自主可控

Search documents

异动盘点1023|芯片股延续跌势,黄金股继续走低;诺和诺德跌超2%,GE Vernova跌超1%。

贝塔投资智库· 2025-10-23 04:00

Group 1: Hong Kong Stock Market Highlights - China Hongqiao (01378) rose over 2% as the company continued its share buyback, spending HKD 7.5941 million to repurchase 300,000 shares [1] - Sands China (01928) increased by over 3% following its parent company Las Vegas Sands Corp.'s announcement of a 2.7% rise in adjusted property EBITDA for Q3 [1] - Aluminum Corporation of China International (02068) fell over 11% amid market focus on potential transactions involving Chalco and its rich overseas operational experience [1] - Giant Bio (02367) gained over 6% as its controlling shareholder increased holdings by 500,000 shares, with Citigroup suggesting the market overreacted to pre-sale performance [1] - Li Ning (02331) rose over 6% as the brand announced its entry into Meituan Flash Purchase on October 20 [1] - Semiconductor stocks continued to decline, with Huahong Semiconductor (01347) down over 6% and SMIC (00981) down nearly 1%, as the U.S. plans to restrict key software exports [1] - China National Heavy Duty Truck Group (03808) increased over 2% with September heavy truck exports reaching a record high of 15,000 units, expecting annual exports to exceed 150,000 units [1] Group 2: Steel and Banking Sector Performance - Steel stocks faced declines, with Maanshan Iron & Steel (00323) down over 3% and Angang Steel (00347) down over 2%, as seasonal demand fell short of expectations [2] - Chinese banks continued to rise, with Postal Savings Bank (01658) up over 3% and Agricultural Bank of China (01288) nearly 1%, supported by multiple catalysts for bank revaluation according to Morgan Stanley [2] - Gold stocks continued to decline, with China Silver Group (00815) down over 1% and Lingbao Gold (03330) down over 2%, following a significant drop in gold prices [2] Group 3: U.S. Stock Market Highlights - Mattel (MAT.US) fell 2.76% after reporting a 6% year-over-year decline in Q3 sales to USD 1.74 billion, below market expectations [3] - NIO (NIO.US) rose 0.59% as its L90 model achieved a record weekly delivery volume, with production capacity up 50% from the previous month [3] - Intuitive Surgical (ISRG.US) surged 13.89% due to a 22.9% year-over-year revenue increase driven by demand for its da Vinci robotic systems for minimally invasive surgeries [3] - Texas Instruments (TXN.US) dropped 5.60% as its Q4 revenue and profit forecasts fell short of Wall Street expectations [3] - Weibo (WB.US) increased 5.22% as it plans to announce its Q3 2025 financial results in mid-November, although its advertising business may face multiple pressures [3] - Barclays (BCS.US) rose 4.41% despite a 7% year-over-year decline in pre-tax profit for Q3 [4] - Google (GOOGL.US) increased 0.49% as it negotiates a cloud computing service contract with Anthropic, potentially worth several billion USD [4]

芯片股延续跌势 美国拟限制关键软件出口 机构看好国内自主可控进程加速

Zhi Tong Cai Jing· 2025-10-23 03:23

Core Viewpoint - The semiconductor sector continues to decline, influenced by potential U.S. export controls on products using American software for production in China, leading to a drop in related stocks and further declines in U.S. markets [1] Group 1: Stock Performance - Huahong Semiconductor (01347) fell by 7.5%, trading at HKD 70.25 [1] - Shanghai Fudan (01385) decreased by 6.43%, trading at HKD 39 [1] - Jingmen Semiconductor (02878) dropped by 1.96%, trading at HKD 0.5 [1] - SMIC (00981) declined by 1.87%, trading at HKD 73.45 [1] Group 2: U.S. Export Controls - Reports indicate that the White House is considering regulations on products using U.S. software for exports to China, which has contributed to the decline in U.S. stocks, particularly in EDA software [1] - NVIDIA has confirmed its complete exit from the Chinese AI chip market, while Micron plans to halt server chip supplies to China [1] Group 3: Industry Analysis - According to a report from CICC, the U.S. export controls on semiconductors and rare earths signify a shift in trade friction towards core upstream technologies and raw materials, which may accelerate domestic industry self-sufficiency and promote domestic substitution [1] - According to招商证券, the ongoing U.S. export controls are expected to hasten the domestic self-sufficiency process, with an anticipated acceleration in the expansion of advanced production lines in China by 2026, which may positively impact orders in domestic equipment and components sectors [1]

