CH MODERN D(01117)

Search documents

中国圣牧拟获现代牧业溢价约14.75%提全购要约

Zhi Tong Cai Jing· 2025-10-30 14:40

Group 1 - Modern Dairy Holdings has conditionally agreed to purchase 107.2 million shares of China Shengmu from shareholders for a total cash consideration of HKD 37.52 million, representing approximately 1.28% of China Shengmu's total issued share capital as of the announcement date [1] - Following the completion of the share purchase agreements, Modern Dairy Holdings and its concert parties will hold approximately 30% or more of China Shengmu's total issued share capital, triggering an obligation to make a mandatory offer for all outstanding shares at HKD 0.35 per share, a premium of about 14.75% over the last closing price of HKD 0.305 [2] - The merger will result in a combined herd size of over 610,000 heads, allowing Modern Dairy Holdings to leverage economies of scale in procurement of bulk materials like feed, thereby reducing unit costs and enhancing market competitiveness [3] Group 2 - The acquisition and subsequent offer are expected to strengthen Modern Dairy Holdings' market position in the raw milk supply sector, enhancing its overall risk resilience and competitive edge [3]

中国圣牧(01432.HK)获现代牧业(01117.HK)溢价约14.75%提强制有条件现金要约收购

Ge Long Hui· 2025-10-30 14:37

Group 1 - Modern Dairy Holdings and China Shengmu announced a share purchase agreement for the sale of 107.2 million shares of China Shengmu, representing approximately 1.28% of its total issued share capital, for a total cash consideration of HKD 37.52 million [1] - Start Great irrevocably granted Modern Dairy Holdings the proxy to exercise voting rights for 2,086,942,512 shares of China Shengmu, which is about 24.90% of its total issued share capital [1] - Following the completion of the share purchase agreements, Modern Dairy Holdings and its concert parties will hold 30% or more of China Shengmu's total issued share capital, triggering a mandatory offer for all outstanding shares at a price of HKD 0.35 per share, which is a premium of approximately 14.75% over the last closing price of HKD 0.305 [2] Group 2 - Modern Dairy Holdings intends to maintain the listing status of China Shengmu on the Stock Exchange after the offer concludes [3] - Modern Dairy Holdings is a leading dairy farming operator and raw milk producer in China, focusing on supplying high-quality raw milk to dairy product manufacturers [3]

中国圣牧(01432)拟获现代牧业(01117)溢价约14.75%提全购要约

智通财经网· 2025-10-30 14:33

Group 1 - The core agreement involves Modern Dairy Holdings agreeing to purchase 107.2 million shares of China Shengmu from selling shareholders for a total cash consideration of HKD 37.52 million, representing approximately 1.28% of China Shengmu's total issued share capital as of the announcement date [1] - Following the completion of the share purchase agreements, Modern Dairy Holdings and its concert parties will hold approximately 30% or more of China Shengmu's total issued share capital, triggering a mandatory offer for all outstanding shares not already owned [2] - The acquisition will enhance the scale of Modern Dairy Holdings and China Shengmu's combined herd size to over 610,000 heads, allowing for economies of scale and improved purchasing power for raw materials, thereby reducing unit costs and strengthening market competitiveness [3] Group 2 - The mandatory offer price for the shares will be HKD 0.35 per share, which is a premium of approximately 14.75% over the last closing price of HKD 0.305 [2] - Approximately 576.1 million shares of China Shengmu will be subject to the mandatory offer, with a maximum consideration payable by Modern Dairy Holdings estimated at around HKD 2.0163 billion [2] - The consolidation of operations is expected to solidify Modern Dairy Holdings' leading position in the raw milk supply market and enhance its overall risk resilience [3]

现代牧业(01117) - (1) 有关买卖中国圣牧待售股份的有条件协议; (2) START GR...

2025-10-30 14:12

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負 責,對其準確性或完整性亦不發表任何聲明,並明確表示,概不對因本公告全部 或任何部分內容而產生或因倚賴該等內容而引致的任何損失承擔任何責任。 本 公 告 僅 供 參 考,並 不 構 成 收 購、購 買 或 認 購 現 代 牧 業 控 股 或 中 國 聖 牧 證 券 的 邀 請 或 要 約,亦 不 在 任 何 司 法 權 區 構 成 任 何 投 票 或 批 准 的 招 攬。本 公 告 不 會 於 或向構成違反相關司法權區相關法律的任何司法權區發佈、刊發或派發。 China Modern Dairy Holdings Ltd. 中國現代牧業控股有限公司 (於開曼群島註冊成立的有限公司) (4)中國現代牧業控股有限公司的主要及關連交易 以 及 (5)中國現代牧業控股有限公司委任獨立財務顧問 (股份代號:1117) 公 告 (1)有關買賣中國聖牧有機奶業有限公司待售股份的有條件協議 (2)START GREAT授予中國現代牧業控股有限公司 不可撤銷表決代理權 (3)中信里昂證券有限公司代表中國現代牧業控股有限公司 提出的可能強制有條件現金要約以收購中 ...

