CSN(600029)

Search documents

南方航空(600029):公司点评:成本优化明显 Q3净利大增

SINOLINK SECURITIES· 2025-10-28 07:09

Investment Rating - The report maintains a "Buy" rating for the company, indicating an expected price increase of over 15% in the next 6-12 months [4][12]. Core Insights - The company reported a revenue of 137.6 billion yuan for the first three quarters of 2025, a year-on-year increase of 2.2%, with a net profit of 2.3 billion yuan, up 17.4% [2]. - In Q3 2025, the company achieved a revenue of 51.4 billion yuan, reflecting a 3% increase year-on-year, and a net profit of 3.84 billion yuan, which is a 20% increase compared to the previous year [2]. - The growth in revenue was primarily driven by an increase in passenger traffic (RPK), which rose by 6% year-on-year, with domestic routes increasing by 5% and international routes by 9% [2]. - The company’s load factor reached a record high of 85.9% in Q3 2025, indicating strong demand and the potential for future price increases [3]. Summary by Sections Performance - For Q3 2025, the company’s revenue was 51.4 billion yuan, a 3% increase year-on-year, while the net profit was 3.84 billion yuan, up 20% [2]. - The overall revenue for the first three quarters of 2025 was 137.6 billion yuan, with a net profit of 2.3 billion yuan [2]. Cost Optimization - The gross margin for Q3 2025 was 16.5%, an increase of 1.1 percentage points year-on-year, attributed to cost improvements [3]. - The unit cost per seat kilometer decreased by 3.9% to 0.41 yuan due to lower oil prices [3]. Profit Forecast and Valuation - The net profit forecasts for 2025, 2026, and 2027 have been revised upwards to 1.3 billion yuan, 6.6 billion yuan, and 9.8 billion yuan, respectively [4]. - The report anticipates a sustainable improvement in supply-demand dynamics, leading to potential price increases and profit releases in the medium term [3].

交通运输行业周报:原油运价环比有所下跌,9月快递业务量同比增长12.7%-20251028

Bank of China Securities· 2025-10-28 06:55

Investment Rating - The report rates the transportation industry as "Outperform" [1] Core Views - Crude oil freight rates have decreased month-on-month, while container shipping rates on long-distance routes have increased. The China Import Crude Oil Comprehensive Index (CTFI) reported 1632.26 points on October 23, down 8.9% from October 16. The VLCC market remains cautious due to the implementation of special port fees between China and the US, leading to a weak sentiment among shipowners [2][13] - Guangdong Province has released a high-quality development plan for the low-altitude economy, aiming to establish itself as a national leader in this sector. The civil aviation industry has shown steady growth in the first three quarters of 2025, with a total transport turnover of 1220.3 billion ton-kilometers, a year-on-year increase of 10.3% [2][15][16] - In Shenzhen, the monthly delivery volume of autonomous vehicles has surpassed one million, with a year-on-year growth of 12.7% in express delivery volume in September. The postal industry reported a total business income of 152.57 billion yuan in September, up 6.8% year-on-year [2][22][24] Summary by Sections Industry Hot Events - Crude oil freight rates have decreased, while container shipping rates on long-distance routes have increased. The CTFI reported a decrease of 8.9% [2][13] - Guangdong's low-altitude economy development plan aims to optimize airspace management and promote low-altitude logistics [15][16] - Shenzhen's autonomous vehicle delivery volume has exceeded one million, with express delivery volume growing by 12.7% [22][24] High-Frequency Data Tracking - The Baltic Air Freight Price Index has increased month-on-month but decreased year-on-year. The Shanghai outbound air freight price index has shown a month-on-month increase of 6.9% [26] - Domestic cargo flights have increased by 3.05% year-on-year, while international flights have risen by 15.86% [32] - The express delivery business volume in September increased by 12.7% year-on-year, with total business income reaching 127.37 billion yuan [50][54] Investment Recommendations - Focus on the equipment and manufacturing export chain, recommending companies like COSCO Shipping Specialized Carriers, China Merchants Energy Shipping, and Huamao Logistics [4] - Pay attention to the low-altitude economy investment opportunities, recommending CITIC Offshore Helicopter [4] - Consider investment opportunities in the highway and railway sectors, recommending companies like Gansu Expressway and Beijing-Shanghai High-Speed Railway [4] - Explore investment opportunities in the express delivery sector, recommending SF Express, Jitu Express, and Yunda Express [4]

