CPIC(601601)

Search documents

天水监管分局同意太平洋产险天水中心支公司变更营业场所

Jin Tou Wang· 2025-10-30 03:47

Core Points - The National Financial Supervision Administration of Tianshui has approved the change of business location for China Pacific Property Insurance Co., Ltd. Tianshui Branch [1] - The new business location is specified as the third floor of the Postal Delivery Building on Fendou Lane, Qinzou District, Tianshui City, Gansu Province [1] - China Pacific Property Insurance Co., Ltd. is required to handle the change and obtain the necessary permits in accordance with relevant regulations [1]

东吴证券:三季度公募基金减持保险持仓 券商及互金持仓环比基本持平

Zhi Tong Cai Jing· 2025-10-29 10:53

Core Viewpoint - The report from Dongwu Securities indicates a slight decrease in public fund holdings in the non-bank financial sector as of the end of Q3 2025, with expectations for continued benefits from an improving market environment [1][5]. Summary by Category Public Fund Holdings - As of the end of Q3 2025, public fund stock investments in the non-bank financial sector accounted for 1.61%, a decrease of 0.32 percentage points from Q2 2025. This represents an underweight of 8.35 percentage points compared to the market capitalization of the CSI 300 index, with a slight narrowing of the underweight by 0.13 percentage points from Q2 2025 [2]. Insurance Sector - The insurance sector's holdings were at 0.78%, down 0.32 percentage points from Q2 2025. Notably, China Life and Ping An saw increases in shareholdings, while other companies like PICC and Taikang Life experienced significant reductions [3]. - The dynamic valuation for the insurance sector was 0.66x PEV, remaining stable compared to Q2 2025. The holdings for major insurers as of Q3 2025 were: China Life (0.02%), Ping An (0.48%), Taikang (0.18%), Xinhua (0.09%), and PICC (0.01%) [3]. Brokerage and Internet Finance Sector - The holdings in the brokerage and internet finance sector remained relatively stable at 0.74%, with a slight increase of 0.01 percentage points from the first half of 2025. Traditional brokerages accounted for 0.54% of the holdings, reflecting a 0.01 percentage point increase [4]. - The valuation for the brokerage industry (CITIC Securities II Index) was 1.55x P/B at the end of Q3 2025, up from 1.41x P/B at the end of the first half of 2025 [4]. Market Trends and Recommendations - The non-bank financial sector has shown continuous improvement in market conditions, with significant increases in trading volumes. The average daily trading volume for equity funds reached 18,723 billion yuan in the first three quarters of 2025, a year-on-year increase of 109%, with Q3 alone seeing a 208% increase [5]. - Key recommendations for investment include China Ping An, Xinhua Insurance, China Life, CITIC Securities, Tonghuashun, and Jiufang Zhitu Holdings, as the sector remains underweighted in public fund portfolios [1][5].

保险板块10月29日涨0.92%,中国平安领涨,主力资金净流出5.05亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Insights - The insurance sector experienced a rise of 0.92% on October 29, with China Ping An leading the gains [1] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index closed at 13691.38, up 1.95% [1] Insurance Sector Performance - China Ping An (601318) closed at 58.95, with a gain of 2.06% and a trading volume of 1.0444 million shares, amounting to a transaction value of 6.172 billion [1] - New China Life Insurance (601336) closed at 70.05, up 1.49%, with a trading volume of 169,100 shares [1] - China Pacific Insurance (601601) closed at 37.60, up 0.80%, with a trading volume of 590,700 shares [1] - China Life Insurance (601628) closed at 45.22, up 0.27%, with a trading volume of 175,700 shares [1] - China Reinsurance (601319) closed at 8.83, up 0.46%, with a trading volume of 589,300 shares [1] Fund Flow Analysis - The insurance sector saw a net outflow of 505 million from institutional investors, while retail investors contributed a net inflow of 434 million [1] - Among individual stocks, New China Life Insurance had a net inflow of 27.46 million from institutional investors, while China Ping An experienced a net outflow of 306 million [2] - China Life Insurance saw a net inflow of 19.49 million from retail investors, despite a net outflow of 51.38 million from institutional investors [2]

瞄准投保难题!高赔付风险燃油营运车上线“车险好投保”

