焦炭

Search documents

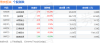

焦炭板块10月16日涨2.01%,安泰集团领涨,主力资金净流入2.24亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

Core Insights - The coke sector experienced a 2.01% increase on October 16, with Antai Group leading the gains [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Sector Performance - Antai Group's stock price rose by 10.20% to 2.70, with a trading volume of 1.8985 million shares and a transaction value of 500 million yuan [1] - Baotailong's stock price increased by 10.03% to 3.95, with a trading volume of 3.8671 million shares and a transaction value of 1.456 billion yuan [1] - Shanxi Coking Coal's stock price rose by 1.70% to 4.18, with a trading volume of 521,600 shares and a transaction value of 217 million yuan [1] - Shaanxi Black Cat's stock price increased by 1.56% to 3.90, with a trading volume of 789,100 shares and a transaction value of 306 million yuan [1] - Yunnan Coal Energy's stock price rose by 1.23% to 4.12, with a trading volume of 386,400 shares and a transaction value of 159 million yuan [1] - Yunwei Co.'s stock price increased by 0.28% to 3.61, with a trading volume of 215,000 shares and a transaction value of 77.4935 million yuan [1] - Meijin Energy's stock price decreased by 0.60% to 5.00, with a trading volume of 778,800 shares and a transaction value of 389.7 million yuan [1] Capital Flow - The coke sector saw a net inflow of 224 million yuan from main funds, while retail funds experienced a net outflow of 113 million yuan and 111 million yuan respectively [1] - Baotailong had a main fund net inflow of 131 million yuan, while retail funds saw a net outflow of 90.41 million yuan [2] - Antai Group experienced a main fund net inflow of 60.25 million yuan, with retail funds seeing a net outflow of 44.32 million yuan [2] - Shanxi Coking Coal had a main fund net inflow of 29.04 million yuan, with retail funds experiencing a net outflow of 8.61 million yuan [2] - Shaanxi Black Cat saw a main fund net inflow of 12.34 million yuan, while retail funds had a net inflow of 0.33 million yuan [2] - Yunnan Coal Energy had a main fund net inflow of 7.76 million yuan, with retail funds seeing a net inflow of 0.86 million yuan [2] - Yunwei Co. experienced a main fund net outflow of 2.72 million yuan, while retail funds had a net inflow of 0.26 million yuan [2] - Meijin Energy had a main fund net outflow of 13.91 million yuan, with retail funds seeing a net inflow of 1.78 million yuan [2]

针状焦板块活跃 宝泰隆涨停

Xin Lang Cai Jing· 2025-10-16 06:48

Group 1 - The needle coke sector is active, with Baotailong hitting the daily limit up [1]

