YOURAN DAIRY(09858)

Search documents

优然牧业(09858) - 截至二零二五年十月三十一日止之股份发行人的证券变动月报表

2025-11-03 08:32

| 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 09858 | 說明 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | 法定/註冊股本 | | | 上月底結存 | | | 10,000,000,000 | USD | | 0.00001 USD | | 100,000 | | 增加 / 減少 (-) | | | | | | USD | | | | 本月底結存 | | | 10,000,000,000 | USD | | 0.00001 USD | | 100,000 | 本月底法定/註冊股本總額: USD 100,000 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年10月31日 狀態: 新提交 致:香港交易及結算所有限公司 公司名稱: 中國優然牧業集團有限公司 呈交日期: 2025年11月3日 I. 法定/註冊股 ...

港股食品饮料板块投资启示

INDUSTRIAL SECURITIES· 2025-10-31 14:20

Investment Rating - The report provides a positive outlook for the Hong Kong food and beverage sector, indicating potential investment opportunities in resilient companies within the industry [2][9]. Core Insights - The report outlines six phases of the Hang Seng Consumer Staples Index, highlighting the cyclical nature of the industry and the impact of external factors such as economic conditions and policy changes on consumer demand [3][4][28]. - The analysis emphasizes the importance of identifying resilient stocks in the food and beverage sector, particularly in the upstream farming and downstream dairy product industries, as they are expected to benefit from market dynamics and policy support [6][7][53]. Summary by Sections Phase Review of the Hang Seng Consumer Staples Index - Phase 1: Downward trend due to slowing GDP and reduced consumer demand, leading to a decline in the index [3]. - Phase 2: Strong recovery driven by global economic recovery and improved earnings of leading consumer staples companies [3]. - Phase 3: Period of volatility influenced by trade tensions and tightening global liquidity [3]. - Phase 4: Rapid increase in the index due to the rigid demand for essential consumption during the pandemic [3]. - Phase 5: Continuous decline influenced by repeated pandemic disruptions and rising raw material costs [4]. - Phase 6: Valuation recovery initiated by domestic consumption policies and inflow of long-term capital [4][28]. Investment Opportunities in the Food and Beverage Sector - Upstream farming opportunities are highlighted, with a focus on the dairy and beef sectors, where prices are expected to stabilize and rise due to supply constraints and recovering demand [6][44]. - Downstream dairy product opportunities are supported by recent policies aimed at boosting demand and improving market competition, which will benefit leading companies in the sector [7][53]. Investment Recommendations - Companies such as Yurun Agriculture (09858.HK) and Modern Farming (01117.HK) are recommended for their strong cash flow and potential to benefit from the anticipated recovery in raw milk prices [9][57]. - The report suggests that policy support will create upward momentum for companies like Mengniu Dairy (02319.HK) and H&H International Holdings (01112.HK), which are positioned to capitalize on market opportunities [10][57]. - The potential for industry restructuring and the emergence of leading companies is noted, particularly in the coconut water segment, with recommendations for IFBH (06603.HK) [11][58].

行业点评报告:食品饮料持仓新低,优先布局白酒和成长型标的

KAIYUAN SECURITIES· 2025-10-31 08:22

Investment Rating - The industry investment rating is "Positive" (maintained) [1] Core Viewpoints - The food and beverage sector has seen a decline in fund allocation, with the configuration ratio dropping to a new low of 6.4% in Q3 2025 from 8.0% in Q2 2025, indicating a significant reduction in investment interest [5][14] - The white wine sector is expected to reach a performance and valuation bottom, with recommendations to strategically invest in this area due to its relatively low valuation and stable chip structure [8][40] - The beverage and snack sectors are performing well, driven by their essential consumption characteristics and resilience against external market fluctuations [41][43] Summary by Sections Fund Allocation Trends - In Q3 2025, the allocation ratio for food and beverage in all market funds decreased to 6.4%, down 1.6 percentage points from Q2 2025, marking the lowest level since 2020 [5][14] - The allocation ratio for active equity funds in food and beverage fell to 4.1% in Q3 2025, down from 5.6% in Q2 2025, reflecting a continued significant reduction in investment [5][14] White Wine Sector Insights - The proportion of active equity funds heavily invested in white wine decreased from 4.0% in Q2 2025 to 3.2% in Q3 2025, indicating a trend of reduced allocation across both active and passive funds [6][25] - Companies with cleared financial reports, such as Luzhou Laojiao and Shede Liquor, are gaining market favor, while others like Wuliangye and Moutai are seeing reduced holdings [6][25] Performance and Market Dynamics - The food and beverage sector's market value increased by 3.7% in Q3 2025, but it underperformed the CSI 300 index by approximately 18.6 percentage points, ranking fifth from the bottom in the overall market [15][21] - The overall market transaction amount for the food and beverage sector fell to 1.65%, down 1.05 percentage points from the previous quarter, indicating a decline in trading activity [15][21] Investment Recommendations - It is suggested to strategically invest in the white wine sector, focusing on stable companies like Kweichow Moutai and Shanxi Fenjiu, as well as those undergoing market reforms like Shede Liquor [8][40] - For the broader consumer goods sector, attention should be given to companies that benefit from new channels and product categories, such as Wei Long and Ximai Foods [43]