Guo Ji Jin Rong Bao· 2025-10-29 05:37

Core Viewpoint - The "Car Insurance Good to Insure" platform has expanded to include a new insurance option for high-compensation risk fuel-operated vehicles, providing an alternative to traditional insurance channels for vehicle owners [1][3]. Group 1: Platform Expansion - The platform now offers insurance for high-compensation risk fuel-operated vehicles, including taxis, rental vehicles, and commercial trucks, in addition to existing services for new energy vehicles [3][6]. - A total of 11 insurance companies are participating in this initiative, including major firms such as PICC Property and Casualty, Ping An Property and Casualty, and China Life Property and Casualty [1][3]. Group 2: Insurance Process - The insurance process remains unchanged, allowing personal clients to use WeChat and Alipay for self-service insurance applications, while corporate clients can register online and receive follow-up contact from insurance companies [2][3]. - The platform has established a customer service hotline and intelligent customer service features to assist users throughout the insurance process [3][4]. Group 3: Industry Context - The platform aims to address the challenges faced by fuel-operated vehicles, which have high usage intensity and claim rates, making insurance difficult to obtain [1][6]. - Since its launch, the platform has successfully facilitated insurance for over 1.1 million new energy vehicles, providing risk coverage exceeding 1.1 trillion yuan [6]. Group 4: Future Developments - The platform will gradually integrate additional insurance companies to enhance service availability and coverage [7][8]. - Insurance companies participating in the platform are expected to adhere to consumer protection standards and ensure quality service while managing risks effectively [8][9].

香港中国保险业 - 2025 年二季度香港保费增长加速;竞争持续加剧-Hong KongChina Insurance-2Q25 HK Premiums Growth Accelerated; Continued Intensified Competition

2025-10-29 02:52

Summary of the Conference Call on Hong Kong/China Insurance Industry Industry Overview - The conference call focused on the Hong Kong/China insurance industry, specifically discussing the premium growth and competitive landscape in the market during the second quarter of 2025 [7][2]. Key Points Premium Growth - Hong Kong's annualized premium equivalent (APE) reached HK$47.9 billion in 2Q25, representing a 57% year-on-year increase, significantly higher than the 25% growth observed in 1Q25 [3][2]. - This growth marks the second highest quarterly APE, just below the HK$51.2 billion recorded in 1Q25 [3][2]. - The strong influx of mainland Chinese visitors to Hong Kong is expected to maintain a consistent mix of onshore and offshore contributions to the market [3][2]. Competitive Landscape - Intense competition in the broker channel was highlighted, with its market share increasing by 5 percentage points year-on-year to 34% on an APE basis [4][2]. - In contrast, the banks and agency channels experienced a decline in market share, losing 6 percentage points and 2 percentage points, respectively, to 37% and 22% [4][2]. - Manulife's broker channel saw an impressive APE growth of 171%, while FWD's broker channel grew by 70% year-on-year [4][2]. - AIA and Prudential experienced a slight decline in market share, losing 2.2 percentage points and 3.2 percentage points year-on-year, while Manulife gained 0.5 percentage points [4][2]. Payment Patterns - The payment pattern for new business showed some growth, with single pay's first-year premium (FYP) remaining stable year-on-year at 45% of overall FYP, while the mix for policies with a duration of less than 5 years increased by 5 percentage points to 30% [5][2]. - The dominance of USD currency policies continued, accounting for 77% of total APE, while HKD policies gained 4 percentage points to represent 19% of total APE in 2Q25 [5][2]. Future Outlook - The competitive environment is expected to see some relief due to an illustrative rate cut at the end of June and further commission cuts anticipated in early 2026 [4][2]. Additional Insights - The report indicates that the overall industry view remains attractive, suggesting potential investment opportunities within the Hong Kong/China insurance sector [7][2]. - The data presented in the call is supported by various exhibits detailing market share, payment patterns, and visitor statistics, which provide a comprehensive view of the current market dynamics [12][2][18][2]. Conclusion - The Hong Kong/China insurance industry is experiencing robust growth in premiums, particularly in the broker channel, amidst intense competition. The future outlook suggests potential stabilization in competitive pressures, making it an attractive sector for investment.

