Wen Hua Cai Jing

Search documents

政策预期向好 沪铜重回强势状态【10月24日SHFE市场收盘评论】

Wen Hua Cai Jing· 2025-10-24 09:53

Core Viewpoint - Copper prices in Shanghai opened higher in the morning and significantly increased in the afternoon, closing up by 2.5%, with the highest price reaching 87,860 yuan, indicating a return to a high range [1] Group 1: Market Conditions - The improvement in global risk appetite and positive domestic policy expectations have led to increased market confidence, contributing to the strong performance of copper prices [1] - The recent easing of the China-U.S. trade situation has further boosted market sentiment, resulting in a strong performance in the domestic stock market and supporting copper prices [1] Group 2: Economic Policies - The announcement of the "14th Five-Year Plan" has significantly uplifted market sentiment, leading to a broad increase in commodity prices, including copper [1] - The Federal Reserve has initiated interest rate cuts, with market expectations indicating two more cuts within the year, contributing to a macroeconomic environment of fiscal and monetary easing in the U.S. [1]

市场氛围向暖 沪铜偏强运行【盘中快讯】

Wen Hua Cai Jing· 2025-10-24 09:53

Core Viewpoint - International copper and domestic copper prices are experiencing a strong upward trend, with both increasing by over 2% due to ongoing tightness in the copper mining sector and improved risk appetite in the market [1] Group 1 - The tightness in the copper mining sector continues to provide support for copper prices [1] - Recent improvements in market risk appetite are contributing to the bullish trend in copper prices [1] - Domestic policy expectations are becoming more favorable, further reinforcing the strength of copper prices [1]

俄罗斯Nornickel维持2025年镍产量预估不变

Wen Hua Cai Jing· 2025-10-24 01:43

Core Viewpoint - Nornickel maintains its nickel production outlook for 2025 at 196,000-204,000 tons, despite challenges faced in the previous quarters due to seasonal flooding and equipment replacement [1] Group 1: Nickel Production - In Q3 2025, Nornickel's nickel production increased by 18% compared to the previous quarter, reaching 54,000 tons, attributed to processing more raw materials accumulated in Q2 [1] - The company attributes a 4% decline in nickel production over the first nine months to the need for replacement of Western mining equipment [1] Group 2: Palladium Production - Palladium production in Q3 decreased by 6% to 617,000 ounces, also impacted by transportation disruptions at Dudinka port [1] - The company noted that the longer production cycle for palladium contributed to the decline in output [1] Group 3: Operational Adjustments - Nornickel's COO, Evgeniy Fedorov, indicated that the adjustments in production were due to the Polar Division mine transitioning to new mining equipment, which temporarily reduced ore output [1]

ILZSG:2025年8月全球铅市场转为供应短缺

Wen Hua Cai Jing· 2025-10-24 01:35

Core Insights - The global lead market is projected to shift to a supply deficit of 2,500 tons in August 2025, compared to a surplus of 10,800 tons in July 2025 [1] - For the period from January to August 2025, the global refined lead supply surplus is estimated at 51,000 tons, contrasting with a supply deficit of 17,000 tons during the same period in the previous year [1] Supply and Demand Data - Global mined lead production in August 2025 is reported at 383.3 thousand tons, slightly up from 381.5 thousand tons in July 2025 [1] - Global refined lead production for August 2025 stands at 1,099.7 thousand tons, marginally increasing from 1,096.9 thousand tons in July 2025 [1] - Global refined lead consumption in August 2025 is recorded at 1,102.2 thousand tons, up from 1,086.1 thousand tons in July 2025 [1] - The refined lead supply-demand balance indicates a shift from a surplus of 10.8 thousand tons in July 2025 to a deficit of 2.5 thousand tons in August 2025 [1]

自由港麦克莫兰公司第三季度铜和黄金产量同比下降

Wen Hua Cai Jing· 2025-10-24 01:17

Core Insights - Freeport-McMoRan reported a decline in copper and gold production for Q3, but profits exceeded Wall Street expectations due to rising copper prices offsetting production losses from the temporary shutdown of the Grasberg mine in Indonesia [2][3] Production and Sales - Q3 copper production was 912 million pounds, down from 1.1 billion pounds in the same period last year, attributed to a landslide incident and lower ore grades in Indonesia [2][4] - Q3 gold production was 287,000 ounces, a decrease from 456,000 ounces year-over-year, also impacted by the landslide and lower ore grades [2][4] - Q3 copper sales were 977 million pounds, slightly below the guidance of 990 million pounds, and lower than 1 billion pounds in Q3 2024 [2][4] - Q3 gold sales reached 336,000 ounces, down 4% from the guidance of 335,000 ounces and lower than 558,000 ounces in Q3 2024 [3][4] Pricing and Costs - The average realized price for copper in Q3 was $4.68 per pound, compared to $4.30 per pound in the same quarter last year [2][4] - The average realized price for gold in Q3 was $3,539 per ounce, significantly higher than $2,568 per ounce in the previous year [4] - Site production and delivery costs for copper were $2.71 per pound, while unit net cash costs were $1.40 per pound [4]