中国必选消费品10月成本报告:包材价格上行,啤酒现货成本指数同比上涨

Haitong Securities International· 2025-10-28 15:13

Investment Rating - The report provides various investment ratings for companies in the consumer staples sector, with "Outperform" ratings for companies like China Feihe, Haidilao, and China Resources Beer, while Budweiser APAC is rated as "Neutral" [1]. Core Insights - The report highlights a rise in packaging material prices and an increase in the beer spot cost index by 2.96% year-on-year, indicating upward pressure on costs in the consumer staples sector [1][35]. - The cost indices for six categories of consumer goods monitored by HTI mostly increased, with notable changes in spot and futures indices across beer, frozen food, soft drinks, instant noodles, dairy products, and condiments [35]. Summary by Category Beer - The beer spot cost index is at 116.32, down 0.06% from last week, while the futures index is at 115.68, up 1.2% [13]. - Year-to-date, the spot index has decreased by 0.86%, and the futures index has decreased by 7.13% [14]. Condiments - The condiments spot cost index is at 100.51, down 0.1%, and the futures index is at 101.3, up 1.55% [17]. - Year-to-date, the spot index has decreased by 2.66%, and the futures index has decreased by 7.47% [17]. Dairy Products - The dairy products spot cost index is at 101.25, down 0.13%, and the futures index is at 91.04, up 0.69% [20]. - Year-to-date, the spot index has decreased by 2.89%, and the futures index has decreased by 3.28% [20]. Instant Noodles - The instant noodles spot cost index is at 103.62, down 0.23%, and the futures index is at 102.53, up 0.88% [23]. - Year-to-date, the spot index has decreased by 2.29%, and the futures index has decreased by 5.47% [24]. Frozen Food - The frozen food spot cost index is at 120.39, up 1.02%, and the futures index is at 119.44, up 1.72% [28]. - Year-to-date, the spot index has decreased by 0.17%, and the futures index has decreased by 1.35% [28]. Soft Drinks - The soft drinks spot cost index is at 109.39, up 0.22%, and the futures index is at 109.26, up 0.72% [31]. - Year-to-date, the spot index has decreased by 3.04%, and the futures index has decreased by 9.54% [31].

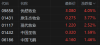

乳业股午前普涨

Mei Ri Jing Ji Xin Wen· 2025-10-28 04:11

Core Viewpoint - Dairy stocks experienced a significant midday rally, indicating positive market sentiment towards the sector [1] Company Performance - YouRan MuYe (09858.HK) saw an increase of 5.74%, reaching HKD 3.13 [1] - Modern MuYe (01117.HK) rose by 3.36%, trading at HKD 1.23 [1] - China Feihe (06186.HK) gained 1.95%, with a price of HKD 4.18 [1] - China Shengmu (01432.HK) increased by 1.59%, priced at HKD 0.32 [1]

港股异动 | 乳业股午前普涨 原奶价格近期迎阶段性稳定 行业下半年去化有望提速

Xin Lang Cai Jing· 2025-10-28 04:04

Group 1 - Dairy stocks experienced a midday surge, with Yurun Dairy rising by 5.74% to HKD 3.13, Modern Dairy up by 3.36% to HKD 1.23, China Feihe increasing by 1.95% to HKD 4.18, and China Shengmu rising by 1.59% to HKD 0.32 [1] - Guosheng Securities reported that after a four-year decline, raw milk prices have recently stabilized, with the national average price increasing from CNY 3.02/kg on August 1 to CNY 3.04/kg by the end of September, and prices in Ningxia rising from CNY 2.1-2.2/kg to CNY 3.5-3.7/kg [1] - The increase in milk prices is attributed to demand from the Mid-Autumn Festival and National Day gifts, as well as a natural decrease in supply due to the "heat stress" phase for dairy cows from July to September [1] Group 2 - Tianfeng Securities noted that since September, while some regions have seen a rebound in raw milk prices due to pre-holiday stocking and student milk production demand, overall prices in major production areas remain stable [2] - Current milk prices are still below the cost line, leading to ongoing industry losses and financial pressure from silage, with a 0.18% month-on-month decrease in dairy cow inventory in September, following a 0.2% decline in August, totaling an approximate 8% reduction [2] - Despite short-term support for milk prices from holiday factors, the trend of capacity reduction in dairy companies continues, and the end of the capacity reduction cycle may be nearing, making a price cycle turning point worth anticipating [2]

