POP MART(PMRTY)

Search documents

港股泡泡玛特跌幅扩大至7%

Mei Ri Jing Ji Xin Wen· 2025-10-23 01:51

Group 1 - The stock of Pop Mart in Hong Kong has seen a decline of 7%, currently priced at 239.2 HKD, with a total market capitalization of 320.7 billion HKD [1] - Year-to-date, Pop Mart's stock has experienced a cumulative increase of 167% [1]

北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-22 17:11

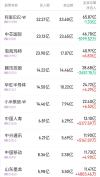

Core Viewpoint - The Hong Kong stock market experienced significant net inflows from northbound trading, with notable buying activity in specific stocks such as Pop Mart and Xiaomi, while other stocks like Alibaba faced substantial net selling [2][6]. Group 1: Stock Performance - Pop Mart (09992) received a net inflow of HKD 11.2 billion, with a projected revenue growth of 245%-250% year-on-year for Q3 2025, driven by strong domestic and international sales [6]. - Xiaomi Group-W (01810) saw a net inflow of HKD 4.81 billion, following a share buyback of 10.7 million shares at prices between HKD 45.9 and HKD 46.76, totaling approximately HKD 4.94 billion [6]. - Semiconductor stocks, including Huahong Semiconductor (01347) and SMIC (00981), attracted net inflows of HKD 4.41 billion and HKD 1.28 billion, respectively, amid positive sentiment regarding the semiconductor industry's growth driven by AI [6]. Group 2: Company Earnings and Projections - China Mobile (00941) reported Q3 service revenue of HKD 216.2 billion, a year-on-year increase of 0.8%, with EBITDA declining by 1.7% to HKD 79.4 billion, slightly below market expectations [7]. - China Life (02628) projected a net profit of approximately HKD 156.79 billion to HKD 177.69 billion for the first three quarters, reflecting a year-on-year growth of 50% to 70% [7]. - The report indicated that the net profit for Q3 could grow by 75% to 106% year-on-year, driven by improved investment returns and optimized asset allocation [7]. Group 3: Market Sentiment and Trends - The overall market sentiment showed a divergence in fund flows, with significant net selling in stocks like Alibaba (09988) and Tencent (00700), indicating cautious investor sentiment amid global economic uncertainties [8]. - The report highlighted that the current market volatility is influenced more by emotional factors rather than fundamental reversals, suggesting a need for careful timing in investment strategies [7].

泡泡玛特(09992.HK)25Q3经营情况前瞻:新品上新势能强劲 预计各渠道持续高速增长

Ge Long Hui· 2025-10-22 12:55

Core Viewpoint - The company is expected to show strong growth in Q3 2025, with significant increases in revenue and adjusted net profit driven by new product launches and continuous channel growth [1][2] Financial Performance - For Q3 2025, the company anticipates a revenue growth of 154.2% year-on-year, reaching approximately 9.17 billion yuan, and an adjusted net profit growth of 198.6%, amounting to about 3.03 billion yuan [1] - The adjusted profit margin is projected to be 33% [1] Product Development - In Q3 2025, the company plans to launch 31 new series of blind box figures and plush products, with a slight decrease in new series compared to the previous quarter but maintaining year-on-year levels [1] - Popular new products include various themed series that sold out on their launch day [1] Retail Expansion - As of the end of August, the company had 513 retail stores in mainland China, a 6.4% increase year-on-year, and 1,837 robot stores [1] - The average revenue per store increased by 57% to 2.48 million yuan for the July-August period [1] Online Sales Performance - The company's official Douyin flagship store achieved a GMV of 1.31 billion yuan in Q3 2025, a year-on-year increase of 302.2%, with sales volume reaching 9.49 million, up 677.9% [2] - The Tmall flagship store generated revenue of 251 million yuan, a 73.1% increase year-on-year, while JD.com saw a revenue increase of 99.6% for the same period [2] Future Outlook - The company has adjusted its profit forecasts for 2025-2027, with expected adjusted net profits of 10.96 billion, 14.92 billion, and 18.31 billion yuan respectively [2] - The adjusted PE ratios for 2025-2027 are projected to be 32.3x, 23.8x, and 19.4x [2]