《黑色》日报-20251016

Guang Fa Qi Huo· 2025-10-16 02:58

1. Report Industry Investment Ratings - No industry investment ratings are provided in the reports. 2. Core Views Steel Industry - Although there is an oversupply of steel and an accumulation of plate stocks, there are no signs of a collapse in demand. The inventory pressure can be relieved by compressing profits and reducing production. However, attention should be paid to the impact of new iron ore production capacity on steel. It is recommended to wait and see for single - sided trading and focus on the recovery of apparent demand in the weekly data of Steel Union today [1]. Iron Ore Industry - Due to the weak steel prices and declining profitability of steel mills, the weak demand will force the iron ore market to operate weakly. The overall commissioning progress of the Simandou project is faster than expected. The iron ore market is shifting from a state of tight balance to one of relative abundance. It is recommended to wait and see for single - sided trading, with a reference range of 750 - 800, and the arbitrage strategy of going long on coking coal and short on iron ore is recommended [3]. Coke Industry - The coke futures showed a volatile and weak trend. The cost is expected to increase due to concerns about coking coal supply caused by mining accidents. It is recommended to go long on coke 2601 at low prices, with a reference range of 1550 - 1700, and the arbitrage strategy of going long on coking coal and short on coke is recommended [5]. Coking Coal Industry - The coking coal futures showed a volatile trend. The spot price is expected to enter a rebound trend. It is recommended to go long on coking coal 2601 at low prices, with a reference range of 1080 - 1200, and the arbitrage strategy of going long on coking coal and short on coke is recommended [5]. 3. Summary by Directory Steel Industry - **Prices and Spreads**: The spot and futures prices of rebar and hot - rolled coils generally declined. For example, the spot price of rebar in East China dropped from 3210 yuan/ton to 3190 yuan/ton, and the 01 contract price of rebar decreased from 3061 yuan/ton to 3034 yuan/ton [1]. - **Cost and Profit**: The cost of steel billets decreased by 10 yuan/ton, and the profit of hot - rolled coils in East China decreased by 33 yuan/ton. The profit of rebar in most regions was in a loss state [1]. - **Production**: The daily average pig iron output decreased by 0.3 to 241.5 tons, a decrease of 0.1%. The output of five major steel products decreased by 3.8 tons to 863.3 tons, a decrease of 0.4%. The output of rebar decreased by 3.6 tons to 203.4 tons, a decrease of 1.7% [1]. - **Inventory**: The inventory of five major steel products increased by 127.9 tons to 1600.7 tons, an increase of 8.7%. The inventory of rebar increased by 57.4 tons to 602.3 tons, an increase of 9.5% [1]. - **Transaction and Demand**: The building materials trading volume decreased by 1.1 to 10.6 tons, a decrease of 10.8%. The apparent demand of five major steel products decreased by 153.4 tons to 751.4 tons, a decrease of 17.0% [1]. Iron Ore Industry - **Prices and Spreads**: The warehouse receipt costs of various iron ore powders decreased slightly, and the 01 contract basis of some iron ore powders increased. For example, the warehouse receipt cost of PB powder decreased from 827.1 yuan/ton to 821.6 yuan/ton, and the 01 contract basis of Bar - mixed powder increased from 53.2 yuan/ton to 55.5 yuan/ton [3]. - **Supply**: The global shipping volume of iron ore decreased by 71.5 tons to 3207.5 tons, a decrease of 2.2%, while the arrival volume at 45 ports increased by 437.1 tons to 3045.8 tons, an increase of 16.8% [3]. - **Demand**: The daily average pig iron output of 247 steel mills decreased by 0.3 to 241.5 tons, a decrease of 0.1%. The national monthly pig iron output decreased by 100.5 tons to 6979.3 tons, a decrease of 1.4% [3]. - **Inventory**: The port inventory increased by 61.6 tons to 14086.14 tons, an increase of 0.4%, and the imported ore inventory of 247 steel mills decreased by 990.6 tons to 9046.2 tons, a decrease of 9.9% [3]. Coke and Coking Coal Industry Coke - **Prices and Spreads**: The prices of coke futures contracts decreased slightly. The 01 contract of coke decreased from 1655 yuan/ton to 1642 yuan/ton, a decrease of 0.8%. The coking profit decreased by 11 yuan/ton to - 54 yuan/ton [5]. - **Supply**: The daily average output of all - sample coking plants remained unchanged at 66.1 tons, and the daily average output of 247 steel mills decreased by 0.3 to 241.5 tons, a decrease of 0.1% [5]. - **Demand**: The pig iron output of 247 steel mills decreased by 0.3 to 241.5 tons, a decrease of 0.1% [5]. - **Inventory**: The total coke inventory decreased by 10.1 tons to 909.8 tons, a decrease of 1.1%. The coke inventory of coking plants increased, while the inventory of steel mills and ports decreased [5]. Coking Coal - **Prices and Spreads**: The prices of coking coal futures contracts decreased slightly. The 01 contract of coking coal decreased from 1154 yuan/ton to 1151 yuan/ton, a decrease of 0.2%. The profit of sample coal mines remained unchanged at 466 yuan/ton [5]. - **Supply**: The raw coal output decreased by 31.3 tons to 836.7 tons, a decrease of 3.6%, and the clean coal output decreased by 19.8 tons to 426.3 tons, a decrease of 4.4% [5]. - **Demand**: The daily average output of all - sample coking plants remained unchanged at 66.1 tons, and the daily average output of 247 steel mills decreased by 0.3 to 241.5 tons, a decrease of 0.1% [5]. - **Inventory**: The coal mine inventory increased, while the inventory of ports, coking plants, and steel mills decreased [5].

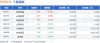

焦炭板块10月15日跌1.19%,宝泰隆领跌,主力资金净流出2.78亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-15 08:33

Core Viewpoint - The coking coal sector experienced a decline of 1.19% on October 15, with Baotailong leading the drop, while the overall stock market indices showed positive performance with the Shanghai Composite Index rising by 1.22% and the Shenzhen Component Index increasing by 1.73% [1]. Group 1: Market Performance - The coking coal sector's decline was marked by Baotailong's significant drop, contributing to the overall negative trend in the sector [1]. - The Shanghai Composite Index closed at 3912.21, reflecting an increase of 1.22%, while the Shenzhen Component Index closed at 13118.75, up by 1.73% [1]. Group 2: Individual Stock Performance - Key stocks in the coking coal sector showed varied performance, with Shaanxi Black Cat (601015) closing at 3.84, up by 0.52%, and Yunmei Energy (600792) at 4.07, up by 0.49% [1]. - Baotailong (601011) experienced a significant decline of 9.34%, closing at 3.59, while other stocks like Shanxi Coking (600740) and Yungwei Co. (600725) also faced losses [1]. Group 3: Capital Flow - The coking coal sector saw a net outflow of 278 million yuan from main funds, while retail investors contributed a net inflow of 163 million yuan [1]. - The capital flow data indicates that while main funds withdrew, retail investors were more active, particularly in stocks like Yunwei Co. (600725), which saw a net inflow of 945.75 million yuan from retail investors [2].

