Tai Mei Ti A P P

Search documents

萝卜快跑,赢得比赛的最后一块拼图

Tai Mei Ti A P P· 2025-10-12 03:57

Core Insights - The recognition of autonomous driving technology by Time Magazine as one of the best inventions of 2025 signifies its maturity and global acceptance, moving beyond early-stage validation to a focus on safety and scalability [1][3] - The acknowledgment of China's "LuoBo Kuaiban" as a major competitor to Waymo indicates a shift in the global narrative of autonomous driving, highlighting a competitive landscape dominated by key players including LuoBo Kuaiban, Waymo, and Tesla [3][4] Group 1: Global Recognition and Competitive Landscape - Time Magazine's award reflects a broader acceptance of autonomous driving technology, marking a transition from technological breakthroughs to market competition and industry restructuring [3][4] - LuoBo Kuaiban's rapid globalization and strategic partnerships with local leaders have positioned it as a significant player in the autonomous driving sector, influencing the strategies of established competitors like Waymo [4][5] Group 2: Strategic Globalization Approach - LuoBo Kuaiban's strategy involves collaborating with global ecosystem giants rather than entering new markets as a disruptor, which has allowed it to establish a foothold in overseas markets efficiently [5][6] - The partnership with Lyft to deploy thousands of autonomous vehicles in Europe exemplifies LuoBo Kuaiban's approach of providing a comprehensive operational system rather than just vehicles [5][6] Group 3: Market Adaptation and Regulatory Success - LuoBo Kuaiban's success in obtaining the first autonomous vehicle testing license in Dubai and its plans to deploy over 1,000 vehicles demonstrate its ability to adapt to local regulatory environments [6][7] - The company's experience in complex domestic road conditions has enhanced its adaptability, allowing it to quickly adjust to different international markets [15][16] Group 4: Safety and Cost Efficiency - LuoBo Kuaiban's autonomous driving system boasts a safety record significantly better than human drivers, with a cumulative safe driving mileage exceeding 200 million kilometers [11][14] - The cost of LuoBo Kuaiban's sixth-generation autonomous vehicle is approximately 204,600 yuan, making it significantly cheaper than competitors like Waymo, which positions it favorably for large-scale deployment [14][15] Group 5: Future Market Potential and Regulatory Environment - The potential market for autonomous ride-hailing services is projected to reach $10 trillion by 2030, with both the U.S. and China leading the way [18][19] - The ongoing legislative efforts in various countries to facilitate autonomous driving operations highlight the importance of a supportive regulatory environment for the industry's growth [19][20]

猪价狂跌、融资收紧,猪企能否熬过这个寒冬?| 行业风向标

Tai Mei Ti A P P· 2025-10-11 14:41

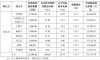

Core Insights - The continuous decline in pig prices has created significant challenges for pig farming companies, with prices dropping to a new low of 11.20 yuan/kg, below the cost line of 13-14 yuan/kg for most producers [2][3][6] - Major companies like Wen's Foodstuffs and New Hope are adopting a "volume compensates for price" strategy, but this has not mitigated the impact of falling prices [2][6] - The tightening of financing options due to policy changes is exacerbating the cash flow issues faced by some pig farming companies, leading to a survival-of-the-fittest scenario in the industry [9][11] Industry Overview - As of October 11, the national average price for live pigs was 11.20 yuan/kg, reflecting a 15.92% month-on-month decline and a 38.36% year-on-year drop [3] - The industry is experiencing widespread losses, with many companies forced to sell off stock due to oversupply, leading to a grim outlook for the future [8][12] - The government has implemented measures to control pig production capacity, aiming to stabilize prices and reduce the number of breeding sows [9][12] Company Performance - Major pig farming companies reported declining sales and revenues in September 2025, with examples including: - Muyuan Foods sold 5.573 million pigs, generating 9.066 billion yuan in revenue, with an average price of 12.88 yuan/kg, all showing declines from August [7] - Wen's Foodstuffs sold 3.3253 million pigs, with a revenue of 4.975 billion yuan and an average price of 13.18 yuan/kg, also reflecting declines [7] - New Hope sold 1.3942 million pigs, generating 1.746 billion yuan in revenue, with an average price of 12.89 yuan/kg, showing significant year-on-year declines [7] Market Dynamics - The market is entering a phase of weak demand and strong supply, with an increase in planned slaughter numbers for October, indicating continued pressure on prices [12] - Analysts predict that the fourth quarter will be crucial for the performance of listed pig farming companies, with price recovery largely dependent on the effectiveness of production capacity controls [12][13] - The ongoing price decline is expected to lead to a reduction in production capacity, although the timing and extent of this adjustment remain uncertain [13]