南方航空(600029):景气向上有望推动盈利弹性兑现

HTSC· 2025-10-28 03:40

Investment Rating - The report maintains a "Buy" rating for both A and H shares of the company, with target prices set at RMB 8.70 for A shares and HKD 6.30 for H shares [6]. Core Insights - The company reported a revenue of RMB 137.67 billion for the first nine months of 2025, reflecting a year-on-year increase of 2.2%, and a net profit attributable to shareholders of RMB 2.31 billion, up 17.4% [1]. - The third quarter of 2025 saw a revenue of RMB 51.37 billion, a 3.0% increase year-on-year, and a net profit of RMB 3.84 billion, marking a 20.3% increase [1][2]. - The report indicates that the airline industry is showing signs of recovery, with a tightening supply of flight schedules and a potential for ticket prices to turn positive in the fourth quarter of 2025 [1][4]. Financial Performance - The company's operating costs for the third quarter of 2025 were RMB 42.87 billion, a 1.6% increase year-on-year, while the average price of aviation fuel decreased by 11% [3]. - Gross profit for the third quarter increased by 10.6% to RMB 8.50 billion, resulting in a gross margin of 16.5%, up 1.1 percentage points year-on-year [3]. - The company’s fleet size reached 936 passenger aircraft and 20 cargo aircraft by September 2025, maintaining a leading position in the industry [4]. Profitability Forecast - The report projects significant growth in net profit for the years 2025 to 2027, with estimates of RMB 6.42 billion, RMB 6.05 billion, and RMB 8.56 billion respectively, corresponding to EPS of RMB 0.04, RMB 0.33, and RMB 0.47 [5][9]. - The report anticipates a continued improvement in unit revenue per passenger kilometer, with expectations for ticket prices to remain positive [5][25]. Market Dynamics - The supply growth in the airline industry is expected to remain low, which should support revenue improvement for the company [4]. - The report highlights that the cargo business is showing resilience, which may contribute to profit growth [4].

