航空等

Search documents

富国天成红利灵活配置混合:2025年第四季度利润1569.78万元 净值增长率2.96%

Sou Hu Cai Jing· 2026-01-23 15:26

Core Viewpoint - The report highlights the performance and strategy of the FuGuo TianCheng Dividend Flexible Allocation Mixed Fund (100029) for Q4 2025, indicating a profit of 15.6978 million yuan and a net asset value growth rate of 2.96% during the quarter [2]. Fund Performance - As of January 22, the fund's unit net value was 1.018 yuan, with a three-month return of 5.18%, a six-month return of 8.87%, a one-year return of 20.48%, and a three-year return of -9.89% [3]. - The fund's Sharpe ratio over the past three years was -0.0978, ranking 1212 out of 1275 comparable funds [9]. - The maximum drawdown over the past three years was 31.26%, with the largest single-quarter drawdown occurring in Q1 2022 at 21.54% [11]. Fund Strategy and Holdings - The fund manager noted a balanced allocation strategy in Q4 2025, with a focus on stable dividend stocks and gradual increases in low-valued sectors such as travel, chemicals, and consumer goods [2]. - The average stock position over the past three years was 70.1%, compared to the industry average of 72.57% [14]. - As of Q4 2025, the fund's top ten holdings included Ningbo Bank, China Ping An, China Shenhua, China Pacific Insurance, Wens Foodstuff Group, Shaanxi Coal and Chemical Industry, Ping An Bank, Baosteel, China Southern Airlines, and Guokai Tiancheng [18]. Fund Size - The fund's total size as of the end of Q4 2025 was 535 million yuan [15].

回眸2025丨系统施治防范廉洁风险

Zhong Yang Ji Wei Guo Jia Jian Wei Wang Zhan· 2026-01-08 23:50

Core Viewpoint - Hunan Province is intensifying its focus on addressing prominent issues within state-owned enterprises (SOEs) to prevent corruption and ensure high-quality development [3][10]. Group 1: Supervision and Accountability - The Hunan Provincial Commission for Discipline Inspection and Supervision is enhancing oversight in the engineering construction sector, particularly focusing on project progress and fund utilization [3]. - In 2025, the provincial authorities reported 844 cases related to SOE issues, leading to 360 investigations involving 387 individuals [5]. - The provincial government emphasizes the importance of political supervision and accountability, particularly for key positions within SOEs, to ensure compliance with party discipline [5][6]. Group 2: Targeted Anti-Corruption Measures - A notable case involved the former deputy general manager of Hunan Construction Group, who was expelled from the party for serious violations, highlighting the crackdown on the "eating from enterprises" issue [4]. - The provincial authorities are utilizing a "room-group-enterprise" linkage mechanism to address issues in investment decisions, financial credit, and project approvals [4][5]. - The provincial government is implementing a comprehensive approach to tackle corruption, focusing on engineering bidding and supply chain management to mitigate risks [7][8]. Group 3: Education and Cultural Initiatives - The provincial authorities are conducting warning education sessions using typical cases to educate SOE employees about the consequences of corruption [9]. - Initiatives include organizing activities for party members to strengthen their commitment to integrity and ethical conduct [10]. - The government is promoting a culture of integrity through various educational programs and community engagement to foster a clean political environment [10][11].

培育创新生态合肥秀出未来产业“繁星图”

