PING AN OF CHINA(601318)

Search documents

大摩、小摩、贝莱德等9大外资公募持仓出炉!光模块等AI科技成布局热门!

私募排排网· 2025-10-29 07:00

Core Viewpoint - The A-share market has shown a significant recovery this year, with the Shanghai Composite Index surpassing 4000 points, reflecting strong investment interest from foreign public funds, including major players like Morgan Stanley and BlackRock [3] Foreign Fund Holdings - In the third quarter, six foreign public funds increased their stock holdings, with Allianz Fund and Schroders Fund showing remarkable growth rates of 77.10% and 82.03% respectively [5] - Morgan Chase Fund's asset scale reached 213.22 billion, holding 194 stocks with a total market value of approximately 756.73 billion [6] - Morgan Stanley Fund's asset scale was 270.04 billion, with a focus on sectors like pharmaceuticals and AI, achieving an average return of 140.35% for its top twenty holdings [9] Key Stock Performances - The top holdings of Morgan Chase Fund included CATL, which saw a price increase of 45.29% year-to-date, with a total holding value of 3.66 billion [7] - New Yi Sheng, a key stock for Morgan Stanley Fund, experienced a staggering increase of 255.27% this year [10] - The top three holdings of Manulife Fund were all in the computing power industry, with 19 out of 20 stocks showing significant price increases [12] Investment Trends - The recent optimization of the Qualified Foreign Institutional Investor (QFII) system is expected to attract more foreign capital into the Chinese market, enhancing liquidity [3] - BlackRock Fund has notably increased its holdings in CATL, with a total market value of approximately 2.11 billion [15] - Fidelity Fund emphasizes the growth potential of Chinese technology stocks, despite a more diversified current portfolio [20] Market Outlook - The outlook for the A-share market remains optimistic, with expectations of new highs as the market stabilizes [18] - Roadshow Fund has maintained its positions in traditional blue-chip stocks while also focusing on technology stocks [19]

险资举牌次数再创新高,这类资产是挚爱

Mei Ri Jing Ji Xin Wen· 2025-10-29 06:27

Group 1 - The core viewpoint of the articles highlights that insurance capital has reached a record high in shareholding activities this year, with 31 instances of stake acquisitions, surpassing the previous peak in 2020 and reaching the highest level since records began in 2015 [1] - Ping An Asset Management has increased its stake in China Merchants Bank H-shares to 18.04% by purchasing 3.278 million shares, indicating that the underlying client is likely to be insurance capital [1] - Analysts suggest that the insurance capital strategy has transitioned from a "buy-and-hold" phase (1.0) to a more selective and balanced approach (2.0) [1] Group 2 - This year, insurance capital has made 24 stake acquisitions, primarily in the financial and public utility sectors, with additional investments in electrical equipment, information technology, and healthcare [1] - Low valuations and high dividend yields are significant reasons for the selection of investment targets by insurance capital, as exemplified by the Agricultural Bank of China H-shares, where Ping An's average purchase price increased from HKD 4.2257 at the beginning of the year to HKD 5.6306 by October 20 [1] - The dividend yield of Agricultural Bank of China H-shares has decreased from 5.95% at the beginning of the year to around 4.4%, but it still offers a favorable spread compared to current life insurance product interest rates [1] Group 3 - Ping An's investment style is characterized as a "sweeping" approach, focusing solely on financial stocks, including Postal Savings Bank H-shares, China Merchants Bank H-shares, Agricultural Bank of China H-shares, China Pacific Insurance H-shares, and China Life H-shares [2] - Other companies exhibit a more diversified selection style, as seen with Great Wall Life's stake acquisitions in China Water Affairs, Datang Renewable, Qinhuangdao Port, and New天绿能, spanning public utilities and transportation sectors [2] - For investors looking to emulate insurance capital strategies, a focus on H-share banks can be achieved through the Hong Kong Stock Connect Financial ETF, which has a 60% weight in H-share banks, while those seeking a diversified style may consider the Hong Kong Central State-Owned Enterprises Dividend ETF [2]