泡泡玛特Q3运营情况点评

Xin Lang Cai Jing· 2025-10-22 12:19

Core Viewpoint - The company reported a significant year-on-year revenue growth of 245%-250% for Q3 2025, exceeding market expectations, with strong performance across various channels and regions [1][2]. Revenue Performance - Domestic revenue in China grew by 185%-190%, with offline channels increasing by 130%-135% and online channels by 300%-305% [1]. - Overseas revenue surged by 365%-370%, with specific growth rates of 170%-175% in the Asia-Pacific region, 1265%-1270% in the Americas, and 735%-740% in Europe and other regions [1]. IP Development and Longevity - The commercial value curve of the labubu IP does not align with its popularity curve, indicating that high-quality IPs have a longer lifecycle than market perceptions suggest [1]. - Historical data shows that most of the company's key IPs have achieved continuous year-on-year revenue growth, with MOLLY, an early artist IP, maintaining a CAGR of 22% from 2019 to 2023 [1]. Global Market Expansion - The company is leveraging its diverse IP matrix to enhance its presence in global markets, which is crucial for catering to varying cultural preferences [2]. - The success of multiple IPs in overseas markets, such as crybaby and 星星人, demonstrates a notable increase in popularity, with regional differences in demand [2]. - The company is optimistic about expanding its store presence in overseas markets, which will allow for greater audience reach and maximize the commercial value of its diverse IP matrix [2].

泡泡玛特(09992):财务数据一览

BOCOM International· 2025-10-22 10:27

Investment Rating - The report maintains a "Buy" rating for the company, Pop Mart (9992 HK) [2][15]. Core Insights - The report highlights a sustained growth momentum, leading to an upward revision of profit forecasts and target price, reaffirming the "Buy" rating [2][6][7]. - The target price has been raised to HKD 401.60, indicating a potential upside of 60.4% from the current price of HKD 250.40 [1][15]. Financial Performance Summary - Revenue projections for 2025 have been increased by 11%, with expectations of continued sales momentum into Q4 due to the retail peak season [6][7]. - The company is expected to achieve significant revenue growth, with 2025 revenue estimated at RMB 35,899 million, reflecting a year-on-year growth of 175.3% [5][16]. - Net profit for 2025 is projected to reach RMB 12,421 million, representing a year-on-year increase of 296.7% [5][16]. Market Growth Dynamics - The company reported a 245-250% year-on-year revenue growth in Q3 2025, with the domestic market growing by 185-190% and overseas markets experiencing a remarkable growth of 365-370% [6][7]. - The domestic market's online sales grew by 300-305%, driven by effective live-streaming e-commerce and refined online membership operations [6][7]. - The overseas market, particularly the Americas, showed exceptional performance, with revenue growth of 1265-1270% in Q3 [6][7]. Profitability and Valuation Metrics - The report anticipates an increase in profit margins, with gross profit margin expected to reach 70.8% in 2025 [8][11]. - The company’s price-to-earnings ratio is projected to be 24.5 times for 2025, indicating an attractive valuation given the expected growth [5][16]. - The report notes that the company’s ability to monetize its IP platform continues to strengthen, with significant contributions expected from new IPs and product innovations [6][7].

泡泡玛特:如何利用IP经济撬动年轻消费?