南方航空 - 2025 年三季度业绩超预期;上行周期逐步兑现

2025-10-28 03:06

Summary of China Southern Airlines 3Q25 Earnings Call Company Overview - **Company**: China Southern Airlines (CSA) - **Ticker**: 1055.HK - **Industry**: Transportation & Infrastructure - **Market Cap**: Rmb108,739.8 million - **Current Share Price**: HK$4.65 - **Price Target**: HK$5.33, indicating a 15% upside potential [5][7] Key Financial Highlights - **Net Profit**: Rmb3.8 billion in 3Q25, representing a 20% year-over-year increase [2][7] - **Profit Before Tax (PBT)**: Rmb5.8 billion, up 30% YoY, excluding Rmb0.3 billion of foreign exchange loss [2][7] - **Revenue**: Rmb51.4 billion in 3Q25, a 3% YoY increase [7] - **Operating Cash Flow**: Rmb18 billion in 3Q25, a 62% YoY increase, contributing to a total of Rmb32 billion for the first nine months of 2025 [7] - **Capital Expenditure (Capex)**: Rmb8 billion in 9M25, indicating positive free cash flow after lease payments [7] Operational Metrics - **Available Seat Kilometers (ASK)**: Increased by 5.7% YoY [7] - **Revenue Passenger Kilometers (RPK)**: Increased by 6.2% YoY, reaching 115% of 2019 levels [7] - **Unit Cost (including fuel)**: Decreased by 3% YoY, but increased by 3% compared to 3Q19 [7] Market Outlook - **Profitability**: High probability of continued YoY profitability improvement in 4Q25, with expectations of full-year profitability [7] - **Yield Trends**: Anticipated low-single-digit YoY drop in passenger yield in 3Q25, supported by strong long-haul international yields and improved domestic yields in September [7] Valuation and Risks - **Valuation Methodology**: Utilizes probability-weighted P/BV multiples with different scenarios (bull, base, bear) for 2026 estimates [13] - **Bull Case P/BV**: 3.2x; Base Case P/BV: 1.9x; Bear Case P/BV: 1.0x [13] - **Upside Risks**: Include yield improvements from higher ticket prices, faster-than-expected traffic recovery, and significant RMB appreciation [13] - **Downside Risks**: Include weak travel demand and RMB depreciation [13] Analyst Ratings - **Stock Rating**: Overweight [5] - **Industry View**: In-Line [5] Additional Insights - **Earnings Estimates**: Morgan Stanley's earnings estimates for CSA are above consensus for 2026-2027 [7] - **Market Sentiment**: The overall sentiment remains bullish on Chinese airlines, with CSA-H rated as Overweight and CSA-A rated as Equal-weight [7] This summary encapsulates the key points from the earnings call, highlighting the financial performance, operational metrics, market outlook, and valuation considerations for China Southern Airlines.

华泰证券今日早参-20251028

HTSC· 2025-10-28 02:38

Group 1: Macroeconomic Insights - In September, industrial enterprises' profits improved year-on-year to 21.6%, up from 20.4% in August, driven by a low base effect and strong export performance [3] - Revenue growth for industrial enterprises also increased to 3.1% in September from 2.3% in August, indicating a positive trend in cash flow due to anti-involution policies [3] Group 2: Fixed Income Market Analysis - The bond market has shown signs of recovery in October, influenced by trade tensions and a loose liquidity environment, with expectations for a better fourth quarter compared to the third [5] - The market anticipates a controlled impact from new redemption regulations, with a focus on short to medium-term credit bonds as a primary investment strategy [5] Group 3: Oil and Gas Sector - Oil prices have entered a downward trend due to OPEC+ increasing production targets and seasonal demand decline, with Brent crude expected to average $68 in 2025 and $62 in 2026 [9] - Despite short-term volatility from geopolitical tensions, the long-term outlook suggests limited impact from sanctions on oil prices, with high-dividend energy companies presenting investment opportunities [9] Group 4: Real Estate and Construction - The real estate market is experiencing a decline in transaction volumes for both new and second-hand homes, attributed to high base effects and seasonal factors [8] - The construction sector shows mixed signals, with some recovery in cement supply and demand, while asphalt production rates have decreased [8] Group 5: Key Company Performances - Beike-W (2423 HK) is projected to benefit from a gradual market recovery, with a target price of HKD 65.64 based on a 26x PE ratio for 2026 [11] - Zhiou Technology (301376 CH) reported a revenue of CNY 60.8 billion for the first three quarters, with a year-on-year growth of 6.2%, and is expected to improve profitability as tariff risks ease [12] - Tianhai Defense (300008 CH) showed significant growth in Q3, with a revenue increase of 57.27% year-on-year, driven by strong orders in shipbuilding and defense sectors [14] - Kuka Home (603816 CH) reported steady revenue growth of 6.5% in Q3, with a focus on global expansion and brand strength [15] - Weixing New Materials (002372 CH) experienced a revenue decline of 9.83% in Q3, but is expected to see margin recovery as product prices stabilize [16] Group 6: Consumer Goods and Services - Salted Fish (002847 CH) reported a revenue increase of 14.7% year-on-year, with a focus on optimizing product categories and channels to enhance profitability [27] - Petty Co. (300673 CH) continues to see strong growth in its domestic brand, with a focus on single product strategies despite challenges in overseas markets [18] - Jiangsu Bank (601009 CH) reported a steady growth in net profit and revenue, driven by stable interest income and effective cost management [32]