中国必选消费品10月成本报告:包材价格上行,啤酒现货成本指数同比上涨

Haitong Securities International· 2025-10-28 15:13

Investment Rating - The report provides various investment ratings for companies in the consumer staples sector, with "Outperform" ratings for companies like China Feihe, Haidilao, and China Resources Beer, while Budweiser APAC is rated as "Neutral" [1]. Core Insights - The report highlights a rise in packaging material prices and an increase in the beer spot cost index by 2.96% year-on-year, indicating upward pressure on costs in the consumer staples sector [1][35]. - The cost indices for six categories of consumer goods monitored by HTI mostly increased, with notable changes in spot and futures indices across beer, frozen food, soft drinks, instant noodles, dairy products, and condiments [35]. Summary by Category Beer - The beer spot cost index is at 116.32, down 0.06% from last week, while the futures index is at 115.68, up 1.2% [13]. - Year-to-date, the spot index has decreased by 0.86%, and the futures index has decreased by 7.13% [14]. Condiments - The condiments spot cost index is at 100.51, down 0.1%, and the futures index is at 101.3, up 1.55% [17]. - Year-to-date, the spot index has decreased by 2.66%, and the futures index has decreased by 7.47% [17]. Dairy Products - The dairy products spot cost index is at 101.25, down 0.13%, and the futures index is at 91.04, up 0.69% [20]. - Year-to-date, the spot index has decreased by 2.89%, and the futures index has decreased by 3.28% [20]. Instant Noodles - The instant noodles spot cost index is at 103.62, down 0.23%, and the futures index is at 102.53, up 0.88% [23]. - Year-to-date, the spot index has decreased by 2.29%, and the futures index has decreased by 5.47% [24]. Frozen Food - The frozen food spot cost index is at 120.39, up 1.02%, and the futures index is at 119.44, up 1.72% [28]. - Year-to-date, the spot index has decreased by 0.17%, and the futures index has decreased by 1.35% [28]. Soft Drinks - The soft drinks spot cost index is at 109.39, up 0.22%, and the futures index is at 109.26, up 0.72% [31]. - Year-to-date, the spot index has decreased by 3.04%, and the futures index has decreased by 9.54% [31].

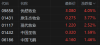

乳业股午前普涨

Mei Ri Jing Ji Xin Wen· 2025-10-28 04:11

Core Viewpoint - Dairy stocks experienced a significant midday rally, indicating positive market sentiment towards the sector [1] Company Performance - YouRan MuYe (09858.HK) saw an increase of 5.74%, reaching HKD 3.13 [1] - Modern MuYe (01117.HK) rose by 3.36%, trading at HKD 1.23 [1] - China Feihe (06186.HK) gained 1.95%, with a price of HKD 4.18 [1] - China Shengmu (01432.HK) increased by 1.59%, priced at HKD 0.32 [1]

港股异动 | 乳业股午前普涨 原奶价格近期迎阶段性稳定 行业下半年去化有望提速

Xin Lang Cai Jing· 2025-10-28 04:04

Group 1 - Dairy stocks experienced a midday surge, with Yurun Dairy rising by 5.74% to HKD 3.13, Modern Dairy up by 3.36% to HKD 1.23, China Feihe increasing by 1.95% to HKD 4.18, and China Shengmu rising by 1.59% to HKD 0.32 [1] - Guosheng Securities reported that after a four-year decline, raw milk prices have recently stabilized, with the national average price increasing from CNY 3.02/kg on August 1 to CNY 3.04/kg by the end of September, and prices in Ningxia rising from CNY 2.1-2.2/kg to CNY 3.5-3.7/kg [1] - The increase in milk prices is attributed to demand from the Mid-Autumn Festival and National Day gifts, as well as a natural decrease in supply due to the "heat stress" phase for dairy cows from July to September [1] Group 2 - Tianfeng Securities noted that since September, while some regions have seen a rebound in raw milk prices due to pre-holiday stocking and student milk production demand, overall prices in major production areas remain stable [2] - Current milk prices are still below the cost line, leading to ongoing industry losses and financial pressure from silage, with a 0.18% month-on-month decrease in dairy cow inventory in September, following a 0.2% decline in August, totaling an approximate 8% reduction [2] - Despite short-term support for milk prices from holiday factors, the trend of capacity reduction in dairy companies continues, and the end of the capacity reduction cycle may be nearing, making a price cycle turning point worth anticipating [2]

