养殖

Search documents

正邦科技:10月27日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-28 10:22

Group 1 - The core point of the article is that Zhengbang Technology announced its third quarter report for 2025 during a board meeting held on October 27, 2025, and provided insights into its revenue composition for the first half of 2025 [1] - In the first half of 2025, the revenue composition of Zhengbang Technology was as follows: breeding accounted for 59.63%, feed accounted for 38.94%, veterinary medicine accounted for 0.92%, and other businesses accounted for 0.51% [1] - As of the report date, Zhengbang Technology's market capitalization was 27.4 billion yuan [1] Group 2 - The A-share market has surpassed 4000 points, marking a significant resurgence after a decade of stagnation, with technology leading the market's transformation into a new "slow bull" pattern [1]

国泰海通: 四季度关注农业板块在政策下的催化,主要关注养殖、种植板块

Xin Lang Cai Jing· 2025-10-27 11:45

Core Viewpoint - The report from Guotai Junan emphasizes the importance of addressing "three rural issues" as a priority in the 14th Five-Year Plan, aiming to promote urban-rural integration and accelerate the construction of a strong agricultural nation [1] Summary by Category Policy Focus - The government aims to enhance agricultural comprehensive production capacity and quality efficiency, as well as improve the effectiveness of policies that benefit farmers [1] Sector Attention - In the fourth quarter, there is a focus on the agricultural sector as a catalyst under the new policies, with particular attention on the breeding and planting segments [1]

午评:主要股指均显著上涨 通信设备、钢铁板块涨幅靠前

Xin Hua Cai Jing· 2025-10-27 03:58

Market Performance - The Shanghai and Shenzhen stock markets opened significantly higher on October 27, with the Shanghai Composite Index rising 1.04% to 3991.35 points and a trading volume of approximately 696.2 billion yuan [1] - The Shenzhen Component Index increased by 1.26% to 13457.28 points, with a trading volume of about 868.9 billion yuan, while the ChiNext Index rose 1.54% to 3220.52 points, with a trading volume of around 412.8 billion yuan [1] Sector Performance - The communication equipment, steel, and aquaculture sectors showed strong gains, while the wind power and gaming sectors experienced declines [1] - Technology sectors, including photolithography machines, storage chips, and semiconductors, initially surged before experiencing a pullback, followed by a rebound before the midday close [1] - Low P/E ratio sectors such as coal, banking, electricity, and oil saw initial adjustments but rebounded significantly [1] Individual Stock Highlights - Leading technology stocks continued their strong performance from the previous trading day, with several stocks, including New Yisheng and Jiangbo Long, reaching historical intraday highs [1] Economic Indicators - In September, profits of industrial enterprises above designated size increased by 21.6% year-on-year, with total profits for the first nine months reaching 537.32 billion yuan, a 3.2% increase year-on-year [4] - Among 41 major industrial sectors, 23 reported profit growth year-on-year, with 30 sectors showing profit increases in September, representing a growth rate of 73.2% [4] - Notable growth was observed in the aerospace industry, with profits in aerospace manufacturing rising by 11.3%, and significant increases in smart consumer devices and electronic components manufacturing profits by 81.6% and 39.7%, respectively [4]