中国南方航空绩后涨6%带动航空股上涨,股价创2023年8月以来新高

Ge Long Hui· 2025-10-28 02:16

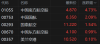

消息上,南方航空昨日晚公告,2025年第三季度营收为513.74亿元,同比增长3.01%;净利润为38.4亿 元,同比增长20.26%。前三季度营收为1376.65亿元,同比增长2.23%;净利润为23.07亿元,同比增长 17.40%。 10月28日,港股航空股盘初拉升,尤其是中国南方航空绩后涨至6%领衔,并且创2023年8月以来新高, 中国国航目前涨2%,国泰航空涨1.5%,中国东方航空涨1%,美兰空港跟涨。 从民航局了解到,全国民航从10月26日起至2026年3月28日执行冬春航季航班计划。新航季共有210家国 内外航空公司计划每周安排客货运航班11.95万班,比去年同期增长1.3%。有分析指,在过去两三年, 受疫情和国际航线停滞影响,航空股长期处于历史估值底部。近期以来,伴随着航空板块的持续拉升, 这块"价值洼地"似乎出现了明显的修复行情。 港股频道更多独家策划、专家专栏,免费查阅>>责任编辑:栎树 | 代码 | 名称 | 最新价 涨跌幅 v | | --- | --- | --- | | 01055 | 中国南方航空股 | 4.870 4.73% | | 00753 | 中国国航 | 6.350 2 ...

港股异动 | 南方航空(01055)涨超6% 三季度归母净利同比增两成至38.4亿元

Zhi Tong Cai Jing· 2025-10-28 02:16

(原标题:港股异动 | 南方航空(01055)涨超6% 三季度归母净利同比增两成至38.4亿元) 智通财经APP获悉,南方航空(01055)涨超6%,截至发稿,涨6.02%,报4.93港元,成交额3835.69万港 元。 消息面上,中国南方航空股份发布公告称,2025年前三季度,营业收入1376.65亿元(人民币,下同),同 比增长2.23%;归属于上市公司股东的净利润23.07亿元,同比增长17.40%。其中三季度公司实现收入 513.74亿元,同增3.0%;归母净利润38.40亿元,同增20.3%。 华泰证券表示,往后展望,新航季时刻数同比持续收紧,景气呈现底部好转迹象,叠加反内卷和低基 数,该行认为票价同比转正有望在4Q延续。中长期行业供给增速或将保持低位,支撑收益水平改善, 同时油价下跌有望降低航司成本压力,共同推动航司兑现盈利弹性。 ...

港股异动丨中国南方航空绩后涨6%带动航空股上涨,股价创2023年8月以来新高

Ge Long Hui· 2025-10-28 02:04

有分析指,在过去两三年,受疫情和国际航线停滞影响,航空股长期处于历史估值底部。近期以来,伴 随着航空板块的持续拉升,这块"价值洼地"似乎出现了明显的修复行情。(格隆汇) | 代码 | 名称 | 最新价 涨跌幅 v | | --- | --- | --- | | 01055 | 中国南方航空股 | 4.870 4.73% | | 00753 | 中国国航 | 6.350 2.09% | | 00293 | 国泰航空 | 11.220 1.54% | | 00670 | 中国东方航空股 | 4.100 0.99% | | 00357 | 美兰空港 | 10.520 0.10% | 从民航局了解到,全国民航从10月26日起至2026年3月28日执行冬春航季航班计划。新航季共有210家国 内外航空公司计划每周安排客货运航班11.95万班,比去年同期增长1.3%。 港股航空股盘初拉升,尤其是中国南方航空绩后涨至6%领衔,并且创2023年8月以来新高,中国国航目 前涨2%,国泰航空涨1.5%,中国东方航空涨1%,美兰空港跟涨。 消息上,南方航空昨日晚公告,2025年第三季度营收为513.74亿元,同比增长3.01%;净利 ...