港股异动 | 芯片股延续跌势 美国拟限制关键软件出口 机构看好国内自主可控进程加速

智通财经网· 2025-10-23 03:18

Core Viewpoint - Semiconductor stocks continue to decline, influenced by potential U.S. export controls on products using American software for production and export to China, leading to further drops in U.S. stock markets [1] Group 1: Stock Performance - Huahong Semiconductor (01347) fell by 7.5%, trading at HKD 70.25 [1] - Shanghai Fudan (01385) decreased by 6.43%, trading at HKD 39 [1] - Jingmen Semiconductor (02878) dropped by 1.96%, trading at HKD 0.5 [1] - SMIC (00981) declined by 1.87%, trading at HKD 73.45 [1] Group 2: Regulatory Developments - Reports indicate that the White House is considering regulations on products using U.S. software for production and export to China, which has contributed to the decline in semiconductor stocks [1] - Notably, NVIDIA has confirmed its complete exit from the Chinese AI chip market, and Micron plans to halt server chip supplies to China [1] Group 3: Industry Analysis - According to a report from CICC, U.S.-China export controls in semiconductors and rare earths signify a shift in trade friction towards core technologies and raw materials [1] - The implementation of semiconductor export controls by the U.S. is expected to accelerate the domestic industry's self-sufficiency and promote domestic substitution [1] - According to招商证券, the ongoing U.S. export controls are likely to expedite the domestic self-sufficiency process, with expectations for increased orders in domestic equipment and components as advanced production lines expand by 2026 [1]

北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-22 17:11

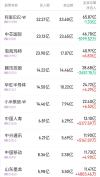

Core Viewpoint - The Hong Kong stock market experienced significant net inflows from northbound trading, with notable buying activity in specific stocks such as Pop Mart and Xiaomi, while other stocks like Alibaba faced substantial net selling [2][6]. Group 1: Stock Performance - Pop Mart (09992) received a net inflow of HKD 11.2 billion, with a projected revenue growth of 245%-250% year-on-year for Q3 2025, driven by strong domestic and international sales [6]. - Xiaomi Group-W (01810) saw a net inflow of HKD 4.81 billion, following a share buyback of 10.7 million shares at prices between HKD 45.9 and HKD 46.76, totaling approximately HKD 4.94 billion [6]. - Semiconductor stocks, including Huahong Semiconductor (01347) and SMIC (00981), attracted net inflows of HKD 4.41 billion and HKD 1.28 billion, respectively, amid positive sentiment regarding the semiconductor industry's growth driven by AI [6]. Group 2: Company Earnings and Projections - China Mobile (00941) reported Q3 service revenue of HKD 216.2 billion, a year-on-year increase of 0.8%, with EBITDA declining by 1.7% to HKD 79.4 billion, slightly below market expectations [7]. - China Life (02628) projected a net profit of approximately HKD 156.79 billion to HKD 177.69 billion for the first three quarters, reflecting a year-on-year growth of 50% to 70% [7]. - The report indicated that the net profit for Q3 could grow by 75% to 106% year-on-year, driven by improved investment returns and optimized asset allocation [7]. Group 3: Market Sentiment and Trends - The overall market sentiment showed a divergence in fund flows, with significant net selling in stocks like Alibaba (09988) and Tencent (00700), indicating cautious investor sentiment amid global economic uncertainties [8]. - The report highlighted that the current market volatility is influenced more by emotional factors rather than fundamental reversals, suggesting a need for careful timing in investment strategies [7].