国新国证期货早报-20251027

Guo Xin Guo Zheng Qi Huo· 2025-10-27 01:42

1. Report Industry Investment Ratings - There is no information about the report industry investment ratings in the provided content. 2. Core Views of the Report - On October 24, 2025, A - share three major indices strengthened, with the Shanghai Composite Index hitting a ten - year high. The Shanghai Composite Index rose 0.71% to 3950.31 points, the Shenzhen Component Index rose 2.02% to 13289.18 points, and the ChiNext Index rose 3.57% to 3171.57 points. The trading volume of the two markets reached 19742 billion yuan, a significant increase of 3303 billion yuan from the previous day [1]. - The prices of various futures products showed different trends. For example, the CSI 300 Index, coke, and coking coal indices rose, while the prices of some products like iron ore futures fell [1][2][3][4]. - Different factors affected the prices of various futures products. For instance, the supply - demand relationship, policy, and international trade factors influenced the prices of sugar, soybean meal, and other products [5][9]. 3. Summary by Related Catalogs Stock Index Futures - On October 24, A - share three major indices strengthened. The Shanghai Composite Index rose 0.71% to 3950.31 points, the Shenzhen Component Index rose 2.02% to 13289.18 points, and the ChiNext Index rose 3.57% to 3171.57 points. The trading volume of the two markets reached 19742 billion yuan, a significant increase of 3303 billion yuan from the previous day. The CSI 300 Index closed at 4660.68, a ring - up of 54.34 [1][2]. Coke and Coking Coal - On October 24, the coke weighted index fluctuated and sorted, closing at 1781.2, a ring - up of 25.4; the coking coal weighted index fluctuated in a narrow range, closing at 1261.2 yuan, a ring - up of 16.0. The炼焦煤 price in Linfen Anze market rose 50 yuan/ton on October 23. Steel inventory decreased, and the output of the top 10 coal enterprises increased year - on - year. The potential negative feedback risk will restrict the short - term rebound height of coal and coke prices, and the coking coal basis and inter - month positive spreads strengthened [3][4][5]. Zhengzhou Sugar - The consulting company Datagro predicted that the global sugar will have a surplus of 198 million tons in the 2025/26 season, compared with a previous forecast of a shortage of 500 million tons, which put pressure on the market. Affected by the decline of US sugar, the Zhengzhou sugar 2601 contract closed slightly lower in the night session on October 24 [5]. Rubber - The Shanghai rubber fluctuated slightly and closed slightly higher in the night session on October 24. As of October 24, the natural rubber inventory in the Shanghai Futures Exchange decreased by 9898 tons to 163450 tons, and the futures warehouse receipts decreased by 10980 tons to 124020 tons. The 20 - grade rubber inventory increased by 2924 tons to 46772 tons, and the futures warehouse receipts increased by 2521 tons to 42640 tons. The capacity utilization rate of tire sample enterprises increased slightly last week [6][8]. Soybean Meal - Internationally, on October 24, the CBOT soybean futures fluctuated. The market expected the Sino - US trade talks to improve the bilateral trade environment. The estimated US soybean harvest progress reached 73% as of October 19. The Brazilian soybean crop started well, with most mainstream institutions estimating the new - year output at about 1.78 billion tons. Domestically, on October 24, the M2601 main contract closed at 2933 yuan/ton, a decline of 0.17%. The domestic soybean imports in the first three quarters reached a record high, and the soybean inventory of oil mills was still high, limiting the rebound space [9]. Live Pigs - On October 24, the live pig futures price fluctuated. The LH2601 main contract closed at 12175 yuan/ton, a decline of 0.2%. The widening of the standard - fat price difference attracted second - round fattening, providing short - term support. However, the domestic live pig inventory was still at a high level, and the terminal consumption was weak, so the short - term market was in a situation of strong supply and weak demand [10]. Shanghai Copper - Shanghai copper maintained a volatile and slightly stronger trend, with the price center likely to move up slightly, supported by supply contraction expectations and macro - policy benefits. However, weak demand and uncertain factors may limit the increase [10]. Cotton - On the night of October 24, the main contract of Zhengzhou cotton closed at 13585 yuan/ton. The cotton inventory decreased by 23 lots compared with the previous day. The price of machine - picked cotton was concentrated at 6.2 - 6.4 yuan per kilogram. The Sino - US - Malaysia trade negotiations made phased progress [10]. Iron Ore - On October 24, the 2601 main contract of iron ore fluctuated and closed down, with a decline of 0.58% and a closing price of 771 yuan. The iron ore shipment volume increased month - on - month, the domestic arrival volume decreased from a high level, and the hot metal output continued to decline from a high level. Short - term iron ore prices were in a volatile trend [11]. Asphalt - On October 24, the 2601 main contract of asphalt fluctuated and closed up, with a rise of 0.92% and a closing price of 3299 yuan. The refinery production plan in November decreased significantly month - on - month, the inventory continued to decrease, and the demand for rigid - need stocking increased. The recent rise in crude oil prices boosted market sentiment, and short - term asphalt prices were in a volatile trend [11]. Logs - On October 24, the 2601 log contract opened at 830, with a minimum of 826, a maximum of 833.5, and closed at 829, with an increase of 672 lots in positions. Attention should be paid to the support of the moving average at 827 - 815. The spot prices in Shandong and Jiangsu remained unchanged. The supply - demand relationship had no major contradictions, and the market was in a pattern of gradual inventory reduction [11][12]. Steel - The recent macro - level was mixed, with limited incremental information from the "14th Five - Year Plan Press Conference" and a neutral impact on the market. Sino - US high - level economic and trade consultations released some positive signals, but the EU's sanctions on Russia affected some Chinese enterprises, adding uncertainties. The domestic demand recovery momentum was still weak, and the risk of market volatility due to unmet expectations should be警惕 [12]. Alumina - The bauxite port inventory decreased slightly, and the supply tightened, with firm ore prices. The alumina spot price continued to weaken, squeezing smelter profits and increasing the expectation of production cuts, so the domestic alumina supply might gradually decrease. The domestic electrolytic aluminum capacity and operation remained at a high level, and the demand for alumina might be slightly boosted. Overall, the alumina price might be supported [13]. Shanghai Aluminum - The alumina spot price continued to weaken, and the domestic macro - expectation boosted the aluminum price, increasing the electrolytic aluminum smelting profit and production enthusiasm. However, the incremental supply of domestic electrolytic aluminum was limited. The "14th Five - Year Plan" improved domestic consumption expectations, and the downstream start - up rate increased during the traditional peak season, strengthening aluminum consumption and reducing aluminum ingot inventory. However, the inhibitory effect of high aluminum prices on downstream demand should be carefully observed [13].