大恒科技“无主”:新股东高息举债接棒“徐翔系”,火速跨界埋风险

Tai Mei Ti A P P· 2025-10-11 12:48

Core Viewpoint - The control of Daheng Technology has shifted from Zheng Suzhen (mother of Xu Xiang) to "ownerless," with Li Rongrong and Zhou Zhengchang holding a combined 9.26% stake, making them the largest shareholders and acting in concert. This change follows the judicial auction of Zheng Suzhen's shares, which were sold for 1.71 billion yuan after intense bidding, raising concerns about the identities and funding sources of the new shareholders [1][2][4]. Shareholder Changes - The auction involved 8 bidders, with a total of 12.996 million shares (29.75% of the company) sold at a price of 17.1 billion yuan, reflecting a 60% premium over the starting price of 1.21 billion yuan [2][3]. - Li Rongrong, the leading bidder, is described as a middle-level cadre from a state-owned logistics company, raising questions about her ability to invest 360 million yuan [4][5]. Funding Sources and Relationships - The new shareholders have declared no shareholding proxies, but the funding sources of Li Rongrong and Zhou Zhengchang are under scrutiny due to their potential connections to the Xu Xiang family [4][5]. - Li Rongrong and Zhou Zhengchang have a common funding source, Zhou Jianbo, who is related to Zhou Zhengchang, further complicating the understanding of their financial relationships [5][11]. Financial Structure and Risks - Most of the new shareholders are heavily reliant on loans, with interest rates ranging from 4.5% to 12%. Li Rongrong has borrowed 120 million yuan at a 9% interest rate, indicating a high financial risk [7][11]. - The company has recently established a subsidiary in the semiconductor sector, a significant shift from its core business in machine vision, which raises concerns about the lack of relevant experience and resources [8][10]. Control and Future Outlook - The current ownership structure leaves Daheng Technology's control uncertain, as Li Rongrong and Zhou Zhengchang's combined stake is only 9.26%, and they have no plans to increase their holdings in the next 12 months [8][10]. - The potential for other shareholders to consolidate control poses a risk to the company's strategic direction, especially with the involvement of China New Era Limited, which has historical ties to the company [10][11].