Zhong Guo Zheng Quan Bao· 2025-12-07 20:22

Group 1 - The "2025 Science and Technology Investment Conference" held in Hefei showcased over 70 high-quality enterprises in sectors such as new energy, integrated circuits, low-altitude economy, new materials, and high-end equipment, with 12 selected hard-tech companies presenting their innovations [1][3] - Hefei's innovation ecosystem is highlighted as a "high-level circular ecology" that integrates technology, industry, and finance, demonstrating the city's commitment to fostering a vibrant science and technology industry [1][4] - The event attracted significant interest from investment institutions, indicating a strong demand for quality projects and a willingness to engage with innovative companies [3][4] Group 2 - Hefei Lanyiy Aviation, a participant in the roadshow, focuses on urban air mobility (UAM) and has achieved a significant milestone by obtaining acceptance for its type certification application from the Civil Aviation Administration of China within 23 months of establishment [1] - Guokexiang Optical aims to miniaturize large scientific devices into desktop models, providing advanced light sources for semiconductor testing and new material development [2] - Other notable companies include Ruishi Medical with its digital PET technology, and Shuduo Optical, which has developed a leading intraoperative fluorescence guidance system for cellular imaging [2] Group 3 - The roadshow serves as a platform for showcasing technological achievements and commercial applications, with investment institutions actively engaging with presenting companies to explore further collaboration [3] - Hefei's strategic focus on technology innovation is evident in its establishment of 13 large scientific facilities and its leadership in six major industries, with a stable contribution of 56% from emerging industries to the industrial output [3][4] - The local government and industry capital are playing a crucial role as "patient partners," providing not only initial funding but also long-term strategic support to help companies transition from technology to market [4]

最高跌超14%!日本旅游消费股大跌

Sou Hu Cai Jing· 2025-11-17 07:29

Group 1 - Japanese stock market experiences significant declines in consumer stocks, with FOOD&LIFE COMPANIES dropping over 14%, and other notable declines including Japan Electronics down over 11% and Shiseido down over 9% [1] - Other companies such as Isetan Mitsukoshi, Seasonal Credit, Japan Airport Building, Muji, and Sanrio saw declines exceeding 7%, while Nissan, Asics, and Japan Airlines dropped over 4% [1] Group 2 - The Chinese Ministry of Culture and Tourism issued a warning against traveling to Japan due to provocative remarks from Japanese leaders regarding Taiwan, which could impact the safety of Chinese citizens in Japan [3] - The Japanese economy could face a GDP reduction of 0.36% if the number of Chinese tourists significantly decreases, translating to an estimated economic loss of 2.2 trillion yen, approximately 101.16 billion yuan [3] - China is Japan's largest trading partner, with a projected trade total of 308.3 billion USD in 2024, including 156.25 billion USD in imports from China [3]

Snap-on Incorporated (SNA) Presents at Baird 55th Annual Global Industrial Conference Transcript

Seeking Alpha· 2025-11-12 18:11

Core Insights - Snap-on is a leader in the auto aftermarket and other industries, focusing on providing specialized tools for critical tasks where failure has significant consequences [1][2] - The company emphasizes direct engagement with customers at their work sites to identify specific challenges that can be addressed with Snap-on tools, rather than relying on surveys or analyses [2] Company Overview - Snap-on operates across various industries, including automotive repair and aviation, targeting customers who require reliable and repeatable solutions [2] - The company has a diverse product range with 85,000 SKUs and continues to expand its offerings to solve a wide array of problems [2]