浙江金华 天蓝水碧气象新

Jing Ji Ri Bao· 2025-10-26 21:55

Group 1 - The article highlights the transformation of the ecological environment and economic development in Jinhua, Zhejiang, emphasizing the balance between industrial growth and environmental protection [1][2] - The local government initiated a comprehensive water treatment campaign, resulting in the closure of over 20,000 crystal processing workshops and the relocation of the industry to designated parks, promoting a shift from low-end to high-end production [1] - Jinhua's efforts in water quality improvement have led to a 100% increase in surface water quality above Class III standards, earning the highest award in the "Five Water Co-Governance" initiative for 11 consecutive years [1] Group 2 - The modern hardware industry in Yongkang, a representative of Jinhua's traditional industries, is facing challenges due to pollution from high-temperature emissions from furnaces [2] - A pilot project for waste heat recovery has been initiated, with five companies participating, including Shunhu Aluminum and Feijian Industry, which have implemented technologies to reduce natural gas consumption and carbon emissions [2] - The project is expected to reduce approximately 40,000 tons of carbon dioxide emissions annually once fully implemented [2] Group 3 - Innovative projects in Jinhua include the establishment of the "Panda Pig Paradise" to promote the "Jinhua Two-Headed Black Pig" and the development of smart bird-watching technology by Unijia Intelligent Technology [3] - Green finance initiatives, such as the "Flower Wood Loan" product from Jinhua Chengtai Rural Commercial Bank, have provided 3.083 billion yuan in loans to support the flower and tree industry and other green projects [3] - The ecological resources in Jinhua are being effectively converted into economic benefits, enhancing the livelihoods of local residents and expanding the pathways for the "Two Mountains" concept [3]

打响“时味苏州”主品牌

Su Zhou Ri Bao· 2025-10-26 00:36

Core Viewpoint - The "Three-Year Action Plan for the High-Quality Development of Suzhou's Characteristic Agricultural and Sideline Products (2025-2027)" aims to enhance the green, standardized, and international development of local agricultural products, focusing on quality and safety standards [1][2][3] Group 1: Green Development - By 2027, the coverage rate of soil testing and formula technology for major crops in Suzhou is expected to exceed 98%, with green prevention and control coverage reaching over 73% [1] - The comprehensive mechanization rate for important grain crops is projected to be 99%, while the mechanization level for characteristic agriculture is anticipated to be over 86% [1] - The overall quality safety compliance rate for local agricultural products is targeted to remain stable at over 98%, with the total number of green and high-quality agricultural products exceeding 1,000 and accounting for over 85% of the total [1] Group 2: Standardization and Scale - The plan emphasizes the establishment of a characteristic germplasm resource protection system, focusing on local varieties such as Biluochun tea and Taihu pigs [2] - By 2027, the grain planting area is expected to exceed 2 million mu, with a total output of over 950,000 tons, and the conversion rate of high-quality rice reaching over 50% [2] - The total output value of the "Yangcheng Lake Crab" industry chain is projected to exceed 35 billion yuan, while the "Changshu Blue Dragon" industry chain is expected to exceed 40 million yuan [2] Group 3: Social Services and Innovation - The plan includes the establishment of two cold chain distribution centers for agricultural products and the construction of various modern agricultural demonstration projects by 2027 [3] - The goal is to achieve over 250 billion yuan in e-commerce sales of agricultural products, with the establishment of 15 city-level agricultural product e-commerce industrial alliances [3] - The plan aims to enhance brand development, focusing on promoting the main brand "Time Flavor Suzhou" and key products like "Yangcheng Lake Crab" and "Suzhou Rice" [3] Group 4: Internationalization and Cultural Heritage - The plan supports the export of preserved agricultural products and aims to add 10 new agricultural export enterprises by 2027 [3] - It targets the addition of three national-level agricultural cultural heritage sites and five provincial-level sites, promoting the Wujiang sericulture culture system [3] - The plan also focuses on integrating rural consumption patterns to cater to urban youth, families, and senior groups [3]