Sou Hu Cai Jing· 2025-10-22 10:19

Core Insights - The article highlights the success of Pop Mart as a leading cultural entertainment brand in China, emphasizing its ability to tap into the emotional needs of millennials and Gen Z consumers through innovative IP development and marketing strategies [1][2]. Group 1: Business Overview - Pop Mart was established in 2010 and has expanded its operations to over 80 countries, with more than 450 offline stores and over 2,300 robot stores by the end of 2023 [1]. - The company successfully opened its first overseas park in 2024 and achieved full coverage of provincial-level stores in China [1]. - The LABUBU series saw a global launch in April 2025, with products selling out rapidly in markets like the US and UK [1]. Group 2: Targeting Millennials - Pop Mart effectively targets millennials by focusing on emotional value rather than just product functionality, transforming from a toy brand to a cultural IP operator [2]. - The brand creates narratives around its IPs, allowing products to embody characters with rich backstories, enhancing emotional connections with consumers [2][3]. Group 3: IP Development - The MOLLY IP has evolved from a simple character to a "star IP" with a complex personality, featuring seasonal storylines that engage fans [3]. - Other IPs like PUCKY and SKULL PANDA also have distinct characteristics that appeal to different consumer segments [3]. Group 4: Product Strategy - Pop Mart offers a diverse range of products, from basic blind boxes to high-end limited sculptures, catering to various consumer needs [6]. - The company has a highly responsive supply chain, allowing for rapid product design and production, minimizing inventory issues [6][7]. Group 5: Pricing Strategy - Pop Mart employs a pricing strategy based on "mass appeal + scarcity," with regular blind boxes priced around 59 yuan, appealing to younger consumers [8]. - The LABUBU series saw a price increase of nearly 30% in the US market, yet demand remained strong due to perceived scarcity [9]. Group 6: Marketing and User Engagement - The brand leverages social media platforms like Xiaohongshu, Douyin, and Weibo to enhance brand visibility and engage with consumers through relatable content [11][12]. - User-generated content (UGC) plays a crucial role in building brand loyalty and community, as consumers share their experiences and interactions with the products [14]. Group 7: Experiential Marketing - Pop Mart has established themed stores and pop-up shops in major cities, creating immersive experiences that deepen emotional connections with consumers [17]. - The company integrates online and offline channels, allowing users to preview products online and experience them in-store, enhancing overall engagement [21].

港股速报|港股全天表现疲软 泡泡玛特获多家大行“买入评级”

Mei Ri Jing Ji Xin Wen· 2025-10-22 09:10

今日(10月22日),港股市场全天表现低迷。 截至收盘,恒指报收于25781.77点,下跌245.78点,跌幅0.94%。 打开百度APP畅享高清图片 恒生科技指数报收于5923.09点,下跌84.85点,跌幅1.41%。 消息面,美银重申泡泡玛特"买入"评级,预计第四季将持续推出新产品。美银证券发表研究报告指出, 泡泡玛特第三季业绩表现强劲,收入按年增长245%至250%,超出市场预期。该行重申"买入"评级,目 标价为400港元。 此外,中银国际上调泡泡玛特目标价至405.6港元,维持"买入"评级。 瑞银上调泡泡玛特目标价至435港元;摩根大通上调泡泡玛特目标价至350港元;里昂维持泡泡玛特"跑 赢大市"评级。 焦点公司方面,中铝国际(601068.SH)A股涨停,带动H股午后飙升,最终收盘大涨30%。 消息面,有媒体称,力拓考虑与中铝集团进行资产换股权交易,但截至发稿,公司方面尚无正式消息发 布。 另外,泡泡玛特(09992.HK)公布财报后,今日高开近8%,但随后涨幅收窄,最终上涨2.4%,报256.4 港元。 其他方面,盘面上,科网股全线下跌,网易跌超3%,联想跌超2%,快手、百度、阿里巴巴、哔哩哔 ...