行业景气度系列八:制造业供需回落,非制造业需求增加

Hua Tai Qi Huo· 2025-11-03 05:21

Report Summary 1. Report Industry Investment Rating No information regarding the report industry investment rating is provided in the content. 2. Core Viewpoints - **Manufacturing**: In October, the manufacturing PMI's five - year percentile was at 6.7%, with a change of - 44.1%. Supply contracted (3 - month average: the production index was 50.8, down 0.3 percentage points month - on - month), demand declined (new orders were 49.3, down 0.2 percentage points month - on - month), and inventory increased (finished - product inventory up 0.2 percentage points to 47.7, raw - material inventory down 0.1 percentage points to 47.9) [3]. - **Non - manufacturing**: In October, the non - manufacturing PMI's five - year percentile was at 16.9%, with a change of 5.1%. Supply slowed (3 - month average: the employee index was 45.3, down 0.1 percentage points month - on - month), demand increased (new orders were 46.2, up 0.1 percentage points month - on - month), and inventory increased (inventory was 45.5, up 0.2 percentage points month - on - month) [4]. 3. Summary According to the Table of Contents 3.1 Overview - Manufacturing PMI: In October, the five - year percentile was 6.7%, with a change of - 44.1%. Eight industries were in the expansion range, unchanged month - on - month and 3 less year - on - year [9]. - Non - manufacturing PMI: In October, the five - year percentile was 16.9%, with a change of 5.1%. Thirteen industries were in the expansion range, 5 more month - on - month and 1 more year - on - year [9]. 3.2 Demand: Focus on the Improvement of Automobile and Textile Industries - Manufacturing: The 3 - month average of new orders in October was 49.3, down 0.2 percentage points month - on - month. Eight industries improved month - on - month, and 7 declined [16]. - Non - manufacturing: The 3 - month average of new orders in October was 46.2, up 0.1 percentage points month - on - month. Service new orders decreased 0.1 percentage points month - on - month, while construction new orders increased 1.1 percentage points month - on - month. Nine industries improved month - on - month, and 6 declined [16]. 3.3 Supply: Focus on the Decline of Civil Engineering and the Improvement of Automobile and Pharmaceutical Industries - Manufacturing: The 3 - month average of the production index in October was 50.8, down 0.3 percentage points month - on - month. Seven industries improved month - on - month, and 8 declined. The employee index was 48.2, up 0.1 percentage points month - on - month. Eleven industries improved month - on - month, and 4 declined [24]. - Non - manufacturing: The 3 - month average of the employee index in October was 45.3, down 0.1 percentage points month - on - month. Service decreased 0.1 percentage points month - on - month, and construction decreased 0.3 percentage points month - on - month. Ten industries improved month - on - month, and 3 declined [24]. 3.4 Price: Focus on the Decline of Ferrous Metals and the Improvement of Aviation - Manufacturing: The 3 - month average of the ex - factory price index in October was 48.3, down 0.3 percentage points month - on - month. Nine industries' ex - factory prices improved month - on - month, and 6 declined. The profit trend in March decreased 0.5 percentage points month - on - month, continuing to converge [32]. - Non - manufacturing: The 3 - month average of the non - manufacturing charge price index in October was 47.9, unchanged month - on - month. Service was unchanged, and construction decreased 0.3 percentage points month - on - month. Ten industries improved month - on - month, and 5 declined. The profit in March increased 0.4 percentage points month - on - month, with service unchanged and construction increasing 2.7 percentage points month - on - month [32]. 3.5 Inventory: Focus on the De - stocking of Non - ferrous Metals, Postal, and Construction Decoration Industries - Manufacturing: The 3 - month average of the finished - product inventory in October increased 0.2 percentage points to 47.7. Nine industries' inventory increased month - on - month, and 6 declined. The raw - material inventory decreased 0.1 percentage points to 47.9. Eight industries' inventory increased month - on - month, and 6 declined [39]. - Non - manufacturing: The 3 - month average of the non - manufacturing inventory in October was 45.5, up 0.2 percentage points month - on - month. Service increased 0.2 percentage points month - on - month, and construction increased 0.5 percentage points month - on - month. Four industries' inventory increased month - on - month, and 11 declined [39]. 3.6 Main Manufacturing Industry PMI Charts The report provides detailed data on various manufacturing industries' PMI, including specific values, month - on - month, year - on - year, and three - year average changes for multiple indicators such as new orders, production, and inventory in industries like special equipment, general equipment, automobiles, computers, and others [47][49][54].