2025广东企业500强出炉:中国平安、华润、华为位居前三

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-29 06:01

Core Insights - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1] - The total operating revenue of the top 500 enterprises reached 19.36 trillion yuan, with total assets exceeding 68 trillion yuan and total R&D investment amounting to 584.96 billion yuan [1][3] Revenue Growth - The total revenue of Guangdong's top 500 enterprises has increased from 16.73 trillion yuan in 2021 to 19.36 trillion yuan in 2025, marking a historical high with a growth rate of 3.36% in 2025, a significant rebound from 0.37% in 2024 [3][5] - The revenue growth reflects the resilience and innovative vitality of these enterprises amid complex international situations and domestic reform challenges [3] Asset Expansion - The total assets of Guangdong's top 500 enterprises grew from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5] - This growth indicates a continuous strengthening of the comprehensive strength of these enterprises [5] R&D Investment - The total R&D expenditure of Guangdong's top 500 enterprises is projected to reach 584.96 billion yuan by 2025, with a focus on basic research and key core technology areas [5] - The knowledge-intensive sectors, particularly scientific research and technical services, show a high R&D intensity of 19.00%, with R&D expenses amounting to 191.65 billion yuan [6] Tax Contributions - Despite the growth in assets and revenue, the total tax contributions of these enterprises have steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [6] Regional Coordination - The report highlights a significant disparity in the distribution of enterprises, with 98.25% of revenue and 98.91% of net profit concentrated in the Pearl River Delta region, while other regions like East Guangdong and West Guangdong have less than 0.3% [8][10] - To address this imbalance, the report suggests establishing a regional collaborative system that combines innovation radiation from the Pearl River Delta with the unique characteristics of East and West Guangdong [10]

中国平安(601318):3Q25归母净利润/归母营运利润yoy+45%/+15%,表现亮眼

Shenwan Hongyuan Securities· 2025-10-29 05:57

Investment Rating - The report maintains a "Buy" rating for the company, with an upward adjustment of profit forecasts for 2025-2027 [6]. Core Insights - The company's net profit attributable to shareholders for Q3 2025 increased by 45.4% year-on-year, reaching 648.09 billion yuan, while the operating profit rose by 15.2% to 385.32 billion yuan, indicating strong performance [4][5]. - For the first three quarters of 2025, the company achieved a net profit of 1,328.56 billion yuan, a year-on-year increase of 11.5%, and an operating profit of 1,162.64 billion yuan, up 7.2% [4]. - The company’s new business value (NBV) for Q3 2025 surged by 58.3% year-on-year, reflecting robust growth momentum driven by anticipated interest rate cuts [5][8]. Financial Performance Summary - The company’s total revenue for 2025 is projected to be 1,064.09 billion yuan, with a year-on-year growth rate of 3.4% [7]. - The net profit attributable to shareholders is expected to reach 142.92 billion yuan in 2025, representing a 12.9% increase compared to the previous year [7]. - The company’s price-to-earnings (P/E) ratio for 2025 is estimated at 7.32, while the price-to-embedded value (P/EV) is projected to be 0.69 [7]. Business Segment Performance - The life insurance, property insurance, and banking segments reported operating profits of 787.68 billion yuan, 150.74 billion yuan, and 222.21 billion yuan respectively, with year-on-year growth rates of 1.9%, 8.3%, and a decline of 3.5% [4]. - The asset management segment showed improvement, turning profitable with a contribution of 49.7 billion yuan to operating profit [4]. Investment Asset Growth - The company’s investment assets grew by 11.9% year-to-date, reaching 6.41 trillion yuan, with non-annualized net and comprehensive investment returns of 2.8% and 5.4% respectively [6].

2025广东企业500强出炉:中国平安、华润、华为位居前三

21世纪经济报道· 2025-10-29 05:56

Core Viewpoint - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1]. Group 1: Scale and Growth - The total revenue of the top 500 enterprises in Guangdong reached 19.36 trillion yuan, setting a historical record [2][3]. - From 2021 to 2025, the total revenue of these enterprises is projected to increase from 16.73 trillion yuan to 19.36 trillion yuan, with a growth rate of 3.36% in 2025, significantly rebounding from 0.37% in 2024 [3]. Group 2: Asset Expansion - The total assets of Guangdong's top 500 enterprises are expected to grow from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5]. - In 2025, the total R&D expenditure of these enterprises is projected to reach 584.96 billion yuan, indicating a shift towards investing more in fundamental research and key core technologies [5]. Group 3: Industry Structure and R&D Investment - Knowledge-intensive sectors are particularly active, with the scientific research and technical services industry having a R&D intensity of 19.00%, amounting to 191.65 billion yuan in R&D expenses [6]. - The manufacturing sector, as a cornerstone of the economy, has a total R&D expenditure of 279.51 billion yuan [6]. Group 4: Taxation and Policy Impact - Despite growth in assets and revenue, the total tax paid by enterprises has steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [8]. - This "two increases and one decrease" trend indicates that tax reduction policies have created favorable conditions for enterprises to increase R&D investment and expand production [8]. Group 5: Regional Coordination and Challenges - The report highlights a significant disparity in performance among regions, with the Pearl River Delta region accounting for 98.25% of the revenue and 98.91% of the net profit of the top 500 enterprises [10]. - The report suggests establishing a regional collaborative system that combines "Pearl River Delta innovation radiation + unique undertakings in eastern and western Guangdong" to enhance coordination and innovation spillover effects [12].

