Morgan Stanley(MS)

Search documents

失业率或临时性上升!美国政府停摆进入第22天,创史上第二长纪录

Hua Er Jie Jian Wen· 2025-10-22 11:55

Core Viewpoint - The U.S. government shutdown has entered its 22nd day, becoming the second longest in history, with potential implications for economic data and Federal Reserve decision-making [1][2] Economic Data Impact - The shutdown is causing a "data black hole," leading to the suspension of key economic data releases, which poses a direct challenge for the Federal Reserve's decision-making process [2] - Morgan Stanley estimates that 750,000 federal employees will be furloughed daily, which will temporarily inflate the unemployment rate by 44 basis points, despite eventual back pay [2][3] Economic Loss Assessment - Despite the chaos in data, Morgan Stanley believes the actual economic loss is manageable, estimating a GDP drag of about 0.25%, with most impacts expected to be repaired in the following quarter [3] - Federal employees will miss their first full paycheck this Friday, exacerbating economic damage, and the White House warns of potential disruptions in military pay and federal food assistance [3] Political Stalemate - The shutdown stems from a deadlock between Democrats and Republicans over healthcare subsidies, with Democrats demanding relief for 22 million Americans facing rising insurance premiums [4] - Former President Trump has stated that negotiations will not occur until the shutdown ends, complicating the path to a resolution [4] Cost Disagreement - The core disagreement revolves around the cost of extending healthcare subsidies, which were initially introduced as emergency measures during the pandemic and are projected to increase federal debt by $350 billion over the next decade [5] - Moderate senators have not made progress in private negotiations, with key figures expressing skepticism about finding a way out of the deadlock [5]

增持中国资产是大势所趋!四位大咖把脉全球资产配置

Zheng Quan Shi Bao· 2025-10-22 09:25

Core Insights - The global investment diversification trend is evident, with Chinese assets, particularly in the technology sector, experiencing a revaluation opportunity, while gold remains a valuable asset for allocation [1][7]. Group 1: Economic Perspectives - CICC's chief economist, Peng Wensheng, noted that the strong performance of the A-share market is primarily due to a decrease in risk premiums rather than improvements in corporate earnings [2]. - Guosen Securities' chief economist, Xun Yugen, believes the current bull market has entered its second phase, driven by fundamentals, particularly in the technology sector [3]. - Morgan Stanley's chief China equity strategist, Wang Ying, emphasized the increasing global interest in Chinese assets, particularly in high-tech sectors, despite their relatively low allocation in global portfolios [4]. Group 2: Global Economic Outlook - Wang Ying projected a slowdown in global GDP growth from 3.0% in 2025 to 2.8% in 2026, with inflation rates expected to remain stable [5]. - UBS's Hu Yifan highlighted the global diversification trend and the opportunities arising from the global rate-cutting cycle, suggesting that the Fed's rate cuts will positively impact stock markets [6]. Group 3: Gold as an Investment - There is a consensus among economists regarding the value of gold as an investment, with expectations of at least a 5% increase in gold prices [7][8]. - Hu Yifan pointed out that the depreciation of the dollar and the downgrade of U.S. Treasury ratings have led to increased interest in gold as a risk diversification strategy [9]. Group 4: Stock Market Strategies - Morgan Stanley's Wang Ying recommended equal-weighted global stock allocations but noted significant regional disparities, favoring the U.S. market for its scale and quality [11]. - In the Chinese market, Wang Ying expressed optimism due to macroeconomic stabilization and global recognition of innovation capabilities in AI and biotechnology [12].