广发期货日评-20251015

Guang Fa Qi Huo· 2025-10-15 07:15

1. Report Industry Investment Ratings - No specific industry investment ratings are provided in the report. 2. Core Views - The market risk preference may be suppressed in the short - term due to Trump's statement on tariff hikes, causing A - shares to decline, but the stock index is expected to fall first and then rebound, with an upward long - term trend [3]. - The bond market warms up due to stock market adjustments and loose liquidity, and short - term treasury bond futures are expected to continue to fluctuate within a range [3]. - Gold has large market fluctuations before the APEC meeting in South Korea at the end of October, and silver maintains a strong trend [3]. - Steel products' hot - rolled coils have accumulated inventory, and attention should be paid to post - holiday demand recovery; the iron ore market has weakened [3]. - The price of crude oil is under pressure due to Sino - US trade tensions and a pessimistic IEA report; most chemical products have weak supply - demand expectations [3]. - Agricultural products such as soybeans, corn, and palm oil are affected by various factors and show different trends, with some under pressure and some in a weak pattern [3]. - Special commodities like soda ash and glass are in a situation of oversupply and weak operation; industrial silicon prices are weakly fluctuating [3]. - New energy products such as polysilicon and lithium carbonate have different trends, with polysilicon having a late - session rebound and lithium carbonate having a tight - balance fundamental situation [3]. 3. Summary by Related Catalogs Financial Index Futures - The stock index rises and then falls, with a style switch on the market. Due to the tariff conflict, the stock index is expected to fall first and then rebound in the short - term, and the long - term upward trend remains unchanged. Conservative investors can wait for the volatility to converge and then enter the market at low prices [3]. Treasury Bonds - The stock market adjustment and loose liquidity promote the bond market to warm up. Short - term treasury bond futures are expected to continue to fluctuate within a range. For example, T2512 may fluctuate between 107.4 - 108.3, and it is recommended to wait and see for over - adjustment opportunities [3]. Precious Metals - Gold has large fluctuations before the APEC meeting in South Korea at the end of October. One can choose to buy lightly above 910 yuan and set stop - loss and take - profit. Silver maintains a strong trend above 50 dollars [3]. Shipping Index (European Line) - From the perspective of macro - uncertainty factors, it is recommended to be cautious and wait and see [3]. Black Steel - Hot - rolled coils have accumulated a lot of inventory, and attention should be paid to post - holiday demand recovery. The profit of the coil - screw spread converges [3]. Iron Ore - Supply - side disturbances weaken, shipments decline, arrivals increase, and the iron ore market weakens. It is recommended to wait and see for the time being, with a reference range of 750 - 830 [3]. Coking Coal - After the holiday, coal prices in coal - producing areas are weak, downstream replenishment demand weakens, and there are concerns about reduced Mongolian coal supply. It is recommended to go long on JM2601 at low prices, with a reference range of 1080 - 1200 [3]. Coke - The first round of price increases was implemented before the holiday, and there is not much room for further increases. It is recommended to go long on J2601 at low prices, with a reference range of 1550 - 1700 [3]. Non - ferrous - Copper prices fluctuate, and it is recommended to take profit on long positions at high prices. Aluminum, zinc, nickel, stainless steel, etc. all have corresponding price reference ranges and operation suggestions [3]. - Tin can be bought when the macro - sentiment drops. Energy and Chemical Crude Oil - Sino - US trade tensions and a pessimistic IEA report suppress oil prices. It is recommended to maintain a short - selling strategy on the single side, with support levels for different benchmarks provided [3]. Chemical Products - Most chemical products such as urea, PX, PTA, etc. have weak supply - demand expectations, and corresponding operation suggestions such as short - selling on rebounds and month - spread reverse arbitrage are given [3]. Agricultural Products - Different agricultural products such as soybeans, corn, palm oil, sugar, cotton, eggs, apples, and dates are affected by various factors and show different trends and price ranges, with corresponding operation suggestions [3]. Special Commodities - Soda ash and glass are in a situation of oversupply and weak operation, and it is recommended to hold short positions. Rubber can be observed during the peak - production period, and industrial silicon prices fluctuate within a range [3]. New Energy - Polysilicon rebounds in the late session, and it is recommended to hold long positions. Lithium carbonate has a tight - balance fundamental situation, with a price - center reference range of 70,000 - 75,000 yuan [3].