康泰医学收FDA警告信:美国市场准入临时“断档”,两成营收来源告急

Tai Mei Ti A P P· 2025-10-11 11:41

Core Viewpoint - The warning letter from the FDA has placed Kangtai Medical (300869.SZ) in a position of compliance risk, as the company faces challenges in rectifying identified issues before regaining access to the U.S. market [1][2][10]. Summary by Sections Compliance Issues - Kangtai Medical received a warning letter from the FDA on October 2, following an inspection from June 9 to 12, which found that the company's medical device products did not comply with the U.S. federal regulations 21 CFR Part 820 [1][3]. - The FDA's actions are based on the inspection results, which are aimed at ensuring ongoing compliance with quality system regulations [3][10]. Impact on Revenue - The U.S. market accounts for approximately 23.84% of Kangtai Medical's revenue in 2024, which is projected to drop to 19.26% in the first half of 2025. A prolonged rectification period could significantly impact the company's overall revenue for 2025 [6][9]. - The temporary restriction on product entry into the U.S. market could lead to a loss of existing distributors as they may turn to other compliant companies [6][7]. Rectification Process - The rectification period for compliance issues typically ranges from 3 to 12 months, depending on the severity of the violations. Simple corrections may be resolved more quickly, while more complex issues could take longer [5][10]. - Kangtai Medical has not disclosed specific details regarding the violations or its rectification plan, which adds uncertainty to the timeline for regaining market access [5][6]. Industry Challenges - The situation highlights a broader challenge faced by Chinese medical device companies, which often find it easier to enter foreign markets than to maintain compliance once established [2][10]. - Recent cases of other Chinese medical device companies receiving FDA warning letters indicate a trend of compliance issues arising from cost control and operational simplifications post-market entry [10][11]. Regulatory Environment - The FDA's compliance requirements are dynamic, and companies must continuously adhere to them to avoid penalties, including potential loss of registration [10][12]. - The increasing scrutiny from overseas regulatory bodies emphasizes the need for companies to integrate compliance into their core operations rather than viewing it as a one-time requirement [12].

英国前首相“跳槽”美国硅谷,欧洲AI可能真没救了

Tai Mei Ti A P P· 2025-10-11 10:23

Core Insights - The appointment of former UK Prime Minister Rishi Sunak as a senior advisor to Microsoft and AI startup Anthropic highlights the challenges faced by the European AI industry, symbolizing a shift of political assets from Europe to American tech giants [1][2][3] - The economic gap between the EU and the US has widened, with the EU's GDP in Q1 2025 estimated at approximately $4.85 trillion, compared to the US's $7.32 trillion, exacerbated by low growth in core economies like Germany and France [2] - Europe's AI industry struggles with a "Brussels Paradox," where stringent regulations intended to ensure ethical AI development have hindered commercial growth, leading to a significant lag in innovation compared to the US and China [4][5] Economic Context - The EU's GDP briefly surpassed that of the US in 2007 but has since fallen behind, with the current economic landscape reflecting a significant decline in competitiveness [2] - The EU's share of global generative AI patents is only 6.7%, while the US and China hold 74.96%, indicating a structural lag in innovation [3] Regulatory Challenges - The EU's comprehensive AI regulation, the AI Act, aims to set global standards but has become a "compliance tax" for local startups, diverting resources from innovation to regulatory adherence [5][6] - The regulatory environment in Europe is seen as a barrier to rapid innovation, contrasting sharply with the agile development models employed by US firms [5] Capital and Investment Landscape - The US has a robust capital ecosystem that supports AI startups through aggressive venture capital and strategic investments, while Europe’s investment landscape is characterized by conservatism and fragmentation [6][7] - The lack of a unified investment framework in Europe leads to difficulties in capital flow and integration, further stifling innovation [7] Talent Drain - European AI startups face a talent drain as top scientists are attracted to better opportunities in the US, where salaries and resources are significantly more appealing [7][8] - This cycle of "capital shortage—talent loss—innovation stagnation" creates a vicious cycle that undermines the competitiveness of the European AI sector [8] Ethical and Competitive Concerns - The controversy surrounding Mistral AI, which faced allegations of unethical practices, underscores the fragility of trust in the European AI landscape, potentially damaging its competitive position [10][11] - The incident raises questions about the integrity of European AI firms and their ability to maintain ethical standards while competing globally [11] Comparative Analysis with China - The challenges faced by Europe in AI development serve as a cautionary tale for China, which has its own set of advantages and disadvantages in the AI landscape [12] - While Europe struggles with fragmented markets and regulatory burdens, China benefits from a unified digital market and abundant data, highlighting the need for Europe to adapt its strategies to remain competitive [12] Conclusion - Sunak's transition to the tech industry serves as a stark reminder of the structural weaknesses in European AI, emphasizing the need for a cohesive strategy that aligns political will with technological and capital resources to foster innovation [13]