云南10家企业拟上市

Sou Hu Cai Jing· 2025-10-13 14:10

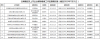

Group 1: Capital Market Overview - As of the end of August, Yunnan Province has 39 listed companies, including 15 on the Shanghai Stock Exchange, 22 on the Shenzhen Stock Exchange, and 2 on the Beijing Stock Exchange, with a total share capital of 69.381 billion shares and a total market value of 867.224 billion yuan [1] - There are 10 companies in the province that are in the process of preparing for listing [1] Group 2: Financing Situation - By the end of August, 4 listed companies in Yunnan announced refinancing plans, and 2 companies are undergoing major asset restructuring [2] - In the New Third Board market, 1 company was delisted in August, leaving a total of 45 companies listed, including 14 in the innovation layer and 31 in the basic layer [2] Group 3: Bond Issuance and Financing - In August, Yunnan enterprises issued 1 new corporate bond through the exchange market, amounting to 1 billion yuan, bringing the total number of corporate bonds issued this year to 24, totaling 20.962 billion yuan [5] - The total outstanding corporate bonds in the region is 119, amounting to 88.488 billion yuan, and there are 31 outstanding asset-backed securities totaling 6.661 billion yuan [5] Group 4: Securities and Futures Market - The trading volume in the Yunnan securities market in August was 761.351 billion yuan, with stock trading accounting for 474.561 billion yuan and public fund trading at 25.091 billion yuan [6] - The total trading volume for the year in the securities market reached 4,495.956 billion yuan, with customer assets amounting to 567.633 billion yuan [6] - In the futures market, the trading volume in August was 314.75 billion yuan, with a total of 24,616.7 billion yuan for the year [6] Group 5: Private Investment Funds - As of the end of August, there are 61 registered private fund managers in Yunnan, with 152 funds filed and a total management scale of 97.245 billion yuan [7]

“十四五”以来中央企业资产总额超过90万亿元 创新实力取得长足进步

Yang Guang Wang· 2025-09-18 00:53

Core Insights - The total assets of central enterprises have exceeded 90 trillion yuan, with total profits increasing to 2.6 trillion yuan, demonstrating strong support for national economic development [1][2] - Since the beginning of the 14th Five-Year Plan, the average annual growth rates for total assets and total profits of central enterprises have been 7.3% and 8.3%, respectively [1] - The operating quality and efficiency of central enterprises have significantly improved, with operating income profit margin rising from 6.2% to 6.7% and labor productivity increasing from 594,000 yuan to 817,000 yuan per employee per year [1] Group 1 - Central enterprises have prioritized technological innovation, with R&D expenditures exceeding 1 trillion yuan for three consecutive years and the investment intensity increasing from 2.6% to 2.8% [1] - Key core technologies in fields such as integrated circuits, industrial mother machines, and industrial software have been successfully tackled, enhancing national confidence and capabilities [2] - Central enterprises are responsible for approximately 80% of crude oil, 70% of natural gas, and 60% of electricity supply, playing an irreplaceable role in energy security and logistics [2] Group 2 - Central enterprises have an average annual procurement volume exceeding 15 trillion yuan, directly impacting around 2 million businesses in the supply chain [2] - Efforts to create a favorable environment for the development of upstream and downstream enterprises, including timely payments and rent reductions, have been emphasized [2]