《黑色》日报-20251015

Guang Fa Qi Huo· 2025-10-15 02:41

Report Summary 1. Industry Investment Rating - No investment rating information is provided in the report. 2. Core Views - **Steel**: Although steel demand is weak, the cost side provides support. For the January contracts, pay attention to the price supports of 3000 for rebar and 3200 for hot-rolled coils. If the hot-rolled coil apparent demand can recover to the 3.25 million tons level at the end of September, the steel inventory pressure will be low. Rebar production is lower than apparent demand, and with losses in tonnage steel profit, it is expected to maintain a de-stocking trend [2]. - **Iron Ore**: Due to the weak operation of steel prices and the continuous decline in the profitability of steel mills, concerns on the supply side and weakness on the demand side will limit iron ore to fluctuate within a range. Pay attention to whether the steel industry implements the ban on new production capacity and production reduction control in the fourth quarter, as well as the progress of China-Australia iron ore negotiations. Macroscopically, focus on the impact of the China-US tariff war and subsequent negotiations. For strategies, iron ore is still in a balanced and slightly tight pattern, and the weakness of finished products drags down raw materials. Temporarily observe on a single side, with the range referring to 750 - 830, and recommend the arbitrage strategy of going long on iron ore and short on hot-rolled coils [5]. - **Coke**: Speculative investors are advised to go long on Coke 2601 at low prices, with the range referring to 1550 - 1700. The arbitrage strategy is to go long on coking coal and short on coke. Pay attention to the signs of bottom stabilization as the market fluctuates greatly [7]. - **Coking Coal**: It is recommended to go long on Coking Coal 2601 at low prices in the short term, with the range referring to 1080 - 1200. The arbitrage strategy is to go long on coking coal and short on coke. Be cautious as the market fluctuates greatly [7]. 3. Summary by Directory Steel - **Prices and Spreads**: Rebar and hot-rolled coil spot and futures prices mostly declined. For example, rebar 05 contract dropped from 3139 to 3114, and hot-rolled coil 05 contract decreased from 3274 to 3248. Steel billet price decreased by 10 to 2930, and plate billet price remained unchanged at 3730. Profits varied, with East China hot-rolled coil profit dropping by 7 to 62 [2]. - **Production**: Daily average pig iron output decreased by 0.3 to 241.5, a 0.1% decline. The output of five major steel products decreased by 3.8 to 863.3, a 0.4% decline. Rebar production decreased by 3.6 to 203.4, a 1.7% decline, with electric furnace output dropping by 2.5 to 23.3, a 9.8% decline [2]. - **Inventory**: The inventory of five major steel products increased by 127.9 to 1600.7, an 8.7% increase. Rebar inventory increased by 57.4 to 659.6, a 9.5% increase, and hot-rolled coil inventory increased by 32.3 to 412.9, an 8.5% increase [2]. - **Demand**: Apparent demand for five major steel products decreased by 153.4 to 751.4, a 17.0% decline. Rebar apparent demand decreased by 87.9 to 153.2, a 36.5% decline, and hot-rolled coil apparent demand decreased by 29.6 to 295.0, a 9.1% decline [2]. Iron Ore - **Prices and Spreads**: The warehouse receipt costs of various iron ore powders decreased, such as the warehouse receipt cost of Carajás fines dropping by 19.8 to 830.8, a 2.3% decline. Spot prices at Rizhao Port also declined, for example, the price of Carajás fines decreased by 18.0 to 908.0, a 1.9% decline [5]. - **Supply**: The weekly global shipment volume of iron ore decreased by 71.5 to 3207.5, a 2.2% decline, while the 45-port arrival volume increased by 437.1 to 3045.8, a 16.8% increase. The national monthly import volume increased by 61.5 to 10522.5, a 0.6% increase [5]. - **Demand**: The weekly average daily pig iron output of 247 steel mills decreased by 0.3 to 241.5, a 0.1% decline. The weekly average daily port clearance volume of 45 ports decreased by 9.4 to 327.0, a 2.8% decline. The national monthly pig iron output decreased by 100.5 to 6979.3, a 1.4% decline, and the national monthly crude steel output decreased by 229.0 to 7736.9, a 2.9% decline [5]. - **Inventory**: The 45-port inventory increased by 61.6 to 14086.14, a 0.4% increase. The imported ore inventory of 247 steel mills decreased by 990.6 to 9046.2, a 9.9% decline, and the inventory available days of 64 steel mills decreased by 4.0 to 21.0, a 16.0% decline [5]. Coke and Coking Coal - **Prices and Spreads**: The price of Shanxi quasi-primary wet quenched coke (warehouse receipt) remained unchanged at 1561, and the price of Shanxi medium-sulfur primary coking coal (warehouse receipt) also remained unchanged at 1270. Coke 01 contract increased by 12 to 1655, and coking coal 01 contract increased by 8 to 1154 [7]. - **Supply**: The weekly average daily output of all-sample coking plants remained unchanged at 66.1. The weekly output of coke decreased by 0.3 to 241.5, a 0.1% decline. For coking coal, the output of sample coal mines decreased, with raw coal output decreasing by 31.3 to 836.7, a 3.6% decline, and clean coal output decreasing by 19.8 to 426.3, a 4.4% decline [7]. - **Demand**: The weekly pig iron output of 247 steel mills decreased by 0.3 to 241.5, a 0.1% decline. The weekly demand for coke decreased, and the demand for coking coal also weakened as the coking plant's operation rate decreased slightly [7]. - **Inventory**: Coke total inventory decreased by 10.1 to 909.8, a 1.1% decline. The inventory of all-sample coking plants increased by 1.5 to 63.8, a 2.5% increase, while the inventory of 247 steel mills decreased by 12.6 to 650.8, a 1.9% decline. For coking coal, the inventory of all-sample coking plants decreased by 78.7 to 959.1, a 7.6% decline, and the inventory of 247 steel mills decreased by 6.9 to 781.1, a 0.9% decline [7].

