [1] Group 4: Analyst Insights - According to Zhongtai Securities, bonds are considered "weak assets," suggesting a cautious approach to bond investments [1] - The preference for equities over bonds is driven by institutional rebalancing demands, influencing capital allocation between these asset classes [1]

国债期货日报-20250905

Nan Hua Qi Huo· 2025-09-05 10:20

Report Overview - Report Title: Treasury Bond Futures Daily Report - Report Date: 2025/09/05 - Analyst: Xu Chenxi (Investment Consulting License Number: Z0001908) - Investment Consulting Business Qualification: CSRC License [2011] 1290 [1] Industry Investment Rating - Not provided in the report Core View - The report suggests a trading strategy of taking advantage of market fluctuations. It advises buying on dips and setting profit targets. The bond market may continue to fluctuate in a situation where stocks are strong and bonds are weak, as long as the A-share market does not show an obvious downward trend [2][4] Key Points Summarized by Section Market Performance - On Friday, Treasury bond futures opened lower and closed down across the board, with TL experiencing the largest decline. Spot bond yields rose across the board but fell back after the futures market closed. The open market had a net withdrawal of 59.46 billion yuan. The funding situation was loose, with DR001 remaining around 1.31% [2] - The A-share market's sharp adjustment the previous day did not bring more upward momentum to the bond market. Instead, the bond market declined as the stock market rebounded strongly. The 30-year Treasury bond issuance rate was slightly higher, and the situation was mediocre [4] Specific Contract Data | Contract | 2025-09-05 Price | 2025-09-04 Price | Change | 2025-09-05 Position | 2025-09-04 Position | Position Change | | --- | --- | --- | --- | --- | --- | --- | | TS2512 | 102.388 | 102.44 | -0.052 | 73,830 | 76,004 | -2,174 | | TF2512 | 105.58 | 105.745 | -0.165 | 139,550 | 142,981 | -3,431 | | T2512 | 107.92 | 108.27 | -0.35 | 218,747 | 217,136 | 1,611 | | TL2512 | 116.3 | 117.4 | -1.1 | 142,701 | 140,684 | 2,017 | [5] Basis and Trading Volume Data | Contract | 2025-09-05 Basis | 2025-09-04 Basis | Basis Change | 2025-09-05 Trading Volume | 2025-09-04 Trading Volume | Volume Change | | --- | --- | --- | --- | --- | --- | --- | | TS (CTD) | -0.0605 | -0.0299 | -0.0306 | 32,921 | 31,545 | 1,376 | | TF (CTD) | -0.0455 | 0.0269 | -0.0724 | 75,029 | 62,934 | 12,095 | | T (CTD) | 0.3381 | 0.3866 | -0.0485 | 92,512 | 83,913 | 8,599 | | TL (CTD) | 0.6967 | 0.8792 | -0.1825 | 169,741 | 135,244 | 34,497 | [7] Market News - The Ministry of Industry and Information Technology and the State Administration for Market Regulation issued the "Stable Growth Action Plan for the Electronic Information Manufacturing Industry from 2025 - 2026" [3] - US ADP employment growth in August slowed significantly to 54,000, and the number of initial jobless claims last week reached the highest level since June [3] - The weighted winning bid yields for the 1-year and 30-year Treasury bonds issued by the Ministry of Finance were 1.3485% and 2.1139% respectively, with full - scale multiples of 2.33 and 3.02, and marginal multiples of 1.61 and 4.46 [3]

公募基金上半年盈利超6361亿元 权益类基金成“盈利担当”