睿远基金旗下明星经理持仓出炉!看好人工智能浪潮 增持阿里巴巴等

Zhi Tong Cai Jing· 2025-10-28 13:45

Core Viewpoint - The report highlights that prominent fund managers from Ruifeng Fund have increased their holdings in leading technology companies like Alibaba, indicating a strong belief in the potential of artificial intelligence as a major technological transformation following the internet era [1]. Fund Performance - The Ruifeng Growth Value Mixed Fund, managed by Fu Pengbo and Zhu Lin, saw a net value increase of over 50% in Q3, with A-class shares rising by 51.09%, outperforming the benchmark by 14.82%, marking the highest quarterly record since its inception in 2019 [1]. - The Ruifeng Balanced Value Three-Year Holding Mixed A Fund, managed by Zhao Feng, reported a net value growth rate of 19.29%, exceeding the benchmark return of 13.70% during the same period [3][4]. Portfolio Adjustments - The top ten holdings of the Ruifeng Growth Value Mixed Fund included stocks that doubled in price during Q3, such as Xinyi Technology, Shenghong Technology, and Cambricon, although these were reduced in the portfolio [1]. - The fund maintained a high stock asset allocation with over 90% in equities, and the top ten holdings accounted for 66% of the net value, showing a significant increase from the previous quarter [2][3]. Sector Focus - The fund managers expressed a continued positive outlook on artificial intelligence, focusing on sectors such as internet technology, optical modules, PCB, chips, and innovative pharmaceuticals [2][3]. - The report indicates that the concentration of holdings increased due to significant price rises in key stocks, particularly in the new energy and Apple supply chain sectors [3]. Investment Strategy - Zhao Feng emphasized that AI is becoming the largest technological transformation after the internet, with rapid adoption across various industries [5]. - The report notes that while there are uncertainties regarding the future returns from substantial investments in foundational models and data centers, leading internet companies are well-positioned financially to support these capital expenditures [6].

广发中证港股通非银ETF(513750):业绩高增筑底,估值修复在途,保险板块景气回升助力港股通非银稳健领跑

Soochow Securities· 2025-10-28 12:02

Investment Rating - The report maintains an "Overweight" rating for the Guangfa CSI Hong Kong Stock Connect Non-Bank ETF (513750.SH) [1] Core Insights - The insurance sector is experiencing a recovery in profitability, driven by strong performance in Q3 2025, with major companies like China Life, New China Life, and China Property & Casualty reporting net profit growth rates of 106%, 101%, and 122% respectively [11][12] - The report emphasizes the importance of the PEV (Price of Embedded Value) valuation system for insurance companies, which reflects long-term profitability potential more accurately than traditional PE or PB metrics [20][22] - The report highlights the low valuation levels of the insurance sector, with average PEV ratios for A/H shares at 0.72x and 0.51x, indicating a significant margin of safety and potential for value appreciation [34][37] - The Guangfa CSI Hong Kong Stock Connect Non-Bank Index focuses heavily on the insurance sector, providing a unique investment opportunity with a high concentration of insurance assets [41][47] Summary by Sections 1. Q3 Performance and Investment Value of Insurance Stocks - The report notes that listed insurance companies achieved high net profit growth in Q3 2025, exceeding expectations despite a high base from the previous year [11][12] - The increase in investment income from equity investments is identified as a key driver of this growth, with insurance funds significantly increasing their equity allocations [13][17] - The high proportion of FVTPL (Fair Value Through Profit or Loss) assets among insurance companies enhances profit elasticity, allowing for direct reflection of market gains in profit figures [17][19] 2. Guangfa CSI Hong Kong Stock Connect Non-Bank ETF (513750.SH) Overview - The ETF is noted for its unique focus on insurance, with a significant portion of its holdings in major insurance companies, making it a rare investment vehicle in the market [41][47] - The ETF has shown strong liquidity and growth, with an average daily trading volume of 1.818 billion yuan and a fund size of 21.214 billion yuan as of October 24, 2025 [5][41] - The ETF's performance is highlighted, with a cumulative return of 66.68% and an annualized return of 36.83%, positioning it favorably compared to other financial sector ETFs [5][41]

保险板块10月28日跌0.13%,新华保险领跌,主力资金净流入1.15亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:40