中美在海事、物流和造船领域开启博弈

Guo Tai Jun An Qi Huo· 2025-10-15 01:41

1. Report Industry Investment Rating No relevant content provided. 2. Core Views of the Report - The US officially imposed restrictions such as port fees on China's maritime, logistics, and shipbuilding sectors. China strongly opposed this and announced counter - measures against 5 US - related subsidiaries of Hanwha Ocean Co., Ltd., highlighting China's determination to counter in key areas [7]. - For LPG, the price of domestic propane at the cost of arrival (tax - included) is basically below 4,000 yuan/ton. The demand has increased significantly, but it has not rebounded under speculative demand. The short - term pattern of strong domestic and weak foreign is clear, which is bullish for the long - short spread on the futures market, but the impact of Sino - US trade disputes and crude oil price trends should be noted [9][10]. - For cotton, the short - term trend is stable. Before mid - November, attention should be paid to the development of international economic and trade situations. The short - term trend of cotton futures is expected to be weakly volatile [11]. - For the container shipping index (European line), it will be volatile in the short term. Attention should be paid to the change in shipping capacity in November. The recent sharp rise was affected by China's counter - measures against Hanwha Ocean, but it has no substantial impact on the European line. The fundamentals show that most shipping companies are expected to be fully loaded in week 43, and the no - show rate needs further observation [12]. 3. Summary by Related Catalogs 3.1 Metal Products - **Gold**: Continues to reach new highs. The Fed Chairman Powell hinted at another interest rate cut and that the balance - sheet reduction is nearing the end, which is favorable for gold prices [21]. - **Silver**: The contradiction in the spot market has eased, and the price has risen and then fallen [21]. - **Copper**: The market is cautious, and the price is volatile. The production of Codelco in Chile has decreased, and China's copper imports in September have shown different trends [25][27]. - **Zinc**: The trend is weakly volatile. The Fed's attitude towards interest rates affects the market, and inventory and price data show certain changes [28]. - **Lead**: The inventory has increased, and the price is under pressure. The Fed's interest - rate policy also has an impact on the lead market [31]. - **Tin**: Attention should be paid to the macro - impact. The price of tin has declined, and inventory and price differences have changed [34]. - **Aluminum**: Ranges within a certain interval. Alumina's price center moves down, and cast aluminum alloy follows the trend of electrolytic aluminum. Market data such as inventory and price differences have changed [38]. - **Nickel**: The macro - sentiment has turned bearish, and the nickel price is oscillating at a low level. Stainless steel is under pressure from both the macro - environment and the actual situation, but the cost limits the downward space [41]. - **Lithium Carbonate**: The demand is improving, and the warehouse receipts are being cleared. The short - term trend is relatively strong [44]. - **Industrial Silicon**: The supply - demand pattern is weak [47]. - **Polysilicon**: Meetings are being held this week, and the futures market is expected to rise [48]. 3.2 Building Materials and Energy - **Iron Ore**: The price fluctuates widely. Market data such as inventory and price differences have changed, and relevant policies have an impact on the market [52]. - **Rebar and Hot - Rolled Coil**: The current situation is weak, and the expectation has also weakened. Steel prices may decline slightly [54]. - **Silicon Ferroalloy and Manganese Ferroalloy**: The quotations in the main production areas are unstable, and the prices fluctuate widely. The prices of manganese ore at ports have moved down [58]. - **Coke and Coking Coal**: The expectations are fluctuating, and the prices fluctuate widely. Market data such as inventory and price differences have changed [61][62]. - **Log**: The price oscillates repeatedly [64]. 3.3 Chemical Products - **Para - Xylene and PTA**: The medium - term trend remains weak [17]. - **MEG**: The spread between January and May contracts is in a reverse - arbitrage situation [17]. - **Rubber**: The price oscillates [17]. - **Synthetic Rubber**: The trend is weak [17]. - **Asphalt**: The price has declined following the oil price [17]. - **LLDPE and PP**: The trends are weak [17]. - **Caustic Soda**: Do not short in the short term [17]. - **Pulp**: The price oscillates [17]. - **Glass**: The price of raw glass is stable [17]. - **Methanol**: The price is under pressure and oscillates [17]. - **Urea**: The short - term trend is oscillating, and the medium - term trend is under pressure [17]. - **Styrene**: Stop loss on short positions [17]. - **Soda Ash**: The spot market has not changed much [17]. 3.4 Agricultural Products - **Palm Oil**: The driving force from the origin is limited. Attention should be paid to the support at the lower level [20]. - **Soybean Oil**: The price moves within a certain range. Attention should be paid to Sino - US economic and trade relations [20]. - **Soybean Meal and Soybean**: The trade concerns have resurfaced, and the prices may rebound and oscillate [20]. - **Corn**: The price has rebounded [20]. - **Sugar**: The price oscillates within a certain range [20]. - **Egg**: The price oscillates [20]. - **Live Pig**: The bottom of the spot price has not been reached [20]. - **Peanut**: Attention should be paid to the weather in the producing areas [20].