Huan Qiu Wang· 2025-09-01 07:08

Group 1 - The core viewpoint of the articles highlights a significant rebound in the A-share market during the first half of 2025, with equity assets driving strong performance in public funds, resulting in an overall investment income of 636.17 billion yuan [1] - Equity funds, particularly stock and mixed funds, have shown remarkable performance, contributing over 334.44 billion yuan to the total public fund income, which is more than half of the overall earnings [2] - The bond and money market funds have seen a decline in profitability compared to the same period last year, with bond funds earning 95.50 billion yuan and money market funds earning 95.45 billion yuan [2] Group 2 - The trend of increasing concentration among top fund companies is evident, with 162 fund companies reporting positive investment returns, and only 7 companies posting losses [4] - Leading companies such as E Fund and Huaxia Fund achieved investment returns exceeding 55 billion yuan, showcasing their strong market positioning [4] - The performance of broad-based ETFs has been particularly strong, with the Huatai-PB CSI 300 ETF leading with a profit of 8.1 billion yuan, indicating their effectiveness in capturing market rebounds [5] Group 3 - The structural differentiation in fund performance is notable, with broad-based ETFs dominating the profit rankings, while thematic index funds, particularly in sectors like liquor and photovoltaic, faced significant losses [5] - The top ten loss-making products are predominantly passive funds, highlighting the challenges faced by thematic funds in a rapidly changing market environment [5]

分析人士:短期股强债弱格局延续

Qi Huo Ri Bao· 2025-08-26 22:31

Group 1 - The core viewpoint of the articles indicates a persistent "see-saw" market trend where equities are strong while bonds are weak, driven by monetary policy expectations and market dynamics [1][2][3] - Analysts suggest that the recent rebound in government bond futures is primarily due to a net MLF injection of 300 billion yuan by the central bank, reflecting a monetary easing stance [1][3] - Historical data shows that since 2010, the "see-saw" trend has occurred 13 times, lasting an average of about 3 months, with the Shanghai Composite Index rising approximately 20% during these periods [2] Group 2 - The current "see-saw" trend has lasted about 1.5 months, with the Shanghai Composite Index up 10% and 10-year and 30-year government bond yields rising by 14 basis points and 22 basis points, respectively [2] - Factors influencing the end of the "see-saw" trend include monetary policy, fundamental economic conditions, and significant external events [2][3] - The central bank's recent monetary policy report did not mention any plans for rate cuts or restarting government bond purchases, indicating limited room for bond market strength in the near term [2][3] Group 3 - The equity market's strong performance has led to a significant outflow of funds from the bond market, driven by a heightened profit effect in equities rather than a tightening of the economic outlook [3] - The potential for a rate cut by the central bank in the fourth quarter could provide support for the bond market, especially if it aims to stabilize the real estate sector or prevent rapid appreciation of the yuan [3][4] - The upcoming manufacturing PMI data is anticipated to have a positive impact on the bond market if it exceeds 50, while the equity market may face short-term correction pressure after recent gains [4]

盈米小帮投顾组合本周复盘+第7期信号发车

Sou Hu Cai Jing· 2025-08-22 07:24

Market Overview - The global market continued the trend of "strong stocks and weak bonds" over the past week, with overall stock market gains, particularly notable performances from Japan and A-shares, while bonds and gold weakened [1][29]. Weekly Performance Review - Global stock markets generally rose, with specific indices showing the following changes: - A-shares (CSI 300) increased by 2.84% - Hong Kong's Hang Seng Index rose by 1.08% - Japan's Nikkei 225 surged by 4.53% - The US Nasdaq 100 gained 0.80% - The German DAX increased by 0.97% - India's Sensex 30 rose by 0.83% - Vietnam's Ho Chi Minh Index increased by 2.47% - In contrast, bond markets experienced declines, with the overall bond market down by 0.56%, and US 20-year+ Treasury bonds falling by 1.12% [2][7][29]. Investment Strategies - The "Rui Ding Tou Global Version" portfolio achieved a weekly increase of 0.8%, reaching a historical high, with a year-to-date return of 11.19% [6][8]. - The "Lazy Balanced" portfolio rose by 0.53%, with a cumulative return of 7.80% year-to-date, indicating a strong performance for a conservative, balanced strategy [11]. - The "Peace of Mind Bond" portfolio declined by 0.42%, with a year-to-date return of only 0.58%, reflecting the overall weakness in the bond market [15]. Future Outlook - The company maintains a cautious outlook, aiming to preserve existing gains and avoid missing out on opportunities, with a target of maintaining over 10% returns for the year [8][12].