AI出海东南亚,EDTech落先手

Tai Mei Ti A P P· 2025-10-11 10:04

Core Insights - The trend of Chinese AI technology expanding into Southeast Asia has become prominent, with significant advancements in large models and intelligent agents driving this process [2] - The educational sector has emerged as a primary area for the application of AI technology, addressing challenges such as teacher shortages and resource imbalances in the region [3][4] Group 1: Technology Characteristics and Output Efficiency - The differences in AI development stages between China and Southeast Asia create a complementary relationship, facilitating accelerated technology output [2] - The efficiency of technology output has improved by 3-5 times, with system deployment time reduced from six months to two months due to the capabilities of large models [2] - The strategic implementation of "R&D in major cities, integration in Guangxi, and application in ASEAN" is shortening the technology landing path [2] Group 2: Educational Sector as a Priority Area - Southeast Asia's K12 education faces significant challenges, such as a teacher-student ratio of 1:40 in Indonesia, which is 2.5 times that of China, necessitating the addition of 4.5 million teachers by 2030 [3] - The low coverage of computer classrooms and the multilingual nature of the region exacerbate educational resource fragmentation, making AI real-time translation systems valuable for enhancing classroom interaction [3] - The structural contradictions in the education system are evident, with Indonesia lacking 120,000 science teachers and Vietnam facing a shortage of 5,000 AI-related faculty [3] Group 3: Collaborative Foundations and Trust - The long-standing educational exchange between China and Southeast Asia fosters a unique trust for technology output, with Chinese students making up 57% of international students in Malaysia [4] - The need for programming courses in Malaysia is high, with 300,000 university students requiring such training but only 2,000 qualified computer teachers available [5] Group 4: Systematic Cooperation and Policy Support - The collaboration between China and Southeast Asia has evolved from isolated applications to systematic outputs, with Tsinghua University's "Y-type education system" being implemented in Thailand [6] - Malaysia's National AI Roadmap 2021-2025 prioritizes "intelligent education," planning to invest 230 million MYR in a national education data platform [6] - Local government demand for educational solutions is driving technology transfer, with 21% of the AI scene demand list in Nanning focused on education [6] Group 5: Innovative Approaches to Technology Transfer - Chinese companies are adopting a different approach to technology transfer in Southeast Asia, focusing on empowering local teams rather than merely providing services [7] - The collaboration model includes a three-tier technology transfer system, enabling local engineers to independently iterate on AI tools [7][9] Group 6: Talent Development and Sustainable Growth - AI education cooperation is not a one-way output but aims to cultivate a shared talent pool, with plans to establish 10 AI joint laboratories in ASEAN by 2025-2030 [12] - The value of graduates involved in AI education projects is significantly higher, with starting salaries 40% above traditional computer science graduates [13] - The establishment of a national qualification framework for AI education in Malaysia reflects a trend towards co-building regional talent standards [13] Group 7: Business Sustainability and Value Creation - The core of business sustainability lies in value sharing, with Chinese companies transitioning from "technology providers" to "ecosystem builders" [14] - The profitability of AI education initiatives is linked to the value created for local partners, emphasizing a long-term collaborative approach [14]