乳业股午前普涨 原奶价格近期迎阶段性稳定 行业下半年去化有望提速

Zhi Tong Cai Jing· 2025-10-28 04:02

Group 1 - Dairy stocks experienced a significant increase, with YouRan Dairy rising by 5.74% to HKD 3.13, Modern Dairy up by 3.36% to HKD 1.23, China Feihe increasing by 1.95% to HKD 4.18, and China Shengmu rising by 1.59% to HKD 0.32 [1] - Guosheng Securities reported that after a four-year decline, raw milk prices have recently stabilized, with the national average price rising from RMB 3.02/kg in August to RMB 3.04/kg by the end of September, and prices in Ningxia increasing from RMB 2.1-2.2/kg to RMB 3.5-3.7/kg [1] - The increase in milk prices is attributed to demand from the Mid-Autumn Festival and National Day gifts, as well as a natural decrease in supply due to the "heat stress" phase for dairy cows from July to September [1] Group 2 - Tianfeng Securities noted that since September, while there has been a rebound in raw milk prices in some regions due to pre-holiday stocking and student milk production demand, overall prices in major production areas remain stable [2] - Current milk prices are still below the cost line, leading to ongoing industry losses and financial pressure from silage, with a 0.18% decrease in dairy cow inventory in September compared to August [2] - The cumulative reduction in dairy cow inventory has reached approximately 8%, and while the holiday factors provide short-term support for milk prices, the trend of capacity reduction continues [2]

港股异动丨乳制品股反弹 优然牧业涨4% 中国飞鹤涨1.5% 机构指奶价拐点仍可期

Ge Long Hui· 2025-10-28 03:45

Core Viewpoint - The Hong Kong dairy stocks have rebounded after a period of decline, with several companies showing positive price movements, although the overall dairy price remains below cost levels, indicating ongoing industry challenges [1]. Group 1: Market Performance - Yurun Dairy increased by 4%, Ecological Dairy by 3.77%, Modern Dairy by 2.5%, China Shengmu by 1.5%, and China Feihe by 1.46% [2]. - The rebound in stock prices is attributed to pre-holiday inventory buildup and increased demand for student milk production [1]. Group 2: Industry Conditions - Despite the short-term support for milk prices due to holiday factors, the trend of capacity reduction in the dairy industry continues [1]. - The overall milk price remains below the cost line, leading to ongoing industry losses and financial pressures from silage [1]. - The number of dairy cows decreased by 0.18% month-on-month in September, following a 0.2% decline in August, with a cumulative reduction of approximately 8% [1]. Group 3: Future Outlook - The capacity reduction trend may be nearing its end, and a turning point in the milk price cycle is anticipated [1].

奶牛“口粮上新”,青贮玉米收获忙

Nei Meng Gu Ri Bao· 2025-10-25 04:29

Core Insights - The article highlights the efficient harvesting and storage of silage corn by Youran Agriculture, emphasizing its importance in dairy farming as a high-quality feed source [1][3]. Group 1: Company Operations - Youran Agriculture has established a comprehensive storage chain for silage corn, ensuring efficient operations from harvesting to storage [1]. - The company has identified and bred over 50 varieties of silage corn suitable for different regions, enhancing its seed resource library [1]. - Youran Agriculture has developed an innovative "silage shredding" technology that improves the fermentation process and increases milk production by enhancing feed digestibility [1]. Group 2: Industry Trends - Inner Mongolia is expanding its silage corn planting area to 15.33 million acres in 2024, alongside other forage crops like oats and alfalfa [3]. - The region's large-scale farms are adopting a complete feeding strategy that includes alfalfa, whole corn silage, and vitamin-mineral supplements [3]. - The healthy development of the forage industry is benefiting farmers, with reports of increased income from selling silage corn directly to cooperatives [3]. Group 3: Agricultural Practices - Inner Mongolia is increasing the area of artificial forage cultivation and improving silage corn production capabilities [4]. - The region is promoting the use of crop straw resources and advanced storage techniques to enhance the utilization rate of straw as feed [4].

牧业股集体走高 短期因素不影响肉奶大周期共振 奶肉联动模式企业盈利能力突出

Zhi Tong Cai Jing· 2025-10-16 04:57

Core Viewpoint - Livestock stocks have collectively risen, with significant gains observed in companies such as YouRan Agriculture, Modern Farming, and China Shengmu, indicating a positive market sentiment despite recent price adjustments in the sector [1][1][1] Group 1: Stock Performance - YouRan Agriculture (09858) increased by 6.71%, trading at HKD 3.34 [1] - Modern Farming (01117) rose by 4.2%, trading at HKD 1.24 [1] - China Shengmu (01432) and Original Ecological Agriculture (01431) also saw gains of 1.45% and 1.82%, respectively [1] Group 2: Market Analysis - CITIC Securities reported that the recent slowdown in the reduction of dairy cow inventory has led to a temporary price correction in livestock stocks, but this will not disrupt the underlying cyclical logic of the industry [1][1] - The dairy cow inventory is expected to continue its downward trend, with the turning point for raw milk prices approaching as seasonal demand weakens and operational pressures on farms increase [1][1] Group 3: Future Outlook - Tianfeng Securities indicated that the current phase of dairy cow capacity reduction may be nearing its end, with Q3 silage procurement potentially accelerating the clearing of marginal stocks [1] - Raw milk prices are anticipated to bottom out and rebound, while beef prices may also see a turning point, although various factors such as funding, confidence, and environmental regulations could impact the pace of restocking [1][1] - Companies with cow resources or those employing a "milk-meat linkage" model are expected to demonstrate stronger profitability [1]