比“缺芯”还严重?90%市场被美日垄断,中国正在逐步突破精密仪器领域

Xin Lang Cai Jing· 2025-10-22 11:13

Core Viewpoint - The intensifying Sino-U.S. technology competition has made semiconductors a focal point, but the challenges faced by China in the precision instruments sector are even more severe, with the market largely dominated by the U.S. and Japan [1][8]. Semiconductor Industry - China's semiconductor industry began developing in 1956, with the first integrated circuit produced in 1965, but market demand stagnated in the 1970s until policy support in 2000 [4][5]. - SMIC has transitioned from a foundry to achieving technological breakthroughs, notably mass-producing 14nm processes in 2020 [6]. - Despite being the largest chip consumer globally, China's self-sufficiency rate in semiconductors is projected to remain below 30% in 2024 [7]. Precision Instruments Sector - Precision instruments, referred to as the "mother machine" of industry, are critical for high-end manufacturing [9]. - The CNC machine tool market in China is expected to reach $59.2 billion by 2025, with a high dependency on imports for high-end products at 45% [11]. - The high-end market is dominated by Japanese companies like Yamazaki Mazak and DMG Mori, while domestic companies face significant challenges due to strict export controls under the Wassenaar Arrangement [11]. - The electron microscope market is similarly dominated by international giants such as Zeiss and Thermo Fisher, with Chinese products still lagging in performance [11]. Challenges and Solutions - The core issue lies in the weakness of foundational technology and short-sighted industrial orientation, with domestic companies focusing more on short-term returns rather than long-term research [15]. - The Chinese government has increased support for high-end manufacturing, and domestic enterprises are making progress in fields like CNC machine tools and electron microscopes [16][17]. - To break the U.S.-Japan monopoly, China needs to address foundational research weaknesses, increase long-term investment in R&D, and enhance industry-academia collaboration to foster innovation [17]. Future Outlook - China's breakthroughs in precision instruments are ongoing, with a hopeful future if the country maintains its commitment to technological self-reliance [19][20].

国泰海通|固收:不惧扰动,保持定力

国泰海通证券研究· 2025-10-22 11:04

Core Viewpoint - The convertible bond market is experiencing significant short-term valuation compression, but given the resilience of the equity market, convertible bonds still present investment opportunities, particularly through a low premium strategy [1][2]. Group 1: Market Performance - The Shanghai Composite Index declined by 1.47% last week, while the China Convertible Bond Index fell by 2.35%, indicating a notable compression in convertible bond valuations [1]. - Institutional profit-taking is a major factor influencing short-term valuations in the convertible bond market, although long-term trends remain positive as long as the equity market continues its upward trajectory [1][2]. Group 2: Valuation and Risks - As of October 17, the average parity of convertible bonds was 97.34 yuan, with an average conversion premium rate of 39.99%. High premium convertible bonds have seen significant compression in their conversion premium rates due to increased expectations of forced redemptions [1]. - Large-scale convertible bonds, such as those from Liugong and Hengbang, have experienced rapid compression in premium rates following market speculation about forced redemptions, highlighting the risks associated with high premium and large-scale convertible bonds [1]. Group 3: Investment Strategy - Despite external disturbances, the equity market's upward trend is expected to continue, providing a favorable environment for convertible bonds, which exhibit relative resilience and investment value [2]. - In a sustained bull market, a low premium strategy is recommended as it allows for better participation in the upside of underlying stocks while minimizing valuation compression risks [2]. - The technology sector, particularly semiconductor stocks and TMT industries benefiting from increased overseas AI capital expenditure, is identified as a key investment focus, alongside a balanced approach to cyclical and financial sectors [2].

股债分化格局下:两款“固收+权益”产品三季度涨超10%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 07:52

Overall Performance - In Q3 2025, the capital market exhibited significant differentiation due to the "stock-bond seesaw" effect, with the equity market performing strongly while the bond market faced overall pressure [5] - The A-share market experienced a notable upward trend, with the CSI 300 index rising by 17.90% and the Wind All A index increasing by 19.46%, while the ChiNext index surged over 50%, highlighting a growth style dominated by sectors such as artificial intelligence and technology [5][6] Product Analysis - The "fixed income + equity" products generally had conservative equity positions, with many products holding less than 2% in equities, resulting in limited impact from the stock market's rise [6] - The top 10 products listed primarily came from eight wealth management companies, with the top two products achieving net value growth rates exceeding 10% and exhibiting low maximum drawdowns [6][7] - The top-ranked product, "Xing Shi (Minimum Holding 14 Days) Daily Open 2B" from Yunnan Rural Commercial Bank Wealth Management, was positioned to allocate 0-20% in equity assets but held no equity assets as of Q2 2025, with over 51.33% of its assets in cash and bank deposits [6][7] - The second-ranked product, "Stable Wealth (Quarterly Increment) 001C" from Bank of China Wealth Management, had a bond asset ratio of 71.22% as of June 2025, with a significant portion of its holdings in financial bonds, corporate bonds, and private placement bonds [7] - Looking ahead to Q4, the market sentiment remains relatively optimistic towards the equity market, while the bond market may present short-term trading opportunities after the Q3 correction, although further declines in yields are expected to be limited [7]