增持中国资产是大势所趋!四位大咖把脉全球资产配置

证券时报· 2025-10-22 09:11

Core Insights - The article discusses the perspectives of four leading economists on global asset allocation and investment opportunities in China, particularly in the technology sector and gold as a safe-haven asset [2]. Group 1: Economic Perspectives - CICC's chief economist, Peng Wensheng, attributes the strong performance of the A-share market to a decrease in risk premium rather than improvements in corporate earnings, indicating a significant improvement in market expectations since last year [5]. - Guosen Securities' chief economist, Xun Yugen, believes the current bull market began on September 24, 2024, and compares it to the "5.19 Bull Market" of 1999, suggesting that the current market is still in its early stages [7]. - Xun Yugen also emphasizes that the bull market is driven by fundamentals, particularly in the technology sector, and suggests a rotation towards undervalued sectors like real estate and consumer goods [10]. Group 2: Investment Opportunities in China - Morgan Stanley's chief China equity strategist, Wang Ying, notes that global investors have a relatively low allocation to Chinese stocks, indicating a trend towards increasing investment in high-tech sectors such as AI and automation [11]. - Wang Ying forecasts that global GDP growth will slow from 3.0% in 2025 to 2.8% in 2026, with inflation rates expected to remain stable, providing central banks with policy flexibility [14]. Group 3: Global Monetary Policy and Gold - UBS's Hu Yifan highlights the global trend of declining interest rates, which, along with strong corporate earnings and advancements in AI, presents new investment opportunities [16]. - There is a consensus among economists regarding the value of gold in asset allocation, with Wang Ying predicting at least a 5% increase in gold prices due to historical performance during rate-cutting cycles and geopolitical uncertainties [20]. - Hu Yifan supports the view that holding gold is a good strategy for diversifying investments and hedging against risks, especially in light of the recent depreciation of the US dollar [21]. Group 4: Global Market Differentiation - In terms of global stock market allocation, Morgan Stanley suggests an equal-weight strategy but notes significant regional differentiation, favoring the US market for its scale and quality [24]. - The firm recommends focusing on high-quality stocks and cyclical stocks in the US while being cautious about trade uncertainties that could lead to market volatility [24]. - For emerging markets, Morgan Stanley prefers domestically oriented companies and financial stocks, avoiding exporters and semiconductor hardware firms [25].

2200亿美元,国际顶级投行从质疑到All-in中国创新药

3 6 Ke· 2025-10-22 01:00

Core Insights - The attitude of foreign capital towards Chinese medical assets has dramatically reversed within a year, shifting from a neutral to a positive outlook on the biotechnology sector in China [1][3][7] Group 1: Market Sentiment Shift - Morgan Stanley's report titled "China Biotech: Innovation Dawn" indicates that China's biotechnology sector is now viewed as a critical part of the global new drug supply chain, with projected pharmaceutical revenues reaching $34 billion by 2030 and $220 billion by 2040 [1][3] - The number of foreign institutions conducting research on Chinese biotech companies has surged, with notable firms like State Street Bank and BlackRock showing increased interest [1][2] - The collective buying actions of foreign investors, such as JPMorgan and Citigroup, reflect a significant shift in sentiment towards Chinese innovative drug companies [2][5] Group 2: Investment Dynamics - The efficiency of converting research interest into actual holdings is evident, as seen in the stock price surge of WuXi AppTec, which rose by 6.52% due to increased foreign investment [2] - Major foreign investors have increased their holdings in key Chinese biotech firms, indicating a trend of strategic accumulation among top foreign capital [5][6] - The report highlights that foreign capital is now viewing specific sectors in China as essential assets in the global technology race, with over 90% of U.S. investors expressing plans to increase exposure to Chinese stocks, particularly in biotechnology [6][7] Group 3: Industry Evolution - The narrative surrounding China's pharmaceutical industry has shifted from being cost-driven to innovation-driven, acknowledging the significant advancements in the sector [3][4] - Morgan Stanley and Goldman Sachs both emphasize the growing recognition of China's innovative capabilities in biotechnology, with expectations that several leading biotech firms will reach breakeven by 2025-2026 [4][8] - The report outlines that the Chinese biotech sector is becoming a key player in filling the revenue gaps created by patent expirations in multinational corporations (MNCs), with an estimated $115 billion revenue loss due to patent cliffs by 2035 [8][10] Group 4: Future Projections - By 2040, China's share of FDA-approved drugs is expected to rise from 5% to 35%, with a projected global sales figure exceeding $1.22 trillion even in the most pessimistic scenarios [25][27] - The report anticipates that the collaboration between MNCs and Chinese biotech firms will intensify, driven by the need to address revenue shortfalls from patent expirations [10][14] - The overall improvement in clinical trial data integrity and the increasing number of new molecular entities launched in China are contributing to a more favorable investment landscape [20][22]