滴滴自动驾驶完成20亿元D轮融资,累计融资超100亿

Tai Mei Ti A P P· 2025-10-11 07:16

Core Insights - Didi's autonomous driving division has completed a new round of financing, raising a total of 2 billion RMB, with support from major AI industry funds in Beijing [2] - The funds will be used to enhance AI research and development and promote the application of Level 4 (L4) autonomous driving technology [2][5] - Didi's autonomous driving has accumulated over 10 billion RMB in total financing, with a post-investment valuation exceeding 5 billion USD (approximately 35.7 billion RMB) [2] Financing History - Didi's autonomous driving division has undergone several financing rounds since its establishment in 2016, with significant investments from various international and domestic firms [3] - The financing rounds include: - A round in May 2020, exceeding 500 million USD led by SoftBank Vision Fund II - B round in January 2021, raising 300 million USD led by IDG Capital - C round in October 2024, raising 298 million USD led by GAC Group - D round in October 2025, raising 2 billion RMB from multiple investors [3] Technology and Market Trends - The integration of AI technologies with autonomous driving is a key focus for the automotive industry, with major manufacturers prioritizing this area [4] - Autonomous driving is categorized into six levels (L0 to L5), with L4 representing a significant advancement towards fully autonomous vehicles [4] Application and Development - Didi has launched its first autonomous driving concept car, DidiNeuron, and has obtained road testing qualifications in multiple cities [5] - The company is conducting comprehensive testing of its autonomous vehicles in complex scenarios and plans to deliver a new generation of autonomous vehicles by the end of 2025 [5] - Didi has also developed an AI travel assistant, enhancing user experience through customized travel solutions [7] Future Market Potential - According to McKinsey, the total sales of autonomous vehicles are projected to reach approximately 230 billion USD by 2030, with the order value for autonomous driving-based services expected to reach around 260 billion USD [7]

东鹏饮料再次递表港交所:海外能否成为第二增长曲线?

Tai Mei Ti A P P· 2025-10-11 03:49

Core Viewpoint - Dongpeng Beverage (Group) Co., Ltd. has submitted its H-share listing application for the second time, indicating its strong ambition to go public in Hong Kong despite previous setbacks [2][3]. Financial Performance - In 2024, the company achieved a revenue of 15.83 billion yuan, a year-on-year increase of 40.6%, and a net profit of 3.33 billion yuan, up 63.1% [2]. - For the first half of 2025, Dongpeng reported a revenue of 10.737 billion yuan, a growth of 36.37%, and a net profit of 2.375 billion yuan, an increase of 37.22% [2]. - Analysts predict that Dongpeng's total revenue for 2025 will exceed 20 billion yuan for the first time [2]. Market Position and Challenges - Dongpeng Beverage is a leading player in the Chinese functional beverage market, with a market capitalization of 160 billion yuan [2]. - The company has faced challenges in its Hong Kong listing process, including regulatory requirements related to foreign investment and data protection [3][6]. - The company's revenue is heavily concentrated in the energy drink segment, which accounted for over 80% of its income in recent years [5]. Product Structure and Growth - Dongpeng's core product, Dongpeng Special Drink, has seen its revenue contribution decline from 96.6% in 2022 to 84% in 2024, indicating a need for diversification [5]. - The gross profit margin has improved from 41.6% in 2022 to 44.1% in 2024, and further to 44.4% in the first half of 2025 [5]. International Expansion - Dongpeng has initiated efforts to explore overseas markets, particularly in Southeast Asia, by establishing a Hong Kong subsidiary and planning to build production bases [8][10]. - The company aims to cater to local tastes in Southeast Asia and has partnered with local distributors to enhance its market presence [10][11]. - Dongpeng is also investing in new production facilities, including a 1.2 billion yuan base in Hainan and a planned $200 million factory in Indonesia [10][11]. Strategic Goals - The Hong Kong IPO is seen as a strategic move to enhance capital strength, improve international brand image, and address the company's reliance on a single product category [10][12]. - The company recognizes the long-term impact of international market expansion on its overall strategy, despite the challenges it faces in competing with established brands like Red Bull and Monster [11][12].