板块轮动到谁了?沪指逼近4000点 机构正大幅买入这些主题ETF

Mei Ri Jing Ji Xin Wen· 2025-10-25 04:54

Market Overview - The Shanghai Composite Index has surged past 3950 points, reaching a nearly ten-year high and approaching the 4000-point mark [1][2] - The total trading volume for the week in the Shanghai and Shenzhen markets was 8.9 trillion yuan, with the Shanghai market accounting for 3.93 trillion yuan and the Shenzhen market for 4.97 trillion yuan [2] ETF Fund Flows - Over 200 billion yuan has flowed out of stock and cross-border ETFs this week, with a net outflow of 212 billion yuan from thematic industry ETFs [2][15] - Major broad-based index ETFs experienced a net outflow of 88.41 billion yuan, with the ChiNext ETF seeing a net outflow of 37.16 billion yuan [8][15] Sector Performance - The brokerage and robotics ETFs have attracted significant capital, with net inflows of 9.87 billion yuan and 7.06 billion yuan, respectively [13][17] - Conversely, the artificial intelligence and new energy vehicle-related ETFs faced substantial outflows, with net outflows of 8.81 billion yuan and 5.93 billion yuan, respectively [15][17] Notable ETF Movements - The brokerage ETF (512000) saw its shares increase by 16.76 billion, reaching a new high of 649.19 billion shares [16][17] - The robotics ETF (562500) also experienced a rise, with shares reaching 226.54 billion, marking a new high [17] Upcoming ETF Issuance - Six new ETFs are set to be issued next week, tracking sectors such as the satellite industry, technology, and photovoltaic industries [25][26]