黑色金属日报-20251014

Guo Tou Qi Huo· 2025-10-14 12:34

Report Industry Investment Ratings - Thread steel: ☆☆☆, indicating a relatively balanced short - term multi/empty trend with poor operability on the current market, suggesting to wait and see [1] - Hot - rolled coil: ☆☆☆, same as above [1] - Iron ore: ☆☆☆, same as above [1] - Coke: ★☆★, with a bullish/ bearish bias but poor operability on the market [1] - Coking coal: ★☆★, same as above [1] - Silicon manganese: ☆☆☆, same as above [1] - Ferrosilicon: ☆☆☆, same as above [1] Core Viewpoints - The overall steel market is under pressure in the short term due to weak demand, negative feedback in the industrial chain, and macro - environment factors. Iron ore is expected to fluctuate at a high level. Coke and coking coal have support at previous lows, and silicon manganese and ferrosilicon have relatively stable demand and supply situations. External factors such as trade frictions and tariff policies need continuous attention [2][3][4] Summaries by Related Catalogs Steel - The steel futures market continued to decline today. During the long holiday, terminal demand decreased significantly month - on - month and remained weak year - on - year. Production decreased slightly, and inventory increased significantly. The recovery of post - holiday demand needs further observation. With the decline of steel mill profits, the negative feedback expectation in the industrial chain keeps fermenting. The overall domestic demand is still weak, and the steel export in September remained high. The market is under short - term pressure, and attention should be paid to the progress of bilateral games and domestic demand stimulus policies [2] Iron Ore - The iron ore futures market declined today. The global shipment decreased month - on - month but was stronger than the same period last year. The domestic arrival volume rebounded significantly and reached a new high this year. The iron - making water output decreased slightly but remained resilient at a high level. After the National Day, steel mills have a certain restocking demand, but the pressure of future production cuts is increasing. The negative feedback expectation in the industrial chain is strengthening, and the market sentiment has weakened. It is expected to fluctuate at a high level, and attention should be paid to the progress of Sino - US trade [3] Coke - The coke price rebounded after reaching the bottom during the day. The first round of price increases in the coking industry was fully implemented, and the second round was postponed. The profit level is average, daily production decreased slightly, and inventory decreased slightly. After pre - holiday restocking, downstream enterprises are mainly consuming inventory, and the purchasing intention of traders is general. The carbon element supply is abundant, and the high - level iron - making water provides support for raw materials. The support near the previous low is relatively solid. The futures price has a slight premium, and the market has certain expectations for the safety production assessment in the main coking coal production areas. Attention should be paid to the impact of US tariff increases [4] Coking Coal - The coking coal price rebounded after reaching the bottom during the day. The production of coking coal mines increased slightly, the spot auction turnover decreased slightly, and the transaction price remained stable. The terminal inventory decreased. The total coking coal inventory decreased significantly month - on - month, and the production - end inventory increased slightly. During the double festivals, some coking coal mines actively reduced production efficiency, resulting in a decrease in output. The carbon element supply is abundant, and the high - level iron - making water provides support for raw materials. The support near the previous low is relatively solid. The futures price has a slight discount to Mongolian coal, and the market has certain expectations for the safety production assessment in the main coking coal production areas. Attention should be paid to the impact of US tariff increases [6] Silicon Manganese - The silicon manganese price fluctuated during the day. The demand side, with high - level iron - making water production. The weekly production of silicon manganese decreased slightly but remained at a high level. The inventory decreased slightly, and the spot and futures demand is still good. The forward quotation of manganese ore increased slightly month - on - month, and the spot ore was boosted by the market. The manganese ore inventory decreased slightly, and the contradiction is not prominent. Attention should be paid to the impact of external trade frictions [7] Ferrosilicon - The ferrosilicon price fluctuated during the day. The demand side, with high - level iron - making water production. The export demand remained at about 30,000 tons, with a marginal impact. The production of magnesium metal increased slightly month - on - month, and the secondary demand increased marginally. The overall demand is acceptable. The supply of ferrosilicon remained at a high level, and the on - balance - sheet inventory continued to decline. Attention should be paid to the impact of external trade frictions [8]