三季报最高增308%,美国摩根重仓7家,这家龙头被外资顶格买入

Sou Hu Cai Jing· 2025-10-21 17:55

Core Insights - Foreign investments in A-shares are increasingly focused on companies with explosive earnings growth, as evidenced by significant profit increases in several firms [1][3][6] Group 1: Company Performance - Guangting Information reported a staggering 308% year-on-year profit increase, rising from approximately 10 million to 44.77 million [1] - StarNet Yuda experienced over 800% unexpected growth, attracting investments from major institutions like UBS and Morgan Stanley [3] - Siyuan Electric's profit grew from 1.4 billion to 2 billion, marking a 46.94% increase, with foreign ownership reaching 26% [5] - Guoguang Chain's net profit increased from 8 million to 11 million, a growth of 40.36%, drawing interest from JP Morgan and Goldman Sachs [5] Group 2: Investment Trends - Foreign investors, particularly from Morgan Stanley, show a clear preference for industry leaders with strong earnings growth as their primary selection criterion [6] - Investment focus is on high-growth sectors such as smart cockpits, unmanned systems, artificial intelligence applications, and electric equipment, aligning with China's industrial upgrade and policy support [8] - The presence of multiple top-tier international institutions in a company's shareholder list indicates strong market interest and confidence [3][5] Group 3: Investment Strategy - Foreign capital is diversifying its portfolio, balancing high-growth tech stocks with stable consumer companies like Guoguang Chain, which offers regional advantages and stable cash flow [8] - The investment approach reflects a strategy to mitigate risks while capitalizing on growth opportunities in various sectors [8] - Observing foreign capital movements can provide insights into market trends, as these decisions are based on in-depth research of macroeconomic conditions and company fundamentals [10]

Morgan Stanley: Q3 Proves A Repricing Is In Store

Seeking Alpha· 2025-10-21 16:56

Core Insights - The article highlights Rick's extensive experience in trading stocks and options, emphasizing his status as a Wall Street Journal best-selling author with over 20 years in the industry [1] Group 1: Author Background - Rick has been featured in major publications such as Good Morning America, Washington Post, and Yahoo Finance, showcasing his credibility and influence in the financial sector [1] - He authored "The Financially Independent Millennial" in 2018, sharing his journey to financial independence by age 35, despite a lack of early financial education [1] Group 2: Writing Style and Themes - Rick's writing is characterized by its accessibility, often including key advice he would give to his younger self, making complex financial concepts easier to understand for readers [1] - In addition to financial topics, Rick also writes about cruise ship travel, indicating a diverse range of interests beyond finance [1]

Goldman downgraded, Coinbase initiated: Wall Street's top analyst calls

Yahoo Finance· 2025-10-21 13:32

Upgrades - BofA upgraded Eversource (ES) to Buy from Neutral with a price target of $85, up from $73, citing an "improving regulatory tone" and a projected 6% EPS growth through 2029 [2] - Leerink upgraded Exelixis (EXEL) to Outperform from Market Perform with a price target of $48, up from $38, following the Phase 3 STELLAR-303 trial results, which established important levers for long-term investment despite a 12% stock decline [3] - Citi upgraded Nextracker (NXT) to Buy from Neutral with a price target of $114, up from $66, highlighting its dominant position in tracker sales and potential revenue contributions from acquired businesses by FY30 [4] - Citi upgraded Sunrun (RUN) to Buy from Neutral with a price target of $26, up from $11, noting benefits from rising electricity rates and increased leverage over suppliers due to market shifts [5] - Raymond James upgraded Capri Holdings (CPRI) to Outperform from Market Perform with a price target of $25, indicating a favorable turnaround position supported by improving demand and conservative guidance [6] Downgrades - JPMorgan downgraded Goldman Sachs (GS) to Neutral from Overweight with a price target of $750, up from $625, citing high current valuations compared to European investment banks [7] - BNP Paribas Exane downgraded Verizon (VZ) to Neutral from Outperform with a price target of $44, raising concerns about strategic direction following a recent CEO change [7] - BNP Paribas Exane downgraded NuScale Power (SMR) to Underperform from Neutral with a price target of $25, down from $41, due to concerns over cumulative shipments and financial commitments [7] - Citi downgraded NuScale to Sell from Neutral with a price target of $37.50, down from $46, highlighting potential sales by Fluor and stretched valuations [7] - TD Cowen downgraded Tempus AI (TEM) to Hold from Buy with a price target of $88, up from $72, viewing the stock as fairly valued after a significant rally [7] - Wells Fargo downgraded Cleveland-Cliffs (CLF) to Underweight from Equal Weight with an unchanged price target of $11, describing the recent stock rally as "excess exuberance" [7]

Morgan Stanley CIO Mike Wilson: The Fed needs to cut rates in a more meaningful way

CNBC Television· 2025-10-21 12:40

Mike Wilson, Morgan Stanley CIO and chief U.S. equity strategist, joins 'Squawk Box' to discuss the state of the economy, latest market trends, where to find opportunity in the markets, the Fed's interest rate outlook, and more. ...