南方航空(01055.HK)涨超6%

Mei Ri Jing Ji Xin Wen· 2025-10-28 02:02

每经AI快讯,南方航空(01055.HK)涨超6%,截至发稿,涨6.02%,报4.93港元,成交额3835.69万港元。 ...

陆家嘴财经早餐2025年10月28日星期二

Wind万得· 2025-10-27 23:08

Group 1 - Wang Yi, the Foreign Minister, communicated with U.S. Secretary of State Rubio, expressing hope for mutual efforts to prepare for high-level interactions and create conditions for the development of China-U.S. relations [2] - The People's Bank of China will maintain a supportive monetary policy stance, resume open market operations for government bonds, and explore measures to support personal credit repair [2][3] - The National Bureau of Statistics reported that profits of industrial enterprises above designated size increased by 21.6% year-on-year in September, with high-tech manufacturing and equipment manufacturing showing rapid growth [3] Group 2 - The State Administration of Foreign Exchange will introduce nine new policy measures focusing on trade facilitation, including expanding cross-border trade pilot programs and optimizing foreign exchange fund settlement for new trade entities [3] - The Ministry of Finance reported that in September, central government revenue was 691.3 billion yuan, while expenditure was 1.5844 trillion yuan [4] - The 138th Canton Fair saw participation from nearly 240,000 overseas buyers from 223 countries and regions, marking a 6.8% increase compared to the previous session [4] Group 3 - The China Securities Regulatory Commission (CSRC) released a plan to optimize the Qualified Foreign Institutional Investor (QFII) system, enhancing its attractiveness to long-term foreign capital [5] - The CSRC also issued opinions on strengthening the protection of small and medium investors in the capital market, proposing 23 specific measures across various aspects [5] - A-share market saw significant gains, with the Shanghai Composite Index approaching the 4000-point mark, driven by strong performance in technology stocks [5][6] Group 4 - The Hong Kong Hang Seng Index closed up 1.05%, with notable gains in pharmaceutical and materials sectors, while Southbound funds recorded a net purchase of 2.873 billion HKD [6] - The Shanghai Stock Exchange announced the third advisory committee member list, including founders from various tech companies [6] - New listings on the STAR Market include He Yuan Bio, Xi'an Yicai, and Bibet, with a total of 758,000 investor accounts opening trading permissions for the STAR Growth Layer [6] Group 5 - QFII holdings in A-shares reached 1.018 billion shares, valued at approximately 21.283 billion yuan, with a focus on cyclical sectors like non-ferrous metals and electricity [7] - Five listed securities firms have disclosed their Q3 reports, showing growth in both revenue and net profit, indicating a recovery in brokerage and asset management businesses [7] Group 6 - The central bank's market operations led to a significant drop in bond yields, with the 30-year special government bond yield falling by 5.75 basis points [18] - The trading association emphasized the need for stricter supervision of funds raised through debt financing tools [18] - Hebei Province disclosed special bond issuance information, with 4.738 billion yuan allocated for land storage, marking a pilot area for non-self-examination [18] Group 7 - The U.S. stock market saw all three major indices rise, with the Dow Jones up 0.71% and the Nasdaq up 1.86%, driven by easing international trade tensions [16] - European stock indices also experienced slight increases, reflecting improved market sentiment following U.S.-China trade discussions [16] - The Nikkei 225 index in Japan closed above 50,000 points for the first time, indicating strong market performance [16] Group 8 - The international gold futures market saw a decline, with COMEX gold futures dropping by 3.40% [20] - Brent crude oil futures experienced a slight decrease, while U.S. oil futures rose marginally [20] - The OPEC+ group is expected to discuss a slight increase in oil production at their upcoming meeting [21]