广发期货《黑色》日报-20251014

Guang Fa Qi Huo· 2025-10-14 05:18

Report 1: Steel Industry Investment Rating No investment rating is provided in the report. Core View Although steel demand is weak, the cost side provides support. Pay attention to the support levels around 3000 and 3200 for the January contract of rebar and hot-rolled coil respectively. The short-term weak macro sentiment will suppress the black market, but if the Sino-US friction intensifies in the medium term, the inflation expectation of upstream resource products will increase. [1] Summary by Directory - **Steel Prices and Spreads**: Rebar and hot-rolled coil spot and futures prices mostly declined. For example, the spot price of rebar in East China dropped from 3230 to 3220 yuan/ton, and the 05 contract of rebar decreased from 3159 to 3139 yuan/ton. [1] - **Cost and Profit**: The steel billet price decreased by 10 to 2940 yuan/ton, and the profit of hot-rolled coil in East China decreased by 7. [1] - **Mills**: The daily average pig iron output decreased by 0.3 to 241.5 tons, a decline of 0.1%. The output of five major steel products decreased by 3.8 to 863.3 tons, a decline of 0.4%. [1] - **Inventory**: The inventory of five major steel products increased by 127.9 to 1600.7 tons, an increase of 8.7%. The rebar inventory increased by 57.4 to 659.6 tons, an increase of 9.5%. [1] - **Trading and Demand**: The building materials trading volume decreased by 0.7 to 9.1 tons, a decline of 7.1%. The apparent demand for five major steel products decreased by 153.4 to 751.4 tons, a decline of 17.0%. [1] Report 2: Iron Ore Industry Investment Rating No investment rating is provided in the report. Core View The iron ore market is in a balanced and slightly tight pattern. The weak performance of finished products drags down the raw materials. The iron ore is expected to fluctuate within a range. It is recommended to go long on the Iron Ore 2601 contract at low levels and conduct an arbitrage strategy of going long on iron ore and short on hot-rolled coil. [4] Summary by Directory - **Iron Ore Prices and Spreads**: The warehouse receipt costs of various iron ore powders increased, and the 1-5 spread increased by 3.0 to 23.5, an increase of 14.6%. [4] - **Supply**: The weekly global shipment volume of iron ore decreased by 71.5 to 3207.5 tons, a decline of 2.2%, and the 45-port arrival volume increased by 437.1 to 3045.8 tons, an increase of 16.8%. [4] - **Demand**: The weekly average daily pig iron output of 247 steel mills decreased by 0.3 to 241.5 tons, a decline of 0.1%. The national monthly crude steel output decreased by 229.0 to 7736.9 tons, a decline of 2.9%. [4] - **Inventory Changes**: The 45-port inventory increased by 46.7 to 14024.5 tons, an increase of 0.3%, and the imported ore inventory of 247 steel mills decreased by 990.6 to 9046.2 tons, a decline of 9.9%. [4] Report 3: Coke and Coking Coal Industry Investment Rating No investment rating is provided in the report. Core View For coke, it is recommended to go short on the Coke 2601 contract at high levels, with a reference range of 1550 - 1700, and conduct an arbitrage strategy of going long on iron ore and short on coke. For coking coal, it is recommended to go short on the Coking Coal 2601 contract at high levels, with a reference range of 1050 - 1200, and conduct an arbitrage strategy of going long on iron ore and short on coking coal. [6] Summary by Directory - **Coke and Coking Coal Prices and Spreads**: The prices of coke and coking coal contracts mostly declined. For example, the 01 contract of coke decreased from 1667 to 1643 yuan/ton, and the 01 contract of coking coal decreased from 1161 to 1146 yuan/ton. [6] - **Supply**: The daily average output of all-sample coking plants remained unchanged at 66.1 tons, and the output of raw coal decreased by 31.3 to 836.7 tons, a decline of 3.6%. [6] - **Demand**: The iron ore output decreased by 0.3 to 241.5 tons, a decline of 0.1%. [6] - **Inventory Changes**: The total coke inventory decreased by 10.1 to 909.8 tons, a decline of 1.1%, and the coking coal inventory of all-sample coking plants decreased by 78.7 to 959.1 tons, a decline of 7.6%. [6]