欧洲债市将迎“数据革命”,新规或引爆电子交易新浪潮

智通财经网· 2025-10-21 09:24

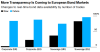

智通财经APP获悉,华尔街的各大银行认为,欧洲债券市场数据的质量和可获取性若能得到改善,将推 动电子交易迎来新的增长浪潮。摩根大通公司、美国银行以及摩根士丹利表示,新的规定要求对债券交 易进行更详细的报告,并建立一个能够追踪实时市场活动的数据池,这将提高透明度,并改善基于计算 机的交易模式。 摩根大通全球固定收益、外汇及大宗商品市场结构与流动性策略主管Kate Finlayson表示:"数据可能是 实现进一步电子化的重要先决条件。它有助于构建交易模型和算法。在交易完成之后,数据也是评估算 法表现所必需的。" 与美国相比,欧洲债券市场在采用某些算法策略方面进展较为缓慢。在美国,债券交易数据早就通过 TRACE 系统进行了整合。 "我们见证了诸多创新,但有时在固定收益领域(尤其是这一领域)的感觉却像是在浓稠的糖浆中艰难前 行。"MarketAxess欧洲、中东及亚太地区交易产品主管Gareth Coltman说道。"准确获取数据至关重 要。" 虽然更优质的债券数据将有助于提高效率,但这也可能会侵蚀银行的利润空间。在美国,引入 TRACE 系统后,交易双方的买卖价差缩小,投资者每年的交易成本降低了近 10 亿美元。 ...

跨资产流动与配置- 因 “错失恐惧症”(FOMO),资金流动呈 “拉锯” 状态-Cross-Asset Flows and Allocations-Fund Flows 'Yo-yo' on FOMO

2025-10-21 01:52

Summary of Key Points from the Conference Call Industry Overview - The report discusses trends in fund flows across various asset classes, particularly focusing on US equities, commodities (especially gold), and fixed income markets. [2][9][66] Core Insights 1. **Fund Flows Dynamics**: - Strong inflows into US equities and commodities, particularly gold, are driven by investor sentiment characterized by "FOMO" (Fear of Missing Out) rather than fundamental valuations. [2][9][66] - Since August 2025, US equity ETFs and mutual funds have attracted approximately **US$134 billion** in inflows, with **US$39 billion** directed towards emerging market (EM) equity funds. [11][12] - Flows to US equity funds have rebounded significantly after a dip post-Liberation Day, with the week of September 17 witnessing the highest net flow in a year. [13][14] 2. **US vs. International Markets**: - Flows to US equities have surged at the expense of European and Japanese markets, despite high relative valuations in the US. [9][14][21] - European equities have seen fluctuating inflows, with a cumulative **US$49 billion** YTD, but the inflow momentum appears to have plateaued. [22] - Japanese equities are experiencing persistent outflows, with a YTD net flow of approximately **negative US$10 billion**, the lowest in a decade. [25] 3. **Gold and Commodities**: - Commodities funds have seen **US$44 billion** in net inflows YTD, with a significant increase in weekly flows since July, averaging over **US$2.6 billion** in September. [39][40] - The report anticipates continued strong demand for gold, projecting prices could reach **US$4,500/oz by the end of 2026**. [45] 4. **Fixed Income Trends**: - US bonds have attracted around **US$360 billion** in net inflows YTD, while European fixed-income funds have seen **US$110 billion**, marking the highest inflows in over a decade. [53][56] - There is a notable shift in preference towards US investment-grade (IG) corporate bonds, with significant inflows observed in September 2025. [57] Additional Insights - The report emphasizes that while current flows are favorable towards US assets, the potential for rapid shifts in investor sentiment remains, highlighting the volatility associated with "FOMO" flows. [66] - The analysis suggests that ongoing Federal Reserve easing policies will likely support these favorable flow trends in the near term. [66] Conclusion - The overall sentiment in the market indicates a preference for US equities and commodities, particularly gold, driven by momentum rather than fundamentals. However, the potential for quick reversals in flows due to changing investor sentiment is acknowledged. [66]