瞄准投保难题!高赔付风险燃油营运车上线“车险好投保”

Guo Ji Jin Rong Bao· 2025-10-29 05:37

Core Viewpoint - The "Car Insurance Good to Insure" platform has expanded to include a new insurance option for high-compensation risk fuel-operated vehicles, providing an alternative to traditional insurance channels for vehicle owners [1][3]. Group 1: Platform Expansion - The platform now offers insurance for high-compensation risk fuel-operated vehicles, including taxis, rental vehicles, and commercial trucks, in addition to existing services for new energy vehicles [3][6]. - A total of 11 insurance companies are participating in this initiative, including major firms such as PICC Property and Casualty, Ping An Property and Casualty, and China Life Property and Casualty [1][3]. Group 2: Insurance Process - The insurance process remains unchanged, allowing personal clients to use WeChat and Alipay for self-service insurance applications, while corporate clients can register online and receive follow-up contact from insurance companies [2][3]. - The platform has established a customer service hotline and intelligent customer service features to assist users throughout the insurance process [3][4]. Group 3: Industry Context - The platform aims to address the challenges faced by fuel-operated vehicles, which have high usage intensity and claim rates, making insurance difficult to obtain [1][6]. - Since its launch, the platform has successfully facilitated insurance for over 1.1 million new energy vehicles, providing risk coverage exceeding 1.1 trillion yuan [6]. Group 4: Future Developments - The platform will gradually integrate additional insurance companies to enhance service availability and coverage [7][8]. - Insurance companies participating in the platform are expected to adhere to consumer protection standards and ensure quality service while managing risks effectively [8][9].

华泰证券今日早参-20251029

HTSC· 2025-10-29 05:11

Core Insights - The report highlights concerns regarding the independence of the Federal Reserve, particularly in light of political pressures, which may impact the macroeconomic narrative and the valuation of the US dollar [2] - The report provides a detailed analysis of various companies, focusing on their financial performance and strategic initiatives [3][4][5][6][7][8][10][11][12][17][19][20][22][24][25][26][27][28][30][31] Company Summaries - **Lihigh Food (300973 CH, Buy)**: The company reported revenue of 3.14 billion and net profit of 250 million for the first three quarters of 2025, showing year-on-year growth of 15.7% and 22.0% respectively. Despite pressure on gross margins due to rising palm oil prices, effective cost control has helped maintain profitability [3] - **Red Flag Chain (002697 CH, Accumulate)**: The company achieved revenue of 7.11 billion in the first three quarters of 2025, a year-on-year decrease of 8.5%. The net profit was 383 million, down 1.9% year-on-year. The company is focusing on internal management and cost reduction to improve profitability [4] - **Kanglong Chemical (300759 CH, Buy)**: The company reported revenue of 10.086 billion and adjusted net profit of 1.227 billion for the first three quarters of 2025, reflecting year-on-year growth of 14.4% and 10.8% respectively. The company has raised its revenue growth guidance for 2025 from 10-15% to 12-16% [5] - **Zhou Dasheng (002867 CH, Buy)**: The company reported revenue of 6.772 billion for the first three quarters of 2025, a decline of 37.3% year-on-year, while net profit increased by 3.1%. The growth in net profit is attributed to a higher proportion of high-margin products [6] - **Aimeike (300896 CH, Buy)**: The company reported revenue of 566 million in Q3 2025, down 21.3% year-on-year, with a net profit of 304 million, down 34.6%. The company is focusing on expanding its product pipeline and international market presence [7] - **Leixin Technology (688018 CH, Accumulate)**: The company achieved revenue of 1.912 billion in the first three quarters of 2025, a year-on-year increase of 30.97%. Despite a slight decline in Q3 revenue, the company is expanding its market presence in high-performance SoC [8] - **Zhongke Chuangda (300496 CH, Buy)**: The company reported revenue of 5.148 billion for the first three quarters of 2025, reflecting a year-on-year increase of 39.34%. The growth is driven by the AIOT sector [9] - **Yihua (301029 CH, Buy)**: The company reported revenue of 736 million in Q3 2025, up 17.52% year-on-year, with a net profit of 136 million, up 28.59%. The growth is attributed to the continued demand in lithium battery and automotive sectors [10] - **Huazhi Technology (688281 CH, Buy)**: The company reported revenue of 285 million in Q3 2025, a year-on-year increase of 12.85%. The company is focusing on its leading position in stealth materials [11] - **Chengdu Bank (601838 CH, Buy)**: The bank reported a net profit of 5.0% and revenue growth of 3.0% for the first nine months of 2025, indicating stable performance despite non-interest income fluctuations [12] - **Yun Tianhua (600096 CH, Buy)**: The company reported revenue of 12.6 billion in Q3 2025, a year-on-year decrease of 14%, but net profit increased by 24%. The company benefits from strong export demand for phosphate products [13] - **Funi Co., Ltd. (600483 CH, Buy)**: The company reported revenue of 3.666 billion in Q3 2025, down 4.04% year-on-year, but net profit increased by 11.53%. The company is focusing on its project reserves and renewable energy contributions [14] - **Hongcheng Environment (600461 CH, Buy)**: The company reported revenue of 1.738 billion in Q3 2025, up 2.41% year-on-year, with net profit of 324 million, reflecting stable operational performance [15] - **Op Lighting (603515 CH, Accumulate)**: The company reported revenue of 1.692 billion in Q3 2025, down 0.59% year-on-year, with net profit of 208 million, down 12.22%. The company is expected to recover as the housing market stabilizes [16] Industry Insights - The macroeconomic environment is influenced by political pressures on the Federal Reserve, which may affect market confidence and asset valuations [2] - The food and beverage sector is experiencing mixed performance, with some companies managing to maintain profitability through cost control and strategic initiatives [3][4][5][6] - The healthcare and pharmaceutical sectors are showing resilience, with companies reporting steady revenue growth and improved cash flow [7][8][9] - The technology sector, particularly in AI and IoT, is witnessing significant growth, driven by increased demand for advanced solutions [10][11][12] - The banking sector is showing stable performance, with banks managing to maintain profitability despite fluctuations in non-interest income [13][14] - The energy sector is focusing on renewable energy projects, with companies looking to expand their project reserves and improve operational efficiency [15][16]