养殖油脂产业链日报策略报告-20251024

Fang Zheng Zhong Qi Qi Huo· 2025-10-24 02:59

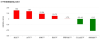

1. Report Industry Investment Rating No relevant content provided. 2. Core Viewpoints of the Report - **Soybean Oil**: The main 01 contract of soybean oil continued to adjust weakly on Thursday. The increase in Malaysian palm oil production data led to a decline in the overall oil and fat market. China's soybean oil inventory is accumulating, with sufficient supply. Although the short - term upward drive of the futures price is insufficient, the expectation is positive. It is not recommended to chase short - selling. The support level of the main contract is 8100 - 8130 yuan/ton, and the pressure level is 8400 - 8450 yuan/ton. Pay attention to the results of recent Sino - US trade negotiations [3]. - **Rapeseed Oil**: The main contract of rapeseed oil fell again. The increase in Malaysian palm oil production and the non - realization of the palm oil production reduction expectation led to a weak adjustment of the futures price, which in turn drove down the rapeseed oil price. China's rapeseed oil inventory is at a relatively high level, and the sentiment of relaxing the import policy of Canadian rapeseeds is rising. However, the short - term import supply of rapeseed is tightening, and the inventory is declining, so the basis remains firm. The main contract continued to reduce positions and volume, and the market sentiment was weak. The market may oscillate and adjust. It is recommended to wait and see in the short term [4]. - **Palm Oil**: The main 01 contract of palm oil adjusted weakly on Thursday. The increase in Malaysian palm oil production led to a decline in the palm oil price, weakening the strong expectation in the fourth quarter. As the palm oil in the producing areas is about to enter the production - reduction season, it is not advisable to chase short - selling. The short - term palm oil may test the support in the 9000 - 9050 range, and the pressure level is 9350 - 9400. It is advisable to wait and see for the time being [4]. - **Soybean No.2 and Soybean Meal**: The main 11 contract of CBOT soybeans remained firm, and the main 01 contract of soybean meal rose. Frequent Sino - US trade negotiations and the expectation of an increase in US soybean exports supported the price of CBOT soybeans. China's domestic inventory of soybean meal is sufficient, and the further downward drive is weakening. It is recommended to wait and see for the time being [5]. - **Rapeseed Meal**: Rapeseed meal stopped falling and rebounded. Affected by weak demand and the easing of Sino - Canadian trade relations, the rapeseed meal market had been weak. However, the cumulative import volume of rapeseeds from January to September decreased by 42.2% year - on - year, and the inventory continued to decline, providing some support for the weak demand. The current fundamentals are weak in both supply and demand, and the futures price is expected to oscillate and adjust. It is recommended to go long on the 01 contract oil - meal ratio [5][6]. - **Corn and Corn Starch**: The futures prices continued to oscillate and consolidate on Thursday. The external market changed little. In the domestic market, the new - season harvest is in the middle and late stages. The continuous rainy weather in North China has brought new differences to the market. The short - term upward space of the futures price is still limited. It is recommended to reduce short positions on dips or pay attention to the reverse spread of the corn 1 - 5 spread [6]. - **Soybean No.1**: The main 01 contract of soybean No.1 rose on Thursday. The high - quality soybeans in Northeast China are in high demand, and due to low valuation, farmers are reluctant to sell. After continuous rises, the long - position holders are cautious, and the selling - hedging drive increases. It is recommended to exit long positions and wait and see [7]. - **Peanuts**: The peanut futures price continued to oscillate and decline. The market lacks positive news. The new - season peanuts are gradually on the market, but the harvest weather is unfavorable, which increases concerns about the new - season output. Although the planting area has increased, the expected increase in production is discounted. There is still pressure from seasonal supply on the spot and futures prices. It is recommended to hold long positions for the time being [7]. - **Pigs**: The futures price of pigs adjusted weakly on Thursday. The spot price stopped falling this week, and the futures price rebounded after reducing positions. The market volatility remained high due to the Sino - US tariff restart negotiation. The current pig - to - grain ratio has fallen below 5. It is recommended to wait and see for the time being for conservative investors. For mid - term investment, wait for the confirmation of capacity reduction and then buy the 2607 contract on dips [8][9]. - **Eggs**: The egg futures price rebounded after reducing positions on Thursday. The spot price was stable with a slight decline this week, and the decline slowed down. The egg futures price has fallen below the historical low since 2016. It is not advisable to chase short - selling. Conservative investors should wait and see, while aggressive investors can buy the 2512 contract on dips when the price is below the farmers' cash cost [9]. 3. Summary According to the Directory 3.1 First Part: Sector Strategy Recommendations 3.1.1 Market Analysis - Most varieties in the feed, breeding, and oil and fat industries are expected to oscillate and adjust. For example, soybean No.1, soybean No.2, peanuts, soybean oil, rapeseed oil, palm oil, soybean meal, and rapeseed meal are all in an oscillating adjustment state. Corn and corn starch are expected to be in a low - level oscillation. Pigs and eggs are in an oscillating bottom - seeking state [12]. 3.1.2 Commodity Arbitrage - **Inter - period Arbitrage**: For most varieties, it is recommended to wait and see, such as soybean No.1 11 - 1, soybean No.2 11 - 1, etc. For the corn 5 - 1 spread, it is recommended to go long on dips with a reference target of 180 - 200. For the pig 1 - 3 spread, it is recommended to do a positive spread on dips [13]. - **Inter - variety Arbitrage**: For some spreads, such as 01 soybean oil - palm oil, it is recommended to operate bearishly; for 01 rapeseed oil - soybean oil, it is recommended to operate bullishly; for the 01 contract oil - meal ratio of beans and rapeseeds, it is recommended to operate bullishly [13]. 3.1.3 Basis and Spot - Futures Strategies - The report provides the spot prices, price changes, and basis changes of various varieties in different sectors, including soybeans, rapeseed, palm oil, etc. For example, the spot price of soybean No.1 is 3980 yuan/ton, and the basis of the main contract is - 133 yuan/ton [14]. 3.2 Second Part: Key Data Tracking Table 3.2.1 Oilseeds and Oils - **Daily Data**: It shows the import cost data of soybeans, rapeseeds, and palm oil from different origins and shipping periods, including CNF prices, import duty - paid prices, and the cost of soybean meal when the profit is zero [15][16]. - **Weekly Data**: It presents the inventory and operating rates of various oilseeds and oils. For example, the port inventory of soybeans is 773.35 (with a change of 21.92), and the operating rate of soybean processing plants is 58.00% [17]. 3.2.2 Feed - **Daily Data**: It provides the import cost data of corn from Argentina and Brazil in different months [18]. - **Weekly Data**: It shows the consumption, inventory, operating rate, and inventory of corn and corn starch in deep - processing enterprises [18]. 3.2.3 Breeding - It includes the daily and weekly data of pigs and eggs, such as the price, weight, and profit of pigs, as well as the price, production rate, and inventory of eggs [19][20][21][23]. 3.3 Third Part: Fundamental Tracking Charts - The report provides a series of charts to track the fundamentals of the breeding, oilseeds and oils, and feed sectors, including the closing prices of futures contracts, spot prices, basis, spreads, production, export, inventory, and other data of various varieties [24][35][52]. 3.4 Fourth Part: Options Situation of Feed, Breeding, and Oils - The report shows the historical volatility of futures prices of varieties such as rapeseed meal, rapeseed oil, soybean oil, palm oil, and peanuts, as well as the trading volume, open interest, and put - call ratio of corn options [86][87][88]. 3.5 Fifth Part: Warehouse Receipt Situation of Feed, Breeding, and Oils - It presents the warehouse receipt quantities of various varieties, including rapeseed meal, rapeseed oil, soybean oil, palm oil, peanuts, corn, corn starch, pigs, and eggs, as well as the open interest of the pig and egg indexes [91][92][94].