广发证券:重视环保板块三季报绩优个股 重申股息+国产替代

Zhi Tong Cai Jing· 2025-10-22 03:09

Group 1 - The core viewpoint of the report indicates that the environmental protection industry is entering a phase of stable growth, with expectations for increased dividends due to reduced capital expenditures and improved cash flow [1][2] - The report highlights the acceleration of domestic substitution in the scientific instrument sector, driven by government procurement policies that favor domestic products with a 20% price evaluation discount [1] - The solid waste and water sectors are identified as key areas for investment, with specific companies recommended for their strong performance and cash flow improvement [1][2] Group 2 - The report notes that the dividend payout ratio in the solid waste sector has significantly increased, with 10 out of 12 companies raising their absolute dividend amounts, and an average dividend ratio of 42%, up by 10.6 percentage points year-on-year [2] - Companies such as Huanlan Environment, Shanghai Industrial Holdings, and others are suggested for their potential in dividend growth as the industry matures and capital expenditures decrease [2]

科技风格是否会切换,红利是否会接力?机构:“再平衡”后,科技或仍是主线

Mei Ri Jing Ji Xin Wen· 2025-10-22 03:04

Group 1 - A-shares and Hong Kong stocks experienced a decline, with major indices opening lower and the ChiNext index briefly turning positive before falling [1] - The Hang Seng Technology Index dropped over 1%, with most tech stocks declining, while the largest A-share ETF in the same sector saw a nearly 2% drop [1] - The market is currently undergoing a "rebalancing" phase, with a potential shift in investment styles driven by defensive thinking, although the core drivers of the bull market remain intact [1] Group 2 - The investment strategy emphasizes maintaining confidence in the bull market, focusing on technology as the primary driver and PPI trading as a secondary approach [2] - Key sectors to watch include technology growth and self-sufficiency, with specific attention to batteries, power grids, robotics, and AI applications [2] - There are opportunities in cyclical sectors benefiting from marginal PPI improvements, such as steel, chemicals, and real estate, which may see valuation recovery [2]

沪指重回3900点 消费电子板块全天活跃

Shang Hai Zheng Quan Bao· 2025-10-21 18:22

10月21日,A股三大指数延续上涨态势,沪指重回3900点上方,科技股持续走强带动创业板指再次领 涨。截至收盘,上证指数报3916.33点,涨1.36%;深证成指报13077.32点,涨2.06%;创业板指报 3083.72点,涨3.02%。沪深北三市全天成交18927亿元,较前一个交易日放量1414亿元。 盘面上,全市场超4600只个股上涨,科技股持续获资金青睐。深地科技概念开始发酵,德石股份连续2 日以20%幅度涨停;光模块等算力硬件股持续走强,中际旭创盘中涨超10%,新易盛涨超10%;银行板 块震荡走强,农业银行涨1.68%,日线收获13连阳,股价续创历史新高。 消费电子板块全天活跃 消费电子板块昨日全天表现活跃,立讯精密盘中一度触及涨停。截至收盘,环旭电子、闻泰科技涨停, 工业富联接近涨停。 消息面上,市场研究机构Counterpoint Research监测的初步数据显示,三季度全球智能手机出货量同比 增长4%。苹果本季度全球出货量同比增速为前五大品牌中增速最快,全新发布的iPhone 17系列备受欢 迎,多地区预售量创历史新高。 此外,Meta运动AI智能眼镜Oakley Meta Vanguar ...