金属普涨 期铜收涨 受助于乐观需求前景【10月23日LME收盘】

Wen Hua Cai Jing· 2025-10-24 01:03

Group 1 - LME copper prices increased by $191, or 1.79%, closing at $10,854 per ton, reaching the highest level since October 9 [1][2] - Year-to-date, LME copper has risen by 23.5%, previously hitting a peak of $11,000 per ton on October 9 [4] - Strong economic data from China is driving optimism in copper demand, with expectations of potential additional stimulus policies [4] Group 2 - LME aluminum prices rose by $55.50, or 1.98%, closing at $2,862.50 per ton, marking the highest level since May 2022 [2][4] - Supply concerns are impacting aluminum prices, particularly due to South32's announcement of a suspension at its Mozal smelter in South Africa due to power supply issues [4]

澳大利亚西部矿山集团展开概括研究,测试Mulga Tank镍项目

Wen Hua Cai Jing· 2025-10-23 13:01

Core Insights - Western Mines Group is conducting a feasibility study and metallurgical testing on its Mulga Tank project, which is claimed to be Australia's largest nickel deposit with over 5 million tons of metal reserves [2] - The company aims to achieve high recovery rates and become a low-cost producer of sulfide nickel, with expectations that the Mulga Tank deposit could become a strategic asset within three to five years, potentially rivaling Canada Nickel's Crawford deposit [2] - The nickel reserves at Mulga Tank are approximately 5.3 million tons, with 1.6 million tons classified as indicated resources and 3.5-3.6 million tons as inferred resources [2] - The company has invested $10 million in the project and has recently completed another round of financing, ensuring sufficient funding for the next 6-12 months [2] Nickel Market Outlook - The company remains optimistic about nickel prices, stating that a price of $15,000 per ton is a solid bottom, especially as mining costs in Indonesia are rising [3] - Indonesia accounts for 63% of global refined nickel production, and the rising costs there may increase opportunities for Western Australia, which is considered a "world-class nickel province" [3] - Market participants during LME week expressed optimism about nickel's future, as Indonesia needs higher nickel prices to address fiscal shortfalls and achieve budget balance [4] Strategic Positioning - Western Mines Group aims to position itself in the lower half of the nickel production cost curve, with lower CO2 emissions expected from its sulfide mining operations compared to the common laterite deposits in Indonesia [4] - The company is following the trend of Western countries shifting towards low-grade nickel deposits, with Canada Nickel's Crawford deposit leading this change [5] - The company plans to present the economic viability of the Mulga Tank project in 2026, showcasing it as a "superior ore body" [6]

Antofagasta:第三季度铜产量为16.18万吨 环比增长1%

Wen Hua Cai Jing· 2025-10-23 12:26

Group 1 - Antofagasta reported a copper production of 161,800 tons in Q3 2025, representing a 1% quarter-on-quarter increase, with an annual production guidance of 660,000-700,000 tons at the lower end [2] - China's copper industry faces three major challenges: increasing reliance on foreign upstream resources, overcapacity in the midstream processing sector, and downstream demand being suppressed by high copper prices [2] - To assist the industry in navigating these changes, Shanghai Nonferrous Metals Network collaborated with copper industry enterprises to compile the "2026 China Copper Industry Chain Distribution Map," available in both Chinese and English [2]

沪铅大幅拉升 触及近七个月高位【沪铅收盘评论】

Wen Hua Cai Jing· 2025-10-23 09:49

Core Viewpoint - The lead market is experiencing a significant price increase due to limited supply and low social inventory, despite concerns about downstream demand as temperatures drop [1] Supply and Demand Dynamics - Lead prices on the Shanghai Futures Exchange rose sharply, with the main contract increasing by over 3% at one point and closing with a gain of 2.68% [1] - Supply constraints are exacerbated by new regulations in Hebei, restricting the entry of certain vehicles into factories, impacting the transportation of raw materials and finished products [1] - The production of recycled lead is expected to recover as companies resume operations, but current supply remains limited, with social inventory still at low levels [1] Market Sentiment and Price Forecast - According to Guotou Futures, there is a coexistence of reduced primary lead production and insufficient recovery in recycled lead production, leading to a strong performance in Shanghai lead prices [1] - Market concerns about weakening consumption due to colder weather and expectations of overseas lead supply additions are creating pressure on the rebound of lead prices, resulting in increased market divergence [1] - The forecast for lead prices is expected to oscillate within the range of 16,500 to 17,300 yuan per ton [1]

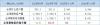

10月22日LME金属库存及注销仓单数据

Wen Hua Cai Jing· 2025-10-23 08:56

Group 1: Inventory Changes - Copper inventory increased by 75 units, representing a 0.05% rise, with a total of 136,925 units [1] - Zinc inventory decreased by 600 units, showing a 1.70% decline, totaling 34,700 units [1] - Aluminum inventory decreased by 4,375 units, reflecting a 1.79% drop, with a total of 239,750 units [1] - Tin inventory decreased by 25 units, resulting in a 0.91% decline, totaling 2,720 units [1] Group 2: Registered and Cancelled Warehouse Receipts - Registered warehouse receipts for copper decreased by 1.12%, totaling 126,150 units, while cancelled receipts increased by 16.17% to 10,775 units [2] - For zinc, registered receipts increased by 1.74% to 24,850 units, while cancelled receipts decreased by 9.43% to 9,850 units [2] - Aluminum registered receipts remained unchanged at 76,475 units, with cancelled receipts at 163,275 units, representing 68.10% of the total [7] Group 3: Location-Specific Inventory Changes - In Kaohsiung, copper inventory increased by 200 units to 53,450 units [4] - Rotterdam saw a decrease in copper inventory by 50 units, totaling 14,350 units [4] - Singapore's aluminum inventory remained stable at 275 units [5] - Zinc inventory in Singapore decreased by 900 units, totaling 32,950 units [9]