Core Insights - The insurance sector experienced a slight decline of 0.13% on October 28, with Xinhua Insurance leading the drop [1] - The Shanghai Composite Index closed at 3988.22, down 0.22%, while the Shenzhen Component Index closed at 13430.1, down 0.44% [1] Insurance Sector Performance - China Pacific Insurance (601601) closed at 37.30, up 0.46% with a trading volume of 389,600 shares and a transaction value of 1.453 billion [1] - China Life Insurance (601628) closed at 45.10, up 0.09% with a trading volume of 141,200 shares and a transaction value of 634 million [1] - Ping An Insurance (601318) closed at 57.76, up 0.02% with a trading volume of 491,300 shares and a transaction value of 2.843 billion [1] - China Reinsurance (601319) closed at 8.79, down 1.01% with a trading volume of 588,200 shares and a transaction value of 518 million [1] - Xinhua Insurance (601336) closed at 69.02, down 1.29% with a trading volume of 167,600 shares and a transaction value of 1.15977 billion [1] Fund Flow Analysis - The insurance sector saw a net inflow of 115 million from institutional investors, while retail investors experienced a net outflow of 626.947 million [1] - Among individual stocks, Ping An Insurance had a net inflow of 175 million from institutional investors, but a net outflow of 90.5114 million from retail investors [2] - China Life Insurance had a net inflow of 12.908 million from institutional investors, with retail investors also experiencing a net outflow of 4.6734 million [2] - China Pacific Insurance had a net inflow of 3.2091 million from institutional investors, while retail investors faced a net outflow of 16.8047 million [2] - Xinhua Insurance had a net outflow of 44.6415 million from institutional investors, but a net inflow of 10.2975 million from retail investors [2]

山西监管局同意太平洋寿险太原市高新支公司变更营业场所

Jin Tou Wang· 2025-10-28 03:58

Core Viewpoint - The National Financial Supervision Administration of Shanxi has approved the relocation of the Pacific Life Insurance Taiyuan High-tech Branch to a new address in Taiyuan City, Shanxi Province [1] Group 1 - The new business location for the Pacific Life Insurance Taiyuan High-tech Branch is set to be at Room 901 and 905, 9th Floor, No. 215, Sports Road, Xiaodian District, Taiyuan City, Shanxi Province [1] - The approval includes a directive for the Pacific Life Insurance Taiyuan Center Branch to timely handle the relocation and license renewal procedures as per relevant regulations [1]

举牌热情延续,全年迄今34起:保险行业周报(20251020-20251024)-20251027

Huachuang Securities· 2025-10-27 10:43

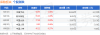

Investment Rating - The report maintains a "Recommendation" rating for the insurance industry, indicating an expected increase in the industry index by more than 5% over the next 3-6 months compared to the benchmark index [20]. Core Insights - The insurance index rose by 2.99% this week, underperforming the broader market by 0.26 percentage points. Key stocks such as China Life and Ping An saw significant gains, with China Life increasing by 8.75% [1]. - For the first three quarters of 2025, China Life is projected to achieve a net profit attributable to shareholders between 156.785 billion and 177.689 billion yuan, representing a year-on-year growth of 50%-70% [2]. - The commercial auto insurance premiums for new energy vehicles reached 108.79 billion yuan in the first three quarters of this year, reflecting a year-on-year growth of 36.6%, significantly higher than the overall auto insurance premium growth of 3.21% [2]. - The report highlights a total of 34 instances of insurance capital increasing their stakes in companies this year, indicating a strong interest in high-quality equity investments [3]. Summary by Sections Market Performance - The insurance sector's market capitalization stands at approximately 32,624.92 billion yuan, with a circulating market value of 22,503.22 billion yuan [4]. - The absolute performance over the last month, six months, and twelve months is 8.2%, 20.1%, and 5.5%, respectively, while the relative performance shows a decline of 13.1% over the past year [5]. Stake Increases and Mergers - The report notes that insurance capital's enthusiasm for stake increases has been rising, with a notable concentration in sectors such as banking and public utilities [3]. - The report identifies two main categories for the purpose of stake increases: equity investments focusing on high ROE assets and stock investments emphasizing high dividends [7]. Company Valuations and Recommendations - The report provides specific valuations for key companies, with China Life at a PEV of 0.85x, Ping An at 0.7x, and China Pacific at 1.21x, among others [4][9]. - Recommendations for specific companies include China Pacific, China Property & Casualty H, China Life H, and China Re H, with a strong push for China Ping An if the equity market continues to outperform expectations [8].