广发期货日评-20251014

Guang Fa Qi Huo· 2025-10-14 02:11

1. Report Industry Investment Ratings - No specific industry investment ratings are provided in the report. 2. Core Viewpoints - Trade friction disturbs the stock index, which opens lower but is expected to rebound after the initial decline, with the long - term upward trend remaining unchanged. The bond market influence is complex, and the 10 - year Treasury bond has increased allocation value when the interest rate rises above 1.8%. Gold has large fluctuations before the APEC meeting in South Korea at the end of October. Different commodities have different trends and corresponding trading suggestions based on their fundamentals and market conditions [3]. 3. Summary by Related Catalogs Financial Sector - **Stock Index**: Affected by trade friction, the stock index opens lower. It is recommended to sell put options near MO2512 - P - 7000 to collect premiums [3]. - **Treasury Bonds**: With the cooling of risk - aversion sentiment, the spot bond interest rate rises. The T2512 oscillation range may be between 107.4 - 108.3, and it is advisable to wait for oversold opportunities [3]. - **Precious Metals**: Due to the continuous fermentation of Sino - US trade friction concerns, precious metals reach new highs. It is recommended to buy gold at a light position above 910 yuan and maintain a long - silver strategy above 50 dollars [3]. - **Shipping Index (European Line)**: Given macro uncertainties, it is recommended to observe cautiously [3]. Black Sector - **Steel**: Affected by Sino - US friction, steel prices are weakly sorted. It is recommended to wait and see on a single - side basis and conduct reverse arbitrage on the monthly spread [3]. - **Iron Ore**: Supply disturbances weaken, and it is recommended to go long on iron ore 2601 at low prices, with a reference range of 780 - 850, and conduct arbitrage by going long on iron ore and short on hot - rolled coils [3]. - **Coking Coal**: After the festival, coking coal prices have a phased correction. It is recommended to go short on coking coal 2601 at high prices, with a reference range of 1050 - 1200, and conduct arbitrage by going long on iron ore and short on coking coal [3]. - **Coke**: The first round of price increases has been implemented before the festival, and there is limited room for further increases. It is recommended to go short on coke 2601 at high prices, with a reference range of 1550 - 1700, and conduct arbitrage by going long on iron ore and short on coke [3]. Non - ferrous Sector - **Copper**: With the easing of tariff concerns, copper prices are strongly running. It is recommended to take profits on long positions at high prices and pay attention to the support at 84000 - 85000 [3]. - **Alumina**: The market supply is sufficient, and the spot price continues to fall. The main operation range is 2850 - 3050 [3]. - **Aluminum**: The macro - environment boosts the price center to around 21000, and the main reference range is 20700 - 21300 [3]. - **Aluminum Alloy**: The scrap aluminum quotation is firm, and the finished ingot price rises with the aluminum price. The main reference range is 20200 - 20800 [3]. - **Zinc**: The fundamentals have limited support for prices, and zinc prices oscillate. The main reference range is 21500 - 22500 [3]. - **Tin**: With the repair of the macro - sentiment, tin prices rise slightly. It is recommended to wait and see [3]. - **Nickel**: The macro - expectations are volatile, and the main reference range is 120000 - 126000 [3]. - **Stainless Steel**: The macro - risk increases, and the industrial demand is still insufficient. The main reference range is 12500 - 13000 [3]. Energy and Chemical Sector - **Crude Oil**: The macro - sentiment repair promotes the oil price rebound, but the loose fundamentals suppress the oil price. It is recommended to take a short - selling approach on a single - side basis [3]. - **Urea**: The market trading sentiment improves, but the short - term rebound lacks fundamental support. It is recommended to take a short - selling approach on a single - side basis and reduce the implied volatility at high prices on the option side [3]. - **PX**: The supply - demand expectation is weak, and the oil price support is limited. It is recommended to wait and see on PX11 and look for short - selling opportunities on rebounds, and conduct reverse arbitrage on the monthly spread [3]. - **PTA**: The supply - demand expectation is weak, and the driving force is limited. It is recommended to wait and see on TA and pay attention to the support near 4500, and conduct rolling reverse arbitrage on TA1 - 5 [3]. - **Short - fiber**: The inventory pressure is not large, and there is short - term support. It is recommended to increase the spread at low positions, but the driving force is limited [3]. - **Bottle Chip**: The supply - demand pattern of bottle chips remains loose, but the cost side is weak, and the short - term processing fee improves. The trading suggestions are the same as those for PTA, and the main processing fee is expected to fluctuate between 350 - 500 yuan/ton [3]. - **Ethanol**: The port inventory accumulates, and the supply - demand structure of MEG in the far - month is weak. It is recommended to short - sell EG01 at high prices, hold the seller of the out - of - the - money call option EG2601 - C - 4350, and conduct reverse arbitrage on EG1 - 5 at high prices [3]. - **Caustic Soda**: The spot price is stable with a slight decline, and the short - term downstream demand for alumina is average. It is recommended to hold short positions [3]. - **PVC**: The spot procurement enthusiasm is average, and the disk continues to weaken. It is recommended to wait and see [3]. - **Benzene**: The supply - demand is relatively loose, and the price driving force is limited. BZ2603 is expected to oscillate following benzene ethylene and the oil price in the short term [3]. - **Styrene**: The supply - demand expectation is weak, and the benzene ethylene price may be under pressure. It is recommended to short - sell on the rebound of EB11 and increase the spread at the low level of the EB - BZ spread [3]. - **Synthetic Rubber**: The cost support weakens, and the supply - demand is relatively loose. It is recommended to hold the seller of the call option BR2511 - C - 11400 [3]. - **LLDPE**: The disk price drops, and the arbitrage transaction is average. It is recommended to pay attention to the inventory - reduction inflection point [3]. - **PP**: The PDH profit is significantly repaired, and the transaction improves. It is recommended to wait and see [3]. - **Methanol**: The basis strengthens significantly, and the transaction is acceptable. It is recommended to pay attention to the positive spread arbitrage opportunity between March and May [3]. Agricultural Sector - **Soybean and Related Products**: Affected by the changing Sino - US trade expectations, the supply pressure suppresses domestic prices. It is recommended to pay attention to the support of 01 near 2900 [3]. - **Live Pig**: The slaughter pressure of the breeding end is large, and the pig price remains low, showing a weak oscillating trend [3]. - **Corn**: As the supply increases, the disk price is under pressure and runs weakly [3]. - **Palm Oil**: Supported by the fundamentals, palm oil stops falling and recovers. The main short - term oscillation range may be between 9000 - 9500 [3]. - **Sugar**: The overseas supply outlook is broad, and the raw sugar price drops sharply. It is recommended to take a short - selling approach in the short term [3]. - **Cotton**: With the new cotton gradually coming onto the market, the supply pressure increases. It is recommended to hold short positions [3]. - **Egg**: After the festival, the demand weakens, and it maintains a short - bias trend. It is recommended to close short positions on the 2511 contract at low prices and pay attention to the monthly spread reverse arbitrage opportunity [3]. - **Apple**: The redness of late - Fuji apples is relatively light, and the high - quality apples have a significant price advantage. The main price runs near 8600 [3]. - **Jujube**: As the harvest time approaches, the long - short game intensifies, and it is bearish in the long - term [3]. - **Soda Ash**: The supply - demand surplus is difficult to reverse, and the soda ash price runs weakly. It is recommended to take a short - selling approach on the rebound [3]. Special Commodity Sector - **Glass**: The production and sales performance is average, and the logic of the off - peak season in the peak season continues. It is recommended to observe cautiously [3]. - **Rubber**: It is recommended to pay attention to the raw material price increase situation during the peak production season and wait and see [3]. - **Industrial Silicon**: The supply increases, and with cost support, the price oscillates between 8300 - 9000 yuan/ton [3]. New Energy Sector - **Polysilicon**: The supply increases, and polysilicon is under pressure. It is recommended to try to go long at low prices when the price returns to the lower edge of the range, and pay attention to the implementation of capacity storage [3]. - **Lithium Carbonate**: The macro - environment is weak, the fundamentals maintain a tight balance, and the main price center is expected to be in the range of 7 - 7.5 million [3].