一篇搞懂:飞书多维表格、n8n、Dify 等自动化工作流里的 Webhook 到底是个啥

Tai Mei Ti A P P· 2025-10-11 03:27

Core Insights - The article explains the concept of Webhook in simple terms, comparing it to a "doorbell" for systems to notify each other in real-time, eliminating the need for constant polling [2][10][12]. Group 1: Understanding Webhook - Webhook is described as a "reverse" API that allows systems to send notifications to each other without the need for constant inquiries [10][12]. - The traditional API method requires users to actively check for updates, which is inefficient and resource-consuming [6][7]. - Webhook simplifies this process by allowing systems to push notifications when specific events occur, such as payment confirmations [12][14]. Group 2: Installation and Functionality - Setting up a Webhook involves three main steps: providing a Callback URL, specifying the events to subscribe to, and handling incoming notifications [17][20][23]. - The Callback URL acts as the "address" where notifications will be sent, and it must be configured in the system that will send the notifications [18][19]. - The system sends an HTTP POST request containing a Payload with relevant information when an event occurs [24][26]. Group 3: Common Pitfalls - Security is a major concern, as the Webhook URL is publicly accessible, making it vulnerable to unauthorized requests [29][30]. - Implementing signature verification is crucial to ensure that notifications are legitimate and from trusted sources [33][35]. - Handling duplicate notifications is necessary to prevent processing the same event multiple times, which can lead to errors [39][40]. Group 4: Practical Implementation - The article provides a step-by-step guide for setting up a Webhook receiver using Python and Flask, including code examples [26][50][56]. - It emphasizes the importance of using tools like Ngrok to expose local servers to the internet for testing purposes [62][63]. - Postman is recommended for sending test requests to verify the Webhook functionality [70][73]. Group 5: Automation with n8n - The article concludes by demonstrating how to integrate Webhook functionality into n8n for automated workflows, allowing for seamless communication between systems [75][88]. - It highlights the shift from a "pull" model to a "push" model in system interactions, enhancing efficiency and responsiveness [85].

关于数字资产“高级持续性威胁(APT)”及“链上防火墙”多智能体协同的思考

Tai Mei Ti A P P· 2025-10-11 03:27

Core Insights - The article discusses the evolving landscape of digital asset security, highlighting the emergence of state-sponsored hacking groups, particularly North Korea's Lazarus Group, which has stolen over $6 billion in cryptocurrency since 2017, with $2 billion taken in 2025 alone [2][11] - It emphasizes the need for a paradigm shift in security measures, moving from traditional static defenses to AI-driven dynamic and proactive strategies to combat advanced persistent threats (APTs) in the digital asset space [4][10] Group 1: Evolving Threat Landscape - The digital asset security environment has fundamentally changed, with threats now involving state-sponsored professional hacker organizations rather than just individual criminal groups [2][3] - The Lazarus Group's activities are strategically aimed at funding North Korea's military programs, particularly nuclear weapons and missile development [2] - The characteristics of APTs in the digital asset realm include direct financial stakes, short attack chains, and highly customized attack methods targeting high-net-worth individuals and corporate executives [3] Group 2: AI-Driven Security Transformation - AI and intelligent agent technologies are essential for evolving security paradigms, as they align well with the transparent and data-rich nature of the digital asset world [4][5] - The shift from rule-based to behavior-driven defenses allows for the detection of previously unseen and highly disguised attack methods [4] - AI's ability to analyze vast amounts of on-chain data enables proactive threat prediction and real-time monitoring, crucial for countering state-level APTs [5][9] Group 3: Implementation of Intelligent Defense Systems - The concept of a "smart agent army" is introduced, where AI technologies create a multi-layered defense system for digital assets [6][8] - On a personal level, AI agents act as "digital bodyguards," monitoring wallet activities and intervening in real-time during suspicious transactions [7] - At the enterprise level, AI systems function as risk control officers, analyzing transaction patterns and freezing suspicious accounts before money laundering occurs [7] Group 4: Future of Digital Asset Security - The future security framework will rely on a collaborative ecosystem of multiple intelligent agents, enhancing the overall security capabilities [8] - The "on-chain firewall" concept is proposed, which utilizes AI for proactive defense, real-time monitoring, and rapid response to threats [9][10] - This AI-driven firewall represents a shift from passive vulnerability management to active risk intervention, establishing a comprehensive security lifecycle for digital assets [10]