乳业股午前普涨 原奶价格近期迎阶段性稳定 行业下半年去化有望提速

Zhi Tong Cai Jing· 2025-10-28 04:02

Group 1 - Dairy stocks experienced a significant increase, with YouRan Dairy rising by 5.74% to HKD 3.13, Modern Dairy up by 3.36% to HKD 1.23, China Feihe increasing by 1.95% to HKD 4.18, and China Shengmu rising by 1.59% to HKD 0.32 [1] - Guosheng Securities reported that after a four-year decline, raw milk prices have recently stabilized, with the national average price rising from RMB 3.02/kg in August to RMB 3.04/kg by the end of September, and prices in Ningxia increasing from RMB 2.1-2.2/kg to RMB 3.5-3.7/kg [1] - The increase in milk prices is attributed to demand from the Mid-Autumn Festival and National Day gifts, as well as a natural decrease in supply due to the "heat stress" phase for dairy cows from July to September [1] Group 2 - Tianfeng Securities noted that since September, while there has been a rebound in raw milk prices in some regions due to pre-holiday stocking and student milk production demand, overall prices in major production areas remain stable [2] - Current milk prices are still below the cost line, leading to ongoing industry losses and financial pressure from silage, with a 0.18% decrease in dairy cow inventory in September compared to August [2] - The cumulative reduction in dairy cow inventory has reached approximately 8%, and while the holiday factors provide short-term support for milk prices, the trend of capacity reduction continues [2]

港股异动丨乳制品股反弹 优然牧业涨4% 中国飞鹤涨1.5% 机构指奶价拐点仍可期

Ge Long Hui· 2025-10-28 03:45

Core Viewpoint - The Hong Kong dairy stocks have rebounded after a period of decline, with several companies showing positive price movements, although the overall dairy price remains below cost levels, indicating ongoing industry challenges [1]. Group 1: Market Performance - Yurun Dairy increased by 4%, Ecological Dairy by 3.77%, Modern Dairy by 2.5%, China Shengmu by 1.5%, and China Feihe by 1.46% [2]. - The rebound in stock prices is attributed to pre-holiday inventory buildup and increased demand for student milk production [1]. Group 2: Industry Conditions - Despite the short-term support for milk prices due to holiday factors, the trend of capacity reduction in the dairy industry continues [1]. - The overall milk price remains below the cost line, leading to ongoing industry losses and financial pressures from silage [1]. - The number of dairy cows decreased by 0.18% month-on-month in September, following a 0.2% decline in August, with a cumulative reduction of approximately 8% [1]. Group 3: Future Outlook - The capacity reduction trend may be nearing its end, and a turning point in the milk price cycle is anticipated [1].

牧业股集体走高 短期因素不影响肉奶大周期共振 奶肉联动模式企业盈利能力突出

Zhi Tong Cai Jing· 2025-10-16 04:57

Core Viewpoint - Livestock stocks have collectively risen, with significant gains observed in companies such as YouRan Agriculture, Modern Farming, and China Shengmu, indicating a positive market sentiment despite recent price adjustments in the sector [1][1][1] Group 1: Stock Performance - YouRan Agriculture (09858) increased by 6.71%, trading at HKD 3.34 [1] - Modern Farming (01117) rose by 4.2%, trading at HKD 1.24 [1] - China Shengmu (01432) and Original Ecological Agriculture (01431) also saw gains of 1.45% and 1.82%, respectively [1] Group 2: Market Analysis - CITIC Securities reported that the recent slowdown in the reduction of dairy cow inventory has led to a temporary price correction in livestock stocks, but this will not disrupt the underlying cyclical logic of the industry [1][1] - The dairy cow inventory is expected to continue its downward trend, with the turning point for raw milk prices approaching as seasonal demand weakens and operational pressures on farms increase [1][1] Group 3: Future Outlook - Tianfeng Securities indicated that the current phase of dairy cow capacity reduction may be nearing its end, with Q3 silage procurement potentially accelerating the clearing of marginal stocks [1] - Raw milk prices are anticipated to bottom out and rebound, while beef prices may also see a turning point, although various factors such as funding, confidence, and environmental regulations could impact the pace of restocking [1][1] - Companies with cow resources or those employing a "milk-meat linkage" model are expected to demonstrate stronger profitability [1]