国资委:中央企业有效投资进一步扩大 带动效应显著

Zhong Guo Xin Wen Wang· 2025-09-17 08:24

Core Viewpoint - The press conference highlighted the achievements of central enterprises in China during the "14th Five-Year Plan," emphasizing their solid progress in high-quality development and maintaining a stable and improving growth trajectory [1] Group 1: Stability - The foundation of stability has been continuously strengthened, with total assets of central enterprises increasing from 68.8 trillion yuan at the end of the "13th Five-Year Plan" to 91 trillion yuan by the end of 2024, and state-owned capital equity rising from 14.2 trillion yuan to 18.3 trillion yuan, with average annual growth rates of 7.3% and 6.5% respectively [2] - Operational efficiency has remained stable, with expected increases in value added and total profits during the "14th Five-Year Plan" of 40% and 50% compared to the "13th Five-Year Plan," alongside improvements in labor productivity, return on net assets, and debt-to-asset ratios [2] Group 2: Progress - Effective investment has been further expanded, with central enterprises completing a total fixed asset investment of 19 trillion yuan from 2021 to 2024, achieving an average annual growth rate of 6.3% [3] - The quality of listed companies has improved, with measures taken by the State-owned Assets Supervision and Administration Commission (SASAC) to enhance market performance, resulting in a nearly 50% increase in the market value of central enterprise-controlled listed companies to over 22 trillion yuan since the end of the "13th Five-Year Plan" [3] - Central enterprises have implemented cash dividends totaling 2.5 trillion yuan during the "14th Five-Year Plan," contributing to the stability of the capital market [3] Group 3: Quality - Central enterprises have played a crucial role in supporting the stable and healthy operation of the economy and society, supplying approximately 80% of crude oil, 70% of natural gas, and 60% of electricity [4] - They have significantly impacted the supply chain, with an average annual procurement volume exceeding 15 trillion yuan, directly benefiting around 2 million enterprises and indirectly affecting nearly 7 million [4] - Efforts to create a favorable environment for the development of upstream and downstream enterprises, including timely payments and rent reductions, have been emphasized [4]

贵州上市公司2025年中期成绩单出炉

Sou Hu Cai Jing· 2025-09-03 01:34

Core Insights - Guizhou listed companies have shown strong performance in the first half of 2025, with 25 companies reporting profits and 19 companies achieving year-on-year revenue growth, leading to the highest compound growth rates in net profit and revenue nationally over the past five years [1][5] Revenue Growth - Guizhou listed companies achieved a total revenue of 172.85 billion yuan in the first half of 2025, marking a year-on-year increase of 6.03%, ranking 4th nationally and 3rd in the western region, surpassing the provincial GDP growth by 0.73 percentage points [2] - The revenue has maintained continuous positive growth from 2021 to 2025, with a compound growth rate of 11.09%, ranking 2nd nationally [2] Individual Company Performance - Among Guizhou listed companies, 18 firms reported revenues exceeding 1 billion yuan, and 6 companies surpassed 5 billion yuan, with Kweichow Moutai leading at 89.39 billion yuan [4] - 19 companies reported year-on-year revenue growth, with 8 companies achieving double-digit growth; Andar Technology led with a 126.80% increase [4] Profitability - Guizhou listed companies reported a total net profit of 50.26 billion yuan in the first half of 2025, ranking 9th nationally and 2nd in the western region, reflecting a year-on-year growth of 5.37% and a 60.45% increase compared to 2021 [5] - 25 companies reported profits, with Kweichow Moutai again leading at 45.40 billion yuan; 11 companies experienced year-on-year profit growth [6] Research and Development Investment - A total of 33 Guizhou listed companies disclosed R&D expenditures amounting to 2.52 billion yuan, a slight increase of 0.04% year-on-year, and a 70.18% increase compared to 2021 [9] - 24 companies exceeded the national average R&D intensity of 2.12%, with 8 companies surpassing 5% [10] International Expansion - 13 companies reported overseas business income totaling 18.29 billion yuan, a year-on-year increase of 18.66%, with both the number of participating companies and revenue scale reaching new highs [14] - Zhongwei Co. achieved 10.78 billion yuan in overseas revenue, ranking 7th among western listed companies [15] Shareholder Returns - In the first half of 2025, Guizhou listed companies showed a significant increase in mid-term dividend announcements, with 7 companies disclosing plans totaling 591 million yuan, nearly quadrupling from the previous year [17] - 8 companies engaged in share buybacks, investing a total of 7.14 billion yuan, ranking 6th nationally and 1st in the western region [18] Notable Corporate Actions - Kweichow Moutai announced plans to buy back shares worth between 3 billion and 3.3 billion yuan, demonstrating confidence in its long-term value [21] - Guizhou Tire's major shareholder committed to not reducing their stake in the company for twelve months [21]