港股收盘 | 恒指收跌0.94% 泡泡玛特逆市升超2% 老铺黄金折价配股跌8%

Zhi Tong Cai Jing· 2025-10-22 08:54

Market Overview - The Hong Kong stock market failed to maintain its rebound, with the three major indices experiencing fluctuations and declines. The Hang Seng Index closed down 0.94% at 25,781.77 points, with a total trading volume of 227.54 billion HKD [1] - The largest external uncertainty facing the market is the US-China rivalry, which affects investor sentiment and causes short-term volatility. However, it is anticipated that after this short-term adjustment, the Hong Kong market may present a better entry opportunity [1] Blue-Chip Stocks Performance - Pop Mart (09992) rose 2.4% to 256.4 HKD, contributing 6.98 points to the Hang Seng Index. The company reported a projected revenue growth of 245%-250% year-on-year for Q3 2025, with China revenue up 185%-190% and overseas revenue up 365%-370% [2] - Other blue-chip stocks included China National Pharmaceutical (01099) up 4.27%, Shenzhou International (02313) up 1.72%, while Chow Tai Fook (01929) fell 5.65% and CSPC Pharmaceutical (01093) dropped 5.16%, negatively impacting the index [2] Sector Performance - Large technology stocks showed weak performance, with Alibaba down nearly 2% and Tencent down over 1%. Gold stocks collectively declined due to significant market sell-offs, with China Silver Group (00815) down 8.33% and Lingbao Gold (03330) down 4.75% [3][4] - Conversely, banking and oil stocks were active, with China Oilfield Services (601808) up over 3% and Agricultural Bank of China up 1.56%, reaching a historical high [3][4] Banking Sector Insights - Everbright Securities noted that the banking sector is entering a favorable reallocation window, with strong operational resilience and stable earnings expected for the upcoming quarterly reports. The sector's "high dividend, low valuation" attributes are becoming more pronounced [5] - The banking stocks showed positive movement, with Chongqing Bank (01963) and Agricultural Bank of China (01288) both up 1.56% [4][5] Oil and Gas Sector - Oil and gas stocks generally rose, with Sinopec Oilfield Services (01033) up 4.76% and Shandong Molong (00568) up 4.65%. The deep-sea economy concept is gaining attention, with Brent crude oil futures rising over 2% [5][6] Notable Stock Movements - Xuan Bamboo Biotechnology (02575) surged 31.87% after presenting positive clinical trial results for breast cancer treatment [7] - Chalco International (02068) rose 30.52% amid reports of potential asset swaps with Rio Tinto [8] - Guanghe Tong (00638) fell 11.72% on its first trading day, while Lao Pu Gold (06181) dropped 8.21% due to a planned share placement [9][10] - Innovent Biologics (01801) experienced a decline of 1.96% despite announcing a significant global strategic partnership with Takeda Pharmaceuticals [11]

港股收盘(10.22) | 恒指收跌0.94% 泡泡玛特(09992)逆市升超2% 老铺黄金(06181)折价配股跌8%

智通财经网· 2025-10-22 08:47

Market Overview - The Hong Kong stock market failed to maintain its rebound, with the Hang Seng Index closing down 0.94% at 25,781.77 points and a total turnover of 227.54 billion HKD [1] - The largest external uncertainty facing the market is the US-China rivalry, which has impacted investor sentiment and caused short-term volatility [1] Blue Chip Performance - Pop Mart (09992) rose 2.4% to 256.4 HKD, contributing 6.98 points to the Hang Seng Index, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [2] - Other blue chips included China National Pharmaceutical Group (01099) up 4.27% and Shenzhou International (02313) up 1.72%, while Chow Tai Fook (01929) fell 5.65% [2] Sector Performance - Large tech stocks showed weak performance, with Alibaba down nearly 2% and Tencent down over 1% [3] - Gold and silver stocks faced significant declines due to geopolitical factors and profit-taking, with China Silver Group (00815) down 8.33% [4] - Banking stocks were active, with Chongqing Bank (01963) and Agricultural Bank of China (01288) both up 1.56% [4][5] Notable Company Developments - Xuan Bamboo Bio (02575) reached a new high, rising 31.87% after presenting positive clinical trial results for breast cancer treatment [7] - Chalco International (02068) surged 30.52% amid reports of potential asset swaps with Rio Tinto [8] - Guanghe Communication (00638) debuted below its offering price, falling 11.72% [9] - Laopuhuang (06181) saw a significant drop of 8.21% after announcing a discounted share placement [10] - Innovent Biologics (01801) announced a global strategic partnership with Takeda Pharmaceutical, potentially worth up to 114 billion USD [11]