险资举牌次数,创新高!红利策略进入2.0阶段?

券商中国· 2025-10-29 04:41

Core Viewpoint - The insurance capital's stake acquisition has reached a record high in 2023, indicating a shift in investment strategy from aggressive buying to selective investment [1][4][8]. Group 1: Stake Acquisition Trends - Insurance capital has made 31 stake acquisitions this year, surpassing the previous high in 2020 and marking the highest since records began in 2015 [1][4]. - Among the 13 insurance companies involved, China Ping An's Ping An Life led with 12 acquisitions, while China Postal Life followed with 3 [4][5]. - The latest acquisition was by China Postal Life, which increased its stake in China Tonghao H-shares to approximately 5.17% [4]. Group 2: Investment Strategies - Analysts suggest that the insurance capital's investment strategy has transitioned from a "buy-and-hold" approach to a more balanced and selective strategy [3][8]. - The focus of investments has been primarily on undervalued stocks with high dividends, particularly in the financial and public utility sectors [6][8]. - China Ping An's investment style is characterized by continuous buying and holding of financial stocks, while other companies like Great Wall Life have a more diversified selection [6][7]. Group 3: Market Outlook and Future Strategies - The insurance capital is expected to accelerate its allocation towards dividend stocks, with an estimated increase of nearly 320 billion yuan in 2025 [8]. - The shift towards dividend stocks is seen as a response to rising valuations and a narrowing selection of viable stocks [8]. - The industry is also adjusting product structures to enhance the proportion of equity assets in response to low interest rates and regulatory encouragement [8][9].

永川监管分局同意中国平安永川中心支公司双桥营销服务部变更营业场所

Jin Tou Wang· 2025-10-29 04:27

一、同意中国平安人寿保险股份有限公司永川中心支公司双桥营销服务部将营业场所变更为:重庆市大 足区双桥经开区双南路68号附127号3-1(新城港湾)部分房屋。 二、中国平安人寿保险股份有限公司应按照有关规定及时办理变更及许可证换领事宜。 2025年10月27日,国家金融监督管理总局永川监管分局发布批复称,《关于变更中国平安(601318)人 寿保险股份有限公司重庆市永川中心支公司双桥营销服务部营业场所的请示》(平保寿渝分文〔2025〕 9号)收悉。经审核,现批复如下: ...

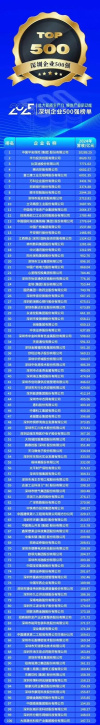

2025深圳企业500强榜单发布 平安华为比亚迪位列前三

Ge Long Hui A P P· 2025-10-29 04:13

Group 1 - The "2025 Shenzhen Top 500 Enterprises List" was released, with Ping An, Huawei, and BYD ranking in the top three positions [1] - The listed companies show a trend of moderate recovery in operating performance, with slight pressure on profitability [1] - The mid-tier companies are continuously strengthening, indicating a growing competitive landscape [1] Group 2 - The competition among leading enterprises is intensifying, reflecting a dynamic market environment [1] - The vitality of private enterprises is highlighted, showcasing their significant role in the economy [1] - The manufacturing sector remains solid, although competition is becoming increasingly differentiated [1]