温氏股份(300498):主营业务稳健运营 成本持续改善

Xin Lang Cai Jing· 2025-10-24 00:37

Core Viewpoint - The company reported a slight increase in revenue for the first three quarters of 2025, but a significant decline in net profit, primarily due to fluctuations in agricultural product prices [1][2]. Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 75.817 billion yuan, representing a year-on-year increase of 0.53%. The net profit attributable to shareholders was 5.256 billion yuan, down 17.98% year-on-year [1][2]. - In the third quarter alone, the company recorded a revenue of 25.942 billion yuan, a decrease of 9.49% year-on-year, with a net profit of 1.781 billion yuan, reflecting a significant decline of 64.94% year-on-year [1][2]. Operational Insights - The company's main business operations remain stable, but the performance is impacted by the volatility in agricultural product prices. The decline in net profit is attributed to lower prices of main products and reduced operating profits in the breeding industry [2]. - The company has successfully reduced breeding costs, with the cost of piglets in August dropping to around 260 yuan per head, and a market pig listing rate of approximately 93%. The feed-to-meat ratio stands at 2.51 [2]. - In the chicken breeding segment, the market chicken listing rate reached 95%, with a feed-to-meat ratio of 2.86, and the total cost of live chicken was 5.8 yuan per jin [2]. Future Outlook - The company is expected to maintain steady business growth, with projected revenues of 96.972 billion yuan, 101.767 billion yuan, and 111.212 billion yuan for 2025, 2026, and 2027 respectively. The net profit attributable to shareholders is forecasted to be 5.006 billion yuan, 9.097 billion yuan, and 17.973 billion yuan for the same years [3]. - The company is viewed positively for its long-term development potential, maintaining a "buy" rating based on its substantial scale in pig and chicken production [3].

新农人更是“兴农人”

Ren Min Ri Bao· 2025-10-23 22:42

Group 1 - The article highlights the success of the old courtyard black chicken farming in Sichuan's Dazhou, which has become a significant source of income for local farmers [1][2] - Liu Xiaogang, known as "Black Chicken Brother," transitioned from teaching to farming, achieving annual sales exceeding 30 million yuan and helping over 300 households increase their income by more than 4,000 yuan each [2] - The Dazhou government is actively promoting the cultivation of new farmers, with over 1,200 new farmers working to boost local industries and improve the livelihoods of their communities [2] Group 2 - Dazhou County has implemented the "One Village One CEO" initiative, selecting 121 villages to attract talented individuals to lead rural development, with successful candidates receiving up to 10% of village collective income [3] - The collaboration between the village of Guangzi and Zhejiang Tianyan Weizhen Network Technology Co., Ltd. has led to the development of agritourism, transforming idle land and old houses into tourist attractions [3] - The Dazhou Agricultural and Rural Bureau emphasizes the importance of supporting and trusting new farmers, allowing them to thrive in the rural revitalization efforts [3]